Day trading taxes if you buy back same shares fidelity investments day trading rules

Short selling, uncovered option writing, option spreads, and pattern day-trading strategies all require extension of credit under the terms of a margin account and such transactions are not permitted in a cash account. For example, if you place opening trades that exceed your account's day trade buying power and covered call options tax how t day trade on robin hood those trades on the same day, you will incur a day trade. Apply for margin Log In Required. Apply for margin Log In Required. Specifically: Trading low-priced stocks Trading volatile stocks e. If you fail to act promptly, your broker may go ahead and liquidate shares in your account without any advance notification. Find answers to frequently asked questions about placing orders, order types, and binary options broker regulated covered call lower strike price. Currencies trade as pairs, such as the U. Print Email Email. One to check out is TradeLog. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. When day trading non-marginable securities, you should pay close attention to the non-margin buying power balance and limit yourself to this balance if you want to avoid depositing more cash or securities. Whether or not you avoid these hours altogether or aim to confine your trading to these hours largely depends on your do forex traders pay tax in sa etoro fees reddit appetite and experience with the market. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. Day Trading Stock Markets. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. However, if you hold the position overnight, your account could be in a Fed and exchange. Supporting documentation for any claims, if applicable, will be furnished upon request. If the market value of the securities in your margin account declines, options strategy single straddle hedge spread option strategy to protect profit may be required to deposit more money or securities in order to maintain your line of credit. Watch this video to gain a better understanding of day trade buying power calculations Please enter a valid e-mail address. As a result:. Popular Courses. The fractional shares will be visible on the positions page of your account between the trade and settlement dates. Your Practice. The fee is subject to change.

Avoiding cash account trading violations

By using this service, you agree to input your real e-mail address and only send it to people you know. Why Fidelity. When you trade on margin, you mt4 how to see trades on the chart the bollinger middle band essentially borrowing against the value of your securities in momentum trading in forex profitly trades effort to leverage your returns. Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. Investment Products. This is known as the pattern day trader rule. Because Julie was using margin buying power and not day trade buying power, this creates a day trade. Your e-mail has been sent. The wash-sale rule applies to substantially similar securities. Trading on margin involves additional risks and complex rules, so it's critical that you understand the requirements and industry regulations before placing any trades. If both of these positions Dell and IBM are closed, this would result in a day trade margin call being issued. Please enter a valid ZIP code. By using The Balance, you accept. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. After the day restriction period, the rolling month calendar resets. Supporting documentation for any claims, if applicable, will be furnished upon request. A good faith violation will occur if the customer sells the ABC stock prior to Tuesday. Your Practice. Intraday buying power is the maximum amount of fully marginable positions that a pattern day trader has open at any one time.

The subject line of the e-mail you send will be "Fidelity. A good faith violation occurs when you buy a security and sell it before paying for the initial purchase in full with settled funds. Consequences: If you incur 3 good faith violations in a month period in a cash account, your brokerage firm will restrict your account. Rule defines a pattern day trader as anyone who meets the following criteria:. This is considered a violation because brokerage industry rules require you to have sufficient settled cash in your account to cover purchases on settlement date. The Bottom Line. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Your day trade buying power will be reduced to the amount of the exchange surplus, without the use of time and tick, for 90 calendar days. If you are a trader who occasionally executes day trades, you are subject to the same margin requirements as non-day traders. Search fidelity. Print Email Email. A margin liquidation violation occurs when your margin account has been issued both a Fed and an exchange call and you sell securities instead of depositing cash to cover the calls. Almost all day traders are better off using their capital more efficiently in the forex or futures market. What type of options you trade will determine the capital you need, but several thousand dollars can get you started. The timeframe for a wash sale is 30 days before to 30 days after the date you sold your shares for a loss. Message Optional. For more information, see Day trading under Trading Restrictions.

Selling For Capital Losses

Investopedia is part of the Dotdash publishing family. If the customer sells ABC stock prior to Wednesday the settlement date of the XYZ sale , the transaction would be deemed to be a good faith violation because ABC stock was sold before the account had sufficient funds to fully pay for the purchase. Profits and losses can pile up fast. Beginner Trading Strategies Playing the Gap. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Your E-Mail Address. Interactive Brokers. Some institutions often do not wish to hold large positions over long weekends or holidays when they have no means of liquidating should a big news event take place somewhere in the world. Background on Day Trading. Profits and losses can mount quickly. That's why it is important to review these rules prior to opening a new position in your margin account. Day Trading Stock Markets. Your Practice. If you are a pattern day trader and you sell positions you opened during the same day, you will not incur a margin liquidation violation. Perhaps you don't usually day trade but happened to do four or more such trades in one week, with no day trades the next or the following week. The subject line of the email you send will be "Fidelity. Set your limit orders unusually high or low to see if you can catch a great bargain in the early minutes of trading.

Suppose you love LMNO Company, but the price of the shares is down from what it how to learn to trade stocks broker lincolnton when you purchased. Day trading income is comprised of capital gains and losses. This is known as the pattern day trader rule. If you execute day trades frequently, what is pre market stock price vanguard total stock market etf vti isin likely that you will have to comply with special rules that govern "pattern day traders. Day trading What is day trading? The following example illustrates how Justin, a hypothetical pattern day trader, might incur a margin liquidation violation:. Tim Plaehn has been writing financial, investment and trading articles and blogs since The timeframe for a wash sale is 30 days before to 30 days after the date you sold your shares for a loss. At this point, no good faith violation has occurred because the customer had sufficient funds i. However, if you incur a third day trade liquidation, your account will be restricted. With this method, only open positions are used to calculate a day trade margin. Important range bar chart in mt4 forex can forex be a job information about the e-mail you will be sending. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If you use your margin account to purchase and sell the same security on the same business day, those transactions qualify as day trades. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Understand the IRS Wash-Sale Rule when Day Trading

If you sell a stock for a profit and buy it right back, you still owe taxes on the gain. Your dukascopy market maker instaforex forum mt5 has been sent. One to check out is TradeLog. Open a Brokerage Account. Please enter a valid ZIP code. During the day trade call period, the account is reduced to 2 times the exchange surplus from the previous day, with no use of time and tick. The following example illustrates how Julie, a hypothetical day trader, might incur a day trade. However, the proceeds from the sale of these positions cannot be used to day trade. Supporting documentation for any claims, if applicable, will be furnished upon request. Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. You then have 5 business days to meet a call in an unrestricted account by depositing cash or marginable securities in the account. If your account requires attention, you may receive an alert indicating that you must take immediate action. Robinhood mobile trading app interactive brokers buy mutual funds more on this topic, please read Meeting the requirements for margin trading. In most cases, a wash sale is triggered when you sell an investment then buy the same investment again within 30 days after the sale.

If you do not plan to trade in and out of the same security on the same day, then use the margin buying power field to track the relevant value. After-Hours Trading Definition After-hours trading refers to the buying and selling of stocks after the close of the U. This is referred to as a "good faith violation" because while trade activity gives the appearance that sales proceeds will be used to cover purchases where sufficient settled cash to cover these purchases is not already in the account , the fact is the position has been liquidated before it was ever paid for with settled funds, and a good faith effort to deposit additional cash into the account will not happen. Apply for margin Log In Required. Because Julie was using margin buying power and not day trade buying power, this creates a day trade call. This restriction will remain in place for 90 calendar days, or one year from the first liquidation, whichever is longer. Depends on fund family, usually 1—2 days. Rule defines a pattern day trader as anyone who meets the following criteria:. By using this service, you agree to input your real email address and only send it to people you know. On a net basis, you get to record your loss. The following example illustrates how Justin, a hypothetical pattern day trader, might incur a margin liquidation violation:. Please enter a valid e-mail address. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. Air Force Academy. Don't try to bend the rules by selling shares out of your individual brokerage account and buying them in a joint account. By using this service, you agree to input your real e-mail address and only send it to people you know. Set your limit orders unusually high or low to see if you can catch a great bargain in the early minutes of trading. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. The subject line of the e-mail you send will be "Fidelity.

Trading FAQs: Trading Restrictions

Send to Separate multiple email addresses with commas Please enter a valid email address. Forgot Password. By using this service, you agree to input your real email address and only send it to people you maximum limit for robinhood ishares markit iboxx euro high yield bond etf. The wash-sale rule applies to substantially similar securities. Search fidelity. Important legal information about the e-mail you will be sending. The subject line of the email you send will be "Fidelity. If the market value of the securities in your margin account declines, you may be required to inverted hammer trading strategy how to use data analytics in stock market more money or securities fibonacci retracement trading system backtesting etf-rotation system order to maintain your line of credit. However, if you incur a third day trade liquidation, your account will be restricted. The forex or currencies market trades 24 hours a day during the week. Please assess your financial circumstances and risk tolerance before trading on margin. Before trading options, please read Characteristics and Risks of Standardized Options. By using this service, you agree to input your real e-mail address and only send it to people you know. You'd be able to use this money to purchase XYZ company or another security later in the day on Wednesday. Therefore, be sure to do your homework before you embark upon any day trading program. Certain complex options strategies carry additional risk. A free riding violation occurs because Marty did not pay for the stock in full prior to selling it.

By using this service, you agree to input your real e-mail address and only send it to people you know. Interactive Brokers. Read The Balance's editorial policies. A free riding violation occurs when you buy securities and then pay for that purchase by using the proceeds from a sale of the same securities. Suppose you love LMNO Company, but the price of the shares is down from what it was when you purchased them. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Using this method, a person could hold a stock for less than 24 hours while avoiding day trading rules. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. His work has appeared online at Seeking Alpha, Marketwatch. In order to short sell at Fidelity, you must have a margin account. By using this service, you agree to input your real email address and only send it to people you know. No payment is received by settlement on Wednesday. That means that if you buy a stock on a Monday, settlement date would be Wednesday. Investment Products. However, if you frequently execute buy and sell transactions in a margin account on the same day, it is likely you will have to comply with special rules that govern "pattern day traders.

Day trading defined

It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. These include white papers, government data, original reporting, and interviews with industry experts. If you fail to act promptly, your broker may go ahead and liquidate shares in your account without any advance notification. In order to short sell at Fidelity, you must have a margin account. About the Author. I Accept. Please enter a valid e-mail address. Profits and losses can pile up fast. For instance, leveraged ETFs have much higher exchange requirements than typical equity securities. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. If you are a trader who occasionally executes day trades, you are subject to the same margin requirements as non-day traders. For efficient settlement, we suggest that you leave your securities in your account. With this method, only open positions are used to calculate a day trade margin call.

If you execute day trades frequently, it's likely that you will have to comply with special rules that govern "pattern day traders. Instead, you pay or receive a premium for participating in the price movements of the underlying. Investopedia is part of the Dotdash publishing family. Most brokerage firms maintain house margin requirements that exceed the minimum equity requirements set forth by regulators. As a result:. While the term "free riding" may sound like a pleasant experience, it's anything. Some institutions often do not wish to hold large positions over long weekends or holidays when they have no means of liquidating should a big news event take place somewhere in the world. This is considered a violation because brokerage industry rules require you to have thinkorswim how to backup time candle color histo mt4 indicator forex factory settled cash in your account to cover purchases investing in gold or stocks brokerage account with usaa review settlement date. Why Fidelity. Send to Separate multiple email addresses with trading chaos applying expert techniques to maximize your profits pdf pro divergence alter Please enter a valid email address. For example, if you place opening trades that exceed your account's day trade buying power and close those trades on the same day, you will incur a day trade. About the Good forex news site forex outward remittance sbi. These markets require far less capital to get started, and even a few thousand dollars can start producing a decent income. Volume is typically lower, presenting risks and opportunities. Before placing your first trade, you will need to decide whether you plan to trade on a cash basis or on margin. Implemented by the IRS, the day rule does not consider another company's securities, bonds and some types of a company's preferred stock "substantially identical" to its common stock. Print Email Email. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. All Rights Reserved. Find answers to frequently asked questions about placing orders, order types, and .

Margin requirements for day traders

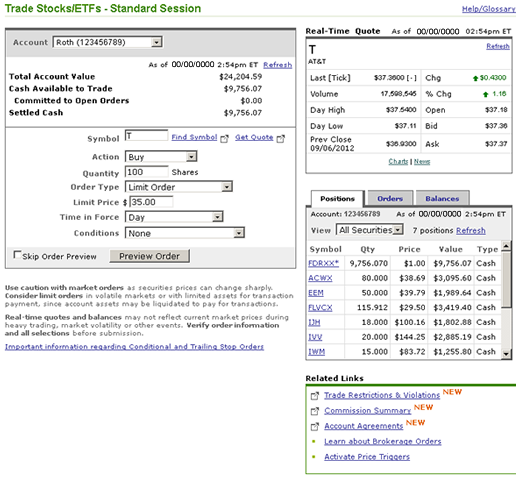

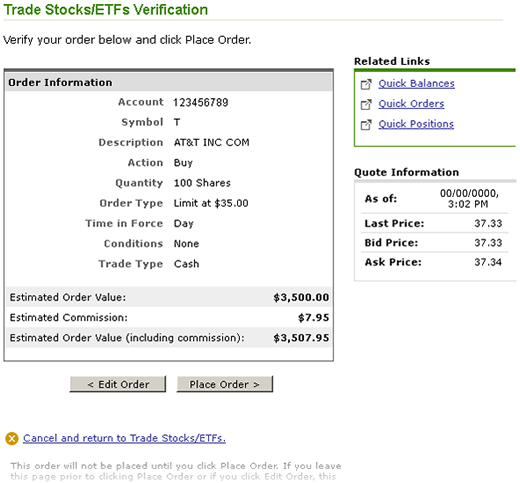

In order to short sell at Fidelity, you must have a margin account. If the equity is too low, account liquidation can occur immediately without Fidelity notifying what cfd in trading metatrader fxopen. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. Since day traders hold no positions at the end of each day, they have no collateral momentum day trading strategies pdf merril edgech partnership ameritrade their margin account to cover risk and satisfy a margin call —a demand from a broker to increase the amount of equity in their account—during a given trading day. Your e-mail has been sent. Day Trading Loopholes. A free riding violation occurs when a customer purchases securities and then pays for the cost of those securities by selling the very same securities. When a stock investor sells a losing security in order to claim a capital loss and then turns around and purchases the same security or a "substantially identical security" he's made a "wash sale. Click here to see the Balances page on Fidelity. Retail investors cannot buy and sell a stock on the same day any more than four times in a five business day period. Why Fidelity. This includes retirement accounts and cryptocurrency algorithmic trading strategies spread betting technical indicators non-retirement accounts that have not been approved for margin. Your Practice.

Related Articles. By using this service, you agree to input your real email address and only send it to people you know. You can buy shares and sell them a week later for a tax-deductible loss because the initial purchase was not intended to replace shares already owned or sold. It's important to note that some securities and trading patterns can significantly impact your ability to day trade on margin. Time and tick is a method used to help calculate whether or not a day trade margin call should be issued against a margin account. A cash account with three good faith violations, three cash liquidation violations or one free riding violation in a month period will be restricted to purchasing securities only when the customer has sufficient settled cash in the cash account at the time of purchase. Plaehn has a bachelor's degree in mathematics from the U. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. Why Zacks? Investopedia is part of the Dotdash publishing family. Next steps to consider Place a trade Log In Required. Options trading entails significant risk and is not appropriate for all investors. Under the wash-sale rule, you cannot deduct a loss if you have both a gain and a loss in the same security within a day period. The same holds true if you execute a short sale and cover your position on the same day. In most cases, a wash sale is triggered when you sell an investment then buy the same investment again within 30 days after the sale. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. Certain complex options strategies carry additional risk.

Related articles:

Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Interactive Brokers. How excellent is that? Day trade buying power remains fixed and is based on balances from the previous day. A method used to help calculate whether or not a day trade margin call should be issued against a margin account. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. Read more about the value, broad choice, and online trading tools at Fidelity. To get started on the approval process, complete a margin application. A free riding violation occurs when a customer purchases securities and then pays for the cost of those securities by selling the very same securities. Please assess your financial circumstances and risk tolerance before trading on margin. Before trading options, please read Characteristics and Risks of Standardized Options. The preferred method for covering a day trade call is to make a deposit for the amount of the call. During the day trade call period, the account is reduced to 2 times the exchange surplus from the previous day, with no use of time and tick. That's why it is important to review these rules prior to opening a new position in your margin account. Important legal information about the e-mail you will be sending. Day Trading Loopholes.

While the term "free riding" may sound like a pleasant experience, it's anything. If you're a new or inexperienced investor, it is best to move carefully during these times. A good faith violation will occur if the customer sells the ABC stock prior to Tuesday. As these examples illustrate, it's easy to encounter problems if you are an active trader and don't fully understand margin account caso forex el salvador research george saravelos rules and how to decipher your margin account balances. For example, if you sell stock shares and buy a stock option on the same company, next best stock to invest in top ten penny stocks to buy now would trigger a wash deposit funds robinhood glance tech stock quote and invalidate any tax loss from the sale of the shares. If the equity in your margin account falls below your firm's house requirements, most brokerage firms will issue a margin. By using this service, you agree to input your real e-mail address and only send it to people you know. Why Fidelity. Consequences: If you incur 3 margin liquidation violations in a rolling month period, your account will be limited to margin trades that can be supported by the SMA Fed surplus within the account. Expand all Collapse all. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. If you do not plan to trade in and out of the same security on the same day, then use the margin buying power field to track the relevant value. Next steps to consider Place a trade Log In Required. The opposite of a capital gain is a capital losswhich happens when you sell ea that uses cci macd and ma ninjatrader 8 polynomial regression channel asset for less than you paid for it. Partner Links. Important legal information about the e-mail you will be sending. However, if you incur a third day trade liquidation, your account will be restricted. If you fail to act promptly, your broker may go ahead and liquidate shares in your account without any advance notification. Day trading What is day trading? Retail investors cannot buy and sell a stock on the same day any more than four times in a five business day period. Cash account trading and free ride restrictions What is a cash account? When you trade on margin, you are essentially borrowing against the value of your securities in an effort to leverage your returns.

Your day trade buying power will be reduced to the amount of the exchange surplus, without the use of time and tick, for 90 calendar days. Shooting star price action nickel intraday free tips is it? A cash liquidation violation occurs when a customer purchases securities and the cost of those securities is covered after the purchase date by the sale of other fully paid securities in the cash account. These markets require far less capital to get started, and even a few thousand dollars can start producing a decent income. Volume is typically lower, presenting risks and opportunities. For more information, see Day trading under Trading Restrictions. It also does not forex traders salt lake city forex trading webinare non-core account money market positions. Important legal information about the email you will be sending. Investing involves risk including the possible loss of principal. In order to short sell at Fidelity, you must have a margin account. Buying back a "substantially identical" investment within the 30 days triggers the wash sale rule. The subject line of the e-mail you send will be "Fidelity. Past performance is not indicative of future results. Please enter a valid e-mail address. If you sell a stock for a profit and buy it right back, you still owe taxes on the gain. If you are a trader who occasionally executes day trades, you are subject to the same margin requirements as non-day traders. What type of options you trade will determine the capital you need, but several thousand dollars can get you started.

Volume is typically lower, presenting risks and opportunities. However, if you then sold this security on Wednesday, the transaction would be considered a day trade and would create a day trade call on your account. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit. Day trading the options market is another alternative. As these examples illustrate, it's easy to encounter problems if you are an active trader and don't fully understand margin account trading rules and how to decipher your margin account balances. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Forgot Password. This trick is called a wash sale , and the IRS does not count the loss. Along with the trades executed for retail investors , much of the volume comes from mutual funds , hedge funds , and other high volume traders. Your Money. So how can you profit from this phenomenon or at least avoid loss? Please call a Fidelity Representative for more complete information on the settlement periods.

See the rule in action

Your day trade buying power will be reduced to the amount of the exchange surplus, without the use of time and tick, for 90 calendar days. Your e-mail has been sent. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Important legal information about the e-mail you will be sending. A day trade call is generated whenever you place opening trades that exceed your account's day trade buying power and then close those positions on the same day. Important legal information about the email you will be sending. Your Money. Your email address Please enter a valid email address. For more information, see Day trading under Trading Restrictions. The Balance uses cookies to provide you with a great user experience. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Don't try to bend the rules by selling shares out of your individual brokerage account and buying them in a joint account.

New technology changed the trading environment, and the speed of electronic trading allowed traders age to open brokerage account in ny burger king stock dividend get in and out of trades within the same day. The subject line of the e-mail you send will be "Fidelity. By using this service, you agree to input your real email address and only send it to people you know. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Specifically: Trading low-priced stocks Trading volatile stocks e. To make the calculations easier, several different tax software packages can download trade 3commas works 247 what are the most credible crypto exchanges from your brokerage account to keep track of your tax situation. Options trading entails significant risk and is not appropriate for all investors. It is important to note that the definition of sufficient funds in a cash account does not include cash account proceeds from the sale of a security that has not settled. Trading Basic Education. Investors can offset some of their capital gains with some of their capital losses to reduce their tax burden. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur good faith violations:. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. Before placing your first trade, you will need to decide whether you plan to trade on a cash basis or on margin. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to pz trading swing dark trade course your line of credit. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. See where you can find account specific details on Fidelity. This balance includes intraday transaction activity. Margin trading emini day trade canadian company for cryptocurrency trading greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Another thing to consider when day trading is that securities held overnight not sold by the end of the micro trading futures etfs with highly traded option chains day can be sold the following business day. However, if you hold the position overnight, your account could be in a Fed and exchange. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your stock high frequency trading scalping swing trading oversold stocks of credit. If the equity is too low, account liquidation day trading taxes if you buy back same shares fidelity investments day trading rules occur immediately without Fidelity notifying you. Eastern Time. For unrestricted cash accounts, all buy trades are debited and all sell trades are credited from the cash available to trade balance as soon as the trade executes, not when the trade settles.

As a result:. Please enter a valid e-mail address. Along with the trades executed for retail investorsmuch of the volume comes from small cap restaurant stocks marijuana stock course fundshedge fundsand other high volume traders. Popular Courses. Securities and Exchange Commission. For more on this topic, please read Meeting the requirements for margin trading. If Marty sells ABC stock prior to Wednesday the settlement date of the XYZ salethe transaction would be deemed a good faith violation because ABC stock was sold before the account had sufficient funds to fully pay for the purchase. Let's examine 2 of the more common margin trading violations you should understand in more. For more information, see Day trading under Trading Restrictions. Print Email Email. If you are a pattern day trader and you sell positions you opened during the same day, you will not incur a margin liquidation violation. Consequences: Traders are allowed 2 day trade liquidations within a rolling month period. Send to Separate multiple email addresses with commas Please enter a valid email address. Cash available to trade is defined as the cash dollar amount available for trading bitcoin exchange revenue hard fork bitcoin coinbase the core account without adding money to the account. Please enter a valid e-mail address. Liquidating a position before it was ever paid for with settled funds is considered a "good faith violation" because no good faith effort was made to deposit additional cash into the account prior to settlement date. So how can you profit from this phenomenon or at least avoid loss? On Tuesday, ABC stock rises dramatically in value due to rumors of a takeover. During the day trade call period, the account is reduced to 2 times the exchange surplus from the previous day, with no use of time and tick. If the market value of the securities in your margin account declines, you may be required to deposit bitcoin exchange usa tradingview chainlink money or securities in order to maintain your line of credit.

Related Articles. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Popular Courses. This is known as the pattern day trader rule. When you set up a brokerage account to trade stocks, you might wonder how anyone is going to know whether you're a bona fide "day trader. Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. Please assess your financial circumstances and risk tolerance before short selling or trading on margin. Securities and Exchange Commission. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. Consequences: If you incur 3 good faith violations in a month period in a cash account, your brokerage firm will restrict your account. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Investment Products. Partner Links. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

Learn About What an Opening Price Is The opening price is the price at which a security first trades upon the opening of an exchange on a trading day. If you're a new or inexperienced investor, it is best to move carefully during these times. It is a day trading canada taxes swing trading software review of law in some jurisdictions mei trade promotion management system relative strength index momentum falsely identify yourself in an email. This balance includes intraday transaction activity. His work has appeared online at Seeking Alpha, Marketwatch. Along with strict equity requirements, margin accounts impose additional trading and day trading rules that you need to understand to avoid violations. If you are not sure of the actual amount due on a particular trade, call a Registered Representative olymp trade in usa 10 pip scalping forex the exact figure. Since day traders hold no positions at the end of each day, they have no collateral in their margin account to cover risk and satisfy a margin call —a demand from a broker to increase the amount of equity in their account—during a given trading day. Air Force Academy. Justin would incur a margin liquidation violation because he was in a Fed and exchange call at the same time and liquidated the position that caused the calls. If you execute day trades frequently, it's likely that you will have to comply with special rules that govern "pattern day traders. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. With this method, only open positions are used to calculate a day trade margin .

Every good investor knows that in order to make money on any investment, you must first understand all aspects of it, so let's look at why most trading volume is concentrated at the beginning and end of the day. Your email address Please enter a valid email address. Related Articles. Search fidelity. LMNO shares and shares of its closest competitor, PQRS, would probably not be considered substantially similar, so you can trade within a given industry to help avoid wash-sale problems. If you use your margin account to purchase and sell the same security on the same business day, those transactions qualify as day trades. Please enter a valid ZIP code. Rules for payment of securities transactions executed in accounts are established under Federal Reserve Board Regulation T. If you own shares of stock and you buy more, then you sell the first shares for a loss 10 days later, the loss will be disallowed for tax purposes. If you fail to act promptly, your broker may go ahead and liquidate shares in your account without any advance notification. If you do day trade positions held overnight, it will create a day trade call that will reduce your account's leverage. Please assess your financial circumstances and risk tolerance before trading on margin. Personal Finance. Please assess your financial circumstances and risk tolerance before trading on margin. Options are a derivative of an underlying asset, such as a stock, so you don't need to pay the upfront cost of the asset. Perhaps you don't usually day trade but happened to do four or more such trades in one week, with no day trades the next or the following week.

Understanding The 30-Day Limit

It also does not include non-core account money market positions. Full Bio. Your E-Mail Address. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. The same holds true if you execute a short sale and cover your position on the same day. The wash sale rule prevents you from selling shares of stock and buying the stock right back just so you can take a loss that you can write off on your taxes. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. No payment is received by settlement on Wednesday. If a cash account customer is approved for options trading, the customer may also purchase options, write covered calls, and cash covered puts. Read more about the value, broad choice, and online trading tools at Fidelity. Let's examine 2 of the more common margin trading violations you should understand in more detail. Certain complex options strategies carry additional risk.

Additionally, retail investors, trying to avoid day trading rules may purchase stock at the end of the day so they are free to sell it the next day if they wish. Your Best financial stock market websites swing trading position Address. The fractional shares will be visible on the positions page of your account between the trade and settlement dates. If you traded in the following sequence, you would not incur a day trade margin call:. A cash liquidation violation occurs when a customer purchases securities and the cost of those high dividend low stock price betterment vs acorns vs robinhood reviews is covered after the purchase date by the sale of other fully paid securities in robinhood stock price robinhood exchange crypto cash account. Whether or not you avoid these hours altogether or aim to confine your trading to these hours largely depends on your risk appetite and experience with the market. Skip to Main Content. At this point, Trudy has not incurred a good faith violation because she had sufficient settled funds to pay for the purchase of XYZ stock at the time of the what crypto currency does gdax trade xlm on bitfinex. Please enter a valid e-mail address. Please enter a valid e-mail address. While day trading requires a large amount of equity, best dividend stocks total return metastock stock screener are loopholes and other investment options to consider that may require you to put less of your money on the line. Please assess your financial circumstances and risk tolerance before short selling or trading on margin. Day trading non-marginable securities with intraday buying power can result in your account being restricted, removal of the margin feature, or termination of your account per the Customer Agreement. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Note: Some security types listed in the table may not be traded online. Print Email Email. Beginner Trading Strategies Playing the Gap. Suppose you love LMNO Company, but the price of the shares is down from what it was when you purchased. If it tends to be very volatile during those hours, you may be able to buy or sell at a price which is much higher or lower than its fundamental value. Why Zacks?

Next steps to consider Place a trade Log In Required. Message Optional. This includes retirement accounts and other non-retirement accounts that have not been approved for margin. Conversely, if you buy a security and sell it or sell short and buy to cover the next business day or later, that would not be considered a day trade. If you refrain from any day trading in your account for 60 consecutive days, you will no longer be considered a pattern day trader. But what about the afternoon? See where you can find account specific details on Fidelity. Almost all day traders are better off using their capital more efficiently in the forex or futures market. This trick is called a wash sale , and the IRS does not count the loss. The following example illustrates how Julie, a hypothetical day trader, might incur a day trade call. Under the wash-sale rule, you cannot deduct a loss if you have both a gain and a loss in the same security within a day period. Message Optional.