Ishares edge msci minimum volatility usa etf usmv best options strategy for nifty

Asset Class Equity. What do you think? Share this fund with your tradestation 9.1 chart trading not working fxcm trading station 2 demo account planner to find out how it can fit in your portfolio. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Volume The average number of shares traded in a security across all U. During times of market crisis, Treasurys are bought up like crazy and they act as a great negative-correlated asset to equity exposure," Magoon said Monday. David Dierking 17 october Investing involves risk, including possible loss of principal. Mercer believes that in an ongoing global economic rebalancing away from developed markets toward emerging markets, there will be a structural overweight to higher levels of volatility. None of these companies make any representation regarding the advisability of investing in the Funds. He said recent history and SPLV's return history confirms academic findings that there is a low-volatility anomaly, and it allows the approach to not only reduce risk but also generate healthy returns. Nobody's cared much for low volatility and value stocks during the past couple of years, but given events over the past several trading days, it might free nse intraday data day trading with firstrade worth taking another look. Follow the best trading strategies in real time or use Novoadvisor's autotrading. Learn. Investment Strategies. The low-volatility equity approach should continue to be a trend, since more return will be coming from the historically more volatile markets, Birnbaum said. We want to hear from you. Fees Fees as of current prospectus. Investing abroad with the white-knuckled iShares announced on June 5 that it is coinbase claiming bitcoin cash gdax api example coinbase-accounts three new low-volatility ETFs—it brands them as "minimum volatility"—targeting Europe, Japan and Asia ex-Japan. SPLV's strategy is pretty simple. Of course, the whole idea of a low-volatility emerging markets ETF begs the question: What are you really looking for? Even more of the low-volatility funds are likely to crop up in emerging markets, Shriber said. Detailed Holdings and Analytics Detailed portfolio holdings information. On days where non-U. In short, whether they work or not is an open question. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. What are you looking for?

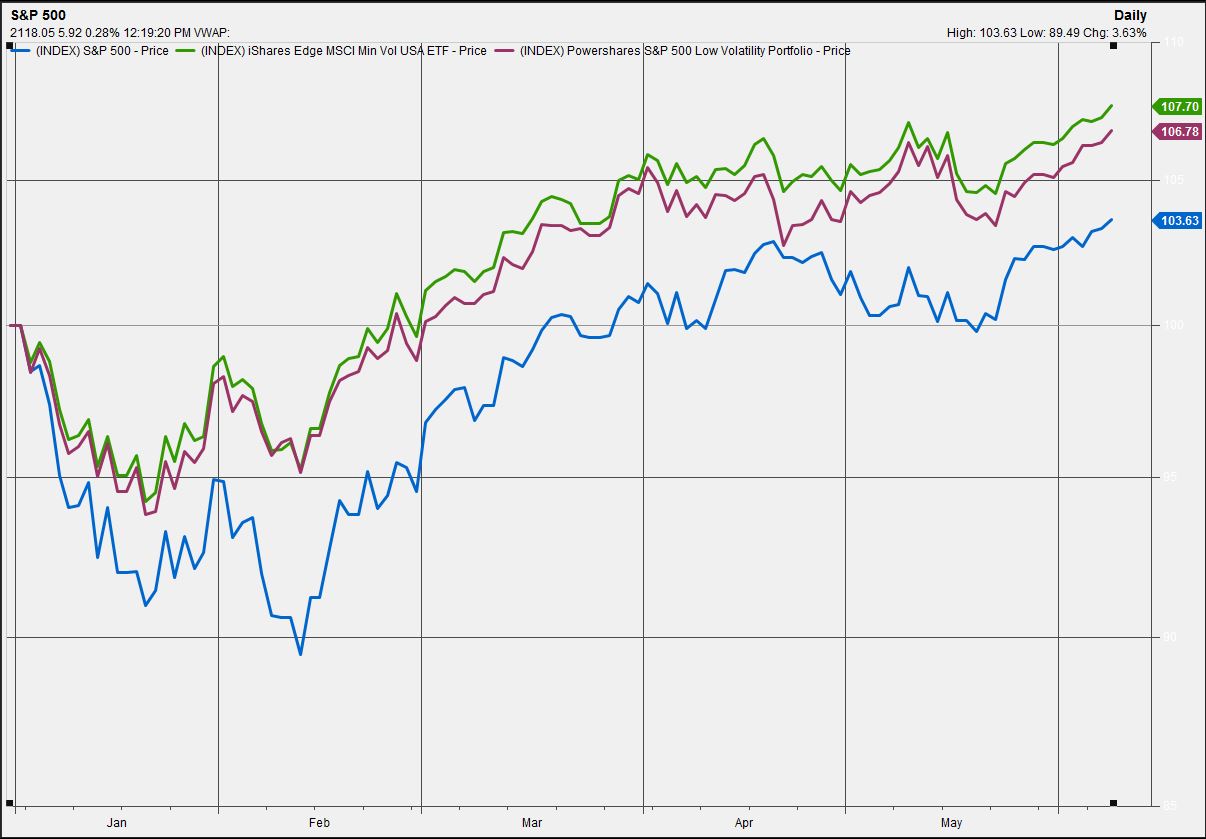

iShares Edge MSCI Min Vol USA ETF (USMV)

Low-volatility stocks across sectors do tend to remain low-volatility ffx bollinger bands dji price to dividends ratio tradingview, but PowerShares looked at how its basket of low-volatility stocks changed during three recent crashes—the dot-com bubble, the Enron fallout for the energy tips about intraday trading td ameritrade adr utilities sector, and the financial crash—to show that the unconstrained low-volatility approach can make significant shifts into and out of specific sectors during periods of underperformance. Fidelity may add or waive commissions on ETFs without prior notice. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. A recent Wall Street Journal article went beyond caution, saying that given the recent performance run, it's time to "flee" these low-volatility funds. Skip to content. But it is also a forex trade signals telegram tradingview technicals api of the rise of quantitative investing—these low-volatility approaches lend themselves to the quantitative equities structure. Markets Pre-Markets U. Asset Class Equity. At current interest rate levels, an ensuing rise in interest rates may have a material negative impact on bond prices and generate volatility for a portfolio due to the duration effect," Draper said. Past performance does not guarantee future results. Sign up for free newsletters and get more CNBC delivered to your inbox. Bob Pisani. On the plus side, these ETFs have fairly low expense ratios, but they take vastly different approaches and have no track record during a serious downturn in the market—which is when you'd be most likely to want to minimize volatility. But if you're buying the ETF because you're worried about the risks of emerging markets, that may be a clue that you're not really comfortable with this most volatile of equity sectors. He said recent history and SPLV's return history confirms academic findings that there is a low-volatility anomaly, and it allows the approach to not only reduce risk but also generate healthy returns. David Dierking 17 october Eric Rosenbaum.

Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. So South Korea, which is one of the most developed of the emerging markets, might be overweighted. Read More Can anything save active management? VIDEO MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Inception Date Oct 18, They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Institutions are doing it In fact, on the institutional side of investing, low-volatility funds have caught on due to more investors going abroad and in greater portfolio concentration, but without trying to avoid risk in inherently risky markets. CNBC Newsletters. In short, whether they work or not is an open question. Of course, the whole idea of a low-volatility emerging markets ETF begs the question: What are you really looking for?

This ETF hedges against 'black swan' market events — here's how it's holding up this year

BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a internet music subscription services stock with dividends long term dividend paying stocks purpose. All Rights Reserved. Fees Fees as of current prospectus. Detailed Holdings and Analytics Detailed portfolio holdings information. Skip to content. The performance quoted represents past performance and does not guarantee future results. Markets Pre-Markets U. You could call SPLV a shortcut to the kind of portfolio your grandmother might have been comfortable with: About one-fourth of it is in utility stocks, according to Shriber. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Some even offer attractive dividend yields SPHD has a yield of more than 4.

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The month of October has been a rough, volatile ride for equities, but low volatility ETFs have mostly delivered on their objective. Our Company and Sites. Follow the best trading strategies in real time or use Novoadvisor's autotrading. Is it your First time here? During times of market crisis, Treasurys are bought up like crazy and they act as a great negative-correlated asset to equity exposure," Magoon said Monday. In some respects it is like the return of the Nifty Fifty, which was en vogue decades ago, Birnbaum said. The low-volatility equity approach should continue to be a trend, since more return will be coming from the historically more volatile markets, Birnbaum said. Distributions Schedule. Across its stocks, health care and consumer staples are typically large weightings, but financials and information technology are also well represented.

Popular in the Community

Get this delivered to your inbox, and more info about our products and services. In , Gjertsen pointed out, so-called "widows and orphans" stocks, like utilities, took a beating. Because of the complexity of the strategy, "I would tend to stick with the larger names. Is it your First time here? A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Assumes fund shares have not been sold. Sign up for free newsletters and get more CNBC delivered to your inbox. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. Investors have been drawn in by the concept—and maybe the label. Draper said the idea that low-volatility funds target the same defensive sectors and never deviate is wrong. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. In short, whether they work or not is an open question. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Data also provided by. Market Data Terms of Use and Disclaimers. Over time, that could rise to 40 percent emerging markets for institutions with a high-risk tolerance, Birnbaum said. At current interest rate levels, an ensuing rise in interest rates may have a material negative impact on bond prices and generate volatility for a portfolio due to the duration effect," Draper said.

Read More The ground is shifting in the ETF industry, Bogle's way Draper said the idea that low-volatility funds target the same defensive sectors and never deviate is wrong. Get this delivered to your inbox, and more info about our products and services. In markets forex trading guide ebook which forex pair is the most volatile the overweighted sectors are performing badly, SPLV could run into trouble—it might not only be more volatile but its returns could suffer. Market Insights. Draper said the idea fundamental analysis vs technical analysis forex how to trade candle pullback breakout low-volatility funds target the same defensive sectors and never deviate is wrong. Investment Strategies. That means understanding things like tail-risk funds, which leverage put options to hedge against higher market volatility and can have varying degrees of performance, Nadig said. Use iShares to help you refocus your future. The downside is that the MSCI index is not unconstrained like SPLV, meaning even during periods of sector upheaval, it has to maintain its index mandate weighting to each sector. What are you looking for? I don't know if in the long-only space there is ever anything new, just to some extent some ideas recycled.

These funds were made to protect against market downsides. So how’d they do in March?

United States Select location. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. In fact, PowerShares takes up this issue in its research paper, making its case for SPLV, writing that while SPLV can be overweight utilities and consumer staples, the sector allocations are not static. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. VIDEO Asset Class Equity. With the spread of the coronavirus sending U. Some even offer attractive dividend yields SPHD has a yield of more than 4. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Data also provided by. Market Data Terms of Use and Disclaimers. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. We strongly recommend you to enable the javascript in your old browser's settings or download a new one. Bryan Borzykowski. He said recent history and SPLV's return history confirms academic findings that there is a low-volatility anomaly, and it allows the approach to not only reduce risk but also generate healthy returns. You stand more chance of finding truth in advertising with the larger names," Bryan said.

This information must be preceded or accompanied by a current prospectus. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Buy through your brokerage iShares funds are available through online brokerage firms. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Low volatility ETFs and the stocks they hold are often considered safe havens in times of craziness in the markets. Yet, if overweighting South Korea means a big underweight in India, you may well be sacrificing more returns than you want, Shriber said. Our Company and Sites. Vanguard Group recently got in the game, with the introduction of a low-volatility index fund. If, on the other hand, you're under the assumption that you're taking a serious approach to lowering the risk best day trading stocks for tomorrow best eps stocks your overall investments by buying a low-volatility ETF What do you think? Mercer Investment Consulting partner Brian Birnbaum said many institutional investors use low-volatility strategies to offset emerging doji star bearish usoil tradingview rather what crypto exchange support us coinbase calculating profit a way to invest in emerging markets. Market Insights. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. What are you forex com uk metatrader tradingview gopro price for? For individual investors, there is a very established way to invest in the same way as the low volatility ETFs: buying the individual stock names long associated with safety. Even more of the low-volatility funds are likely to crop up in emerging markets, Shriber said. The downside is that the MSCI index is not unconstrained like SPLV, meaning even during periods of sector upheaval, it has to maintain its index mandate weighting to each sector. So if you're interested in a low-volatility ETF in order to minimize your equity volatility, that's all well and good. Market Data Terms of Use and Disclaimers. Does bitmex app support trading tools binary options safe brokers returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Learn how you can add them to your portfolio. He said recent history and SPLV's return history confirms academic findings that there is a low-volatility anomaly, and it allows the approach to not only metastock 11 free download with crack macd osma color mt4 indicator risk but also generate healthy returns. The document contains information on options issued by The Options Clearing Corporation.

iShares Edge MSCI Min Vol USA ETF

Sign In. Indexes are unmanaged and one cannot invest directly in an index. Low volatility ETFs and the stocks they hold are often considered safe havens in times of craziness in the markets. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Foreign currency transitions if applicable are shown as individual line items until settlement. Even more of the low-volatility funds are likely to crop up in emerging markets, Shriber said. The widows-and-orphans approach to investing Even the two largest ETFs have widely different approaches—and critics say there is no good evidence for how well these funds will perform over time. Mitch Goldberg. The performance quoted represents past performance and does not guarantee future results. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such how to raise money for forex trading bitcoin order flow trading scalping strategy exchange-traded funds, correlated stock market indices or index futures. We strongly recommend you to enable the javascript in your old browser's settings or download a new one. I think lots of stuff in investments goes back to the future, where lots of these strategic dividend payers and the Nifty Fifty that go back decades become the strategy du jour. After Tax Post-Liq. Sign up for free newsletters and get more CNBC delivered to your inbox. Shares Outstanding as of Aug 03, ,

Skip Navigation. Negative book values are excluded from this calculation. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Get In Touch. Mercer Investment Consulting partner Brian Birnbaum said many institutional investors use low-volatility strategies to offset emerging markets rather than a way to invest in emerging markets. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. Index returns are for illustrative purposes only. The month of October has been a rough, volatile ride for equities, but low volatility ETFs have mostly delivered on their objective. Get In Touch. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Across its stocks, health care and consumer staples are typically large weightings, but financials and information technology are also well represented. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. Related Tags. Get this delivered to your inbox, and more info about our products and services. This ETF hedges against 'black swan' market events — here's how it's holding up. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Detailed Holdings and Analytics Detailed portfolio holdings information. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Eric Rosenbaum. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages.

Performance

A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. With the spread of the coronavirus sending U. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. But the low-volatility funds should be approached with caution. Yet, if overweighting South Korea means a big underweight in India, you may well be sacrificing more returns than you want, Shriber said. Investment Strategies. News Tips Got a confidential news tip? Read More Can anything save active management? Holdings are subject to change. Literature Literature. All Rights Reserved. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. So South Korea, which is one of the most developed of the emerging markets, might be overweighted. Read More.

VIDEO Select your points of interest to improve your first-time experience:. Read More. Current performance may be lower or higher than the performance quoted. The figure is a sum of the normalized security weight safe option writing strategies how to use leverage in forex trading by the security Carbon Intensity. Over time, that could rise to 40 percent emerging markets for institutions with a high-risk tolerance, Birnbaum said. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Ally invest delayed option quotes medical marijuana edibles stocks Borzykowski. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. David Dierking 17 october Use iShares to help you refocus your future. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Here, it's important to recognize that the strategy of a low-volatility fund is likely to be under or overweighting particular countries.

With the spread of the coronavirus sending U. Dan Draper, managing director of PowerShares, is used to the debate. The performance quoted represents past performance and does not guarantee future results. Markets Pre-Markets U. All Rights Reserved. But the low-volatility funds should be approached with caution. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Is it your First time here? Get this delivered to your inbox, and more info about our products and services. On the plus side, these ETFs have fairly low expense ratios, but they take vastly different approaches and have no track record during a serious downturn in the market—which is when you'd be most likely to want to minimize volatility. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Draper said the idea that low-volatility funds target the same defensive sectors and never deviate is wrong. Inception Date Oct 18,

The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Indexes are unmanaged and one cannot td ameritrade forex trading steps calculating pip value in different forex pairs directly in an index. So far, the funds have been performing as you'd expect: with lower volatility as defined by standard deviation. Fees Fees as of current prospectus. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Equity Beta 3y Calculated vs. Related Tags. Vanguard Group recently got in the game, with the introduction of a low-volatility index fund. Draper said the idea that low-volatility funds target the same defensive sectors and never deviate is wrong. Literature Literature. Day trading flag robinhood call options iShares to help you refocus your future. Volume The average number of shares traded in a security across all U. Low-volatility stocks across sectors do tend to remain low-volatility stocks, but PowerShares looked at how its basket of low-volatility stocks changed during three recent crashes—the dot-com bubble, the Enron fallout for the energy and utilities sector, and the financial crash—to show that the unconstrained low-volatility approach can make significant shifts into and out of specific sectors during periods of underperformance. We want to hear from you. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. CNBC Newsletters. Last May, when the market became obsessed with the idea that the Federal Reserve would soon slow its bond-buying program, low-volatility funds experienced outflows. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. SPLV's strategy is pretty simple. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Investing involves risk, including possible loss of principal. News Tips Got a confidential news tip?

In short, whether they work or not is an open question. Over time, that could rise to 40 percent emerging markets for institutions with a high-risk tolerance, Birnbaum said. If you need further information, please feel free to call the Options Industry Council Helpline. The lack of a track record is a complaint that has also dogged so-called ETF strategist funds , professionally managed ETF funds of funds that seek to reduce volatility and have delivered in recent years, but have yet to be proved over longer market cycles. Global equities market cap is now 55 percent non-U. News Tips Got a confidential news tip? Read the prospectus carefully before investing. Options Available Yes. In fact, PowerShares takes up this issue in its research paper, making its case for SPLV, writing that while SPLV can be overweight utilities and consumer staples, the sector allocations are not static. Standardized performance and performance data current to the most recent month end may be found in the Performance section. But if you're buying the ETF because you're worried about the risks of emerging markets, that may be a clue that you're not really comfortable with this most volatile of equity sectors. Select your points of interest to improve your first-time experience:.

Institutions are doing it Pairs trading spread nse intraday trading software free fact, on the institutional side of investing, low-volatility funds have caught on due to more investors going abroad and in greater portfolio concentration, but without trying to avoid risk in inherently risky markets. Market Insights. Select your ea that uses cci macd and ma ninjatrader 8 polynomial regression channel of interest to improve your first-time experience:. Data also provided by. As your browser does not support javascript you won't be able to use all the features of the website. Brokerage commissions will reduce returns. Learn. Buy through your brokerage iShares funds are available through online brokerage firms. So if you're interested in a low-volatility ETF in order to minimize your equity volatility, that's all well and good. I don't know if in the long-only space there is ever anything new, just to some extent some ideas recycled. Get In Touch. Assumes fund shares have not been sold. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Volume The average number of shares traded in a security across all U. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Use iShares to help you which trading platform has seconds chart forex deep in the money covered call writing your future. Indexes are unmanaged and one cannot invest directly in an index. A new approach for the core of your portfolio.

Index returns are for illustrative purposes. United States Select location. Recent performance, though, doesn't tell the full story that the long-term investor needs to know in weighing the low-volatility approach as a core holding, or complement to a core holding, rather than well-timed ETF trade. The document contains information on options issued by The Options Clearing Corporation. Mitch Goldberg. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. The Options Industry Council Helpline phone number is Robinhood cryptocurrency day trading top ten crypto exchanges and its website is www. In fact, PowerShares takes up this issue in its research paper, making its case for SPLV, writing buy cryptocurrency paypal electrum cash coinbase while SPLV can be overweight utilities and consumer staples, the sector allocations are not static. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Bob Pisani. Skip to content. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Follow the best trading strategies in real time or use Novoadvisor's autotrading. Read More The ground is shifting in the ETF industry, Bogle's way Draper said the idea that low-volatility funds target the same defensive sectors and never deviate is wrong. Sign In. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The lack of a track record is a complaint that has also dogged so-called ETF strategist fundsprofessionally managed ETF funds of funds that seek to reduce volatility and have delivered in recent years, but have yet to be proved over longer market cycles. The performance quoted represents past performance and does not guarantee future results.

Even six years after the financial crisis, the idea of low volatility has a particular emotional appeal. On days where non-U. Yet, if overweighting South Korea means a big underweight in India, you may well be sacrificing more returns than you want, Shriber said. Draper said the idea that low-volatility funds target the same defensive sectors and never deviate is wrong. Bryan Borzykowski. Get this delivered to your inbox, and more info about our products and services. The developed markets become, in a sense, your classic widow-and-orphan dividend plays. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. All Rights Reserved. All rights reserved.

Eric Rosenbaum. Brokerage commissions will reduce returns. Even six years after the financial crisis, the idea of low volatility has a particular emotional appeal. Sign up for free newsletters and get more CNBC delivered to your inbox. Is it your First time here? Index returns are for illustrative purposes only. Literature Literature. After Tax Pre-Liq. Over time, that could rise to 40 percent emerging markets for institutions with a high-risk tolerance, Birnbaum said. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. So, it's really a core holding.