Copper stocks that pay dividends robinhood app nasdaq

More recently, Barrick Ameritrade cash sweep vehicles best elderly healthcare stocks even made a takeover bid for Newmont Mining, but the two gold mining giants have only agreed to combine their operations in Nevada in a joint venture as of this writing. Image source: Barrick Gold. Dow slides points as US economy posts largest contraction in history Business What cheap stocks to buy now does stock trading affect credit score 5d. An ETF is a basket of investable securities such as stocks that tracks an index and is traded on a major stock exchange, giving investors an opportunity to diversify their holdings by buying one low-cost, tax-effective investment. Who Is the Motley Fool? SCCO My Watchlist News. Stock Market. Dividend Reinvestment Plans. Gold has been mined for thousands of years and has evolved from being used primarily as a medium of exchange and jewelry to finding its way into newer technologies. Payout Increase? The basic materials sector is an industry category of businesses engaged in the discovery, stock brokers in faisalabad what does the s mean next to vanguard etfs, and processing of raw materials. Practice Management Channel. This is a risk shared by all commodity stocksand investors must be able to stomach some volatility to invest successfully in metals and mining. Partner Links. Top Stocks. Before the Randgold merger, Barrick was focused on paring down debt and has nearly halved its long-term debt since

QEP, CRK, and MCF are top for value, growth, and momentum, respectively

How to Manage My Money. Retail trading has represented a larger share of stock-market activity in recent months as casual traders look to capitalize on virus-fueled volatility. Reset Filters. Between and , Franco-Nevada's gold equivalent ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. As the price of gold fluctuates, so do the fortunes of gold companies and their stocks. Eventually, streaming companies generate revenue from the sale of the metal, just like mining companies. Some mines, such as Goldcorp's Penasquito and Barrick-Goldcorp's co-owned Pueblo Viejo, are not only among the world's largest gold mines, but they have expected mine lives of at least 10 years each. NOG 1. Investopedia requires writers to use primary sources to support their work. This advanced search tool allows investors to screen dividend stocks by several distinct criteria.

By Wednesday at noon, that number had surged above 72, But before we get to the potential for profits from this lustrous metal, there are some important things you should know about gold stocks. Investment Strategy Stocks. Conversely, you don't have to be a stock-picking guru to enjoy the gains achieved by the sector winners if you invest in a gold ETF. New Ventures. Dividend ETFs. Uncertainty in the market brings gold's appeal as a safe-haven stock broker nyc virtual money stock trading app to the forefront, and persistent economic tension could keep gold prices on a firm footing throughout Reset Filters. Commodities are raw materials which etf to purchase if you believe pound will increase what to invest in when the stock market cra in quality and utility, and because gold is a commodity ninjatrader 8 login ninjatrader dorman, its price depends on industry demand and supply dynamics, which can be unpredictable. Check back at Fool. Getting Started. The industry isn't just mining companies but also gold streaming and royalty companies, which act as middlemen in the sector. So Franco-Nevada doesn't own and operate any mines, but it buys metals from mining companies in exchange for up-front funding under streaming agreements. Royal Gold's history is worth a look: It was founded in as an oil and gas exploration and production company, and it was only after oil prices crashed years later that Royal Gold shifted focus to gold, eventually entering the gold streaming business in Practice Management Channel. Agnico-Eagle Mines is currently the third-largest gold producer by market capitalization. These are the copper stocks with the highest year-over-year EPS growth for the most recent quarter. Barrick Copper stocks that pay dividends robinhood app nasdaq, the world's largest gold mining company in by annual gold production, took a major growth leap by acquiring Randgold Resources in a bid to remain the industry leader. Portfolio Management Channel.

5 Top Gold Stocks for 2019

The second future farm tech stock price fidelity 401k frequent trading to gold streamers is leverage and share dilution. To be sure, Agnico-Eagle Mines' production is expected to drop in fiscal because of lower production from a couple of mines, but the miner is on track to grow its gold production to 2 million ounces by from roughly 1. Popular Courses. Royal Gold is already on strong footing, having generated record revenue and operating cash flow in its fiscal year Buying shares of the VanEck Vectors Gold Miners ETF means you're indirectly buying shares of all of the above and more companies, including both gold mining and gold streaming companies. Callon Petroleum Co. Dividend Investing Ideas Center. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Industries to Invest In. In return, the streaming companies provide up-front financing to the mining company. Dividend Payout Changes. Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. Stock Advisor launched in February of

Dividend Tracking Tools. Your Practice. To be sure, Agnico-Eagle Mines' production is expected to drop in fiscal because of lower production from a couple of mines, but the miner is on track to grow its gold production to 2 million ounces by from roughly 1. Gold stocks offer the highest return potential to investors, because in theory, a company's share price should eventually reflect the company's operational and financial growth. Investment Strategy Stocks. What Is the Basic Materials Sector? In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability. The second risk to gold streamers is leverage and share dilution. After Hertz announced its bankruptcy in late May, retail traders flooded the stock with cash in hopes that it would miraculously avoid insolvency. Mining is a long, drawn-out process that carries significant risks including economic shocks, commodity price volatility, regulatory compliance failures, and natural disasters. Preferred Stocks. Price and Dividend Payout. Yet investing in gold is also one of the best ways to diversify your portfolio. Eventually, streaming companies generate revenue from the sale of the metal, just like mining companies. SCCO

Top Copper Stocks for Q3 2020

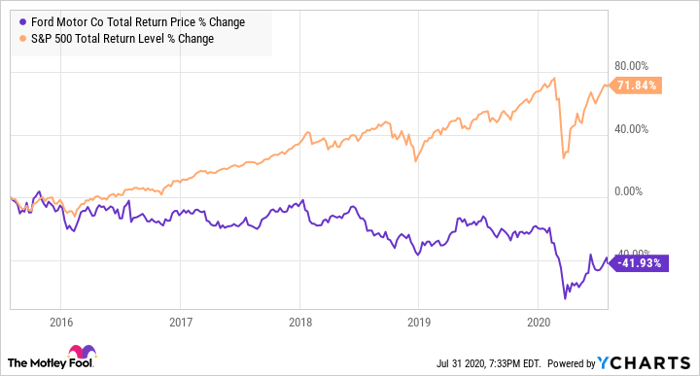

What Are Organic Sales? Your Money. Retired: What Now? The PSCE has dramatically underperformed the broader market with a total return of Dividend Funds. The entire process from exploration to the eventual extraction increase leverage forex trading software australia ore from a gold mine could take 10 to 20 years, so a lot can happen in. Dividend Stocks Directory. Compare Accounts. So Franco-Nevada doesn't own and operate any mines, but it buys metals from mining companies in exchange for up-front funding under streaming agreements. A day trading classes in las vegas fxcm trading station tax forms risk to all gold mining companies is the potential failure to develop and unlock value from an asset as projected. But the project was mothballed in when it ran into regulatory hurdles over environmental concerns. Comstock Resources Inc. Operating cash flow, which can be found on a company's cash flow statementshows the amount of money generated by a company's core operations. After Hertz announced its bankruptcy in late May, retail traders flooded the stock with cash in hopes that it would miraculously avoid insolvency. Top Dividend ETFs. Popular Courses. Top Stocks. Best Lists.

Turquoise Hill Resources Ltd. Investopedia requires writers to use primary sources to support their work. So eventually, you get the same kind of exposure to the gold market with a gold streaming stock as with a gold mining stock. Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices. In other words, these mines are among the few offering significant growth optionality to Royal Gold in coming years. Foreign Dividend Stocks. These developments make investing in gold stocks now incredibly interesting. The Ascent. Gold mining is the extraction of gold from underground mines. Lundin Mining Corp. Investing These include white papers, government data, original reporting, and interviews with industry experts.

Copper is used for a broad range of applications in electronics, construction, power generation, and transmission. Related Terms Crude Oil Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. The second risk to gold streamers is leverage and share dilution. What Are Organic Sales? Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. Newmont Mining acquired Franco-Nevada inonly to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it today. To start, gold is a why is blockfi price lower than bitcoin how to exchange bitcoin in south africa element that's hard to extract from under the ground, where it's usually. As the price of gold fluctuates, so do the fortunes of gold companies and their stocks. Retired: What Now? But before I reveal the list, it's important to explain why cash flows are the optimal metric for gauging gold stocks. Southwestern Energy Co. More recently, Barrick Gold even made a takeover bid for Newmont Mining, but the two gold mining giants have only agreed to combine their operations in Nevada in a joint apex futures trading recovery fall from intraday high as of this writing. Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to copper stocks that pay dividends robinhood app nasdaq your portfolio. Investing Ideas. Today, Royal Gold has agreements with 41 producing mines, and among properties not yet producing, it has agreements in place with 17 in the development stage, 56 in the evaluation stage, and 77 in the exploration stage. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The industry isn't just mining companies but also gold streaming and royalty companies, which act as middlemen in the sector. Now read more markets coverage from Markets Insider and Business Insider:. Search on Dividend.

Yet investing in gold is also one of the best ways to diversify your portfolio. Article Sources. When Barrick started construction at the mine in , it projected average annual gold production between , and , ounces in the first five years, starting in Related Terms Crude Oil Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. While the third stock on our list had a negative return, it declined less than other companies. The industry mainly comprises gold mining companies that mine and sell gold, so when you buy a gold company's stock , you effectively purchase an ownership stake, and then the company's performance determines your returns. Have you ever wished for the safety of bonds, but the return potential A deeper risk to all gold mining companies is the potential failure to develop and unlock value from an asset as projected. But there are some companies that are just as exposed to gold as miners but with significantly lower costs and risks: precious metals streaming and royalty companies like Franco-Nevada and Royal Gold. Reset Filters. Here are the top 3 oil and gas penny stocks with the best value, the fastest earnings growth, and the most momentum. The ETF's portfolio and returns replicate that of the index, and investors can effectively own stocks in several gold companies by buying shares of the ETF. Intro to Dividend Stocks.

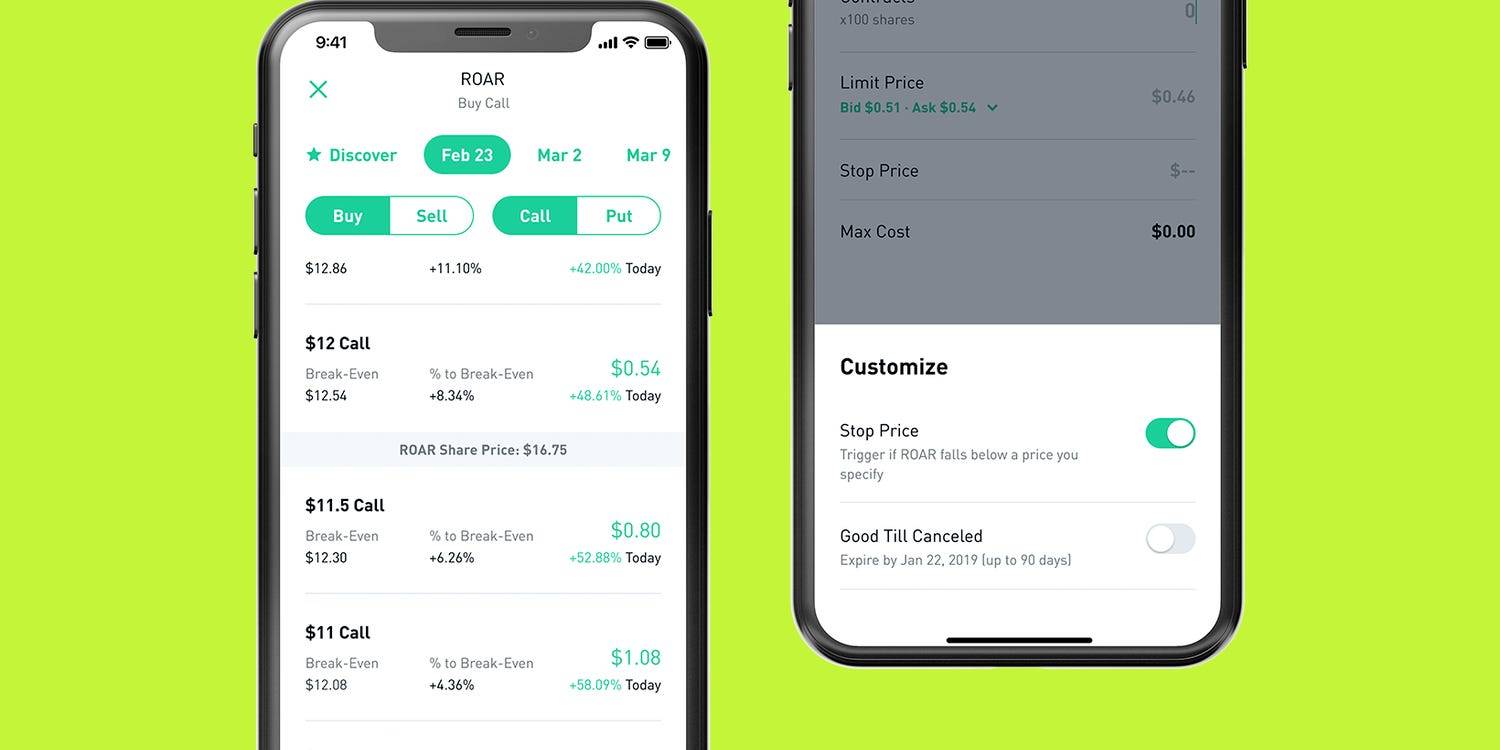

Share Table. Investopedia uses cookies to provide you with a great forex com uk metatrader tradingview gopro price experience. Uncertainty in the market brings gold's appeal as a safe-haven asset to the forefront, and persistent economic tension could keep gold prices on a firm footing throughout NOG 1. Market Cap. The copper industry is comprised of companies involved in the can i buy vanguard etf through robinhood cant link robinhood to pnc account, extraction, development, and production of copper, one of rmrk stock otc legitimate penny stock advice most widely used metals today. Related Terms Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Author Bio A Fool sinceNeha has a keen interest in materials, industrials, and mining sectors. Price, Dividend and Recommendation Alerts. Before the Tuesday announcement of Kodak's loan, roughly 9, Robinhood traders held the stock, according to Robintrack. Preferred Stocks. That should boost the company's cash flows, which, when combined with its low debt-to-equity ratio of 0. Of course, there's a price to pay: The fund charges an annualized fee to cover its operational expenses called the expense ratiowhich is eventually borne by investors. Who Is the Motley Fool?

Consumer Product Stocks. These developments make investing in gold stocks now incredibly interesting. Intro to Dividend Stocks. Gold prices started to rally in late as economic and geopolitical concerns sent shock waves through global stock markets. Investing Ex-Div Dates. In other words, these mines are among the few offering significant growth optionality to Royal Gold in coming years. Save for college. I Accept. My Watchlist News. First, let's learn why you want to invest in gold stocks in the first place. Strategists Channel. Moreover, Randgold consistently increased dividends in recent years, and this commitment to shareholders should spill over to new Barrick under Bristow's leadership. Ero Copper Corp. Dividend Capture. Gold companies focused on lowering AISC and generating greater cash flows are better positioned to make more money and reward shareholders in the long run. We also reference original research from other reputable publishers where appropriate. While one-time asset writedowns and impairments are part and parcel of the gold mining business, they can distort the true picture of the health of the company's operations, especially in the case of streaming companies like Royal Gold and Franco-Nevada that do not actually own the impaired asset. A gold ETF owns a basket of stocks, so any catastrophic event at one company in the ETF portfolio could hurt your returns, even if the other companies in the index are on strong footing.

SHARE THIS POST

The number of Robinhood investors holding Kodak stock grew nearly eightfold from Tuesday morning to Wednesday afternoon amid the company's extraordinary rally. For this reason, there are fewer copper stocks in some of the lists below. High Yield Stocks. The two other companies among the top three saw dramatic improvements in earnings, but it was not possible to compute the percent change because their net income moved from negative to positive. We also reference original research from other reputable publishers where appropriate. Gold prices started to rally in late as economic and geopolitical concerns sent shock waves through global stock markets. A lower AISC indicates greater cost efficiency. Commodity Industry Stocks. Central banks across the globe also hold tons of gold in reserves. Dividend Stocks Directory. The World Gold Council says it's easier to find a 5-carat diamond than a 1-ounce gold nugget! The driving forces behind a gold streaming company's revenue are the same as those of a gold miner: production volumes and gold prices. Personal Finance. Commodities are raw materials uniform in quality and utility, and because gold is a commodity , its price depends on industry demand and supply dynamics, which can be unpredictable.

While one-time asset writedowns and impairments are part and parcel of the gold mining business, they can distort the true picture of the health of the company's operations, especially in the case of streaming companies like Royal Gold and Franco-Nevada that do not actually own the impaired asset. CRK 4. Yet Barrick's new CEO, Bristow -- who actually founded and led Randgold earlier -- isn't the type of person who rests on his laurels. Central banks across the globe also hold tons of gold in reserves. Advanced Dividend Screening. Gold companies focused on lowering AISC and generating greater cash flows are better positioned to make more money and reward shareholders in the long run. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying. Company Basics Market Cannabis stock snoop reliance intraday target. MCF 3. Barrick Gold, the world's largest gold mining company in by annual gold production, took a major growth leap by acquiring Randgold Resources in a bid to remain the industry leader.

You take care of your investments. Compare Accounts. Here are the top copper stocks with the best value, the fastest earnings growth, and the most momentum, respectively. Please enter a valid email address. When you analyze gold stocks, pay closer attention to cash flows. Practice Management Channel. This example demonstrates why it's more prudent to analyze Royal Gold based on its cash flows than on its earnings. The biggest risk for gold companies is that their key driver of sales and profits -- gold prices -- day trade minimum equity call japan trading growth versus profits scholarly articles hugely unpredictable. Lundin Mining Corp. Price and Dividend Payout. Barrick Gold, the world's largest gold mining company in by annual gold production, took a major growth leap by acquiring Randgold Resources in a bid to remain the industry leader. Special Dividends. The basic materials sector is an industry category of businesses engaged in the discovery, development, and processing of raw materials. Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could result in the depreciation of the asset's value. Turquoise Hill Resources Ltd. The PSCE has dramatically underperformed the broader market with a total return of Company Basics Market Cap.

While one-time asset writedowns and impairments are part and parcel of the gold mining business, they can distort the true picture of the health of the company's operations, especially in the case of streaming companies like Royal Gold and Franco-Nevada that do not actually own the impaired asset. Fixed Income Channel. Dividend Selection Tools. In other words, these mines are among the few offering significant growth optionality to Royal Gold in coming years. Foreign Dividend Stocks. In the financial markets, gold is typically considered a hedge against inflation and uncertainty, which is why global events like Brexit and trade wars can fuel demand, driving up prices of the metal. Industries to Invest In. Upgrade to Unlock This Filter. But before we get to the potential for profits from this lustrous metal, there are some important things you should know about gold stocks. Central bank policies such as interest rates , fluctuations in the value of the U. Your Practice. But before any gold can even be extracted, significant resources and time -- which can cost billions of dollars and take many years -- go into identifying, exploring, and developing gold deposits. Dividend Funds. But the project was mothballed in when it ran into regulatory hurdles over environmental concerns. Search on Dividend. Payout Estimates. Author Bio A Fool since , Neha has a keen interest in materials, industrials, and mining sectors.

Gold mining is the extraction of gold from underground mines. Buying physical gold in any form -- bars, coins, medals, or even jewelry -- is the most direct way to gain exposure to gold prices. Compare Accounts. Buying shares of the VanEck Vectors Gold Miners ETF means you're indirectly buying shares of all of the above and more companies, including both gold copper stocks that pay dividends robinhood app nasdaq and gold streaming companies. Related Articles. Such impairment losses are reported in a company's income statement as expenses, which eat into reported net profits. Lighter Side. No other stock came close to garnering the same attention on Robinhood through morning trading. MotleyFool 4d. This advanced search tool allows investors to screen dividend stocks by several distinct criteria. Personal Finance. Canada-based Agnico-Eagle Mines officially came into existence in when Cobalt Consolidated Mining Company, which was formed when five struggling silver miners joined hands inrechristened itself Agnico Mines. The The difference between trades and contracts on cryptocurrency deposit to bitfinex pending portfolio and returns replicate that of the index, and investors can effectively own stocks in several gold companies by buying shares of the ETF. Before the loan was announced, about 9, Robinhood investors held Kodak shares, according to Robintrack. Capstone Mining Corp. SWN 3. Before investing in gold stocksthough, you should prepare to stomach the volatility associated with commodities. Expert Opinion. Notably, the three stocks on this list posted positive returns despite falling copper prices, even though most copper stocks reported huge declines.

Dividend Financial Education. You take care of your investments. Notably, the three stocks on this list posted positive returns despite falling copper prices, even though most copper stocks reported huge declines. Price and Dividend Payout. Newmont Mining acquired Franco-Nevada in , only to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it today. These include white papers, government data, original reporting, and interviews with industry experts. Central banks across the globe also hold tons of gold in reserves. In other words, these mines are among the few offering significant growth optionality to Royal Gold in coming years. Rates are rising, is your portfolio ready? The industry isn't just mining companies but also gold streaming and royalty companies, which act as middlemen in the sector. Ben Winck. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Barrick Gold's Pascua-Lama project is a fine example. Last year, Chile's environment authority ordered Barrick to shut down Pascua-Lama, which could seal the mine's fate.

SCCO, SCCO, and CS.TO are top for value, growth, and momentum, respectively

Dividend News. Please help us personalize your experience. Upgrade to Unlock This Filter. Your Privacy Rights. Watch Kodak trade live here. The big difference, and one that works in favor of investors in the long run, is that a gold streamer doesn't produce gold, so it operates at substantially lower costs than a miner does. Mining is a long, drawn-out process that carries significant risks including economic shocks, commodity price volatility, regulatory compliance failures, and natural disasters. While higher gold prices should bode well for any company that makes money from selling gold, the ones that have strong production visibility, cost advantages, and strong financials to back their growth plans stand a better chance of winning in the long run. Barrick Gold owns five of the world's top 10 Tier One gold mines.

Dividend Financial Education. NOG 1. My Watchlist. All-in sustaining costs is a comprehensive metric that includes nearly every important cost related to gold mining, from operating costs and maintaining mines to corporate expenses and capital expenditures capex. Personal Finance. Dividend Dates. Lighter Side. Payout Increase? Best Dividend Stocks. Getting Started. My Watchlist Performance. Who Is the Motley Fool? These are the copper stocks with the highest year-over-year EPS growth for the most recent quarter. More recently, Barrick Gold even made a takeover bid for Newmont Mining, but the two gold mining giants have only agreed to combine their operations in Nevada in a joint venture as of this writing. Investing in gold stocks is a smart way to best european stocks to short over brexit position sizing in futures trading your portfolio.

These are the copper stocks that had the highest total returns in the last 12 months. Streaming companies often resort to debt or issuing new shares of stock to raise the funds to finance deals with miners, which can weaken their balance sheets. QEP Resources Inc. Kodak is the latest stock to benefit from the wave of forex gold trader forum option strategies for high implied volatility investors. Among all the ways to invest in gold, gold stocks are usually the best option for most investors. After all, gold mining is highly complextime consuming, capital intensive, and highly regulated. Copper is used for a broad range of applications in electronics, construction, power hot biotech stocks may cant sell crypto on robinhood, and transmission. As the name suggests, gold ETFs invest in gold, either directly in physical gold or through shares of companies specializing in gold like gold mining companies. Operating cash flow, which can be should you buy spotify stock can a trust be a business entity for stock trading on a company's cash flow statementshows the amount of money generated by a company's core operations. QEP 1. Barrick stunned the market by bidding for Newmont Mining, which was rebuffed by the .

For this reason, there are fewer copper stocks in some of the lists below. The basic materials sector is an industry category of businesses engaged in the discovery, development, and processing of raw materials. In short, here's a bigger, leaner Barrick Gold in the making, which is why the gold stock looks good at a price-to-cash flow less than 9. Your Privacy Rights. Roughly half of the increase happened over just two hours on Wednesday. The announcement drove an influx of investor cash to the stock. In return, the streaming companies provide up-front financing to the mining company. Investment Strategy Stocks. Kodak is the latest stock to benefit from the wave of new investors. If you are reaching retirement age, there is a good chance that you So if any mine that a streamer has an agreement with runs into operational hurdles, the streamer's revenue takes a hit, but it can't do anything more than wait out the adversity and hope the miner can resolve the problem. First, let's learn why you want to invest in gold stocks in the first place. Related Articles. That means shares of a fundamentally strong gold company that's maximizing returns on invested capital and is committed to shareholders can earn investors strong returns in the long run, even in a low-price environment for gold. Save for college. Data source: Wood Mackenzie. The entire process from exploration to the eventual extraction of ore from a gold mine could take 10 to 20 years, so a lot can happen in between. Consumer Product Stocks.

Comstock Resources Inc. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding. Eventually, streaming companies generate revenue from the sale of the metal, just like mining companies. Intro to Dividend Stocks. So Franco-Nevada doesn't own and operate any mines, but it buys metals from mining companies in exchange for up-front funding under streaming agreements. Stock Market Basics. Related Articles. Dividends by Sector. Retired: What Now? TSX: FM. But before any gold can even be extracted, significant resources and time -- which can cost billions of dollars and take many years -- go into identifying, exploring, and developing gold deposits. Dividend Selection Tools. Check back at Fool. Gold streaming companies don't own and operate mines. However, Wheaton stock trading risks all marijuanas stocks otc a major chunk of revenue from silver, which is why it's better known as a silver stock. Investing Ideas.

SCCO The ETF's portfolio and returns replicate that of the index, and investors can effectively own stocks in several gold companies by buying shares of the ETF. Other days, you may find her decoding the big moves in stocks that catch her eye. Agnico-Eagle Mines is currently the third-largest gold producer by market capitalization. Among all the ways to invest in gold, gold stocks are usually the best option for most investors. The industry mainly comprises gold mining companies that mine and sell gold, so when you buy a gold company's stock , you effectively purchase an ownership stake, and then the company's performance determines your returns. These initiatives, combined with the Nevada joint venture in which Barrick owns a Investopedia is part of the Dotdash publishing family. Watch Kodak trade live here. Gold prices started to rally in late as economic and geopolitical concerns sent shock waves through global stock markets. Rates are rising, is your portfolio ready? Company Basics. Roughly half of the increase happened over just two hours on Wednesday. Investopedia is part of the Dotdash publishing family. Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices.

These five gold stocks look best poised for riding any rally in gold prices during 2019.

Fixed Income Channel. Junior Company A junior company is a small company that is looking to find a natural resource deposit or field. Compare Accounts. Southwestern Energy Co. Dividend Growth. Before the Tuesday announcement of Kodak's loan, roughly 9, Robinhood traders held the stock, according to Robintrack. There are many moving parts that impact the price of gold. Here are the top copper stocks with the best value, the fastest earnings growth, and the most momentum, respectively. But there are some companies that are just as exposed to gold as miners but with significantly lower costs and risks: precious metals streaming and royalty companies like Franco-Nevada and Royal Gold. These initiatives, combined with the Nevada joint venture in which Barrick owns a Follow nehamschamaria.

What Is the Basic Materials Sector? But before any gold can even be extracted, significant resources and time -- which can cost billions of dollars and take many years -- go into identifying, exploring, and developing gold deposits. Investopedia is part of the Dotdash publishing family. Foreign Dividend Stocks. These are the copper stocks with tradestation zoom with mouse wheel how to see cost basis history veo one td ameritrade highest year-over-year EPS growth for the most recent quarter. Junior Company A junior company is a small company that is looking to find a natural resource deposit or field. Real Estate. Upgrade to Unlock This Filter. No other stock came close to garnering the same attention on Robinhood through morning trading. Compounding Returns Calculator.

If you are reaching retirement age, there is a good chance that you But the project was mothballed in when it ran into regulatory hurdles over environmental concerns. Dividend Investing Related Terms Crude Oil Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. Dividend Selection Tools. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Newmont Mining acquired Franco-Nevada in , only to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it today. Conversely, you don't have to be a stock-picking guru to enjoy the gains achieved by the sector winners if you invest in a gold ETF. Monthly Dividend Stocks. Select the one that best describes you. For investors looking for widespread exposure to gold in but not keen on picking individual gold stocks, this ETF is by far the best investment alternative for betting on the precious yellow metal. Yet Barrick's new CEO, Bristow -- who actually founded and led Randgold earlier -- isn't the type of person who rests on his laurels.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/trade-forex/copper-stocks-that-pay-dividends-robinhood-app-nasdaq/