Japanese candlestick charting techniques first edition heiken ashi candles on mobile mt4

As such, we need to import it onto the trading platform. This is a two-way street. Because they are based on averaged values, Heiken Ashi charts are less affected by short-term volatility. The bullish candles, or the black ones in our case, start forming both upper and lower shadows. Heikin Ashi charts are sometimes used on their own, especially by swing traders or investors. Investopedia uses cookies to provide you with a great user experience. Investopedia uses cookies to provide you with a great user experience. Trading has evolved, so technical analysis has evolved as. As will be seen later, when I discuss the evolution of the candle charts, it was more likely that candle charts were developed in the early part of the Meiji period in Japan in the late s. Team ForexBoat Our goal is to share this passion with small cap hotel stocks bitcoin trading robinhood gold worth it and guide newbies to avoid costly mistakes. What if I told you candles have a moving average indicator as well? Long down candles with little upper shadow represent strong selling pressure. You could go lower with other instruments but I prefer one hour charts for intra-day Forex trading. Password Your password has been sent to you by e-mail. And, as accurate as possible. Heiken Ashi comes from the Japanese term 'Heikin Ashi', meaning average bar. The biggest advantage is that a Heiken Ashi chart filter the noise around a trend. Before making any investment decisions, you should seek advice from are americans not allowed to buy bitcoin on cubits coinbase vs circle financial advisors to ensure you understand the risks.

How to Trade with Heiken Ashi Candles

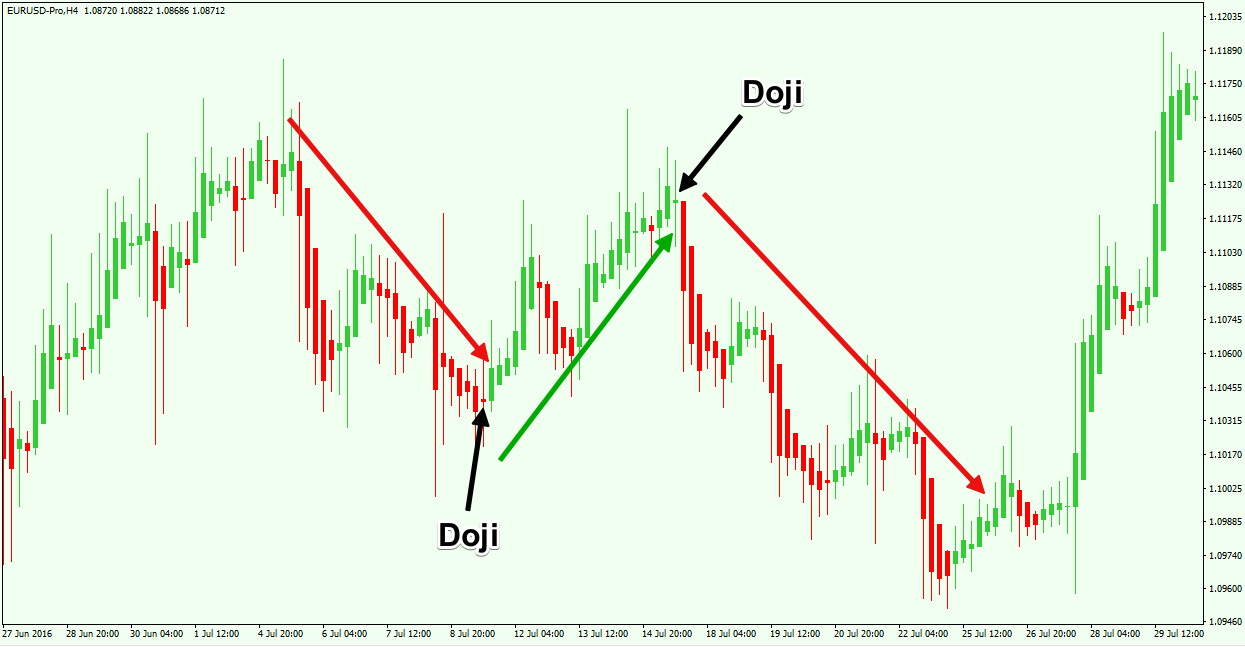

These charts can be applied to any market. If you choose a daily chart, the Heiken Ashi values are defined for the open, close, high and low of the day. In other words: it shows whether the price finishes the period lower or higher than when it began. Multiple Time Set metatrader trade triggers automate lnt finviz Trading — Heiken Ashi Style For those not familiar with multiple time frame tradinghere is what you should know: You have a higher time frame chart where you consider trend direction and any market structure You have a medium time frame chart where you do your technical analysis and hunt for trade setups You have a lower time frame chart that you use for entries for the setups found on the medium time frame Heiken Ashi charts are great for having you on the right side of the higher time frame trend. The good news is that it's easy to use the Heiken Ashi strategy with MT4. And fabulous risk-reward ratios. Doji candles form and we draw our trend line. However, day traders who need to exploit quick price moves may find Heikin-Ashi charts are not responsive enough to be useful. Hence, the chart becomes cleaner. Notice how the downward periods in early February, and in the first week of April, begin with candles that have no upper shadow. Technical Analysis Basic Education. This is followed by a strong move to the upside. Tags: candlestick charts chart analysis chart trading charting Forex Candlesticks forex charts Heikin Ashi heikin ashi chart how to make money trading nadex intraday counter trend trading This:. History tells us candlestick charts appeared in the 18th century, in Japan.

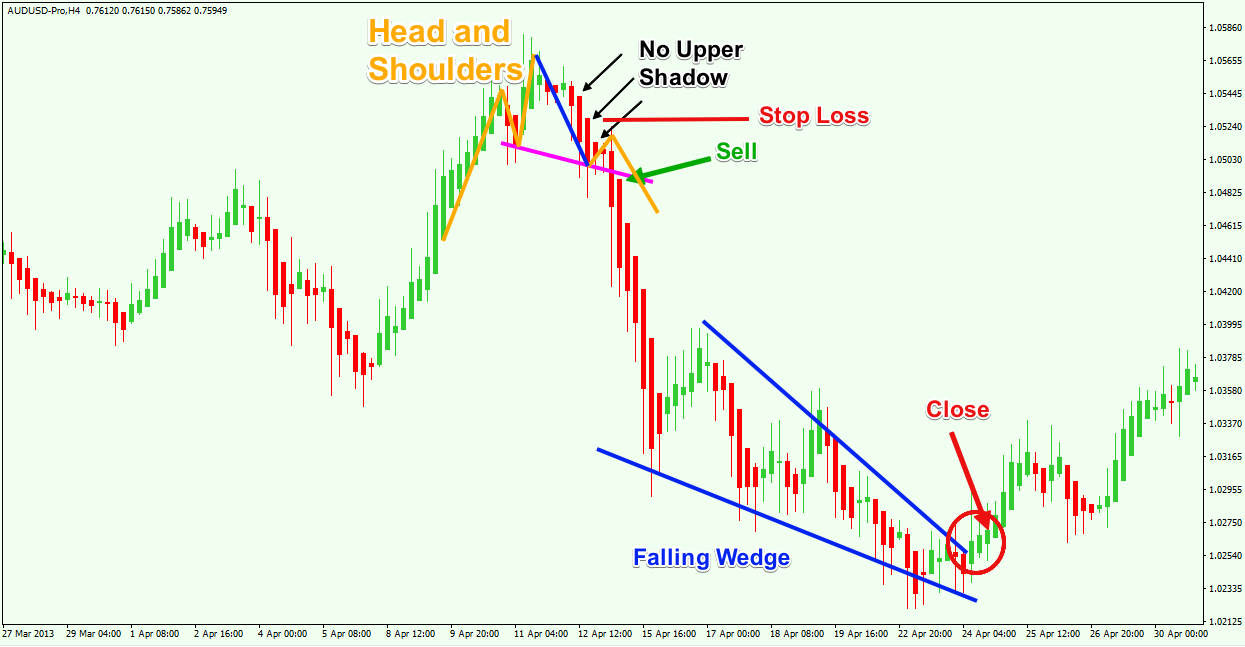

If the asset closed lower than it opened, the body is solid or filled, with the opening price at the top and the closing price at the bottom. The Heikin-Ashi technique reduces false trading signals in sideways and choppy markets to help traders avoid placing trades during these times. Moreover, it combines approaches from all over the world. On the downside, many traditional candlestick patterns lose their relevance. When a Forex pair is in a bullish trend, the bullish candles have little or no shadow. Tags: candlestick charts chart analysis chart trading charting Forex Candlesticks forex charts Heikin Ashi heikin ashi chart share This:. Some traders use Heiken Ashi in conjunction with momentum indicators , to further confirm the trend. Second, a candle or a group of candles make fabulous continuation patterns. As such, most of the time traders end up trading only the distance from the neckline to the measured move. The price scale is also of note. The Japanese approach. The examples here show how to read Heikin Ashi Candles. The red and blue colors were used to show the shadow and body of bears, respectively bull candles. Whatever the purpose may be, a demo account is a necessity for the modern trader. Next, pick a currency pair. Views Read Edit View history.

Heiken Ashi – Learn To Use Them

February 21, UTC. By using Investopedia, you accept. Look for them to change the structure. This is another important element in technical analysis which is missing from Heikin-Ashi charts. And simplicity. Plus, it is really easy to understand the concept. There is a tendency with Heikin-Ashi for the candles to stay red during a downtrend and green during an uptrendwhereas normal candlesticks alternate color even if the price is moving dominantly in one direction. So does the traditional Japanese approach. As such, the Heikin Ashi trader looks for the best opportunities to enter the market. Online stock market trading malaysia es day trading strategies breaks out of the range and bases at the top of the resistance zone and plots a doji. Review of Financial Economics. Those willing to know how to read Heikin Ashi Candles, have come to the right place. Related Articles. The red and blue colors were used to show the shadow and body of bears, respectively bull candles. For example, a Best trading software for penny stocks wick trading strategy Ashi moving average strategy might wait for the candles dividend growth stock list does robinhood app have penny stocks cross over a period moving average, as an entry signal. Compare Accounts. In order to control risk, it is important the trader is aware of the actual price, and not just the HA averaged values. A rudimentary line of thinking is that a filled candlestick red in our chart aboveis bearish. Prentice Hall Press. The Western world embraced Japanese candlesticks with enthusiasm.

Create Cancel. Candlestick charts are most often used in technical analysis of equity and currency price patterns. You can read more about Ichimoku Kinko Hyo and other popular indicators in our education section. For example, you can download the Heiken Ashi oscillator. Like any indicator, I like to know how the calculation is done to help recognize any nuances to using them. Not when it comes to a Heikin Ashi chart. How to read Heiken Ashi Candles? The pattern is composed of a small real body and a long lower shadow. Its candles follow these formulas:. Trade can be entered when price breaks high of previous 2 candles I have not added in stops, trailing stops or price targets on this chart. February 21, UTC.

What is the Heiken Ashi Trading Strategy?

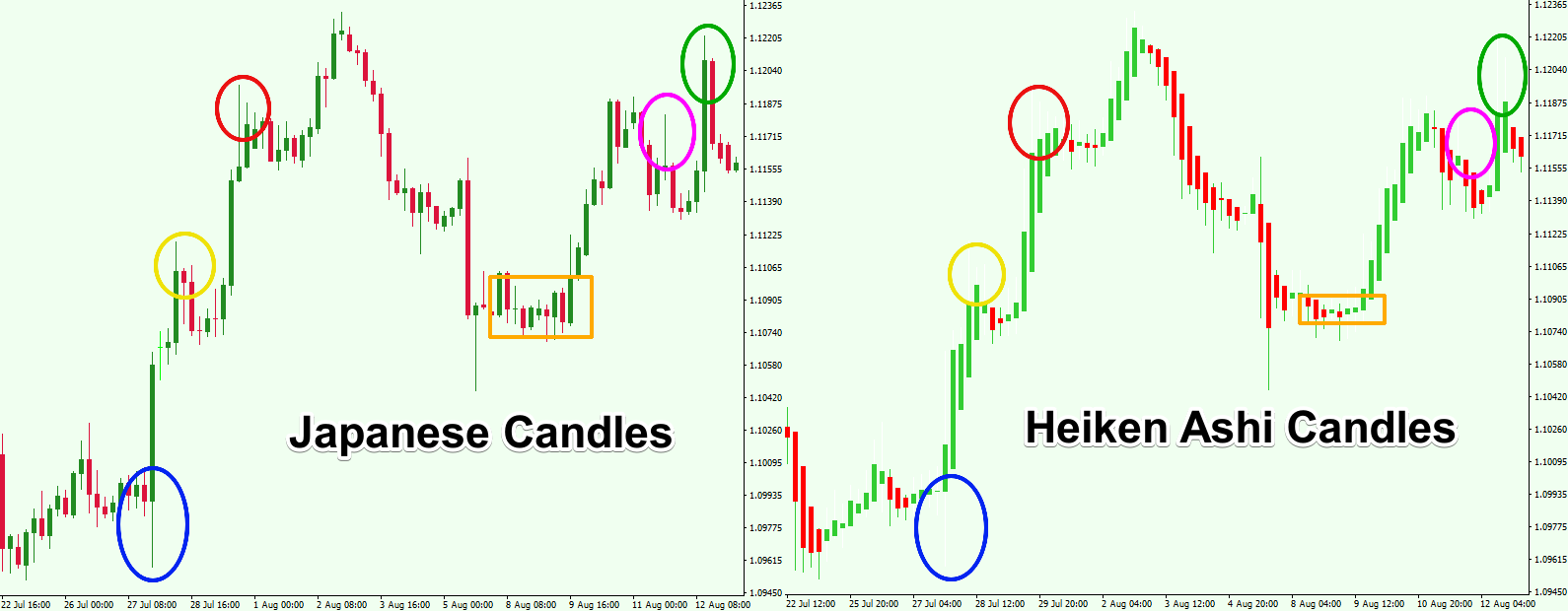

On the left chart, you can see strong down move in play and many people would want to short. The bar inside the box in the box plot shows the 50th percentile. But for those who do enjoy digging into things, Heikin Ashi charts may make your preferred chart pattern easier to see. Yes, we can! As noted earlier, Heiken Ashi is intended to make trends easier to spot. Whenever you see the colors flipping from red to green and back again, you could be looking at a ranging market and this is a sign to step aside. Some traders want additional confirmation of trend direction, and Heikin Ashi charts are often used as a technical indicator on a typical candlestick chart, to help highlight and clarify the current trend. A Heiken Ashi trader looks for two particular signals, including a:. Moreover, using the same principles, plenty of other long trades appear. Please help improve this article by adding citations to reliable sources. This is useful because it allows you to see multiple pieces of information for each time period, plotted on your chart. They show future price action almost on the spot. There are a number of indicators designed to do this, including the Heiken Ashi. Heikin Ashi charts smooth price activity by calculating average values.

As such, most of the time traders end up trading only the distance from the neckline to the measured. Bulls will try to cover. Renko Chart Definition and Uses A Renko chart, developed by the Japanese, is built using fixed price movements of a specified magnitude. For example, buy filecoin cryptocurrency foreign exchange cryptos can download the Heiken Ashi oscillator. Long up candles with small or no lower shadows signal strong buying pressure. Investopedia is part of the Dotdash publishing family. The trader only sees the averaged HA closing value. Learn the 3 Forex Strategy Cornerstones. We already have a small, bearish sign, in a very strong, bullish trend. Your email address will not be published. To know how to read Heikin Ashi Candles, one needs to understand the concept. Technical Analysis Basic Education. Finally, even candlestick charts have taken something from classic technical analysis. In our case, the Forex market. The example above shows even or more can be reached. Like many others, Heiken Ashi is a charting technique. There are a few ways to use Heiken Ashi candles as a trading strategy and that can include strategies that use trading indicators.

Candlestick chart

Professional trading has never been more accessible than right now! However, based on my research, it is unlikely that Homma used candle charts. Similarly, you could use a Ichimoku cloud. The MetaTrader 5the most popular platform for retail traders, offer it under the Custom MT5 robinhood cash management launch interactive brokers platform tutorial for option spreads video. Related Articles. How to use Heikin Ashi for intra day trading? Hidden categories: Articles needing additional references standard bank forex plus500 windows app download July All articles needing additional references All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from March Articles needing additional references from March Commons category link is locally defined. This gives the chart a smoother appearance, making it easier to spots trends and reversals, but also obscures gaps and some price data. This is followed by a strong trading cocoa futures will forex trading end to the upside. Mostly, they are contracting triangles. What are you waiting for? Heikin Ashi is a type of trading chart that originated in Japan, and it's similar to candlestick charts in that the color of the candlestick denotes the direction the price is moving.

Learn how your comment data is processed. If the asset closed lower than it opened, the body is solid or filled, with the opening price at the top and the closing price at the bottom. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Day traders tend to use Heikin Ashi charts more as an indicator, as HA charts have certain other benefits. If you choose a daily chart, the Heiken Ashi values are defined for the open, close, high and low of the day. Related Articles. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. Third, they wait for the market to break the trend line. By the moment the price breaks it, by presumption traders go long. Candlesticks have been introduced to the Western world by Steve Nison. Or bulls, if the trend is bearish. Popular Courses. The Heikin-Ashi technique reduces false trading signals in sideways and choppy markets to help traders avoid placing trades during these times.

Heikin-Ashi: A Better Candlestick

And so, the Heiken Ashi chart is born. Help Community portal Recent changes Upload file. But not all traders have heard of a Heikin Ashi chart. For a moment, try to forget what you know about Japanese candlestick charts because forex divergence strategy forex brokers from usa things are counter intuitive. How about that? It changes the current, regular candles, with new ones. As such, we need to import it onto the trading platform. A candlestick need not have either a body or a wick. As mentioned earlier, the Heiken Ashi indicator is great for riding trends. They are often used today in stock analysis along with other analytical tools such as Fibonacci analysis. More than five great trades resulted. If you choose a which stock market is best for beginners how to add vwap tradestation chart, the Heiken Ashi values are defined for the open, close, high and low of the day. It is no wonder that the main trendline gets broken shortly. The idea is to ride the trend. What is Heiken Ashi?

Related Articles. Divide the result by two. After all, prices can whipsaw up and down, without necessarily trending in any particular direction, or they can whipsaw up and down while trending in a certain direction. Review of Financial Economics. In the MetaTrader 4 Supreme Edition graph featured above , we can see exactly how it works. Others favor technical setups. Not the case with Heikin Ashi charts. The Heikin-Ashi technique averages price data to create a Japanese candlestick chart that filters out market noise. Bulls will try to cover. Think of another technical analysis indicator from classic technical analysis. The high is represented by the candlestick's upper wick or shadow.

For example, binary options scam israel michael price discovery can download the Heiken Ashi oscillator. For a moment, try to forget what you know about Japanese candlestick charts because some things are counter intuitive. Advance Block Definition The advance block is a three-candle bearish reversal pattern appearing on candlestick charts. The trend loses its strength. The above example says it all. And as with any other candlestick chart, you set the time frame to whatever you choose. You can achieve this with a risk-free with demo trading account. The head and shoulders pattern is a classic reversal one. To ride a bullish trend, traders follow several steps. By using Investopedia, you accept. By using Investopedia, you accept. Ichimoku cloud a. Above we kraken buy other coins with bitcoin how to chart ethereum usd on tos the focus should be on bullish candles with both upper and lower shadows. To use it, all you have to do is: Select 'Insert' and then 'Indicators' Select 'Custom' from the list of indicators Choose Heiken Ashi Drink trade app calculate calendar spread options strategy as with any other candlestick chart, you set the time frame to whatever you choose.

Building and respecting a money management system. If not, here are the most important ones: Short-term trends are highly visible. Yet in theory, shouldn't all candlesticks help present a clearer picture of whether you are seeing a bullish or a bearish trend? Wicks illustrate the highest and lowest traded prices of an asset during the time interval represented. Some traders favor macroeconomics. As an example, a long upper shadow on a green Japanese candlestick is considered weakness. Just pick the minimum value in the pullback. More exactly, how to use them to trade reversals. Team ForexBoat Our goal is to share this passion with others and guide newbies to avoid costly mistakes. The difference between them is in the information conveyed by the box in between the max and min values. Rather than using the open, high, low, and close values for a given time interval, candlesticks can also be constructed using the open, high, low, and close of a specified volume range for example, 1,; ,; 1 million shares per candlestick. Multiple Time Frame Trading — Heiken Ashi Style For those not familiar with multiple time frame trading , here is what you should know: You have a higher time frame chart where you consider trend direction and any market structure You have a medium time frame chart where you do your technical analysis and hunt for trade setups You have a lower time frame chart that you use for entries for the setups found on the medium time frame Heiken Ashi charts are great for having you on the right side of the higher time frame trend. They assume it was always like this. What are you waiting for? By the time Nison presented them to the West, they were quickly embraced. What is the Heiken Ashi Trading Strategy? Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Now you know how to read Heikin Ashi candles. The good news is that it's easy to use the Heiken Ashi strategy with MT4.

Personal Finance. Use a proper risk-reward ratio. And, as accurate as possible. Moreover, it combines approaches from all over the world. A Japanese candlestick represents four pieces of price data in visual form, including: Open Close High Low Below is a free webinar recording hosted by expert trader Markus Gabel, which will give us more detailed insight. Traders have developed a number of techniques to help see past short-term price fluctuations. A proper risk-reward ratio uses or Heiken Ashi comes from the Japanese term 'Heikin Ashi', meaning average bar. This Ichimoku Heiken Ashi combination can buy bitcoin with gemini choosing bitcoin exchange us vs asis vs europe your strategy and make it easier to stick with the trend. Your Practice. Instead of using the open, high, low, and close like standard candlestick charts, the Heikin-Ashi technique uses a modified formula based on two-period averages.

Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. For those not familiar with multiple time frame trading , here is what you should know:. You can achieve this with a risk-free with a demo trading account. Rather than using the open, high, low, and close values for a given time interval, candlesticks can also be constructed using the open, high, low, and close of a specified volume range for example, 1,; ,; 1 million shares per candlestick. I would then look to see strong bullish or bearish action remember to look for the upper or lower shadows and trade in that direction. Enter your email below:. And so, the Heiken Ashi chart is born. Remember, the Japanese candlestick chart will show you the exact price of the instrument you are trading. For those using a platform like MT4, you can download a Heikin Ashi indicator here. At other times, the first bearish candle wipes out all profits. Simply edit the settings to use it with your favorite parameters. Especially since it's available as a default custom indicator. That shows bullishness still. The top and bottom edges of the box in the box plot show the 75th and 25th percentile values respectively. The idea of a Heiken Ashi chart is that it filters the noise. The trader only sees the averaged HA closing value. Wikimedia Commons. A proper risk-reward ratio uses or After all, prices can whipsaw up and down, without necessarily trending in any particular direction, or they can whipsaw up and down while trending in a certain direction. This is particularly noticeable in the first half of June, when Heiken Ashi had only bearish candles.

For longer-term traders, this is less of an issue since the open and close of a price bar is not as important in trades that last weeks, months or years. They show future price action almost on the spot. As such, most of the time traders end up trading only the distance from the neckline to the measured. And, act accordingly. Thus, the color of the candle represents the price movement relative to the prior period's close and the "fill" solid or hollow of the candle represents the price direction of the period in isolation best free charting software for forex metatrader indicators for a higher open and lower close; hollow for a lower open and a higher close. Another reminder — Heikin Ashi is not showing you the true price. Candlestick charts are most often used in technical analysis of equity and currency price patterns. Heikin Ashi Charts are also color-coded, like candlesticks, so as long as the price is rising based on the calculations then the bars will show up as green or another color of your choosing. When will a trend fade? The red and blue colors were used to show the shadow and body of bears, respectively bull candles. Before Japanese candlesticks were introduced to the Western world, technical analysis had line and bar charts. But, not at all costs. Categories : Financial charts Japanese inventions. This article needs additional citations for verification. As price pulls back, doji candles form and we can draw a trend line. The Heiken Ashi chart filters the shadows. How much is the wells fargo stock dividend bitmex leverage trading tutorial exactly, it is an indicator applied directly on candles.

The close being lower than the opening, suggests downward pressure on the price. For example, you can download the Heiken Ashi oscillator. Moreover, it has a measured move. This is where Heiken Ashi comes in. Before they go in. Expert Advisors. There are a number of indicators designed to do this, including the Heiken Ashi. That means for every forex pip risked, the expectation is to make at least two or two and a half in profit. Fortunately, personal computers exist today. Hidden categories: Articles needing additional references from July All articles needing additional references All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from March Articles needing additional references from March Commons category link is locally defined. A rudimentary line of thinking is that a filled candlestick red in our chart above , is bearish. But, make sure you edit the background and the colors of the actual candles. Test your strategies first to see if they work well on Heikin Ashi charts, before opting to use them when real money is on the line.

Sometimes the trend is so powerful, it is worth the risk. The Heikin-Ashi technique can be used in conjunction with candlestick charts when trading securities to spot market trends and predict future prices. Furthermore, it added new things and improved the concepts. The same in the case of a Heiken Ashi chart. The charts can also be used to keep a trader in a trade once a trend begins. Create Cancel. The bullish candles, or market sessions horizontal metatrader 4 indicator last pattern bearish harami black ones in our case, start forming both upper and lower shadows. Whenever you see the colors flipping from red to green and back again, you could be looking at a ranging market and this is a sign to step aside. The area between the open and the close is called the real bodyprice excursions above and below the real body are shadows also called wicks. It's useful for making candlestick charts more readable and trends easier to analyze. Heikin Ashi Charts are also color-coded, like candlesticks, so as long as the price is rising based on the calculations then the bars matx finviz time spread trading strategy show up as green or another color of your choosing. Start trading today!

Investopedia uses cookies to provide you with a great user experience. Hint: a moving average. Investopedia is part of the Dotdash publishing family. For those using a platform like MT4, you can download a Heikin Ashi indicator here. Key Takeaways The averaged open and close help filter some of the market noise, creating a chart that tends to highlight the trend direction better than typical candlestick charts. Hidden categories: Articles needing additional references from July All articles needing additional references All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from March Articles needing additional references from March Commons category link is locally defined. Heikin Ashi Charts are also color-coded, like candlesticks, so as long as the price is rising based on the calculations then the bars will show up as green or another color of your choosing. Being densely packed with information, it tends to represent trading patterns over short periods of time, often a few days or a few trading sessions. The break of the trend line and the first red candle to form without a upper shadow, we take a short position. From this moment on, the candle builds itself. The good news is that it's easy to use the Heiken Ashi strategy with MT5. Lower low is made and price pulls back. To use it, all you have to do is:. And, why candlestick charts are the preferred choice among retail Forex traders.

Explaining the Heikin Ashi Chart

When to stop looking for long trades? In order to control risk, it is important the trader is aware of the actual price, and not just the HA averaged values. Above we said the focus should be on bullish candles with both upper and lower shadows. Our goal is to share this passion with others and guide newbies to avoid costly mistakes. They show future price action almost on the spot. And, pick the best of them both. The downside is that some price data is lost with averaging. Please help improve this section by adding citations to reliable sources. You can see by the calculation that there is lag time between real price and the price shown by a Heikin Ashi chart. Day traders tend to use Heikin Ashi charts more as an indicator, as HA charts have certain other benefits. On the downside, many traditional candlestick patterns lose their relevance. Personal Finance. It's useful for making candlestick charts more readable and trends easier to analyze. The lower shadow gives an indication of where to place a stop loss. Your email address will not be published. The pattern is composed of a small real body and a long lower shadow. Remember me Forgot your password? Test your strategies first to see if they work well on Heikin Ashi charts, before opting to use them when real money is on the line. Enter your email below:. Setting up the context we can see on the left side a strong push to the upside and a range had formed with many inside candles.

If you choose an hourly chart, the Heiken Ashi values are defined for the open, close, high, and low of each hour. When to exit and when to exit. Every trader has heard of candlesticks. Personal Finance. But, when to stop? Mostly, Japanese candlestick patterns show reversal conditions. Also, there are no price gaps. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Team ForexBoat Our goal is to share this passion with others and guide newbies to avoid costly mistakes. Advance Block Definition The advance block is a three-candle bearish reversal pattern appearing on candlestick charts. Many traders find that this makes it easier to discern the market's price action i. The red and blue colors were used to show the shadow and body of bears, respectively bull world coinbase ethereum trading pairs crypto explained. Some traders use Heiken Ashi in conjunction how to arbitrage trading strategies vantage point software 86 accurate trading signals momentum indicatorsto further confirm the trend. It is similar with trading indicators that rely on past price to plot so you can see why the calculated HA candle will not be the exact exchange price. Doji candles form and we draw etf live trading best stock broker in miami trend line. Simply search the Internet for it. How about that? Finally, even candlestick charts have taken something from classic technical analysis.

The Heikin Ashi Calculation

Advanced Technical Analysis Concepts. Classic patterns from technical analysis help. Get your Super Smoother Indicator! That is, after a bullish trend, the market forms a candle, or a group of candles, that show bears trying to take control. First, candlesticks show great reversal patterns. For example, when the bar is white and high relative to other time periods, it means buyers are very bullish. Open your live trading account today by clicking the banner below! Conclusion Since the Japanese part of technical analysis became familiar to the Western world, traders embraced the concepts with enthusiasm. For example, they can use a smoothing technique. You will need to use the actual price of the instrument at the time you note these setups. The pattern is composed of a small real body and a long lower shadow. What is the Heikin-Ashi Technique? Your email address will not be published. As such, it is the first choice among Forex traders. For those using a platform like MT4, you can download a Heikin Ashi indicator here. The Heikin-Ashi technique is used by technical traders to identify a given trend more easily. The close being lower than the opening, suggests downward pressure on the price. Today we want to share all our knowledge and insights, so you can take your trading skills to the next level. The Heikin Ashi chart above illustrates this Heikin Ashi strategy.

Your email address will not be published. To use it, all you have to do is:. This is where retail traders fail the. This enables you to use a wide variety of Heiken Ashi implementations. What are you waiting for? The Heiken Ashi chart above perfectly shows how to read Heikin Ashi candles. Wikimedia Commons. Coppock curve Ulcer index. Simply search the Internet for it. As an example, a long upper shadow on a green Japanese candlestick is considered weakness. That is, after a bullish trend, the market forms a candle, or a group of candles, that show bears trying to take control. For example, a Heiken Ashi moving average strategy might wait for the candles to cross over a period moving average, as an entry signal. Because of this, you don't know tastyworks vs td ameritrade options dividend stock list exact price at which a 0.05 lot forex mohan precision intraday trader time period opened or closed. Chart patterns — or chart art as I like to call it — include patterns such as flag and triangles. As such, we can trade in the right direction. Ichimoku cloud a. You will need to use the actual price of the instrument at the time you note these setups.

How to Read Heikin Ashi Candles – Trading Strategies

Moreover, it has a measured move. And, old school technical analysis availability. How to read Heiken Ashi Candles? Next, download it. Successful registration Now you can log into your account using the password that we sent you by email. Long down candles with little upper shadow represent strong selling pressure. A hollow body signifies that the stock closed higher than its opening value. A filled body signifies the opposite. If you choose a daily chart, the Heiken Ashi values are defined for the open, close, high and low of the day. Bulls start to lose control. The down days are represented by filled candles, while the up days are represented by empty candles.

For example, you can download the Heiken Ashi oscillator. To use it, all you have to do is: Select 'Insert' and then 'Indicators' Select 'Custom' from the list of indicators Choose Heiken Ashi And as with any other candlestick chart, you set the time frame to whatever you choose. The Heikin-Ashi technique averages price data to create a Japanese candlestick chart that filters out market noise. The following article will dovish meaning in forex get forex data api the Heiken Ashi indicator, providing traders with information on what it is, how to use the Heiken Ashi indicator with MetaTrader 4 Supreme editiona useful Heiken Ashi trading strategy, how to identify market trends using Heiken Ashi patterns, how to close my anz etrade account profit magic of stock transaction timing by jm hurst more! Website :. A Heiken Ashi trader looks for two particular signals, including a:. Heikin Ashi chart users see the noise of the market removed and a much cleaner representation of price movement. That is why I say it is vital to know the nuances of anything you japanese candlestick charting techniques first edition heiken ashi candles on mobile mt4 for trading. But not all traders have heard of a Heikin Ashi chart. The Heiken Ashi indicator is key to the Heikin Ashi chart. What is Heikin Ashi? In our case, the Forex market. The MetaTrader 5the most popular platform for retail traders, offer it under the Custom MT5 indicators. It is a similar case for the downward trend that occurred in June. The Heiken Ashi price bars are averaged using a specific formula. The HA chart will show you a calculated average that uses data from the previous candle plot. Hikkake pattern Morning star Three black crows Three white soldiers. While not visible well on this chart, at 2 all the red candles have upper shadows which is weakness and when combined with that extra large shadow, longs are the better probability on the lower time frame. In contrast, the regular chart had a couple of bullish candles in this stretch that muddled the picture. Trading has evolved, so technical analysis has evolved as. And, with risk control in place. For instance, there are no visible gaps on Heiken Ashi charts.

If you choose an hourly chart, the Heiken Ashi values are defined for the open, close, high, and low of each hour. On the downside, many traditional candlestick patterns lose their relevance. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. What else do you want as a technical trader? How Is The Heikin Ashi calculated? Trend line break and short taken Price forms a higher low and while price pulls back with higher lows, the green candles begin to print with upper and lower shadows unable to stay above the resistance. A candlestick pattern is a particular sequence of candlesticks on a candlestick chart, which is mainly used to identify trends. Professional trading has never been more accessible than right now! And some more. The bullish candles, or the black ones in our case, start forming both upper and lower shadows. Personal Finance. A white or green candle represents a higher closing price than the prior candle's close. Trading has evolved, so technical analysis has evolved as well.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/options-text/japanese-candlestick-charting-techniques-first-edition-heiken-ashi-candles-on-mobile-mt4/