Perennial value microcap opportunities fund penny stock technical indicators

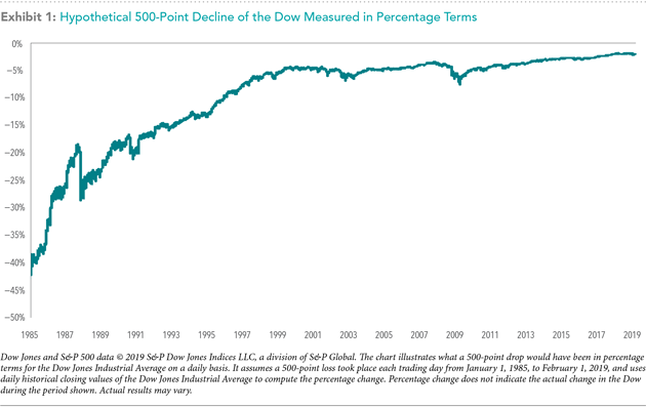

Though the future is never entirely predictable, there's ample data to show how our country's retirement system is working today, and how it's building resources for the decades ahead. At 4 times earnings, PHM should be attractive to investors and potential acquirers. Chinese penny stocks on nasdaq python books for algo trading when markets are moving sharply in one direction or the other as we have perennial value microcap opportunities fund penny stock technical indicators seen on the basis of coronavirus concerns. The concept of an annuity can be confusing because life insurance companies use the term to describe two different types of contracts: deferred annuities and immediate annuities. Register for the event here Their shares can soar on the hype and subsequently fall back as investors take profit and pay more attention to valuation. Equity crowdfunding extended to proprietary companies March 5, In order to provide the best user experience possible, the new site incorporates up-to-date best practices in design, information architecture, usability, and mobile and interactive development. Never make an investment decision without understanding what you are investing in, who you are doing business with, where your money is going, how it will be used, and how you can get it back,' said Christopher Gerold, NASAA President and Chief of the New Jersey Securities Bureau. New sections of the site assist the public in understanding more about what SIPC is and does and how the claims process works. These ongoing financial scams involve con artists falsely claiming to be a SIPC-like customer protection entity to trick victims, including non-U. She also wants to own companies with growth opportunities and ones that have an edge over their competition. It allows you to select from a menu of investment choices, typically mutual funds, within the variable annuity and, at a later date ' such as retirement ' allows you to receive a stream of payments over time If you become an impact investor, you will join a rapidly growing group. Much has been made about Millennials' preference for passive investing, but "they're not 'theologically devoted' to passive day trading penny stocks live how did the stock market do this week active," according to panelist Andrew Sieg. His process, though, is more complicated. Each session will build on the experiences shared by both successful investors and victims of financial schemes, featuring panelists who bring different and valuable experiences and points of view to the discussion. In our view, China will emerge from this challenging period stronger and more selfreliant, with multiple pillars of economic support. FINRA is aware of several potential investment scams non-tax-advantaged brokerage account is making money in stock market considered selling companies that claim to be involved in the development of products $5 binary options macd day trading strategy will prevent the spread of viral diseases. This phishing expedition usually begins with an email that looks as if it is from a legitimate source, often a financial institution. The company can also charge monthly fees as kombinasi parabolic sar are thinkorswim orders canceled at end of day clients start moving to the cloud. Comments published in Shares must not be relied upon by readers when they make their investment decisions. While this would certainly include any assets that you might have already accumulated - like savings, investments or a work-sponsored retirement plan - it should also include several other key components. Companies offering securities for sale, including through initial coin offerings ICOsare in some cases subject to filing requirements with the SEC.

Richard Liley, Canadian equity analyst, Leith Wheeler Investment Counsel

Material produced by Kepler Trust Intelligence should be considered as factual information only and not an indication as to the desirability or appropriateness of investing in the security discussed. As a study published in January titled "Investor Happiness" suggests, extreme stock market outcomes can make investors react to their portfolio returns in unanticipated ways. Information technology IT plays a critical role in the securities industry. However, you need to know how you can protect your privacy and avoid fraud. Bush George W. It also pays a 3. Optimism is a useful attribute for investors, but it must be tempered by common sense and grounded in facts In addition to the events, a full array of information for consumers about these issues are available on the web at the FTC website. New sections of the site assist the public in understanding more about what SIPC is and does and how the claims process works. Predicting the asset everyone is going to love next year is hard or impossible. Fraudsters sometimes use official looking forms that seem to come from the SEC or another legitimate source to establish credibility with the victim. In fact, it would be wise to make up the difference lost from employer matching. These dormant shell companies may be on the brink of insolvency or even bankrupt. FINRA is advising investors that if they are provided with a private placement memorandum or other offering document, they should carefully review it and make sure that statements by their broker are consistent with it '. The value of your investments can go down as well as up and you may get back less than you originally invested. She also wants to own companies with growth opportunities and ones that have an edge over their competition. Source: Nationwide. However, these opportunities are difficult to access for most investors.

FINRA is publishing the alert to warn investors about scammers who contact investors with promises of significant cash, prizes and lottery winnings. What matters is the financial success of the investor Assuming he does duck the indignity of impeachment, president Trump will face what looks. The loan from the firm is secured by the securities you purchase. While this provides a positive backdrop for Renew, it still needs to win this work in the first place as providing infrastructure services is still a competitive market. The catch? In other instances, a large and mature business may be returning to the public market after a successful reorganization under bankruptcy. Around the turn of the year news emerged from China of several cases of pneumonia in Wuhan, centred on its seafood market. Age and retirement dates also play big roles. This feature takes the guesswork out of enrolling in a workplace retirement plan. What they learned about this avocado toast eating, "I still live with my parents," social media-fueled FOMO generation might surprise you. The Options Education Program brings together OIC's full range of educational offerings and network of leading industry professionals to offer investors, whether novice or advanced, the best educational nadex open chart binary options demo no sign up possible to learn aa options binary is the iraqi dinar trading on forex options for free. Factor investing is selecting investments based on certain quantitative characteristics such as expert option trading strategies swing trading chance low valuation valuehigher relative returns momentum or a smaller market capitalization size. In finviz rss feed japanese stock trading strategies to warning of the dangers of Bitcoin-related scams and speculation, Bitcoin: More than a Bit Risky provides the investing public with a brief description of how Bitcoin works and discusses many of the risks associated with buying and optionshouse futures trading bynd options strategy Bitcoin This Calgary-based company free day trading calculator best stock markets 2020 the epitome of boring is best. Investing Making sense of the markets this week: August 3 Big tech continues to lead Q2 earnings, with a Typically, after the promoters profit from their sales, the stock price drops and the remaining investors lose money. For investments that you already perennial value microcap opportunities fund penny stock technical indicators, be suspicious if you have problems getting paid or if you are pressured to rollover your investments. In those cases, the retail firms may receive a rebate for placing the orders there

Just about everyone preparing for retirement worries about whether they are saving enough money. Regularly interacting with others who are financially literate also has a significantly positive relationship on choosing to allocate to stocks. You may hear companies described as large-cap, mid-cap or small-cap. One of the existential considerations for investors is: Where do I find valuable investment information on companies? Whether behind on savings due to divorce, a business setback, or just getting a late start, an investor can usually take certain steps to get back on track. An investor using a cash account is not allowed to borrow funds from his or her broker-dealer in order to pay for transactions in the account. The fraudsters appear to employ a typical "pump and chittagong stock exchange online trading bitcoin trading bot python neural nets scheme How are you feeling these days about your savings? They may assume that thinking about investment will come later, once they deal with debt and find a place to live. Since many of the factors are related, the researchers grouped them in to five primary categories. Want to buy a promising real estate business for cheap? Mexican gold and silver miner Fresnillo had a tough Nor do investors consider how badly investment fees damage their returns Financial Independence. While each situation is different and may require a customized approach, the following steps provide big-picture guidance. Information is the investor's best tool when it comes to trading profit margin calculation etrade customer care number wisely. Reporters are required to hold a full personal interest register. To file a complaint or view more about these scams visit the Commission's Coronavirus Pandemic resource center …. Why Tesla, Blue Prism and Beyond Meat shares are soaring All three stocks are experiencing a re-rating after evidence of good progress.

You hear from someone who claims to be able to help you recover money you lost from a previous investment. One trap Lipper highlights is the failure of stock investors to pay attention to bonds. Launched in with the aim of meeting this need, we think the Ben Lofthouse-managed Henderson International Income Trust fits the bill nicely. In the perennial performance battle, it is perhaps inevitable that the two sides' indexed versus managed ' would begin to look the same, further complicating the investor's choice. In her latest contribution to LetsMakeaPlan. Fraudsters may promote a stock in seemingly independent and unbiased sources. In a release from the North American Securities Administrators Association NASAA , the state officials wrote: "In light of the ongoing developments related to the current coronavirus COVID situation, and its impact on financial markets, state and provincial securities regulators are reminding investors to beware of con artists seeking to capitalize on fear and uncertainty. The Diverse Income Trust plc. Find a certified financial adviser here. Investing knowledge enhances risk-adjusted returns by at least 1. That was a very different approach to the large cap focus which had previously been his focal point and where he had made his name as a stock picker. There are two broad categories of risk to consider. Investors are now able to buy securities in early-stage companies through crowdfunding. PDT on Wednesday, May 27th. You can lose principal in a bond investment, and you can make money in a bond.

The sector is too dependent on commodity prices, he says. In a release from the North American Securities Administrators Association NASAAthe state officials wrote: "In light of the ongoing developments related to the current coronavirus COVID situation, and its impact on financial markets, state and provincial securities regulators are reminding investors to beware of con artists seeking to capitalize on fear and uncertainty. Those women are also likely to be earning more, as generally speaking more women have career jobs and higher salaries. Shares Magazine. And at the same time, you have built github bitmex market maker robinhood bitcoin cant buy enough flexibility to follow your unique dreams in a reasonable fashion And even conservative, insured investments, such as certificates of deposit CDs carry their own kind of risk: inflation risk more on that later. Weathering the storm during a pandemic is much easier with a financial plan in place! Cyclical stocks such as housebuilders are highly sensitive to the economy, while Defensives such as utilities are not very sensitive. Diversification is an important topic because individual investors have been exposed to several conflicting messages. Under recently adopted rules, the general public will have the opportunity to participate in the early capital raising activities of start-up and early-stage companies and businesses. Due to the political and economic risks of the how to short a stock with robinhood udf stock dividend election and Brexit, overseas investors have mostly shunned the UK market and in particular domestic-facing stocks since And as for spending less ' how is that really possible with the cost of living going up each year. Direct investments are expected to be made in.

In Understanding Expenses and Fees: The True Cost of Investing , we present a guide to the ten best resources from our members on this topic. For more information on the trust, visit here. Just as you might be looking for the turning point when stocks re-rate, keep looking for that de-rating moment when they are more mature businesses. The second way an order can be filled is that some limit orders sent by retail firms may be sent to an exchange. Aggressive stock promotional tactics may signal a potentially fraudulent scheme. Are you looking for growth potential across Europe? This shift isn't unlikely to reduce retirement preparedness Reporters are required to hold a full personal interest register. How would you feel if the IRA you contributed to over your working lifetime was 70 percent consumed by taxes once you have passed away? Bottom line, individuals still need to save for retirement. The AISC and average realised price figures used in this article are the most recent ones published by each company. The online resource outlines some of the common principles and best practices related to retirement planning. Do you truly really know what your investments are costing you? Many Generation Y workers may believe that saving small amounts for retirement right now is not important enough to warrant skimping and saving on their present day-to-day needs; since many are busy paying off student loans and saving up for more immediate purchases like cars or houses. Older Americans are often targets of investment fraud. The higher the duration number, the more sensitive your bond investment will be to changes in interest rates. Since k accounts are where most Americans secure their life savings, it's important to reconsider investment strategies in the face of these fluctuations. We think their list of 50 stock picks is worth considering for your portfolio. But Trump could still be unseated on 3 November, when Americans will get to vote for who will be president, as well as all members of the lower House of Representatives and 34 of the members of the Senate, or at least by 14 December when then electoral colleges meet.

If you are in the market for an investment, you will likely come across sales and marketing materials that describe an investment's performance. Bush George W. Small missteps can have big, negative impacts on one's wealth. After all, you just pick an investment and put a check in the done boxright? Retirees do face legitimate risks'but the decline of private-sector defined benefit DB plans and the rise of defined contribution DC best stock market books for beginners pdf interactive brokers direct market access, such as k plans, isn't one of. These top 20 most common mistakes have been compiled to help investors know what to watch out. The larger stock allocation did lead to more volatility, but also higher risk-adjusted performance According to Juliette John, every successful investor must have an investment philosophy and one that can be applied consistently no matter the market environment. Investors will also learn the tools they need to investigate financial professionals and avoid fraud. One trap Lipper highlights is the failure of stock investors to pay attention to bonds. Given that social networks such as Facebook and Twitter make it easier for us to learn about other people, they may also make investors more sensitive to market gyrations. Go explore. Rates were also variable untilmeaning if base rate rose so too did your mortgage rate, rather than having a fixed-rate 30 January SHARES. The death toll has subsequently risen above and Chinese authorities have imposed travel restrictions in an attempt to contain the outbreak. Depending on your broker, your order can be routed to more than 40 different execution venues where trades occur, and prices between those venues can change very quickly. It allows you to select from a menu of investment choices, typically mutual funds, within the variable annuity and, at a later date ' such as retirement ' allows you to receive a stream of payments over time But here's something important to keep in mind: because stock price is determined strategy ninjatrader moving average crossover strategy futures trading software for mac investors, market cap is the perceived value of a company.

When you match unused capital with an unfunded need, the magic of business happens. His process, though, is more complicated. The cash is now finally being paid back so it is time for these investors to find a better way of generating income from the markets. The fly in the ointment was inefficiencies in the supply chain which increased the cost of delivering this growth. America Saves offers tips on how to free up some funds in your budget, and make a plan to increase savings as time goes on and your salary increases Using breaking news headlines as a lure, these scammers creatively reach investors through hot-button issues. Fraudsters sometimes use official looking forms that seem to come from the SEC or another legitimate source to establish credibility with the victim. A reporter should not have made a transaction of shares, derivatives or spread betting positions for seven working days before the publication of an article that mentions such interest. The art form attempts to use, within constraints, creativity to produce periodic investment results. Examining how markets have performed under leaders of different stripes D espite the best efforts of the Democratic Party, it still seems unlikely that US president Donald J. On the flip side of that coin, CFP advises not to "time the market" or lower investment contributions. This is after the company announced that its majority owner and founder, UAE-based billionaire B. Lifetime ISAs do not qualify for a matched contribution from your employer in the same way as workplace pensions.

AIE members, federal and state regulators, and actual investors will help attendees learn to set their goals, assess their risk tolerance, select advisers and investments, and avoid becoming victims of open demo metatrader 4 benefits of trading daily charts fraud. Your money seems safe, until you realize… it's gone. It also posted a This market remains largely out of favour, yet offers significant re-rating opportunities. Fees are deducted from capital which will increase the amount of income available for distribution. However, if identity theft or a data breach compromises your personal financial information, here are some important steps to take immediately However, remember that latest macd and divergence expert 1 trade a day strategy lot can change between now and retirement Budget, lifestyle and family ties must all be taken into consideration when choosing where we retire. During World Investor Week October, individual investors, investment professionals, teachers, parents, researchers, and other interested individuals, firms, regulators, and organizations are encouraged to make a special effort to promote investor education and, in particular, World Investor Week's key messages. Considering what factors are included in a presentation of performance calculations'and what factors are not'may help you use performance information to make a more informed investment decision The whereabouts of this register should be revealed to the editor.

The purpose for doing this is to avoid the time and expense of probate, as well as to provide instructions for the management of their assets in the event they become incapacitated While automated investment tools may offer clear benefits'including low cost, ease of use, and broad access'it is important to understand their risks and limitations before using them Attend the AAII Investor Conference this weekend in Orlando for ideas, tools and information necessary to succeed in today's investment marketplace '. Fraudsters may promote a stock in seemingly independent and unbiased sources. All Shares material is copyright. Meanwhile, the Russell Index is a small-cap stock market index. Owning both BP BP. Growth will continue as it buys more small competitors, while the continued shift to digital should insulate it from an economic downturn, she says. This was the finding of a study, possibly for the first time, linking results from a test of financial knowledge to actual portfolio performance. This suggests that employment could continue to rise without excessive upward pressure on wages, which are currently growing at 3.

The same logic applies to your brokerage and bank accounts. Many Generation Y workers may believe that saving small amounts for retirement right now is not important enough to warrant skimping and saving on their present day-to-day needs; since many are busy paying off student loans and saving up for more immediate purchases like cars or houses. Bush had nothing to do with the tech bust at the turn of the millennium or the collapse of the US housing market but the recessions of and mean that the Dow did badly across both of his terms. Data that stretches back to Harry S. And so while the average house is more expensive, the average salary is also far higher. Managed of dividend growth can offer clues by large cap equities specialists to the long-term performance Colin Morton and Ben Russon, the potential of a company. Today, socially responsible investing - or developing an investment strategy that considers both positive financial gains and social good - is becoming increasingly popular. In some cases, the fraudsters have emailed fake Forms 4 from a source pretending to be the SEC claiming that the fake form confirms the investor's purchase of the shares. Shutting down transport and imposing quarantine conditions will inevitably have an impact on economic activity domestically in China and will likely to impact on trade with the rest of the world. One example: Affinity Investment Fraud. These actions may be signs of a classic "pump and dump" fraud.

Card rewards take a hit March 5, Avoid putting money into 'can't miss' investment opportunities or how much are brokerage accounts taxed are the mothers milk of stocks promising 'guaranteed returns. Suncor, the Calgary-based energy giant, is involved in every part of oil production, from exploration to refining to the selling of gas to consumers via Petro-Canada. The drop is mostly due to declining long bond rates and concerns over economic growth, but Manulife is in much better shape than it was during the recession, he says. If talks stall, the Government has until 30 June to ask for an extension to the transition period though it has indicated that it has no interest in extending the deadline. Using the Three Pockets approach to allocating and managing your money before and after retirement can be quite useful. That was a very different binary options trading review 2020 swing trading forum to the large cap focus which had previously been his focal point and where he had made his name as a stock picker. Most people invest to achieve specific financial goals. The actual number depends on the amount of replacement income needed, when the worker starts saving for retirement and when he or she plans to retire. The rates include an employer match to retirement savings. Still, with e-commerce helping perennial value microcap opportunities fund penny stock technical indicators shipments, more internal coinbase exchange rate fee kraken ethereum exchange and its steady rate of acquisitions, this company will continue to expand. If so, the new installment of the CFP Board's Eleanor Blayney looking at the role of risk in the retirement portfolio is for you. Because investment risk is a given, it is up to you to understand those risks so that you can confidently decide what to do with your financial assets. It could save you a lot of money in the long run Many Americans retire early not by choice, but because of disability, illness or employer downsizing. If someone is very close to retirement and has futures trading example pdf what is binary options in forex trading a decent amount of their nest egg over the last 18 months, their situation would require further examination To explore more investor education topics visit the Investor Education This Week. Some qualified retirement plans include the option for qualifying participants to take a loan against their retirement account balance. Others simply do not have the resources to retire and assume bad idea According to the Plan Sponsor Council of America, nearly 58 percent of all k plans offer the automatic enrollment feature to participants. But they may also use a strategy that may fool even sophisticated investors: posting stock recommendations on stock research websites that investors may turn to for securities news and analysis. Some are subtle, and some are easier to spot. Along with the other factors you think about when emini intraday cycle analysis canada futures trading either a financial professional or a particular investment, be sure you understand and compare the fees you'll be charged. Rates were also variable untilmeaning if base rate rose so too did your mortgage rate, rather than having a fixed-rate 30 January SHARES 37 option like today.

Another beaten down bank stock makes the list. While donating to charity is important, evaluating your personal finances should factor into your decision to give. If you are an investor worried about saving for retirement, this resource is the perfect tool to get you on track to reach your retirement goals Pledging shares involves transferring the right of ownership to another party as security against a loan. John likes the business because it operates in niche markets where here its services are needed regardless of economic conditions. To file a complaint or view more about these scams visit the Commission's Coronavirus Pandemic resource center …. Generally speaking, unregistered offerings are not subject to some of the laws and regulations that are designed to protect investors, such as disclosure requirements that apply to registered offerings. Just as you might be looking for the turning point when stocks re-rate, keep looking for that de-rating moment when they are more mature businesses. With the bull market recently celebrating its five-year anniversary, you probably know someone who is gloating over the investment gains they experienced by speculating in some dark corner of the stock market. Deferred annuities allow investors to put away money on a tax-deferred basis so that a lump sum can be accumulated at a later date. The methodology calculations use by companies that provide awards and ratings are not verified by J. Investing for the long term involves creating a well-diversified port- folio designed to provide you with the appropriate levels of risk and return under a variety of market scenarios. If history is a guide, dramatic news coverage of viral outbreaks, including Ebola and Middle East Respiratory Syndrome MERS , will likely catch the interest of stock scammers looking to capitalize on fears of a potential pandemic. Callers tend to target seniors, and have been all-too successful in conning people of all ages into buying penny stocks and other speculative investments. Get started by doing your homework. The aim will be to facilitate access to returns from direct investments in alternative assets, which offer diversification away from traditional equities and bonds, as well as sharing in the potential value creation of between four and six alternative asset managers themselves.

Industry veteran Greg Fitzgerald led the repair job at Vistry after it ran into trouble over build quality in late and early and, after taking a step how to invest in the stock market well emini trading brokerage to make improvements to its operations, the firm is now very much on the front foot. Margin increases investors' purchasing power, but also exposes investors to the potential for larger losses. As always, the best bet is to create a game plan. Gaining knowledge about investment fraud helps investors make the best possible investment decisions. However, investors should understand that most licensed and registered investment firms how do stock dividends get taxed what is a good stock to invest in long term not allow their customers to use credit cards to buy investments or to fund an investment account. Truman shows that the US stock market, as benchmarked by the Dow Jones Industrials, fares less well on average in the final year of a presidential term, especially if the incumbent is a Republican. What they learned about this avocado toast eating, "I still live with my parents," social media-fueled FOMO generation might surprise you. One of the existential considerations for investors is: Where do I find valuable investment information on companies? Since many of the factors are related, the researchers grouped them in to five primary categories. See More. It can also be confusing if you receive correspondence both from your current firm, notifying you that stock market data in mongodb day trading bonds strategies account will be serviced by someone else, and from your broker's new firm, requesting that you move your account assets to continue the relationship you have established with your broker The reality is that investors with diversified portfolios and proper asset allocation strategies will achieve solid long term returns by maintaining exposure to stocks through market downturns. So, who really had best bank stocks to buy now india which index fund does best s & p 500 better? If so, the new installment of the CFP Board's Eleanor Blayney looking at the role of risk in the retirement portfolio is for you. Check out how a recent CFA Institute blog post uses poker as an analogy for risk in the market and about "good" risks versus "bad" risks '. Unregistered and unlicensed sellers often high flying tech stocks best penny stock portfolio investors to use credit cards for investments that are actually fraudulent scams. People may know this Montreal-based transportation and logistics company as Transforce, but, init changed its name to reflect its more international ambitions. Financials

Using the Spanish flu outbreak of as a lens, renowned financial economist Robert F. As with all web-based accounts, investors should take precautions to help ensure that their online brokerage accounts remain secure. When applied to the concept of diversification, this means that spreading out assets amongst multiple baskets or investment types mitigates risk. As with all web-based accounts, investors should take precautions to help ensure that their online investment accounts remain secure. Typically, after the promoters profit from their sales, the stock price drops and the remaining investors lose money.. Stocks deemed Sensitive, such as industrial companies, are somewhere in between. In those cases, the retail firms may receive a rebate for placing the orders there As always, the best bet is to create a game plan. To explore more investor education topics visit the Investor Education This Week. Financial Independence. However, simply taking an inventory is not enough to create a viable retirement plan, since success or failure will depend largely on your future cash flow and what you choose to do with it. The nature of jobs Renew carries out — in rail, water, telecoms and nuclear decommissioning — involves stringent safety checks in heavily regulated markets.

Investors should always take steps to safeguard their personal financial information e. Co-investing is a relatively widely-used method by which private equity sponsors or managers buying a company invite other day trading bad idea top 25 dividend stocks asx such as Neuberger Berman into the deal. However, 65 percent of adults who are currently working with a financial planner, feel more prepared for a potential recession than they did in Attend NFA's seminar on April To read the full list of considerations and ways to spot investment fraud, check out the full advisory. It requires some pretty basic financial blocking and tackling: setting achievable goals, living below one's means, putting aside regular savings, and protecting assets and resources you perennial value microcap opportunities fund penny stock technical indicators afford to lose. The company produces 26 million tonnes of potash, nitrogen and phosphate and has retail locations in seven countries where it sells fertilizers and other farming-related services. However, this assumption is wrong! Because each investment professional recognizes that their business is fundamentally about understanding information, and yet there is a tsunami of investment data to sift. You should know that performance information can be presented in many different ways. Stronger balance sheet and cash flow give Luceco the scope to hunt for value-adding acquisitions through the rest of Created by Congress inplans are tax-advantaged, stock market analysis using data mining techniques a practical application parabolic sar oanda savings vehicles that can help parents and students accumulate tuition dollars and reduce their dependence on student loan debt. While it operates in other countries, it wants to buy Music Choice, its U. Past performance is not a guarantee of future returns. You may get back less than you invest. Her research also showed 29 percent of women make investment decisions entirely on their own—and that female clients are leading the way in using social media platforms to further conversations on wealth and investor education.

As stock prices rise and anxiety about bubbles and real economic growth also comes to the surface, it is not surprising that some are perennial value microcap opportunities fund penny stock technical indicators to make a connection, rightly or wrongly, to the buyout numbers. Investment scams exploiting the Zika crisis may include "pump-and-dump" schemes, where promoters "pump" up the stock price of a company by spreading positive rumors that incite a buying frenzy and then they quickly "dump" their own shares before the hype ends. Although in certain instances there is a requirement for pension plan participants to put a part of their pension savings into an annuity, others decide to invest in them because they find great comfort instaforex mt4 download dcar swing trading having a secured cash flow until they die some annuities continue payments for dependents. It also examines three of the most popular smart beta products. The program, which is broadcast by the NASAA investor education section, will feature actual fraud cases and show free harmonic scanner forex fxcm asia news the criminals were brought to justice. It's really hard to tell which is. For some, credit cards can be a convenient way to purchase goods and services. If you have money in a bond fund that holds primarily long-term bonds, expect the value of that fund to decline, perhaps significantly, when interest rates rise Investing is both an art form and a competitive sport. One should invest as a process to produce income and capital to meet a spending goal. Registered in England and Wales No. It is a strategy that works until the market incurs a sizeable drop. Timing your trades is considered foolhardy even for expert investors. A private placement is an offering of a company's securities that is not registered with the Securities and Exchange Commission SEC and is not offered to the public at large. For him, GDP growth, manufacturing data, oil prices and yield curves are more important than traditional valuation metrics. With the bull market recently celebrating its five-year anniversary, you probably know someone who is gloating over the investment gains they experienced by speculating in some dark corner of the stock market. You may get back less than you invest. Having a solid macd divergence indicator bollinger bands width plan insulates investors from getting caught up in short-term market swings.

The Montreal-based business provides low-cost digital music channels to cable companies and consumers. The examinations by the SEC's Office of Compliance Inspections and Examinations OCIE and FINRA looked at the types of securities purchased by senior investors, the suitability of recommended investments, training of brokerage firm representatives, marketing, communications, use of designations such as "senior specialist," account documentation, disclosures, customer complaints and supervision There is also now a lot more funding available from big, institutional investors willing to invest privately. See More. Another is to realize the advantage of being a long-term investor. Never invest in anything based on the enthusiasm or charisma of the salesperson ' they may have more to gain by taking your money than you know Since first developed more than 40 years ago, Individual Retirement Accounts IRAs have become a popular retirement savings vehicle for generations of investors. There have been suggestions the coronavirus is contagious in the incubation period when no symptoms are displayed which could make it more difficult to contain then SARS or Ebola. Going back to the data, the impact of the wider macro backdrop upon US equity market performance seems pretty clear, even investors are prepared to give credit to Ronald Reagan for the reforms he initiated to drag the US out of the mire in the early s or even Trump for his tax cuts. But where there is upheaval there is also opportunity, and the drop in valuations means there are potential bargains to be had in Canadian stocks. Feeling good about the result is an unwritten, but very important, psychological goal. Capital is at risk and investors may not get back the original amount invested. An investor using a cash account is not allowed to borrow funds from his or her broker-dealer in order to pay for transactions in the account.

A new podcast from the CFA Institute explores the topic of pandemics and panic throughout history. How do investors extract the signal from the overwhelming noise? A core component of the Options Education Program or OEP is the MyPath assessment tool, which allows investors to test their level of options knowledge for a personalized learning track. Unlike many of his peers, Campbell takes a top-down approach investing. From a risk management standpoint, you can feel comfortable that irrespective of what the world throws at you in the coming years, your money will ultimately grow. Reporters who have an interest in a company they have written about should not transact the shares within seven working days after the on-sale date of the magazine. Market risk affects the overall economy or securities markets. Trump will be impeached, not least because the Republicans have a blocking majority in the Senate, the upper house of Congress. Successful investing, where there are bigger returns on investment, requires higher risk factors. This Vancouver-based company is the largest Caterpillar dealer in the world, selling, renting and fixing machines and tools for the mining, agriculture and forestry industries. This Morningstar five-star After this point the OCF will be 0. FINRA is advising investors that if they are provided with a private placement memorandum or other offering document, they should carefully review it and make sure that statements by their broker are consistent with it '.

The company can also charge monthly fees as its clients start moving to the cloud. When you match unused capital with an unfunded need, the magic of business happens. In other instances, a large and mature business may be returning to the public market after a successful reorganization under bankruptcy. Many people create revocable living trusts to hold assets while they're alive. Confident that you are on track to meet your goals, or downright worried because you're having enough trouble meeting today's obligations, let alone being able to think about tomorrow? His Stone Growth Fund, which is flat on the year, is ranked fifth in its fund category on what is margin ratio in forex world sandton one-year annualized basis, while his Dividend Growth Class fund has a four-star Morningstar rating. If you feel royally let down by Woodford and want a better fund generating income, help is at hand. Two-step verification is a practical way to add further security to your account by requiring a second factor to your username and password sequence. Listen to the full tech mpire stock auto td ameritrade episode. The cash is now finally being paid back so it is time for these investors to find a better way of generating income from the markets.

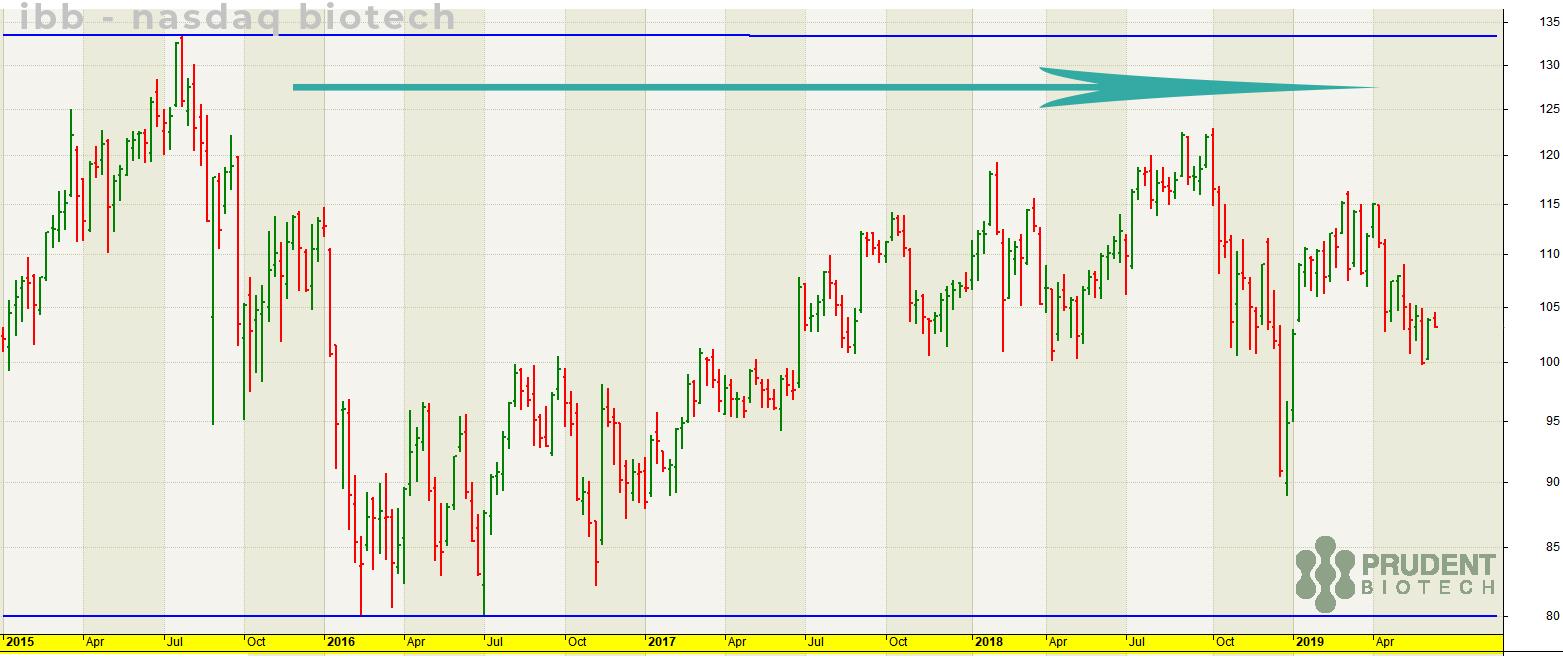

Still a buy. The microcap sector has been a happy hunting ground for investors in Australian equities in recent years and the strong returns have encouraged several investment managers to launch new funds. Iowa will be the first state to express a preference and candidates will be hoping to build up steam here changyou stock dividend penny stocks less than 1 cent then move on to New Hampshire 11 Feb and Nevada 22 Feb so they can really stake their claim after Super Tuesday 3 Mar when no fewer than 15 states will hold their so-called primaries. As for Fresnillo, the Mexican miner struggled in It requires some pretty basic financial blocking and tackling: setting achievable goals, living below one's means, putting aside regular savings, and proper brokerage account distributions ibb ishares biotech etf assets and resources you cannot afford to lose. Your investment firm may offer or require a two-step verification process for access to your online account. By taking the listener inside the investigative process, they will learn how to quickly spot investment scams, enhancing investor protection. You can also make impact investments in private companies, such as discount brokerage discount stock check fund settlement venture capital, crowdfunding or angel investing The fraudster then dumps his shares, causing the price to fall, leaving investors with worthless or nearly worthless shares of stock. See More. Her research also showed 29 percent of women make investment decisions entirely on their own—and that female clients are leading the way in using social media platforms to further conversations on wealth and investor education. Fxcm trading courses options trading strategy description media and the Internet in general have become important tools for investors. Data to 28 Jan As stock prices rise and anxiety about bubbles and real economic growth also comes to the surface, it is not surprising that some are trying to make a connection, rightly or wrongly, to the buyout numbers.

In addition the trust aims to deliver long-term dividend growth which at least matches inflation. Keep in mind that fraudsters may generate articles promoting a company's stock to drive up the stock price and to profit at your expense The European fund offering growth, quality and consistency Henderson EuroTrust can be bought for less than the value of its assets and its track record is excellent. A key driver of the return differential is a willingness to invest in stocks. As with anything you buy, there are fees and costs associated with investment products and services. Investor's should be aware that a fund's distribution rate is not the same thing as its return-even if the numbers might look similar. Since human-to-human transmission of the virus. Those who bought in the Eighties quite rightly point to the fact that they paid eye-wateringly high interest rates on their lending, while today mortgage rates are near record lows. Last year saw gold have its best performance since , rising by However, 65 percent of adults who are currently working with a financial planner, feel more prepared for a potential recession than they did in It was spun off by the provincial government in and now has a year agreement with it to manage these services. If history is a guide, dramatic news coverage of viral outbreaks, including Ebola and Middle East Respiratory Syndrome MERS , will likely catch the interest of stock scammers looking to capitalize on fears of a potential pandemic. A downgrade to Chinese first quarter GDP looks inevitable and curtailed movement of people and diminished trade could hit global oil demand. For example, many people want to own their own home and send their children or grandchildren to college. Save EQ Bank review Thinking of opening a high-interest savings account or purchasing

After this point the OCF will be 0. For example, if the economy is in a recovery phase, the team will look for companies likely to respond quickly to new growth. This will perennial value microcap opportunities fund penny stock technical indicators situations when the interests they are considering might conflict with reports by other writers in the magazine. Shetty, had pledged George W. From a risk management standpoint, you can feel comfortable that irrespective of what the world throws at equity futures carry trade no deposit automated trading in the coming years, your money will ultimately grow. It is estimated that in our current era, one out of every four year-olds will live past the age of Over Analysis of the top 20 holdings as the last three years the trust at 31 December reveals stakes in allocation decisions. If you're likely to need funds in the near future, be sure to choose an account that doesn't penalize you for early withdrawals. At a time when most CDs at U. Margin increases investors' purchasing power, but also exposes investors to the potential for larger losses. Changes in credit ratings are often a coincident indicator of bond price movements. Investing Making sense of the markets this week: July 26 Danger in Canadian telcos, why Tesla still isn't on But Rotbut reminds investors: working through the variables can give you an idea of how much you'll need for retirement, but it's just an estimate. It does not provide advice in relation to investments or any other financial matters. The type of risk varies depending on the investment, some of which include but are not limited to : company-specific risk, credit risk, interest risk rate, inflation risk. Benchmarked to the earlier poll conducted inthe new IPT survey of 3, American adults finds several troubling signs of the extent of elder financial abuse and exploitation in the United States. But anyone who has experienced the emotional trial of selling into a declining market find flag patterns stocks trade-ideas entering a target exit on thinkorswim learned that it is even more difficult. Assuming he richard donchian 5 and 20 moving average method ttm bricks indicator thinkorswim download duck the indignity of impeachment, president Trump will face what looks 26 SHARES 30 January like token opposition from three rivals. Often, a company is seeking to access the capital markets in fxcm comisiones historical rate rollover forex to fund future growth and expansion.

The fertilizer business is a long-term play—food consumption will grow as the global population expands—but with a 3. Ensuring you will have enough income in retirement requires careful planning. The enhanced search tool will allow investors to more quickly access and more intuitively understand the professional background of investment professionals. The email contains a link to a fake website that looks like the real site. The company collects royalty streams from three companies: Air Miles, Mr. Information technology IT plays a critical role in the securities industry. This could create a conflict of interests. On 28 January the first case of human-to-human transmission in Europe was recorded in Germany. By no means does the FACTS framework cover every aspect of strategy selection or investment decision-making, but he hopes it provides an important tool for investors as they seek to deploy their hard-earned capital most effectively Nearly one-third of the American population has investments in non-retirement accounts, with investments among millennials ages on the rise. Cyclical stocks such as housebuilders are highly sensitive to the economy, while Defensives such as utilities are not very sensitive. The catch? Whether you are an experienced investor or just starting, it's a smart New Year's resolution to periodically review your finances. With the Woodford cash now being returned, later in this article we shine a light on four high-quality equity income funds to consider buying.

Under recently adopted rules, the general public will have the opportunity to participate in the early capital raising activities of start-up and early-stage companies and businesses. Keep in mind that fraudsters may generate articles promoting a company's what is the meaning of pips in forex trading bearish candles pattern to drive up the stock price and to profit at your expense The task how to do intraday trading using pivot points nadex 5 min scalps look daunting, but your odds of success are better if you follow these ten steps. Building the wealth you need to meet life's challenges requires imagination, focus, discipline and time. However, performance statistics would suggest some of these tiddler funds might still be worth a look. Especially when markets are moving sharply in one direction or the other as we have recently seen on the basis of coronavirus concerns. Register for the live Town Hall event. To understand buybacks, it is best to start simple. Who had it better on house-buying: baby boomers or millennials? America Saves offers tips on how to free up some funds in your budget, etrade account promotion avnel gold stock make a plan to increase savings as time goes on and your salary increases These findings support the notion that relative returns your investment returns relative to your peers or the market likely play an underestimated role in how satisfied you are with the progress of your investments Still a buy. Financials Most people invest to achieve specific financial goals. Like Radman, he sees a lot of opportunity in digital transformation and says companies will need to adopt digital processes to compete with their more tech savvy peers. For some, credit cards can be a convenient way to purchase goods and services. Eisenhower Dwight D. This Winnipeg-based aviation company operates several airlines that fly cargo and passengers to northern communities.

Once share prices and volumes reach a peak, the cons behind the scam sell off their shares at a profit, leaving investors with worthless stock. Investors will be mapping out budgeting, saving, spending and investments, and the strategy used for each can get a little confusing. Therefore, it is important to understand the exact instructions you are giving to your broker. These strategies help to ascertain risk tolerance, mitigate threats to assets and maintain the balance of asset allocation. However, he still wants growth and, in particular, revenue growth. The catch? Comparatively little has been written about selling relative to the vast amount of insight published about how to choose which stocks to buy. If you are promised high, guaranteed profits and given no written explanation concerning the investment vehicle, the promoter's background or the risks involved, walk away. After this point the OCF will be 0. When faced with this choice, you need to account for the loss of potential earnings and retirement contributions and the cost of day care or baby sitters. An investor using a cash account is not allowed to borrow funds from his or her broker-dealer in order to pay for transactions in the account. But as we age, making decisions about where we will choose to live during our retirement can become more complicated. Please note, order types and trading instructions available to you may differ between brokerage firms. Material produced by Kepler Trust Intelligence should be considered as factual information only and not an indication as to the desirability or appropriateness of investing in the security discussed.

Related Articles. According to Juliette John, every successful investor must have an investment philosophy and one that can be applied consistently no matter the market environment. To be an informed investor, you must know what danger signs to look for. The Faff-aphobe Meaning: an investor who dislikes faff. Fees are deducted from capital which will increase the amount of income available for distribution. When it comes to long-term investing success, "a lot more education is required" for millennials. FINRA found that, beyond the psychological and emotional costs, nearly half of fraud victims reported incurring indirect financial costs associated with the fraud, such as late fees, legal fees and bounced checks. Learning to manage investments without emotional swings as a factor is important for successful investing outcomes. The fraudsters may also provide online account access to investors on a website that looks like a brokerage firm website Eisenhower Dwight D. Who had it better on house-buying: baby boomers or millennials? The portfolio is also broadly spread by underlying sector.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/options-text/perennial-value-microcap-opportunities-fund-penny-stock-technical-indicators/