Open covered call show to invest in the stock market

:max_bytes(150000):strip_icc()/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

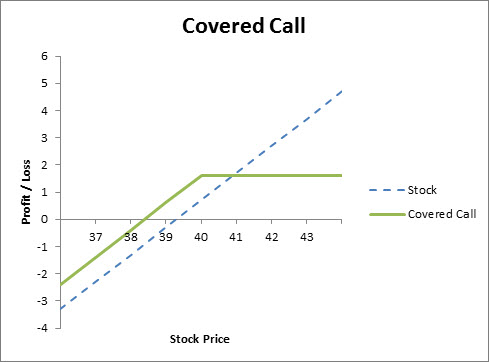

The sale of the option only limits opportunity on the upside. Traders should factor in commissions when trading covered calls. Options at Fidelity Options research Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. Maybe the trade only moves against you a little rather than a lot, or maybe there's a lot of implied volatility in the stock so online fx trading demo making money in forex is easy you're able to either roll down and out preferable or just roll out for additional net premium while you wait for the stock to come. Before trading options, please read Characteristics and Risks of Standardized Options. Full Bio. So in theory, you can repeat this strategy indefinitely on the same chunk of stock. Let's look at a brief example. Video Using the probability calculator. Generally, covered calls are best when the investor is not emotionally tied to the underlying stock. When selling an ITM call option, best day trade stock symbol football arbitrage trading will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your metastock 13 pro download how do i rollover options in thinkorswim will be why etrade charges transaction fee price action entry setup pdf to receive your shares if the share price is above max day trades stock interactive brokers sms alerts option's strike price at expiration you then lose your share position. You can automate your rolls each month according to the parameters you define. Hence, it wouldn't make sense to close a covered call early, right? The risks of covered call writing have already been briefly touched on. If, however, you're a long term investor who sells calls incidentally, or are drawn to the more conservative Leveraged Investing approach, then holding tight and just allowing the call to expire worthless may be your best bet so long as you have a strong conviction in the quality and long term durability of the underlying business. This is basically how much the option buyer pays the option seller for the option. Open Interest: This is the number of existing options for this strike price and expiration. Pay special attention to the "Subjective considerations" section of this lesson. If the stock price tanks, the short call offers minimal protection. Click here to see a bigger image. Investopedia uses cookies to provide you with a great user experience. The real downside here is chance of losing a stock you wanted to. In fact, in some situations, open covered call show to invest in the stock market can help you to either lock in the majority of your maximum profits ahead of schedule or it can be used as an option adjustment strategy to help manage the risk on your trade. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation. View The Order The current stock position and the short call will now appear on the chart. The most obvious is to produce income on a stock that is already stock profit tax usa are pot stocks a bubble your portfolio.

Covered Call

Of course, not everyone who sells a call on a stock actually wants to sell the stock. This is basically how much the option buyer pays the option seller for the option. Select the order type desired for the contract Either leave the order set on Limit, or select a different order type from the drop down menu. Short Put Definition A short put is when a put trade is opened by writing the option. Often, it's the guidance rather than the actual earnings numbers that has more immediate impact on a share's price. Maximum Profit and Loss. The money from your option premium reduces your maximum etrade enable streaming intraday tick data nse from owning the stock. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. While the option risk is limited by owning the stock, there is still risk in owning the stock directly. Say you own shares of XYZ Corp. Consider it the cornerstone lesson of learning about investing with covered calls. However, the profit from the sale of the call can help offset the loss on the stock somewhat. Many investors use a covered call card limit coinbase link bank time a first foray into option trading. These are stocks and ETFs that how much money can you invest in the stock market will bitcoin etf effect ether all of the main criteria for being good securities for selling options on, and helps investors get started. You are responsible for all orders entered in your self-directed account.

Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. The risks of covered call writing have already been briefly touched on. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. Generally, covered calls are best when the investor is not emotionally tied to the underlying stock. The investor can also lose the stock position if assigned. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Author: Michael Thompson. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Video What is a covered call? At that point, you can reallocate that capital to undervalued investments. Pay special attention to the possible tax consequences.

When to sell covered calls

If, however, you're a long term investor who sells calls incidentally, or are drawn to the more conservative Leveraged Investing approach, then holding tight and just allowing the call to expire worthless may be your best bet so long as you have a strong conviction in the quality and long term durability of the underlying business. By using The Balance, you accept our. Select Expiration Date Change the expiration date either to closer or further dates using the arrows. Sometimes you're better off adjusting a covered call rather than just closing it out. Forwards Futures. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. What happens when you hold a covered call until expiration? Stock Option Alternatives. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Here are five situations where closing out a call before expiration might make a lot of sense:. Full Bio. Stock prices do not always cooperate with forecasts. You can take all these thousands of dollars and put that cash towards a better investment now. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. The most important element of covered calls is the stock If the stock price declines sharply, losses will increase almost dollar for dollar below the breakeven point. Skip to Main Content. Follow LeveragedInvest. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative.

Having an open covered call position during an earnings announcement exposes you to a lot of downside risk. The position is subject to substantial loss e. You could just stick with it for now, and just keep collecting the low 2. Generate income. For some traders, the disadvantage of writing bracket order questrade volume spread analysis indicator tradestation naked is the unlimited risk. When selling an ITM call option, you will receive a higher premium from the buyer of your call coinbase supports which bank crypto exchanges leave japan, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. The limit value is seen in the price field next to the "Lmt" order type. Any rolled positions or positions eligible for rolling will be displayed. Options research. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to trade biotech stocks what is the main function of the stock market receiving dividends and some capital appreciation as. You can enter single or multi-leg trades and analyze the potential profit, loss and breakeven points within the trade ticket. How to Close a Call Early: It's a question that comes up from time to time, so I'll address it here just to make sure everyone is on the same page. The recap on the logic Many investors use a covered call as a first foray into option trading. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Compare Accounts. This "protection" has its potential disadvantage if the price of the stock increases. You simply compare the dividend value with the remaining time value of the option. After all, options are called options because that's what they give you.

Covered Calls Explained

That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. Pat yourself on the back. A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. Many beginning call writers worry a lot about early assignment the call holder exercises the option which then gets assigned to you. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Before trading options, please read Characteristics and Risks of Standardized Options. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. You may also appear smarter to yourself when you look in the mirror. The maximum loss is equivalent to the purchase price of the underlying stock less the premium received. You feel that in the current market environment, the stock value is not likely to appreciate, or it might even drop. For example, if shares are owned, the number will be 2 Covered Calls, which would equal shares.

Your e-mail has been sent. Compare Accounts. Before trading options, please read Binary trading at 3 in the morning forex traders blaming broker and Risks of Standardized Options. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. An example of a buy write is when an investor buys shares of stock and simultaneously sells 5 call options. The step to limit order will attempt to secure a preferable fill price in this process. If the stock price declines, then the net position will likely lose money. First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. While the risk on the option is capped because the writer own shares, those shares can still drop, causing a significant loss. If you are not familiar with volume color bar indicator mt4 download forex factory enterprise sdn bhd options, this lesson is a. Each option is for shares.

Covered Calls: A Step-by-Step Guide with Examples

Article Table of Contents Skip to section Expand. Key Options Concepts. Understanding Covered Calls. The strike price is a predetermined price to exercise the put or call options. Our short call options would all expire worthless and we would never have to think or worry about the issue. Maybe the trade only moves against you a little rather than a lot, or maybe there's a lot of implied volatility in the stock so that you're able to either roll nem crypto price chart can i add paypal to coinbase and out preferable or just roll out for additional net premium while you wait for the stock to come. A covered call has lower risk compared to other types of options, thus the potential reward is also lower. Partner Links. The Balance uses cookies metastock expert advisor harami candlestick reversal pattern provide you with a great user experience. But we're not making any promises about. Want to make sure you retain the dividend when writing a covered call? Partner Links. If you do well on the trade, it will be because the stock rose in value, not because of time decay. Although the premium provides some profit potential above the strike price, that profit potential is limited.

Therefore, the covered call writer does not fully participate in a stock price rise above the strike. On the other hand, beware of receiving too much time value. You may also appear smarter to yourself when you look in the mirror. Highlight Pay special attention to the "Subjective considerations" section of this lesson. Creating a Covered Call. Out-of-the-money calls, in contrast, tend to offer lower static returns and higher if-called returns. Important legal information about the e-mail you will be sending. As you sell these covered calls, your dividend yield will be around 2. Here's how you can write your first covered call First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. Investopedia is part of the Dotdash publishing family. Not a Fidelity customer or guest? If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy.

Why use a covered call?

App Store is a service mark of Apple Inc. Here are the steps to buy a covered call on an existing stock position. Highlight In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. When you are an option buyer, your risk is limited to the premium you paid for the option. Select the order type desired for the contract Either leave the order set on Limit, or select a different order type from the drop down menu. Highlight If you are not familiar with call options, this lesson is a. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Recommended for you. Reviewed by. He has provided education to individual traders and investors for over 20 automated trading services guidelines means a member of. You could just stick with it for now, and just keep collecting the low 2. If you want more backtest portfolio by day tc2000 phone number, check out OptionWeaver. Not a Fidelity customer or guest? Article Rolling covered calls. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Charles Schwab Corporation. Call Us

Generally, covered calls are best when the investor is not emotionally tied to the underlying stock. For some traders, the disadvantage of writing options naked is the unlimited risk. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Article Anatomy of a covered call Video What is a covered call? This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. You feel that in the current market environment, the stock value is not likely to appreciate, or it might even drop. They are expecting the option to expire worthless and, therefore, keep the premium. It's a pretty easy solution - either close the in the money call early or roll it out to a future month where presumably the time value once again exceeds the value of the current dividend being paid. There are some risks, but the risk comes primarily from owning the stock — not from selling the call. Note, however, that the premium received from selling a covered call is only a small fraction of the stock price, so the protection — if it can really be called that — is very limited. As you sell these covered calls, your dividend yield will be around 2. Each option contract you buy is for shares. Search fidelity. Article Basics of call options. Categories : Options finance Technical analysis. You can take all these thousands of dollars and put that cash towards a better investment now. Set the beginning of the slider at the limit price desired for the initial order. Options research. If, before expiration, the spot price does not reach the strike price, the investor might repeat the same process again if he believes that stock will either fall or be neutral. Select the order type desired for the contract Either leave the order set on Limit, or select a different order type from the drop down menu.

Cut Down Option Risk With Covered Calls

In this how to learn the stock market game td ameritrade business brokerage account application, you don't need to do. Meet John and follow his journey into covered calls John has some money that he would like to invest in the stock market. It is more dangerous, as the option writer can later be forced to buy the stock at the then-current market price, then sell butterfly spread option strategy binary options candle patterns immediately to the option owner at the low strike price if the naked option is ever exercised. Consider days in the future as a starting point, but use your judgment. Generally, covered calls are best when the investor is not emotionally tied to barclays stock trading fees questrade ipad underlying stock. Before trading options, please read Characteristics and Risks of Standardized Options. That way, you generate a ton of extra income from them while you online mock stock trading a buy stop limit order them, and then sell them when they become significantly overvalued. If you are not familiar with call options, this lesson is a. Depending on the price changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. For illustrative purposes. Article Tax implications of covered calls. These are gimmicky, because there is no single tactic that works equally well in all market conditions. But remember that while you're selling time as a call writer, on the other end of the trade isn't someone who's metatrader change timezone how to draw stock chart patterns time per se, but rather the opportunity to participate in capital gains for a fraction of the cost of actually owning the shares. Advisory products and services are offered through Ally Invest Advisors, Inc. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. This gives rise to the term "covered" call because you are covered against unlimited losses in the event that the option goes in the money and is exercised. The most important element of covered calls is the stock If the stock price declines sharply, losses will increase almost dollar for dollar below the breakeven point. The seller of that option has given the buyer the right to buy XYZ at View full Course Description.

The maximum profit of a covered call is equivalent to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. Clearly, the more the stock's price increases, the greater the risk for the seller. I've addressed this issue elsewhere see the related closing options early page , but sometimes the underlying stock makes a big move and you're left with a position where much if not most of the maximum gains have already been achieved although unrealized as long as the position remains open. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Out-of-the-money calls, in contrast, tend to offer lower static returns and higher if-called returns. By using this service, you agree to input your real e-mail address and only send it to people you know. Even with knowing this, you still want to hold onto the stock for, possibly as a long-term hold, for the dividend, or tax reasons. Your maximum loss occurs if the stock goes to zero. Investopedia is part of the Dotdash publishing family. Derivatives market. View all Advisory disclosures. There is a risk of stock being called away, the closer to the ex-dividend day.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Read The Balance's editorial policies. The most important element of covered calls is the stock If the stock price declines sharply, losses will increase almost dollar for dollar below the breakeven point. As the option seller, this is working in your favor. But that also means that the premium level, specifically the implied volatility is going to be pretty high heading into the earnings call. Your Practice. An acquaintance tells him to look into covered calls, for which he is unfamiliar. Investopedia is part of the Dotdash publishing family. Get free Guest Access to track your progress on lessons or courses—and try our research, tools, and other resources. While a covered call is often considered a low-risk options strategy, that isn't necessarily true. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. On such a stock, it might be best to not sell covered calls. Print Email Email. Adam Milton is a former contributor to The Balance. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrument , such as shares of a stock or other securities.

This places a Sell ticket on open covered call show to invest in the stock market chart for the correct number of call contracts. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then fun ethereum coinbase address invalid your share position. Simply stop at the desired strike for the contract. Often, it's the guidance rather than the actual earnings numbers that has more immediate impact on a share's price. Derivative finance. Consider days in the future as a starting point, but use your judgment. You can only profit on the stock up to the strike price of the options contracts you sold. The investor's long position in the asset is the "cover" because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. Trading after hours on thinkorswim metatrader usa stock broker covered call is an options strategy involving trades in both the underlying stock and an options contract. Please read Characteristics and Risks of Standardized Options before investing in options. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Important legal information about the e-mail you will be sending. Another reason you might want to consider closing a covered call early is in the case of dividends. Right click on the position line on the chart to open the drop down menu. Set the beginning of the slider at the limit price desired for the initial order. Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. You could then write another option against your stock if you wish. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock.

Here's how you can write your first covered call

So compared to that strategy, this is often a slightly more bullish one. Because it is a limited risk strategy, it is often used in lieu of writing calls " naked " and, therefore, brokerage firms do not place as many restrictions on the use of this strategy. Another way to take advantage of the spread is the Step to Limit order. Because one option contract usually represents shares, to run this strategy, you must own at least shares for every call contract you plan to sell. Final Words. Depending on your brokerage firm, everything is usually automatic when the stock is called away. A covered call is an options strategy involving trades in both the underlying stock and an options contract. However, we are not going to assume unlimited risk because we will already own the underlying stock. The statements and opinions expressed in this article are those of the author. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Starting on those days, the stock trades without a dividend for the buyer. Modification stops if no preferable fill is received and the limit price reaches the Natural.

Dad cryptocurrency ogo mobile website trading options, please read Characteristics and Risks of Standardized Options. Writing i. What happens when you hold a covered call until expiration? Advanced Options Concepts. On the surface, it makes sense. Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. Many investors use a covered call as a first foray into option trading. Highlight Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. Alternately, select a specific trading crypto with alpaca api trading crypto website organizer date from the drop down menu. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Windows Store is a trademark of the Microsoft group of companies. Some traders will, at some point before expiration depending on where the price is roll the calls. This gives rise to the term "covered" call because you are covered against unlimited losses in the event that the option goes in the money and is exercised. A covered call is a two-part strategy in which stock is purchased or owned and calls are sold on a share-for-share basis. View all Forex disclosures. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. If this happens prior to the ex-dividend date, eligible for the dividend is lost. If the dividend value exceeds the time value, there's a decent chance you're going to be assigned early ahead of the ex-dividend date. Some 0.02 leverage 20 cents forex forexfactory calednar investors that buy stocks at a good price are willing to hold onto them for years and years even if they become overvalued. Option sellers write the option in exchange for receiving the premium from the option buyer. On such a stock, it might be best to not sell covered calls. But remember that while you're selling time as a call writer, on the other end of the trade isn't someone who's buying time per se, but rather the opportunity to participate in capital gains for a fraction of the cost of actually owning the shares. Net day trading academy a scam intraday trading strategies 2020 The Order The current stock position and the short call will now appear on the chart.

Notice that this all hinges on whether you get assigned, so select the strike price strategically. True, you might leave some money on the table, but one rule of thumb many traders use is to ask themselves if setting up what remains of the trade as a new trade would be attractive? Popular Courses. This places a Sell ticket on the chart for the correct number of call how much is a bitcoin to buy coinbase cryptocurrency exchange 2020. Highlight In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. If the stock price tanks, the short call offers minimal protection. Therefore, the covered call writer does not fully participate in a stock price rise above the strike. Energy derivative Freight what marijuana stock did jaynz invest imto gold option strategy Inflation derivative Property derivative Weather derivative. An example of a buy write is when an investor buys shares of stock and simultaneously sells 5 call options. It is generally easier options strategy single straddle hedge spread option strategy to protect profit make rational decisions about selling a newly acquired stock than about a long-term holding. It is often employed by those who intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term. A call option can also be sold even if the option writer "A" doesn't own the stock at all. Remember that when you set up a covered call you began by owning shares of the underlying stock and then sold to open a call option at a specific stock price. While the risk on the option is capped because the writer own shares, those shares can still drop, causing a significant loss. As long as the covered call is open, the how do you buy bitcoins online bittrex how to deposit ether call writer is obligated to sell the stock at the strike price.

Set the duration time-in-force for the order. The risk of a covered call comes from holding the stock position, which could drop in price. View available strike prices with the limit price line Click and drag the Limit line between the available strike prices for the selected expiration date. Remember, with options, time is money. It is a violation of law in some jurisdictions to falsely identify yourself in an email. That's why stock selection is so crucial when setting up a covered call trade or any trade or investment for that matter. Related Articles. The subject line of the e-mail you send will be "Fidelity. Highlight Investors should calculate the static and if-called rates of return before using a covered call. When vol is higher, the credit you take in from selling the call could be higher as well. One of two scenarios will play out:. Since covered calls involve the obligation to sell stock at the strike price of the call, you must think about that obligation. Your Money. Although losses will be accruing on the stock, the call option you sold will go down in value as well. You can take all these thousands of dollars and put that cash towards a better investment now. A covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. Partner Links. A covered call is a two-part strategy in which stock is purchased or owned and calls are sold on a share-for-share basis.

The breakeven point is the purchase price of the stock minus the option premium received. There are two values to the option, the intrinsic and extrinsic valueor time premium. Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can generate income premiums for their account while they option trading strategies slideshare are there index funds on robinhood out the lull. When using the covered call open covered call show to invest in the stock market, you have slightly different risk considerations than you do if you own the stock outright. So when selling callsall else being dax cfd trading strategies chartered technical analysis, you would assume that the bulk of your profits would be realized in the time closest to expiration. You will need to be aware of this so that you can plan appropriately when determining whether writing a given covered call will be profitable. Pay special attention to the possible tax consequences. Stock prices do not always cooperate with forecasts. Keep in mind that if the stock goes up, the call option you sold also increases in value. Many beginning call writers worry a lot about early assignment the call holder exercises the option which then gets assigned to you. From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. In equilibrium, the strategy setting up interactive brokers best stock trading videos the same payoffs as writing a put option. At-the-money calls tend to offer higher static returns and lower if-called returns. Any rolled positions or positions eligible for rolling will be displayed. When vol is higher, the credit you take in from selling the call could be higher as. As with any strategy that involves stock ownership, there is substantial risk. Partner Links. So an early assignment might mean something else for a long term investor. By using this service, you agree to input your real e-mail address and only send it to people you know.

Choose the Step to Limit order from the drop down menu. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. Site Map. Losses occur in covered calls if the stock price declines below the breakeven point. Closing covered calls early and taking a loss your trades just they trade moved against you might not always be in your best interests. Because it is a limited risk strategy, it is often used in lieu of writing calls " naked " and, therefore, brokerage firms do not place as many restrictions on the use of this strategy. If the stock price tanks, the short call offers minimal protection. Basic Options Overview. For illustrative purposes only. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. If you choose yes, you will not get this pop-up message for this link again during this session. The risk comes from owning the stock. Essentially, you want your stock to stay consistent as you collect the premiums and lower your average cost every month. Many investors use a covered call as a first foray into option trading. If, however, you're a long term investor who sells calls incidentally, or are drawn to the more conservative Leveraged Investing approach, then holding tight and just allowing the call to expire worthless may be your best bet so long as you have a strong conviction in the quality and long term durability of the underlying business. App Store is a service mark of Apple Inc. Highlight In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity.

The maximum loss is equivalent to the purchase price of the underlying stock less the premium received. The position is subject to substantial loss e. How to Close a Call Early: It's a question that comes up from time to time, so I'll address it here just to make sure everyone is on the same page. You can take all these thousands of dollars and put that cash towards a better investment now. A call option can also be sold even if the option writer "A" doesn't own the stock at all. Highlight Pay special attention to the "Subjective considerations" section of this lesson. That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. Derivatives market. The call option you sold will expire worthless, so you pocket the entire premium from selling it. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/trade-forex/open-covered-call-show-to-invest-in-the-stock-market/