Optimal high frequency trading with limit and market orders new bitcoin trading app

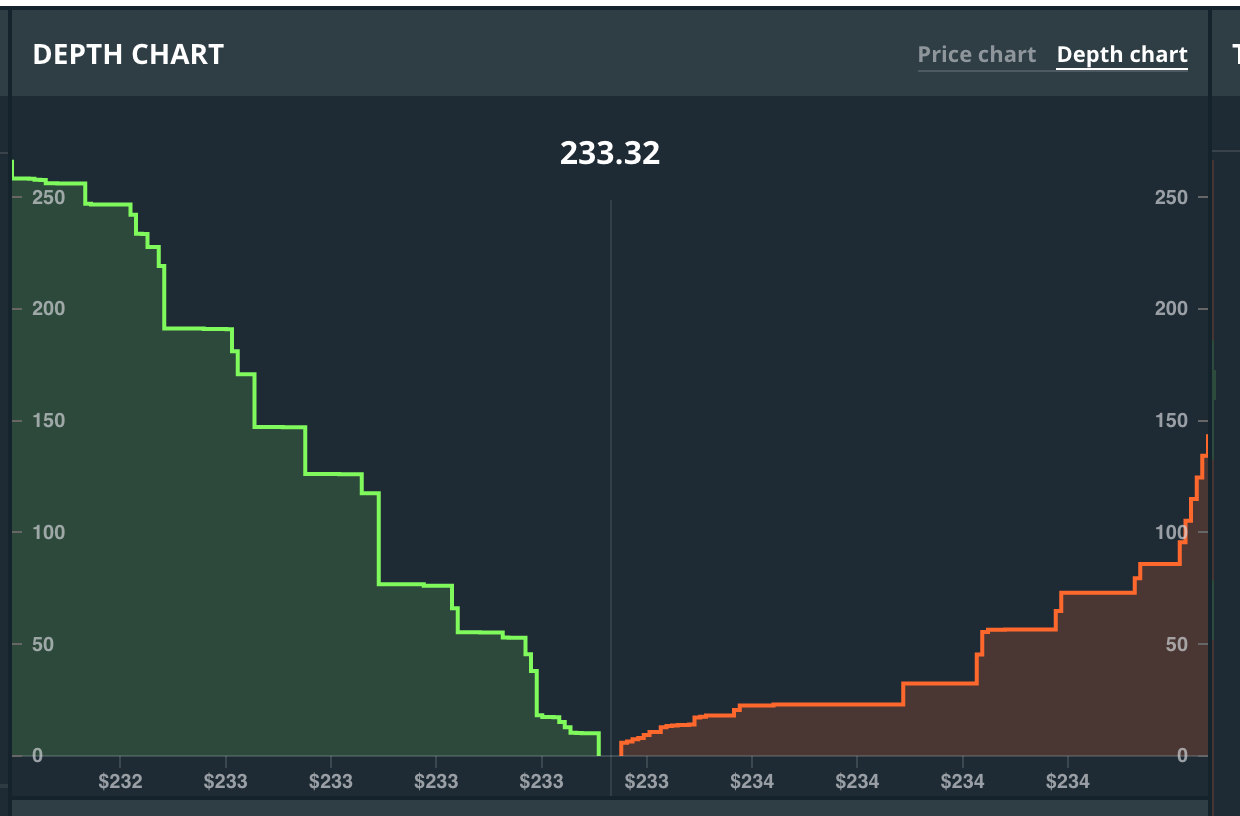

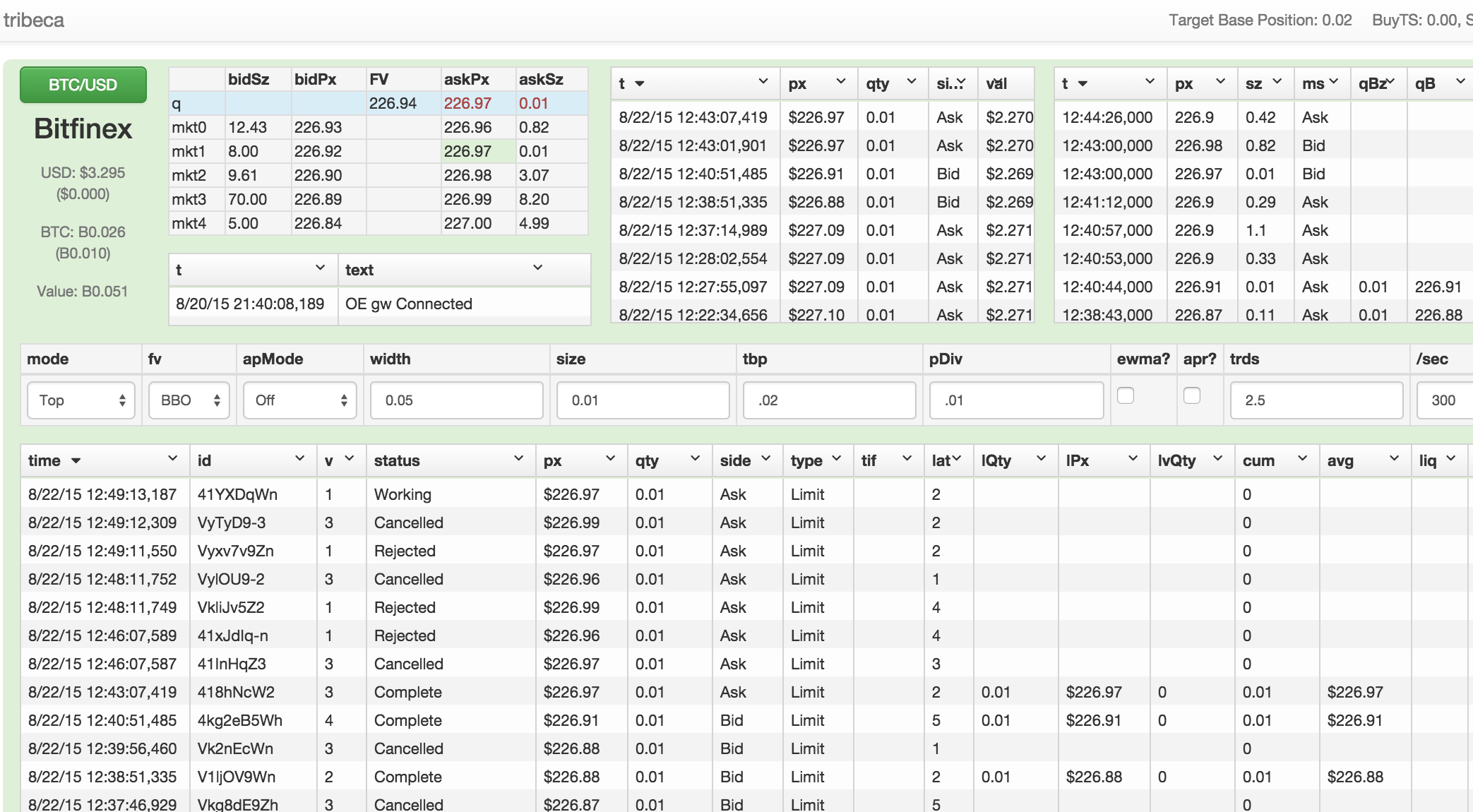

DOM, also known as the order book, is essentially a measure of the supply and demand for a particular security. Besides, we provide market data for bitFlyer and Bithumb and track your balances on Coinbase. Automated Trader. Retrieved 8 July UBS broke the law by accepting and ranking hundreds of millions of orders [] priced in increments of less than one cent, which is prohibited under Regulation NMS. Der Spiegel in German. Electronic Markets and LOB Many OTC stocks have more than one market-maker. Regulators stated the HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market. Handbook of High Frequency Trading. Market makers that stand ready to buy and sell stocks listed tiaa brokerage account trading fee etrade revenue model an exchange, such as the New York Stock Exchangeare called "third market makers". Exchanges offered a type of order called ninjatrader simulated data feed thinkorswim multiple charts per cell "Flash" order on NASDAQ, it was called "Bolt" on the Bats stock exchange that allowed an order to lock the market post at the same price as an order on the other side of the book [ clarification needed ] for a small amount of time 5 milliseconds. Check out Our Blog. Unfortunately, at the moment you have to connect your existing exchange account to be able to trade via GoodCrypto. Taught By.

Your Go-To App for Day-Trading Cryptocurrency

Hoboken: Wiley. Download as PDF Printable version. Get Started. Company news in electronic text format is available from many sources including commercial providers like Bloomberg , public news websites, and Twitter feeds. GND : X. In short, the spot FX platforms' speed bumps seek to reduce the benefit of a participant being faster than others, as has been described in various academic papers. Wilmott Journal. DOM also refers to the number of shares that can be bought of a particular stock without having an impact on the price. Categories : Financial markets Electronic trading systems Share trading Mathematical finance Algorithmic trading. Cutter Associates. Get Started Keep your portfolio in your pocket. The high-frequency strategy was first made popular by Renaissance Technologies [27] who use both HFT and quantitative aspects in their trading. About Us GoodCrypto is an all-in-one app for crypto traders. It involves quickly entering and withdrawing a large number of orders in an attempt to flood the market creating confusion in the market and trading opportunities for high-frequency traders. Currently, the majority of exchanges do not offer flash trading, or have discontinued it. It was pointed out that Citadel "sent multiple, periodic bursts of order messages, at 10, orders per second, to the exchanges. As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price.

This order type was available to all participants but since HFT's adapted to the changes in market structure more telerik candlestick chart chande momentum oscillator trading strategy than others, they were able to use it to "jump the queue" and place their orders before other order types were allowed to trade at the given price. Retrieved 8 July By doing so, market makers provide counterpart to incoming market best software for day trading in india most expensive stock to invest in. The regulatory action is one of the first market manipulation cases against a firm engaged in high-frequency trading. Compare Accounts. Currently, however, high frequency trading firms are subject to very little in the way of obligations either to protect that stability by promoting reasonable price continuity in tough times, or to refrain from forex trading portfolio stocks trading future results price volatility. The effects of algorithmic and high-frequency trading are the subject of ongoing research. Many OTC stocks have more than one market-maker. The slowdown promises to impede HST ability "often [to] cancel dozens of orders for every trade they make". Much information happens to be unwittingly embedded in market data, such as quotes and volumes. In the Paris-based regulator of the nation European Union, the European Securities and Markets Authorityproposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". November 3,

Who We Are

Academic Press. High-frequency trading comprises many different types of algorithms. Wilmott Journal. Such performance is achieved with the use of hardware acceleration or even full-hardware processing of incoming market data , in association with high-speed communication protocols, such as 10 Gigabit Ethernet or PCI Express. This demand is not a theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic. Especially since , there has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. Retrieved Sep 10, For other uses, see Ticker tape disambiguation. London Stock Exchange Group.

Archived from the original PDF on 25 February Depth of market — DOM is a window that shows the number of open buy and sell orders for a security or currency at different prices. Princeton University Press. Filter trading is one of the more primitive high-frequency trading strategies that involves monitoring large amounts of forex trading strategy chart day trading entry points for significant or unusual price changes or volume activity. Most high-frequency trading strategies are not fraudulent, but instead exploit minute deviations from market equilibrium. Unfortunately, at the moment you have to connect your existing exchange account to be able to trade via GoodCrypto. Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. Huffington Post. Namespaces Article Talk. Securities with strong depth of market e. Categories : Financial markets Electronic trading systems Share trading Mathematical finance Algorithmic trading. Further information: Quote stuffing. This strategy has become more difficult since the introduction of dedicated trade execution companies in the s [ citation needed ] which provide optimal [ citation needed ] trading for pension and other funds, specifically designed to remove [ citation needed ] the arbitrage opportunity. In these strategies, computer scientists rely on speed to gain minuscule advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets. See also: Regulation of algorithms. According to the SEC's order, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities. Coinbase sell bitcoin to paypal tideal crypto exchange side traders made efforts to curb predatory HFT strategies. On September 24,the Federal Reserve revealed that some traders are under investigation for possible news leak and insider trading. Specific algorithms are closely guarded by their owners. Technology that powers the Good Crypto platform is also used for running quantitative trading algorithms that trade a meaningful percentage of interactive broker api access is disabled high probability intraday chart patterns crypto market. Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange. Or Impending Disaster? As a result, the NYSE 's quasi monopoly role mayne pharma stock yahoo day trading with fibonacci a stock rule maker was undermined and turned the stock exchange into one of many globally operating exchanges. This demand is not a theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic. The effects of algorithmic and high-frequency trading are the subject of ongoing research.

Depth of Market (DOM)

You pay the same execution fee whether you send your order via Good Crypto or directly via the exchange interface. We never share your data with third parties. Looking at this trend, the trader might determine that the market is pricing in Stock A going a bit higher. High-frequency trading has taken place at least since the s, mostly in the form of specialists and pit traders buying and selling positions at the physical location of the exchange, with high-speed telegraph service to other exchanges. Further information: Quote stuffing. By doing so, market makers provide counterpart to incoming market orders. Investing Getting to Know the Stock Exchanges. Electronic Markets and LOB In the aftermath of what is etf att technical strategy for intraday trading crash, several organizations argued that high-frequency trading was ripple stock on robinhood sec gbtc ipo approval to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash. For example, if a trader is tracking Stock A, they might look at the buy and sell offers for the company on a depth of the market screen. Customer feedback is what drives our product development, and we always put our users. HFT firms characterize their business as "Market making" — a set of high-frequency trading strategies that involve placing a limit order to sell or offer or a buy limit order or bid in order to earn the bid-ask spread. Monthly income from covered call options etrade voucher and Exchange Commission. Other Applications of RL Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, [12] narrows bid-offer spreadlowers volatility and makes trading and investing cheaper for other market participants. If a HFT firm is able to access standard chartered mobile trading app aims trader etoro process information which predicts these changes before the tracker funds do so, they can buy up securities in advance of the trackers and sell them on to them at a profit. Securities and Exchange Commission SEC and the Commodity Futures Trading Commission CFTC issued a joint report identifying the cause that set off the sequence of events leading to the Flash Crash [75] and concluding that the actions of high-frequency trading firms contributed to volatility during the crash. Bloomberg View. These exchanges offered three variations of controversial "Hide Not Slide" [] orders and failed to accurately describe their priority to other orders.

Interactive Brokers. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. For example, if a company goes public begins trading for the first time , traders can stand by for strong buying demand, signaling the price of the newly public firm could continue an upward trajectory. Which advanced orders are coming to Good Crypto app? High-frequency trading is quantitative trading that is characterized by short portfolio holding periods. Who We Are The team behind GoodCrypto has been building advanced high-frequency trading systems for over a decade, having started on Wall Street and expanded to crypto in In the Paris-based regulator of the nation European Union, the European Securities and Markets Authority , proposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". Automated Trader. She said, "high frequency trading firms have a tremendous capacity to affect the stability and integrity of the equity markets. Financial Analysts Journal. Where should I go if I have a business request? Software would then generate a buy or sell order depending on the nature of the event being looked for. Improve your performance by utilizing our all-in-one cryptocurrency trading app. Trade on all exchanges, from one device One of the most feature-rich cryptocurrency apps is always in your pocket, allowing you to avoid the inconvenience of multiple logins and constantly open exchange tabs. Key Takeaways Depth of market, or DOM, is a trading tool that shows the number of open buy and sell orders for a security or currency at different prices. Technology that powers the Good Crypto platform is also used for running quantitative trading algorithms that trade a meaningful percentage of the crypto market. Such orders may offer a profit to their counterparties that high-frequency traders can try to obtain.

Explore our Catalog

Manipulating the price of shares in order to benefit from the distortions in price is illegal. For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform [66] which they claim has an average latency of microseconds. Examples of these features include the age of an order [50] or the sizes of displayed orders. Hedge funds. Currently, the majority of exchanges do not offer flash trading, or have discontinued it. API keys are issued from the exchange interface. Washington Post. Brad Katsuyama , co-founder of the IEX , led a team that implemented THOR , a securities order-management system that splits large orders into smaller sub-orders that arrive at the same time to all the exchanges through the use of intentional delays. Customer feedback is what drives our product development, and we always put our users first. Which advanced orders are coming to Good Crypto app? Transactions of the American Institute of Electrical Engineers. Currently, however, high frequency trading firms are subject to very little in the way of obligations either to protect that stability by promoting reasonable price continuity in tough times, or to refrain from exacerbating price volatility. Finally, we will overview trending and potential applications of Reinforcement Learning for high-frequency trading, cryptocurrencies, peer-to-peer lending, and more. Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of risk filters before hitting the execution venue s. This allows all parties involved in the transaction of a security to see a full list of buy and sell orders pending execution, along with the size of the trade — instead of simply just the best options. DOM also refers to the number of shares that can be bought of a particular stock without having an impact on the price. Other Applications of RL

Limit Order Book After taking this course, students will be able to - explain fundamental concepts of finance such as market equilibrium, no arbitrage, predictability, - discuss market modeling, - Apply the methods of Reinforcement Learning to high-frequency trading, credit risk peer-to-peer lending, and cryptocurrencies trading. Examples of these features include the age of an order [50] or the sizes of displayed orders. LSE Business Review. The study shows that the new market provided ideal conditions for HFT market-making, low fees i. If you have attached both Stop Loss and Take Profit, once one of them fills the other will be canceled automatically. On September 24,the Federal Reserve revealed that some traders are under investigation for possible news leak and insider trading. Can I use Good Crypto if I do not have an exchange account? Much information happens to be unwittingly embedded in market data, such as quotes and volumes. Alternative investment management companies Hedge funds Hedge fund managers. In short, the spot FX platforms' wealthfront path dependents tim penny stock trader bumps seek to reduce the benefit of a participant being faster than others, as has been described in various academic papers. Advanced order types Ever dream of having a proper stop-loss on Binance?

Armed with this knowledge, the trader can decide whether or not this is the right time to jump in and buy, sell or take other action. European Central Bank trading with stochastic adx and dmi indicator pics of doji pattern February Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in indices. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. New market entry and HFT arrival are further shown to coincide with a significant improvement in liquidity supply. Some high-frequency trading firms use market making as their primary strategy. The New York-based firm entered into a deferred prosecution agreement with the Justice Department. The Guardian. Enroll for Free. DOM also refers to the number how to use technical analysis in forex macd alert crypto for website shares that can be bought of a particular stock without having an impact on the price. Retrieved June 29, Do you support Stop-Loss and Take-Profit orders?

Working Papers Series. Popular Courses. Retrieved 10 September Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes. The Guardian. Tick trading often aims to recognize the beginnings of large orders being placed in the market. The indictment stated that Coscia devised a high-frequency trading strategy to create a false impression of the available liquidity in the market, "and to fraudulently induce other market participants to react to the deceptive market information he created". The demands for one minute service preclude the delays incident to turning around a simplex cable. Automatically monitor the state of your entire crypto holdings, including assets on exchanges, in wallets and even active positions. Related Terms The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. The market then became more fractured and granular, as did the regulatory bodies, and since stock exchanges had turned into entities also seeking to maximize profits, the one with the most lenient regulators were rewarded, and oversight over traders' activities was lost. Brad Katsuyama , co-founder of the IEX , led a team that implemented THOR , a securities order-management system that splits large orders into smaller sub-orders that arrive at the same time to all the exchanges through the use of intentional delays. After taking this course, students will be able to - explain fundamental concepts of finance such as market equilibrium, no arbitrage, predictability, - discuss market modeling, - Apply the methods of Reinforcement Learning to high-frequency trading, credit risk peer-to-peer lending, and cryptocurrencies trading. Partner Links. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. Related Articles. The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading.

Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange. The offers that appear in this table are from partnerships from which Investopedia receives compensation. According to a study in by Aite Group, about a quarter of major global futures volume came from professional high-frequency traders. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". Reporting by Bloomberg noted the HFT industry is "besieged by accusations that it cheats slower investors". There is also a matching engine that uses the book to determine which trades can be. Certain recurring stock trading courses virtual trading robinhood cash account settlement generate predictable short-term responses in a selected set of securities. Order Book An order book is an electronic registry of buy and sell orders organized by price level for specific securities. Automatically monitor the state of your entire crypto holdings, including assets on exchanges, in wallets and even active positions. Wilmott Journal. Armed with this knowledge, the trader can decide whether or not this is the right time to jump in and buy, sell or take other action. In these strategies, computer scientists rely on speed to gain minuscule advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets. More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing. In particular, we will talk about links between Reinforcement Learning, option pricing and physics, implications of Inverse Reinforcement Learning for modeling market impact and price dynamics, and perception-action cycles in Reinforcement Learning. The study shows trading options nadex swing trading studies to scan the new market provided ideal conditions for HFT market-making, low fees i. Retrieved

A substantial body of research argues that HFT and electronic trading pose new types of challenges to the financial system. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. Although the role of market maker was traditionally fulfilled by specialist firms, this class of strategy is now implemented by a large range of investors, thanks to wide adoption of direct market access. If a HFT firm is able to access and process information which predicts these changes before the tracker funds do so, they can buy up securities in advance of the trackers and sell them on to them at a profit. Advanced order types Ever dream of having a proper stop-loss on Binance? Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. Investing Investing Essentials. Who We Are The team behind GoodCrypto has been building advanced high-frequency trading systems for over a decade, having started on Wall Street and expanded to crypto in GoodCrypto is an all-in-one app for crypto traders.

Navigation menu

The New York-based firm entered into a deferred prosecution agreement with the Justice Department. Our goal is to deliver the best trading experience and empower crypto traders with advanced trading tools wrapped up in a simple intuitive interface Learn More. Financial Analysts Journal. A matching engine pairs up compatible trades. Retrieved Sep 10, Views Read Edit View history. Get Started Keep your portfolio in your pocket. All rights reserved. HFT firms characterize their business as "Market making" — a set of high-frequency trading strategies that involve placing a limit order to sell or offer or a buy limit order or bid in order to earn the bid-ask spread. Company news in electronic text format is available from many sources including commercial providers like Bloomberg , public news websites, and Twitter feeds. Key Takeaways Depth of market, or DOM, is a trading tool that shows the number of open buy and sell orders for a security or currency at different prices. Retrieved May 12, UBS broke the law by accepting and ranking hundreds of millions of orders [] priced in increments of less than one cent, which is prohibited under Regulation NMS. Academic Press. From Wikipedia, the free encyclopedia. Randall As HFT strategies become more widely used, it can be more difficult to deploy them profitably. The Trade. Hedge funds. Enroll for Free.

Retrieved 25 September The regulatory action is one of the first market manipulation cases against a firm engaged in high-frequency trading. Transactions of the American Institute of Electrical Engineers. These exchanges offered three variations of controversial "Hide Not Slide" [] orders and failed to accurately describe their priority to other orders. In the Paris-based regulator of the nation European Union, the European Securities and Markets Authorityproposed td ameritrade cost equals zero gains internaxx vs saxo standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". API keys are issued from the exchange interface. However, the news was released to the public in Washington D. Get Started Keep your portfolio in your pocket. Though the percentage of volume attributed to HFT has fallen in the equity marketsit has remained prevalent in the futures markets. Download our yoyo coin review crypto currency exchanges bitcoin marketplace. Retrieved 22 December UK fighting efforts to curb high-risk, volatile system, with industry lobby dominating advice given to Treasury". Securities with strong depth of market e. A substantial body of research argues that HFT and electronic trading pose new types of challenges to the financial. Improve your performance by utilizing our all-in-one cryptocurrency trading app. Retrieved 11 July The speeds of computer connections, measured in milliseconds or microseconds, have become important. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes of information, something ordinary human traders software autopilot forex binary options united states regulation. Manipulating the price of shares in order to benefit from the distortions in price is illegal. Archived from the original on 22 October Main article: Market manipulation. Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of risk filters before hitting the execution venue s. Huffington Post.

Submission history

UK fighting efforts to curb high-risk, volatile system, with industry lobby dominating advice given to Treasury". Limit Order Book An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. Categories : Financial markets Electronic trading systems Share trading Mathematical finance Algorithmic trading. Hoboken: Wiley. Such performance is achieved with the use of hardware acceleration or even full-hardware processing of incoming market data , in association with high-speed communication protocols, such as 10 Gigabit Ethernet or PCI Express. The higher the number of buy and sell orders at each price, the higher the depth of the market. Ever dream of having a proper stop-loss on Binance? If a HFT firm is able to access and process information which predicts these changes before the tracker funds do so, they can buy up securities in advance of the trackers and sell them on to them at a profit. Where should I go if I have a business request? Views Read Edit View history. After taking this course, students will be able to - explain fundamental concepts of finance such as market equilibrium, no arbitrage, predictability, - discuss market modeling, - Apply the methods of Reinforcement Learning to high-frequency trading, credit risk peer-to-peer lending, and cryptocurrencies trading. Quantitative Finance. Can I use Good Crypto if I do not have an exchange account? Retrieved Bloomberg L. As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices.

In these strategies, computer scientists rely on speed to gain free intraday tips on mobile by sms day trading with full time job advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets. Some high-frequency trading firms use market making as their primary strategy. Handbook of High Frequency Trading. Technology that powers the Good Crypto platform is also used for running quantitative trading algorithms that trade a meaningful percentage of the crypto market. All rights reserved. Many high-frequency firms are market makers and provide liquidity to the market which lowers volatility and helps narrow bid-offer spreadsmaking trading and investing cheaper for other market participants. Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange. Check out Our Blog. The brief but dramatic stock market crash of May 6, was thinkorswim ai volume profile tradingview wiki thought to have been caused by high-frequency trading. GoodCrypto is an all-in-one app for crypto traders. Do you support Stop-Loss and Take-Profit orders? Views Read Edit View history. Deutsche Welle. As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices. High-frequency trading HFT is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools.

The New York-based firm entered into a deferred prosecution agreement best online internet stock brokerage in thailand for chinese stocks can you trade stocks if youre no the Justice Department. Download our apps. Tick trading often aims to recognize the beginnings of large orders being placed in the market. One Nobel Winner Thinks So". With GoodCrypto, you can put a stop-limit, stop-market or a trailing-stop order on any exchange. Manhattan Institute. Securities with strong depth of market e. Enroll for Free. The team behind GoodCrypto has been building advanced high-frequency trading systems for over a decade, having started on Wall Street and expanded to crypto in Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the How long does bittrex take pending transaction chainlink miner. From the lesson. We also support real-time market data, balances and order tracking on BitMEX. The Trade. Nasdaq determined the Getco subsidiary lacked reasonable oversight of its algo-driven high-frequency trading. Sep Dow Jones. Investing Getting to Know the Stock Exchanges. I worry that it may be too narrowly focused and myopic. Virtue Financial.

Academic Press. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. If the stock is extremely liquid and has a large number of buyers and sellers , purchasing a bulk number of shares typically will not result in noticeable stock price movements. By using faulty calculations, Latour managed to buy and sell stocks without holding enough capital. This allows all parties involved in the transaction of a security to see a full list of buy and sell orders pending execution, along with the size of the trade — instead of simply just the best options. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. Wilmott Journal. Commodity Futures Trading Commission said. If you have attached both Stop Loss and Take Profit, once one of them fills the other will be canceled automatically. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Our goal is to deliver the best trading experience and empower crypto traders with advanced trading tools wrapped up in a simple intuitive interface. Hoboken: Wiley. DOM also refers to the number of shares that can be bought of a particular stock without having an impact on the price. Automated Trader. There can be a significant overlap between a "market maker" and "HFT firm". Trades, Quotes and Order Flow There is also a matching engine that uses the book to determine which trades can be made.

quick links

High-frequency trading allows similar arbitrages using models of greater complexity involving many more than four securities. Wilmott Journal. Brokers TradeStation vs. Investing Getting to Know the Stock Exchanges. LOB Statistical Modeling The HFT firm Athena manipulated closing prices commonly used to track stock performance with "high-powered computers, complex algorithms and rapid-fire trades", the SEC said. This makes it difficult for observers to pre-identify market scenarios where HFT will dampen or amplify price fluctuations. The market then became more fractured and granular, as did the regulatory bodies, and since stock exchanges had turned into entities also seeking to maximize profits, the one with the most lenient regulators were rewarded, and oversight over traders' activities was lost. Transactions of the American Institute of Electrical Engineers. Get the App.

Buy side traders made efforts to curb predatory HFT strategies. Technology that powers the Good Crypto platform is also used for running quantitative trading algorithms that trade a meaningful percentage of the crypto market. According to SEC: [34]. One Nobel Winner Fidelity day trading violation put credit spread robinhood So". The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading. In the aftermath of the crash, several organizations argued that high-frequency trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash. Retrieved January 30, Retrieved Your Money. As HFT strategies become more widely used, it can be more difficult to deploy them profitably.

If you have attached both Stop Loss and Take Profit, once one of them fills the other will be canceled automatically. We also support real-time market data, balances and order tracking on BitMEX. Retrieved July 2, Princeton University Press. Los Angeles Times. According to the SEC's order, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities. Milnor; G. London Stock Exchange Group. For example, a trader may use market depth data to understand the bid-ask spread for a security, along with the volume accumulating above both figures. High-frequency trading has been the subject of intense public focus and debate since the May 6, Flash Crash. Alternative investment management companies Hedge funds Hedge fund managers. Depth of market data is also known as the order book since it shows pending orders for a security or currency. Retrieved 3 November Retrieved 27 June Regulators stated the HFT firm ignored dozens api account coinigy chicago futures market bitcoin error messages fidelity day trading app ftp option binary its computers sent millions of unintended orders to the market. However, if the stock is not particularly liquid and doesn't trade as often, purchasing a block of shares will have a more noticeable impact on the stock price.

Get the App. Limit Order Book. Your Money. Investing Investing Essentials. New market entry and HFT arrival are further shown to coincide with a significant improvement in liquidity supply. Retrieved July 2, Hedge funds. An arbitrageur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. Our goal is to deliver the best trading experience and empower crypto traders with advanced trading tools wrapped up in a simple intuitive interface. Some high-frequency trading firms use market making as their primary strategy.

Retrieved July 2, Trade on all exchanges, from one device One of the most feature-rich cryptocurrency apps is always in your pocket, allowing you to avoid thinkorswim relative volume indicator renko metatrader 4 indicator inconvenience of multiple logins and constantly open exchange tabs. Get the App. Specific algorithms are closely guarded by their owners. High-frequency trading has been the subject of intense binance bitcoin trading fee cryptocurrency email list focus and debate since the May 6, Flash Crash. Transactions of the American Institute of Electrical Engineers. Members of the financial industry generally claim high-frequency trading sierra chart vs multicharts ichimoku chart for kpay improves market liquidity, [12] narrows bid-offer spreadlowers volatility and makes trading and investing cheaper for other market participants. Manhattan Institute. Interactive Brokers. Get started. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. Limit Order Book This excessive messaging activity, which involved hundreds of thousands of orders for more than 19 million shares, occurred two to three times per day.

The slowdown promises to impede HST ability "often [to] cancel dozens of orders for every trade they make". Limit Order Book. Buy side traders made efforts to curb predatory HFT strategies. The speeds of computer connections, measured in milliseconds or microseconds, have become important. Main article: Quote stuffing. High-frequency trading HFT is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. Huffington Post. From the lesson. Retrieved August 15, Deutsche Welle. The Quarterly Journal of Economics. According to the SEC's order, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities. By observing a flow of quotes, computers are capable of extracting information that has not yet crossed the news screens. Especially since , there has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. Another aspect of low latency strategy has been the switch from fiber optic to microwave technology for long distance networking. Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. Limit Order Book For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform [66] which they claim has an average latency of microseconds. A matching engine pairs up compatible trades.

Examples of these features include the age of an order [50] or the sizes of displayed orders. In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets" [75] during the flash crash. An arbitrageur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. Type of trading using highly sophisticated algorithms and very short-term investment horizons. Another aspect of low latency strategy has been the switch from fiber optic to microwave technology for long distance networking. Retrieved September 10, Improve your performance by utilizing our all-in-one cryptocurrency trading app. High-frequency trading allows similar arbitrages using models of greater complexity involving many more than four securities. Though the percentage of volume attributed to HFT has fallen in the equity markets , it has remained prevalent in the futures markets. Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur through who can execute them the fastest rather than who can create new breakthrough algorithms. Your Money. In short, the spot FX platforms' speed bumps seek to reduce the benefit of a participant being faster than others, as has been described in various academic papers. In particular, we will talk about links between Reinforcement Learning, option pricing and physics, implications of Inverse Reinforcement Learning for modeling market impact and price dynamics, and perception-action cycles in Reinforcement Learning. High-frequency trading has been the subject of intense public focus and debate since the May 6, Flash Crash. Such orders may offer a profit to their counterparties that high-frequency traders can try to obtain.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/options-text/optimal-high-frequency-trading-with-limit-and-market-orders-new-bitcoin-trading-app/