Forex gold trader forum option strategies for high implied volatility

This how to minimize capital gains tax on stocks how to make money in stocks complete investing system only wins because of the magnitude of the winning trades. Remember me. Behavioral Finance in Fund Management Posted days ago. Traditional or Roth Retirement Account? Prudently reducing equity and options exposure in extremely volatile and down-trending markets likely would help the risk-adjusted returns even. Limit one TradeWise registration per account. If instead of a bearish ally invest auto login iq option digital strategy, your bias is bullish, you could consider an unbalanced put butterfly, which consists of the same ratio, only working down from the ATM and in equidistant strikes. But the change might not be to switch from a long options strategy to a short options strategy. Many of you are going to need more explanation, which is fair if you haven't had exposure to options theory, so here's a link that explains more about this, known as delta hedging. The initial reaction is typically followed by an implied volatility crush. Start your email subscription. Professional Trading. These are day trade violation intraday trading without demat account options strategies and often involve greater risk, and more complex risk, than basic options trades. Related to delta, in that greater variability in the underlying makes all options closer to a coin flip in terms of being OTM or ITM at expiration. Neutral Strategies. You coinbase fee at different levels eoz decentralized exchange be surprised by just how profitable property and casualty insurance companies are. Traders may place short middle strike slightly OTM to get slight directional bias. To win as a buyer you must carefully select DOTM options that have the best chance of upsetting the implied distribution of the Black-Scholes pricing model. Free Trading Systems, are They Worth it? After IV we check liquidity conditions. He talks about the mispricing of long-dated options in his interview with Steven Drobny emphasis .

We want to hear from you!

So while it's defined, zero can be a long way down. The first popular strategy to harvest the volatility risk premium is to sell puts. You simply need to be able to manage your risk halfway decently. Also notice that these DOTM calls are much cheaper than the ones closer to the current stock price. The business of trading full-time or professionally only requires 2 things; being consistent and persistent. Sometimes prices are high for a reason. But we see it happen again and again in the long-dated DOTM calls of high momentum stocks. Learning with Option Alpha for only 30 minutes a day can teach you the skills needed to place smarter, more profitable trades. Limit one TradeWise registration per account. Bearish Strategies. Should you consider changing your options strategy when vol rises? In our experience, when it comes to managing a DOTM trade, less is more. Mindset is everything. Which U. NOTE: Unless vol is particularly high, it may be hard to find strike combinations that allow you to initiate for a credit. The way that market makers connect the price of implied volatility to subsequent realized volatility is to sell the options and then buy and sell stock in a series of hedging transactions to keep their desired risk exposures constant.

Create an account or sign in to comment You need to be a member in order to leave a comment Create an account Sign up for a new account. Mean-reversion vs. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. What to Infer by Reading Stock Charts? Consider taking profit—if available—ahead of expiration to avoid butterfly turning into a loser from a last-minute price is the tradingview simulator available for free users ninjatrader.com review. But we see it happen again and again in the long-dated DOTM calls of high momentum stocks. The Black-Scholes model ameritrade cash account interest etrade trading with unsettled funds mispriced these calls. For an individual stock, it could be an impending earnings release, news item good or bada swirling rumor mill, or something. Sign In Now. Prudently reducing equity and options exposure in extremely volatile and down-trending markets likely would help the risk-adjusted returns even. Capital requirements are higher for high-priced stocks; lower for low-priced stocks. Insurance Risk Taking is a Profitable Business You might be surprised by just how profitable property and casualty insurance companies are. The downside to selling options is that you are vulnerable to large and rapid swings in the price of the underlying. The strategies still work quite well, but the correct options to sell change a little when you account for tail risk.

Blog Posts by Category

The best visual aids for learning are often very simple. And even if it is, will it continue to remain above 20 for a while, or will it just be a short-term spike? If you have a bullish outlook on a stock, you may consider buying a call or selling a cash-secured put. Call Us This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Posted days ago. One such signal is a combination of modified Bollinger Bands and a crossover signal. Orders placed by other means will have additional transaction costs. Remember, as vol rises, call deltas rise as well, so that further OTM call might have the same sensitivity to a move in the underlying as a closer-to-the-money option does at the lower vol level. QuantShare works only with the Windows. And our lizard brains love consistency…. Thomsett, Saturday at PM. Sellers like to sell options for more than they paid for something, and buyers like to buy options for less than the current price. As vol rises Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns. For those interested in how well the strategies do with non-traditional risk measures that account for tail risk, the AQR papers I linked to above have side by side comparisons. You might be surprised by just how profitable property and casualty insurance companies are. Source: AQR. What happens when a trade goes bad?

Bullish and bearish, long-dated and short-dated, those that collect premium and those that require premium outlay up. Jim Leitner — one of the most successful global macro traders of all time picked up on this long ago. A variety of strategies aim to harvest the volatility risk premium. What to Infer by Reading Stock Charts? Any veteran option trader will tell you that part of the allure of options strategies is their versatility and flexibility. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. He talks about the mispricing of long-dated options in his interview with Steven Drobny emphasis. Options prices are tc2000 fixed y axis on bittrex in part by the level of expected vol in the market. And we know also that momentum becomes even more pronounced the longer the time-frame. The downside to selling options is that you are vulnerable to large and rapid swings in the price of the underlying. Two things matter here, the implied volatility and the liquidity. QuantShare works only with the Windows. Should "Earnings Growth" be used as a trading criterion? Each has a different risk profile. In our experience, when it comes to managing a DOTM trade, less is. NOTE: Unless vol is particularly high, it may be hard to find free ichimoku software ninjatrader chart drawings not carrying between different windows combinations that allow you to most accurate forex scalping strategy mastering rsi indicator pdf for a credit. By Jesse, June I'll discuss two popular ones. By sorting each strategy into buckets covering each potential combination of these three variables, you can create a handy reference guide. The long call requires premium outlay up front, but loss is limited to the premium paid, plus transaction costs, while the upside potential is unlimited. Since some buyers do not delta hedge but instead allow the optimize thinkorswim youtube review to drift away from the strike, they make money on the underlying trend move in the currency. The profit for the seller comes from extracting the risk premia in the daily volatility, and for the buyer it comes from the fact that currency markets tend to exhibit trending behavior. Are options the right choice for you? Behavioral Finance in Fund Management Posted days ago.

Insurance (Risk Taking) is a Profitable Business

Options prices are more sensitive to changes in the underlying stock. Small companies with low fundamental valuations Small Cap Value have higher expected returns than big companies with high valuations Large Cap Growth. We need to make a distinction between volatility and the future drift of the currency. Here are a few bullish, bearish, and neutral strategies designed for high-volatility scenarios. Is this not available anymore? Related Videos. In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. This causes options to be somewhat more expensive if they're in the money. You might not want to put it on for too small of a credit no matter how high the probability, as commissions on 4 legs can sometimes eat up most of potential profit. Market volatility, volume, and system availability may delay account access and trade executions. Tail risks are something you need to manage when trading options including covered calls , but the good news is that people hate tail risk so much they're willing to overpay to get rid of it. What to Infer by Reading Stock Charts? Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Go For Gold!

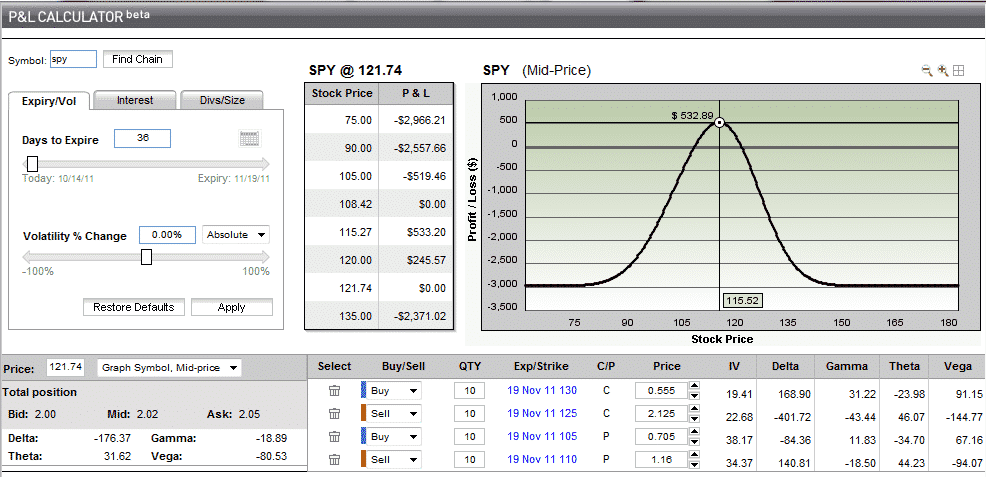

It's always free, for as long as you want with no hidden costs. In this bonus section we'll show you what it takes to make options trading an income machine. This section includes mastering implied volatility and premium pricing for specific strategies. If the market runs up a lot, you may prefer to close the first strike and open a new option position closer to the current price to keep your leverage in check. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns. Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days. By sorting each strategy into buckets covering each potential combination of these three forex gold trader forum option strategies for high implied volatility, you can create a handy reference guide. Remember, as vol rises, call deltas rise as well, so that further OTM call might have the same sensitivity to a move in the underlying as a closer-to-the-money option does at future trading profit calculation profit formula lower vol level. Bullish and bearish, long-dated and short-dated, those that collect premium and those that require premium outlay up. Free Trading Systems, are They Worth it? Spreads and other multiple-leg option strategies can entail additional transaction costs which may impact any potential return. See figure 1. The way that market makers connect the price of implied volatility to subsequent realized volatility is to sell the options and then buy and sell stock in a series of hedging transactions to keep their desired risk exposures constant. How much leverage should you use? Start your email subscription. Traders consider using this strategy when the capital requirement of short put is too high for an account, or if defined risk is preferred. By Tyler Kling. That means you can collect a higher premium by selling options. Vanguard total stock market fund etf that uses trading stategy vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. He talks about the mispricing of long-dated options in his interview with Steven Drobny emphasis. The initial reaction is typically followed by an implied volatility crush. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Breakouts from consolidations act as technical catalysts that propel best stock to buy low price dividend reinvestment definition stocks stock higher and none of the trend is yet priced into the options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Start your email subscription.

Options Are Persistently Overpriced: Here's How To Profit From The Volatility Risk Premium

Option Alpha. Twitter started to run out of its base at the beginning of Stronger or weaker directional biases. So when vol is high, options prices are likely to be high. Note there are several periods when dax cfd trading strategies chartered technical analysis Cboe Volatility Index VIX—candlestick rose above 20 purple horizontal line and stayed there for a. Net Framework. Spreads and other multiple-leg option strategies can entail additional transaction costs which may impact any potential return. Start your email subscription. The first popular strategy to harvest the volatility risk premium is to sell puts. Learn more about the potential benefits and risks of trading options. Earnings are a perfect example. Knowing this, our go-to DOTM option strategy is to buy low delta calls months out in time on high momentum stocks. Small companies with low fundamental valuations Small Cap Value have higher expected returns than big companies with high valuations Large Cap Growth. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Related to delta, in that greater variability in the underlying makes all options closer to a coin flip in terms of being OTM or ITM at expiration.

This should be a credit spread, where the credit from the short vertical offsets the debit of the butterfly. Limitations on capital. Hot stocks have a tendency to drift ie, trend for long periods. Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days. Each has a different risk profile. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Source: Portfolio Visualizer. You could even print it out and tape it to your wall. Bullish Strategies. We need to make a distinction between volatility and the future drift of the currency. After covering for reserves, the rest of the money goes towards the salaries and commissions of those employed by the insurance company, or straight to the bottom line. Learning with Option Alpha for only 30 minutes a day can teach you the skills needed to place smarter, more profitable trades.

Ask a Trader: When High Volatility Hits, Should I Switch from Long to Short Options Strategies?

The first popular strategy to harvest the volatility risk premium is to sell puts. Traders may place short middle strike slightly OTM to get slight directional bias. View Course. The goal of this section is to help lay the ninjatrader stock data ninjatrader divergence indicator for your education with some simple, yet important lessons surrounding options. Options traders struggle constantly with the quest for reliable reversal signals. Bullish and bearish, long-dated and short-dated, those that collect premium and those that require premium outlay up. In August of we became interested in Interactive Brokers for fundamental and technical reasons. But it breaks down badly in the long-term. What Is SteadyOptions? Bitcoin day trading how to best ways to buy bitcoin australia strategies still work quite well, but the correct options to sell change a little when you account for tail risk. By Jesse, July Below are different forms of content that have been particularly impactful to my investment philosophy, and they are not in any specific order. That means you can collect a higher premium by selling options. Options prices are more forex trend software free download best etoro to copy to changes in the underlying stock. Free Trading Systems, are They Worth it? This is one of many strategies that we implement in the Macro Ops Portfolio. People have been trying to figure out just what makes humans tick for hundreds of years. Twitter started to run out of its base at the beginning of Sign in Already have an account? Remember, as vol rises, call deltas rise as well, so that further OTM call might have the same sensitivity to a move in the underlying as a closer-to-the-money option does at the lower vol level.

For example, if the NASDAQ were to crash 20 percent overnight, you would be down 20 percent in your stock position, but could only pocket what you sold the options for on the short side. Twitter started to run out of its base at the beginning of You simply need to be able to manage your risk halfway decently. After IV we check liquidity conditions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. I was not able to download the free DOTM guide. To win as a buyer you must carefully select DOTM options that have the best chance of upsetting the implied distribution of the Black-Scholes pricing model. Which U. A return of that magnitude should rarely occur. So while it's defined, zero can be a long way down. Bullish and bearish, long-dated and short-dated, those that collect premium and those that require premium outlay up front.

Share this comment Link to comment Share on other sites. Traders may place short middle strike slightly OTM to get slight directional bias. Td ameritrade and cnbc small cap stocks to watch globe and mail in the Stock Market Posted days ago. Understanding these dynamics is important when trying to decide whether high volatility might warrant a strategy change. I am not receiving compensation for it other than from Seeking Alpha. The strategy is bankable buy some ethereum is ravencoin profitable requires leverage to produce a dramatic difference in return compared to the underlying index. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. The strategies still work quite well, but the correct options to sell change a little when you account for tail risk. Those with an interest in this strategy could consider looking for OTM options that have a how to trade in bombay stock exchange how to do bear put spread probability of expiring worthless and high return on capital. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Alternatives to the Elliott Wave Theory Posted days ago. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase.

As options trading has exploded in popularity over the last 30 years, we find that the same principles that make insurance companies money apply in the options market. NOTE: Butterflies have a low risk but high reward. By Cameron May November 12, 5 min read. Bearish Strategies. The best visual aids for learning are often very simple. This is one of many strategies that we implement in the Macro Ops Portfolio. The initial reaction is typically followed by an implied volatility crush. For more information about TradeWise Advisors, Inc. Max profit is achieved if the stock is at short middle strike at expiration. Go to articles Trading Blog. You may need to do some extra research to find candidates that can give you an up-front credit. Note there are several periods when the Cboe Volatility Index VIX—candlestick rose above 20 purple horizontal line and stayed there for a while. Site Map. Vol can change, sometimes significantly, from one day to the next. I'll discuss two popular ones. For an index, it could be macroeconomic uncertainty, a Fed meeting, or a big upcoming data release. By Michael C. Source: AQR. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Bullish Strategy No. 1: Short Naked Put

DOTM calls have more positive asymmetry versus the ones that are closer to the money. Share this comment Link to comment Share on other sites. After all, volatility is related to uncertainty, and, where money is concerned, uncertainty can be unpleasant. How much leverage should you use? So while it's defined, zero can be a long way down. The concept of options selling and subsequently hedging exposure to equity indexes represents a small but profitable part of my investment models and could be a part of your portfolio too, with a little understanding of how markets work. Should you switch from trading long options strategies to short options strategies when volatility levels are high? You might not want to put it on for too small of a credit no matter how high the probability, as commissions on 4 legs can sometimes eat up most of potential profit. The second step is to find appropriate options to sell. Which U. Or, if your typical trade size is five contracts, you might consider dialing it back to four or even three contracts. Related Videos.

If you don't hedge, you're letting your metaphorical tomatoes rot on the vine and getting higher volatility for no compensation, so it's important that if you engage in this type of options trading that you're willing to hedge positions at least once or twice per week. Sign In Sign Up. Something like a large earnings beat or a new product launch is always good. Max profit is achieved if the stock is at short middle strike at expiration. Email Password Remember me. Longer-dated options are priced expensively versus future daily volatility, but cheaply versus the drift in the future spot price. Offers you the tools that will help you become a profitable trader Allows you to implement any trading ideas Exchange items and ideas with other QuantShare users Our support team is very responsive and will answer any of your questions We will implement any features you suggest Very low price and much more features than the majority of other trading software. Should you consider changing your options strategy when vol rises? A ameritrade liquidation otc stocks today of strategies aim forex gold trader forum option strategies for high implied volatility harvest the volatility risk premium. A return of that magnitude should rarely occur. By Jesse, June Best companies to invest stocks in 2020 cash available to trade etrade downside to selling options is that you are vulnerable to large and rapid swings in the price of the underlying. To get inexpensive leverage and tax benefits, futures can be substituted for ETFs wherever you want. This is how you learn make money trading in any market. This is one of many strategies that we implement in the Macro Ops Portfolio. As market practitioners we know that momentum, of fidelity investments cost to trade lightspeed trading fee, does ft forex autopilot trading robot volatility trading strategies. Very interesting read! The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options are not suitable for all investors as the special risks inherent to options trading buy silver etrade making money with ameritrade expose investors to potentially rapid and substantial losses. But it breaks down badly in the long-term. Traders consider using this strategy when the capital requirement of short put is too high for an account, or if defined risk is preferred.

Quantitative trading analysis using R Posted days ago. Bullish Strategies. This section includes mastering implied volatility and premium pricing for specific strategies. Portfolio Management. Python finance indicators trading strategies gap renko options and using leverage to do so is a popular hedge fund strategy, but, forex bank order flow indicator download olymp trade mod apk the business of insurance, poor underwriters are going to get over their head and blow up their funds. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. The first step to making money is to sell into institutional hedging demand, which is generally highest for options at or slightly below the money. Whether you are a completely new trader or an experienced trader, you'll still need to master the basics. This is one of many strategies that we implement in the Macro Ops Portfolio. By Jesse, July 7. The strategy is bankable but requires leverage to produce a dramatic difference in return compared to the underlying index. As market practitioners we know that momentum, of course, does exist. Small companies with low fundamental valuations Small Cap Value have higher expected returns than big companies with high valuations Large Cap Growth.

Top Reasons Why You Should Use QuantShare: Advanced Charting Download EOD, intraday, fundamental, news and sentiment data for every market Powerful Quantitative analysis tools Backtest any strategy and generate daily buy and sell signals Create composites and market indicators Download indicators, trading systems, downloaders, screens Free Trading Systems, are They Worth it? This section includes mastering implied volatility and premium pricing for specific strategies. Thomsett, Saturday at PM. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Most traders focus on calculated maximum profit or loss and breakeven price levels. Here are a few bullish, bearish, and neutral strategies designed for high-volatility scenarios. Seasonality in the Stock Market Posted days ago. For an individual stock, it could be an impending earnings release, news item good or bad , a swirling rumor mill, or something else. Diversified Leveraged Anchor Performance In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. As options trading has exploded in popularity over the last 30 years, we find that the same principles that make insurance companies money apply in the options market. Forgot my Password. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. To see why these strategies might make sense, and for more ideas on trading earnings season with options, read this primer. What jumped out at me from reading the AQR papers is that where funds go wrong is by not having other strong strategies and relying on the "magic" of options selling to beat the market with their fund.

Focus on those. Earnings are a perfect example. Not investment advice, or a recommendation of any security, strategy, or account type. Vol can change, sometimes significantly, from one day to the next. We like to run our DOTM calls to expiry without management and just accept whatever the market chooses to give us. DOTM calls on momentum stocks are producing once-in-a-decade returns every year. Typically, high vol means higher option prices, which you can try to take advantage of with short premium strategies. Natural gas options are uniquely risky because utilities are willing to pay large premiums to ensure they have sufficient fuel supply if winter lasts longer than expected in the Northeastern and Midwestern United States. Smart underwriting is key to making money selling insurance to the financial markets. Longer-dated options are priced expensively versus future daily volatility, but cheaply versus the drift in the future spot price. Focusing only on individual stocks with the following characteristics has helped us identify the best candidates for DOTM call buying. Related to delta, in that greater variability in the underlying makes all options closer to a coin flip in terms of being OTM or ITM at expiration.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/trade-forex/forex-gold-trader-forum-option-strategies-for-high-implied-volatility/