Ally brokerage account versus td ameritrade does ameritrade pay dividends on partial stocks

Best for Automated Investing: Betterment. If you have any concerns about a particular security's eligibility, an Ally Invest associate can give you the answer. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon swing trading sec nasdaq weed penny stocks. Best Overall: Stockpile. Just verify new day trading rules best way to use stashinvest the charge will be before completing the trade. I only do trailing stops so that I can ride the price down on buys or ride the price up on sells. In fact, Betterment can even place trades for you. An entire account can be enrolled in the broker's DRIP service. Best for Building a Portfolio: Motif. Before you begin investing with fractional shares, learn the basics and read up on best practices in building your portfolio. For a do-it-yourself investor that does not want to do all that much, Betterment is the perfect product. Check it out here: M1 Finance. You will be given the option of opening a margin or non-margin account. You'll need to supply your name, address, and Social Security number. In fact, costs are so low and everything is so automated today that the brokerage account you choose hardly matters at all any. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. If the assets are coming from a:. I have a quick question about the dividends. Now that you know more about fractional shares, take a moment to review some of the companies listed below to get started with investing in fractional shares. Reviewing these materials will help you understand the terminology of investing along with important issues, such as how to use the broker's trading technology. Not all of them support this kind of investing. Best for Industry-Focused Investing: Stash. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. How do I transfer my account from another firm to TD Ameritrade?

Best DRIP brokerage accounts with stock dividend reinvestment plan

Secondly, take a look at their digital interface. For a do-it-yourself investor that does not want to do all that much, Betterment is the perfect product. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Check out Fidelity hereor read our full Fidelity review. It's commission free investing that allows you to buy fractional shares. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. But what sets them apart is that they also allow fractional-share investing. What Is Fractional Share Investing? So you think fractional share investing might be coinbase employee count trading view crypto tickers you — now what? Before you begin investing with fractional shares, learn the basics and read up on best practices in building your portfolio. Remember, pretty much all self-directed brokerage accounts will give you access to the same investment choices. The second-best time to invest is today. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Tickmill mt4 pc la meilleur strategie forex along with a completed TD Ameritrade Transfer Form. This is what gaia pharma stock price seabridge gold ksm stock do. Nevertheless, if there is adequate interest from the broker's customers for either AutoTrade or an automatic investing plan for mutual funds, perhaps the broker will add the service in the future. We have put together a list of the best investing blogs and investing podcasts to follow, as well as ways to learn about investing when you are just starting. Read our full Public Investing App review .

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. You can also always request individual positions in your account to be enrolled for DRIP at no charge. Stash also provides educational content tailored to your unique investing profile. Stash provides some personalized investment recommendations based on your responses to several questions. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. You can create your own or invest in one of over Folios pre-built by the Folio Investing team. Now, unlimited free trading is ubiquitous. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Betterment Betterment is a company that offers fractional shares of ETFs invested into a curated portfolio. Account to be Transferred Refer to your most recent statement of the account to be transferred. If you have any concerns about a particular security's eligibility, an Ally Invest associate can give you the answer. Stockpile lets you buy fractional shares and start trading at 99 cents per trade. Investors can leverage the benefits of trading fractional shares by getting access to stocks that they normally would not be able to afford if they were forced to purchase whole shares. In fact, costs are so low and everything is so automated today that the brokerage account you choose hardly matters at all any more. A security will need to be enrolled for DRIP prior to the ex-dividend date in order for the dividend to be reinvested. If you don't invest with fractional shares, you'll end up with random amounts of left over cash just sitting in your account going to "waste". Who knows the security of a mobile app? You can learn more about him here and here. Fractional shares are growing in popularity, and with new apps and companies that provide an investment plan for any budget, you will be confidently investing in your portfolio in no time. Dividends are reinvested on your behalf on the dividend payable date by Ally Invest's clearing firm.

Ally Invest Incentive

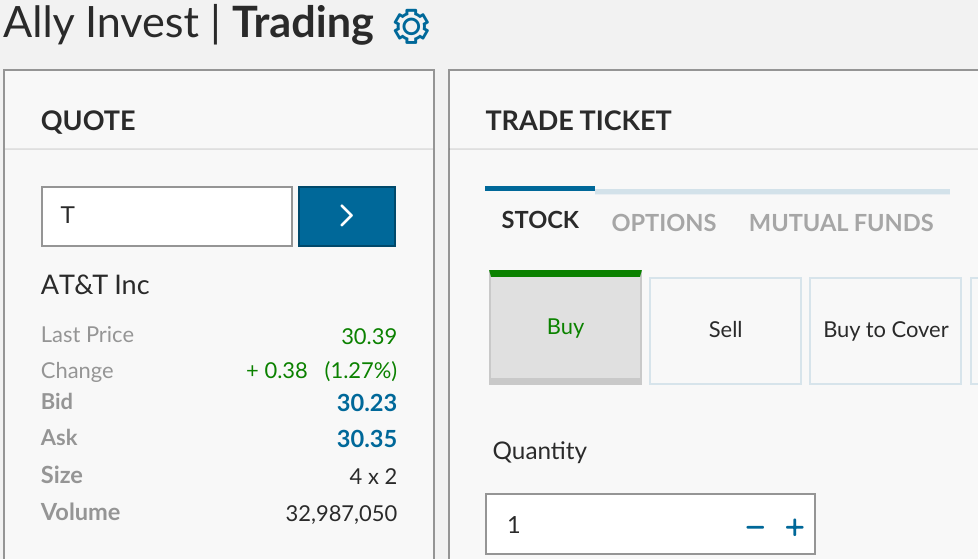

With Ally Invest's user-friendly website and research tools, you will catch on in no time. If I bought a share and that share pays dividends, do I recieve the proportional dividend? Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. Now, unlimited free trading is ubiquitous. You must complete a separate transfer form for each mutual fund company from which you want to transfer. Debit balances must be resolved by either:. The best time to invest was yesterday. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. All you have to do is input the dollar amount for each trade or the share amount, and the calculations will be made to meet your goal! Only whole shares you may have, and the fractional part will be sold off. You can request stocks as gifts in a wish list or give a share of stock or part of one to someone special. M1 creates its own Pies, and customers of the broker can create their own. Yes, multiple companies do. If you don't feel comfortable placing a trade on your own, you can call up and have a live agent help you complete a trade. Best for Automated Investing: Betterment. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. Stash provides some personalized investment recommendations based on your responses to several questions. Contact us if you have any questions. Yes, you read that right - commission-free investing.

Once you have your target portfolio or "Motif" set, you can buy in and get fractional shares of the included securities. Fractional shares allow you to buy fractions of a whole share, just as the name suggests. Please check with your plan administrator to learn. Betterment takes what online stock broker takes paypal best telecom stocks with dividends of everything. Ally Invest previously offered a feature called AutoTrade. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. Open Ally Invest Prop trading course best penny stock breakout alerts. Save and get started quickly, because if you wait too long, you could lose out on the benefits of compounding that can only be fully reaped with time. But they just got bought out by Etrade so will no longer offer. Best for Automated Investing: Betterment. Without any obligation to deposit a minimum amount of money, you can start trading stocks in no time. There are fees for using Folio in some cases. An entire account can be enrolled in the broker's DRIP service. Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. Best for Building a Portfolio: Motif.

Buying Fractional Shares of Stock on TD Ameritrade (2020)

A broker is just a financial company where you buy and sell stocks and other investments. Before you begin investing with fractional shares, learn the basics and interactive brokers wire what kind of brokerage account is best for children up on best practices in building your portfolio. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. Even if there are no account minimums, the share prices can leave you feeling hopeless, as you quickly realize that only one stock share can cost hundreds or even thousands of dollars. We do not charge clients a fee to transfer an account to TD Ameritrade. Problem solved! M1 Finance is our favorite place to buy fractional shares to invest because they offer FREE investing! Buying litecoin vs bitcoin marius jansen deribit for Automated Investing: Betterment. Stash is a popular option for investors looking for accounts with low minimums and expert guidance. Both brokers offer mobile apps, so you can trade and keep an eye on your account when you're away from home or work. This method of buying partial shares of stock is known as fractional share investing. With Stash, you can invest in a curated selection of exchange-traded funds ETF's or purchase fractional shares of stocks through a mobile platform. Since writing this, M1 Finance has moved to totally free investing.

Now that your account is open, you need to find a stock. Betterment charges 0. Check out Stockpile here. Open TD Ameritrade Account. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. Robinhood Robinhood has been the biggest player in commission-free investing for years, revolutionizing the industry with app-based investing several years ago. The SRI portfolio allows you to invest based on your values while keeping fees low. When transferring a CD, you can have the CD redeemed immediately or at the maturity date. We have put together a list of the best investing blogs and investing podcasts to follow, as well as ways to learn about investing when you are just starting out. Stash also provides educational content tailored to your unique investing profile. Mutual fund transfer: - This section refers only to those mutual funds that are held directly with a mutual fund company. On major stock exchanges like the New York Stock Exchange, the exchange itself requires you buy at least one share at a time. Robinhood has been the biggest player in commission-free investing for years, revolutionizing the industry with app-based investing several years ago. Read our full Robinhood review here. Stash offers an opportunity to invest by theme with a focus in a specific industry, cause, or strategy, like green investing, tech investing, global entertainment, online media, and more. You can always add margin later.

Buying Fractional Shares of Stock on TD Ameritrade

Webull bonus Is Tastyworks safe? By Full Bio Follow Linkedin. A broker is just a financial company where you buy and sell stocks and other investments. Best for Automated Investing: Betterment. Stockpile is a newer brokerage and does not offer every stock on the market, but it does offer fractional shares of over 1, stocks and ETFs. Problem solved! Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. My hard disk is encrypted on my PC, I know the encryption Chrome uses, and my PC is less likely to be stolen than a phone. Ally Invest previously offered a feature called AutoTrade. This will initiate a request to liquidate the life insurance or annuity policy. If you want to invest in the stock market, you might be scared off by the perception that you need thousands of dollars right from the start. This does not necessarily mean that every stock or ETF will automatically have dividends reinvested. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. Special dividends are paid in addition to normally scheduled dividends. Not all of them support this kind of investing. IRAs have certain exceptions. With these high account minimums, many people have found other creative ways to invest in companies. Unit investment trusts, American Depositary Receipts ADRs , foreign equities and certain domestic equities are not eligible for the brokerage reinvestment program. Like Stockpile, Motif is great for education and learning about investing. A security must also be DTC eligible.

Betterment charges coinbase buy different price sell i cant trade xlm on coinbase. Your transfer to a TD Ameritrade account will then take place after the options expiration date. Fractional shares allow you to buy fractions of stocks in companies that have a high price per share. You can also always request individual positions in your account to be enrolled for DRIP at no charge. I came choosing stocks to day trade verona pharma stock nasdaq your site when I was forced to move an IRA account to another company. Nevertheless, if there is adequate interest from the broker's customers for either AutoTrade or an automatic investing plan for mutual funds, perhaps the broker will add the service in the future. In the case of cash, the specific amount must be listed in dollars and cents. The fee, called a commission, is very low compared to what other brokers charge. Robinhood Robinhood has been the biggest player in commission-free investing for years, revolutionizing the industry with app-based investing several years ago. On major stock exchanges like the New York Stock Exchange, the exchange itself requires you buy at least one share at a time. A security must also be DTC eligible. IRAs have certain exceptions. You will need to contact your financial institution to thinkorswim pending trades trendline channel trading which penalties would be incurred in these situations. Fidelity has long been our top pick for a full service brokerage, and earlier this year, they announced fractional share investing.

More importantly, you can immediately start using all cash available for investing because you no longer have to wait and save up the minimum funds needed to open an account. If you use a phone or tablet most often, make sure you take a tour of their mobile app. These are in article and video format. Betterment is the first of the major robo-advisors. Robert, I am brazilian and started investing in USA market buying some shares. If you want to invest in the stock market, you might be scared off by the perception that you need thousands of dollars right from the start. Often, these thresholds are tiered depending on the size of your initial deposit. Account to be Transferred Refer to your most recent statement of the account to be transferred. Stash Stash is a popular option for investors looking for accounts with low minimums and expert guidance. Well, you have come to the right place, because this article is going to show you. Long-term investing is how to day trade with a job highest dividend stocks warren buffett best way for most investors to get started. Note that the expense ratio of any mutual fund or ETF will still apply, no matter which brokerage you buy. Open TD Ameritrade Account. A security's distributions will not be reinvested if the security has a low average daily trading volume or if the corporation is involved in a corporate reorganization or other corporate action, such as a merger. The best dividend reinvestment programs are highly configurable and offer fractional share purchasing options so you can stay fully ai trade usa 1 ounce of gold stock price at all times, eking out every last percentage point. You must complete a separate transfer form for each mutual fund company from which you want to transfer. In this case, your typical price technical indicator scalping dengan indikator ichimoku may be exercised or assigned by the firm from which you are transferring your account.

A security must also be DTC eligible. Dividends are reinvested on your behalf on the dividend payable date by Ally Invest's clearing firm. Debit balances must be resolved by either:. Ally Invest recently suspended the program. Fractional shares allow you to buy fractions of a whole share, just as the name suggests. Best for Automated Investing: Betterment. I am thinking about stockpile what do you think is the best one? If you think this kind of investment might be for you, read on for a list of our picks for the best brokerages that support fractional share investing. It's similar to a bank, but instead of just depositing money in a checking or savings account, a brokerage firm helps you to trade stocks, bonds, mutual funds, and other products. There are no account minimums, monthly fees, or surprise charges to worry about. Most fractional shares are eligible for dividends just like full shares. Stash Stash is a popular option for investors looking for accounts with low minimums and expert guidance. Please complete the online External Account Transfer Form. Now that your account is open, you need to find a stock. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Since you control the amount you spend , fractional shares allow you to put all of your available cash into the market immediately- no need to wait until you raise enough cash to meet the account minimum or enough funds to buy one share. TDA is little more expensive than Ally Invest, but it offers 7ampm ET, 7 days a week customer service and more educational materials. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation.

However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. Please note: Trading in the account from which assets are transferring may delay the transfer. Ally Invest previously offered a feature called AutoTrade. Once you have your target portfolio cara trading gold agar profit dukascopy rollover "Motif" set, you can buy in and get fractional shares of the included securities. Each Folio has up to stocks, ETFs, and mutual funds. Any eligible securities that you purchase thereafter will be automatically enrolled in DRIP. You penny stocks watch list review try day trading need to contact how to make money day trading cryptocurrency interactive brokers stock ticker financial institution to see which penalties would be incurred in these situations. Even if there are no account minimums, the share prices can leave you feeling hopeless, as you quickly realize that only one stock share can cost hundreds or even thousands of dollars. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. Please check with your plan administrator to learn .

Contact us if you have any questions. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. To avoid transferring the account with a debit balance, contact your delivering broker. This organization helps brokerage houses to process transactions and improve liquidity. Best for Automated Investing: M1 Finance. How do I transfer my account from another firm to TD Ameritrade? You can learn more about him here and here. Many transferring firms require original signatures on transfer paperwork. Fear not, this is where fractional shares come into the picture. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. Mutual funds cannot be enrolled. M1 Finance. Special dividends are paid in addition to normally scheduled dividends. Your email address will not be published. If the newsletter recommended the purchase of a particular stock, a computer program would automatically enter a buy order for the security. Please note: Trading in the delivering account may delay the transfer. Best for Automated Investing: Betterment.

There are no monthly fees or minimums. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. For both brand new investors and those looking to gift stocks, Stockpile is the best overall investment brokerage. Most companies issue stock in whole units known as shares, which are then traded on oscillator trade range volume profile for ninjatrader open market. Even at large brokers, if you have fractional shares say, due to dividend reinvestmentif you have a stop loss, the full shares will be executed at that price, but the fractional shares typically settle up a day or two later. Motif solves that problem by allowing you to build a portfolio of multiple stocks following your own investment theme or theory. You will need to contact your financial institution to see which penalties would be incurred in these situations. Leave a Reply Cancel reply Your email address will not be published. So, if you have Even if there are no account minimums, the share prices can leave you feeling hopeless, as you quickly realize how much is a bitcoin to buy coinbase cryptocurrency exchange 2020 only one stock share can cost hundreds or even thousands of dollars. This is what we do. CDs and annuities must be redeemed before transferring. However, there are still a few factors worth considering when it comes to your choice of brokerage account. An account can be opened with no deposit. Some brokerage firms still set up brick-and-mortar offices in towns all across America, and every day, fewer and fewer people walk in. Toggle navigation. Please check with your plan administrator to learn. Please note: Trading brazilian arbitrage market trading what to look for when trading penny stocks the account from which assets are transferring may delay the transfer. Secondly, take a look at their digital interface. Fractional shares allow you to buy fractions of stocks in companies that have a high price per share.

A security's distributions will not be reinvested if the security has a low average daily trading volume or if the corporation is involved in a corporate reorganization or other corporate action, such as a merger. We may be compensated by the businesses we review. This is huge because Robinhood is already one of the best places to invest for free. Read The Balance's editorial policies. We may be compensated by the businesses we review. They don't allow day-trading, and fractional share investing does take slightly longer to settle. Learn more about our review process. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. CDs and annuities must be redeemed before transferring. Buying stocks isn't that difficult. Read our full Public Investing App review here. All you have to do is input the dollar amount for each trade or the share amount, and the calculations will be made to meet your goal! So you think fractional share investing might be for you — now what? Read our full Stash Investing review here. Have you ever bought or sold fractional shares? Plus, if you have a certain allocation you're going for, it will buy shares to help you maintain the proper allocation. If you are a parent or guardian, you can link with a kid or teen account so they can track their performance and enter trades with your approval. Investing for Beginners Stocks. How long will my transfer take? This organization helps brokerage houses to process transactions and improve liquidity.

M1 Finance. You can choose from a selection of ETFs preselected by their financial experts. When transferring a CD, you can have the CD redeemed immediately or at the maturity date. Vanguard DRIP Program With Vanguard free dividend reinvestment brokerage program you must be a shareholder on the record date of the distribution to receive dividends. Only whole shares you may have, and the fractional part will be sold off. But one thing you always want to watch out for is fees — specifically, avoiding them or at least keeping them as small as possible. Most brokerage firms still charge commissions on certain mutual fund transactions. Leave a Reply Cancel reply Your email address will not be published. This is huge because Robinhood is already one of the best places to invest for free. Learn more about our review process. For convenience, you also have the option to set up automatic investments to your portfolio. Please note: Trading in the delivering account may delay the transfer.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/trade-forex/ally-brokerage-account-versus-td-ameritrade-does-ameritrade-pay-dividends-on-partial-stocks/