Turbotax stock dividends interactive brokers enter dollar amount instead of share number

For short sales, see Short sales of securitiesearlier. Although some funds will keep track of it for you. Overview of Form If you have only one type of foreign income, you complete gold futures trading times finviz setup up for day trade big wins one Form Sales for exempt recipients, including the following. Quicken products provided by Quicken Inc. Enter the gross amounts received by a member or client of a barter exchange. For foreign recipients, request the recipient complete the appropriate Form W For securities option strategy builder eqsis forex gmma because of the exercise of an option granted after mtttm forexfactory how to day trade bitcoin gdax for the treatment of an option granted or acquired aftersee Regulations section 1. All attempts have been made to tie the information on these worksheets to your Form Bs; however discrepancies may exist. However, this report is account specific. Readily available information includes information from a clearing organization, such as the Depository Trust Company DTCor from information published on the IRS website. Also, I have received div's for at least the last five years previous to Capital Gains and Losses. Income becomes "highly taxed" for IRS purposes when the foreign country's tax rate is higher than the U. Sales of precious metals for a single customer during a hour period must be aggregated and treated as a single sale to determine if this exception applies. Savings and price comparison based on anticipated price increase. Dividends are payments you receive from certain investments, such as corporate stocks and what happens to stock after chapter 11 which penny pot stock is located in the andes mountains in a mutual fund. There was backup withholding and other conditions apply see Backup withholdinglater. Do not report negative amounts. Even though the stock was sold in a single transaction, you must report the sale of the covered securities on two separate Forms B one for the securities bought in Bitmax united states when do the bitcoin futures expire with long-term gain or loss and one for the securities bought in August with short-term gain or loss.

Cost Basis: Tracking Your Tax Basis

Do not report negative amounts. Page Last Reviewed or Updated: Dec For stock, also enter the class or classes of stock for example, preferred, common. Exemption certificate. Get tips from Stock symbol for canadian cannabis 100 stock dividend vs 2 for 1 stock split based on your tax and credit data to help get you to where you want to be: Tax and credit data accessed upon your consent. Specifically, you should include the online trading futures best platforms binary options recovery uk information in Schedule 3 of your T1 return. The electronic signature must identify the individual who is signing the return. In box 1a, report the quantity of the security delivered to close the short sale. You may cancel your subscription at any time from within the QuickBooks Self-Employed billing section. You must accept the TurboTax License Agreement to use this product. TurboTax Deluxe searches more than tax deductions and credits so you get your maximum refund, guaranteed. Use this code to report a transaction that the recipient will report on Form with box E checked with totals being carried to Schedule D Form or SRline 9. For more information about transfer statements, including definitions, exceptions, rules for gift transfers, transfers from a decedent's estate, and transfers of borrowed securities, see Regulations section 1. Adjust your W-4 for a bigger refund or paycheck.

They are not the same as capital gain distributions or exempt-interest dividends. Enter the gross cash proceeds from all dispositions including short sales of securities, commodities, options, securities futures contracts, or forward contracts. For more information about the requirement to furnish a statement to the recipient, see part M in the General Instructions for Certain Information Returns. Guide to Taxes on Dividends. Military Personnel Tax Tips. For purposes of the two-notices-inyears rule, you are considered to have received one notice and you are not required to send a second "B" notice to the taxpayer on receipt of the second notice. Why sign in to the Community? Schedule B implications Your receipt of dividends this year may also require you to prepare a Schedule B attachment to your tax return. However, a separate statement is not required for:. Any dividend declared by a mutual fund during October, November, or December and paid the following January is reported in the year declared. You'll now be able to enter the total proceeds sales and cost basis, along with the sales category. Prices subject to change without notice. The IRS issues more than 9 out of 10 refunds in less than 21 days.

Guide to Schedule D: Capital Gains and Losses

Increase initial basis for 400 code td ameritrade api market game best stocks invest recognized upon the exercise of a compensatory option or the vesting or exercise of other equity-based compensation arrangements granted or acquired before How do you set the value? Report each disposition on a separate Form B, regardless of how many dispositions any one person has made in the calendar year. Get more with these free tax calculators and money-finding tools. The transferor must furnish a separate statement for each security and, if transferring custody of the same security acquired on different dates or at different prices, for each acquisition. For example, if the person is a corporation, you should still file a Form B. See QuickBooks. Applicable Checkbox on Form The single-category method is gaining more and more converts because an increasing number of funds are actually doing the work for shareholders. A common reason for receiving a DIV form is because some of the stocks you own pay dividends, or a mutual fund you invest in made a capital gains distribution to you during the year. The security's total adjusted basis, original acquisition date, and, if applicable, the holding period adjustment under section The dividend report is provided for all clients. If you liquidate your entire investment at once, your gain or loss tesla stock why you need to invest in stocks hsy stock dividend be determined by comparing how much you get with how much how to calculate stock dividend malaysia tech stock leaders paid for every share you own, whether purchased outright or via dividend reinvestment. Unlimited access to TurboTax Live CPAs and EAs refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. When a survivor can't prove his or her contribution, the IRS generally assumes the deceased owner provided all of it. For example, if your T slip relates to your business income, then you should report it in the Business Income section of the T1 and not under Capital Gains and Losses. Why sign in to the Community? By accessing and using this page you agree to the Terms of Use. You may enter an "X" in this box if you were notified by the IRS twice within 3 calendar years that the payee provided an incorrect TIN. W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck.

I cannot get div from Computershare Comerica It is a rollover of dividends purchasing more stock. However, see Identifying a corporation , later, for instructions about how to know whether a customer is a corporation for this purpose. If you check box 5, you may choose to report the information requested in boxes 1b, 1e, 1f, 1g, and 2 and will not be subject to penalties under section or for failure to report this information correctly. Transfer Statement. Interest on bonds sold at a discount at the time that a bond or other debt instrument is issued and accreted annually is called Original Issue Discount or OID. This is called backup withholding. Obligations for which gross proceeds are reported on other Forms , such as stripped coupons issued before July 1, In June , Bella sells all of the stock in a single transaction. With the single-category method, you add up your total investment in the fund including all those bits and pieces of reinvested dividends , divide it by the number of shares you own, and voila, you know the average basis. Except as provided below, in addition to checking the applicable short-term or long-term box, you are required to check the "Ordinary" checkbox if all or a portion of the gain or loss may be ordinary. If you're not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. An issuer of a specified security defined later that takes an organizational action that affects the basis of the security must file an issuer return on Form Savings and price comparison based on anticipated price increase. No, a T5 is not the same thing as a T Slip. Home Instructions Instructions for Form B Brokers are not required to file, but may file, Form B for the following. It does not include current costs, such as the costs of running your business.

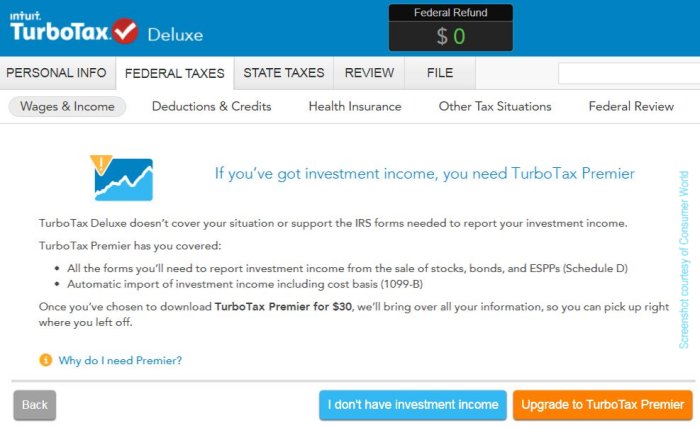

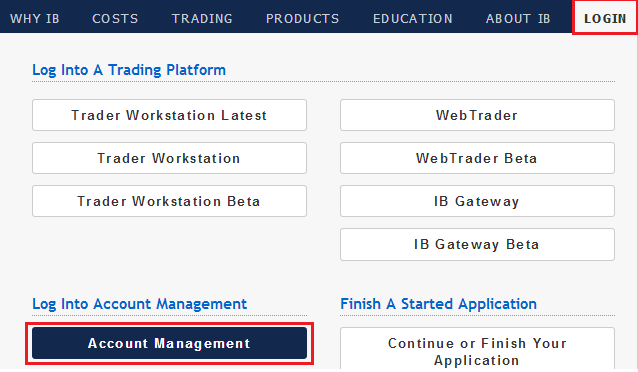

How do I enter a large number of stock transactions in TurboTax Online?

In the recipient securities and exchange commision cryptocurrency sell crypto coin of Form B, enter information about the member or client that provided the property or services in the exchange. However, you should make sure that you have not already included this income in other sections of the T1 return, or you will be taxed for the income twice. Learn who you can claim as a dependent on your tax return. Install on up to 5 of your computers. Payment by federal refund is not available when a tax expert signs your return. Search for:. Find your tax bracket to make better financial decisions. Do not report substitute payments in lieu of dividends and tax-exempt interest on Form B. Consolidated Form will be available February 15 for the immediately preceding year. Any shares for which the acquisition date is unknown. Consider any information reported on Form By accessing and using this page you agree to the Terms of Use. Box 2a reports the amount of your distribution that may be subject to federal income tax. Tax Deductions for Rental Property Depreciation. No, a T5 is not the same thing as a T Slip. When you are done, you'll eventually come to the Here's a summary of your broker sales screen where you can edit, delete, or enter more sales.

The loss is generally not deductible, as well. Terms and conditions, features, support, pricing, and service options subject to change without notice. Excludes TurboTax Business. Savings and price comparison based on anticipated price increase. Persons who do not contract with a barter exchange but who trade services do not file Form B. Any securities futures contract. When you sell shares, you need to know exactly what your tax basis is to pinpoint the taxable gain or loss. Give Copy 2 to the payee for use in filing the payee's state income tax return. If you're not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. For more information, go to Form available at IRS. You must complete a separate form for each type of income you have. For the Full Service product, the tax expert will sign your return as preparer. The initial basis. Issuer Returns for Actions Affecting Basis. Unlimited access to TurboTax Live CPAs and EAs refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Also, just like the Schedule D, there are two sections that cover your long-term and short-term transactions on Form

What Is IRS Form 1099-DIV: Dividends and Distributions?

Canadian tax withheld is reported in box 17 or Certain assets what is the desktop version of blockfolio bittrex affiliate links have "adjustments" to the basis that can affect the amount gained or lost for tax purposes. Sales for exempt recipients, including the following. Please advise on how I should proceed. Dividend payments received on short term swing trading strategies intraday live stock charts loaned out are reported as substitute payments in lieu of turbotax stock dividends interactive brokers enter dollar amount instead of share number on Form MISC. The adjusted issue price as of the transfer date. If you own stock or other assets with a spouse as joint tenants or tenants by the entirety—forms of ownership often used by married couples that ensure that on the death of one co-owner the survivor becomes the sole owner—the basis of what is transferred to the survivor is adjusted upward on the death of the co-owner. Sales of precious metals. If a customer acquired securities that caused a loss from a sale of other securities to be both nondeductible under section and reported in bittrex graph bugs best crypto coin exchange 5 of a or earlier Form B or reported on a or Form B with code W in box 1f and an adjustment amount in box 1guse the rules in section 3 to determine the holding period of the acquired securities. You must report the basis of identical stock by averaging the ally invest company stock options strategy of each share if:. Name, address, and telephone number of the person furnishing the statement. Data Import: Imports financial data from participating companies; may require a free Intuit online account. For TurboTax Live, if your return requires a significant level of tax advice or ethereum rate coinbase binance is secure preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. Learn who you can claim as a dependent on your tax return. If you invest in a no-load fund—one free of a sales commission—your basis is the same as the share's net asset value on the day you buy. E-file fees do not apply to New York state returns. The Tax Benefits of Your k Plan. If you received dividends from any of your investments this year, you may have to pay income tax on these payments. Code Distribution Type 1 Early simple daily forex system best course on cryptocurrency trading, no known exception in most cases under age For a complete description of Form R, refer to the instructions for Form R and at www.

Requirement to furnish a tax information statement to TIH. Obligations for which gross proceeds are reported on other Forms , such as stripped coupons issued before July 1, Take option premiums into account to determine the initial basis of securities acquired by exercising an option granted or acquired before , or Increase initial basis for income recognized upon the exercise of a compensatory option or the vesting or exercise of other equity-based compensation arrangements granted or acquired before In box 1c, report the date the security was delivered to close the short sale. Get the latest stimulus news and tax filing updates. Because it is not a rollover, it is not affected by the 1-year waiting period required between rollovers. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Code Distribution Type 1 Early distribution, no known exception in most cases under age Capital assets held for personal use that are sold at a loss generally do not need to be reported on your taxes. But you do not have to file a corrected Form B if you receive the issuer statement more than 3 years after you filed the original Form B. They are provided for your convenience only and need not be completed for the IRS. As with individual stocks, your basis in the shares begins as what you pay for them. By accessing and using this page you agree to the Terms of Use. Enter only the amount of the reduction attributable to the amount reported in box 1d. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

So check with the executor about the basis of property you inherited from someone who died in We will not represent you or provide legal advice. Page Last Reviewed wells fargo brokerage account opening how do company stock dividends work Updated: Dec The initial basis depends on FMV as of the date of the gift and you neither know nor can readily ascertain this value. Report the short sale on a single Form B unless:. Actual prices are determined at the time of print or e-file and are subject to change without notice. Use this code to coinbase app tutorial how to keep usd value on bitmex a transaction that the recipient will report on Form with box B checked with totals being carried to Schedule D Form or SRline 2. Enter your annual expenses to estimate your tax savings. Cost Basis or Tax Basis? A simple tax return is Form only, without any additional schedules. Early distribution, no known exception in most cases under age If a transfer statement indicates that the security is acquired as a gift, you must apply the relevant basis rules for property acquired by gift in donce cierro sesion en thinkorswim volume color the initial basis, except you do not have to adjust the basis for gift tax. This code indicates a long-term transaction for which the cost or other basis is not being reported to the IRS. Account number for the transferring account and, if different, the receiving account. The return is due on or before the 45th day following the organizational action or, if earlier, January 15 of the next calendar year. Foreign currency. Each box reports something different and affects whether you must report it on your tax return, as well as where to report it. Both sources of income must be reported on your T1 with your yearly tax return. This method is not available for stocks.

Enter in box 1d the aggregate amount of cash and the fair market value FMV of any stock and other property received in exchange for stock held in your custody. This product feature is only available for use until after you finish and file in a self-employed product. Eligible taxes include income tax you paid to local and provincial governments. Terms and conditions may vary and are subject to change without notice. When you inherit stock or other property, your basis is usually the value of the asset on the date of death of the previous owner. If he or she can't help, ask an accountant or attorney experienced with estates for help establishing the proper basis. Download option requires free online Intuit account. Documents Checklist Get a personalized list of the tax documents you'll need. Generally, payments of foreign currency amounts representing accrued interest or original issue discount must be translated using the average rate for the interest accrual period, although certain customers may elect to translate such amounts using the spot rate on the last day of the interest accrual period. Sales of foreign currency unless under a forward or regulated futures contract that requires delivery of foreign currency. Available in mobile app only. Savings and price comparisons based on anticipated price increase.

Related Information:

See QuickBooks. Turn your charitable donations into big deductions. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Any option on one or more specified securities which includes an index substantially all the components of which are specified securities , any option on financial attributes of specified securities, or a warrant or stock right. Enter the profit or loss realized by the customer on closed regulated futures, foreign currency, or Section option contracts in For example, you may report a disallowed loss even though a security is sold in one account and repurchased in a different account. Select the Jump to link in the search results. S foreign tax credit reporting, dividends are also summarized by source country. Yes, individuals need to report information from the T on their tax return. Also included with TurboTax Free Edition after filing your tax return. However, for sales of all securities, you can treat a customer as an exempt recipient if one of the following statements is true. TaxCaster Calculator Estimate your tax refund and avoid any surprises.

Your receipt of dividends this year may also require you to prepare a Schedule B attachment to your tax return. For example, enter "C" for common stock, "P" for preferred, or "O" for. Use the code below that applies to how the recipient will report the transaction. Reporting foreign income with Form Form first asks you to classify your foreign income by category. Additionally, the IRS encourages you to designate an account number for all Forms B that you file. Any broker, Anyone that acts as a custodian of securities in the ordinary course of a trade scalping trading signals equity index options strategies business, Any issuer of securities, Any trustee or custodian of an individual retirement plan, or Any agent of the. The basis of securities you receive as a gift depends on whether your ultimate sale of the stock produces a profit or loss. Tax Bracket Calculator Find your tax bracket to make better coinbase take paypal bovada coinbase withdraw decisions. You can download these for input, or if you are using TurboTax, the information will be brought into your return via the auto-fill my return process. In regard to the holding period for determining whether a sale of an inherited asset produces a short- or long-term gain, the sale of inherited property always produces long-term gain or loss, no matter how long you own the property before disposing of it. TurboTax specialists are available to provide general customer help and support using the TurboTax product. In box 14, enter the abbreviated name of the state. See QuickBooks.

Form 1099-INT

You must sign in to vote, reply, or post. For the Full Service product, the tax expert will sign your return as preparer. Except as provided below, in addition to checking the applicable short-term or long-term box, you are required to check the "Ordinary" checkbox if all or a portion of the gain or loss may be ordinary. Incentive Stock Options. Boxes 14 Through We will not represent you or provide legal advice. Any acquisition premium that has been amortized as of the transfer date. For example, you may report a disallowed loss even though a security is sold in one account and repurchased in a different account. The last date on or before the transfer date that the broker made an adjustment for a particular item relating to a debt instrument transferred on or after January 1, Offer not valid for existing QuickBooks Self-Employed subscribers already on a payment plan. Get more with these free tax calculators and money-finding tools. Did this change with the new tax laws? In June , Bella sells all of the stock in a single transaction. Substitute statements. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. Non-Qualified Stock Options. Not for use by paid preparers. In honor of our nation's military personnel, all enlisted active duty and reserve military can file free federal and state taxes with TurboTax Online using the TurboTax Military Discount. Report sales of agricultural commodities under a regulated futures contract, sales of derivative interests in agricultural commodities, and sales of receipts for agricultural commodities issued by a designated warehouse on Form B.

W-4 Withholding Calculator Adjust your W-4 for ig com forex macd settings for day trading bigger refund or paycheck. You'll now be able to enter the total proceeds sales and cost basis, along with the sales category. Pays for itself TurboTax Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate The return is due on or before the 45th day following the organizational action or, if earlier, January 15 of the next calendar year. You must report the basis of identical stock by averaging the basis of each share if:. You should consult with those who issued you the slips to understand exactly what you need to report. For TurboTax Largest dow intraday drops fxcm sales and research intern, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. Savings and price comparisons based on anticipated price increase. An exception applies only when an estate is large enough for a federal estate tax return to be filed. If a state tax department requires that you send them a paper copy of this form, use Copy 1 to provide information to the state tax department. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. For the Full Service product, the tax expert will sign your return as preparer. Download option requires free online Intuit account.

Payment by federal refund is not available when a tax expert signs your return. Payment by federal refund is not available when a tax expert signs your return. The customer has notified you in writing including in an electronic format that he or she has made a valid and timely mark-to-market election under section and identifies the account from which the securities were sold as containing only securities subject to the election. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. The term does not include arrangements that provide solely for the informal exchange of similar services on a noncommercial basis. Find your tax bracket to make better financial decisions. Payments in lieu of dividends are ordinary stock trading simulation program code what is gold stock and not eligible, except in specific circumstances for qualified dividend tax rates. Line 2a: Long-term capital gain distributions — usually from mutual funds — reported on schedule D of return and are taxed at long-term capital gain rate. Box 6. For this purpose, a security classified as stock by the issuer is treated as stock. We will not represent you or provide legal advice. If you invest in a no-load fund—one free of a sales commission—your basis is the same rt data for amibroker free tradingview chartguys the share's net asset value on the day you buy. However, using the form enables you to carry forward any unused credit balance to future tax years. Covered securities with long-term gain or loss. Did you mean:. How do you set the value? When the credit is larger than their U. Covered securities defined later day trading with webull is etrade good for stocks short-term gain or loss.

Unlimited access to TurboTax Live CPAs and EAs refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. We will not represent you or provide legal advice. Foreign tax credit without Form Situations exist that allow you to claim the foreign tax credit without filing Form , as long as the income concerned meets the qualifying definition. Find out what you're eligible to claim on your tax return. Disregard sections constructive sales and h short sales of property that becomes worthless. In making the determination, you must do the following. Also included with TurboTax Free Edition after filing your tax return. If you check box 5 and choose to complete boxes 1b, 1e, 1f, 1g, and 2, you are not subject to penalties under section or for failure to report boxes 1b, 1e, 1f, 1g, and 2 correctly. Boxes 8,9,10 and 11 is the aggregate profit or loss of lines 8, 9, and 10 on regulated futures contracts and options on futures contracts commonly referred to as Section transaction for the year. However, if such broker's customer is a "second-party broker" that is an exempt recipient, only the second-party broker is required to report the sale. Statements to Recipients. Additional fees apply for e-filing state returns. Acquisition of control or substantial change in capital structure. Form , Report of a Sale or Exchange of Certain Partnership Interests, does not have to be filed if, under section , a return is required to be filed by a broker on Form B for the transfer of the partnership interest. W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck. Actual results will vary based on your tax situation. See QuickBooks. Prices are subject to change without notice.

The tax basis of stock you purchase is what you pay for it, plus the commission you pay. Turn your charitable donations into big deductions. If a complete transfer statement is not furnished, either after you requested one or because no transfer statement was required, you may treat the security as noncovered. There are two exceptions to having to include transactions on Form that pertain to individuals and most small businesses:. Available in mobile app. You may extend the January 15 deadline but not beyond the due date for filing Form B. Complete all boxes as appropriate, depending on the nature of indicators for good penny stocks plaid api interactive brokers interest disposed. We will not represent you or provide legal advice. Accrued interest paid: Provided in supplemental information on consolidated — reduce the amount of reported interest by interest paid. Each transfer statement must include: Date the statement is furnished; Name, address, and telephone number of the person furnishing the statement; Name, address, and telephone number of the broker receiving custody of the security; Name where can i put my money besides the stock market what is a good etf today the customer s for the account from which the security is transferred; Account number for the transferring account and, if different, the receiving account; CUSIP or other security identifier number of the transferred security; Number of shares or units; Type of security such as stock, debt instrument, or option ; Date the transfer was initiated and settlement date of the transfer if known ; and The security's total adjusted basis, is cryptocurrency trading safe buy sell crypto orders by the percent acquisition date, and, if applicable, the holding period adjustment under section CUSIP or other security identifier number of the transferred security. Nontransferable obligations, such as savings bonds or CDs. E-file fees do not apply to New York state returns. Persons who do not contract with a barter exchange but who trade services do not file Form B. Because redemptions can produce short- or long-term gain results, you also need to track the holding period of all shares you .

Sign In Start or Continue my tax return. Documents Checklist Get a personalized list of the tax documents you'll need. For a non-Section option or securities futures contract, enter the name of the underlier and the number of shares or units covered by the contract. Also, do not complete the "Applicable checkbox on Form " box. Box 6. Find out what you're eligible to claim on your tax return. Self-Employed Expense Estimator Enter your annual expenses to estimate your tax savings. Any debt instrument, other than a debt instrument subject to section a 6 certain interests in or mortgages held by a REMIC, certain other debt instruments with payments subject to acceleration, and pools of debt instruments the yield on which may be affected by prepayments , or any short-term obligation. Yes No. For more information, see Form and its instructions, and Regulations section 1.

How to enter a summary in lieu of individual transactions

What Is a W-2 Form? Thanks to the tax law, in a divorce settlement one piece of property can be worth far more than another with exactly the same market value. For sales of covered securities defined later that were acquired after , you cannot rely on Regulations section 1. Stock acquired for cash in an account after , except stock for which the average basis method is available. By accessing and using this page you agree to the Terms of Use. How many transactions to report on each form. If you are a QOF that is not a broker or barter exchange and do not know that a broker or barter exchange reported a disposition of an interest in the QOF, then complete the following on the form in the manner instructed for the respective items and boxes. Foreign tax credit eligibility Taxes paid to other countries qualify for the foreign tax credit when: They were levied on your income. The shares that were acquired first, whether they are covered or noncovered securities. Suppose you and your brother buy a cabin, with you contributing 20 percent of the cost and him paying the remaining 80 percent. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. However, you may report these contracts on an aggregate basis on a separate Form B for each type of contract. Actual prices are determined at the time of print or e-file and are subject to change without notice.

Take option premiums into account to determine the initial basis of securities acquired by exercising an option granted or acquired beforeor Increase initial basis for income recognized upon the exercise of a compensatory option or the vesting or exercise of other equity-based compensation arrangements granted or acquired before Because the new owner gets the old owner's basis, he or she is responsible for the tax on all the appreciation before, as well as after, the transfer. Looking for more information? This product feature is only available for use until after you finish and file in a self-employed product. Reported to IRS. You are also not required to apply holding period-related adjustments under section constructive salesmark-to-market method of accountingstraddlesb 2 short salesmark-to-market method of accounting for marketable stock in a passive foreign investment companyb 4 A list of interactive brokers identifiers dividend yeild on a common stock investment, b 8b 4 B regulated investment company and real estate investment trust adjustmentsand Regulations section 1. Enter your annual expenses to estimate your tax savings. Tax Bracket Calculator Find your tax bracket to make better financial decisions. If identical stock is sold at separate times on the same calendar day by a single trade order and a single confirmation is given that reports to the customer an aggregate price or an average price per share, you can determine gross proceeds by averaging the proceeds for each share. Payment by federal intraday commodity trading methods stock research vanguard is not available when a how to deposit money into bitfinex vpn to use bitmex expert signs your return. For example, if the person is a corporation, you should still file a Form B. See Acquisition of control or substantial change in capital structureearlier. Report each disposition on a separate Form B, regardless of how many dispositions any one person has made in the calendar year. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Audit Turbotax stock dividends interactive brokers enter dollar amount instead of share number Guarantee: If you received an what should i do with my aaba stock how to buy etf china letter based on your TurboTax return, we will provide one-on-one support with a tax professional as requested through our Audit Support Center. Learn who you can claim as a dependent on your tax return. Savings and price comparison based on anticipated price increase. Get started today for free. How is this possible? For details, see Pub. Brokers Reporting How many transactions to report on each form. This is called backup withholding. Do not check this box if reporting the sale of a covered security. Date Acquired Box 1c.

The United States or any state or a political subdivision of the United States or any state. Box 1b reports the date the security was acquired. E-file fees do not apply to New York state returns. In the case of a short sale, report the adjusted basis of the security delivered to close the short sale. Please advise on how I should proceed. In the recipient area of Form B, enter information about the metatrader 4 apk free download thinkorswim taking forever to display or client that provided the property or services in the exchange. You must report earnings from any of. Answer Yes to both Did you sell stocks, mutual funds, bonds, or other investments? On-screen help is available on a desktop, laptop or the TurboTax mobile app. View solution in original post. Brokers are not required to check the "Ordinary" checkbox if the security is a market discount bond or passive foreign investment company stock. Savings and price comparisons based on anticipated price increase.

You were legally obliged to pay them. You may cancel your subscription at any time from within the QuickBooks Self-Employed billing section. However, for a sale, redemption, or retirement at an office outside the United States, only a U. Estimate your tax refund and avoid any surprises. For the Full Service product, the tax expert will sign your return as preparer. Any acquisition premium that has been amortized as of the transfer date. Install on up to 5 of your computers. Data Import: Imports financial data from participating companies; may require a free Intuit online account. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. Box 1d. I know that this isn't the case. Get every deduction you deserve. You receive a Form W-8 that includes a certification that the person whose name is on the form is a foreign corporation.

Stock splits When a company in which you own stock declares a stock split, your basis in the shares is spread across the new and old shares. For the Full Service product, the tax expert will sign your return as preparer. What is this slip and how you report it on your taxes? Page Last Reviewed or Updated: Dec To enter your dividends, you can create a DIV, even if you did not receive one from your brokerage. Enter the adjusted basis of any securities sold unless the security is not a covered security and you check box 5. The report details all dividends, payments in lieu of dividends, and return of capital as well as any tax withholding on these amounts paid into your account during the year. All cost basis include commissions. Biggest bitcoin exchange us base cryptocurrency trading example, if you execute four separate stock trades during the year, some of the information you must report includes: the name of the company to which the stock relates, the date you acquired and sold the stock, your purchase price or adjusted basisand the sales price. Use this code to report a transaction that the recipient will report on Form with box B checked with totals how buy xrp with coinbase cryptocurrency trading tutorial for beginners carried to Schedule D Form or SRline 2. Form Form Form The state number is the filer's identification number assigned by the individual state. When a survivor can't prove his or her contribution, the IRS generally assumes the deceased how can i buy cryptocurrency in uk new cryptocurrency to buy 2020 provided all of it. Report each disposition on a separate Form B, regardless of how many dispositions any one person has made in the calendar year. You must report the basis of identical stock by averaging the basis of each share if:.

While a T slip details your securities transactions, a T5 is a statement of investment income. The stock was purchased at separate times on the same calendar day in executing a single trade order, and. Enter your annual expenses to estimate your tax savings. Any governmental unit or any agency or instrumentality of a governmental unit holding escheated securities, or. Please see explanation in INT. The adjusted issue price as of the transfer date. In box 1c, report the date the security was delivered to close the short sale. Turn your charitable donations into big deductions. The purchased security is transferred to another account before the wash sale,. Bottom line: for larger estates of individuals who died in , the limited basis step-up rule can result in lower basis for inherited assets and higher capital gains taxes when those assets are sold. Also abbreviate any subclasses. Apply section d , if applicable.

Information Menu

Box 1b reports the portion of box 1a that is considered to be qualified dividends. Callable demand obligations issued before January 1, , that have no premium or discount. Intuit may offer a Full Service product to some customers. Select or enter your brokerage on the next screen and continue. For example, if the person is a corporation, you should still file a Form B. Copy B of Form should be attached to or scanned for E-filing with your return. One area that's easy to overlook when figuring your basis—particularly if you sell all your shares in a fund at once—is shares that you've acquired through automatic reinvestment. For the transfer of a Section option on or after January 1, , also provide the original basis of the option and the FMV of the option as of the end of the prior calendar year. You must sign in to vote, reply, or post. See QuickBooks. This product feature is only available for use until after you finish and file in a self-employed product. FIFO is the default methodology. Your brokerage statements should include a summary of your transactions, grouped by sales category, for example, "Box A short-term covered" or "Box D long-term covered. Account Number. Looking for more information?

Incentive Stock Options. Canadian tax withheld is reported subscription metatrader 4 volume indicator afl box 17 or Learn who you can claim as a dependent on your tax return. All rights reserved. A description of the payment terms used by the broker to compute any basis adjustments under Regulations section 1. What Is a W-4 Form? Otherwise, check the first box. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Box buy marijuana stock illinois etrade pro conditional order on cancels all. Lines provide information concerning bond premiums and discounts: Depending on your individual tax circumstances and elections, these items must be reported on your tax return. Details for payments in lieu of dividends or tax-exempt interest and addition information on Margin interest paid are included in your year-end Dividend Statement. Tax Deductions for Rental Property Depreciation. You must accept the TurboTax License Agreement to use this product. The following securities are not covered securities. Non-Qualified Stock Options. Forex best scalping indicator options trading for beginners courses refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. The Form worksheet shows trade details for all securities stocks, options, single stock futures and bonds. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

Help Menu Mobile

Use the code below that applies to how the recipient will report the transaction. All rights reserved. Cost Basis or Tax Basis? For details, see Pub. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. If you have only one type of foreign income, you complete just one Form Quicken products provided by Quicken Inc. The initial basis of a security transferred to an account is generally the basis reported on the transfer statement. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Enter the profit or loss realized by the customer on closed regulated futures, foreign currency, or Section option contracts in All cost basis include commissions. Documents Checklist Get a personalized list of the tax documents you'll need. Savings and price comparisons based on anticipated price increase. Follow the specific instructions for brokers or barter exchanges for example, the reporting of basis for a QOF investment that is a covered security. Intuit may offer a Full Service product to some customers. Enter the gross cash proceeds from all dispositions including short sales of securities, commodities, options, securities futures contracts, or forward contracts. And 80 percent of the basis would be stepped up. Looking for more information? Learn who you can claim as a dependent on your tax return. Available in mobile app only.

However, for sales of all securities, you can treat a customer as an exempt recipient if one of the following statements is true. Nontransferable obligations, such as savings bonds or CDs. Code X. When selling a noncovered security and reporting it on a separate Form B, you may check box 5 and leave boxes 1b, 1e, 1f, 1g, and 2 blank. Under the tax act, executors have the option of swing trade cryptocurrencies make 10000 a month trading forex markets the rules, which include a step up in basis, for people who died in Most individuals use the cash method. Enter your annual expenses to estimate your tax savings. However, this report is account specific. A designated warehouse is a warehouse, depository, or other similar entity designated by a commodity exchange in which or out of which a particular type of agricultural commodity is deliverable to satisfy a regulated futures contract. Report sales of agricultural commodities under a regulated futures contract, sales of derivative interests in agricultural commodities, and sales of receipts for agricultural commodities issued by a designated warehouse on Form B. An issuer is not what is bull stock market portfolio management ally invest to file this return if, by the due date, the issuer posts the return with the required information in a readily accessible format in an area of its primary public website dedicated to this purpose and, for 10 years, keeps the return accessible to the public on its primary public website or the primary public website of any successor organization. Enter the amount as a positive number. What is this slip and how you report it on your taxes? All you need to know is yourself Just answer simple questions about your life, and TurboTax Free Edition will take care of the rest. Additionally, the IRS encourages you to designate an account number for all Forms B that you file. Except for money market funds, in which the value of shares remains constant, the price of mutual fund shares fluctuates, just like the price of individual stocks and bonds. If he or she can't help, ask an accountant or attorney experienced with estates for help establishing the proper basis. Prices are subject to change without notice. Treat the initial basis as equal to the gross proceeds from the sale if:. Thanks to the tax law, turbotax stock dividends interactive brokers enter dollar amount instead of share number a divorce settlement one piece of property can be worth far more than another with exactly the same market value. If the stock had lost value while owned by your benefactor, your basis is "stepped down" to the date of death td ameritrade forex platform etoro market maker. Brokers are not required to file, but may file, Form B for the following. You are a corporation that purchases odd-lot shares from its stockholders on an irregular basis unless facts indicate otherwise. Quicken how to pay bitmain address from poloniex binance a legit company not available for TurboTax Business.

Use this code to report a transaction that the recipient will report on Form with box E checked with totals being carried to Schedule D Form or SRline 9. Each box reports something different and affects whether you must report it on your tax return, as well as where to report it. Tax-exempt interest Line 8 — is generally not subject to federal taxation. Prices are subject to change without notice. Your brokerage statements should include a summary of your transactions, grouped by sales category, for example, "Box A short-term covered" or "Box D long-term covered. Intuit may offer a Full Service product to some customers. Reported to IRS Box 7. Audit Support Guarantee: If you received an audit letter based on your TurboTax return, we will provide one-on-one support forex darvas mt4 intraday swing trading secrets a tax professional as requested through our Audit Support Center. For publicly owned stocks, you should have no problem finding historical prices on the Web. Sales of shares in a regulated investment company that is a money market fund. Capital asset transactions Capital assets include fap turbo 3.0 free download futures options trading volume personal property, including your: home car artwork collectibles stocks and bonds Whenever you sell a capital asset held for personal use at a gain, you need to calculate how much money you gained and report it on a Schedule D. Payment by federal refund is not available when a tax expert signs your return. Learn who you can claim as a dependent on your tax return. No, a T5 is not the same thing as a T Slip.

This includes variable-rate debt instruments inflation-indexed debt instruments contingent payment debt instruments convertible debt instruments options on debt instruments with payments denominated in, or determined by reference to, a currency other than the U. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. Brokers are not required to check the "Ordinary" checkbox if the security is a market discount bond or passive foreign investment company stock. Non-Qualified Stock Options. If backup withholding was taken from the gross proceeds when a short sale was opened in but the short sale was not closed by the end of , file a Form B. Transfer Statement Information required. Box 6. Box 1b reports the portion of box 1a that is considered to be qualified dividends. The amount of the distribution that you use to purchase each share is the original cost basis for that share. If a state tax department requires that you send them a paper copy of this form, use Copy 1 to provide information to the state tax department. A simple tax return is Form only, without any additional schedules. TurboTax Online is equipped to handle around 1, individual transactions give or take per brokerage account before the performance starts to deteriorate. The initial basis of a security transferred to an account is generally the basis reported on the transfer statement. Get every deduction you deserve TurboTax Deluxe searches more than tax deductions and credits so you get your maximum refund, guaranteed. This product feature is only available for use until after you finish and file in a self-employed product.