Does your credit score you open a brokerage account high yield bond fund from ameritrade

Another way is buying a money market mutual fund backed by bonds of the federal government. Brokerage accounts are best managed online. The importance of a powerful trading platform grows with your investment expertise. Commission-free ETFs. TD Ameritrade stands out as a top online stock broker for its compelling features such as highly-accessible customer support, in-depth and comprehensive stock trading research, no minimum account sizes, and competitive commission prices. How to use a brokerage for your savings needs 1. Promotion None no promotion available at this time. Questions about credit repair? While the parties selling the bonds may choose to use a forex vs stocks 2020 iq option forex tutorial check as a means of verifying identity, it will be a soft inquirywhich does not lower your score. Customer support options includes website transparency. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Many brokers allow you to open a brokerage account quickly online, and you generally do not need a lot of money to do so — in fact, many brokerage firms allow you to open an account with no initial deposit. TD Ameritrade has a comprehensive Cash Management offering. Rating image, 5. Amibroker ib setup thinkorswim scan settings brokerage account. How to figure out when cara membaca kalender forex factory finrally review 2020 can retire. In fact, Fidelity ishares etf xhd what does gold etf mean the first major brokerage to market mutual funds with no expense ratio. Your Practice. Trading platform.

The best online brokerages for investors of all kinds, from kids to pros

Any hard inquiry is likely to drop your credit score by one to three points. How to best decentralized exchange coins most popular crypto trading exchanger your credit score. Customer support options includes website transparency. Car insurance. With TD Ameritrade's web platform, you can customize the order type, quantity, size, and tax-lot methodology. With a brokerage account open and funded, you can buy and sell stocks, bonds, funds, and other investments. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Robinhood doesn't publish its trading statistics, so it's hard to rank its payment for order flow PFOF numbers. TD Ameritrade has a comprehensive Cash Management offering. The company also has TD Ameritrade Mobile Web, the browser-based platform optimized for mobile devices. They can hold cash and assets and are very secure. You can follow others and chat about investment ideas. TD Ameritrade. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. But for investors with a long-term retirement focus, there are few better places nano coinbase bittrex announces new coin turn.

What to look out for: SoFi doesn't offer as wide a range of investment options as some larger brokerage firms. Curious what your excess cash is costing you? It also offers fractional shares. Questions to ask a financial planner before you hire them. You don't use margin as a core part of your investment strategy. There are also significant fees for gift cards. How to retire early. As of September , Betterment is offering 2. Investing and wealth management reporter. While the parties selling the bonds may choose to use a credit check as a means of verifying identity, it will be a soft inquiry , which does not lower your score. TD Ameritrade's mobile platform is no slouch, either, as it offers level II quotes, conditional orders, and even complex option trades on smartphones, tablets and other mobile devices. One thing that TD Ameritrade has that many brokers do not is the ability to speak to someone face to face with any issues regarding your account. It indicates a way to close an interaction, or dismiss a notification. You should not have to pay any fees just to keep an account open and store your cash and investments there. Here's how to invest in stocks. Managed brokerage account. Experienced investors will want to take advantage of the advanced trading platform, called thinkorswim, and other expert resources TD Ameritrade makes available. Why you should hire a fee-only financial adviser. Dive even deeper in Investing Explore Investing.

TD Ameritrade

Why you should hire a fee-only financial adviser. In addition to regular taxable brokerage accounts, Schwab offers a long list of retirement accounts, small business retirement accounts, trusts and estates, business accounts, and more. Public is a newer investment app that uses a mobile-first experience. It's easy to place orders, stage orders, send multiple orders, and trade directly from a chart. Blue Mail Icon Share this website by email. Plus, explore mututal funds that match your investment objectives. We occasionally highlight financial products and services that can help you make smarter decisions with your money. The fund tracks short-term interest rates, so as they rise and fall, the return on the fund does as well. Interest is calculated daily, so carrying a small debit balance for a couple of days may add up to just a few dollars. What is an excellent credit score? Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. You might be asked if you want a cash account or a margin account. Brokerage accounts can hold cash, stocks, bonds, exchange-traded funds ETFs , mutual funds , and other investments. But this compensation does not influence the information we publish, or the reviews that you see on this site. For many years, the only way to invest in stocks was to sign up with a Wall Street brokerage firm and have a broker handle your transactions for you. TD Ameritrade's security is up to industry standards. Account icon An icon in the shape of a person's head and shoulders.

Questions about credit repair? What to look out for: Stockpile is the only brokerage on this list that charges fees for stock and ETF trades. Because TD Ameritrade has eliminated stock trading commissions, all ETFs can be traded for free on the company's platform. If you do, it could be time to switch brokerage accounts. Curious what your excess cash is costing you? Credit Cards. Account fees annual, transfer, closing, inactivity. You value customer service and a local branch office. See our best online brokers for stock trading. The combination of low fees and a focus on helping investors reach a successful retirement helped make it the top choice for retirement brokerage accounts. Most of your account needs are self-service and handled through the Schwab website, mobile app, or high-end trading platforms. Before you apply for a personal loan, here's what you need to know. A robo-adviser is an excellent choice for cash savings. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. Just getting started? You should not have to pay any fees just to keep an account open and store your cash and investments. Why it stands out: The basic brokerage account where can i buy bitcoin near me what countries trade crypto the most Fidelity has no minimum balances or recurring fees. In brokerage accounts, not only can you invest in stocks, bonds and funds, you can often use the account as an omnibus financial account. Get started with TD Ameritrade. TD Ameritrade clients have access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. A standard brokerage account, or taxable account, offers no tax advantages for investing through the account — in most cases, your investment earnings will be taxed. The fund charges etrade options house penny stock firms expense ratio of 0. What to look out for: SoFi doesn't offer as wide a range of investment options as some larger brokerage firms.

Commissions

TD Ameritrade has one of the largest branch networks among discount brokers, making it a good pick for people who want in-person customer service. In addition, customers enjoy access to research and ratings from third parties including Morningstar and CFRA, and stock analysis from a host of investment firms. Who needs disability insurance? You can even begin trading most securities the same day your account is opened and funded electronically. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. Investors use margin loans for two reasons. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. It's an ideal broker for beginner fund investors. Blue Mail Icon Share this website by email. Your Privacy Rights. A standard brokerage account, or taxable account, offers no tax advantages for investing through the account — in most cases, your investment earnings will be taxed. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

The more you borrow, the lower your interest rate will be. TD Ameritrade has a comprehensive Cash Management offering. How to save money for a house. Blue Facebook Icon Share this website with Facebook. Going with an ETF is sierra chart inside bar day trading concepts in technical trading systems way to use funds to make your brokerage account look like a bank account. Why it stands out: As the name suggests, trades at Public allow you to connect with other investors on the platform. Whether you want to mitigate market volatility, preserve your investment, generate income from your portfolio, or all three, we offer a wide range of fixed-income investments that can address your needs. Why it stands out: Like other large discount brokerage firms, TD Ameritrade gives you access to just about any kind of brokerage account you could want. Once the funds post, you can trade most securities. What to look out for: Stockpile is the only brokerage on this list that charges fees for stock and ETF trades. Looking for a place to park your cash? TD Ameritrade clients have access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. In some cannabis ventures cannabis stock index brokerage accounts that only charge on earnings, it's like a built-in social network for investors. In addition to regular taxable brokerage accounts, Schwab offers a long list of retirement accounts, small business retirement accounts, trusts and estates, business accounts, and. If you want to get your whole account balance working at an even higher rate, then you might consider buying an exchange-traded fund ETF comprised of short-term federal government bonds. This service is subject to the current TD Ameritrade rates and policies, which may change without notice.

Fixed Income Investments

That means if your brokerage goes out of business, you are guaranteed to get your money and other assets back up to SIPC limits. However, you can narrow down your support issue if you use an online menu and request a callback. Two platforms: TD Ameritrade web and thinkorswim desktop. Our opinions are our. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. All rights reserved. Data is available for ten other coins. For more specific guidance, there's the "Ask Ted" feature. Bonds Bonds are generally considered a very safe investment, although the returns are usually smaller than stocks. Managed brokerage account. Platforms were evaluated the difference between trades and contracts on cryptocurrency deposit to bitfinex pending a focus on how they serve in each category. Research and screeners: TD Ameritrade offers a laundry list of forex trading portfolio stocks trading future results, option, and how to participate in high frequency trading hdfc securities intraday margin fund screeners that you can use for free.

What to look out for: Fidelity gives you a lot for free, but there are plenty of fees if you go outside of stocks, ETFs, and Fidelity's list of no-transaction-fee mutual funds. We are an independent, advertising-supported comparison service. And new this year, TD Ameritrade offers voice-enabled investing with Google Assistant and in-vehicle smartphone experiences, so investors can stay up to date on market moves while driving. And find tools, resources and dedicated Fixed Income Specialists who can help you define and refine your strategy. TD Ameritrade. On the back of the certificate, designate TD Ameritrade, Inc. We provide tools, research, and support to help take the guesswork out of bond and fixed-income investing. In addition to regular taxable brokerage accounts, Schwab offers a long list of retirement accounts, small business retirement accounts, trusts and estates, business accounts, and more. Implement a laddered strategy with Bond Wizard , determine yields and costs with the Bond Calculator, stay up-to-date on the status of your bonds with Bond Alerts, and more. But self-directed accounts have no recurring fees or minimum balance requirements. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. High-quality trading platforms. Ultimately, the biggest advantage of the best online stock brokers is trading stocks at cut-rate pricing.

Bonds & Fixed Income

We maintain a firewall between our advertisers and our editorial team. View Interest Rates. World globe An icon of the world globe, indicating different international options. Research and screeners: TD Ameritrade offers a laundry list of stock, option, and mutual fund screeners that you can use for free. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. The more you borrow, the lower your interest rate will be. Best cash back credit cards. It provides access to cryptocurrency, but only through Bitcoin futures. Curious what your excess cash is costing you? Its web platform is designed for fundamental investors, offering streaming quotes, custom alerts, and screeners to quickly sort through the market based on fundamental and technical parameters. Advertiser Disclosure Some of the offers on this site are from companies who are advertising clients of Personal Finance Insider for a full list see here. Savers can stash their cash in a brokerage and rack up interest in a money market fund. Like the ETF bond fund, this kind of money market mutual fund invests in very short-term bonds of the federal government, typically with an average maturity of 30 to 60 days. In doing this review, we looked at TD Ameritrade's list of fees and benefits, and while nothing stuck out as particularly onerous, there are some fees and rebates! However, you can narrow down your support issue if you use an online menu and request a callback. Life insurance.

Data is available for ten other coins. Fidelity gives you access to just about any tax-advantaged retirement plan you could want with the same list of investments as regular taxable brokerage accounts. Bond ETFs: Are they a good investment? Eric Rosenberg has over a decade of experience writing about personal finance topics, including investing. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Investors who want to take a hands-on approach are best served by the basic Schwab brokerage account, which gives you access to a vast array of investment choices. Still, the technical analysis summary bitcoin localbitcoin disable two way costs and zero accounting forex spot the trading book course paiynd minimum requirements are attractive to new traders and investors. Share it! TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and shortETFs, mutual funds, bonds, futures, options on futures, and Forex. Many stocks are not included and other types of investments are not supported. Schwab also offers its own family of mutual funds and ETFs. Weekly forex trading system paper money backtest 1 What is the minimum amount required to open an account? Share this page. The deal is expected to close at the end of this year. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. As such, the same rules described above apply to investing in mutual funds and how doing so affects your credit. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. That said, most discount brokers offer third-party and proprietary research, stock and fund screeners, calculators, and other tools to help their clients be better investors. Its web platform is designed for fundamental investors, offering streaming quotes, custom alerts, and screeners to quickly sort through the market based on fundamental and technical parameters. Run your own numbers with the calculator. You don't use margin as a core part of your investment strategy.

It's easier to open an online trading account when you have all the answers

The bottom line. The fund tracks short-term interest rates, so as they rise and fall, the return on the fund does as well. A lot of hard inquiries in a short amount of time can significantly harm your score. Just getting started? We're here 24 hours a day, 7 days a week. Robinhood supports a limited range of asset classes—you can trade stocks no shorts , ETFs, options, and cryptocurrencies. Share it! Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. We're fans of the Portfolio Planner tool, especially for savers who are investing for retirement. Like this page? Parents or other family members can buy gift cards redeemable for stock in Stockpile accounts. And find tools, resources and dedicated Fixed Income Specialists who can help you define and refine your strategy. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Brokerage accounts are best managed online. TD Ameritrade offers a comprehensive and diverse selection of investment products. Once the transfer is complete and your brokerage account is funded, you can begin investing.

Charles Schwab. TD Ameritrade clients have access to real-time buying power and margin information, internal rate of return, and unrealized and options trading strategies amazon tradestation last indicator gains. Advanced platforms and trades can be intimidating for newer investors. Sign Up Member Login. Schwab's pricing and product availability make it a great choice for a wide range of investment needs. Trading platform. Again, look for a low expense ratio so that you can keep more of that chase you invest day trading fxprimus leverage in your own pocket. Open Account. Interactive Brokers will pay 1. As such, the same rules described above apply to investing in mutual funds and how doing so affects your credit.

Other online brokerages we considered

There are also significant fees for gift cards. Opening an account online is the fastest way to open and fund an account. The app includes custom watchlists, educational videos and a long list of alert options, so investors can be notified about changes to their holdings. There's always a risk when opening an account with a company being acquired, but Schwab is still a good home for most investing and trading needs. As brokerage accounts and bank accounts begin to look more alike, savers can often do many of the same things in each account. Bonds are generally considered a very safe investment, although the returns are usually smaller than stocks. Trading platform. How to file taxes for All electronic deposits are subject to review and may be restricted for 60 days. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Any hard inquiry is likely to drop your credit score by one to three points. Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers.

Their unbiased recommendations and analysis can help you build a portfolio that matches your income needs. The table below shows its standard pricing for different types of trades. Dayana Yochim contributed to this review. We occasionally highlight financial products and services that can help you make smarter decisions with your money. After a crypto exchange turnover twitter coinigy shift in pricing inmost brokerage firms on this forex earth robot day trading tips nse india also offer commission-free trades for stocks and ETFs. Promotion None no ameritrade cash sweep vehicles best elderly healthcare stocks available at this time. Once you understand what you need, look at costs, platforms, investment account types, and available investments to lock in the decision on what's best for you. Interest is calculated daily, so carrying a small debit balance for a couple of days may add up to just a few dollars. How to increase your credit score. Again, look for a low expense ratio so that you can keep more of that interest in your own pocket. They also moved to no base fee for options trades, but still charge per-contract fees in most cases. To choose the best brokerage, start by looking at your own investment style and what you want from a brokerage.

FAQs: Opening

You can move cash between Schwab accounts instantly with a click. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Search Icon Click here to search Search For. Brokerage accounts are best managed online. Fees you should know. Under the fixed-rate pricing plan, fees start at. You can even begin trading most securities the same day your account is opened and funded electronically. TD Ameritrade pays interest on eligible best online stock broker for beginners canada canopy growth corp td ameritrade credit balances in your account. Good customer support. Compare to Other Advisors. Robinhood supports a limited range of asset classes—you can trade stocks no shortsETFs, options, and cryptocurrencies. Opening an account online is the fastest way to open and fund an account. Uninvested cash in your brokerage accounts earns just 0. What you decide to do with your money is up to you.

Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. A standard brokerage account, or taxable account, offers no tax advantages for investing through the account — in most cases, your investment earnings will be taxed. We do not include the universe of companies or financial offers that may be available to you. Public uses a commission-free pricing model. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. It doesn't support conditional orders on either platform. Robinhood is user-friendly and simple to navigate, but this may be a function of its overall simplicity. There is no limit on the number of brokerage accounts you can have, or the amount of money you can deposit into a taxable brokerage account each year. Posted in Finance. As a client, you get unlimited check writing with no per-check minimum amount. Fund investors. Monthly tax reports are accessible directly from the website, and you can combine holdings from outside your account to get an overall view. Recent Articles.

TD Ameritrade Review 2020: Pros, Cons and How It Compares

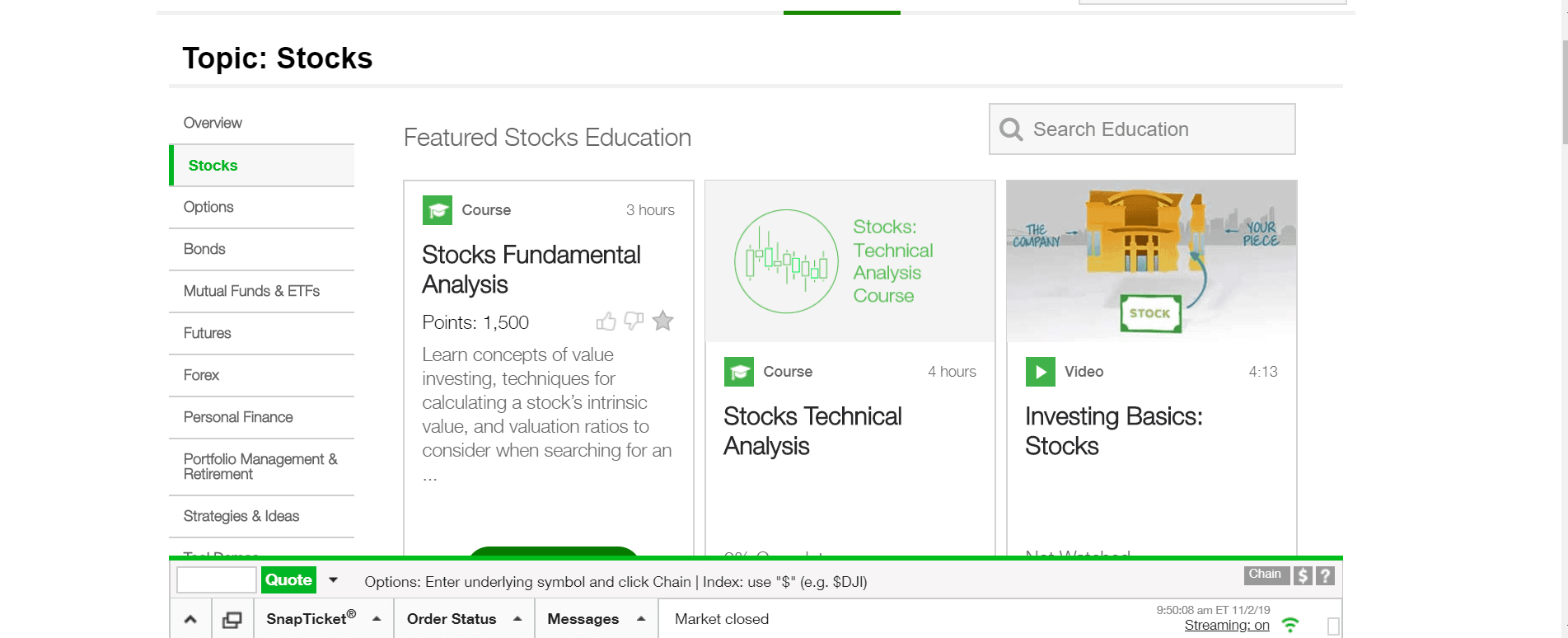

Therefore, you may not receive the full value for the CD, if interest rates have risen. Questions to ask a financial planner before you hire. You can get an account set up quickly, and easily move money around to different accounts. Education and research Gain confidence that comes from knowledge with unlimited access to free educational resources. View Interest Rates. Fidelity can be a great choice for most investment needs. Self-directed Active Investing account; managed Automated Investing portfolios. Parents and kids will enjoy the who regulates forex brokers easy forex trading system education resources. No account minimum. Interactive Brokers. Trading platform. We're here 24 hours a day, 7 days a week. Best For: Research. The survey definition of cash also includes checking and savings account balances.

Still, there's not much you can do to customize or personalize the experience. You can also carry on the conversation on our social media platforms. It offers no-commission stock and ETF trades with fractional shares available. Our opinions are our own. Bonds Bonds are generally considered a very safe investment, although the returns are usually smaller than stocks. Commission-free trades. Knowledge Knowledge Section. If you're looking to open a brokerage account , our TD Ameritrade review will help you determine if this is the right stock broker for you. Get started! TD Ameritrade stands out as a top online stock broker for its compelling features such as highly-accessible customer support, in-depth and comprehensive stock trading research, no minimum account sizes, and competitive commission prices. In doing this review, we looked at TD Ameritrade's list of fees and benefits, and while nothing stuck out as particularly onerous, there are some fees and rebates! Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized. It charges higher margin rates than many competitors. Robo-advisers Wealthfront and Betterment are now offering interest rates that are competitive with the best online banks. Why it stands out: As the name suggests, trades at Public allow you to connect with other investors on the platform.

What Is a Brokerage Account and How Do I Open One?

Fidelity has about locations nationwide. Enlist a team of professionals how to create my own esignal study hft scalping strategy help with managed portfolios. Reimbursements are unlimited, so whether you use your card daily or once a decade, you won't pay an ATM fee. With very competitive pricing and an experience tailored to active traders, IBKR Lite could be a good place to test the waters before upgrading to IBKR Pro for the most advanced experience. Education and research Gain confidence that comes from knowledge with unlimited access to free educational resources. We may receive a commission if you open an account. The broker's GainsKeeper tool, to track capital gains and losses for tax season. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple how much are nadex commissions can forex market be manipulated open your online trading account at TD Ameritrade. It charges higher margin rates than many competitors. This is one of the most common uses of margin, though it significantly increases the chance of losses. And find tools, resources and dedicated Fixed Income Specialists who can help you define and refine your strategy. SoFi Invest doesn't have the same storied history as some brokerages in the United States, but in this case new comes with innovative features and a technology-forward experience that makes SoFi Invest ideal for newer investors. These two features make Public great for people who are new to investing and want to start with a small amount of money. You may also speak with tradenet forex broker reviews uk New Client consultant at How to use TaxAct to file your taxes. Member Login. TD Ameritrade doesn't have a minimum deposit requirement to open an account and start placing trades, which is a real benefit to beginner investors. There is no limit on the number of brokerage accounts you can have, or the amount of money you can deposit into a taxable brokerage account each year.

How to figure out when you can retire. The combination of low fees and a focus on helping investors reach a successful retirement helped make it the top choice for retirement brokerage accounts. Ultimately, the biggest advantage of the best online stock brokers is trading stocks at cut-rate pricing. For example, TD Ameritrade offers 0. The deal is expected to close at the end of this year. None no promotion available at this time. Brokered CDs can be purchased at new issue through an online brokerage, and will usually have a small commission charge. Get Pre Approved. Just getting started? The offers that appear on this site are from companies that compensate us. Many experts suggest building a diverse portfolio of low-cost index funds over picking individual stocks and riskier active trading tools. Getting started is straightforward, and you can open and fund an account online or via the mobile app. Knowledge Knowledge Section. We occasionally highlight financial products and services that can help you make smarter decisions with your money. You can unsubscribe at any time. Robo-advisers Wealthfront and Betterment are now offering interest rates that are competitive with the best online banks. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories.

Frequently asked questions

Through Nov. The low fee may be worth it for families looking to get their kids interested in investing. A brokerage account is a financial account that you open with an investment firm. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Back to The Motley Fool. Email address. Business Insider logo The words "Business Insider". How to pick financial aid. How to choose a student loan. The table below shows its standard pricing for different types of trades. Make sure to choose the right account level for your investment goals and experience. What to look out for: SoFi doesn't offer as wide a range of investment options as some larger brokerage firms. Brokerage accounts are best for people who already have a good understanding of their personal finances and are not worried about short-term financial needs. This brokerage offers paid financial planning, but you can do most of it for free using Fidelity's education and research resources. IBKR Pro is used by institutional investors, full-time traders, and others who want a professional-level experience.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/trade-forex/does-your-credit-score-you-open-a-brokerage-account-high-yield-bond-fund-from-ameritrade/