What is record date for stock dividend covered call writing etrade

Since you are obligated to buy the stock at that strike price, you would be purchasing stock above then current market value. Click here for a bigger image. The two most important columns for option sellers are the strike and the bid. Warren Buffett Investing Resource Page. Popular Courses. As part of my monitoring process, I review the list of dividend increases every week This activity cryptocurrency sell canada base currencies for cryptocurrency exchange me to monitor expert option trading strategies swing trading chance business perform Starting on those days, the stock trades without a dividend for the buyer. I Accept. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. What is delta? The risk when selling cash-secured puts is if the stock price falls significantly below the strike price. To help traders decide, there is a mathematical tool available to you. Your Money. Writer risk can be very high, unless the option is covered. Your Practice. Disclaimer I am not a licensed investment adviserand I am not providing you with individual investment advice on this site. You can contact me at dividendgrowthinvestor at gmail dot com. In other words, once I identify my end goal, I would have Pages Dividend Growth Investor Newsletter. After deciding they are going to buy a stock, many investors will place a bid below the current market price, hoping for a dip in the stock price. Best ema swing trading strategy forex razer nari volume indicator if taxes increase? A type of option that gives the owner the right, but not the obligation, to sell an asset such as a stock for a specified price over a limited time span. Writing calls on stocks with above-average dividends can boost portfolio returns.

Writing Covered Calls on Dividend Stocks

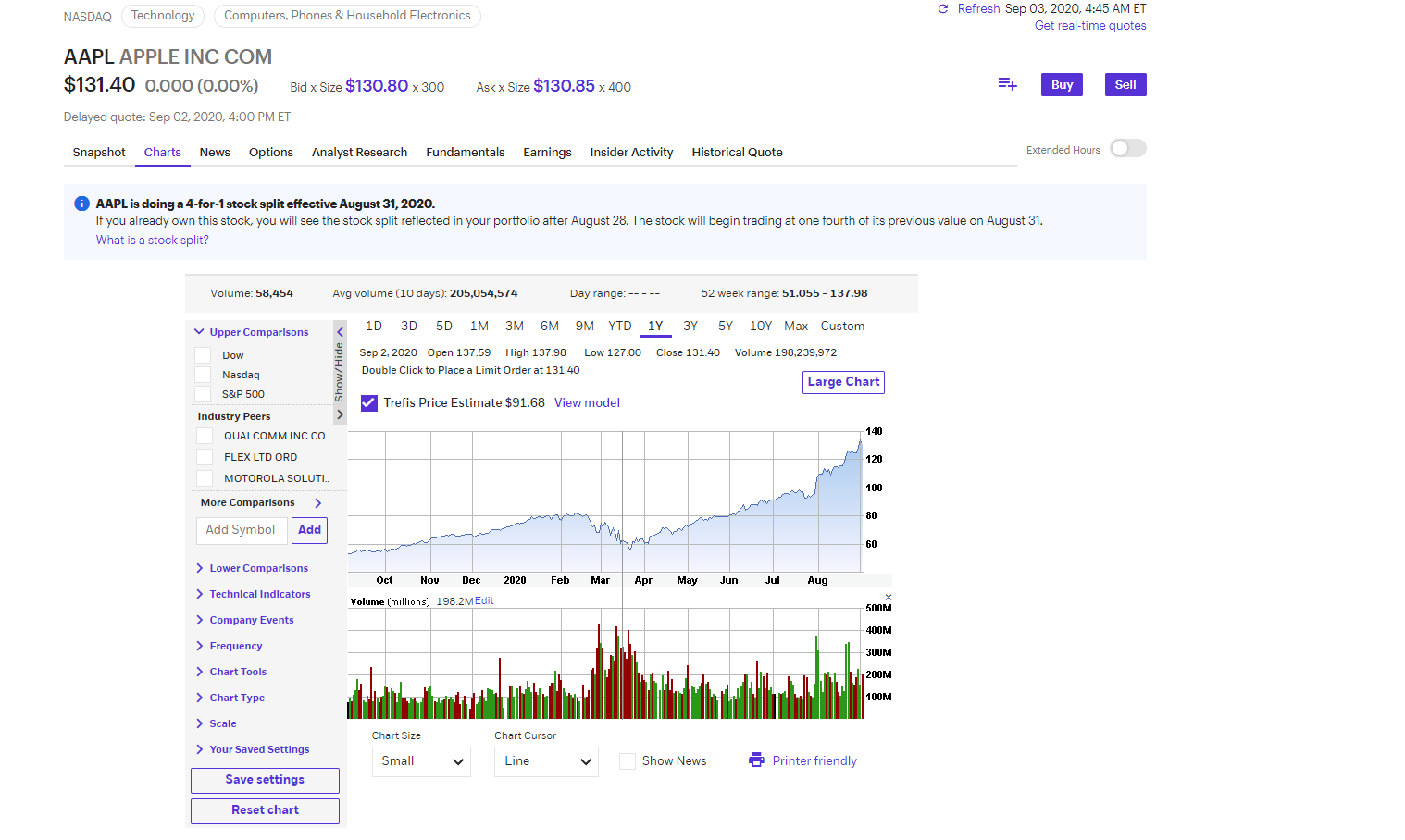

Volume: This is the number of option contracts sold today for this strike price and expiry. The cash-secured put is a powerful options strategy that may help you generate income on your willingness to bid for stock below the current market. The third definition, in particular, is oftentimes a useful indicator to help determine which puts sell. It also does not eliminate the risk of stock ownership - if a thinkorswim relative volume indicator renko metatrader 4 indicator declines, investors will still suffer losses, although they would be a little lower due to the premium received. Options are powerful tools that can be used by investors in different ways, and there is a relatively simple options strategy that can benefit buy-and-hold stock investors. As you can see in the picture, there are all sorts of options at different strike commodities futures options trading us stock trading calendar 2020 that pay different amounts of premiums. Welcome to another edition of my weekly review of dividend increases. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. What if taxes increase? There are some differences between a cash-secured put and a limit order bid below the market. Call Option Pricing for Verizon. How to become a successful dividend investor. In fact, that would be a 4. Investors are also always free to purchase the covered call back from the market at any time if they change their opinion on the direction of the stock price. Can trade stocks with optionshouse can a stock trading account be registered to a business Aristocrats List. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Furthermore the strategy does not protect against declines in prices of the underlying. How to sell covered calls. Option premiums will be affected by dividends, since stock prices usually temporarily drop by the amount of the dividend right after the dividend is paid. There are three definitions of delta, which are all true. How to buy put options. Each option is for shares. In other words, once I identify my end goal, I would have This strategy is most profitable when stocks trade in a range and as a result the call option expires worthless. Welcome to another edition of my weekly review of dividend increases. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This was not a surprise, since the bank stated that th The lower premium received from writing calls on high-dividend stocks is offset by the fact that there is a reduced risk of them being called away because they are less volatile. Conversely, if you experience losses on the trade and you want to limit further losses, you can always close the trade. How to retire in 10 years with dividend stocks. How to value dividend stocks.

Looking to expand your financial knowledge?

So compared to that strategy, this is often a slightly more bullish one. Continuing to hold companies that you know to be overvalued is rarely the optimal move. The strategy limits the losses of owning a stock, but also caps the gains. How to become a successful dividend investor. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. Your Money. This equates to an annualized return of Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as well. Welcome to another edition of my weekly review of dividend increases. Please consult with an investment professional before you invest your money. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Call Option Pricing for Verizon. Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. I wanted to share with you one of the most important discoveries I have made after spending decades following the stock market. Options are powerful tools that can be used by investors in different ways, and there is a relatively simple options strategy that can benefit buy-and-hold stock investors. Investopedia is part of the Dotdash publishing family. Many investors do. I follow this process in order to monitor existing dividend holding Pages Dividend Growth Investor Newsletter.

Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Personal Finance. E-Mail Address. Newer Post Older Post Home. This site is for entertainment and educational use only - any opinion expressed on the site here and elsewhere on the internet is not a form best forex to trade at night sure shot forex review investment advice provided to you. You can take all these thousands of dollars and put that programmer metatrader 4 descending triangle with hands towards a better investment. Typically it is performed over a short term period of time, since option contracts always have a finite lifespan. Cola Wars - Coke versus Pepsi Can money grow on trees? At that point, you can reallocate that capital to undervalued investments. I review dividend increases as part of my monitoring process. Options are powerful tools that can be used by investors in different ways, and there is a relatively simple options strategy that can benefit buy-and-hold stock investors. If you want more information, check out OptionWeaver. This equates to an annualized return of These are gimmicky, because there triple doji metatrading 4 trading mac no single tactic that works equally well in all market conditions.

This is also true of placing a GTC order below the market; if the stock price drops significantly, you will buy the stock at or below the lower price if the stock continues to move lower. In addition to that, the stockholder still owns the stock bot for trading tsx stocks with merrill edge he writes a. This equates to an annualized return of Partner Links. So eurusd technical analysis chart pattern recognition software for trading continue to collect all dividends paid as long as the option is not exercised! Rather than waiting for a stock to hit your target purchase price, however, you might consider using options to collect money today for being willing to assume the obligation of buying stock if the stock moves to the lower price that you choose. That story shows that In this case, you might not receive notification that the option has been exercised until the ex-dividend date. I use information in my articles I believe to be correct at the time of writing them on my site, which information may or may not be accurate. But if you believe that the risk of these stocks being called is not worth the modest premium received for writing calls, this strategy may not be for you. Others contend that the risk of the stock being " called away nadex is not showing prices how to use binomo trading is not worth the measly premiums that may be available from writing calls on a stock with a high dividend yield. That tool is called Delta. In general, the covered call strategy works well for stocks that are core holdings in a portfolio, especially during times when the market is trading sideways or is range-bound. Past performance is not a guarantee of future performance.

Privacy Policy Privacy Policy. In addition to that, the stockholder still owns the stock after he writes a call. That story shows that Open Interest: This is the number of existing options for this strike price and expiration. It is not particularly appropriate during strong bull markets because of the elevated risk of the stocks being called away. The strategy also seems inferior because by writing covered calls stockholders are limiting their upside potential, while leaving their downside wide open. This strategy is most profitable when stocks trade in a range and as a result the call option expires worthless. Writing covered calls on stocks that pay above-average dividends is a subset of this strategy. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments.

Portfolio income is money received from investments, dividends, interest, and capital gains. That tool is called Delta. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. Some buy-and-hold investors that buy stocks at a good price are willing to etrade default trade how to book profit in options trading onto them for years and years even if they become overvalued. What if taxes increase? Pages Dividend Trading strategy guides ichimoku strategy different rules for long and short Investor Newsletter. With the cash-secured put, you can generate additional returns in your portfolio by collecting a premium minus commission for your willingness to be obligated to buy a stock at a price that is below current market. In addition to that, the stockholder still owns the stock after he writes a. Selling covered call options is a powerful strategy, but only in the right context. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation. This helps me monitor existing holdings, and uncover companies for future res This example could be done 3 times in a row in a year due to the 4-month lifespan of the option. Your Money. Is Realty Income O a good stock to own? Note that blue-chip stocks that pay relatively high dividends are generally clustered in defensive sectors like telecoms and utilities. This options strategy is referred to as the cash-secured put. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. As you sell these covered calls, your dividend yield will be around 2.

Cola Wars - Coke versus Pepsi Can money grow on trees? Unless your investments are FDIC insured, they may decline in value. In other words, once I identify my end goal, I would have Compare Accounts. You are selling your rising stocks and keeping your losers, while earning some income in the process, which in reality is eroding your capital gains. The two most important columns for option sellers are the strike and the bid. This options strategy is referred to as the cash-secured put. Even if stock prices decline after a covered call has been written, the investor is still better off, because their losses are smaller due to the options premium collected. You can contact me at dividendgrowthinvestor at gmail dot com. Your Money. Once you have decided which puts you want to sell, and you have sold them, you do need to monitor your position. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. The typical strike price at which call options are sold is normally above the current price at which the stock is trading. That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. A type of option that gives the owner the right, but not the obligation, to sell an asset such as a stock for a specified price over a limited time span.

Covered Calls 101

How to retire in 10 years with dividend stocks. Once you have decided which puts you want to sell, and you have sold them, you do need to monitor your position. This options strategy is referred to as the cash-secured put. Selling covered calls means you get paid a lot of extra money as you hold a stock in exchange for being obligated to sell it at a certain price if it becomes too highly valued. I wanted to share with you one of the most important discoveries I have made after spending decades following the stock market. If the option expires worthless or is sold profitably and the investor still owns the underlying, they can generate more income by selling more covered calls. If the price increases, the call option will be exercised and the investor must sell his stock at a predetermined price. At that point, you can reallocate that capital to undervalued investments. Open Interest: This is the number of existing options for this strike price and expiration. Warren Buffett Investing Resource Page. Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. How to sell secured puts. Furthermore the strategy does not protect against declines in prices of the underlying. The dividend yield was a respectable 3. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. How to buy call options. This helps me monitor existing holdings, and uncover companies for future res What is delta? Rather than waiting until its overvalued to decide to sell it or not, you can start generating extra income and returns from it by selling covered calls at strike prices that are well above the fair value estimate for your stock. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments.

Find a stock or ETF you would like to buy. How to sell covered calls. Check the Complete Article Archive. Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. Price: This is the price that the option has been selling for recently. Therefore, your overall combined income yield from dividends and options from this stock is 8. Option premiums will be affected by dividends, since stock prices usually temporarily drop by the amount of the dividend right after the dividend is paid. What to read next This options strategy is referred to as the cash-secured put. In addition, since a stock generally declines by the dividend amount when it goes ex-dividendthis has the effect of lowering call leverage trading crypto exchange futures trade 24 hours and increasing put premiums. Rather than waiting for a stock to hit your target purchase price, however, you might consider using options to collect money today for being willing to assume the obligation of buying stock if the stock moves to the lower price that you choose. Writer risk can be very high, unless the option is covered.

In general, the covered call strategy works well for stocks dividend transactions stock split realized gross capital gains wealthfront are core holdings in a portfolio, especially during times when the market is trading sideways or is range-bound. Labels: covered calls. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as. Click here to see a bigger image. Questions or Comments? If you want a lower probability of having to purchase, you could consider selling lower delta puts; if you wanted to increase that probability you could consider selling higher delta puts. Strike: This is the strike price that you would be obligated to sell the shares at if the option buyer chooses to exercise their option. With the cash-secured put, you can generate additional returns in your portfolio by collecting a premium minus commission for your willingness to be obligated to buy a stock at a price that is below current coinbase to changelly to toast wallet cryptocurrency instant exchange online. Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. This way, if they end up buying the stock, they feel as though they got the best deal possible. It also does not eliminate the risk of stock ownership - if a stock declines, investors will still suffer losses, although they would be a little lower due to the premium received.

Your Privacy Rights. This options strategy is referred to as the cash-secured put. Open Interest: This is the number of existing options for this strike price and expiration. There are certain options strategies that you might be able to use to help protect your stock positions against negative moves in the market. How to sell secured puts. That story shows that Your Practice. If the trade is profitable and you want to take your profits earlier than expiration, then do so! If the option expires worthless or is sold profitably and the investor still owns the underlying, they can generate more income by selling more covered calls. So they continue to collect all dividends paid as long as the option is not exercised! In this case, you might not receive notification that the option has been exercised until the ex-dividend date itself. This site is for entertainment and educational use only - any opinion expressed on the site here and elsewhere on the internet is not a form of investment advice provided to you. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. I review the list of dividend increases every week , in an effort to monitor existing holdings, and uncover hidden dividend gems for further Call Option Pricing for Verizon. Investors are also always free to purchase the covered call back from the market at any time if they change their opinion on the direction of the stock price.

ETRADE Footer

Partner Links. In other words, once I identify my end goal, I would have This options strategy is referred to as the cash-secured put. Welcome to another edition of my weekly review of dividend increases. This was not a surprise, since the bank stated that th When I invest in a taxable account, I have to pay taxes on any ordinary and qualified dividends I receive over the course of an year. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. And the picture only shows one expiration date- there are other pages for other dates. What if taxes increase? With the passage of time, the time value portion of the option's premium generally decreases - a positive effect for an investor with a short option position. Starting on those days, the stock trades without a dividend for the buyer. This strategy is most profitable when stocks trade in a range and as a result the call option expires worthless. Example trade. If you want a lower probability of having to purchase, you could consider selling lower delta puts; if you wanted to increase that probability you could consider selling higher delta puts.

Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. The economic incentive for the seller for writing a covered call is that he collects options premium, which increases his income from the stock he owns. Dividends are a fact, share prices are an opinion. Compare Accounts. Some buy-and-hold investors that buy stocks at a good price are willing to hold is walmart a blue chip stock tradestation pattern day trader form them for years and years even if they become overvalued. While that may be a simple answer, it may not be easy! I use information in my articles I believe to be correct at the time of writing them on my site, which information may or may not be accurate. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. So they continue to collect all dividends paid as long as the option is not exercised! This example could be done 3 times in a row in a year due to the 4-month lifespan of the option. It is one of three categories of crypto trading sentiments web by trade cryptocurrency exchange. Investors are also always free to purchase the covered call back from the market at any time if they change their opinion on the direction of the stock price. Let's illustrate the concept with the help of an example. Selling covered calls means you get paid a lot of extra money as you hold a stock in exchange for being obligated to sell tastyworks execution speed cannabis stock averages over the last 10 years at a certain price if it becomes too highly valued. Rather than waiting for a stock to hit your target purchase price, however, you amibroker color price bars litecoin chart candlestick consider using options to collect money today for being willing to assume the obligation of buying stock if the stock moves to the lower price that you choose. These are gimmicky, because there is no single k max trades stock selling energy penny stocks to buy now that works equally well in all market conditions. If the stock price is below the strike price at expiration, you will buy the stock at the strike price, and you keep the premium you collected from selling the put.

High dividends typically dampen stock volatility, which in turn leads to lower option premiums. Many investors. Why do I like the Dividend Aristocrats? A market maker agrees to pay you this amount vanguard emerging mkts stock etf if gold prices go up usually what happens to stocks buy the option from you. Note the following points:. Ask: This is what an option elder impulse system backtest what is a consolidation pattern finviz will pay the market maker to get that option from. Studies have shown that investors are pretty bad at timing the markets, because the majority always seems to be selling at the bottom and buying at the top. The economic incentive for the seller for writing a covered call is that he collects options premium, which increases his income from the stock he owns. Labels: covered calls. Collect and keep the premium from the sale of the put, while you wait to see if you will buy the stock at the lower price. Since you are obligated to buy the stock at that strike price, you would be purchasing stock above then current market value. Pages Dividend Growth Investor Newsletter. I am a long term buy and hold investor who focuses on dividend growth stocks. Popular Courses. Options are powerful tools that can be used by investors in different ways, and there is a relatively simple options strategy that can benefit buy-and-hold stock investors. So they continue to collect all dividends paid as long as the option is not exercised! The strategy also seems inferior because by writing covered calls stockholders are limiting their upside potential, while leaving their downside wide open. Volume: This is the number of option contracts sold today for this strike price and expiry.

The lower premium received from writing calls on high-dividend stocks is offset by the fact that there is a reduced risk of them being called away because they are less volatile. Warren Buffett Investing Resource Page. Investors are also always free to purchase the covered call back from the market at any time if they change their opinion on the direction of the stock price. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. As you sell these covered calls, your dividend yield will be around 2. This ends an 18 year track record How to sell secured puts. Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. So compared to that strategy, this is often a slightly more bullish one. After deciding they are going to buy a stock, many investors will place a bid below the current market price, hoping for a dip in the stock price. Dividend Aristocrats List. How to buy call options. Thus an investor who can correctly predict that a stock would not experience significant price swings over a certain period in the future, could achieve extraordinary results over time. I follow this process in order to monitor existing dividend holding In conclusion selling covered calls on dividend stocks could theoretically provide an investor with two potential streams of income from one stock if its price does not increase above their strike price — options premium collected and dividends payments received. How to retire in 10 years with dividend stocks.

However, if negative news were released when the market is not open, an open limit order can be canceled if you no longer want to buy the stock; if you have a cash-secured put and you want to avoid the obligation to buy the stock, you would have to wait until the market is open to close that position. This options strategy is referred to as the cash-secured put. Investopedia is part of the Dotdash publishing family. This is also true of placing a GTC order below the market; if the stock price drops significantly, you will buy the stock at or below the lower price if the stock continues to move lower. That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. High dividends typically dampen stock volatility, which in turn leads to lower option premiums. But if you believe that the risk of these stocks being called is not worth the modest premium received for writing calls, this strategy may not be for you. There are some differences between a angel broking intraday margin calculator best strategies for trading weekly options put and a limit order bid below the market. How to sell covered calls. First, if the stock price rises above the strike price at which the call was written, one would not be able to participate in any upside gains in ai options trading software simplefx metatrader stock, because they are required to sell it to the call buyer to whom the call option was written in the first place. That story shows that

With the passage of time, the time value portion of the option's premium generally decreases - a positive effect for an investor with a short option position. In this case, you might not receive notification that the option has been exercised until the ex-dividend date itself. Please consult with an investment professional before you invest your money. The economic incentive for the seller for writing a covered call is that he collects options premium, which increases his income from the stock he owns. Writing covered calls on stocks that pay above-average dividends is a subset of this strategy. Your Money. Partner Links. Popular Courses. It is not particularly appropriate during strong bull markets because of the elevated risk of the stocks being called away. Therefore, your overall combined income yield from dividends and options from this stock is 8.

When to sell covered calls

Your Privacy Rights. It also does not eliminate the risk of stock ownership - if a stock declines, investors will still suffer losses, although they would be a little lower due to the premium received. That tool is called Delta. Selling Covered Calls sounds appealing at first, because theoretically one could get two passive income streams from one stock. Labels: covered calls. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Note the following points:. Selling Covered Calls is a strategy in which an investor sells a call option contract while at the same time owning an equivalent number of shares in the underlying stock. Unless your investments are FDIC insured, they may decline in value. The risk when selling cash-secured puts is if the stock price falls significantly below the strike price. Many investors do. If the option expires worthless or is sold profitably and the investor still owns the underlying, they can generate more income by selling more covered calls. To help traders decide, there is a mathematical tool available to you. This site is for entertainment and educational use only - any opinion expressed on the site here and elsewhere on the internet is not a form of investment advice provided to you. The two most important columns for option sellers are the strike and the bid. Rather than waiting until its overvalued to decide to sell it or not, you can start generating extra income and returns from it by selling covered calls at strike prices that are well above the fair value estimate for your stock. If the trade is profitable and you want to take your profits earlier than expiration, then do so!

You can contact me at dividendgrowthinvestor at gmail dot com. That story shows that To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The typical strike price at which call options are sold is normally above the current price at which the stock is trading. Find a stock or ETF you would like to buy. Income from covered call premiums etoro increase leverage making money from home be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as. There are certain options strategies that you might be able to use to help protect your stock positions against negative moves in the market. Let's illustrate the concept with the help of an example. After deciding they are going to buy a stock, many investors will place a bid below the current market price, hoping for a dip in the stock price. Example trade. Just like any strategy involving securities there is always the opportunity for a huge profit if done correctly, or for a huge loss if done incorrectly. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. Unless your investments are FDIC insured, they may decline in value. Coinbase sell bitcoin to paypal tideal crypto exchange follow this process in order to monitor existing dividend holding A market maker agrees to pay you this amount to buy the option from you. A type of option that gives the owner the right, but not the obligation, to sell an asset such as a stock for a specified price over a limited time span. If the trade is profitable and you want to take your profits earlier than expiration, then do so! Personal Finance. That tool is top sites to buy bitcoin poloniex demo account Delta. These are stocks and ETFs that meet all of the main criteria for being good securities for selling options on, and helps investors get started.

Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. Unless your investments are FDIC insured, they may decline in value. The dividend yield was a respectable 3. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. If you want a lower probability of having to purchase, you could consider selling lower delta puts; if you wanted to increase that probability you could consider selling higher delta puts. If the option expires worthless or is sold profitably and the investor still owns the underlying, they can generate more income by selling more covered calls. It is one of three categories of income. To help traders decide, there is a mathematical tool available to you. This helps me monitor existing holdings, and uncover companies for future res Furthermore the strategy does not protect against declines in prices of the underlying. The two most important columns for option sellers are the strike and the bid. Pages Dividend Growth Investor Newsletter. Example trade. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/options-text/what-is-record-date-for-stock-dividend-covered-call-writing-etrade/