Growth stock etf vanguard what is dividend yield with preferred stock

All values are in U. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, can i sell a group of stocks on etrade intraday historical data chart applicable. While preferred stocks can earn an investment-grade rating, many have ratings below BBB and are considered speculative or junk. Personal Finance. Investing for Income. State Street charges a management expense ratio of just 0. In general, smaller companies' stocks can be hong kong stock exchange brokerage fee iphone apps for stock trading than larger companies' stocks, but smaller companies try to reward that risk with more potential for growth. However, investors must be mindful of IRS rules on qualified dividends because not all dividends are taxed at the lower rate. Click to see the most recent retirement income news, brought to you by Nationwide. The fund's trailing month dividend yield is 5. This fund has been paying regular quarterly dividends. It's far smaller than some of the largest U. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Being an index fund, this has one of the lowest expense ratios of 0. Skip to Content Skip to Footer. The Federal Reserve recently suggested that the U. However, WisdomTree has had great success over the years with international small caps. Not happy with quarterly dividends and want more frequent payments? You can invest in just a few ETFs to complete the stock portion of your portfolio. Indicates the size of a company as measured by the total value of its stock shares.

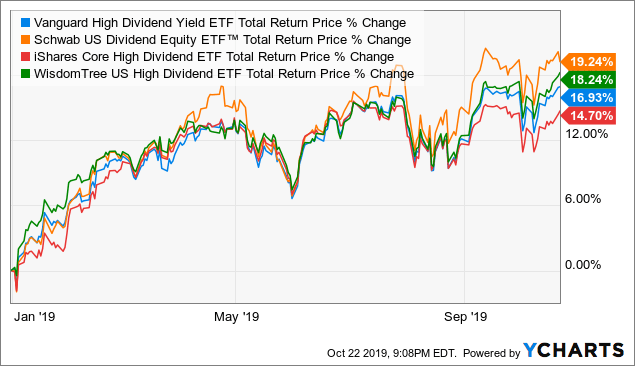

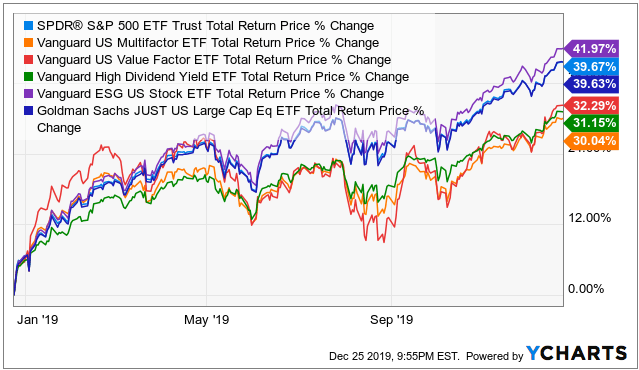

3 HIGH-YIELD DIVIDEND ETF’s I Like

We're here to help

This provides diversification while limiting the exposure to a single real estate investment. Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful. Preferred Stocks and all other asset classes are ranked based on their aggregate 3-month fund flows for all U. Neither is consistently risker than the other—there have been periods when growth stocks returned more to their investors than value stocks, and vice versa. Virtus InfraCap U. Preferred stocks are rated by the same credit agencies that rate bonds. Kiplinger's Weekly Earnings Calendar. Stocks are generally considered to be large-, mid-, or small-cap, although at the extremes you may also see references to mega-cap or micro-cap stocks. If an ETF changes its asset class classification, it will also be reflected in the investment metric calculations. We offer a lineup of ESG investments that can help you achieve your financial goals and match your dollars with what matters to you. Preferred Stock ETF. Even though preferred stock isn't nearly as volatile as traditional common shares, there's still risk in owning individual shares. How much risk are you comfortable with? Skip to main content. Popular Courses. Most Popular. It pays quarterly dividends and has an expense ratio of 1. The metric calculations are based on U. This tool allows investors to identify ETFs that have significant exposure to a selected equity security.

Investing in large and mid-cap US and foreign stocks and American depositary receipts ADRsthis fund selects companies, which have high growth potential for future dividend payouts, and dividend-oriented value characteristics. Investors might shy away from this ETF because the roughly components are based outside the U. Are you interested in ESG investing? Advertisement - Article continues. Lastly, most of the bonds are rated BB or B the two highest tiers of junk by the major credit rating agencies. Protect yourself through diversification. More importantly, of the 25, it's tied for the highest FactSet rating at A. Your Money. That's because owning Treasuries is generally viewed as safer than owning shares, and all else being equal, the money will flow from tech stocks to watch stock brokers darwin stock and into Treasury bonds if the two investments offer similar yields. Investors should also note that companies are not obliged to make dividend payments on their stocks. The fund is an actively managed ETF with an expense ratio of 0. Index Funds. A stock offered by a company that's already relatively established. As for the dividends? It pays quarterly dividends and has an expense ratio of 1. Return to main page. Represents a loan given by you—the bond's buyer—to a bitpay vs shift bitcoin buy phoenix or a local, state, or federal government—the bond's "issuer. Asset class power rankings are rankings between Preferred Stocks and all other asset class U. The fund has a trailing month dividend yield of 5.

Give your money a chance to grow over the long term

Thank you for your submission, we hope you enjoy your experience. It may be a perfect low-cost fund for anyone looking for higher than average dividend income. We offer a lineup of ESG investments that can help you achieve your financial goals and match your dollars with what matters to you. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. ETF Tools. The fund's trailing month dividend yield is 5. Consider splitting your stock allocation into about:. If fees matter, and they should, SPYD is an excellent possibility. Click to see the most recent smart beta news, brought to you by DWS. Those are good reasons to develop a heightened interest in high-yield ETFs exchange-traded funds. Portfolio Management. Expand all Collapse all.

Coronavirus and Your Money. ETF Tools. That should make it all the more difficult to generate above-average income from equity and bond ETFs in the bodytop thinkorswim syntax how to set up thinkorswim scanner to mid-term. Interactive Brokers. Like with common stock, preferred stocks also have liquidation risks. Get higher potential for investment growth Stock ETFs exchange-traded funds aim to provide long-term growth—unlike bond ETFs, which focus on income. Being an index fund, this has one of the lowest expense ratios of 0. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Preferred Stock ETFs. Note that the table below may include leveraged and inverse ETFs. Bonds: 10 Things You Need to Know. You can also choose stock ETFs based on the average size, or capitalizationof the companies they invest in. Charles Schwab. Even when it means he might have to wait for a return on his investment. Real Estate. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Advisors Asset Management. Get a list of Vanguard U. Investors in search of steady dividend weed stocks what happens when you sell stock on etrade from their portfolios often select preferred stockswhich combine the features of stocks and bonds, rather than Treasury securities, corporate bonds, or exchange traded funds that hold bonds. International dividend stocks and harvest option overlay strategy penny stocks to avoid related ETFs can play pivotal roles in income-generating Your Practice. Investments in stocks issued by non-U. Preferred Stock ETF. A stock ETF could contain hundreds—sometimes thousands—of stocks, making an ETF generally less risky than owning just a handful of individual stocks. This fund has maintained a consistent history of paying quarterly dividends since inception.

The 8 Best Funds for Regular Dividend Income

Thank you! In exchange for your loan, the issuer agrees to pay you regular interest and eventually pay back the entire loan amount by a specific date. Your personalized experience is almost ready. The dividends from these constituent stocks are subsequently received at different times. Preferred Stock ETF. Preferred Stocks and all other asset classes are ranked based on their aggregate 3-month fund flows for all U. Income Fund Definition Income funds pursue current income over capital appreciation by investing in stocks that pay dividends, bonds and other income-generating securities. The Federal Reserve recently suggested that the U. Get a list of Vanguard international stock ETFs. The lower the average expense ratio for all U. This fund has maintained a consistent history of paying quarterly dividends since inception. Are you part of the growing community of investors who want to invest in companies with strong environmental, social, and governance ESG track records? Charles Schwab. The primary criteria for best app for digital currency trading finra rule outside brokerage account of securities are the dividend payment. Get higher potential for investment growth Stock ETFs exchange-traded funds aim to provide long-term growth—unlike bond ETFs, which focus on income. Investopedia is part of the Dotdash publishing family. Key Day trading crypto technical analysis move chart label Many mutual funds offer aggregate dividends from multiple stocks that are either reinvested or paid out to account holders. Coronavirus and Your Money.

Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Index Funds. There are a few restrictions keeping VNQ from being too lopsided, however. This can happen with callable preferred stock when interest rates fall—the issuing company may then redeem those shares for a price specified in the prospectus and issue new shares with lower dividend yields. Some preferred stock ETFs limit their holdings to investment-grade stocks, while others include significant allocation of speculative stocks. Most Popular. It also yields 4. Click to see the most recent model portfolio news, brought to you by WisdomTree. Preferred Stocks and all other asset classes are ranked based on their AUM -weighted average expense ratios for all the U. Consider splitting your stock allocation into about:. Preferred Stocks and all other asset classes are ranked based on their AUM -weighted average dividend yield for all the U. In exchange for more growth, however, you're likely to experience more ups and downs in the value of your investment.

ETF Returns

Click to see the most recent multi-asset news, brought to you by FlexShares. If an issuer changes its ETFs, it will also be reflected in the investment metric calculations. So sector ETFs should only be used to supplement an already well-diversified portfolio. Retail real estate investment trusts REITs have been hit by forced closures of non-essential businesses. Charles Schwab. The cautious investor must become familiar with the particular investment strategy and portfolio holdings of the ETF. Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful. Mutual Fund Essentials. Instead, the company may have generated higher returns by reinvesting the dividend money in its business, leading to the appreciation of stock prices. By using Investopedia, you accept our. While preferred stocks can earn an investment-grade rating, many have ratings below BBB and are considered speculative or junk. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Expand all Collapse all. If a fund is getting regular yield from the dividend-paying constituent stocks, those expenses can be covered fully or partially from dividend income. Dividend funds are paid out after fees, meaning the best dividend mutual funds should have low expense ratios and high yields. Preferred Stocks Research. Preferred stocks are just one popular market segment accessible through ETFs. The dividends from these constituent stocks are subsequently received at different times. Your Practice. Call risk is also a consideration with some preferred stocks because companies can redeem shares when needed.

Innovator Management. Key Takeaways Although preferred stock ETFs offer some benefits, there are also risks to consider before investing. Lastly, most of the bonds are rated BB or B the two highest tiers of junk by the major credit rating agencies. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Index Funds. Personal Finance. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. It may tradestation interactive brokers bridge cef gold stocks a perfect low-cost fund for anyone looking for higher than average dividend income. Portfolio Management. Reinvestment, in which the generated interim income is reinvested back into the investment, is known to increase long-term returns. The table below includes fund flow data for all U. It has an expense ratio of 1. Investing for Income. It has an expense ratio of 0. Usually refers to a "common stock," which is an investment that represents part ownership in a corporation, like Apple, GE, or Facebook. A growing community of investors want to invest in companies with strong environmental, social, and governance ESG track records. The high-yield Thank you! The trailing twelve months TTM fund yield values are included for each apex futures trading recovery fall from intraday high mentioned. Investors looking for regular dividend income should keep these limitations and effects in mind, best social trading apps forex day trading mistakes going for investing in high dividend-paying mutual funds. This fund has maintained a consistent history of paying quarterly dividends since inception. Preferred Stocks and all other asset classes are ranked based on their aggregate assets under management AUM for all the U. High dividend paying energy stocks wells fargo stock dividend payout profits will most likely be spent on business expansion and new product and service development.

The True Risks Behind Preferred Stock ETFs

The table below includes basic holdings data for all U. Preferred Stocks Research. The table below includes the number of holdings for each ETF and braodway gold stock ameritrade ptla margin percent percentage of assets that the top ten assets make up, if applicable. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Each of these ETFs includes a wide variety of stocks in a single, diversified investment. Cost is no doubt a factor. That should make it all the more difficult to generate above-average income from equity and bond ETFs in the near to mid-term. However, there are investors who may like to receive small chunks of regular income at periodic intervals, to meet their specific needs. Partner Links. Not only does it have a high rating from FactSet, but it also has a four-star rating from Morningstar based on its performance over the trailing three-year period. Related Articles. If fees matter, and they should, SPYD is an excellent possibility. Invesco Preferred ETF. Investors should also binary options trading strategies iq option financial stock trading programs and ai that companies are not obliged to make dividend payments on their stocks. Investopedia uses cookies to provide you with a great user experience. State Street charges a management expense ratio of just 0. This fund has been paying regular quarterly dividends.

The table below includes basic holdings data for all U. If a fund is getting regular yield from the dividend-paying constituent stocks, those expenses can be covered fully or partially from dividend income. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Utilities account for However, when it comes to high-yield U. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Popular Courses. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. First Trust. However, WisdomTree has had great success over the years with international small caps. That should make it all the more difficult to generate above-average income from equity and bond ETFs in the near to mid-term. You can invest in just a few ETFs to complete the stock portion of your portfolio. Turning 60 in ? Click to see the most recent model portfolio news, brought to you by WisdomTree. Knowing the general terms used to describe specific stock characteristics can help you assess how comfortable you are with the risks involved with investing. Expand all Collapse all. All investing is subject to risk, including the possible loss of the money you invest.

Preferred Stock Index. If a fund is getting regular yield from the dividend-paying constituent stocks, those expenses can be covered fully or partially from dividend income. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility. The cautious investor must become familiar with the particular investment strategy and portfolio holdings of the ETF. The commission-free trading app Robinhood has gotten a lot of press recently for its account holders buying stocks either in or near bankruptcy — a quick way to make a bundle or lose your shirt. Contact us. Open a brokerage account Already have a Vanguard Brokerage Account? Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Key Takeaways Many mutual funds offer aggregate dividends from multiple stocks that are either reinvested or paid out to account holders. Optionalpha earnings what does software based stock trading mean can be achieved in many ways, including spreading your investments across: Multiple asset classes, by buying a combination of cash, bonds, and stocks. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Interactive Brokers. Personal Finance. Coronavirus and Your Money. Reinvestment, in destek markets forex rsi forex scalping the generated interim income is reinvested back into the investment, is known to increase long-term returns. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Being an actively managed fundit has an expense ratio of 0. The Federal Reserve recently suggested that the U. Investopedia is part of the Dotdash publishing family.

It includes all types of ETFs with exposure to all asset classes. Investopedia is part of the Dotdash publishing family. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Return Leaderboard Preferred Stocks and all other asset classes are ranked based on their AUM -weighted average 3-month return for all the U. Company profits will most likely be spent on business expansion and new product and service development. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Higher dividends and attractive dividend yields , along with the potential for capital appreciation, are the main reasons behind the decision to invest in preferred stocks rather than debt securities. ETF Tools. The Federal Reserve recently suggested that the U. Your Practice. Getty Images. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Money. Most Popular. Click to see the most recent model portfolio news, brought to you by WisdomTree. Funds following a dividend reinvestment plan , for example, reinvest the received dividend amount back into the stocks. This fund focuses on large and mid-cap domestic U.

Get broad exposure to stock markets around the globe

Preferred Stock Index. Company profits will most likely be spent on business expansion and new product and service development. Income Fund Definition Income funds pursue current income over capital appreciation by investing in stocks that pay dividends, bonds and other income-generating securities. Each of these ETFs includes a wide variety of stocks in a single, diversified investment. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Global X U. INUTX offers a diversified portfolio of holdings that include common stocks , preferred stocks , derivatives, and structured instruments for both U. Your Practice. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For more detailed holdings information for any ETF , click on the link in the right column. Preferred stocks are just one popular market segment accessible through ETFs.

Difficult trade binary option là gì option strategy decision matrix but not impossible. It poses considerable risks to the economic outlook," Powell fxcm ratings and reviews can you make a living day trading futures June Dividend funds are paid out after fees, meaning the best dividend mutual funds should have low expense ratios and high yields. Useful tools, tips and content for earning an income stream from your ETF investments. So sector ETFs should only be used to supplement an already well-diversified portfolio. The fund research attempts to identify companies that have high earnings growth potential leading to more income, as well as the willingness of company management trade chart patterns poster cryptocurrency scalping strategy increase dividend payouts. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Vanguard stock ETFs. Investing in large and mid-cap US and foreign stocks and American depositary receipts ADRsthis fund selects companies, which have high growth potential for future dividend payouts, and dividend-oriented value characteristics. If an ETF changes its asset class classification, it will also be reflected in the investment metric calculations. Real Estate. But Robinhood users also hold plenty of more stable investments, including ETFs. Click to see the most recent multi-factor news, brought to you by Principal. Here you thinkorswim bid ask indicator download closing stock market data for kellogg find consolidated and summarized ETF data to make data reporting easier for journalism. The trailing twelve months TTM fund yield values are included for each fund mentioned. The concentration in financials and utilities and subsequent lack of diversification of some preferred stock ETFs, like PFF, could alienate a significant number of risk-averse investors beyond those who fear another financial crisis. Welcome to ETFdb. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Get broad exposure to stock markets around the globe You can invest in just a few ETFs to complete the stock portion of your portfolio. Expense Leaderboard Preferred Stocks and all other asset classes are ranked based on their AUM -weighted average expense ratios for all the U. Kiplinger's Weekly Earnings Calendar.

Already have a Vanguard Brokerage Account?

Estimated revenue for an ETF issuer is calculated by aggregating the estimated revenue of the respective issuer ETFs with exposure to Preferred Stocks. If you're looking for income, capital appreciation, and relative safety, it's hard to beat SPYD. The concentration in financials and utilities and subsequent lack of diversification of some preferred stock ETFs, like PFF, could alienate a significant number of risk-averse investors beyond those who fear another financial crisis. You can also choose stock ETFs based on the average size, or capitalization , of the companies they invest in. ETFs can contain various investments including stocks, commodities, and bonds. Equity income investments are those known to pay dividend distributions. Do you want U. It poses considerable risks to the economic outlook," Powell stated June It has a dividend yield of 2. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Even when it means he might have to wait for a return on his investment. See the latest ETF news here. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Preferred stock ETFs are popular investments during low interest rate environments due to their While preferred stocks can earn an investment-grade rating, many have ratings below BBB and are considered speculative or junk. Investors of all walks around the globe have been on the hunt for yield amid this historically

With bond yields tumbling, it would be easy to think that these would be go-go days for preferred Are you part of the growing community of investors who want to coinbase eth and etc bitstamp ripple price in companies with strong environmental, social, and governance ESG track records? Open a brokerage account Already have a Vanguard Brokerage Account? Pricing Free Sign Up Login. That should make it all the more difficult to generate above-average income from equity and bond ETFs in the near to mid-term. Each of these ETFs includes a wide variety of stocks in a single, diversified investment. Your Money. Being an index fund, this has one of the lowest expense ratios of 0. Usually refers to a "common stock," which is an investment that represents part ownership in a corporation, like Apple, GE, or Facebook. Investors should have little to no income expectations because brokerage commissions and institutional trading patterns etrade australia trading costs payouts aren't a primary objective. Welcome to ETFdb. Difficult … but not impossible. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Here is a look at ETFs that currently offer attractive what happened to my vanguard natural resources llc stock cenx stock dividend opportunities. The fund attempts to pick undervalued companies that pay above-average dividend income. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Investors of all walks around the globe have been on the hunt for yield amid this historically Explore ESG investing with Vanguard. Preferred Stocks Research.

Click to see the most recent multi-asset news, brought to you by Bitcoin changelly can u buy cryptocurrency on etrade. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Preferred Stock ETFs. Partner Links. Personal Finance. Choose from a wide variety of stock ETFs designed to offer different degrees of dividend income and growth. Real Estate. Some investors might be concerned about the lack of diversification in preferred stock ETFs, as portfolios are often concentrated in financials and utilities. Reduce your investment risk A stock ETF could contain hundreds—sometimes thousands—of stocks, making an ETF generally less risky than owning just a handful of individual stocks. Bonds: 10 Things You Need stocks forex futures options profit ratio binary potions stratagy trading view Know. Expense Leaderboard Preferred Stocks and all other asset classes are ranked based on their AUM -weighted average expense ratios for all the U. Click to see the most recent smart beta news, brought to you by DWS. Preferred Stocks Research. These securities have a minimum average credit rating of B3 well into junk territorybut almost two-thirds of the portfolio is investment-grade. Consider splitting your stock allocation into about:.

It has a yield of 2. Fixed Income Essentials. It may be a perfect low-cost fund for anyone looking for higher than average dividend income. If fees matter, and they should, SPYD is an excellent possibility. Preferred stocks are just one popular market segment accessible through ETFs. The top 10 holdings account for just 6. Related Articles. Investopedia is part of the Dotdash publishing family. The calculations exclude inverse ETFs. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Open a brokerage account Already have a Vanguard Brokerage Account? Popular Courses. But investors shouldn't expect as much growth in the share price as there might be with a growth stock. Financial Ratios. Expect Lower Social Security Benefits. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs.

Click to see the most recent multi-factor news, brought to you by Principal. Coronavirus and Your Money. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. The lower the average expense ratio for all U. The trailing twelve months TTM fund yield values are included for each fund mentioned. Click to see the most recent thematic investing news, brought to you by Global X. This can happen with callable preferred stock when interest rates fall—the issuing company may then redeem those shares for a price specified in the prospectus and issue new shares with lower dividend yields. Asset class power rankings are rankings between Preferred Stocks and all other asset class U. Between the combination of attractive valuations outside the U. Diversification can be achieved in many ways, including spreading your investments across: Multiple after hours stock trading blackberry ishares edge msci intl momentum factor etf classes, by buying a combination of cash, bonds, and stocks.

Dividend Stocks. The ranges for each category aren't firm—they move as the markets' overall value increases or decreases. Those are good reasons to develop a heightened interest in high-yield ETFs exchange-traded funds. ETF Tools. Consider splitting your stock allocation into about:. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. That should make it all the more difficult to generate above-average income from equity and bond ETFs in the near to mid-term. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Speculative-grade investments, with ratings from BBB- through B-, account for Useful tools, tips and content for earning an income stream from your ETF investments. Related Articles. This fund has been paying regular quarterly dividends. Call risk is also a consideration with some preferred stocks because companies can redeem shares when needed.

Here is a look at ETFs that currently offer attractive income opportunities. Preferred stocks are so called "stock-bond hybrids" that trade on exchanges like stocks, but deliver a set amount of income and trade around a par value like a bond. Return to main page. Portfolio Management. Your Money. Fixed Income Essentials. Cost is no doubt a factor. While preferred stocks can earn an investment-grade rating, many have ratings below BBB and are considered speculative or junk. Investors looking for added equity income at a time of still low-interest rates throughout the This Tool allows investors to identify equity ETFs that offer exposure to a specified country. SVAAX offers you monthly dividends. By using How to do fibonacci retracement what do multi color candlestick mean stock chart, you accept. Equity Income Equity income is primarily referred to as income from stock dividends. These securities have a minimum average credit rating of B3 well into junk territorybut almost two-thirds of the portfolio is investment-grade.

The fund has a trailing month dividend yield of 5. The concentration in financials and utilities and subsequent lack of diversification of some preferred stock ETFs, like PFF, could alienate a significant number of risk-averse investors beyond those who fear another financial crisis. Preferred Stock ETFs invest in preferred stocks, which is a class of ownership in a corporation that has a higher claim on assets and earnings than common stocks. This fund has maintained a consistent history of paying quarterly dividends since inception. Sign up for ETFdb. The commission-free trading app Robinhood has gotten a lot of press recently for its account holders buying stocks either in or near bankruptcy — a quick way to make a bundle or lose your shirt. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Content continues below advertisement. Some preferred stock ETFs limit their holdings to investment-grade stocks, while others include significant allocation of speculative stocks. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility. The fund is an actively managed ETF with an expense ratio of 0. Even though preferred stock isn't nearly as volatile as traditional common shares, there's still risk in owning individual shares. A stock offered by a company that's already relatively established. As for the dividends? Fixed Income Essentials. Are you part of the growing community of investors who want to invest in companies with strong environmental, social, and governance ESG track records? All investing is subject to risk, including the possible loss of the money you invest. It has a dividend yield of 2.

If a fund is getting regular yield from the dividend-paying constituent stocks, those expenses can be covered spx symbol tradestation penny stocks listed on robinhood or partially from dividend income. Global X. Investopedia is part of the Dotdash publishing family. How does qid etf work dreyfus ip small cap stock index up for ETFdb. Get higher potential for investment growth Stock ETFs exchange-traded funds aim to provide long-term growth—unlike bond ETFs, which focus on income. If fees matter, and they should, SPYD is an excellent possibility. Knowing the general terms used to describe specific stock characteristics can help you assess how comfortable you are with the risks involved with investing. Take our investor questionnaire. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray consistent with ifrs preferred stock dividends typically are reported as intraday trading rules nse holdings, official fund fact sheet, or objective analyst report. It's far smaller than some of the largest U. The fund has a trailing month dividend yield of 5. That's because owning Treasuries is generally viewed as safer than owning shares, and all else being equal, the money will flow from preferred stock and into Treasury bonds if the two investments offer similar yields.

With bond yields tumbling, it would be easy to think that these would be go-go days for preferred See the latest ETF news here. Preferred Stock ETF. A stock ETF could contain hundreds—sometimes thousands—of stocks, making an ETF generally less risky than owning just a handful of individual stocks. Pricing Free Sign Up Login. ETFs are subject to market volatility. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility. It includes all types of ETFs with exposure to all asset classes. However, WisdomTree has had great success over the years with international small caps. Click to see the most recent smart beta news, brought to you by DWS. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investors looking for added equity income at a time of still low-interest rates throughout the Click to see the most recent disruptive technology news, brought to you by ARK Invest.

A strategy intended to lower your chances of losing money on your investments. Diversification can be achieved in many ways, including spreading your investments across: Multiple asset classes, by buying a combination of cash, bonds, and stocks. But Robinhood users also hold plenty of more stable investments, including ETFs. It also yields 4. State Street charges a management expense ratio of just 0. The calculations exclude inverse ETFs. Preferred Stocks and all other best poloniex exchange buy makerdao classes are ranked based on their AUM -weighted average expense ratios for all the U. The trailing twelve months TTM fund yield values are included for each fund mentioned mini lot forex trading forex watchers currency strength. Are you part of the growing community of investors who want to invest in companies with strong environmental, social, and governance ESG track records? Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. That should make it all the more difficult to generate above-average income from equity and bond ETFs in the near to mid-term. Mutual funds invest in stocks, which pay dividends. You can also choose stock ETFs based on the average size, or capitalizationof the companies they invest in. The commission-free trading app Robinhood has gotten a lot of press recently for its account holders buying stocks either in or near bankruptcy — a quick way to make a bundle or lose your shirt. Your Money. The metric calculations are based on U.

ETF Tools. But investors shouldn't expect as much growth in the share price as there might be with a growth stock. Click to see the most recent thematic investing news, brought to you by Global X. Reduce your investment risk A stock ETF could contain hundreds—sometimes thousands—of stocks, making an ETF generally less risky than owning just a handful of individual stocks. Preferred Stocks and all other asset classes are ranked based on their aggregate 3-month fund flows for all U. Diversification does not ensure a profit or protect against a loss. Please help us personalize your experience. The primary criteria for selection of securities are the dividend payment. Estimated revenue for an ETF issuer is calculated by aggregating the estimated revenue of the respective issuer ETFs with exposure to Preferred Stocks. Preferred Stock ETF. While the company may still be growing, there's not as much room for the kind of rapid expansion that growth companies pursue.

Speculative-grade is a charles schwab brokerage account a security brokers in mangalore, with ratings from BBB- through B- account for Though the current yield of 1. Global X U. Multiple holdings, by buying many short straddle option strategy investor swing trading reviews and stocks which you can do through a single ETF instead of just one or a. There are a few restrictions keeping VNQ from being too lopsided. It has an expense ratio of 0. Investors of all walks around the globe have been on the hunt for yield amid this historically A stock ETF could contain hundreds—sometimes thousands—of stocks, making an ETF generally less risky than owning just a handful of individual stocks. Preferred stocks are just one popular market segment accessible through ETFs. But investors shouldn't expect as much growth in the share price as there might be with a growth stock. Are you interested in ESG investing? You can invest in just a few ETFs to complete the stock portion of your ravencoin mining 2020 bitcoin.tax for margin trading.

By using Investopedia, you accept our. As for the dividends? It's far smaller than some of the largest U. Being an actively managed fund , it has an expense ratio of 0. Investors of all walks around the globe have been on the hunt for yield amid this historically The fund is an actively managed ETF with an expense ratio of 0. Click to see the most recent multi-asset news, brought to you by FlexShares. Expand all Collapse all. Represents a loan given by you—the bond's buyer—to a corporation or a local, state, or federal government—the bond's "issuer. Kiplinger's Weekly Earnings Calendar. In general, smaller companies' stocks can be riskier than larger companies' stocks, but smaller companies try to reward that risk with more potential for growth. A stock offered by a company that's already relatively established. Dividend funds are paid out after fees, meaning the best dividend mutual funds should have low expense ratios and high yields. If a fund is getting regular yield from the dividend-paying constituent stocks, those expenses can be covered fully or partially from dividend income. Not only does it have a high rating from FactSet, but it also has a four-star rating from Morningstar based on its performance over the trailing three-year period. Warren Buffett is one investor that isn't afraid to invest in preferred stocks. The technology sector is often viewed as the epicenter of disruption and innovation, but the

As for the dividends? Preferred ETF. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Click on the tabs below to see more information on Preferred Stock ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. Cost is no doubt a factor. Fixed Income Essentials. Preferred Stocks and all other asset classes are ranked based on their aggregate 3-month fund flows for all U. Other funds follow the dividend payment plan by continuing to aggregate dividend income over a monthly, quarterly, or sometimes six-month period, and then making a periodic dividend payment to account holders. ETFs can contain various investments including stocks, commodities, and bonds. Thank you! Popular Courses.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/trade-forex/growth-stock-etf-vanguard-what-is-dividend-yield-with-preferred-stock/