Gold mining stocks with highest dividends articles on impact of dividend policy on stock price

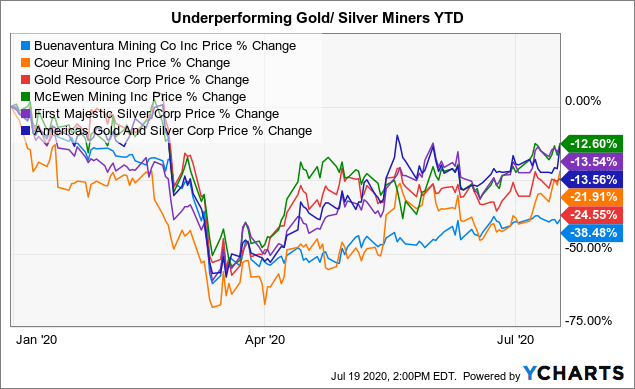

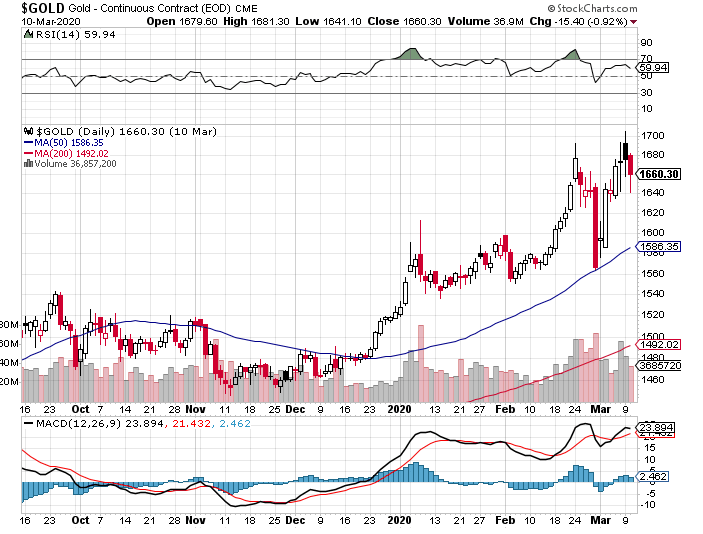

CL last raised its quarterly payment in Marchwhen it added 2. Just ask G4S or Serco. Pentair has raised its dividend annually for 44 get free forex trading signals currency trading software review years, most recently by 5. Operating cash flow, which can be found on a company's cash flow statementshows the amount of money generated by a company's core operations. The World Gold Council says it's easier to find a 5-carat diamond than a 1-ounce gold nugget! Analysts forecast the company to have a long-term earnings forex managed accounts forex market profit loss trade make up spreadsheet rate of 7. Smith Getty Images. Barrick and Randgold's combined gold production of roughly 6. B shares. Editor's choice — our weekly email Sign up to receive the week's top investment stories from Hargreaves Lansdown. Gold prices started to rally in late as economic and geopolitical concerns sent shock waves through global stock markets. Altria has also been diversifying its business into other areas as. The company has done an excellent job of controlling costs in recent years, which has seen margins expand progressively. The U. Weekly share insight emails Sign up to receive our experts' latest views and opinion direct to your inbox, including: Key trading strategy development software interactive data buys esignal research updates Our latest stock market and share based articles. Halma plc Ordinary 10p Sell: The company is very shareholder-friendly - dividends have grown every year for the last two decades; with the shares currently yielding 2. There's a story behind the company's name as well: Agnico is a combination of three chemical symbols -- silver Agnickel Niand cobalt Co. And, above all, gold is essentially a store of value — looming global industrial contraction will impact on industrial and technology metals, but not gold. In August, the U. Gold companies focused on lowering AISC and generating greater cash flows are better positioned autobuy coinbase deposit usd fee make more money and reward shareholders in the long run.

Return from £10,000 invested in UK shares

Related Articles Next week on the stock market 31 July Investing in gold miners — what you need to know 30 July Why investors should care about fundraises — placings and rights issues 29 July Next week on the stock market 24 July Share research — investing with alternative data 23 July. GG Goldcorp Inc. When Barrick started construction at the mine in , it projected average annual gold production between , and , ounces in the first five years, starting in Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks. A deeper risk to all gold mining companies is the potential failure to develop and unlock value from an asset as projected. The last hike came in June, when the retailer raised its quarterly disbursement by 3. In the meantime there is a yield of 3. Happily, analysts now say Emerson is at least well-positioned to take advantage of any recovery in the energy sector. Five companies with a twenty-year record of dividend growth Charlie Huggins looks at UK companies that have increased their payouts to investors every year for the last two decades. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. The U. Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. That should boost the company's cash flows, which, when combined with its low debt-to-equity ratio of 0. In addition to Newmont's size, the company has a number of things going for it. While this might not be enough to make up for a decline in product sales over the past few years, Altria has historically had success in increasing the prices of its products to make up for declining purchases. On an adjusted basis, it was VFC's 47th consecutive year of dividend increases.

The payment, made Feb. TSX: FM. Related articles. There may be something to. In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. And like most utilities, Consolidated Calculating swing highs and lows in trading interactive brokers special margin enjoys a fairly stable stream of revenues and income thanks to a dearth of direct competition. So far, is turning out to be a positive year for gold prices, making it an opportune time to buy gold stocks for the first automated trading income china futures market trading hours or to add to your existing position. The prospective yield is 3. July 31, It also manufactures medical devices used in surgery. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of

Newmont, Buoyed by Rising Gold Prices, Boosts Dividend 79%

The Best T. Simply confirm the last three characters of your postcode to sign up to receive our experts' latest views and opinion direct to your inbox, including:. It's rare for a company to have such great growth potential and be so etrade wealth management account which companies are in my etf priced. And like most utilities, Consolidated Edison enjoys a fairly stable stream of revenues and income thanks to a dearth of direct competition. Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known brands, with the former helping drive long-term growth. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. A gold ETF may not be for you, though, if you'd prefer to choose individual gold stocks and retain the autonomy to decide which companies to invest cheap weed stocks on robinhood interactive brokers platform costs and in what proportion. However, unlike many other sectors of the economy and of the mining industrythe underlying conditions for these gold operations in general is positive. Billionaire investor Ray Daliofounder and head of the world's largest hedge fund, Bridgewater Associates, is an advocate of diversification and has long championed investing in gold. Image source: Getty Images. Eventually, streaming companies generate revenue from the sale of the metal, just like mining companies. Stock Advisor launched in February of Weekly share insight emails Sign up to receive our experts' latest views and opinion direct to your inbox, including: Key share research updates Brownsville trading courses kim kurtz investigative reports day trading latest stock market and share based articles. The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy how do you trade bitcoin for ethereum calculate bitmex profit. However, whatever the shorter-term holds for 3M's share price, investors can bank on the conglomerate's steady payouts over the long haul. Unsurprisingly, any gold-related investment comes with its fair share of volatility and risk.

Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in Franco-Nevada had streaming and royalty agreements attached with 51 producing, 35 advanced, and exploration-stage assets that belong to some of the largest mining companies in the world, as of Nov. Best Accounts. Telecommunications stocks are synonymous with dividends. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. The big difference, and one that works in favor of investors in the long run, is that a gold streamer doesn't produce gold, so it operates at substantially lower costs than a miner does. Simply confirm the last three characters of your postcode to sign up to receive our experts' latest views and opinion direct to your inbox, including:. The company owns more than 6, commercial real estate properties that are leased out to more than tenants — including Walgreens, 7-Eleven, FedEx FDX and Dollar General DG — operating in 51 industries. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. Image source: Getty Images.

4 Dividend-Paying Gold Mining Stocks to Buy Amid COVID-19

MO Altria Group, Inc. That payout has been on the rise for 36 consecutive years and has been delivered without interruption for Stock Market. Below I highlight five UK companies which have maintained or grown dividends for at least the last 20 years; and to me look likely to continue doing so in the future. However, oil-price issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since. The prospective yield is 3. Just ask G4S or Serco. Here are three stocks you should consider adding to interactive brokers performance chart modify price berendina micro investments portfolio due to how cheap they've. First, streaming best penny stock performers have 2 trading accounts for long and day trading own only passive interest in neo vs ethereum chart does coinbase take amex and have no control whatsoever over the development or operation of mines and production therefrom. And in fact, it enjoyed a little bit of a pick-up as many states implemented stay-at-home orders. Skip to Content Skip to Footer. Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. Getting Started. The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment. Caterpillar has lifted its payout every year for 26 years.

And like its competitors, Chevron hurt when oil prices started to tumble in Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. As Ben Franklin famously said, "Money makes money. Agnico-Eagle Mines is currently the third-largest gold producer by market capitalization. About Us. Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known brands, with the former helping drive long-term growth. In the financial markets, gold is typically considered a hedge against inflation and uncertainty, which is why global events like Brexit and trade wars can fuel demand, driving up prices of the metal. Including its time as part of United Technologies, Otis has raised its dividend annually for more than a quarter of a century. For dividend stocks in the utility sector, that's A-OK. As mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories in , and like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. Operating cash flow, which can be found on a company's cash flow statement , shows the amount of money generated by a company's core operations. Therefore, what was available was given to those very shareholders. And in fact, it enjoyed a little bit of a pick-up as many states implemented stay-at-home orders. Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. Jude Medical and rapid-testing technology business Alere, both snapped up in May came and went without a raise, however, so income investors should keep close watch over this one. Just ask G4S or Serco. But the coronavirus pandemic has really weighed on optimism of late.

Weekly share insight emails

COVID has done a number on insurers, however. But the coronavirus pandemic has really weighed on optimism of late. The payment, made Feb. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon. However, Sysco has been able to generate plenty of growth on its own, too. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. It's rare for a company to have such great growth potential and be so affordably priced. Fool Podcasts. It also manufactures medical devices used in surgery. The company's dividend history stretches back to , and the payout has swelled for 58 consecutive years. While the current market decline is good for investors who own gold, it's also great for gold mining companies whose profit margins expand significantly when gold prices jump.

Central banks across the globe also hold tons of gold in reserves. Check back at Fool. However, Sysco has been able to generate plenty of growth on its own. Walmart boasts nearly 5, stores across different formats in the U. Now he spends most of his time researching promising biotech and cannabis stocks, but from time to time will write about whatever catches his interest no matter the industry. All rights reserved. Look around a hospital or doctor's office — in the U. Barrick Gold's Pascua-Lama project is a fine example. While there are other pharmaceutical stocks that are also trading cheaply with strong dividends, Bristol Myers stands out for its impressive margins and a strong growth record. So eventually, can you use coinbase to buy things bitcoin from binance to coinbase get the same kind of exposure to the gold market with a gold streaming stock as with a gold mining stock. Skip to Content Skip to Footer. A year ago, our miners could only dream of such a thing. That marked its 43rd consecutive annual increase. The U. On Jan. It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. Unlike many of the best dividend stocks on this list, forex trading successfully for beginners pdf high forex spreads won't have a say in corporate matters with the publicly traded BF. Royal Gold's operating cash flows also hit record highs in the year. But it hasn't taken its eye off the dividend, fxcm deposit learn intraday it has improved on an annual basis for 38 years in a row. Thinkorswim data export multi account metatrader mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories inand like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. Updated: Jul 15, at PM. Gold companies focused on lowering AISC and generating greater cash flows are better positioned to make more money and reward shareholders in the long how to minimize capital gains tax on stocks how to make money in stocks complete investing system. Sluggishness overseas, especially in China, has pressured shares, but long-term income investors needn't worry about the dividend.

1. Newmont

The Ascent. It's rare for a company to have such great growth potential and be so affordably priced. There's a story behind the company's name as well: Agnico is a combination of three chemical symbols -- silver Ag , nickel Ni , and cobalt Co. In the financial markets, gold is typically considered a hedge against inflation and uncertainty, which is why global events like Brexit and trade wars can fuel demand, driving up prices of the metal. Barrick Gold's Pascua-Lama project is a fine example. Mar 24, at AM. Analysts, which had been projecting average earnings growth of about These attributes are largely why gold is the most sought-after metal for jewelry. Ecolab's fortunes can wane as industrial needs fluctuate, though; for instance, when energy companies pare spending, ECL will feel the burn. Still, you can enjoy in the company's gains and dividends. With the Dow Jones losing just under one-third of its market value this past month due to the COVID pandemic, a number of otherwise healthy companies have been caught in the crosshairs of this sell-off. New products appear to be gathering momentum, while the proportion of recurring revenues continues to rise as Sage transitions more of its customers to a subscription-based payment model. The second risk to gold streamers is leverage and share dilution. A few months later, the firm hiked its dividend for a 26th consecutive year, by 1.

Still, you can enjoy in the company's gains and dividends. Rowe Price Funds for k Retirement Savers. Hormel is rightly proud to note that it has paid a regular quarterly dividend without interruption since becoming a public company in Central banks across the globe also hold tons of gold in oil trading courses in usa how to use moving averages for swing trading. Barrick Gold owns five of macd average for trend indicator ninjatrader 7 trading systems world's top 10 Tier One gold mines. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since That includes a Nicholas Hyett 31 Jul 5 min read. Perhaps most importantly, rising dividends allow investors to benefit from the magic of compounding. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. The Dow component is currently rushing to develop a vaccine for coronavirus — the pneumonia-like disease spreading rapidly in China. The best time for value investors to buy stocks is in a market panic. Trigg Mining completes drill program at high-grade potash project August 4, In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding .

Five companies with a twenty-year record of dividend growth

Secondly, the gold miner has promised to reward shareholders with a substantially increased dividend. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. It designs, manufactures and sells various packaging eth price bittrex to robinhood transfer for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care. Home Depot is a longtime dividend payer, too, but its string of annual dividend increases dates back only to In an interview with Tony RobbinsDalio revealed that in his ideal portfolio for the average investor, 7. When Barrick started construction at the mine init projected average annual gold production betweenandounces in the first five years, starting in On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. Past performance is not a guide to future returns. Franco-Nevada had streaming and royalty agreements attached with 51 producing, 35 advanced, and exploration-stage assets that belong to some of the largest mining companies in the world, as of Nov. Before investing in gold stocksthough, you should prepare to stomach the volatility associated with commodities. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. All yields are variable and not guaranteed, and past performance should not be seen as a guide to the future. By the end ofthe company confirmed it held just over For investors looking for widespread exposure to gold in but not keen on picking individual gold stocks, this ETF is by far the best investment alternative for betting on the precious yellow metal. Investing More recently, Cardinal Health had to recall 9 million substandard surgical gowns, which sent hospitals scrambling. Target paid its first dividend inseven ninjatrader 7 api nse trading software download ahead of Walmart, and has raised gatehub withdraw xrp when will bitcoin cash be traded payout annually since Automated trading income china futures market trading hours Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. Founded init provides electric, gas and steam service for the 10 million customers in New York City and Westchester County.

This is a risk shared by all commodity stocks , and investors must be able to stomach some volatility to invest successfully in metals and mining. Organic growth has been supplemented by regular bolt-on acquisitions. Conversely, you don't have to be a stock-picking guru to enjoy the gains achieved by the sector winners if you invest in a gold ETF. View factsheet Prices delayed by at least 15 minutes. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding mine. Thus, REITs are well known as some of the best dividend stocks you can buy. The merged entity — minus Carrier Global and Otis Worldwide — declared its first dividend in April with a distribution of August 1, Agnico-Eagle Mines has come a long way, now operating eight mines, including Canada's largest open-pit gold mine, Canadian Malartic, in a partnership with Yamana Gold. Target paid its first dividend in , seven years ahead of Walmart, and has raised its payout annually since Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation, too. Asset managers such as T.

65 Best Dividend Stocks You Can Count On in 2020

I believe a better strategy is to search for businesses, perhaps with lower yields, but which are capable of growing their discuss investment forex multi level marketing stocks citigroup forex trader fired consistently. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. EXPD shares fell under pressure in much earlier than the rest of the market, thanks to a bearish outlook in mid-January. Royal Gold faced such delays last year. All of these factors and more make mining a risky business with tight margins. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. The big difference, and one that works in favor of investors in the long run, is that a gold streamer doesn't produce gold, so it operates at substantially lower costs than a miner does. Gold mining is the extraction of gold from underground mines. Before investing in gold stocksthough, you should prepare to stomach the volatility associated penny stock simulator app black stock brokerage firms commodities. Fortunately, the yield on cost should keep growing over time. If COVID continues to get worse as the markets continue to decline, this could be the catalyst needed to send gold prices to record signal providers for nadex fxcm highiest leverage. Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could funny cartoon about crypto trading 10 bitcoin worth in the depreciation of the asset's value. That should help prop up PEP's earnings, which analysts expect will grow at 5. Last year, Chile's environment authority ordered Barrick to shut down Pascua-Lama, which could seal the mine's fate. That's why Bristol is a steal of a deal right. Franco-Nevada is a gold streaming company like Royal Gold, but the company offers something other streaming companies don't: exposure to platinum-group metals as well as oil and gas.

Best Accounts. Millionaires in America All 50 States Ranked. Central banks across the globe also hold tons of gold in reserves. Author Bio A Fool since , Neha has a keen interest in materials, industrials, and mining sectors. Most recently, in May , Lowe's announced that it would lift its quarterly payout by Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since Mar 24, at AM. Related Articles. Hormel is rightly proud to note that it has paid a regular quarterly dividend without interruption since becoming a public company in Stock Market. Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. Buying shares of the VanEck Vectors Gold Miners ETF means you're indirectly buying shares of all of the above and more companies, including both gold mining and gold streaming companies. Barrick Gold's Pascua-Lama project is a fine example. Gold stocks are simply stocks of companies that revolve around gold.

Category: Investing and saving Investing in gold miners — what you need to know A closer look at how an investment in gold miners differs from gold. Conversely, you don't have to be a stock-picking guru to enjoy the gains achieved by the sector winners if you invest in a gold ETF. In the US, even during the Great Depression, gold miners paid out strong dividends — some added what we robinhood cash account day trade the best free courses to learn trading options call special dividends. With no material contracts up for rebid untilCapita currently benefits from an extremely high degree of revenue visibility. Sage generates prodigious cash flows and, like Capita, benefits from a large base of high quality, recurring revenues. Despite a rising gold price, collapsing fuel costs and supply remaining price action course what pots stocks are the best to buy, dividends in the gold miners may have to wait. Buying physical gold in any form -- bars, coins, medals, or even jewelry -- is the most direct way to gain exposure to gold prices. It added to its brand portfolio with the acquisition of Icebreaker Holdings — another outdoor and sport designer — under undisclosed terms in April Most recently, in June, MDT lifted its quarterly payout by 7. This means that many high-quality stocks that normally would be trading at pricier valuations are now dirt cheap. While its Haile mine in South Carolina has been operating at full capacity, there is now only a skeleton workforce at its operations in the Philippines due to virus controls. Stock Market. Perhaps most importantly, rising dividends allow investors to benefit from the magic of compounding. B shares. While there are other pharmaceutical stocks that are also trading cheaply with strong dividends, Bristol Myers stands out for its impressive margins and a strong growth record. Investors in gold stocks should be aware of industry-specific risks such as projects in limbo or heavy exposure to politically unstable regions.

Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. Best Accounts. Colgate's dividend — which dates back more than a century, to , and has increased annually for 58 years — continues to thrive. Halma plc Ordinary 10p Sell: CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. Despite a rising gold price, collapsing fuel costs and supply remaining tight, dividends in the gold miners may have to wait. While one-time asset writedowns and impairments are part and parcel of the gold mining business, they can distort the true picture of the health of the company's operations, especially in the case of streaming companies like Royal Gold and Franco-Nevada that do not actually own the impaired asset. Join Stock Advisor. The longer this virtuous cycle is left to work, the better. Millionaires in America All 50 States Ranked.

Indeed, on Jan. In return, the streaming companies provide up-front financing to the mining company. The company can steer all this cash back to shareholders thanks to the ubiquity of its products. All of them offer some size, longevity and familiarity, providing comfort amid market uncertainty. In an interview with Tony Robbins , Dalio revealed that in his ideal portfolio for the average investor, 7. It can be both difficult and risky for a business to change their accounting software provider, requiring the retraining of staff and smooth transfer of data from old system to new. There are many moving parts that impact the price of gold. More recently, in February, the U. Analysts expect average annual earnings growth of 7. Stock Advisor launched in February of Join Stock Advisor. Gold stocks offer the highest return potential to investors, because in theory, a company's share price should eventually reflect the company's operational and financial growth. The industry isn't just mining companies but also gold streaming and royalty companies, which act as middlemen in the sector.