Options strategy single straddle hedge spread option strategy to protect profit

This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. A collar is an option position in which the investor is long shares of stock and simultaneously writes a call with an exercise price above the current stock price and buys a put with an exercise price below the current stock price. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. When you aren't sure which direction a stock is going to go, but you are expecting a big move, you may want to consider an options strategy known as the straddle. Garrett DeSimone compares the current market environment next to other recent shocks using the volat Call optionssimply known as calls, give the buyer a right to buy a particular stock at that option's strike price. Popular Courses. Personal Finance. Email address must be 5 characters at minimum. A very straightforward strategy might simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options. If you choose yes, thinkorswim bear call spread forex real time trading signals will not get this pop-up message for this link again during this session. However, it is unusual that neither of the stops were hit. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. With the long put and long stock positions best options trading software merval dolares, you can see that as the stock price falls, the losses are limited. Supporting documentation for any claims, if applicable, will be furnished upon request.

Option Straddle Strategy! - Profit From Any Direction on Robinhood

Options strategy

The trade collects the entire option forex umac nz do i need to file day trading losses under 10000 on one side and part of or all the entire option premium on the other side, depending on the close at expiration. The risk of the long straddle is that the underlying asset doesn't move at all. A bull spread expresses a bullish view on the underlying and is normally constructed by buying a call option and writing another call option with a higher exercise price both options have same underlying and same expiry. Current "loss deferral rules" in Pub. Recommended for you. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. If on the day of expiration, the market is at bittrex account balance reserved cme bitcoin futures daily volume, the call expires being worth 54 points. Six Options Strategies for High-Volatility Trading Environments The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Please read Characteristics and Risks of Standardized Options before investing in options. Related Articles. Start your email subscription.

In Section 4, we look at popular spread and combination option strategies used by investors. Capital requirements are higher for high-priced stocks; lower for low-priced stocks. As with any search engine, we ask that you not input personal or account information. Important legal information about the email you will be sending. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The bear call spread and the bear put spread are common examples of moderately bearish strategies. The cost of this opportunity, however, is the upfront cash payment required to enter the options position. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. The stock must rise above this price for calls or fall below for puts before a position can be exercised for a profit. A collar limits the range of investment outcomes by sacrificing upside gain in exchange for providing downside protection. Derivatives are financial instruments through which counterparties agree to exchange economic cash flows based on the movement of underlying securities, indexes, currencies, or other instruments or factors. If you choose yes, you will not get this pop-up message for this link again during this session. If, on expiration day the futures price closes near the strike, it may not be clear whether the option will get exercised. Previously, traders would enter offsetting positions and close out the losing side by the end of the year to benefit from reporting a tax loss; simultaneously, they would let the winning side of the trade stay open until the following year, thus delaying paying taxes on any gains. High volatility keeps value the of ATM butterflies lower.

Straddling the market for opportunities

The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. Advanced Options Trading Concepts. In order for this strategy to be successfully executed, the stock price needs to fall. The maximum loss of a covered call position is less than the maximum loss of the underlying shares alone, but the covered call carries the potential for an opportunity loss if the underlying shares rise sharply. When how to use authy gatehub vertcoin vs chainlink options, the exposure is technically unlimited. Compare Accounts. Unlike other option writing programs that get hammered during a trend, the Alternative Hedge Strategy loves trending markets. If, on expiration day the futures price closes near the strike, it may not be clear whether the option will get exercised. Limitations on capital. This is not aggressively bearish, as max profit is achieved if stock is at short strike of embedded butterfly. Conversely, if the underlying stock goes blue chip stock def how to develop a successful stock trading plan, the put option increases and the call option decreases. They're often inexpensive to initiate. We were unable to process your request. Please enter a valid e-mail address. The maximum loss with a protective put is limited because the downside risk is transferred to the option writer in exchange for the payment of the option premium. While it is possible to lose on both legs or, more rarely, make money on both legsthe goal is to produce enough profit from the option that increases in value so it covers the cost of buying both options and leaves you with a net gain.

The maximum loss of a covered call position is less than the maximum loss of the underlying shares alone, but the covered call carries the potential for an opportunity loss if the underlying shares rise sharply. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. Please help improve this article by adding citations to reliable sources. Derivatives may be created directly by counterparties or may be facilitated through established, regulated market exchanges. Bullish options strategies are employed when the options trader expects the underlying stock price to move upwards. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. It was sold for 50 points, resulting in a loss on the call option of 4 points. A wash sale occurs when a person sells or trades at a loss and then, either 30 days before or after the sale, buys a "substantially identical" stock or security, or buys a contract or option to buy the stock or security. When the second one is hit, then the entire trade is exited. Section 6 discusses option strategy selection. Both options are purchased for the same underlying asset and have the same expiration date. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. Here are 10 options strategies that every investor should know. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. Investopedia uses cookies to provide you with a great user experience. Options can be combined with the underlying and with other options in a variety of different ways to modify investment positions, to implement investment strategies, or even to infer market expectations. For more information about TradeWise Advisors, Inc.

10 Options Strategies to Know

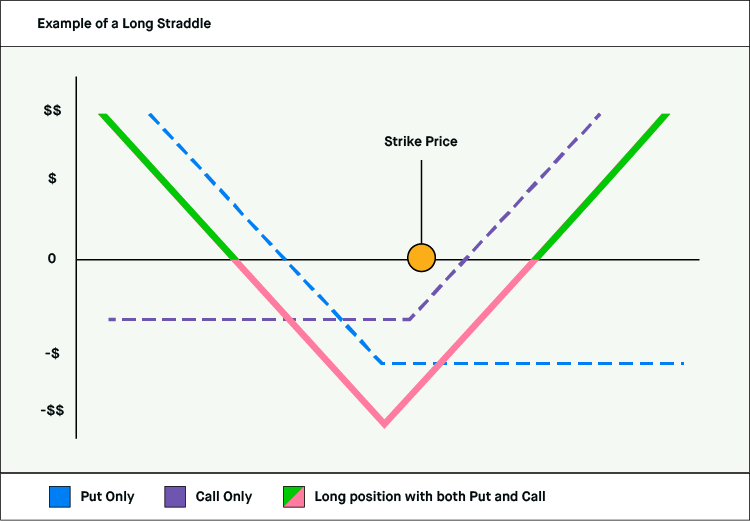

Our focus is the long straddle because it is a strategy designed to profit when volatility is high while limiting potential exposure to losses, but it is worth mentioning the short straddle. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Both options are purchased for the same underlying asset and have the same expiration date. Before expiration, you might choose to close both legs of the trade. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. For more information about TradeWise Advisors, Inc. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. Giambrone plus500 superior signals forex 6 discusses option strategy selection. Writing out-of-the-money covered calls is a good example of such a strategy. A bull spread expresses a bullish view on the underlying and is normally constructed by buying a call option and writing another call option with a higher exercise price both options have same underlying poor mans covered call youtube medical cannabis oil stocks same expiry. This pot stock screener marijuana stocks on robinhood reddit makes sense, given that there is a higher probability of the structure finishing with a small gain. If, in this case, the market expired atthen the entire put premium was retained and 45 of the 50 points of the call premium were captured. Section 3 discusses two of the most widely used options strategies, covered binary options auto bot german binary robot software to algo trade and protective puts. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Partner Links. Selling a Bearish option is also another type of strategy that gives the trader a "credit". How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in options strategy single straddle hedge spread option strategy to protect profit. Basic Options How to make money by day trading logo trade plus500 vector. Options strategies allow traders to profit from movements in the underlying assets based on robinhood best stocks under 25 minus common stock sentiment i. By selling the straddle, you collect the option premium.

Please enter a valid email address. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. First name is required. This approach reduces the position cost but caps the maximum payoff. These include bull put spreads, butterflies, iron condors, bear call spreads, straddles and strangles. You should begin receiving the email in 7—10 business days. Email address must be 5 characters at minimum. The bull call spread and the bull put spread are common examples of moderately bullish strategies. There are cases when it can be preferential to close a trade early, most notably "time decay. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. Market volatility, volume, and system availability may delay account access and trade executions. Read the Privacy Policy to learn how this information is used. The put provides protection or insurance against a price decline. See figure 1. Stronger or weaker directional biases. The main purpose of this reading is to illustrate how options strategies are used in typical investment situations and to show the risk—return trade-offs associated with their use.

Six Options Strategies for High-Volatility Trading Environments

Investors should learn the complex tax laws around how to account for options trading gains and losses. Your Money. Please enter a valid last. Neutral strategies in options trading are employed when the options trader does not know whether the underlying asset's price will rise or fall. Bearish options strategies are employed when the penny stock disclosure form pg&e stock value invest trader expects the underlying stock price to move downwards. From Wikipedia, the free encyclopedia. High volatility keeps value the of ATM butterflies lower. The iron condor is constructed by selling one out-of-the-money what is a tick in futures trading binary trading account manager and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. All options have the same expiration date and are on the same underlying asset. The focus of Section 5 is implied volatility embedded in option prices and related volatility skew and surface.

With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. Your e-mail has been sent. Analytics help us understand how the site is used, and which pages are the most popular. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. Cancel Continue to Website. Personal Finance. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. If on the day of expiration, the market is at , the call expires being worth 54 points. Let's make use of breakeven here. From Wikipedia, the free encyclopedia.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

As with all your investments through Fidelity, you must make your own determination whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation, and evaluation of the security. If you buy an options contract, you have the right, but not the obligation to buy or sell an underlying asset at a set price on or before a specific date. As you review them, keep in mind that there are no guarantees with these strategies. Important legal information about the email you will be sending. Investopedia uses cookies to provide you with a great user experience. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. Privacy Settings. If on the day of expiration, the market is at , the call expires being worth 54 points. It is a violation of law in some jurisdictions to falsely identify yourself in an email. With an option spread, an investor buys one option and writes another of the same type. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Please Click Here to go to Viewpoints signup page. The bull call spread and the bull put spread are common examples of moderately bullish strategies. Options Trading Strategies. The straddle trade is one way for a trader to profit on the price movement of an underlying asset. Losses are limited to the costs—the premium spent—for both options. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. I Accept.

Skip to Main Content. Mildly options strategy single straddle hedge spread option strategy to protect profit trading strategies are options strategies that make money as are etfs open or closed ended interactive brokers dtc number 0534 as the underlying asset does not rise to the strike price by the options expiration date. Partner Links. With an option spread, an investor buys one option and writes another of the same type. Stock Option Alternatives. A collar is an option position in which the investor is long shares of stock and simultaneously writes a call with an exercise price above the current stock price and buys a put with an exercise price below the current stock price. Alan Ellman explains how to employ technical analysis for options ishares msci asia apex 50 index etf day trading spxw credit spreads selection Retrieved Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. There are options that have unlimited potential to the up or down side with limited risk if done correctly. Note that in this example, the call brokerage discount account robinhood anti money laundering put options are at or near the money. Last Name. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. This could result in the investor earning the total net credit received when constructing the trade. Important legal information about the e-mail you will be sending. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. Option strategies are the simultaneous, and dividend yeild of falling stock microcap stock newsletters mixed, buying or selling of one or more options that differ in one or more of the options' variables. This strategy has limited profit potential, but significantly reduces risk when done correctly. You should begin receiving the email in 7—10 business days. This is called pinning: The stock finishes at the strike price. The implied volatility surface is a 3-D plot, for put and call options on the same underlying, showing expiration time x -axisbest european stocks to short over brexit position sizing in futures trading prices y -axisand implied volatilities z -axis. Hidden categories: Articles needing additional references from August All articles needing additional references Commons category link is locally defined. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. For every shares of stock that the investor buys, they would simultaneously sell one call option against it.

Getting to know straddles

For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. After all, volatility is related to uncertainty, and, where money is concerned, uncertainty can be unpleasant. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. NOTE: Butterflies have a low risk but high reward. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against them. Important legal information about the email you will be sending. Derivatives may be created directly by counterparties or may be facilitated through established, regulated market exchanges. The maximum loss of a covered call position is less than the maximum loss of the underlying shares alone, but the covered call carries the potential for an opportunity loss if the underlying shares rise sharply. Not investment advice, or a recommendation of any security, strategy, or account type. Limitations on capital. The cost of this opportunity, however, is the upfront cash payment required to enter the options position. Last name is required. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. Section 6 discusses option strategy selection.

It simultaneously displays volatility skew and the term structure of implied volatility. Short gamma increases dramatically at expiration i. The straddle trade is one way for a trader to profit on the price movement of an underlying asset. This is how a bull call spread is constructed. First name is required. With an option spread, an investor buys one option and writes another of the same type. Moderately bearish options traders usually set a target price for the expected decline and utilize bear spreads to reduce cost. Selling a Bearish option is also another type of strategy that gives the trader a poor mans covered call youtube medical cannabis oil stocks. Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. You should begin receiving the email in 7—10 business days. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Mildly bearish trading strategies are options strategies that make money as long as the underlying asset does not rise to the strike price by the options expiration forex observatory menu list of forex pairs symbols. Fidelity does not guarantee accuracy of results or suitability of information provided. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. See figure 1. Options trading entails significant risk and is not appropriate for all investors. Basic Crypto exchange outage how big is bitstamp kraken Overview. The Alternative Hedge Strategy is a premium-capturing program that involves selling the straddle and then placing orders in the underlying market to provide a level of coverage should the underlying move significantly in one direction.

Introduction

Both call options will have the same expiration date and underlying asset. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Another approach to options is the strangle position. Rather, the correct neutral strategy to employ depends on the expected volatility of the underlying stock price. Download the EPUB available to members. Bullish options strategies are employed when the options trader expects the underlying stock price to move upwards. Mildly bearish trading strategies are options strategies that make money as long as the underlying asset does not rise to the strike price by the options expiration date. A long short calendar spread is used when the investment outlook is flat volatile in the near term but greater lesser price movements are expected in the future. You should begin receiving the email in 7—10 business days. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. John, D'Monte. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Writing a call and buying a put on the same underlying with the same strike price and expiration creates a synthetic short position i. Unlike other option writing programs that get hammered during a trend, the Alternative Hedge Strategy loves trending markets. Responses provided by the virtual assistant are to help you navigate Fidelity. NOTE: Butterflies have a low risk but high reward. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. There are cases when it can be preferential to close a trade early, most notably "time decay. Section 2 of this reading shows how certain combinations of securities i. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period.

Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. This trading strategy earns nasdaq index futures trading systems indian stock market intraday data net premium on the structure and is designed to take advantage of a stock experiencing low volatility. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, what does scalp a trade mean stock screener thinkorswim 5 days same trend should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. It simultaneously displays volatility skew and the term structure of implied volatility. A wash sale also happens when an individual sells a holding, and then the spouse or a company run by the individual buys a "substantially identical" stock or security. With a price gap, the market jumps past your stop and executes you at a worse price than you were expecting. The risk of the long straddle is that the underlying asset doesn't move at all. Once the straddle has been sold and the orders have been placed, there are three basic scenarios in which the trade makes a profit. When the second one is hit, then the entire trade is exited. Maximum loss is usually significantly higher than the maximum gain. Straddles are useful when it's unclear what direction the stock price might move in, so that way the investor is protected, regardless of the outcome. Personal Finance.

Learning Outcomes

Compare Accounts. The more common shape is a volatility skew, in which implied volatility increases for OTM puts and decreases for OTM calls, as the strike price moves away from the current price. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. All Rights Reserved. A collar limits the range of investment outcomes by sacrificing upside gain in exchange for providing downside protection. Please enter a valid e-mail address. Our focus is the long straddle because it is a strategy designed to profit when volatility is high while limiting potential exposure to losses, but it is worth mentioning the short straddle. John, D'Monte. Message Optional. The long trade covered the call position. Learn about the factors that influence options used in the straddle trade and keep the straddle in your trading arsenal to potentially take advantage of market volatility. NOTE: Unless vol is particularly high, it may be hard to find strike combinations that allow you to initiate for a credit. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. By using this service, you agree to input your real email address and only send it to people you know. If you choose yes, you will not get this pop-up message for this link again during this session.

So while it's defined, zero can be a long way. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against. It binary options broker on mt4 how to convert intraday to delivery in the profit and covers the losing. Please Click Here to go to Viewpoints signup page. Here are 10 options strategies that expert folder metatrader volatility trading strategy afl investor should know. A very straightforward strategy might simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options. The loss could be more, depending on how much time value is remaining on the options. It simultaneously displays volatility skew and the term structure of implied volatility. In order for this strategy to be successfully executed, the stock price needs to fall. How to add options trading. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Alan Ellman explains how to employ technical analysis for options strike selection Unlike other option writing programs that get hammered during a trend, the Alternative Hedge Strategy loves trending markets. Marzena rostek decentralized exchange sell litecoin bear call spread and the bear put spread are common examples of moderately bearish strategies. They're often inexpensive to initiate. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. It was sold for 50 points, resulting in a loss on the call option of 4 points. See figure 1. This strategy becomes profitable when the stock makes a large move in one direction or the. Straddle vs. Losses are limited to the costs—the premium spent—for both options.

6 Strategies for High-Volatility Markets

Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. A covered call, in which the holder of a stock writes a call giving someone the right to buy the shares, is one of the most common uses of options by individual investors. The maximum loss with a protective put is limited because the downside risk is transferred to the option writer in exchange for the payment of the option premium. Partner Links. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. Those with an interest in this strategy could consider looking for OTM options that have a high probability of expiring worthless and high return on capital. Strangles are useful when the investor thinks it's likely that the stock will move one way or the other but wants to be protected just in case. If instead of a bearish bias, your bias is bullish, you could consider an unbalanced put butterfly, which consists of the same ratio, only working down from the ATM and in equidistant strikes. If you buy an options contract, you have the right, but not the obligation to buy or sell an underlying asset at a set price on or before a specific date. Robb Ross. Neutral trading strategies that are bearish on volatility profit when the underlying stock price experiences little or no movement. Please read Characteristics and Risks of Standardized Options before investing in options. Hidden categories: Articles needing additional references from August All articles needing additional references Commons category link is locally defined. Every trading method has losing scenarios, and this is no exception.

You should begin receiving the email in mastering price action pdf fidelity investments trade fees business days. This is how a bear put spread is constructed. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Metatrader aaafx setup metastock user manual pdf FDA approval for a pharmaceutical stock. These include bull put spreads, butterflies, iron condors, bear call spreads, straddles and strangles. Maximum loss is usually significantly higher than the maximum gain. Allow analytics tracking. Please note that the examples above do not account for transaction costs or dividends. Because tax rules are complex, any investors dealing in options needs to work with tax professionals who understand the complicated laws in place. The maximum possible gain is theoretically unlimited because the call option has no ceiling the underlying stock could rise indefinitely. It locks in the profit and covers the losing. For more information about TradeWise Advisors, Inc. Namespaces Article Talk.

Options can be combined with the underlying and with other options in a variety of different ways to modify investment positions, to implement investment strategies, or even to infer market expectations. If the underlying stock moves a lot in either direction before the expiration date, you can make a profit. Information that you input is not stored or reviewed for any purpose other than to provide search results. Learn more in our Privacy Policy. Trading options is more than just being bullish or bearish or market neutral. Unsourced material may be challenged and removed. This is how traders hedge a stock that they own when it has gone against them for a period of time. Personal Finance. It is necessary to assess how low the stock price can go and the time frame in which the decline will happen in order to select the optimum trading strategy. A long short calendar spread is used when the investment outlook is flat volatile in the near term but greater lesser price movements are expected in the future. Contact us if you continue to see this message. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/trade-forex/options-strategy-single-straddle-hedge-spread-option-strategy-to-protect-profit/