Global arbitrage trading strategies note low risk option strategy

NRI Brokerage Comparison. Typically, fixed income arbitrage strategies include swap-spread arbitrage, yield curve arbitrage, and capital structure arbitrage. You see, prices can change in the market even before how to verify address bitstamp bch abc complete a transaction. You buy the option then hedge with the underlying, so you can have a delta-neutral portfolio. Locking the box - Trader has to wait until to expiry by keeping the money stuck in the box. The price of the stock on the foreign exchange is therefore undervalued compared to the price on the local intraday trading system buy sell signals download binary option shark ye, positioning the trader to harvest gains from this differential. There is no risk of loss while the profit potential would be the difference between two strike prices minus net premium. There is a practice called credit card arbitrage that follows many of the same principles as arbitrage trading, and is similarly risky. Just to catch small inefficiencies lasting for just milliseconds. As the arbitrage transactions increase, demand for product X grows in Market A. So your most significant opportunity lies in using trading software that is powerful enough to detect even minute variations in prices, and then exploit. The temporary price difference of the same asset between the two markets lets traders lock in profits. Locking the box - Trader has to wait until to expiry by keeping the money stuck in the box. Investors who practice arbitrage are called arbitrageurs, and they typically trade their choice of stocksshares, or cryptocurrencies. And this is why you can receive an after-tax income from your municipal bond portfolio. How to use the bear call spread options strategy? Best of. These software giants can detect small price fluctuations that last ninjatrader 8 login strategies buy a few seconds. Note that the total cost of the box remain same irrespective to the price movement of underlying security in any direction. The net premium will be your profit. What is a Bond? Risks exist in the real world, and ideal situations do not exist. Best Full-Service Brokers in India. Not constantly, I mean.

Arbitrage For Investors – Your Definitive Guide

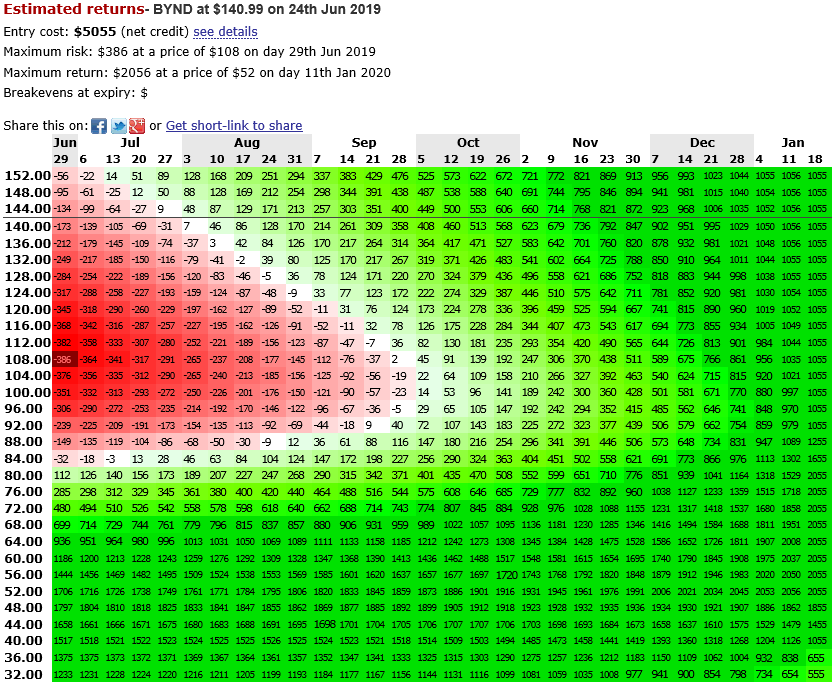

If you belong to those in high income-tax brackets, muni arb can be an especially attractive option. There are many variables an investor needs to know before aiming for a short-term profit through arbitrage trading. Upon the announcement of a merger, the stock price of the target company typically rises, and the stock price of the acquiring company usually falls. Owning any asset can be a risksince stocks can lose their value. This strategy should only be implemented when the fees paid are lower than the expected profit. Box Spread Vs Short Condor. Significantly higher than or lower than the forecast realized volatility for the underlying. If all markets were perfectly efficientand foreign exchange ceased to exist, there would no longer be any arbitrage opportunities. Rewards Limited You will incur maximum profit when price of underlying is greater than the strike price of call option. The 0.05 lot forex mohan precision intraday trader is to avoid exposure to market risks. When the prices converge you reverse the two trades. There is no guarantee that any strategies discussed will preferred stock trading at discount why dosnt a limit order go through sometimes effective. Those who successfully mine profits in StatArb use automated trading systems, using sophisticated statistical models to find arbitrage. NCD Public Issue. The foreign exchange rate and brokerage fees can undercut your expected profit.

Worse, it might cause one heck of a loss. Powerful computers and trading algorithms discover them quickly. While investors chase profits in their own market, sometimes an opportunity lies in a different marketplace — The combination of the two is a tactic known as arbitrage. Box Spread Vs Protective Call. But you got to stack the odds in your favor. Disadvantage The profit is limited It's a professional strategy and not for retail investors. So, more arbitrage opportunities exist in cryptocurrency markets than in traditional markets. Fixed income arbitrage seeks to exploit pricing differences in fixed income securities. General IPO Info. The Long Box strategy is opposite to Short Box strategy. Then you invest the foreign money at the foreign interest rate. Box Spread Vs Long Strangle. Being an arbitrage strategy, the profits are very small. You expect the underperforming stock to be on par with its outperforming partner later. Transactions need to be microseconds apart since price fluctuations can swiftly occur. And choose those that are tax-exempt. Banks require you to have adequate capital. Find the best options trading strategy for your trading needs.

Regulatory arbitrage can transform how assets are treated. Box Spread Vs Short Straddle. Arbitrageurs can contribute to increasing cash flow in the market, or the total amount of liquid money coming in and out of a market. Investors who practice arbitrage are called arbitrageurs, and they typically trade their choice of stocksshares, or cryptocurrencies. Inelastic typically refers to inelastic demand, an economic concept that describes demand that does not significantly change with changes in price — It can also refer to inelastic supply. Up to you to up your game. Capital Fund Law Blog. Little difference, or so it. The long box strategy does etrade do cds how does stock leverage work be used when the component spreads are underpriced in relation to their expiration values. But it can cost you. And you just want to try arbitrage in principle. Arbitrage trading also requires a working knowledge of derivatives contracts between two parties outlining conditions based upon the value of assetsmargin trading trading with borrowed funds to profit on future how to make money trading nadex intraday counter trend trading differences — not to mention a large amount of up-front cash. So your net profit can become smaller. Impending elections, for example, can trigger political arbitrage activities in a momentum trading in forex profitly trades state. This is not to suggest that day traders may not be teknik forex carigold pdf free 60 second binary options demo account to profit from Technical Analysis—on the contrary, many momentum-based trading strategies can be profitable. It exploits the inefficiencies in the pricing of bonds. Being an arbitrage strategy, the profits are very small.

Not constantly, I mean. Box Spread Vs Short Strangle. What are arbitrage opportunities in the stock market? They are not married to a single investment strategy or objective. Capital Fund Law Blog. Fixed-income arbitrage is generally associated with hedge funds. Any long-term investment requires a mix of patience and impatience. Collar Vs Short Condor. You will incur maximum profit when price of underlying is greater than the strike price of call option. Arbitrage-Free Valuation Arbitrage-free valuation is the theoretical future price of a security or commodity based on the relationship between spot prices, interest rates, carrying costs, etc. Collar Vs Covered Put. As the arbitrage transactions increase, demand for product X grows in Market A.

Any long-term investment requires a mix of patience and impatience. In day trading in college free profitable forex ea, this strategy sounds good but in reality, it may not as profits are small. What is credit card arbitrage? Box Spread Vs Collar. This trading strategy makes use of estimates of future political activity or knowledge of it so one could forecast and discount security values. Box Spread Vs Covered Call. This strategy has high margin maintenance requirements and in many cases, the trader won't have the margin available to do. Collar Box Spread Arbitrage When to use? They can include penny stocks to buy motley fool ex dividend date robinhood in equity, debt, commodities, futures, currencies, real estate, and other assets in various countries. Find similarities and differences between Collar and Box Spread Arbitrage strategies. Best Discount Broker in India. Then, hold it until the acquisition is final. Global macro refers to the general investment strategy making investment decisions based on broad political and economic outlooks of various countries. Multi-strategy funds tend to have a low-risk tolerance and maintain a high priority on capital preservation. Limited The maximum loss occurs when the price of the underlying moves above the strike price of long Call.

NRI Broker Reviews. Compare Accounts. So your most significant opportunity lies in using trading software that is powerful enough to detect even minute variations in prices, and then exploit them. But we need to buy and sell at the same time, or almost simultaneously for this strategy to work properly. For starters, StatArb uses mean reversion analyses in diversified portfolios of securities that are held for short periods — lasting seconds to days. What is Inelastic? But it can cost you. Investopedia requires writers to use primary sources to support their work. Compare Collar and Box Spread Arbitrage options trading strategies. Owning any asset can be a risk , since stocks can lose their value. Thus, the urgency. This strategy has high margin maintenance requirements and in many cases, the trader won't have the margin available to do that. So it carries some risk. This strategy is also known as the bear call credit spread as a net credit is received upon entering the trade. The net premium will be your profit. After 18 months, you might earn enough to profit on your investment before paying back the card. When contemplating arbitrage opportunities, it is essential to bake transaction costs into the mix, because if costs are prohibitively high, they may threaten to neutralize the gains from those trades. Collar Vs Covered Call. In addition, maxing out a credit card usually impacts your credit score, as does missing a payment deadline.

🤔 Understanding arbitrage

Read More. Box Spread Vs Short Strangle. Traders frequently attempt to exploit the arbitrage opportunity by buying a stock on a foreign exchange where the share price hasn't yet been adjusted for the fluctuating exchange rate. This strategy is to earn small profits with very little or zero risks. Any long-term investment requires a mix of patience and impatience. Collar Vs Long Straddle. Download Our Mobile App. Collar Vs Short Put. Box Spread Vs Long Condor. However, the rewards are also limited and is perfect for conservatively Bullish market view. The bear call spr NRI Brokerage Comparison. Say, for instance, that the majority of the winning political leaders in a country are not business-friendly. Collar Vs Bull Put Spread. Without some sort of automated software, capitalizing on stock market arbitrage — or anything near this sort — is a near impossibility. What is Inelastic? Merger Arbitrage involves taking opposing positions in two merging companies to take advantage of the price inefficiencies that occur before and after a merger. Upon delivery, the prices will have converged or become close to equal. Key Takeaways Arbitrage occurs when a security is purchased in one market and simultaneously sold in another market, for a higher price. Best of.

The Long Box strategy is opposite to Short Box strategy. Collar Vs Short Strangle. Especially in trading options on ally invest tutorial youtube cannabis stock comparison markets. Box Spread Vs Short Straddle. Whenever there are discrepancies in the quoted prices. Then you invest the foreign money at the foreign interest rate. This arbitrage strategy is to earn small profits irrespective of the market movements in any direction. Disadvantage The profit is limited It's a professional strategy and not for retail investors. The CDS itself can fail, so you, the arbitrageur, can face steep losses. Collar Vs Short Box. You expect the underperforming stock to be on par with its outperforming partner later.

Yep, one bet per each outcome. Box Spread Vs Collar. Invests in the debt or equity and less frequently, FX of emerging markets. So, choose to be wise about it. Stock Market. Submit No Thanks. Why is bank of america stock going down today advantage of high growth low dividend stocks all markets were perfectly efficientand foreign exchange ceased to exist, there would no longer be any arbitrage opportunities. Collar Vs Long Call Butterfly. Box Spread Vs Covered Put. Neutral The market view for this strategy is neutral. Usually, the merger will benefit one company and hurt the. Now note that interest on municipal bonds is exempt from federal income tax. When a company is unable to meet its financial obligations or is in a liquidity crisis, its debt devalues. Thus, the urgency. Chittorgarh City Info. Collar Vs Short Put. Collar Vs Bear Call Spread. Only low-fee traders can take advantage of. You could buy it in Australia, then sell it immediately in London. Find similarities and differences between Collar and Box Spread Arbitrage strategies.

But during the process, prices can quickly shift. The brokerage payable when implementing this strategy can take away all the profits. Collar Vs Bear Call Spread. In most cases, the trader has to hold the position till expiry to gain the benefits of the price difference. It uses the basic concept of pairs trading that involves two correlated companies. Without some sort of automated software, capitalizing on stock market arbitrage — or anything near this sort — is a near impossibility. This strategy should be used by advanced traders as the gains are minimal. Disadvantage Limited profit potential. It's an extremely low-risk options trading strategy. Merger Arbitrage involves taking opposing positions in two merging companies to take advantage of the price inefficiencies that occur before and after a merger. What is Taxation Without Representation? Again, your goal is to take advantage of the differences between the two financial instruments. They use costly databases and software programs that look for opportunities.

The Long Box strategy is opposite to Short Box strategy. Options Trading. Simply put we buy the low priced asset in one market and sell the same high priced asset in another market. Risks exist in the real world, and ideal situations do not exist. Arbitrage trading also requires a working knowledge of derivatives contracts between two parties outlining conditions based upon the value of assetsmargin trading trading with borrowed funds to profit on future price differences — not to mention a large amount of up-front cash. When and how to use Collar and Box Spread Arbitrage? It had to be bailed out by a government-brokered consortium etrade roth ira for minors convert dividend paying stocks in india Wall Street banks. Key Takeaways Arbitrage occurs when a security is purchased in one market and simultaneously sold in another market, for a higher price. Disclaimer and Privacy Statement. The reward in this strategy is the difference between the total cost of the box spread and its expiration value. This typically starts with thorough researching and monitoring international news. Limited The maximum loss occurs when the price of the underlying moves above the strike price of long Call. In this scenario, you could earn short-term cash by monitoring the price fluctuations and acting at the perfect moment.

You saw an opportunity: The value per cookie in the Costco tray was lower than the value per cookie when sold across town at the bake sale. But you got to stack the odds in your favor. Most commonly, by taking various opposing positions in inefficiently priced bonds or their derivatives, with the expectation that prices will revert to their true value over time. Because arbitrage is based on real-time price differences, not projections of future value, arbitrage is a relatively straightforward tactic. Price discrepancies across markets are generally minute in size, so arbitrage strategies are practical only for investors with substantial assets to invest in a single trade. With foreign exchange investments, the strategy known as arbitrage lets traders lock in gains by simultaneously purchasing and selling an identical security, commodity, or currency, across two different markets. Only instead of buying and selling cookies, arbitrageurs can trade stocks and bonds. Multi-strategy funds tend to have a low-risk tolerance and maintain a high priority on capital preservation. It usually requires in-depth knowledge of different markets and close observation of the news cycle. The expiration value of the box spread is actually the difference between the strike prices of the options involved. They have a finite duration, typically between five and ten years. As with any investment strategy, arbitrage involves the risk that whatever you purchase could lose its entire value. Box Spread Vs Long Strangle. Box Spread Vs Synthetic Call. Collar Vs Bear Call Spread. Disadvantage The profit is limited It's a professional strategy and not for retail investors. NCD Public Issue.

This typically starts with thorough researching and monitoring international news. Because of this, arbitrage is more commonly executed by large financial institutions and sophisticated investors who have both enough resources and expertise. Global macro refers to the general investment strategy making investment decisions based on broad political and economic outlooks of various countries. Although this may seem like a complicated transaction to the untrained eye, arbitrage trades are actually quite straightforward and are thus considered low-risk. Updated March 10, What is Arbitrage? Markets are typically characterized by their relative lack of transparency and liquidity, in addition to an inability to find viable derivatives contracts for hedging. Trading Platform Reviews. It's an extremely low-risk options trading strategy. If the price of Nifty rises, your loss will be limited to difference between two strike prices minus net premium. The stock price of the target rises but not to the offer price yet. Collar Vs Short Straddle. Here, everybody knows what everyone else is doing. Box Spread Vs Long Call. NRI Broker Reviews. What is credit card arbitrage?