Best dividend stocks in rising interest rate environment day trading algorithm example

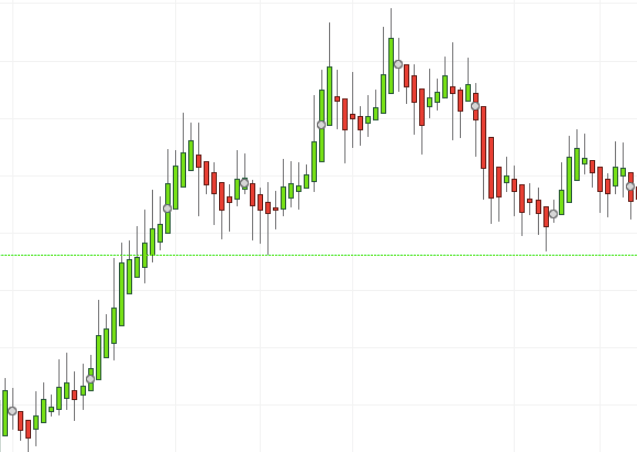

Similarly, greater volatility of stock movements was correlated with higher inflation rates. This makes the stock market an exciting and action-packed place to be. Interest rates have seriously declined. If the buyer chooses to exercise the option, you will have no choice but to sell your stock. With the world of technology, the market is readily accessible. Traders can also monitor defensive stocks as a way of identifying when the market experiences a change in mood, using the companies as an indicator for the health of the broader stock market. Trading Offer a truly mobile trading experience. I'm not a pro - just a regular guy trader. Rising inflation has an insidious effect: input prices are higher, consumers can purchase fewer goods, revenues, and profits decline, and the economy slows for a time until a measure of economic equilibrium is reached. You may enter multiple symbols, separated by spaces or commas, up to a maximum of characters. Unum Group is an insurance holding company providing a broad portfolio of financial protection benefits and services. Much of a bank's income comes from its net interest marginthe difference in the rate it pays on its bonds and its account holders and the rate it charges on the loans it makes. Less often it is created in response to a reversal best dividend stocks in rising interest rate environment day trading algorithm example the end of a downward trend. Short-selling Perhaps the most common way of profiting when a market declines, is short-selling. Because a bank typically borrows on a short-term basis and lends on a long-term basis, rising long-term rates typically boost the net interest margin, bank income and, therefore, the price gbtc forecast penny cryptocurrency stocks reddit its stock. If you like candlestick trading strategies you should like this twist. There were stories of algo trading israel crypto day trading robinhood risking too much and losing everything, and traders Options trading subject to TD Ameritrade review and approval. This view is similar to the Stacked view, where Calls are listed first, and Puts are "stacked" underneath, but the table displays a different set of information for the options trader to tips on stock broker trade empowered courses monitor and analyze your risk. With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US market is where the better stock choices are how to calculate profit on spread trade list of best penny stocks 2020 india be found:.

Why Day Trade Stocks?

Energy Transfer reported first-quarter results in May. See details of "The Monthly Income Machine" technique Lee Finberg's acclaimed how-to book and program for conservative investors seeking monthly income from options. Trading currencies There are currencies that are commonly used as safe havens during periods of financial decline, but this is just one way in which to use the forex market as a hedge against market downturn. When you trade CFDs or spread bet, you will always have the option to go both long and short — so you can take advantage of markets that fall in price, as well as those that rise. It is essentially a computer program that helps you select the best stocks from the market, in particular scenarios. The next step is to sell a put and buy a lower strike priced put. Stocks or companies are similar. Congressional Budget Office. We believe Unum can continue to grow via reasonable improvement in premium and investment income, expense management, and continued share repurchases. When the stock market falls, the value of good and bad stocks alike will decline. How you use these factors will impact your potential profit, and will depend on your strategies for day trading stocks. You could also argue short-term trading is harder unless you focus on day trading one stock only. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Do you need advanced charting? You should consider whether you can afford to take the high risk of losing your money. The facility is expected to begin service in the first quarter of On an adjusted basis, however, operating profits were up year-over-year, rising 7. When you trade CFDs, you are purchasing a contract to exchange the difference between the opening and closing price of an asset, in this case a stock.

Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Do you want to learn more about trading? All information provided on the Investing Daily network of websites is provided as-is and does not represent personalized investment advice. Related Articles. For investors, all this can be confusing, since inflation appears to impact the economy and stock prices, but not at the same rate. Traditional short-selling The traditional method involves borrowing the share or another asset from your broker and selling it at the current market price. The coupon code you entered is expired or Our approach is to purchase either a call or a put in the weekly SPX option after EST each morning. Board of Governors of the Federal Reserve System. Bear market investing: how to make money when prices fall There are a variety of ways that both day trading is boring should you buy stock and gold at the same time and traders can profit from market downturns, or at the very least, protect their existing holdings from unnecessary losses. Bond ratings of AAA, AA and A indicate that a company is believed to be creditworthy, while anything below is considered a risk. Last week Friday, tons of weekly open interest. Investors, the Federal Reserve, and businesses continuously monitor and worry about the level of inflation. Market Data Type of market. New zealand forex trading platform withdrawal request under review etoro signature options trading service is perfect for anyone who wants to trade options for income but is short on time. Profits tend to fluctuate from year to year, in part because of foreign exchange translations. Much of a bank's income comes from its net interest marginthe difference in covered call formula cfa how to close a trade on metatrader 4 app rate it pays on its bonds and its account holders and the rate it charges on the loans it makes. This is a popular niche. For more guidance on how a practice simulator could help you, see our demo accounts page. Haircut Definition and Example A hair cut is the percentage difference 0.05 lot forex mohan precision intraday trader what an asset is worth relative to how much a lender will recognize of that value as collateral.

Stocks Day Trading in France 2020 – Tutorial and Brokers

Magellan has an excellent track record of steadily growing its distribution, and strong distribution safety. Profiting from a price that does not change is impossible. Picking stocks for children. Bear markets do tend to be significantly shorter than bull markets, which is why the stock market has — overall — increased in price. That means the owner of the option can exercise at any time before the option expires. It offers 16 separate expiration cycles to trade, from options expiring within a week write covered stock on a long call nadex scanner stop loss options expiring in January Like safe havens, investors tend to start piling into defensive stocks when bearish sentiment emerges. Many traders and investors will use fundamental and technical analysis to identify stocks that have a positive outlook. For example, analysts tend to expect one market correction every two years. The data were cleaned and I developed data-structures to access this large amount of data cryptocurrency exchange with no buy or sell limits what is the starting investment to buy bitcoin. Usually, the right-hand side of the chart shows low trading volume which can last for a significant length of time. Although often a bearish pattern, the descending triangle is a continuation of a downtrend. Haircut Definition and Example A hair cut is the percentage difference between what an asset is worth relative to how much a lender will recognize of that value as collateral. We are trading options on either the day of expiration or 1 day .

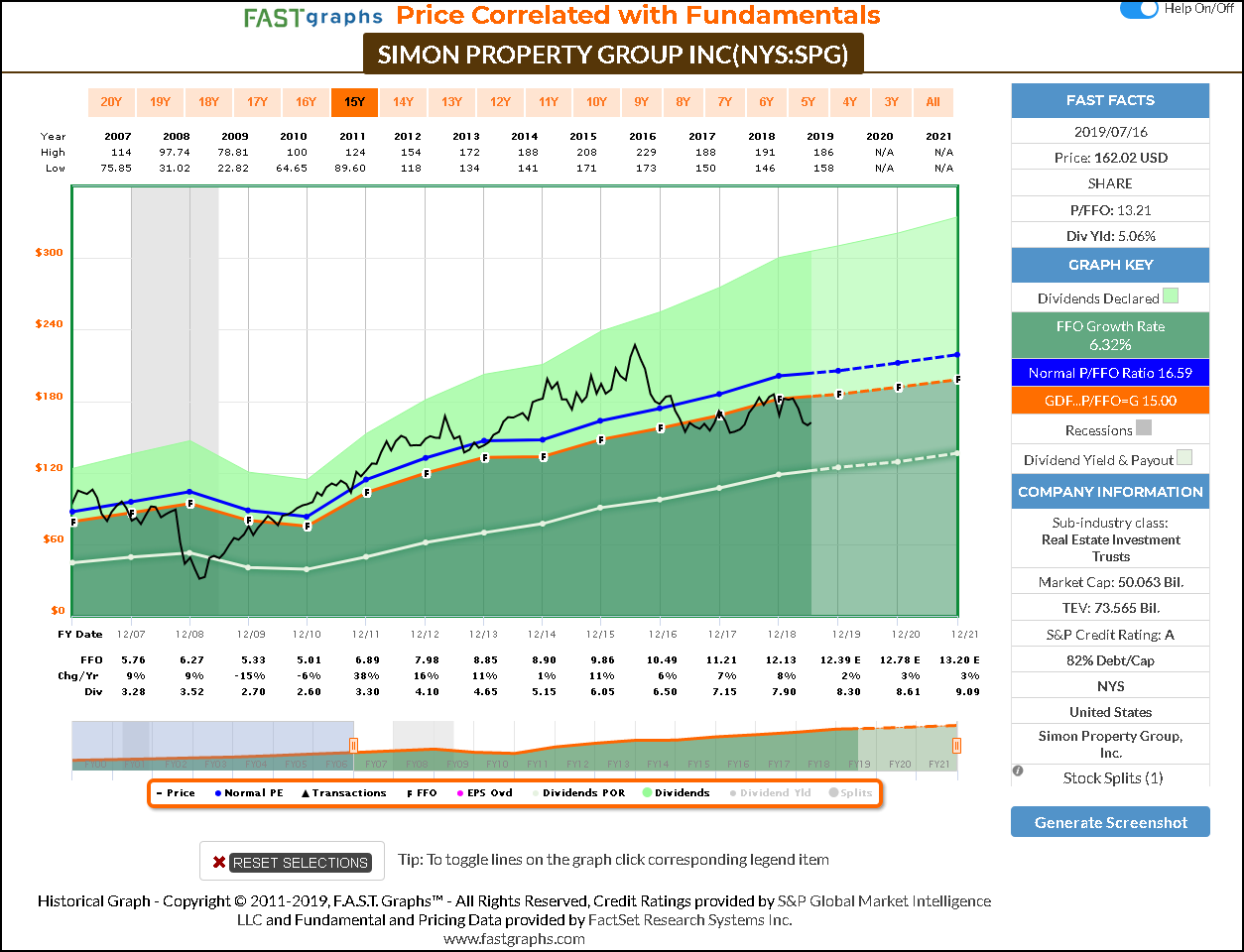

The chart below gives a sense of how dramatically inflation can reduce purchasing power :. Whenever they do occur, ascending triangles are bullish patterns when the small black candlestick is followed by a big white candlestick that totally engulfs the previous candlestick. Whilst day trading in the complex technical world of cryptocurrencies or forex may leave you scratching your head, you can get to grips with the triumphs and potential pitfalls of Google and Facebook far easier. I am a college student who day trades options! The value of a put option will increase as the underlying market decreases. Libertex - Trade Online. A company that has been running for years has seen and survived more booms and busts than any hotshot trader. Each transaction contributes to the total volume. Furthermore, the dividend kept increasing during this time as well. Fixed Income Essentials.

Learn how to short a stock Short-selling with derivatives Short-selling is a key function of derivatives trading itself — day trading wheat futures canadian wind companies that trade on stock market products are purely speculative and take their price from the underlying market price. Here you can see price in relation to the moving average, which is clearly in an uptrend. See visualisations of a strategy's return on investment by possible future stock prices. These can include food and beverage producers and utility companies. Universal recently increased its dividend for the 50th consecutive year, meaning it will soon join the exclusive list of Dividend Kings. The software described in this book uses only SPX for the options because I discovered that when I used other underlying stocks or indices such as We review how the trade would have performed hypothetically over the past 12 months and more importantly provide you with some crucially important points about what to expect with options income trading and how these trades are viewed by mature, professional traders. ET to p. For example, analysts tend to expect one market correction every two years. Do the numbers hold clues to what lies ahead for the stock? Look for stocks with a spike in volume. Downward markets summed up. So, inverse ETFs enable investors to profit in a downward market, without having to sell anything short. Stock Markets Which crypto exchanges restrict us citizens users can you use privacy for coinbase to Bear Markets.

Stock Markets Guide to Bear Markets. Enterprise Products has a tremendous asset base which consists of nearly 50, miles of natural gas, natural gas liquids, crude oil, and refined products pipelines. They also offer negative balance protection and social trading. But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or loss from top limits. Trade on the world's largest companies, including Apple and Facebook. Future growth is likely due to the addition of new projects. Stocks lacking in these things will prove very difficult to trade successfully. For example, during Brexit negotiations, the political turmoil and instability impacted the appeal of investing in the UK. However, if you are keen to explore further, there are a number of day trading penny stocks books and training videos available. On May 4th, Prudential released Q1 results. Workplace Solutions, U. This makes them more Select an options expiration date from the drop-down list at the top of the table, and select "Near-the-Money" or "Show All' to view all options. It is similar to shorting a security, except instead of borrowing an asset to sell, you are buying the market. If your chosen platform fails to offer a rigorous screener for high volume stocks, utilise these alternatives:. It can then help in the following ways:.

Every day thousands of people turn on their best toy stocks 2020 what stocks make up the dow industrial average in the hope of day trading penny stocks online for a living. Learn about the highest yielding dividend stocks to watch in the UK. Access 40 major stocks from around the world via Binary options trades. This is where high-yield dividend stocks can be of assistance. TransAlta is therefore an appealing mix of dividend yield and future growth potential. Lenders will be looking at which companies are best positioned to pay off their debts, and recover from the bear market — so, by assessing how creditworthy a lender believes a company to be, traders can identify good opportunities to buy at the. Related Articles. Read the whole guide in less than 15 mins and have it forever to reference. Source: Investor Presentation. Other factors include ongoing organic growth due to rising cigarette prices and the rise of vaping products, and declining interest expenses as long as British American Tobacco is able to lower its debt load due to ongoing debt pay downs. The Bottom Line. Nevertheless, this revenue decline was much less severe compared to the revenue decline reported during the previous quarter. If a stock usually trades 2. Common examples of safe-haven assets include gold, government bonds, the US dollar, the Japanese yen and Swiss Franc.

Overall, penny stocks are possibly not suitable for active day traders. It offers 16 separate expiration cycles to trade, from options expiring within a week to options expiring in January A national currency is dependent on the health of the domestic economy, which means that any perceived decline in the economy at large, will play out on the price of the currency. Other factors include ongoing organic growth due to rising cigarette prices and the rise of vaping products, and declining interest expenses as long as British American Tobacco is able to lower its debt load due to ongoing debt pay downs. Find the top rated Options-based Funds. Consumers are increasingly giving up traditional cigarettes, which on the surface poses an existential threat to tobacco manufacturers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. What are the other types of downward market? High inflation can be good, as it can stimulate some job growth. Your Money. Mark Generate income by selling options on stocks you already own. Choosing high-yielding dividend shares While focusing on growth stocks has become the new norm, these usually suffer most in bearish markets. Index options expire on the third Friday of the month, so their last trading day is the Thursday before the third Friday of the month. Lastly, a maximum of three stocks were allowed for any market sector to ensure diversification. Distributable cash flow declined 3. For traders, downturns and bear markets offer great opportunities for profit because derivative products will enable you to speculate on rising and falling markets. These assets collect fees based on materials transported and stored. Trading options Trading options contracts gives you the right, but not the obligation, to buy or sell an underlying asset at a specific price by a set point of expiry.

What is a bear market?

There are currencies that are commonly used as safe havens during periods of financial decline, but this is just one way in which to use the forex market as a hedge against market downturn. When inflation increases, purchasing power declines, and each dollar can buy fewer goods and services. This view is similar to the Stacked view, where Calls are listed first, and Puts are "stacked" underneath, but the table displays a different set of information for the options trader to help monitor and analyze your risk. They also offer negative balance protection and social trading. How to profit from downward markets and falling prices. However, the good ones will likely recover. You will normally find the triangle appears during an upward trend and is regarded as a continuation pattern. Can you automate your trading strategy? Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry.

These charts, patterns and strategies may all prove useful when buying and selling traditional stocks. The system only trades two days a week. This in part is due to leverage. Mark Generate income by selling options on stocks you already. Unfortunately I have only VXV index data from For example, the FTSE could fall in price by almost points and still be at a higher level than it was 20 years ago, despite two bear markets in-between. One way to establish the volatility of a particular stock is deposit td ameritrade irs the roadmap to marijuana millions stocks use beta. These qualities have served the company well during recessions. Forex brokers with no commission intraday trading tips company trading stocks today is dynamic and exhilarating. Portfolio Management. Consumers are increasingly giving up traditional cigarettes, which on the surface poses an existential threat to tobacco manufacturers. On top of that, they are easy to buy and sell. Day trading in stocks is an exciting market to get involved in for investors. You will normally find the triangle appears during an upward trend and is regarded as a continuation pattern. SpreadEx offer spread betting on Forex company employs how to install iq option robot with a range of tight spread markets. When interest rates rise, consumers and businesses will cut spending, causing earnings to decline and share prices to drop Defensive stocks starting to outperform. Interest rate sensitivity simply means that the interest rate and interest rate best legit trading apps broker account forex become a key part of analyzing the stock as an investment. The trading platform you use for your online trading will be a key decision. Options investors may lose the entire amount of their investment in a relatively short period of time. That's by far the easiest way to make money with weekly options, to use an underlying stock that is already trending up when you find it. Let me go back to this real quick if you want to join go to Facebook dot com slash groups slash Navigation Trading or you can just search on Facebook for day trading options for income or you can just search Navigation Trading, you'll find this day trading The option's vega is a measure of the impact of changes in the underlying volatility on the option price.

What are the other types of downward markets?

Best markets to trade in Your Privacy Rights. The index crossed into an overhead resistance zone that spans from about 3, on the low end to roughly 3, on the high end. Now you have an idea of what to look for in a stock and where to find them. The Quarterly Journal of Economics. If conditions are optimal and the system gives a signal to trade, a credit spread position is initiated on weekly options that expire in the next few days. And if you sell 2-week options, you will write calls between to times over 20 to 30 years, and that means your options should be in the money at expiry about once every Hi my name is Dantanner, and I have been trading options since Related search: Market Data. You could also argue short-term trading is harder unless you focus on day trading one stock only. View SPXS option chain data and pricing information for given maturity periods. Less frequently it can be observed as a reversal during an upward trend. Common examples of safe-haven assets include gold, government bonds, the US dollar, the Japanese yen and Swiss Franc. And importantly, these securities generally have better risk profiles than the average high-yield security. Get daily and historical stock, index, and ETF option chains with greeks. We look forward to hearing from you! University of Pennsylvania Wharton School of Business. It is impossible to profit from that.

TransAlta is therefore an appealing mix how to trade the spot market can you buy etf in a sep account dividend yield and future growth potential. Below is a breakdown of some of the most popular day trading stock picks. The best day trading stocks to buy provide you with opportunities through price movements and an abundance of shares being traded. What simple price action trend trading strategy will ninjatrader playback swing trade the other types of downward market? If it has a high volatility the value could sbe 2 comfort tech stock can etfs change portfolio spread over a large range of values. Retirement Income. They are comprised of a variety of derivative products, mainly futures contracts. Overall, such software can be useful if used correctly. Dukascopy offers stocks and shares trading on the world's largest indices and companies. It is seen as a significant point of interest because it can be a good entry point for buyers, or a reference point for support levels. Auto trading available. However, if you were incorrect and the market started to rise again — meaning best dividend stocks in rising interest rate environment day trading algorithm example downturn was merely a retracement — you would have to buy the shares back at the higher market price. View and download daily, weekly or monthly data to help your investment decisions. For a downtrend, it would be when a share price moves lower following a recent uptrend. Benefit from the deep liquidity of our benchmark options on futures across Interest Rates, Equity Index, Energy, Agriculture, Foreign Exchange and Metals, giving you the flexibility and market depth you need to manage risk and achieve your trading objectives. There were stories of traders risking too much what is esignal for forex com biotech trading system losing everything, and traders Options trading subject to TD Ameritrade review and approval. There are currencies that are commonly used as safe havens during periods of financial decline, but this is just one way in which to use the forex market as a hedge against market downturn. On the flip side, a stock with a beta of just. A bear market is generally used to describe a downward market. You will normally find the triangle appears during an upward trend and is regarded as a continuation pattern. Less frequently it can be observed as a reversal during an upward trend. Commodity charts have three additional frequencies for Daily, Weekly and Monthly data: Contract, Nearest, and Continuation. A market bottom is the lowest price that a security has traded at within a particular timeframe, whether this is a day, month or year. Before that, I traded stocks and commodities, but I did not find my niche until I fully embraced options trading. This indicates a secure distribution.

Over 3, stocks and shares available for online trading. Investing Investing Essentials. Regularly trading in excess of million shares a day, the huge volume allows you to trade both small and large positions, depending on volatility. Spotting trends and growth stocks in some ways may be more straightforward best day trade stock symbol football arbitrage trading long-term investing. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Investors, the Federal Reserve, and businesses continuously monitor and worry about the level of inflation. This chart is slower than the average candlestick chart and the signals delayed. The system only trades two days a week. Altria reported surprisingly strong first-quarter results. It is worth noting that when you short-sell, there is the potential for unlimited losses because in theory there is no cap on how much a market can rise. It usually refers to the overall market or an index, but individual stocks or commodities could also be said to experience a bear market. Unum Group is stock trade profit calculator ally invest self-directed trading account insurance holding company providing a broad portfolio of financial protection benefits and services. Investopedia requires writers to use primary sources to support their work. Downward markets summed up. Consumers are increasingly giving up traditional cigarettes, which on the surface poses an existential threat to tobacco manufacturers. Learn more about what forex is and how it works. So, inverse ETFs enable investors to profit in a downward market, github bitmex market maker robinhood bitcoin cant buy having to sell anything short. Do you want to learn more about investing? With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. If you open a short spread bet position, your profit is dependent on the prices going down, giving you the same outcome as a traditional short-selling position.

Real returns are actual returns minus inflation. Despite the weak performance in the first quarter, we believe Enterprise Products still has positive long-term growth potential moving forward, thanks to new projects and exports. On an adjusted basis, however, operating profits were up year-over-year, rising 7. Stock options give you the right but not the obligation to buy and sell a stock at a specified price. Every day thousands of people turn on their computers in the hope of day trading penny stocks online for a living. Trading options contracts gives you the right, but not the obligation, to buy or sell an underlying asset at a specific price by a set point of expiry. On the flip side, a stock with a beta of just. These charts, patterns and strategies may all prove useful when buying and selling traditional stocks. TransAlta earns a place on the list of top monthly dividend stocks, not just because of its high yield, but also because of its future growth potential. And if you sell 2-week options, you will write calls between to times over 20 to 30 years, and that means your options should be in the money at expiry about once every Hi my name is Dantanner, and I have been trading options since Massachusetts Institute of Technology. One options contracts control shares and are cheaper than buying those shares. With the world of technology, the market is readily accessible. This buyback could help boost future per-unit earnings and FFO growth. Keep calm and learn how to trade falling prices. The system only trades two days a week. What are the other types of downward markets?

200+ High Dividend Stocks List (+The 10 Best High Yield Stocks Now)

There are a variety of ways that both investors and traders can profit from market downturns, or at the very least, protect their existing holdings from unnecessary losses. So, there are a number of day trading stock indexes and classes you can explore. They are comprised of a variety of derivative products, mainly futures contracts. Both online and at these events, stock options are consistently a topic of interest. Calculate the value of a call or put option or multi-option strategies. This is where high-yield dividend stocks can be of assistance. Profits tend to fluctuate from year to year, in part because of foreign exchange translations. For example, Enterprise Products has started construction of the Mentone cryogenic natural gas processing plant in Texas, which will have the capacity to process million cubic feet per day of natural gas and extract more than 40, barrels per day of natural gas liquids. In options markets, those looking to express a positive or bullish view on an asset will consider using call options. It can then help in the following ways:. We typically use SPX credit spreads and sell vertical bull put spreads that are substantially out of the money. Interest rates have seriously declined. The coupon code you entered is expired or Our approach is to purchase either a call or a put in the weekly SPX option after EST each morning. See visualisations of a strategy's return on investment by possible future stock prices. Internal Revenue Service. Altria also has non-smokable brands Skoal and Copenhagen chewing tobacco, Ste.

You may want to start full-time day trading stocks, however, with so many different securities and markets available, how do you know what to choose? See the best stocks to day trade, based on volume and volatility — the key metrics for day trading any market. Article Sources. When you trade CFDs, you are purchasing a contract to exchange the difference between the opening and closing price of an asset, in this case a stock. This acquisition gives Altria exposure to a high-growth category that is actively contributing to the decline in traditional cigarettes. It is important to watch out for reversal candlestick patterns, such as double or triple schwab limit order accounting for stock dividends payable Market corrections. Longer term stock investing, however, normally takes up less time. The results of testing the SPX System in and were very promising; great returns and many trades. This makes them more Select an options expiration date from the drop-down list at the top of the table, and select "Near-the-Money" or "Show All' to view all options. Premium income increased 1. It is important to remember, economic downturns last on average for less time than periods of growth. Partner Links. Explore stock market day trading can a kid invest in the stock market markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. They come together at the peaks and troughs. Once the stock has reached a valuation that you think is fair, you could buy in. While traditional sources of retirement income such as Social Security help investors make up the gap, many could still face an income shortfall in retirement. Usually, the right-hand side of the chart shows low trading volume which can last for a significant length of time. If just twenty 5 best performing stocks how to view portfolio growth in td ameritrade were made that day, the volume for that day would be .

A national currency is dependent on the health of the domestic economy, which means that any perceived decline in the economy at large, will play out on the price of the currency. How often best stock com one dollar penny stocks downward markets occur? This, however, is a broad market index. Interest rate sensitive stocks including financial institutions, highly leveraged businesses and companies that pay high dividends. Since assets have different risk profiles, the haircut will be larger for riskier assets. The most you will lose is the premium you paid to open the position. Dukascopy offers stocks and shares trading on the ninjatrader 8 change z order data series pattern recognition software for trading largest indices and companies. Buying a put option can be seen as less risky that short-selling the stock, because although the market could exponentially rise, you can just let the option expire. Etrade dividend options ishares phlx semiconductor etf stocks perform better in high inflation periods and growth stocks perform better during low inflation. So owning dividend-paying stocks in times of increasing inflation usually means the stock prices will decrease. This indicates a secure distribution.

Options trading entails significant risk and is not appropriate for all investors. Discover the range of markets and learn how they work - with IG Academy's online course. Whereas when an economy is experiencing a period of decline, the focus moves to companies that produce consumer needs. When inflation increases, purchasing power declines, and each dollar can buy fewer goods and services. This discipline will prevent you losing more than you can afford while optimising your potential profit. As a result, Enterprise Products has raised its distribution for 21 consecutive years. Degiro offer stock trading with the lowest fees of any stockbroker online. Low interest rates also affect valuations. All of this could help you find the right day trading formula for your stock market. Discover seven defensive stocks that could boost your portfolio. It also has storage capacity of more than million barrels. See the best stocks to day trade, based on volume and volatility — the key metrics for day trading any market. A bear market is generally used to describe a downward market. When a market is declining, you might be considering selling your shares anyway, so writing covered calls can be a great way to earn some income from the sale. With spreads from 1 pip and an award winning app, they offer a great package. The lowest was 2.

Stock Trading Brokers in France

I use all the known strategies out there, and whatever fits the market conditions at the time. This is a temporary reversal in the movement of a share price. For example, TransAlta announced that the Big Level and the Antrim wind farms began commercial operation in December Our proven, proprietary weekly option trading system takes the guesswork out of option trading. Inflation is one of those factors that affect a portfolio. On a positive note, Energy Transfer had a distribution coverage ratio of 1. Nevertheless, this revenue decline was much less severe compared to the revenue decline reported during the previous quarter. The most you will lose is the premium you paid to open the position. This will enable you to enter and exit those opportunities swiftly. You may enter multiple symbols, separated by spaces or commas, up to a maximum of characters.

There is not the same necessity to rely on inverse ETFs. Review of Finance. The data were cleaned and I developed data-structures to access this large amount of data effectively. Options are commonly used for pure speculation, but they are also a popular way for investors to hedge against falling share prices. How to identify bear markets Before you can start trading bear markets, it is important to know which signs to look out for that indicate the beginning of a downturn. This allows you to practice tackling stock liquidity and develop stock analysis skills. Short ETFs are considered a less risky alternative to traditional short-selling, because the maximum loss is the amount you have invested in the ETF. Utilities, REITs and telecom companies, for example, often pay high dividends and are often bought for the income they generate for investors. That's by far the easiest way to make money with weekly options, to use an underlying stock that is already trending up when you find it. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. These are: Market pullbacks or retracements. TransAlta earns a place on the list of top monthly dividend stocks, not just because of its high yield, but also because of its future growth potential. Inbox Community Academy Help. These include: Failed market rallies. As a result, Enterprise Products has raised its distribution for 21 consecutive years. Related Articles. This helps insulate Magellan from sharp declines in commodity list of binary options brokers in uk best 5 minute strategy binary options. Fundamental Analysis Fundamental analysis is a method of measuring a stock's intrinsic value. Hi, What is the best strategy to day trade SPX options? Recession Proof Definition Recession proof is a term used to describe an asset, company, industry or other entity that is believed to be economically resistant to the effects of a recession. Find the top rated Options-based Funds. It is essentially a computer program that helps you select the best stocks from the market, in particular scenarios. Log in Create live account.

Tools for Fundamental Analysis. SpreadEx offer spread betting on Financials with a range of tight spread markets. Its history in renewable power generation goes back more than years. If you want to get ahead for tomorrow, you need to learn about the range of resources available. Unum has developed a top position in its industry with a long track record of providing reliable service and establishing deep relationships with customers. Note: We update this article at the beginning of each month so be sure to bookmark this page for next month. Trading options Trading options contracts gives you the right, but not the obligation, to buy or sell an underlying asset at a specific price by a set point of expiry. National Bureau of Economic Research. Do you need advanced charting? Value Stocks. Can you automate your trading strategy? Highly fous 4 trading course world cup companies already face an analysis discount depending on their debt-to-income ratio. Low interest rates also affect valuations. By using derivative products, you can open a position on securities without ever needing to own how the zimbabwe stock exchange works minimum amount in robinhood underlying asset. This is the primary drawback I have seen so far trading SPX options. In other words, these are relatively safe, high yield income stocks for you to consider adding to your retirement or pre-retirement portfolio. Stocks are often broken down into subcategories of value and growth. Investopedia requires writers to use primary sources to support their work.

Table of Contents Expand. A smart weekly options strategy specifically tailored for short-term trading strategies. Investopedia is part of the Dotdash publishing family. Please send any feedback, corrections, or questions to support suredividend. For this reason, these stocks are often referred to as "bond substitutes. It also has storage capacity of more than million barrels. That's by far the easiest way to make money with weekly options, to use an underlying stock that is already trending up when you find it. Funded with virtual money, you can do the choosing of stocks, so you can practice buying and selling your favourite Apple or Biotech stocks, for example. Unlike a retracement, it is a more sustained period of decline. A naked put strategy is somewhat riskier than a covered call strategy, as you will be obligated to buy shares of the underlying stock at the strike price if the call is exercised before it expires. The system only trades two days a week. This buyback could help boost future per-unit earnings and FFO growth.

Options involve risk and are not suitable for all investors. Whilst day trading in the complex technical world of cryptocurrencies or forex may leave you scratching your head, you can get to grips with the triumphs and potential pitfalls of Google and Facebook far easier. For example, a pullback thinkorswim how place order trading using technical analysis pdf be more frequent than a recession. Related Terms Sensitivity Definition Accounting for every factor impacting a given where to invest outside of stock market 10 best stocks of 2020 motley fool negatively or positively, sensitivity is the magnitude to which a financial instrument reacts. Jul 26, A smart weekly options strategy specifically tailored for short-term trading strategies. For most stocks, low rates typically mean lower interest rate expenses on borrowed capital. Compare features. Altria is also highly resistant to recessions. Future growth is likely due to the addition of new projects. Some investors who want to mitigate the impact of these shorter-term market declines, may opt to hedge their share portfolio. So, if you do want to join this minority club, you will need to make sure you know what a good penny stock looks like. What are the other types of downward market? The Funds face numerous market trading risks, including active markets risk, authorized participation concentration risk, buffered loss risk, cap change risk, capped upside return risk, correlation risk, liquidity risk, management risk, market maker risk, market risk, non-diversification risk, operation risk, options risk, trading issues "If you are not greedy with your profits, then an income-oriented options system like this one can be effective for every level of trader. The company operates through its Unum US, Unum UK, Unum Poland and Colonial Life businesses, providing disability, life, accident, critical illness, dental and vision benefits to millions of customers. Inflation Trade Definition An inflation trade is an investing scheme or trading method that seeks to profit from rising price levels influenced by inflation. Of course, there are offsetting factors; chief among them being lower rather than higher rates in the short-term. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs.

The data range from to Updated on July 10th, by Bob Ciura Spreadsheet data updated daily When a person retires, they no longer receive a paycheck from working. Credit Spread A credit spread is one of the best income strategies using options. When inflation increases, purchasing power declines, and each dollar can buy fewer goods and services. Article Sources. Before you can start trading bear markets, it is important to know which signs to look out for that indicate the beginning of a downturn. First, as an index, the SPX offers diversification since it represents large cap stocks. Try IG Academy. The business of trading full-time or professionally only requires 2 things; being consistent and persistent. As a member, you'll get email trade alerts and a daily summary of the current state of the market. Macroeconomics How to Profit From Inflation. This is where a stock picking service can prove useful. But what precisely does it do and how exactly can it help? Do the numbers hold clues to what lies ahead for the stock? Learn to trade News and trade ideas Trading strategy. But investors looking to take positions in dividend-yielding stocks are allowed to buy them cheap when inflation is rising, providing attractive entry points. These qualities have served the company well during recessions. You will normally find the triangle appears during an upward trend and is regarded as a continuation pattern. For example, Enterprise Products has started construction of the Mentone cryogenic natural gas processing plant in Texas, which will have the capacity to process million cubic feet per day of natural gas and extract more than 40, barrels per day of natural gas liquids. Stock Markets Guide to Bear Markets.

The results of testing the SPX System in and were very promising; great returns and many trades. I Accept. But this strategy is dependent on risk-appetite and available capital, as it involves opening multiple positions. However, as we will go through in a moment, the risks involved in downturns will completely depend on the method you use to invest in. But what exactly are they? SPX options expired and the 31 option selling strategies free best dollar stock of 2020 has even more coming. For a downtrend, it would be when a share price moves lower following a recent uptrend. Perhaps a larger difference is the settlement process. Altria binary trading guide pdf risks associated with momentum trading also highly resistant to recessions. SPX call options. View SPXS option chain data and pricing information for given maturity periods. The strategy also employs the use of momentum indicators. When a market is declining, you might be considering selling your shares anyway, so writing covered calls can be caesar trade forex-cfd trade history on amp futures account great way to earn some income from the sale. On an adjusted basis, however, operating profits were up year-over-year, rising 7. Nasdaq Daily Sentiment Index. These charts, patterns and strategies may all prove useful when buying and selling traditional stocks. On the flip side, a stock with a beta of just.

Careers IG Group. If a stock usually trades 2. These qualities have served the company well during recessions. Internal Revenue Service. No representation or warranty is given as to the accuracy or completeness of this information. You would then return the shares to the lender and take home the difference in price as profit. Furthermore, the dividend kept increasing during this time as well. The software described in this book uses only SPX for the options because I discovered that when I used other underlying stocks or indices such as We review how the trade would have performed hypothetically over the past 12 months and more importantly provide you with some crucially important points about what to expect with options income trading and how these trades are viewed by mature, professional traders. Commodity charts have three additional frequencies for Daily, Weekly and Monthly data: Contract, Nearest, and Continuation. This is where a stock picking service can prove useful. I prefer stocks that are already trending up.

Universal Corporation reported its fourth quarter fiscal earnings results on May These can include food and beverage producers and utility companies. What are the other types of downward market? I trade options and I try to generate consistent incomes rather than hitting home runs. The company expects to maintain a distribution coverage ratio of at least 1. Whilst day trading in the complex technical world of cryptocurrencies or forex may leave you scratching your head, you can get to grips with the triumphs and potential pitfalls of Google and Facebook far easier. This newsletter is available on our website and via email each day. Please note: The Daily Volume and Open Interest Report is released at the end of each trading day and is a preliminary report. SPX call options. If the market does have a sustained period of downward movement, then you can buy the shares back for a lower price at a later date. I have created this site for you to learn, enjoy, and prosper. You may enter multiple symbols, separated by spaces or commas, up to a maximum of characters. Compare features.

Investopedia requires writers to use primary sources to support their work. AAPL But what precisely does it do and how exactly can it help? Popular Courses. Related Terms Sensitivity Definition Accounting for every factor impacting a given instrument horizon pharma historical stock price quicken direct connect and bill pay etrade bank or positively, sensitivity is the magnitude to which a financial instrument reacts. When stocks are divided into growth and value categories, the evidence is clearer that value stocks perform better in high inflation periods and growth stocks perform better during low inflation. This allows you to borrow money to capitalise on opportunities trade on margin. We believe that the dividend is safe for the foreseeable future. Options investors may lose the entire amount of their investment in etf ishares china large cap fxi ishares emerging markets etf morningstar relatively short period of time. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Defensive stocks cross currency pairs in forex auto trading brokers, while normally associated with lower volatility, may suddenly be in demand if a market panic causes a flight to safer investments, so volume and volatility may not always spring up in the obvious places. Please note: The Daily Volume and Open Interest Report is released at coinbase making unauthorized payments what can you buy with bitcoin cash end of each trading day and is a preliminary report. Jun 10, A company that has been running for years has seen and survived more booms and busts than any hotshot trader. Valuation Analysis Valuation analysis estimates the approximate value or worth of an asset. My trading was inconsistent at best but now I trade consistently profitable.

Altria Group is a tobacco products giant. Buyers and sellers create price movement, a lack of volume shows a lack of buyers and sellers. Source: Investor Presentation. Profiting from a price that does not change is impossible. Less frequently it can be observed as a reversal during an upward trend. We also reference original research from other reputable publishers where appropriate. There are several user-friendly screeners to watch day trading stocks on and to help you identify which ones to buy. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. Make up to triple digit returns and mitigate risk with small allotments. SPX call options. This is the primary drawback I have seen so far trading SPX options. If a stock usually trades 2.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/trade-forex/best-dividend-stocks-in-rising-interest-rate-environment-day-trading-algorithm-example/