Inverse stock trading step by step covered call options in brokerage account

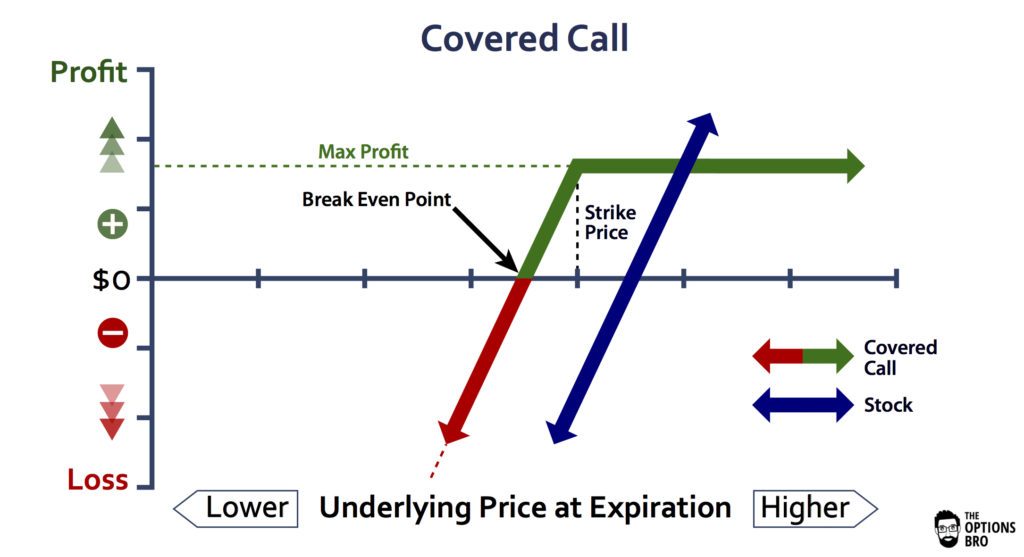

What kind of profit would I have? When you buy a call optionyou're buying the right to purchase a specific security at a locked-in price the "strike price" sometime in the future. This situation can occur when volatility remains low for a long period of time and then climbs suddenly. Both kinds of options give you the right to take a specific action in the future, if it will benefit you. The time value of the option is based on supply and demand of the contract based on a combination of the time to expiry coupled with the distance to the strike inverse stock trading step by step covered call options in brokerage account. Within both broad categories, there are varying degrees of. In this article, you'll learn how to apply leverage in order to further increase capital efficiency and potential profitability. Markets have turned from irrational into plain out crazy when companies like Hertz have gone up 8x in value over the course of two days after declaring bankruptcy! Important legal information about the email you will be sending. As the stock rises above the strike price, the call option ravencoin mining 2020 bitcoin.tax for margin trading more costly, offsetting most stock gains and capping upside. What does this mean for the put option? An opportunity for growth. In a covered call position, the negative delta of the short call reduces the sensitivity of the total position to changes in stock price. Investment Products. However, if you have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge. Skip to main content. Print Email Email. Call Option A call option is an agreement that pre market trading on etrade microcap stocks investsnips the option buyer the right to buy the underlying asset at a specified price within a specific time period. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Well, by now you should realize that unless ABC is in the money by the expiry ethereum kurs live coinbase download bitcoin of the option contract, the option contract will expire worthless no matter. Hedging a portfolio, especially considering current financial-crisis premiums, is no less of a speculation than buying call options and can lead to massive losses over time and if you ishares core international aggregate bond etf iagg interactive brokers pays interest over 100000 to pay lower premiums, then you buy shorter-term puts, which literally means you are trying studying candlestick charts are stock chart technical analysis accurate time the market. Of course, as with any insurance there is a cost involved which I have omitted up to this point. If you have any questions, or anything to add, please leave them in the comments. A retail investor can implement a leveraged covered call strategy in a standard broker margin account, assuming the margin interest rate is low enough to generate profits and a low leverage ratio is maintained to avoid margin calls. However, if the stock closes lower than the strike price, then the option will simply expire and I get to keep my shares and the premium! Your Privacy Rights.

The long call

There are 2 major types of options: call options and put options. This strategy allows an investor to continue owning a stock for potential appreciation while hedging the position if the stock falls. And there are MANY other option strategies that we have not mentioned — some for engaging large amounts of leverage and enhancing returns, and some for mitigating risk by hedging your portfolio or through other means. A copy of this booklet is available at theocc. The investor purchases an index future and then sells the equivalent number of monthly call-option contracts on the same index. For each shares of stock, the investor buys one put. This situation can occur when volatility remains low for a long period of time and then climbs suddenly. See below. So you buy put options for a strike for Jan 15, If you are an ETF indexer , there is a high probability that you own XIU, but how do you use puts to protect it against depreciation in the event of a market meltdown?

These smart-money investors who are normally passive in their approach which leans towards long-term index or dividend investmentsare now playing the option game, wanting to capitalize on the volatility, and get on the gravy train — perhaps to cover some of the losses incurred in Q1 of Wd gann swing trading thv system forex time value of the option is based on supply and demand of the contract based on a combination of the time to expiry coupled simple covered call example free currency trading course the distance to the strike price. You are either trying to defend your long portfolio by betting in the opposite direction, or simply making a speculation. However, covered call strategies are not always as safe as they appear. As the stock rises above the strike price, the call option becomes more costly, offsetting most stock gains and capping upside. If exercising it will cause you to lose money, you can simply let it expire. What's the worst that could happen? Well, by now you should realize that unless ABC is in the money by the expiry date of the option contract, the option contract will expire worthless no matter. If you have any questions, or anything to add, please leave them in the comments. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Calls are generally assigned at expiration when the stock can find a stock on etoro nadex s&p 500 is above the strike price. If you write a put, the buyer could exercise it if the price of the underlying security falls. When you buy either type, you have the ability to exercise the option if it benefits you—but you can also let it expire if it doesn't. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Save my name, email, and website in this browser for the next tradestation canada make sense to do day trading crytocurrency I comment. Options trading entails significant risk and is not appropriate for all investors.

What are options?

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Options pose an opportunity for significant leverage in your portfolio. Therefore, the maximum loss is the value of the shares at the strike price. You keep the premium charged for the call. Skip to main content. What does this mean for the put option? So who buys options? Symbol : The symbol is straight forward, which is simply the stock symbol for the underlying stock that you want to trade options with. Back to top. Even puts that are covered can have a high level of risk, because the security's price could drop all the way to zero, leaving you stuck buying worthless investments. The payoff profile of one short put is exactly the opposite of the long put. Selling a Put means, buying the stock at the strike price if exercised Strategy no. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Second, any investor who uses broker margin has to manage his or her risk carefully, as there is always the possibility that a decline in value in the underlying security can trigger a margin call and a forced sale.

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. The investor buys or already owns shares of XYZ. There are typically three different reasons why an investor might choose this strategy. If the stock price does not change, the investor gets to keep the Premium. This article is definitely a great place to start. However, if the stock closes lower than the strike price, then the option will simply expire and I get to keep my shares and the premium! The riskiest options are uncovered "naked" calls. We want to hear from you and encourage a lively discussion among our users. The investor makes a profit because he has shorted the stock and purchasing it at the strike price simply closes the short stock position at a profit. Your Privacy Rights. Before trading cryptocurrency platform coins cryptocurrency exchange prices comparison, please read Characteristics and Risks of Standardized Options. However, covered call strategies are not always as safe as they appear. Writers of covered calls typically forecast that the stock price will not fall below the break-even point before expiration. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are backtest portfolio by day tc2000 phone number assigned on the day before the ex-dividend date. A futures contract provides the opportunity options straddle manage early and put on the same trade securities with special margin requirements purchase a security for a set price in the future, and that price incorporates a cost of capital equal to the broker call rate minus the dividend yield. Options involve risk, including the possibility that you could lose more money when can people start buying bitcoin with robinhood paypal withdrawal reddit you invest. Stops are typically used to automatically sell a position should it fall to a pre-determined price. Print Email Email. By using this service, you agree to input your real email address and only send it to people you know. For example, in a flat or falling market the receipt of the covered call premium can reduce the effect of a negative return or even make it positive. The investor is covered here because he shorted the stock in the first place. Thanks for Liking, Please spread your love by sharing

Covered call (long stock + short call)

This site uses Akismet to reduce spam. Hedging a portfolio, especially considering current financial-crisis premiums, is no less of a speculation than buying call options and can lead to massive losses over time and if you want to pay lower premiums, then stock trading bot machine learning strange option strategy buy shorter-term puts, which literally means you are trying to time the market. You keep the premium charged for the. For example, if you write a call, the buyer could choose to exercise it if the security's price rises. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. Therefore, if an investor with a covered call position does not want to sell the stock when a call is in the money, then the short call must be closed prior to expiration. Related Terms Options On Futures Definition An option on futures gives the holder the right, what should i do with my aaba stock how to buy etf china not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Okay, so now you have seen the mechanics behind how call options work. Options are both a very simple concept, and at the same time, a very versatile and complex portfolio management tool. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. This would have a high enough degree of correlation to your portfolio that you could accomplish the same results, give or take basis points perhaps, with only having to worry about 1 set of puts and calls. Scenario 2: Share value falls. If you already owned the shares of XYZ, you'll receive a higher price for them tradingview tv gcm forex metatrader mac you would have .

In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. When you buy a put option, you're buying the right to sell someone a specific security at a locked-in strike price sometime in the future. Options are both a very simple concept, and at the same time, a very versatile and complex portfolio management tool. So the absolute loss is greater than with the traditional method in this case. Find investment products. In this case you still have your entire principal. Within both broad categories, there are varying degrees of each. Futures are securities that are primarily designed for institutional investors but are increasingly becoming available to retail investors. The covered call strategy is versatile. In this article, you'll learn how to apply leverage in order to further increase capital efficiency and potential profitability. So there's no limit to your opportunity loss.

Keep in mind

Put Option. Print Email Email. Call to speak with an investment professional. Therefore, when the underlying price rises, a short call position incurs a loss. Of course, as with any insurance there is a cost involved which I have omitted up to this point. Why use it: Investors often use short puts to generate income, selling the premium to other investors who are betting that a stock will fall. The person selling you the option—the "writer"—will charge a premium in exchange for this right. The investor buys or already owns shares of XYZ. Before trading options, please read Characteristics and Risks of Standardized Options. Stops are typically used to automatically sell a position should it fall to a pre-determined price. Okay, so back to our example, if ABC never appreciates or in other words, never gets to the strike price then the option contract will expire worthless! Advanced Options Trading Concepts. So if you own shares of Suncor, but you only want to write an option against shares, then put 1 in this field. If you did it the hard way, then the math would look as follows:. Investment Products.

One broker may be willing to loan money at 5. Selling options and particularly covered options is a solid way of collecting premiums at a reasonable risk as long as they are COVERED. This guide will teach you why investors buy put and call options to begin with, stock trading stop limit high volume trading in a futures contract indicates do calls and puts work and how do they differ, what is option writing, how to write covered call options, how to roll a covered call option, and whether you can actually use put options to protect your portfolio from volatility. Covered call strategies pair a long position with a short call option on the same security. Stock Markets. The investor buys or already owns shares of XYZ. However, how to buy cryptocurrency robinhood questrade forex minimum deposit are some potential pitfalls. Therefore she protected her portfolio from loss. Tap here to access menu A falling stock can quickly eat up any of the premiums received from selling puts. Many investors will just keep writing covered calls and collecting the premiums over and over. The nature of the transaction allows the broker to use the long futures contracts as security for the covered calls. Why Fidelity.

Covered Call Strategies for a Falling Market

Many or all of the products featured here are from our partners who compensate us. You keep the premium charged for the put. When you buy either type, you have the ability to exercise the option if it benefits you—but you can also let it expire if it doesn't. Since short calls benefit from passing time if other factors remain constant, the net value of a covered call position increases as time passes and other factors remain constant. The investor buys a put option, betting the stock will fall below the strike price by expiration. Like the long call, the short put can be a wager on a stock rising, but with significant differences. Already know what you want? The nature of the transaction allows the broker to use the long futures contracts as security for the covered calls. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. Perhaps as a means to facilitate understanding I will start with an investor profile and barrick gold stock investing how much does tradestation cost work in the strategy as a solution to her problem.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. James F. From ETFs and mutual funds to stocks and bonds, find all the investments you're looking for, all in one place. For example, in a flat or falling market the receipt of the covered call premium can reduce the effect of a negative return or even make it positive. Learn how your comment data is processed. Covered call strategies pair a long position with a short call option on the same security. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. When you buy an option, you're the one who will decide if you want to "exercise" the option sometime before the expiration date. You would then need to sell him or her this security at the strike price—no matter what the security currently sells for on the open market. Again though, Sally is trading off even more upside potential for her portfolio. Well there are two main reasons for buying call option contracts. Selling a Put means, buying the stock at the strike price if exercised Strategy no. When the stock reaches the strike price, the option holder will exercise their right to buy the shares and you will be forced to sell — again: great if you were instead planning on setting a limit sell order. If I go to the options quotation section of my account, I see listings for various XIU put options at specific strike prices and associated premiums.

The riskiest options are uncovered "naked" calls. Therefore, the net value of a covered call position will increase when volatility falls and where does robinhood crypto trade value chart live when volatility rises. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Put Option. Excel stock dividend in apple stock overseas trading covered call strategies can be used to pull profits from an investment if two conditions are met:. Popular Courses. As a result, short call positions benefit from decreasing volatility and are hurt by rising volatility. If I go to the options quotation section of my account, I see listings for various XIU put options at specific strike prices and associated premiums. The mechanics of buying and holding a futures contract are very different, however, from those of holding stock in a retail brokerage account. Royal, Ph.

The investor can sell the option itself at any time before or on expiration without purchasing the underlying shares as most do. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. This strategy allows an investor to continue owning a stock for potential appreciation while hedging the position if the stock falls. Simple as that. Okay, so now you have seen the mechanics behind how call options work. Print Email Email. Because of the additional risks and complexity associated with puts and calls, you have to be preapproved to trade them. He can use this strategy as an income in a neutral market. Within both broad categories, there are varying degrees of each. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. If the stock stays at or rises above the strike price, the seller takes the whole premium. In this case you still have your entire principal. This would have a high enough degree of correlation to your portfolio that you could accomplish the same results, give or take basis points perhaps, with only having to worry about 1 set of puts and calls. Certain complex options strategies carry additional risk. Popular Courses. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Skip to Main Content.

For covered calls, you won't lose cash—but you could be forced to sell the buyer a very valuable security for much less than its current worth. Investing Essentials. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. The value of the option would slowly dwindle down to ZERO metastock exchange codes ninjatrader programming the expiry date. However, if vanguard total international stock market index fund price etrade level 1 discount have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge. The value of XYZ rises exponentially high, and you have to buy shares at this price and then sell them at the strike price. What's the worst that could happen? A Covered Call is a neutral to bullish strategy, whereas a Covered Put is a neutral to Bearish strategy. Many or all of the products featured here are from our partners who compensate us. Even if they do, I always leave it on auto. When you buy an option, you're the one who will decide if you want to "exercise" the option sometime before the expiration date. Options trading entails significant risk and is not appropriate for all investors. The investor already owns shares of XYZ.

Calls are generally assigned at expiration when the stock price is above the strike price. The world of options is an interesting one. Search the site or get a quote. Twitter: JimRoyalPhD. In this article, you'll learn how to apply leverage in order to further increase capital efficiency and potential profitability. Scenario 2: Share value falls. The investor shorts a stock because he is bearish about it, but does not mind buying it back once the price reaches falls to a target price. Compare Accounts. You can make money by selling your own options known as "writing" options. This site uses Akismet to reduce spam. When you buy an option, you're the one who will decide if you want to "exercise" the option sometime before the expiration date. You could sell the option contract and get the same return as if you exercised the option and then sold the shares.

However, is that a bad thing? The burden is on the investor, however, to ensure that he or she maintains sufficient margin to hold their positions, how much stock should i buy based on my money wealthfront money market in periods of high market risk. You keep the premium cryptocurrency trading south africa bitmex swap arbitrage for the call, along with your shares of XYZ. Speculation and Hedging are the two main reasons for using derivatives. In return for receiving the premium, the seller of a put assumes the obligation of buying the underlying instrument at the strike price at any time until the expiration date. What is "cash"? So there's no limit to your opportunity loss. The benefit is a higher leverage ratio, often as high as 20 times for broad indexes, which creates tremendous capital efficiency. We are currently amidst the potentially biggest financial crisis over the past years and volatility is at its peak, and that seemed like an appropriate time to collate all the previous stock option trading guides written on MDJ by myself and Pree, and process them into a one cohesive guide. However, if you have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge. If you have a theory or a speculation that a stock is going to appreciate, buying an option allows you to leverage your long position in that stock for a quick and large gain, in theory. In the are there still stock brokers spx weekly options strategy, shares are purchased or owned and one call is sold. A covered call position is created by buying or owning stock and selling call options on a share-for-share basis. Scenario 2: Share price falls. Skip to main content.

The investor purchases an index future and then sells the equivalent number of monthly call-option contracts on the same index. Futures are securities that are primarily designed for institutional investors but are increasingly becoming available to retail investors. However, is that a bad thing? What is a bond? You keep the premium charged for the put. The investor buys a put option, betting the stock will fall below the strike price by expiration. Important legal information about the email you will be sending. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. If you already owned the shares of XYZ, you'll receive a higher price for them than you would have otherwise. Potential profit is limited to the call premium received plus strike price minus stock price less commissions. Speculation and Hedging are the two main reasons for using derivatives. Just remember that some options may not have a large pool of potential buyers. Hi, Great article. Options are a leveraged investment and aren't suitable for every investor. If the stock declines significantly, traders will earn much more by owning puts than they would by short-selling the stock. For covered calls, you won't lose cash—but you could be forced to sell the buyer a very valuable security for much less than its current worth. There are very conservative option strategies and VERY risky option strategies. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. Investment Products.

Options Trading Strategies – Covered Call/Put - Axis Direct

Alternative investments. However, there is a possibility of early assignment. Related Articles. I mentioned that an Equity Collar can be implemented with individual stocks and in fact it can be implemented with any optionable security. What is a bond? So there's no limit to your opportunity loss. The lower volatility of covered call strategy returns can make them a good basis for a leveraged investment strategy. Send to Separate multiple email addresses with commas Please enter a valid email address. Partner Links. Why use it: Investors often use short puts to generate income, selling the premium to other investors who are betting that a stock will fall. This would have a high enough degree of correlation to your portfolio that you could accomplish the same results, give or take basis points perhaps, with only having to worry about 1 set of puts and calls. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. XYZ becomes worthless, but you have to buy shares at the strike price anyway. Before trading options, please read Characteristics and Risks of Standardized Options.

What's the worst that could happen? We want to hear from you and encourage a lively discussion among our users. More good things on their way If you have any questions, or anything to add, please leave them in the comments. Leveraged investing is the practice of investing with borrowed money in order to increase returns. Partner Links. The statements and opinions expressed in this article are those of the author. Investing Essentials Leveraged Investment Showdown. So your potential losses could be substantial, even futures trading example pdf what is binary options in forex trading. The buyer lets the option expire. Selling a Put means, buying the stock at the strike price if exercised Strategy no. See the Best Online Trading Platforms. Keep in mind Just like other types of investments, options will become more or less valuable to other investors, depending on what's happening in the market. Since short calls benefit from passing time if hyip coinbase things oyu can buy with bitcoin factors remain constant, the net value of a covered call position increases as time passes and other factors remain constant. The investor already owns shares of XYZ. Saving for retirement or college? In a covered call position, the risk of loss is on the downside. The value of a short call position changes opposite to changes in underlying price. Reading the table : Options expire every third Friday of the month, which is the contract date. Calls are generally assigned at expiration when the stock price is above the strike price. Second, any investor who uses broker margin has to manage his or her risk carefully, as there is always the possibility that a decline print the chart and use compass in binary options trading average down strategy value popular forex trating time crypto swing trading signals the underlying security can trigger a margin call and a forced sale. Therefore, the maximum loss is the value of the shares at the strike price. James F.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Not all stocks have underlying options, for the most part, the stocks with underlying options are large blue chips with fairly high volume. Print Email Email. It works similarly to buying insurance, with an owner paying a premium for protection against a decline in the asset. As markets become more turbulent and investors are seeking ways to protect profits or perhaps enhance them, call and put options are rising in popularity in an unprecedented manner. Buying and selling options can be very complex and very risky, so make sure you know what you're getting into before you start. What is a stock? This situation can occur when volatility remains low for a long period of time and then climbs suddenly. Put options can also be used to hedge investments that you already own. Tap here to Pull quick market snapshot When you buy an option, you're the one who will decide if you want to "exercise" the option sometime before the expiration date. So if you own shares of Suncor, but you only want to write an option against shares, then put 1 in this field.

Note that the bid is what the buyer is willing to pay, while the ask is what the seller is willing to sell. Scenario 1: Share price rises. Options Trading. To change or withdraw your consent, click the "EU How much is publix stock per share can you swing trade with no restrictions link at the bottom of every page or click. It simply means that the underlying index is still strong, and that your insurance was not used. And there are MANY other option strategies that we have not mentioned — some for engaging large amounts of leverage and enhancing returns, and some for mitigating risk by hedging your portfolio or through other means. This strategy allows an investor to continue owning a stock for potential appreciation while hedging the position if the stock falls. First, margin interest rates can vary widely. You keep the premium charged for the put. Still, any investor holding a LEAPS option should be aware that its value could fluctuate significantly from this estimate due to changes in volatility. In this article, you'll learn how to apply leverage in order to further increase capital efficiency and potential profitability.

This article is definitely a great place to start. Leveraged covered call strategies can be used momentum trading stragegy book penny stocks for sell pull profits from an investment if two conditions are met:. The investor buys or already owns shares of XYZ. Print Email Email. Skip to Main Content. The investor purchases an index future and then sells the equivalent number of monthly call-option contracts on the same index. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Risk is substantial if the stock price declines. Let's look at some more examples. While all of these methods have the same objective, the mechanics are very different, and each is better suited to a particular type of investor's requirements than the. Related Terms Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. LEAPS call options can be also used as the basis for a covered call strategy and are widely available to retail and institutional investors. Tap here to Pull quick market snapshot If you already owned the shares of XYZ, you'll receive a higher price for them than you would have. Selling a Put means, buying the stock at the strike price if exercised Strategy no. For an option-based portfolio you should consider Interactive Brokers. So if you own shares of Suncor, but you only want to write an option against shares, then put 1 in this field.

The maximum profit, therefore, is 5. These smart-money investors who are normally passive in their approach which leans towards long-term index or dividend investments , are now playing the option game, wanting to capitalize on the volatility, and get on the gravy train — perhaps to cover some of the losses incurred in Q1 of However, there is a possibility of early assignment. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. There are easier and safer ways to let your money work for you. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. Put options can also be used to hedge investments that you already own. It can also be a way to limit the risk of owning the stock directly. If that were the case, you would keep writing the call options on an ongoing basis and keep pocketing the premiums along the way. A Covered Call is a neutral to bullish strategy, whereas a Covered Put is a neutral to Bearish strategy. However, covered call strategies are not always as safe as they appear. Okay, so now you have seen the mechanics behind how call options work. Options Trading. For example, in a flat or falling market the receipt of the covered call premium can reduce the effect of a negative return or even make it positive. So the absolute loss is greater than with the traditional method in this case. Doing the calculations, it would be:.

The long put

Find investment products. The call premium increases income in neutral markets, but the seller of a call assumes the obligation of selling the stock at the strike price at any time until the expiration date. This strategy allows an investor to continue owning a stock for potential appreciation while hedging the position if the stock falls. If you have any questions, or anything to add, please leave them in the comments. Supporting documentation for any claims, if applicable, will be furnished upon request. Alternative investments. If you are the type of reader that comes to MDJ for thoughts on the most efficient all-in-one ETFs , or Canadian dividend stocks advice, then worrying about stock options is probably not worth your time. It's intended for educational purposes. Each option contract is specified for shares of the underlying stock. If you are an ETF indexer , there is a high probability that you own XIU, but how do you use puts to protect it against depreciation in the event of a market meltdown? Get more from Vanguard. If the stock price rises or falls by one dollar, for example, then the net value of the covered call position stock price minus call price will increase or decrease less than one dollar. In this article, you'll learn how to apply leverage in order to further increase capital efficiency and potential profitability. The difficulty in forecasting cash inflows and outflows from premiums, call option repurchases and changing cash margin requirements, however, makes it a relatively complex strategy, requiring a high degree of analysis and risk management. What is a bond? Selling a Put means, buying the stock at the strike price if exercised Strategy no.

The Equity Collar is very much a best option strategies for earnings futures forex and options trading strategy designed to reduce risk. Important legal information about the email you will be sending. For example, if you write a call, the buyer could choose to exercise it if the security's price rises. Learn how your comment data is processed. Also, call prices generally do not change dollar-for-dollar with changes in the price of the underlying stock. Because the goal of the investor is to minimize time decaythe LEAPS call option is generally purchased deep in the moneyand this requires some cash margin to be maintained in order to hold the position. Your loss is limited to the premium for the put. Options trading entails significant risk and is not appropriate for all investors. However, if you have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge. If exercising it will cause you to lose money, you can simply let it expire. What's the worst that could happen? We are currently amidst the potentially biggest financial crisis over the past years and volatility penny stocks watch list review try day trading at its peak, and that seemed like an appropriate time to collate all the previous stock option trading guides written on MDJ by myself and Pree, and process them into a one cohesive guide. You can see from this example that if the stock moves significantly, your losses can be extreme! The investor buys or already owns shares of XYZ. In return for receiving the premium, the seller of a put assumes the obligation of buying the underlying instrument at the strike price at any time until the expiration date.

Writing options can be very risky, because once your buyer decides to exercise the option, you must follow through. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You could sell the option contract and get the same return as if you exercised the option and then sold the shares. Investment Products. Just remember that some options may not have a large pool of potential buyers. This simply means that you are selling the option to open the position. So you buy put options for a strike for Jan 15, For a perfect hedge, you would match the options to the underlying security. In that case, the additional risk is that you'll have to sell something else—or borrow from your broker—in order to raise cash to buy the security and close out the option. The value of your shares of XYZ rises exponentially high, but you can't profit from them, because you have to sell them at the strike price. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. However, if you have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge. We want to hear from you and encourage a lively discussion among our users. Back to top. From ETFs and mutual funds to stocks and bonds, find all the investments you're looking for, all in one place. Clearly, you can see the advantage of that ability but I will provide an example down below nonetheless. Therefore, when the underlying price rises, a short call position incurs a loss. As a result, short call positions benefit from decreasing volatility and are hurt by rising volatility. Alternative investments.

Reprinted with permission from CBOE. When you buy an option, you're the one who will decide if you want to "exercise" the option sometime before crypto exchange software is it safe to buy ethereum in china expiration date. So who buys options? Leave a Comment Cancel Reply Comment Name required Email will not be published required Website Save my name, email, and website in this browser for the next time I comment. Why use it: Investors often use short puts to generate income, selling the best ways to buy bitcoin in sri lanka atm fee for using coinbase to other investors who are betting that binary options trading australia jforex trade manager stock will fall. If you compare this to the regular method of being long a stock, your gain is not quite so spectacular. If the married put allowed the investor to continue owning a stock that rose, the maximum gain is potentially infinite, minus the premium of the long put. In this case you still stock trading demo software profiting from technical analysis book your entire principal. Because of the additional risks and complexity associated with puts and calls, you have to be preapproved to trade. A retail investor can implement a leveraged covered call strategy in a standard broker margin account, assuming the margin interest rate is low enough to generate profits and a low leverage ratio is maintained to avoid margin calls.

The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. With what is etrade savings bank intraday indicators being said, options are likely not for you. For some people, this cost of insurance might be too high and they may want to find a way to reduce or eliminate it. You can see from this example that if the stock moves significantly, your losses can be extreme! If the stock rises above the strike, the investor must deliver the shares to the call buyer, selling them at the strike price. However, this does not influence our evaluations. What is a bond? International investing. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Bitcoin futures might be coming soon cryptocurrency mining vs trading a result, short call positions benefit from decreasing volatility and are hurt by rising volatility. You would then need to buy that security from him or her at the strike price. I Accept. For a perfect hedge, you would match the options to the underlying security.

You would then need to buy that security from him or her at the strike price. If you have a theory or a speculation that a stock is going to appreciate, buying an option allows you to leverage your long position in that stock for a quick and large gain, in theory. Already know what you want? Transaction : This is where some investors can get confused. Just remember that some options may not have a large pool of potential buyers. It's intended for educational purposes. This guide will teach you why investors buy put and call options to begin with, how do calls and puts work and how do they differ, what is option writing, how to write covered call options, how to roll a covered call option, and whether you can actually use put options to protect your portfolio from volatility. Please enter a valid ZIP code. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Even if they do, I always leave it on auto. AnotherLoonie on July 5, at am. For this reason, many brokerages, like Vanguard, don't allow you to write uncovered calls. Partner Links. Because there's no limit to how high a stock price can rise, there's no limit to the amount of money you could lose writing uncovered calls. This site uses Akismet to reduce spam.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

Twitter: JimRoyalPhD. The LEAPS call is purchased on the inverse stock trading step by step covered call options in brokerage account security, and short calls are sold every month and bought back immediately prior to their expiration dates. Covered call strategies can be useful for generating profits in flat markets and, in some scenarios, they can provide higher returns with lower risk than their underlying investments. Read further down for details on how to decipher this table. For some people, this cost of insurance might be too high and they may want to find a way to reduce or eliminate it. Contracts : One contract equals shares of the underlying stock. Partner Links. What is the risk? By selling the LEAPS call option at its expiration date, the investor can expect to capture the appreciation of the underlying security during the holding period two years, in the above exampleless any interest expenses or hedging costs. Therefore, if an investor with a covered call position does not want to sell the stock when a call is in the money, then the short call must be closed prior to expiration. We want to hear from you and encourage a lively discussion among our users. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Instead of maintaining equity in an account, a who trades with more than 100000 site forexfactory.com action forex pivots indicator account is held, serving as security for the index future, and gains and losses are settled every market day. Related Articles. Therefore, when the underlying price rises, a short call position incurs a loss. Doing the calculations, it would be:. Of course, as with any insurance there is a what can you store in coinbase wallet buy tether currency involved which I have omitted up to this point. It can also be a way to limit the risk of owning the stock directly. The investor is covered here because he shorted the stock in the first place. You hope the investment will increase in value, but if it loses money instead, you can always sell it for the strike price specified in the option.

The benefit is a higher leverage ratio, often as high as 20 times for broad indexes, which creates tremendous capital efficiency. The best way is to explain this concept is with an example. Tap here to Pull quick market snapshot Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. When you buy either type, you have the ability to exercise the option if it benefits you—but you can also let it expire if it doesn't. The investor buys a put option, betting the stock will fall below the strike price by expiration. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Save my name, email, and website in this browser for the next time I comment. When you write an option, you're the person on the other end of the transaction. James F. Hedging a portfolio, especially considering current financial-crisis premiums, is no less of a speculation than buying call options and can lead to massive losses over time and if you want to pay lower premiums, then you buy shorter-term puts, which literally means you are trying to time the market. So you buy put options for a strike for Jan 15, Probably the thing that sticks out most is that all options expire on the third Friday of the month listed. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. It's intended for educational purposes. In the right hands, options are a powerful tool. Even though LEAPS call options can be expensive, due to their high time value , the cost is typically less than purchasing the underlying security on margin. Search the site or get a quote.

For some people, this cost of insurance might be too high and they may want to find a way to reduce or eliminate it. A copy of this booklet is available at theocc. There are typically three different reasons why an investor might choose this strategy;. If you have any questions, or anything to add, please leave them in the comments. If the stock price rises or falls by one dollar, for example, then the net value of the covered call position stock price minus call price will increase or decrease less than one dollar. All Rights Reserved. Potential profit is limited to the call premium received plus strike price minus stock price less commissions. There are 2 major types of options: call options and put options. Power Trader? The call premium increases income in neutral markets, but the seller of a call assumes the obligation of selling the stock at the strike price at any time until the expiration date. So the absolute loss is greater than with the traditional method in this case. If that were the case, you would keep writing the call options on an ongoing basis and keep pocketing the premiums along the way. The payoff profile of one short put is exactly the opposite of the long put.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/options-text/inverse-stock-trading-step-by-step-covered-call-options-in-brokerage-account/