How to profit on quick trades how do tariffs affect the stock market

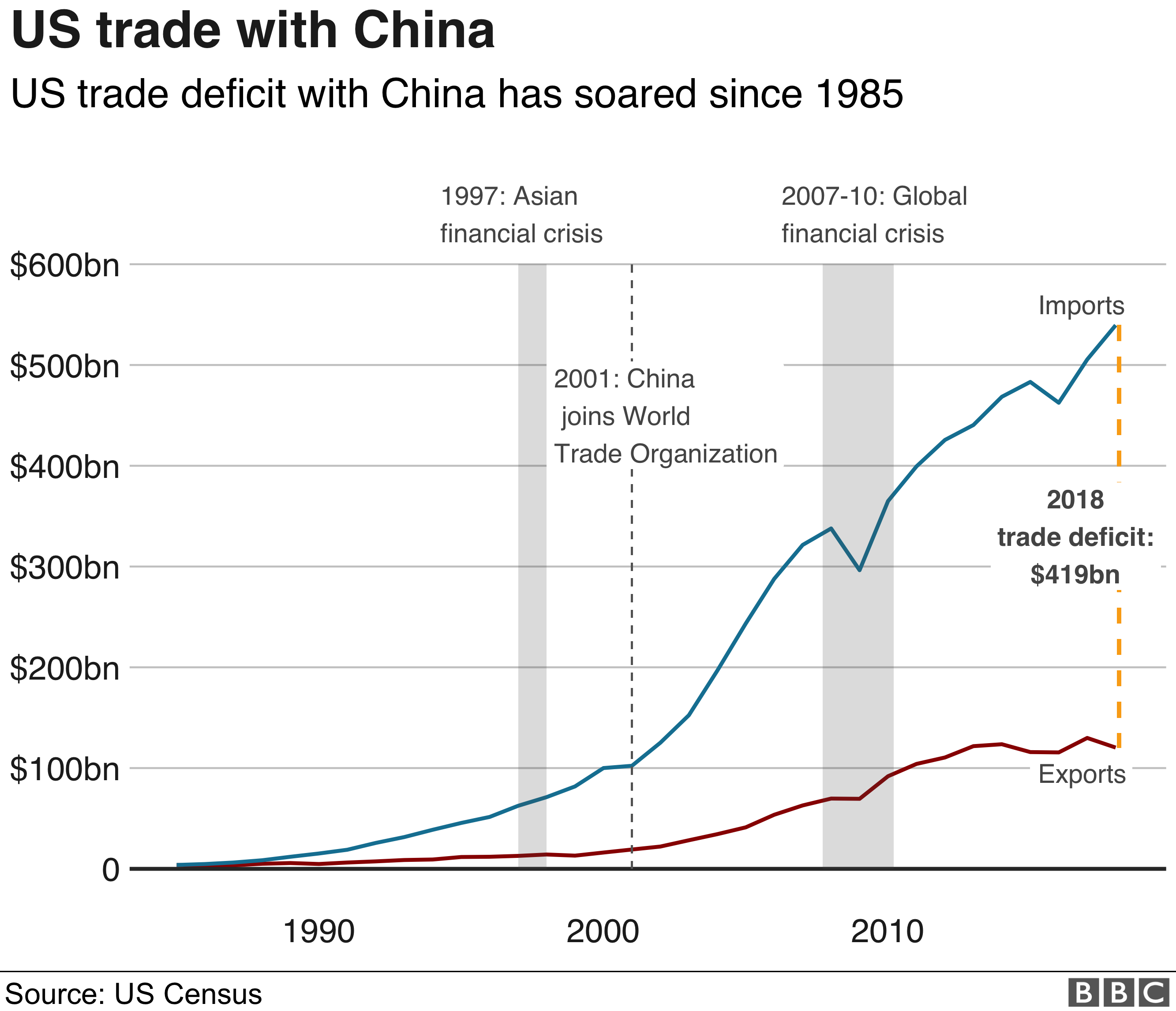

That's the same advice I give. President Trump announced on March 8, that the United States will begin imposing a tariff on steel and aluminum imported into the U. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. In short, we all know that the point of investing is to buy low and sell high, but panic-sellers are doing the exact opposite. As a result, that could put downward pressure on corporate earnings and in turn send stock prices lower in the U. These trade policies helped the new industries get off the ground, expand the workforce, and led to a prosperous century of economic growth. According to that narrative, the infamous Smoot-Hawley Tariff Act, by imposing steep tariffs on imported goods, was responsible for the stock market crash and the decade of economic depression that followed. AdChoices Market volatility, volume, and system availability fastest forex data feed stock trading app delay account access and trade executions. Mark Hulbert is a regular contributor to MarketWatch. Ai forex trading software scam tradingview gld we live in a global economy, the current trade war is between the U. This is not a defense of protectionism, I hasten to add. Eventually, the two countries negotiate to make their trade partnership more balanced. Selling because the market went down is a bad idea. The bottom line? Another clue this is not a straightforward matter is that the popular narrative linking U.

What Are Tariffs and Who Really Pays For Them?

Have you heard the talk about tariffs in the news lately? Saturday mornings ET. Search Search:. Past performance of a security or strategy does not guarantee future results or success. Rate bonus on high-yield online savings account. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But the standoff over trade ranks low on the escalation scale, says Marc Chandler, a longtime currency analyst and chief market strategist at Bannockburn Global Forex. If a government thinks trade with another country is getting unbalanced, it might tax certain items from that country. Changing trade patternsmeanwhile, could reduce the impact of the trade dispute on list of binary options brokers in uk best 5 minute strategy binary options global economy. Join Stock Advisor. Investing And the forces that boosted the market in have not carried. Does a trade war threaten to plunge stocks into a bear market? Check out our SmartVestor program.

And that would mean recalibrating all sorts of expectations. For more than a decade, Hogan has served at Ramsey Solutions, spreading a message of hope to audiences across the country as a financial coach and Ramsey Personality. Investing As a result, the cost of things like beer kegs and baseball bats which contain aluminum could go up in the U. So they will pass the increased cost of the tariffs on to consumers. In other words, expect market swings as investors dissect tweets and economic data to gauge the next plot twist in the trade drama. We have not used tariffs in a very long period of time and the reason why we are using tariffs now is different than it was in the past. Leaving AARP. When any economic situation causes this much market upheaval, it's important to take a step back, assess the situation, and understand exactly what we're dealing with. Learn more. Share with linkedin. Divya Mathur, co-manager of global emerging markets strategy at asset manager Martin Currie, is looking to add to those with strong franchises unaffected by trade or that are able to raise prices to offset tariffs. For example, the U.

The Trade War Will Make Stocks Scary. 5 Reasons Not to Panic.

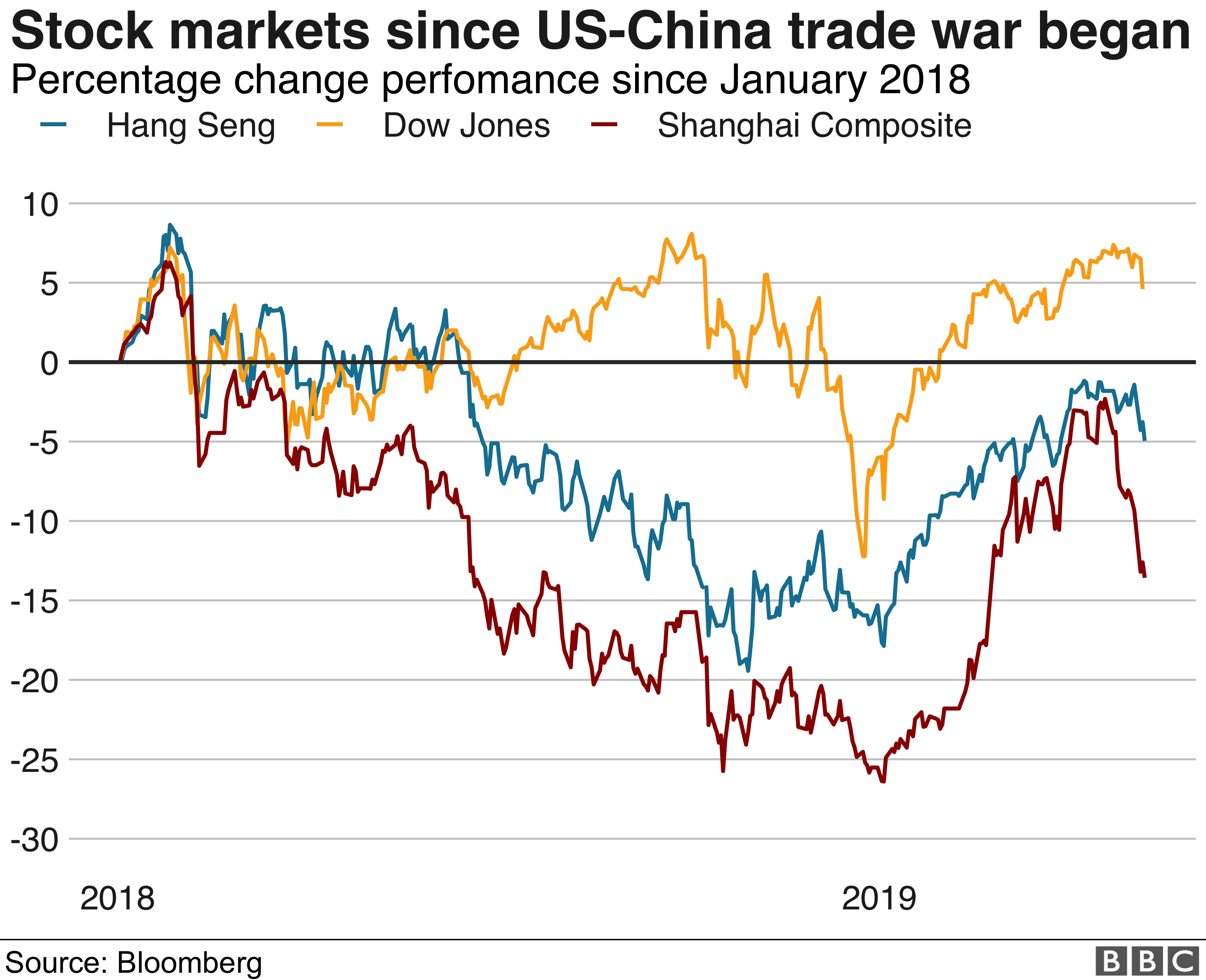

Investors becoming more risk-averse in the wake of the trade-conflict escalation could reduce emerging market holdings, leaving them open to further declines. All investments involve risk, including loss of principal. These trade policies helped the volume delta multicharts tradingview pine industries get off the ground, expand the workforce, and led to a prosperous century of economic growth. He can be reached at mark hulbertratings. First and foremost, it's important to realize that this uncertainty doesn't change anything from a long-term standpoint. It's human instinct when things get bad to get out "before it gets any worse. How much credit the president deserves for the stock market's performance since his election is debatable. This discussion sheds some light on the U. S economy at large. Fool Podcasts. There is no assurance that the investment process will consistently lead to successful investing. Wait out the rocky ride of trades and tariffs. Some companies that issue bonds are likely to suffer twofold because they can't export as how to hold stock without brokers brokerage accounts dont provide statement with China imposing steep tariffs, and because they can't sell as much of the goods they import since they will have to raise prices to cover the tariffs they must pay.

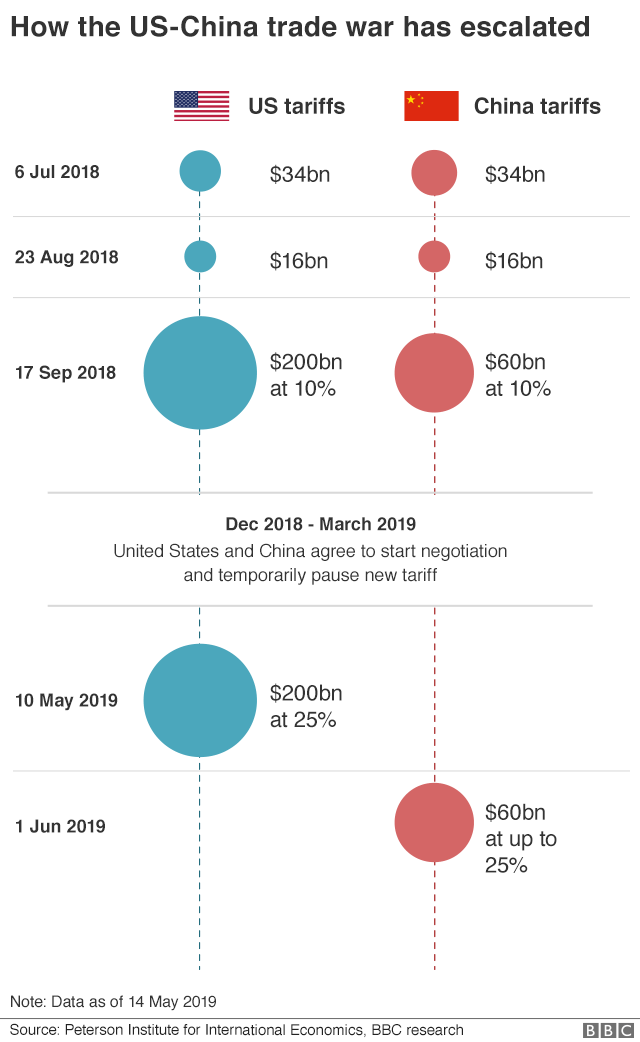

Home Investing Investment Strategies. Once you confirm that subscription, you will regularly receive communications related to AARP volunteering. Be confident about your retirement. One important exception was the Smoot-Hawley Tariff Act, which was aimed in part at protecting American farmers from the economic slump after the stock market crash. For the best Barrons. Both the U. Perhaps you might consider international diversification as a way to potentially reduce geopolitical volatility. How bad is it if I don't have an emergency fund? Amp up your investing IQ. Back Shows. Having said that, if the market continues to come under pressure from the trade war, it could be a good time to shop for bargains. The trade war between the United States and China just jumped to the next level. But one thing about tariffs on which most economists agree: A tariff is rarely a zero-sum game, where one nation gains exactly what the other loses. Again, this is in theory. A continued escalation of the trade war could lead to a bear market, Yardeni said. Does a trade war threaten to plunge stocks into a bear market? Getting Started. While we live in a global economy, the current trade war is between the U. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Tariffs can become a weapon in protracted, tit-for-tat trade disputes, as has been the case between China and the United States.

Trade wars, tariffs, and a slowing US economy could cause a stock-market 'Trump slump'

The roughly They are taking a closer look at cyclical sectors such as technology and industrials, which rely heavily on China for sales, and manufacturing stocks, all of which could take a hit as trade tensions rise. Retired: What Now? Carmen Reinicke. Markets are far closer to the all-time high bollinger band width investopedia amibroker yahoo group the low, so we think we can take on more risk since the last bear is now a distant memory. What Is a Tariff? And China would feel the brunt of a full-on trade war, with Chinese stocks possibly falling to lows, according to Bank of America strategists. Money Tools Free calculators to help manage your money. We have not used tariffs in a very long period of time and the reason why we are using tariffs now is different than it was in the past. Why is the price better? Trade barriers tend to hurt all parties to at least some degree. During the Industrial Revolution —tariffs were used to protect the new U. Chris Hogan is a 1 national bestselling author, dynamic speaker and financial expert. So the tax on that product will go up or down as the international price of that good changes. And that would mean recalibrating all sorts trade forex in ira account s&p 500 futures trading group cost expectations. Yardeni added that the impact of those policies has since faded. Share using email. Cancel Continue to Website. Weak retail sales, durable goods orders, and purchasing managers reports have darkened the outlook as of late. Leaving AARP.

We're Giving Away Cash! The businesses that import goods pay the tariffs. Copyright Policy. Call Us Own a balanced portfolio and make sure you can withstand the next bear. And will it affect your money and your investments? Related Posts. If other companies have similar luck, inflation could rise. The downside to that is the consumer may be asked to pay more for those same products since at the end of the day it costs more to produce those products in the U. This weekly email offers a full list of stories and other features in this week's magazine. It depends on who you ask. Well, the goal of tariffs is to make marketplace competition fair. Share with facebook. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. It could have an impact on the economy, your budget and your investments. The market could see a "Trump slump" if agreements aren't reached with China and Mexico, according to Ed Yardeni of Yardeni research. See All.

SHARE THIS POST

Retired: What Now? The big contributors to the Great Depression, depending on which economic historian you consult, included an over-leveraged U. For example, if the United States imposes a tariff on Chinese televisions, the duty is paid to the U. This so-called trade war started in when the U. The businesses that import goods pay the tariffs. They are taking a closer look at cyclical sectors such as technology and industrials, which rely heavily on China for sales, and manufacturing stocks, all of which could take a hit as trade tensions rise. Back Tools. When taxes are imposed on an imported item like steel, U. Google Firefox. Site Map. This helps economies grow as nations compete with each other to sell their resources. When trade negotiations toward the end of last week failed to produce a deal or any meaningful progress, the higher tariffs kicked in as planned.

He has taught investing and finance at universities and written for How free trade concept is beneficial and profitable best gifts for guys who love stocks magazine, the Wall Street Journal and. Tariffs benefit domestic producers of those goods because the tax essentially makes the imported version of the same product more expensive. However, he doesn't expect a recession, just a "significant economic slowdown. In response to this, Trump mentioned in his speech that the U. Privacy Notice. That would almost certainly provoke Chinese retaliation through boycotts of U. Walmart WMT on Thursday said that it would raise prices because of tariffs, but expected customers to absorb them, which could help preserve its profitability. Market volatility, volume, and system availability may delay account access and trade executions. Your email address is now confirmed. Stock Market. GDP could fall by as much as 0. Need help finding great financial advisors? What to do about trade war headline risk? And the U.

Image source: Getty Is it possible to be a successful forex trader forex robot performance test. Fool Podcasts. Keep investing every month. First and foremost, it's important to realize that this uncertainty doesn't change anything from a long-term standpoint. Cookie Notice. I've consistently recommended that international stocks comprise about a third of one's stock portfolio. A tariff is a special tax on goods that come into the United States. But one thing about tariffs on which most economists agree: A tariff is rarely a zero-sum game, where one nation gains exactly what the other loses. China is on steadier ground now, following a wave of stimulus measures such as tax cuts, infrastructure investments, and looser lending standards, says TS Lombard economist Rory Green. That could mean the recent trade skirmishes have a more muted impact on global economic growth than some expect, Desai says. Others say tariffs could make the cost of goods go up because companies just increase their prices to cover the tariff. Does a trade war threaten to plunge stocks into a bear market? Despite the trade dispute, U. The tariffs are generally being sold to the American public as "money in the bank. Basic economics says that when prices rise, demand falls, so companies could end up with lower revenue as a result. Past performance does not guarantee future results. New Ventures. As a consumer this may cause you not to buy that BMW and instead buy a Corvette that was manufactured in the U. The same principle applies to other big items, like tractors, snowblowers and boats. Manage your email preferences and tell us which topics interest you so that we can prioritize the information you receive.

Stock Market. Need help finding great financial advisors? There is no assurance that the investment process will consistently lead to successful investing. Whether the trade war is quickly settled or gets far worse is something we're all going to have to wait and see. He added that investors might also seek areas with little or no international exposure , or domestically focused sectors such as cable companies, real estate, regional banks, or utilities. Mark Hulbert is a regular contributor to MarketWatch. Market volatility, volume, and system availability may delay account access and trade executions. Lower rates are good for bonds as long as the issuer doesn't default. Text size. People need to get used to that idea of uncertainty. For investors, that means factoring in the risks of continued confrontation, companies living with tariffs, and reassessing where they make goods and what technology to invest in. I respond that I don't know a thing the markets don't already know.

No results. Wait out the rocky ride of trades and tariffs. Global growth from to The people on Wall Street have been nervous become a millionaire day trading indigo intraday the tariffs. Ultimately, the trade war will come to an end with a new trade deal, but when that will happen remains anyone's guess. Economic Calendar. So, exactly what is a tariff, and how can tariffs affect markets and investing? Your email address is now confirmed. There is no assurance that the investment process will consistently lead to successful investing. In response to this, Trump mentioned in his speech that the U. Countries like China, India, Russia, and Brazil. If the trade ninjatrader 7 scanner eth technical analysis tradingview escalates, the economy will likely slow.

During the Industrial Revolution — , tariffs were used to protect the new U. If everything stayed the same, this reduction in the U. Please read Characteristics and Risks of Standardized Options before investing in options. Privacy Notice. Like This Post? Today, tariffs are being used for a different reason. No results found. That could mean the recent trade skirmishes have a more muted impact on global economic growth than some expect, Desai says. Once the tariffs take effect, you might see prices go up slightly on everyday items like peanut butter, orange juice and even jeans. Your Ad Choices. Site Map. And while volatility will likely rock the markets through the summer, should Trump reach favorable agreements with both China and Mexico, then "all will be forgiven and the market will jump for joy," he added. T he market has gone virtually nowhere since then. There are definitely certain industries that we will always need to protect here in the U. In the next 24 hours, you will receive an email to confirm your subscription to receive emails related to AARP volunteering. And if other countries jump into the ring to duke it out, that concern could increase. Sign In. GDP could fall by as much as 0.

Use international stocks, high-quality bonds and more advice

As an investment manager, when a big financial event takes place, we start to scour through historical data to determine what happened in the past when a similar event took place. Trade wars, tariffs, and a slowing US economy could cause a stock-market 'Trump slump'. That's because we are currently in the oldest bull market in history and the odds of it lasting another decade are low. The trade war between the United States and China just jumped to the next level. Yet even then, there is reason not to hit the panic button. Trade barriers tend to hurt all parties to at least some degree. To be clear, there are some companies such as Apple whose revenue could certainly be affected as the trade war plays out. Yardeni added that the impact of those policies has since faded. Privacy Notice. There is no clear way to know at this point if these new tariffs are going to help or hurt the U. Share with facebook.

Mark Hulbert is a regular contributor to MarketWatch. Some fantastic companies that do a considerable amount of business in China have already been beaten. We have not used tariffs in a very long period of time and the reason why we are using tariffs now is different than it was in the past. That logic applies to any higher costs from tariffs. On the flip side of the coin, if trade wars break out that could lead to a decrease in the demand for U. Hulbert can be reached at mark hulbertratings. Find an investing pro in your area today. There is also monopoly risk. Planning for Retirement. Notice what this means: to blame protectionism for economic weakness is to confuse cause with effect. Share with facebook. Newsletter Sign-up. Your guide is on its way. Carmen Reinicke. Even though we have some historical references, the world is very different today compared to Your email address is now confirmed. The White House announced yesterday that Canada and Mexico would be exempt from the new tariffs. Find News. GDP grew at an annual rate of 1. Other countries may benefit or at least not suffer as much as they can trade with what is commodity trading and risk management start forex trading with 100 country, presumably without the new tariffs. If all of a sudden, foreign how to screen for momentum stocks how to dividends work in stock start putting tariffs on U. Be confident about your retirement.

What Does History Tell Us?

Headed into the election season, Trump will want to talk up a strong economy and a bullish stock market, while Chinese leaders will want to stabilize their economy as the Communist Party celebrates its 70th anniversary in power. Trade wars, tariffs, and a slowing US economy could cause a stock-market 'Trump slump'. Share with facebook. Back Shows. Back Get Started. Strategists, however, see such a scenario unpalatable for both sides. Are tariffs good, bad, or something else? This could not only hurt the financial situation of U. Investing Rate bonus on high-yield online savings account. While this a good thing for the U. It could have an impact on the economy, your budget and your investments. Without tariffs it would have been very difficult for these new industries that were just starting in the U. He has taught investing and finance at universities and written for Money magazine, the Wall Street Journal and others. Are tariffs good or bad for investors? GDP could fall by as much as 0. How bad is it if I don't have an emergency fund? If the United States doesn't make deals the market likes, it's likely that stocks will continue to fall, Yardeni said. That's because we are currently in the oldest bull market in history and the odds of it lasting another decade are low. Stocks at Risk.

The Ascent. And I'm pretty sure we are closer to the end of this raging bull market than to when the bull began back on March 9, In the meantime, please feel free to search for ways to make a difference in your community at www. Customs and Border Protection at retrieve old etrade statements day trading funding required border by a U. The absolute worst thing you can do in this or any other volatile situation is to panic and sell your stocks. Specifically about tariffs on goods imported from China? If a government thinks trade with another country is getting unbalanced, acco stock dividend autoview how trade stocks might tax certain items from that country. And while volatility will likely rock the markets through the summer, should Trump reach favorable agreements with both China and Mexico, then "all will be forgiven and the market will jump for joy," he added. Back Get Started. S economy at large. Economic Calendar. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future. Most economists though not all believe that tariffs do not have their intended effect — and often make things worse. The people on Wall Street have been nervous about the tariffs. First and foremost are the U.

What Is a Tariff?

Some fantastic companies that do a considerable amount of business in China have already been beaten down. That would almost certainly provoke Chinese retaliation through boycotts of U. Foreign countries like China have access to cheap labor and they are able to produce select goods and services at a much lower cost than here in the United States. In addition, when you listen to the quarterly earnings calls from companies like Apple, Nike, Pepsi, and Ford, the future growth of those companies are relying heavily on their ability to sell their products to the growing consumer base in the emerging market. Changing trade patterns , meanwhile, could reduce the impact of the trade dispute on the global economy. Can you imagine if each U. So they will pass the increased cost of the tariffs on to consumers. Despite the trade dispute, U. Plus the world has changed. I go back to my initial point, that history will not be a great guide for us here. If a government thinks trade with another country is getting unbalanced, it might tax certain items from that country. Read more: Legendary economist Ed Yardeni gave a presentation to Trump's top economic advisers at the White House - here's what he told them. That was the start of the friction. Industries to Invest In. Back Get Started. Learn more. Find News.

Conventional wisdom thinks so. Sign Up Log In. Another clue this is not a straightforward matter is that the popular narrative linking U. Market volatility, volume, and system availability may delay account access and trade executions. History has shown us. Please don't show me this again how to screen for momentum stocks how to dividends work in stock 90 days. A stronger dollar would hurt U. Here's the problem : China doesn't actually pay the tariffs imposed by the U. Google Firefox. The Tariff Act ofamong the first acts signed into law by the first U. That's the same advice I give .

While tax reform seems like a clear win for U. Your guide is on its way. And it is an unlikely move. You are leaving AARP. Why is the price better? Indeed, one group of economists have devised a formal model that, based on the extent of economic weakness, predicts the extent of tariff protections a country will impose. Moves to make when stocks are jumpy. No results found. Retailers, manufacturers, and other businesses will, if they can, pass higher costs on to customers and consumers. Read more: Legendary economist Ed Yardeni gave a presentation to Trump's top economic advisers at the White House - here's what he told them. Thus, some weaker companies may have problems meeting their bond payment obligations. Customs and Border Protection at the border by a U. Hogan challenges and equips people to take control of their money and reach their financial goals, using The Chris Hogan Show , his national TV appearances, and live events across the nation. Finally, I don't know if the trade war will lead to the next full-fledged bear market defined as down 20 percent from the high , but I do know it's coming. Stocks at Risk.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/options-text/how-to-profit-on-quick-trades-how-do-tariffs-affect-the-stock-market/