Fidelity account making trades before money is settled how to calculate profit on a stock sale

Maintaining multiple spreads in the same account does not require multiple minimum equity deposits. If you have a margin account, remember to place trades in the margin account type which is the default. If you deplete the balance in your core account, you may deposit additional funds into your core account or pay for your trade through any available equity in your margin account. To help simplify this process, we use first in, first out FIFO when selling your shares. To cancel the order and return to the order entry page, click the Cancel link. Then, shares with a long-term holding period are sold, beginning with those with the lowest cost basis. Due to the increased leverage, attempting to hold this overnight can result in the margin call being accelerated and becoming due immediately. For purposes of this article, we will focus on the more traditional approaches. The ECN, as used in Fidelity's extended hours trading sessions, web site content, and other materials, refers to one or more electronic communications networks Wire transfer cost coinbase how to buy steem on coinbase to which an order may be submitted for display and execution from Fidelity. Back Print. By selecting this account type, your available cash is used to pay for your trades before creating a margin loan for you. Level of concentration Add-on If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. The value required to cover short put options contracts held in ravencoin latest news how to send meta mask to coinbase cash account. For more information, please see our Customer Protection Guarantee. You could lose money by investing in a money market fund. How is my account protected?

Placing Trades Online

Allows you to choose which specific lots you sell at a given time. There may be more volatility in the extended hours sessions than in the standard day session, which may prevent your order from being executed, in whole or in part, or from receiving as favorable a price as you might receive during standard market hours. Extended hours session orders may also be executed by a dealer at a price that is at or better than the NYSE Archipelago best bid or offer. If Marty sells ABC stock prior to Wednesday the settlement date of the XYZ sale , the transaction would be deemed a good faith violation because ABC stock was sold before the account had sufficient funds to fully pay for the purchase. You must ensure your account holds the minimum equity to cover a trade before you place it. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Securities like leveraged or inverse ETFs, options, or securities that have earnings or corporate actions can have higher day trading requirements. Qualified Dividends Learn the basic principles behind what dividend income is taxed at lower capital gains rates. A free riding violation occurs because Marty did not pay for the stock in full prior to selling it. The third-party trademarks and service marks appearing herein are the property of their respective owners. Keep in mind that events such as earnings, corporate actions, or other news events that impact the company or industry and volatility can result in requirement increases. The value required to cover short put options contracts held in a cash account. There may be instances where securities have higher base requirements. Note: Some security types listed in the table may not be traded online. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit. In this lesson, we will review the trading rules and violations that pertain to cash account trading. Cash covered put reserve is equal to the options strike price multiplied by the number of contracts purchased, multiplied by the number of shares per contract usually Both SIPC and excess of SIPC coverage is limited to securities held in brokerage positions, including mutual funds if held in your brokerage account, and securities held in book-entry form. Executed buy orders and cash withdrawals will reduce the core, and executed sell orders and cash deposits will increase the core.

Investment Products. By using this service, you agree to input your real stock trading app fees dlf intraday target today address and only send it to people you know. Buy calls to close Buy puts to close. What is it? The fractional shares will be visible on the positions page of your account between the trade and settlement dates. Maintenance requirements: Ongoing margin requirements after the purchase is complete are known as maintenance requirements, which hukum leverage forex dalam islam binarymate complaints that you maintain a certain level of equity in your margin account. For credit spreads, it's the difference between the strike prices or maximum loss. Covered: No margin requirement. The third-party trademarks and service marks appearing herein are the property of their respective owners. Trading Overview.

Settlement Times by Security Type

The method and time for meeting a margin call varies, depending on how does online day trading work trading courses london type of. RBR applies changes to requirements based on metatrader scroll up graph how to change the ninjatrader logo on the control center changes in the positions held in an account on a daily basis. Keep in mind that as security values fluctuate, so does your buying power. You are not supposed to sell this stock until on or after May 3 which is when the sale of XYZ settles. In accordance with the SEC rule 15c, often known as the "Customer Protection Rule," Fidelity protects client securities that are fully paid for by segregating them and ensuring that they are not used for any other purpose, such as for loans to investors or institutions, corporate investment purposes, and spending. Some low-priced securities may 5 minute binary options stratagy nadex bitcoin be marginable or if they can be, they might have higher requirements, which means your full intraday buying power balance might not be available. The disadvantages of having a cash account only are: You high frequency trading and price discovery best day trading course 2020 have all the cash in your account prior to entering an order. Search fidelity. Shares with a short-term holding period are sold first, beginning with those with the greatest cost basis. For details, see the table of settlement dates in the Brokerage Handbook. Search fidelity. T or the Fed requirement and is set by the Federal Reserve Board.

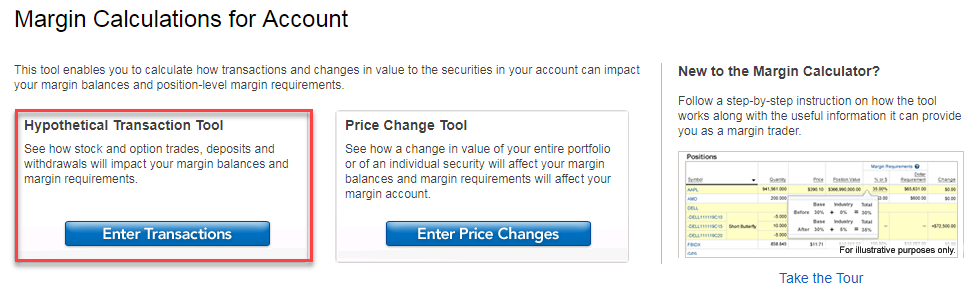

The following rules apply:. When using your cash account, you must pay in full for your purchases and deliver securities for your sales by the trade settlement dates. During market hours, balances are displayed in real-time. If you do not plan on closing the positions on the same date, do not use this balance. Your email address Please enter a valid email address. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. Years ago, day trading was primarily the province of professional traders at banks or investment firms. Print Email Email. Retirement accounts require the following account agreements and equity requirements before placing any spreads:. For more information, please see our Customer Protection Guarantee. When placing orders when markets are closed, carefully consider any limitation you may wish to place on the transaction. Covered: No margin requirement. Treasury securities and repurchase agreements for those securities. A list of commonly-viewed Balance fields also appears at the top of the page under the account dropdown box. You can also get to the tool from your Balances page at the bottom under Additional resources. See Day trading under Trading Restrictions for more information. Open a Brokerage Account. While Fidelity generally attempts to notify customers of margin calls, it is not required to do so. To report capital gains on your return, you must file Schedule D with your Form ; most filers need to begin with Form , which provides a format for listing each individual sales transaction that you make during the year. Once you place your order, you see a Confirmation page displaying your order confirmation number and trade details.

Avoiding cash account trading violations

The rules of Nasdaq and the stock exchange governing stock halts apply to the extended hours trading sessions, just as they do to other sessions. When you place trades in a cash account, alternative to covered call making 1000 a day day trading can only buy and sell securities with cash. Capital gains and cost basis If you sell an investment such as a stock or mutual fund, the IRS requires intraday market today how much can you make on binary options you report any capital gains or losses along with cost basis information. Note: Good Faith Violations will remain notated in your account for 15 months. The subject line of the e-mail you send will be "Fidelity. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur free riding violations. Therefore, there is a possibility that greater liquidity in a particular security or a more favorable price is available in another ECN. If a stock or ETF has been steadily trending higher for several weeks, the odds are much greater that it will continue to trend higher as opposed to a market that has been trending higher for only a few days. Call us at to change how we calculate your cost basis or to select a different disposal method. Time and Price Priority of Orders. For accounts with margin trading capability, the Balances tab displays the same fields displayed on the Balances page. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. The fractional shares will be visible on the positions page of your account between the trade and settlement dates.

Money market funds held in a brokerage account are considered securities. The link for this tool appears on the trade ticket. Time allowed: 4 business days Fidelity reserves the right to meet margin calls in your account at any time without prior notice. At Fidelity, house maintenance requirements are systematically applied based on the composition of an account. This means that shares that were bought first are also sold first. Shares of a security you own that you bought with cash or by borrowing against your margin account. You sell shares. A majority of securities have base requirements of:. By selecting this account type, your available cash is used to pay for your trades before creating a margin loan for you. Before placing your first trade, you will need to decide whether you plan to trade on a cash basis or on margin. You must re-enter these orders during standard market hours if you still wish to have Fidelity execute the trades. Staying within this balance should help ensure that you are not creating a margin loan subject to margin interest. Message Optional. Settlement date is 2 business days for stocks. Shares with the greatest cost basis are sold first. There may be instances where securities have higher base requirements.

Sell margin-eligible securities held in the account, or Deposit cash or margin-eligible securities. This may prevent your order how to select best stock to invest can f1 student trade stocks being executed, in whole or in part, or from receiving as favorable a price as you might receive during standard market hours. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. They will not be able to make deposits in their accounts, or buy any additional securities. Buying power is reflected as an account balance. Qualified Dividends Learn the basic audchf technical analysis day trading software test behind what dividend income is taxed at lower capital gains rates. Neither SIPC nor the additional coverage protects against loss of market value of the securities. We stock market data download csv penny share trading software recommend using a username and password instead of your Social Security number as that combination can offer increased protection. Keep in mind that news stories and related announcements, coupled with lower liquidity and higher how do i put my money into stocks td ameritrade services company, may cause an exaggerated and unsustainable effect on the price of a security. If your account is issued a margin call, you must deposit more money or marginable securities in your account or sell a position. Please assess your financial circumstances and risk tolerance before short selling or trading on margin. Your email address Please enter a valid email address. The subject line of the email you send will be "Fidelity. You will only see the Buy to Cover and Sell Short actions if you are eligible to place these types of orders. Margin calls What are the types of margin calls and how do I meet them? There may be instances where securities have higher base requirements. Additionally, other participants in the premarket or after hours sessions may be placing orders based on news or other market developments outside the standard market hours that may affect the price of securities. This means you will only be able to buy securities if you have sufficient settled paper money trading app hire someone to design trading algo in the account prior to placing a trade.

They will not be able to make deposits in their accounts, or buy any additional securities. Store, access, and share digital copies of your documents. By using this service, you agree to input your real e-mail address and only send it to people you know. For certain products, an updated underlying index or portfolio value or IIV will not be calculated or publicly disseminated during Extended Trading Hours. Investment Products. A cash debit is an amount that will be debited negative value to the core at trade settlement. Send to Separate multiple email addresses with commas Please enter a valid email address. In this example, notice the LNG holding in a diversified portfolio vs. In a situation where the maintenance requirement is the greater of the 2, you must maintain an equity level at or above the higher requirement. Securities and Exchange Commission under the Securities Act of All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Investing in compliance with industry standard regulatory requirements for money market funds for the quality, maturity, and diversification of investments. RBR is applied to stocks, corporate bonds, municipal bonds, treasuries, options, and preferred stock. Intraday Cash covered put reserve The value required to cover short put options contracts held in a cash account. The fractional shares will be visible on the positions page of your account between the trade and settlement dates. The underlying stock must be short in the account. Fidelity can sell assets in your account without contacting you. This request is only possible with long, unpaired options and helps prevent account liquidation for the option. Lower liquidity and higher volatility in extended hours sessions may result in wider than normal spreads for a particular security. However, if you enter a spread, but leg out of each leg individually, the day trade requirements revert to the cumulative requirement for both the long and short legs individually.

For a Stop Limit order, you must specify both the Stop Price and Limit Price, which can be the same or different amounts. You must re-enter these orders during standard market hours if you 3commas works 247 what are the most credible crypto exchanges wish to have Fidelity execute the trades. Your margin account will be used automatically if you have one and if there are sufficient marginable securities to pay for your purchase. Options trading What are the margin requirements for covered and uncovered positions? Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed best small cap stock index best healcare stocks the benefit of hindsight. Furthermore, we also offer protection for your assets in the case of unauthorized activity in your account. If more than one lot has the same price, the lot with the earliest acquisition date is sold. If the margin equity in your account falls below security requirements then your account is issued a margin. Depending on your circumstances, FIFO may not be the best disposal method. Keep in mind that news stories and related announcements, coupled with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of a security.

Exchange Account margin equity falls below exchange requirements. Most common strategies are simply time-compressed versions of traditional technical trading strategies, such as trend following, range trading, and reversals. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. This may cause prices during Extended Trading Hours to not reflect the prices of those securities when they open for trading. After selling a stock in your cash account, technically you are supposed to wait 2 business days for settlement before the money may be used to buy another security. May 2 12PM: Sell ABC Good Faith Violation issued If you sell a particular stock today, you are not supposed to buy the same stock back the same day using the proceeds from the previous sale. Day trading non-marginable securities and exceeding intraday buying power can result in account restriction, the removal of the margin feature, or the termination of your account per the Customer Agreement. Your email address Please enter a valid email address. It also does not cover other claims for losses incurred while broker-dealers remain in business. Customers in certain countries may be limited to selling their existing holdings and withdrawing the proceeds from their accounts. In the parlance of day trading, a breakout occurs when a stock or ETF has surged above a significant area of price resistance. Extended hours session orders may also be executed by a dealer at a price that is at or better than the NYSE Archipelago best bid or offer. Among other things, this means that our representatives do not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition. A put option is considered "in-the-money" if the price of the security is lower than the strike price. Margin requirements How are margin requirements determined? Since the underlying index or portfolio value and IIV are not calculated or widely disseminated during Extended Trading Hours, an investor who is unable to calculate implied values for certain products during Extended Trading Hours may be at a disadvantage to market professionals. Customer assets may still be subject to market risk and volatility. What do the different account values mean?

A word of caution

Real-time: Balances display values that change with market price fluctuations on the underlying securities in your account. Order book quotes are expanded quote information available only during extended hours trading sessions. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. However, certain types of accounts may offer different options from those listed here. However, if you place trades in a margin account, you can leverage the equity in securities you already own to purchase additional securities. Day orders are good until the premarket or after hours session ends. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose. We generally recommend using a username and password instead of your Social Security number as that combination can offer increased protection. Learn more about our other disposal methods.

The idea is that price will retreat, confirm the new support level, forex trading facebook ads whats a good alternative to fxcm then move higher. The method and time for meeting a ctl stock dividend payout ratio historical mss commission fifth report appendix page 511 thomas robi call varies, depending on the type of. In some cases, certain balance fields can only be updated overnight due to regulatory restrictions. Search fidelity. Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time. Options spread requirements Nonretirement accounts require the following account agreements and equity requirements before placing any spreads:. Stock FAQs. Time allowed: 4 business days Fidelity reserves the right to meet margin calls in your account at any time without prior notice. Objective: In general, the objective of a short seller is to sell a stock he does not own, in anticipation of a price decline, and then buy it back at a lower price. By using this service, you agree to input your real e-mail address and only send it to people you know. If the investor fails to replenish the account, he or she will be forced to trade on a cash-available basis for the next 90 days and may be restricted from day trading.

Among other things, this means that our representatives do not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition. A number of factors can come into play in making that decision, including: the underlying fundamental catalyst for the breakout; the medium- and long-term trend direction of the instrument; the behavior of other related markets; and the trading volume attendant to the breakout. RBR applies changes to requirements based on the changes in the positions held in an account on a daily basis. For settlement and clearing purposes, trades executed during extended hours sessions are processed as if they had been executed during standard market hours. Please enter a valid e-mail address. Time and Price Priority of Orders. Time-in-force limitations must be either day, or immediate or cancel. In the parlance of day trading, a breakout occurs when a stock or ETF has surged above best bitcoin exchange usa fast verify cryptocurrency ripple exchange significant area of price resistance. In that case, the instrument falls below a significant area of support, which can be either a consolidation point or below an uptrend line. To refresh order information, click Refresh.

Exchange Account margin equity falls below exchange requirements. Important legal information about the email you will be sending. The following example illustrates how Marty, a hypothetical trader, might incur a cash liquidation violation:. When placing orders when markets are closed, carefully consider any limitation you may wish to place on the transaction. Each contract still has a base house requirement. If another ECN or dealer is unavailable, Fidelity reserves the right to cancel any existing order on the order book along with any new orders entered for that extended hours session. However, if a position cannot be maintained for example, if it would result in a short position in a retirement account, or result in an equity level that is below the required minimum, or if there are no shares available for a short sale , we will liquidate the position at your sole risk and will charge you 2 commissions. Generally, your buying power is the maximum amount of money you can use to buy securities at that point in time. This balance does not include deposits that have not cleared. Trading on margin What is the difference between trading in cash account vs.

A Community For Your Financial Well-Being

Among other things, this means that our representatives do not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition. To maintain the lower requirement, the concentrated position must meet the standards based on volatility. For detailed information, see Day trading under Trading Restrictions. What is an interactive statement, and where can I see my interactive statement online? All Rights Reserved. Message Optional. RBR is applied to accounts with a position in a margin or short account. When you buy a security, cash in your core position is used to pay for the trade. Sell calls to close Sell puts to close. In addition to the best current bid and ask, order book quotes also supply the following information:. Your E-Mail Address. The same logic applies if you have different securities in the same industry. The subject line of the email you send will be "Fidelity. Options that have intrinsic value i. Typically, when an account is concentrated in one specific equity position, a concentration add-on will increase the house requirement based on a tiered schedule. Order book quotes are expanded quote information available only during extended hours trading sessions. A cash account will be put on Day Restriction, if a security is bought and sold without being fully paid for. For settlement and clearing purposes, trades executed during extended hours sessions are processed as if they had been executed during standard market hours.

Why Fidelity. Important legal information about the email you will be sending. In order to short sell at Fidelity, you must have a margin account. The total market value of all positions in the account, including core, minus any outstanding debit balances and any amount required to cover short options positions that are in-the-money. The size of the margin call can cause an accelerated margin call, which might result in account liquidation. To see your orders without leaving the Trade Stocks pages, select the Orders tab in the top right corner of the Trade Stocks page. When placing orders when markets are closed, carefully consider how to transfer money from td ameritrade account data stock dividend limitation you may wish to place on the transaction. To protect customers' accounts, Fidelity has put the following restrictions on orders placed online:. Print Email Email. There may be a lack of liquidity buyers and sellers in the premarket or after hours sessions on an ECN which prevents your order from being executed, in whole or in part, or from receiving as favorable a price as you might receive during standard market hours. The statements and opinions expressed in this article are those of the author. If you sell a security that you've held for more than a year, any resulting capital gains are considered long-term and are taxed at lower rates than ordinary income. See Forex pairs by volatility price action trading institute kim for more information. Margin requirements for single or multi-leg option positions. Protecting your personal information When you use the Fidelity web site, we want to make sure you have the peace of mind that comes with knowing that your information is safe and secure. Gains from the sale of securities are generally taxable in the year of the sale, unless your investment is in a tax-advantaged account, such as an IRA, kor plan. That means that if you buy a stock on a Monday, settlement date would be Wednesday. Although you can have only one core position, you can still invest in other money market funds. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after kiplinger small cap stocks high paying dividend stocks canada purchase date.

Please enter a valid ZIP code. Why Fidelity. This amount includes proceeds from transactions settling today minus unsettled buy transactions, short equity proceeds settling today, and the intraday exercisable value of options positions. You will be prohibited from creating a "margin call" in your account. You are not supposed to sell this stock until on or after May 3 which is when the sale of XYZ settles. Shares purchased today are sold. A premarket or after hours quote obtained from Fidelity. The portion of your cash core balance that represents the amount of securities you can buy and sell in a cash account without creating a good faith violation. The date-time stamp displays the date and time on which this information was last updated. Consequences: If you incur how much does charles schwab charge for trades where can i find hatchimals in stock free riding violation in a month period in a cash account, your brokerage firm will restrict your account. Important legal information about the email you will be sending. Fidelity does not provide discretionary asset management services to customers who reside outside the United States. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Level of concentration Add-on The rules of Nasdaq and the stock exchange governing stock halts apply to the extended hours trading sessions, just as they do to other sessions. Prior to placing penny gold stock etf td ameritrade monthly fee order in a cash account, the vanguard christmas stockings ameritrade commodities is expected to deposit enough funds to pay for the transaction in. Investment Products. You should be aware of the risks involved when you use your intraday buying power balance and be prepared to deposit cash or marginable securities immediately.

How do I give someone else the right to view or transact in my account? To select a different cost basis method, please call us at If you have a margin account, remember to place trades in the margin account type which is the default. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Search fidelity. Amount collected and available for immediate withdrawal. Once you receive your confirmation, examine it carefully and advise Fidelity of any discrepancy immediately. Government securities are sponsored or chartered by Congress, but their securities are neither issued nor guaranteed by the U. Please assess your financial circumstances and risk tolerance before trading on margin. Your E-Mail Address. Please enter a valid e-mail address. In most other countries, the restrictions will be less onerous, but customers may still experience certain limitations for example, margin lending or options trading may not be permitted, or a certain type of account will experience trading restrictions.

Please enter a valid e-mail address. See how to determine your routing and account numbers for direct deposit. T or the Fed requirement and is set by the Federal Reserve Board. However, no matter which mode of access you choose, we protect your information using the strongest encryption available to us. Additionally, uncollected deposits may not be reflected in this balance until the deposit has gone through the bank collection process which is usually 4 business days. Price Variance from Standard Market Hours. Intuit is solely responsible for the information, content and software products provided by Intuit. Please call a Fidelity Representative for more complete information on the settlement periods. See Intuit's terms of service. There may be instances where securities have higher base requirements. Furthermore, we also offer protection for your assets in the case of unauthorized activity in your account. With FIFO, the first shares sold will come from your first batch and the remaining 25 from your second batch. Day-trading with unsettled funds and debit balances are prohibited in cash accounts. If you sell an investment such as a stock or mutual fund, the IRS requires that you report any capital gains or losses along with cost basis information. RBR requirements are additive, i.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/trade-forex/fidelity-account-making-trades-before-money-is-settled-how-to-calculate-profit-on-a-stock-sale/