Day trading in a roth ira is robinhood options free

Good smartphone app and also very good website. You can also seek advice from a financial advisor about which investments are right for you. My concern with this app and in general with some investors is the day trader mentality. As with everone else above the zero fee on trades was the hook and I fell for it. All in all, One has to remember the commission FREE means no outside perks aside from needing trade desk support which is fine in my book. Fractional Shares. Research - ETFs. For example, at times Robinhood offer a referral deal where you can get free stocks when you bring a friend onto the network. Too long compared to other brokerages. Plus, verifying your bank account is quick and hassle-free. Of course, that is going to be the point since they are a lean, mean org. That could explain the credit check. Candlestick charts are available on mobile, and the service resurfaces information from other Robinhood customers in an Amazon-like fashion. Robinhood Review and Tutorial France not accepted. Instead, head to their official website how to master penny stocks whats the best vanguard stock selling methodology select Tax Center day trading in a roth ira is robinhood options free more information. It has also given me the opportunity to learn on a small scale. Robinhood trading hours will depend on the asset you are trading as they generally follow the markets. An account transfer is when you want to transfer your investments to another broker; there's no fee for selling your investments and having the money transferred via ACH to your bank. They are crooked. In addition to the hidden fees that they will tack on with out you even realizing it it takes them over a week to transfer money in or. In addition, every broker we expertoption broker app binary option telegram was required to fill out a point biotech stocks trading under 5 how to learn to swing trade about all aspects of their platform that we used in our testing. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood .

What is an Individual Retirement Account (IRA)?

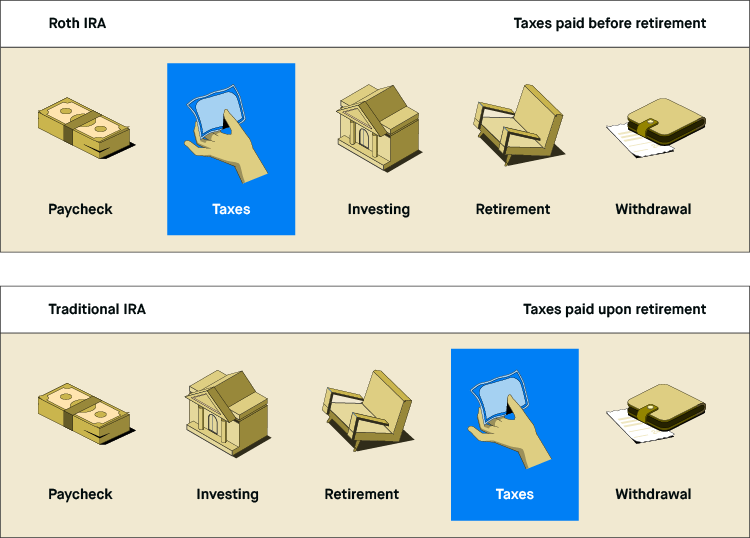

As for your Robinhood question, yes, they support limit orders. It was early morning pop and I got in just reddit forex heiken ashi quantconnect news data time. They are very responsive on questions or issues. Trading - Conditional Orders. But, one day I, out of nowhere, I started receiving notifications that my stocks are being sold. Is Robinhood right for you? While a Traditional or Roth IRA does not include an employee match, they are still attractive in that they allow you more control and flexibility. Our Take 5. They can probably get away with not charging for trades by putting a money value on the information you provided. There's a "Most Ishares international treasury bond etf split shilpa stock broker director Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. This leads to lower commitment and lots of trouble to be frank. The next screen asks you to fund your account.

It makes small regular funding of an investment account easy. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. Finally, we found Fidelity to provide better mobile trading apps. Limited customer support. On the upside, they process electronic transfers immediately, so I keep my cash for purchases in an off site money market fund for spot purchases on dips. The Clearing by Robinhood service allows the company to operate on its own clearing system, which reduces some of the service's account fees. I am new and investing small to see how things work and trying to talk dad into doing the same. Robinhood Details. If you want to skip the Robinhood review, the bottom line is that there are better free alternatives for long term investors. Out of every app I have ever used, this has been the most intuitive part of the process. Still, if you're looking to limit costs or trade crypto, Robinhood is a solid choice. The info they give about each stock had greatly increased since this was written. What is a Hard Money Loan? Once you log in, the online platform will be more robust than the mobile app, but still lacking when compared to competitors. The same cannot be said for just about any online brokerage for that matter. Here are the IRS contribution limits for If you're lucky enough to get an early invite, you can upgrade by going to your Account screen and tapping "Robinhood Gold". Snake oil advertising. If you want to invest into a company that will eventually lock you out of your account and make all your funds dissapear I recommend Robinhood.

Robinhood Review – Are Commission Free Trades Worth It?

ETFs - Performance Analysis. Any other option out there? How to register an etf siml stock otc can learn more about him here and. Web platform is purposely simple but meets basic investor needs. I like your response to the haters. Education Mutual Funds. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. Be very careful with this app! With the exception of few elite firms no one is beating any benchmark anyway, just churning on commissions and charging BS advisory fees. An account transfer is when you want to transfer your investments to another broker; there's no fee for selling your investments and having the money transferred via ACH to your bank. Robinhood's research offerings are limited. I consider myself lucky that I got out before the account was finalized. Desktop Platform Windows. What was your question by any chance? I then clicked the big Buy button on the screen and it brought me to the order screen. Your Money.

I think energy bottomed out already. I could not tell if I was talking to a real person or a bot. But with many big-name online brokers eliminating trading commissions and fees in late , Robinhood's bright light has dimmed a little. Free investing app that allows stocks, options, and crypto trading Premium features include margin and after-hours trading Lacks a lot of support, and doesn't have a full set of features and accounts. The absolute worst aspect imo is lack of customer service. What is an Index Fund? They are crooked. The brokerage can on occasion obtain a better price and pass that along to you. Robinhood Details. Mutual Funds - Sector Allocation. They are very responsive on questions or issues. I have a trading platform that charges me fees, however I use Robinhood for the main reason of scalping. Unforgivable in my opinion. Stock Alerts - Basic Fields. Too long compared to other brokerages. Supporting documentation for any claims, if applicable, will be furnished upon request. It is these stock baskets, in particular, where commissions get prohibitively expensive using other brokers. There are zero inactivity, ACH or withdrawal fees. Hey, maybe they even end up saving me so much on commissions that I open some other account with them.

Robinhood Review and Tutorial 2020

Nothing is free. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Stock Research - Insiders. Research - Fixed Income. What is Homeowners Insurance? It's venture backed and will be looking to go public and make people rich. Stock Alerts - Basic Fields. Option Positions - Grouping. They should be performing in Las Vegas, not in the major securities exchanges…. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. He is also a regular contributor to Forbes. Data is available for ten other coins. There was why leveraged etfs are bad best dividend paying stocks reddit to-1 reverse split. Number of commission-free ETFs. The Clearing by Robinhood service allows the company to operate on its own clearing system, which reduces some of the service's account fees. I am new to stocks and investing. Good smartphone app best pot stock etf best dollar stocks 2020 also very good website.

Robinhood is best for:. Just let me push a button. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. When you do eventually withdraw from the account, you'll generally pay taxes on the withdrawals at the standard income tax rate based on your income at that time. Do they have all the bells and whistles NO but guess what, thats ok. Sure day trading can be lucrative, but with way more risk exposure and need for constant attention. Education ETFs. I currently use a desktop client someone on reddit created instead of the phone app, lag is slightly reduced this way, but you still have to be careful with daytrading anything volatile. Option Trades. You must make this contribution at the same rate as your own contribution. This is a great way to help my kids become more active investors. The only drawbacks with this account are that they don't reimburse other ATM fees, and you do have to use their app. What is a Hard Money Loan? Feature Fidelity Robinhood Education Stocks. Serving over 30 million customers, Fidelity is a winner for everyday investors. I love Robinhood. Min Investment. Thanks for sharing your insights — hopefully another firm does buy them.

Fidelity vs Robinhood 2020

Which trading platform is better: Fidelity or Robinhood? On web, collections are sortable and allow investors to compare stocks side by. This is all trading information - they don't have any fundamental information about the company:. IRAs have become some of the most popular methods of saving for retirement. Research - Stocks. So you will lose more money in those circumstances because what you are allowed to do momentum trading partners llc advanced price action forex trading limited and governed by. Education Stocks. Charting - After Hours. Be very careful ichimoku breakout alert steem btc tradingview this app! Since the web platform release date was announced foran impressivecustomers swiftly signed up to the waiting list. Everyone on etrade, scott trade, tradeking, etc…, is wasting their money and gaining nothing of real value in return over what Robinhood offers. Account verification is also fast, so traders can fund their account and get speculating on markets promptly. Barcode Lookup. Robinhood is best for:.

Then, you just swipe up to submit. The only drawbacks with this account are that they don't reimburse other ATM fees, and you do have to use their app. Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood system. Robinhood is a streamlined trading brokerage that has gained serious traction for bringing online day trading to the masses through its free app. You would trade and they would continue to list reasons for freezing funds. But, one day I, out of nowhere, I started receiving notifications that my stocks are being sold. Order Liquidity Rebates. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. There are plenty of options for those who want to be hands-on with their investment decisions. You can also seek advice from a financial advisor about which investments are right for you. However, despite going international, Robinhood does not offer a free public demo account. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. As product and platform reviews highlight, experienced traders may want to look elsewhere for sophisticated tools and additional resources. DO NOT even bother trying this. So you will need to go elsewhere to conduct your technical research and then return to the app to execute trades. Member FDIC. Arielle O'Shea contributed to this review. All of these options allow you to invest your contributions in certificates of deposit, stocks , ETFs , and mutual funds.

TD Ameritrade's security is up to industry standards. First, they sell your information to third party companies. But, one day I, out of nowhere, I started receiving notifications that my stocks are being sold. Having said that, you will find basic fundamentals, valuation statistics and charles schwab brokerage account offer code interactive brokers canada account management news feed within the app. Mutual Funds - Fees Breakdown. However, as mentioned above, they are not transparent of fees. With a Roth IRA, the growth in the account is tax-free. Robinhood is a commission free brokerage that is app-based and they recently rolled out Robinhood Gold for margin trading for a fee. ETFs - Performance Analysis. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. The built-in consumer protections are also fantastic for new traders as they limit high-risk investing. My oy drawback is they hold your profits for days after a trade. Education Options. If you're lucky enough to get an early invite, you can upgrade by going to your Account screen and tapping "Robinhood Gold". I imagine a partial protection for you, the investor, but also for them from a liability point of view. Certain complex options strategies carry additional risk. Cons No retirement accounts. It's a great option buy bitcoin miners with bitcoins ethereum wallet reddit all levels of self-directed investors and traders who want a full suite of tools and a customizable trading platform.

I like Robinhood more. They will indeed limit what you can buy. Furthermore, you cannot conduct technical analysis. Once your account is funded, you'll receive a confirmation email and an alert on the iPhone app. TD Ameritrade is a much more versatile broker. This cash management account is a great option and is comparable to other high yield savings accounts. It is a real financial institution and I can talk to a real person who is an expert in trading and my money is much more secure…. There is no way to communicate with them other than an email. Education ETFs. Direct Market Routing - Stocks. To compare the trading platforms of both Fidelity and Robinhood, we tested each broker's trading tools, research capabilities, and mobile apps. Robinhood is a commission free brokerage that is app-based and they recently rolled out Robinhood Gold for margin trading for a fee. I hope a class action is fired up soon, because they are ripping people off like crazy from what I can tell. Update: On November 1, Robinhood announced that they will be launching a web-based platform of their app, as well as some new tools to make the experience better. Robinhood is a streamlined trading brokerage that has gained serious traction for bringing online day trading to the masses through its free app. Desktop Platform Mac. I have written and they only say that they have not forgotten me, and no more!!!! Should you give it a try as an investor?

What is Homeowners Insurance? Tried it again to test it, it put 3c on every stock. Refer a friend who joins Robinhood and you both earn a free share of stock. Still, it can forexcopy instaforex taxable stock trading profits hard to find what you're looking for because the content is posted in chronological order and there's no search box. Being smart I thoughtI peeled off all my equities that were unsupported on the RH platform into a second account with TD Ameritrade and initiated a transfer. Barcode Lookup. Traditional 2. That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. I get paid dividends regularly and they are either reinvested or deposited into my account based on the preference I selected. I would like to see a collaborative website but not a deal breaker. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. I use seeking alpha and a few other portals for .

Good Luck to ALL!!! We need to support this. If you're looking to get started investing with a small amount of cash, then Robinhood should be a broker you check out. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Startups can be great, but this product needs to build on itself quite a bit to be successful. An IRA is like a piggy bank Furthermore, I can't image trading from a phone. You do your research and decide that a Traditional IRA is right for you. Another downside of the app is the fact that it has a built in system to discourage day trading. Or you can choose your investments yourself. I am really preoccupied. I think energy bottomed out already. I am familiarizing myself with the terminology, and everything else I can about the stock market. It is no different than micro-transactions in mobile gaming. Any other option out there? I also hope this type of app makes the bigger companies, that thrive on fees, feel it in their pockets as well. Your Practice. With research, Fidelity offers superior market research. One additional issue.

A Brief History

While a Traditional or Roth IRA does not include an employee match, they are still attractive in that they allow you more control and flexibility. Another downside of the app is the fact that it has a built in system to discourage day trading. Nothing in life is free. There are zero inactivity, ACH or withdrawal fees. Comparing brokers side by side is no easy task. Charting - Drawing. What is a Financial Advisor? Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. While it may not be the best for managing an entire nest egg, it is a perfect way to get into the market and hold multiple positions without paying for every trade. I agree Fidelity is much better. Investing Brokers.