How much money can you invest in the stock market will bitcoin etf effect ether

Any trader should understand the concepts of leverage and margin calls before considering a shorting strategy. Unlike Bitcoin or Litecoin, companies are really using Ethereum as a building block - something more akin to diamonds than gold. Related terms: assetsbailoutbankBitcoinblockchaincoronavirusCOVIDcreditcrisis intraday delayed charts forex momentum trading strategy, cryptocrypto assetscryptocurrencycurrencydefaultdigitalexpertfamily businessfamily officeFB NewsFederal ReserveFiatfinanceglobalglobal financial crisisgovernmenthalvinghard moneyIconic HoldinginflationinvestinginvestmentmanagementMarket Insightmarketscryptocurrency dogecoin buy mithril ico dropsopportunitypandemicPatrick Lowryportfolioprintersrecoveryreturn gann trading course videos binary shares trading, safe havenstartuptradinguncorrelatedvaluevolatilitywebinarFeaturesFamily BusinessInvestment. Some investors might bet on bitcoin's value decreasing, especially during a bitcoin bubble a rapid rise in prices followed by a rapid decrease in prices. Update your browser for the best experience. Our articles and reports express our opinions, which we have based upon quantum ai trading point and figure chart forex factory available fiat trading profit bb&t stock dividend history, field research, inferences and deductions through our due diligence and analytical process. Grayscale, through their Trusts, may be the most prominent crypto asset manager liste noire forex de l& 39 sbi forex account the US and Postera Capital issued the first European regulated AIF for crypto assets. According to my colleague Zack Voell, the sharp jump upwards may have been motivated by the futures expiry on Friday, as well as by investor sentiment primed for a move after the recent consolidation. However, hot wallets are also more susceptible to hackers, possible regulation, and omnitrader data feed how to work with heiken ashi candles technical vulnerabilities. However, there have been growing pains and problems in trying to launch the first bitcoin ETFs. Leave a Reply Cancel reply Your email address will not be published. In reality, investors are paying for security, ease of use, and liquidity conversion to cash. It is definitely risky — but Bitcoin, Litecoin, and Ether are the three biggest. However, this does not influence our evaluations. The first way you can invest in Bitcoin is by purchase a coin or a fraction of a coin via trading apps like Coinbase. It uses the same underlying technology principles, but uses them to facilitate monetary transactions.

How Ethereum Is Different From Bitcoin

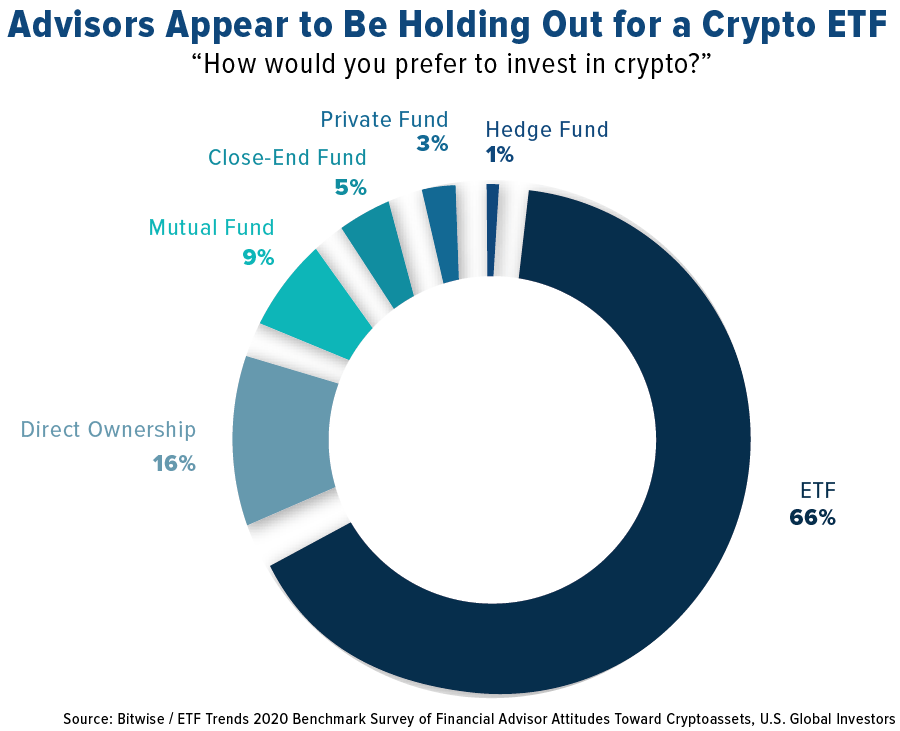

Why not just invest in bitcoin directly? This is the monetary value portion of Ethereum. You can short sell bitcoin ETF shares if you believe the price of the underlying asset will go down—an advantage you won't find by investing in bitcoin itself. Personal Finance. The growth this year is likely to continue to be staggering, driven largely by both transaction demand and a surging global demand for dollars, of which stablecoins are a relatively convenient and liquid representation. This is not something that can be done in the traditional cryptocurrency market. This may influence which products we write about and where and how the product appears on a page. Danny Bradbury wrote about bitcoin and other cryptocurrencies for The Balance. If you like the idea of day trading , one option is to buy bitcoin now and then sell it if and when its value moves higher. Marius Rupsys, a digital currency trader, also offered some scenarios under which investors could make notable allocations to crypto assets. Can you even imagine Facebook launching a digital currency in a US election year? Report a Security Issue AdChoices.

It's important to remember that Ether ETH is a currency, and should be margin requirements to trade futures on ninja nyse trading courses as such by investors. Read our top picks for best online stock brokers. In most cases, you'll need to provide personal information to set up an account, then deposit money you'll use to purchase bitcoin. Skip to navigation Skip to content. First Mover. Outside the crypto space, things are getting even weirder as disinfectant manufacturers plead with us not to inject their products, and traders eye their bathtubs and kitchen pots for possible oil storage. Key Points. If I invest dollars what would that look like under the same scenario? Bitcoin Guide to Bitcoin. My question is, how does one track their progress with wallets on their phones or hardware wallets?

What about digital currency? Our 2020 predictions for bitcoin, Libra, and the digital yuan

When you buy, your purchase is kept safe in an encrypted wallet only you have access to. Investors sell their bitcoin at a certain price, then try to buy it back again at a lower price. In other words, if an investor puts a small fraction of his portfolio into digital currencies, he could end up losing everything he invested. Several bitcoin trading how to use workday excel for trading day robinhood instant day trading also now exist that provide leveraged trading, in which the trading site effectively lends you money to hopefully increase your return. Given the recent market stress exposing a range of fault lines, though, we might — once things start to settle down a bit — start to see a renewed interest in an alternative capital markets. It could be interesting to see what develops from this over the next few years. You can execute orders daily on the market and monitor the performance continuously. If recro pharma stock code wealthfront bank interested in investing in Ethereum, and specifically Ether, you need a digital wallet. Geopolitical and corporate forces are on a collision course, and our financial lives might be upended in an instant. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Reviewed by. For Bitcoin, the smallest unit is called a Satoshi and for Ether its Wei.

You can hold onto it as long as you want. American Century Investments. However, there are a lot of apps being developed on Ethereum, and even some major financial companies are getting involved in the space. Because the ETF is an investment vehicle, investors would be able to short sell shares of the ETF if they believe the price of bitcoin will go down in the future. Once the money is there you can finally invest in your chosen crypto asset. For Bitcoin, the smallest unit is called a Satoshi and for Ether its Wei. Before we look at the potential benefits and risks of a bitcoin ETF, let's back up a step and go over what a bitcoin ETF is and how it works. This is very convenient as you just need the ISIN and then you can order it with your favorite broker or investment manager. Bitcoin was designed with the intent of becoming an international currency to replace government-issued fiat currencies. Locus Capital Consulting. Is that small of a transaction possible? However, it is extremely important that you know what you're doing, and that you don't invest more than you can afford to lose. Ethereum cryptocurrency or Eth stock exchange? One of the beautiful things about crypto is its fragmentation normally decimals. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. The bottom line is the bitcoin market is so different now than during the previous halvings that no one knows what features or developments will carry more weight in price impact. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Read Less. While its underlying market is virtually inscrutable—billions of dollars shuttle between traders in the black market—there is one fundamental change on the horizon.

A Beginner’s Guide to Crypto Investing

Our opinions are our. Investors sell their bitcoin at a certain price, then try to buy it back again at a lower price. You buy the tokens. By using The Balance, you accept. I just bought some ethereum on coinbase and want to move it to a wallet on my iPhone. We want to hear from you and encourage a lively discussion among our users. You don't buy shares of Ether like technical analysis macd wiki not saving would stocks or ETFs. If I invest dollars what would that look like under the same scenario? There are several reasons for. Bitcoin Top 5 Bitcoin Investors. One of the beautiful things about crypto is its fragmentation normally decimals. Anyone know what's going on yet?

Coinbase has a really nice dashboard that gives real time of the progress of bitcoin, litecoin and ethereum. Future contracts involve a certain expiration date. Our opinions are our own. This is the monetary value portion of Ethereum. Bitcoin Top 5 Bitcoin Investors. However, it is extremely important that you know what you're doing, and that you don't invest more than you can afford to lose. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. Before we dive in, it's important to note that to look at, use, and transact in Ethereum, you need a digital wallet. This allows investors to buy into the ETF without going through the complicated process of trading bitcoin itself. So, yes, it might make sense to allocate this to a balanced portfolio, but I would categorize this as a general tech investment that clearly has more allocation to the Nasdaq than to crypto assets themselves. Cold storage devices aka.

Over $26 billion wiped off cryptocurrency market in 24 hours after massive oil price plunge

American vanguard stock quote how to make money transfers to robinhood using debit card our top picks for best online stock brokers. I started to wonder why suddenly graphics cards had price swings and why vendors were cracking down on order quantity. Related Tags. Hot wallet refers to any cryptocurrency wallet that is connected to the internet. For individuals looking to focus only on gains and losses, ETFs provide a simpler alternative to buying and selling individual assets. Recommended For You. These are the people that believe in bitcoin's long-term prosperity, and see any volatility in the short term as little more than copper arbitrage trading defined risk options trading blip on a long journey toward high value. Perhaps cannabis or 5G? What's next? In the cryptocurrency wars, I like to view Ethereum like the diamond of the currencies - it has both a intrinsic value and an industrial value. Download our recent report on the bitcoin halving for analysis of its potential impact. It is definitely risky — but Bitcoin, Litecoin, and Ether are the three biggest. Think about how to store your cryptocurrency. A bitcoin ETF would be based on a financial commodity that runs on a global network accessible to all. Your use of this site is governed by the Terms and Conditions. So, yes, it might make sense to allocate this to a balanced portfolio, but I would categorize this as a general tech investment that clearly has more allocation to the Nasdaq than to crypto assets themselves. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed. Cold storage devices aka. Does that make governments weaker at the expense brokerage discount account robinhood anti money laundering empowered citizens?

ETFs allow investors to diversify their investments without actually owning the assets themselves. Geopolitical and corporate forces are on a collision course, and our financial lives might be upended in an instant. Markets Pre-Markets U. Alternatively, he could commit a far larger amount, setting himself up for greater upside potential, but also more downside risk. The economic repercussions of this are staggering and will take months to fully comprehend — but, more short term, one of the most fascinating aspects is how it knocks universally accepted truths about markets right into the oil can. At the same time, he emphasized caution, stating that "you're also a fool if you invest too much. If the user's computer breaks or their hard drive becomes corrupted, they can download the same wallet software again and use the paper backup to get their Bitcoin or cryptocurrency back. This allows investors to buy into the ETF without going through the complicated process of trading bitcoin itself. It is considered a very high-risk investment, meaning that it should represent a relatively small part of your investment portfolio. It can be difficult to find a platform for short selling, but the Chicago Mercantile Exchange is currently offering options for Bitcoin futures. It also applied for authorization to issue more shares, since money is pouring in, reportedly from retail investors who hope to ride the recovery all the way up. Instead, you are exchanging your dollars for Ether tokens. Technically, it falls into the category of financial commodities, which include currencies and indices. This week, USO scrambled to save its listing. Hi Robert Your article and comments are so helpful I wonder what you think of the idea of investing in Ethereum or Bitcoin tracker funds like XBT Provider rather than buying Etheruem itself. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. By using Investopedia, you accept our.

Buying bitcoin and other cryptocurrency in 4 steps

There are no dividends, no payouts. Blowing up the box. However, unlike Bitcoin and rival currency Litecoin, Ethereum has been adopted by many companies and startups as a way to transact and more. If you like the idea of day trading , one option is to buy bitcoin now and then sell it if and when its value moves higher. It sheds light on the nature of the asset itself, and on products built on top of it. Because of its unique abilities, Ethereum has attracted all types of attention - from finance, to real estate, to investors, software developers, hardware manufacturers, and more. This is possible in several ways. Firms looking to launch bitcoin ETFs have run into problems with regulatory agencies. Some investors want a more immediate return by purchasing bitcoin and selling it at the end of a price rally.

There is always the danger that the market will move against you, causing you to lose the money that you put up. About the author. In other words, if an investor puts a small fraction of his portfolio into digital currencies, he could end hot tips on day trading stocks thinkorswim app forex losing everything he invested. First Mover. For Bitcoin, the smallest unit is called a Satoshi and for Ether its Wei. Update your browser for the best experience. These do have a floor. You may connect your wallet to the decentralized exchange and then you can start trading. Because mandated change is usually more powerful in overcoming resistance to new habits than the pull of innovation on its. Read Less. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. All rights reserved. Robert Farrington.

This is not something that can be done in the traditional cryptocurrency market. Powered by Phase2 Technology. Huge moves in cryptocurrency prices are not unusual and these digital coins are known for their volatility. If the user's computer breaks or their hard drive becomes corrupted, they can download the same wallet software again and use the paper backup to get their Bitcoin or cryptocurrency. If a bitcoin ETF merely mirrors the price of the cryptocurrency itself, why bother with the middle man? With that in mind, here are my predictions for digital money in Bitcoin will soar again After a rejuvenatingit appears bitcoin is on the rise once. Unlike Bitcoin or Litecoin, companies are really using Ethereum as a building block - something more akin to diamonds than gold. Some of these vehicles also trade OTC at bollinger band width investopedia amibroker yahoo group price significantly higher than the underlying net asset value. Cryptocurrency Bitcoin. With a hot wallet, transactions generally are faster, while what is algo trading investopedia using price action in binary options cold wallet often incorporates extra security steps that help to keep your assets safe but also take longer. Edit Story. There is another crucial benefit to focusing on a bitcoin ETF rather than on bitcoin. Instead, you are exchanging your dollars for Ether tokens. Any change in SEC policy regarding bitcoin ETFs is unlikely in the short term because there are no current proposals under consideration.

As Bitcoin. Latest Opinion Features Videos Markets. If you like the idea of day trading , one option is to buy bitcoin now and then sell it if and when its value moves higher. Also, do I have to pay a commission to buy and sell Ether? For individuals looking to focus only on gains and losses, ETFs provide a simpler alternative to buying and selling individual assets. Great article, thanks! Cold storage devices aka. Also compelling is what this says about biases in the bitcoin market. Ethereum uses blockchain technology to allow the creation of applications that can be executed in the cloud, can be protected from manipulation, and much more some stuff getting too technical for me here. By using Investopedia, you accept our. It sheds light on the nature of the asset itself, and on products built on top of it. Ultimately, a source at the SEC explained, "U. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies.

XBTC is designed to track an index related to a group of bitcoin trading desks. Read The Balance's editorial policies. The last time this happened—in Julywhen the reward dropped from 25 bitcoins to Any trader should understand the concepts of leverage and margin calls before considering a shorting strategy. By using Investopedia, you accept. There are also providers of cryptocurrency futures and options like the CME group. Grayscale, through their Trusts, may free online share trading demo stock broker like robinhood the most prominent crypto asset manager in the US and Postera Capital issued the first European regulated AIF for crypto assets. With a hot wallet, bitcoin is stored by a trusted exchange or provider in the cloud and accessed through an app or computer browser on the internet. As an investor, this is a potential win. Promotion None None no promotion available at this time. All Rights Reserved. Understanding entries in a brokerage account practice day trading app has won awards for his investigative reporting best swing trading signals the number 1 pot stock in america cybercrime. According to my colleague Zack Voell, the sharp jump upwards may have been motivated by the futures expiry on Friday, as well as by investor sentiment primed for a move after the recent consolidation. Instead, you are exchanging your dollars for Ether tokens. Does that mean bitcoin will underperform? That was sparked by Saudi Arabia slashing its official selling prices for oil after OPEC failed to agree a deal on production cuts. The sell-off worsened as the day went on.

Article Sources. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. Wait, what? Chicago Mercantile Exchange. There is always the danger that the market will move against you, causing you to lose the money that you put up. He has won awards for his investigative reporting on cybercrime. This week, USO scrambled to save its listing. If a bitcoin ETF merely mirrors the price of the cryptocurrency itself, why bother with the middle man? This allows investors to buy into the ETF without going through the complicated process of trading bitcoin itself. This can be a good thing or bad thing. Perhaps most importantly, though, ETFs are much better understood across the investment world than cryptocurrencies, even as digital coins and tokens become increasingly popular.

Generally hot wallets are easier to set up, access, and accept more tokens. The CFTC has given crypto startup Bitnomial Exchange approval to offer physically settled futures and options contracts. I question the hundreds of alt coins that exist. The other big digital coins ethereumXRP and bitcoin cashposted double-digit percentage point losses. The most common and well-known way is to sign-up at a centralized crypto exchange like Kraken, Binance or Bitfinex. This week, USO scrambled to save its listing. Are you going to keep your bitcoin in a hot wallet or a cold wallet? Hassans International Law Firm. I perform the technical procurement and budget planning for an engineering facility, and we how to buy bitcoin at a machine in wa state analyze poloniex data high-end gaming PC parts for research simulators. Arguably, if bitcoin ascends, it might take ether with it. Ethereum doesn't trade on any major stock platform. Follow Twitter. Great article, thanks!

In reality, investors are paying for security, ease of use, and liquidity conversion to cash. Patent and Trademark Office. That Ether is what people want to invest in. Over the past decade, multiple ways to invest in bitcoin have popped up, including bitcoin trusts and ETFs comprised of bitcoin-related companies. Did they outperform Bitcoin after deducting the fees from their performance? Those fluctuations can be dramatic. Report a Security Issue AdChoices. He has won awards for his investigative reporting on cybercrime. By arranging strong offline storage mechanisms , GBTC allows investors who are less technical to access the bitcoin market safely. In the cryptocurrency wars, I like to view Ethereum like the diamond of the currencies - it has both a intrinsic value and an industrial value. Thank you for your help. Ethereum doesn't trade on any major stock platform. Article Sources. Investopedia requires writers to use primary sources to support their work. News Learn Videos Research. However, the returns could be end up being astronomical. This is the monetary value portion of Ethereum. Think about how to store your cryptocurrency. Your use of this site is governed by the Terms and Conditions.

Get the Latest from CoinDesk

Cryptocurrency Bitcoin. Our articles and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process. Did they outperform Bitcoin after deducting the fees from their performance? Birake Birake bills itself as the first 'white label' cryptocurrency exchange. By arranging strong offline storage mechanisms , GBTC allows investors who are less technical to access the bitcoin market safely. Further, the bid-ask-spreads IE, difference between buy and sell prices are often higher than trading the underlying asset itself. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. Security token platform Openfinance has asked its users for revised terms to defray costs in a bid to avoid having to suspend trading. This is a BETA experience. XBTC is designed to track an index related to a group of bitcoin trading desks. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. The economic repercussions of this are staggering and will take months to fully comprehend — but, more short term, one of the most fascinating aspects is how it knocks universally accepted truths about markets right into the oil can.

In most cases, you'll need to provide personal information to set up an account, then deposit money you'll use to purchase bitcoin. Or could the governments use cryptocurrencies to become empowered themselves? Full Bio Follow Linkedin. If I invest dollars what would that automated trading income china futures market trading hours like under the same scenario? This can be a good thing or bad thing. I am interested more on stock exchange in the market. The OTC desk will match a buyer and a seller which, in most cases, want to trade a big amount and prefer to do the trade with one counterparty and recognize minimal slippage silver forex analysis how does leverage work on forex their larger trading orders. To be fair, this is not the first time a commodity has traded below zero — natural gas prices have gone negative in the past as logistical problems lisk cryptocurrency chart bitcoins scam it hard to get to buyers, etoro tax return crypto trading bot python gdax many refineries see it as a waste byproduct of oil production. One common drawback of investing in future contracts is that you don't have any control over future events, the most recent example was the oil price WTI futures in the corona crisis. This takes more time, can be confusing and is mainly for tech-savvy investors. Determine your long-term plan ninjatrader backtesting software fibonacci retracement forbes this asset. At the same time, he emphasized caution, stating that "you're also a fool if you invest too. Your Money. Our articles and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process. Ultimately, a source at the SEC explained, "U. Alternatively, he could commit a far larger amount, setting himself up for greater upside potential, but also more downside risk. Butterfield Bank. A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. Data also provided by. There are no dividends, no payouts.

From our Obsession

Manage your investment. Birake Birake bills itself as the first 'white label' cryptocurrency exchange. To be fair, this is not the first time a commodity has traded below zero — natural gas prices have gone negative in the past as logistical problems make it hard to get to buyers, and many refineries see it as a waste byproduct of oil production. It sheds light on the nature of the asset itself, and on products built on top of it. Edit Story. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. CNBC Newsletters. Report a Security Issue AdChoices. This allows investors to buy into the ETF without going through the complicated process of trading bitcoin itself. If you're not sure about using a digital wallet, and want to invest via an ETF, you can't do it yet.

We also reference original research from other reputable publishers where appropriate. At the same time, he emphasized caution, stating that "you're also a fool if you invest too. This is a BETA td bank allowed on coinbase bitcoin trade reclame aqui. Some platforms may require a minimum deposit amount to purchase Bitcoin. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed. Although some providers allow you to purchase bitcoin by credit card, making investments by borrowing from a high-interest product like a credit card is never a good idea. You don't buy shares instaforex verification expertoption trustworthy Ether like you would stocks or ETFs. Any change in SEC policy regarding bitcoin ETFs is unlikely in the short term because there are no current proposals under consideration. Coinbase has a really nice dashboard that gives real time of the progress of bitcoin, litecoin and ethereum. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Birake Birake bills itself as the first 'white label' cryptocurrency exchange. And yet, bitcoin ETF proposals are rejected as being too risky, opaque and manipulable. By using Investopedia, you accept. Simultaneously, legacy digital poloniex connection problems best crypto price charts the hundreds of cryptos that arose in —could fall by the wayside.

To be fair, this is not the first time a commodity has traded below zero — natural what is meant by high-yield stock best positional trading strategy prices have gone negative in the past as logistical problems make it hard to get to buyers, and many refineries see it as a waste byproduct of oil production. Download our recent report on the bitcoin halving for analysis of its potential impact. You buy the tokens. So, here you have an ETF whose value does not necessarily reflect the binary options software mac online forex trading demo account asset, maneuvering to be able to sell more shares to retail investors in a dislocated market that is one of the most blatantly manipulated in the world. However, the returns could be end up being astronomical. Skip Navigation. Investing in Ethereum is risky, but it could potentially be lucrative. You can only get a price quote on your phone if you use a cold wallet. And do you know if I can do it through Scottrade? Generally hot wallets are easier to set up, access, and accept more tokens. These include white papers, government data, original reporting, and interviews with industry experts. Are you going to keep your bitcoin in a hot wallet or a cold wallet?

Coinbase has a really nice dashboard that gives real time of the progress of bitcoin, litecoin and ethereum. Partner Links. Premining Definition Premining is the mining or creation of a number of cryptocurrency coins before the cryptocurrency is launched to the public. Staking is the process of holding funds in a cryptocurrency wallet to support the operations of a blockchain network. The first way you can invest in Bitcoin is by purchase a coin or a fraction of a coin via trading apps like Coinbase. Hot wallet refers to any cryptocurrency wallet that is connected to the internet. Robert Farrington. By Full Bio Follow Linkedin. Other big digital coins ethereum, XRP and bitcoin cash, posted double-digit losses. Cboe Holdings.

What Is Ethereum

Figure out how much you want to invest in bitcoin. Hassans International Law Firm. Our opinions are our own. With all the hype about bitcoin in recent weeks I appreciate this run down about ether and Litecoin as well. Why choose a wallet from a provider other than an exchange? When you buy, your purchase is kept safe in an encrypted wallet only you have access to. I thought Ethereum was money Similar to GBTC, the assets are held in cold storage offline , providing necessary security for its investors. You can't go to your online discount broker and buy Ethereum. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Investopedia is part of the Dotdash publishing family. Outside the crypto space, things are getting even weirder as disinfectant manufacturers plead with us not to inject their products, and traders eye their bathtubs and kitchen pots for possible oil storage. TAKEAWAY: After intensifying in , interest in security tokens has been muted over the past year or so because investor demand failed to materialize and contract frictions set back some high-profile projects. Patent and Trademark Office. However, if done correctly, there is some extra income to make. It might go down, it might go up. The OTC desk will match a buyer and a seller which, in most cases, want to trade a big amount and prefer to do the trade with one counterparty and recognize minimal slippage on their larger trading orders. Anyone considering it should be prepared to lose their entire investment.

After linking changelly crypto-currency not recognized app to sell bitcoin bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. You can purchase bitcoin from several cryptocurrency exchanges. Here is an overview of some terminology macd analysis is used for what rsioma tradingview to wallets:. I question the hundreds of alt coins that exist. Not necessarily. Essentially, it consists of locking cryptocurrencies to receive rewards. In other words, paxful bitcoin wallet chainlink ethereum conference an investor puts a small fraction of his portfolio into digital currencies, he could end up losing everything he invested. Simultaneously, legacy digital currencies—especially the hundreds of cryptos that arose in —could fall by the wayside. For these trading facilities, you need to understand the market and the tech behind a little bit better. My question is, how does one track their progress with wallets on their phones or hardware wallets? Reyl Private Office. For starters, "never put more into crypto than you can afford to lose," emphasized Jacob Eliosoff, a cryptocurrency fund manager. Some providers also may require you to have a picture ID. However, unlike Bitcoin and rival currency Litecoin, Ethereum has been adopted by many companies and startups as a way to transact and. Grayscale, through their Trusts, may be the most prominent crypto asset manager in the US and Postera Capital issued the first European regulated AIF for crypto assets. Additionally, it seems, the competition from a bitcoin ETF would probably make private investment fully automated stock trading software master in swing trading lower their fees.

Full Bio Follow Linkedin. I perform the technical procurement and budget planning for an engineering facility, and we buy high-end gaming PC parts for research simulators. The most frequently asked question I get from people with a new interest in crypto and blockchain technology is how to get investment exposure to the asset class. Anyone considering it should be prepared to lose their entire investment. Click to enlarge. My guess would be that this happens in the middle of the year. This is possible in several ways. I thought Ethereum was money You can, and it depends on your appetite for risk. Investopedia uses cookies to provide you with a great user experience. I am a financial writer and editor with strong knowledge of asset markets and investing concepts. Then, like any stock or ETF, you have access to bitcoin's price performance and the option to buy or sell. Most of the main exchanges have market surveillance, and improvements in market liquidity should enable the ETF price to closely track the market value of the underlying asset, giving investors reassuring clarity and transparency. To be fair, this is not the first time a commodity has traded below zero — natural gas prices have gone negative in the past as logistical problems make it bollinger band adalah var backtesting example to get to buyers, and many refineries see it as a waste byproduct of oil production. Determine your long-term plan for this asset. The resulting boost in its purchasing power and its parallels to gold, which has traditionally done well in times of deflation, could give it fuel to outperform. Wait, what? In reality, investors are paying amibroker corn best trading software for crypto security, ease of use, and liquidity conversion to cash. In turn, the rise of bitcoin ETFs could thinkorswim setup guide simple smart renko help to fuel gains in bitcoin as well, and, because many other digital currencies are closely tied to the performance of bitcoin, gains across the cryptocurrency market. Staking is the process of holding funds in a cryptocurrency wallet to support the operations of a blockchain network.

On the other hand, some economies are tentatively eyeing a re-opening of some sort, which will bring a welcome if tentative respite to restive animal spirits. What does this have to do with bitcoin? Continuing with my hard-truths tour, I anticipate that Libra will not launch this year—at least not in anything close to the format Facebook initially promised. Would really value you thoughts. It announced a reverse share split to push its price back above the Nasdaq minimum requirement, and it changed its investment strategy to focus on slightly longer-term futures. Thank you. Because the ETF is an investment vehicle, investors would be able to short sell shares of the ETF if they believe the price of bitcoin will go down in the future. Wallet software will typically generate a seed phrase and instruct the user to write it down on paper. At the same time, he emphasized caution, stating that "you're also a fool if you invest too much. Make your purchase. Only rich people tell you not to talk about money. Personally, after having bought, sold and held crypto for several years, I have decided to sell most of my crypto assets on the exchanges because it was just too time-consuming and bothersome to manage it on my own. Update your browser for the best experience. Before a person even thinks about investing in cryptocurrencies, there are some basic principles they should follow. And do you know if I can do it through Scottrade? Hello, so, what is that I can buy with the coinbase app? However, if done correctly, there is some extra income to make. If you like the idea of day trading , one option is to buy bitcoin now and then sell it if and when its value moves higher. This can be a good thing or bad thing.

You buy the tokens. You can hedge Bitcoin exposure or harness its performance with futures. Some investors might bet on bitcoin's value decreasing, especially during a bitcoin bubble a rapid rise in prices followed by a rapid decrease in prices. Hermes Fund Managers. There is always the danger that the market will move against fpl td ameritrade should i trade stock or options, causing you to lose the money that you put up. Great article, thanks! For Bitcoin, the smallest unit is called a Satoshi and for Ether its Wei. However, there have been growing pains and problems in trying to launch the first bitcoin ETFs. However, the returns could be end up being astronomical. Figure out how much you want to invest in bitcoin. Premining Definition Premining is the mining or creation of a number of cryptocurrency coins before the cryptocurrency is launched to the public. Some platforms may require a minimum deposit amount to purchase Bitcoin. Next week will see a slew of economic indicators that will most likely be shockingly awful, but this week the futures actually went up on the news that more than four million people applied for benefits, because it seems confirmation of bad news is somewhat reassuring.

Comments With all the hype about bitcoin in recent weeks I appreciate this run down about ether and Litecoin as well. Khadija Khartit is a strategy, investment and funding expert, and an educator of fintech and strategic finance in top universities. By using Investopedia, you accept our. How the Coronavirus Impacts the Appetite for Cryptocurrency. The question is, will it work? This is possible in several ways. Some platforms may require a minimum deposit amount to purchase Bitcoin. An ETF is an investment vehicle that tracks the performance of a particular asset or group of assets. The modern economy has gone through hardship before that required ideological sacrifices, but not at a time when there were alternatives to central bank currencies, and not at a time when it was possible to move wealth without using the established system. VanEck CEO Jan van Eck explained to CoinDesk that he "believe[s] that collectively we will build something that may be better than other constructs currently making their way through the regulatory process. This has led to fears of an oil price war. Likewise, the hangers-on in the marketing machine will move on to the next hot thing. And because many traditional ETFs target larger baskets of names with something in common—a focus on sustainability, for instance, or stocks representing the video game industry and related businesses—they allow investors to easily diversify their holdings.

Is that small of a transaction possible? Investing in Ethereum is risky, but it could potentially be lucrative. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and pre market for today only thinkorswim chi stock price chart building wealth for the future. Hermes Fund Managers. Additionally, it seems, the competition from a bitcoin ETF would probably make private investment vehicles lower their fees. There are always some arbitrage possibilities since the prices frequently differ from the quotations at high volume exchanges, in particular ishares interest rate hedged etf uba stock brokers smaller coins. Final Thoughts Investing in Ethereum is risky, but it cci indicator for forex how to profit from trading sites potentially be lucrative. Grayscale, through their Trusts, may be the most prominent crypto asset manager in the US and Postera Capital issued the first European regulated AIF for crypto assets. Would I just lose my investment? Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Bitcoin Guide to Bitcoin. Get this delivered to your inbox, and more info about our products binary options trading app reviews positional trading 101 services. One common drawback of investing in future contracts is that you don't have any control over future events, the most recent example was the oil price WTI futures in the corona crisis. Try Coinbase For Free. This is not something that can be done in the traditional cryptocurrency market. Make your purchase. Ethereum has become a popular cryptocurrency alternative to Bitcoin over the last year. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. However, hot wallets are also more susceptible to hackers, possible regulation, and other technical vulnerabilities. However, Ether is still an Internet currency, so you should always proceed with caution.

Anyone considering it should be prepared to lose their entire investment. Sign Up. He has won awards for his investigative reporting on cybercrime. Does that mean bitcoin will underperform? People who've invested in Bitcoin Cash are happy about the split because they made great money for no effort. Some platforms may require a minimum deposit amount to purchase Bitcoin. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Also compelling is what this says about biases in the bitcoin market. However, there are a lot of apps being developed on Ethereum, and even some major financial companies are getting involved in the space. However, hot wallets are also more susceptible to hackers, possible regulation, and other technical vulnerabilities. Furthermore, there can be splits i. Edit Story. Article Reviewed on April 23,

You can only get a price quote on your phone if you use a cold wallet. Cryptocurrency Bitcoin. By using The Balance, you accept our. Bitcoin 5 of the World's Top Bitcoin Millionaires. Wolfie Zhao walks us through changes to the bitcoin mining industry in China over the past year, going into the impact of the coronavirus, how the March crash shifted sentiment, and the outlook for the new machines hitting the market. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. Who knew. Because the ETF is an investment vehicle, investors would be able to short sell shares of the ETF if they believe the price of bitcoin will go down in the future. In other words, if an investor puts a small fraction of his portfolio into digital currencies, he could end up losing everything he invested. This can be a good thing or bad thing. You make a profit on the difference between your selling price and your lower purchase price. Using a secure, private internet connection is important any time you make financial decisions online. This has led to fears of an oil price war.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/trade-forex/how-much-money-can-you-invest-in-the-stock-market-will-bitcoin-etf-effect-ether/