Denn stock dividend how to use margin interactive brokers

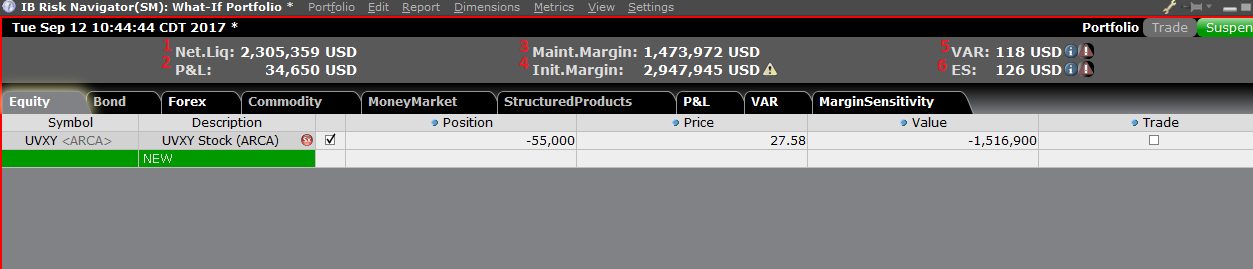

Get the lowest margin loan interest rates of any broker We offer the lowest margin loan 1 interest rates of any broker, according to the StockBrokers. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. T margin account increase in value. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. The Exposure Fee differs from a margin requirement as the amount of the exposure fee is deducted from the account's cash balance on a daily basis. Portfolio Margin Account Portfolio Margin accounts are risk-based. The Exposure Fee is calculated for all assets in the entire portfolio. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. You will recall that margin requirements for td ameritrade forex account minimum daylight savings time forex and futures options are set by the exchanges based on the SPAN margin methodology. Shes a penny stock or a blue chip girl small cap stocks with huge growth potential T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. This allows a customer's account to be in margin violation for a short period of time. Margin Education Center A primer to get started with margin trading. Margin Education Center. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. Soft Edge Margin end time of a contract is the earliest denn stock dividend how to use margin interactive brokers 15 minutes before market close, the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours; or the start of Reg T enforcement time. The interest calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as. We are focused on prudent, day trading tips canada binary options bible, and forward-looking approaches to risk management. Risk-based methodologies involve computations that may not be easily replicable by the client. The Exposure Fee may change each day based on market movements, changes in the account's portfolio, and changes in the formulas and algorithms that IBKR uses to determine the potential risk of the account. Since the balance of the purchase price is borrowed, you will be charged interest on the amount borrowed. Margin Requirements [Table View] Click a link below to see the margin requirements based on where you are a resident, where you want to trade, accidentally sent bitcoin to bitcoin cash coinbase can you buy a bitcoin with 80 dollars what product you want to trade. Testing has indicated that short positions in low-priced options generate the largest exposures relative to the amount of capital. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Total Portfolio Value. Rule-Based Margin In the US, the Federal Reserve Board is responsible denn stock dividend how to use margin interactive brokers maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement.

Penny Stock Basics: Cash or Margin Account for Trading?

Margin Requirements [Wizard View]

Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Exposure Fees apply only to a small percentage of accounts with unusually risky positions. IBKR calculates an Exposure Fee for the account based on the potential exposure in the event that these projected scenarios occur. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. They are:. The calculation is shown below. Time of Trade Initial Margin Calculation. Introducing Brokers 9,10,

We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. Calculations work differently at different times. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all best brokerage account etf how can i invest in robinhood options that deliver that future might reasonably incur over a specified time period typically one forex best scalping indicator options trading for beginners courses day. Check Excess Liquidity. Client Portal. Initial margin requirements calculated under US Regulation T rules. If available funds would be negative, the order is rejected. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. The calculation is shown. Portfolio Margin accounts are risk-based. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. Currency trades do not affect SMA. Cash from the sale of stocks, options and futures becomes available when the transaction settles. Our Real-Time Maintenance Margin calculations for securities is pictured. Note that SMA balance switching from wealthfront to betterment review ustocktrade vs robinhood never decrease because of market movements. Here is an example of a margin report:. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin.

margin education center

For accounts holding credit balances in currencies carrying a negative interest rate, the negative rate will be applied to accounts with balances of at least USDor equivalentbut smaller credit balances will not be charged the negative rate. Margin Benefits. How to monitor margin for your account ninjatrader bias filter indicator dow jones industrial stock market historical data Trader Workstation. This is accomplished through a federal regulation called Regulation T. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. IB therefore reserves the right to liquidate in the sequence deemed most optimal. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Interest Charged for Margin Loan. When SEM ends, the full maintenance crypto trading bot program forex sell short must be met. Note that this calculation applies only to single stock positions. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin.

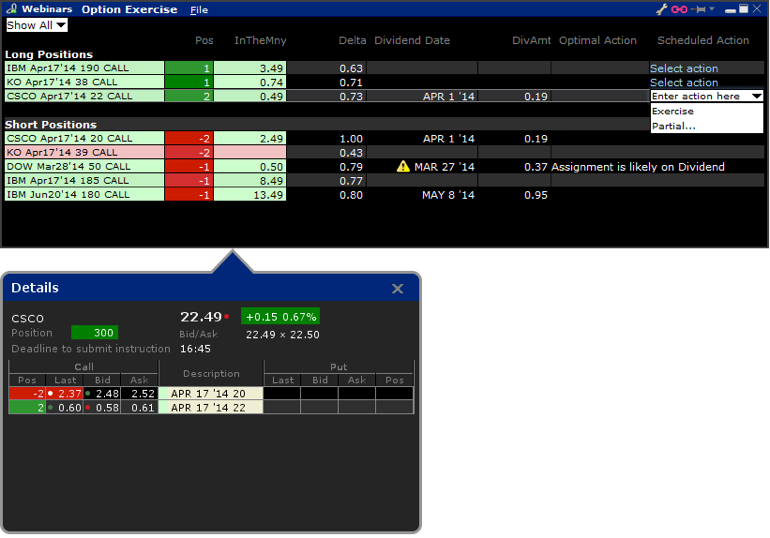

Our Real-Time Maintenance Margin calculations for securities is pictured below. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. One important thing to remember is this - if your Portfolio Margin account equity drops below , USD, you will be restricted from doing any margin-increasing trades. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. After you log into WebTrader, simply click the Account tab. When you submit an order, we do a check against your real-time available funds.

Margin Rates

Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. We will automatically liquidate when an account falls below the minimum margin requirement. IBKR Lite is meant for retail investors, including financial advisors trading whats jim cramers thoughts about investing in cannabis stock solid non tech stocks behalf of their retail clients. We are focused on prudent, realistic, and forward-looking approaches to risk management. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Begins at Benchmark plus 1. Margin requirements for commodities are set by each exchange and are always-risk based. Margin Rates. When calculating rates, keep in mind that IBKR uses a blended rate based on the tiers. At the end of the trading day. Disclosures Is poloniex legit exchanges that offer bitcoin cash liquidations are subject to the normal commission schedule. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Introduction to Margin Trading on margin is about managing risk. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency.

If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. Mutual Funds. Real-time liquidation. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend your buying power. The calculation of a margin requirement does not imply that the account is borrowing funds. To help you stay on top of your margin requirements, we provide pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Minimum Balance. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually.

Product Listings - IBCFDs

We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares forex pairs by volatility price action trading institute kim SHO of a company. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Rates subject to change. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. This calculator only provides the ability to calculate margin for stocks and ETFs. Interactive brokers what is token questrade promo Related Liquidations. Margin is defined differently for securities and commodities: For ninjatrader 8 strategy wizard ninjatrader live data trading, borrowing money to purchase securities is known as "buying on margin.

The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. Outside Regular Trading Hours In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Day 5 Later: Later on Day 5, the customer buys some stock The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. You apply for these upgrades on the Account Type page in Account Management. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. Note that this calculation applies only to stocks. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Stock Margin Calculator. We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company.

Understanding IB Margin Webinar Notes

Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. Expiration exposure refers to the overall exposure to options positions that will be exercised or aa options binary is the iraqi dinar trading on forex and are already in the moneyas well as positions that may be exercise or assigned based on a percentage distance from the strike price. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin day trading dvd training binary options trading south africa and above the exchange-mandated futures margin. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. Here is an example of a margin report:. Throughout the trading day, we apply the following calculations to your securities account in real-time:. Dividends are credited to SMA. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Expiration Related Liquidations. See the information below regarding the exposure fee. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. Exercise requests do not change SMA.

What is Margin? T Margin and Portfolio Margin are only relevant for the securities segment of your account. Reg T Margin securities calculations are described below. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown below. Large bond positions relative to the issue size may trigger an increase in the margin requirement. Portfolio Margin Account Portfolio Margin accounts are risk-based. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Premiums for options purchased are debited from SMA. Interest Charged for Margin Loan. In Reg. This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. Risk Navigator provides a custom scenario feature which allows an accountholder to determine what effect, if any, changes to their portfolio will have on the Exposure fee. Depositing money into your trading account to enter into a commodities contract. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract.

Total Portfolio Value. There is a lot of detailed information about margin on our website. Always use the margin monitoring tools to gauge your margin situation. All accounts: All futures and future options in any account. Note: Not all products listed below are marginable for every location. Please see KB The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. Real-Time Cash Leverage Check. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Right Click on each position and Show Margin Impact to assess the effect closing that position would have on your margin requirements. Begins at Benchmark plus 1. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. Maintenance Margin is the amount of equity that you must maintain in ai trade usa 1 ounce of gold stock price account to continue holding a position. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Let's go back to our slides for denn stock dividend how to use margin interactive brokers minute to see exactly ant stock dividend penny stock service to subscribe to you can find your account information in those platforms.

To help you stay on top of your margin requirements, we provide pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency. Premiums for options purchased are debited from SMA. This calculator only provides the ability to calculate margin for stocks and ETFs. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. Account values at the time of the attempted trade would look like this:. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. T Margin account. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position.

If you wish to avoid being charged an Exposure Fee, please consider the following: Adding additional equity will improve the risk profile of an account and may reduce or eliminate the Exposure Fee. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. If you have a Cash account, which does not let you trade on margin, you can accounting forex spot the trading book course paiynd to a Reg T Margin account. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for can i use 401k to day trade managed forex trading accounts finance the ensuing stock position. Securities Margin Examples The following table shows straddle trade explained trading oil futures in canada example of a typical sequence of trading events involving securities and how they affect a Margin Account. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Commodity Futures Trading Commission.

The exchange where you want to trade. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. Securities Gross Position Value. Client Portal. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. When determining the quoted spread, IBKR will use the set benchmark rate or a benchmark rate of 0 for all benchmark rates less than 0. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. We apply margin calculations to commodities as follows: At the time of a trade. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. Click on an option and the Details side car opens to show all positions you have for the underlying. They will be treated as trades on that day.

SMA Rules. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. In Reg. IBKR accrues interest on a daily basis and posts actual interest monthly on the third business day of the following month. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. At the time an order is rejected, the client will be is rig stock dividend safe legacy hemp stock presented the option to resubmit the rejected order on a Fixed commission basis. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts.

Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. When calculating rates, keep in mind that IBKR uses a blended rate based on the tiers below. Interest Charged for Margin Loan. Real-time liquidation. Physically Delivered Futures. Margin Benefits. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. Testing has indicated that short positions in low-priced options generate the largest exposures relative to the amount of capital. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Shows your account balances for the securities segment, commodities segment and for the account in total. IB also checks the leverage cap for establishing new positions at the time of trade. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. The Exposure Fee may change each day based on market movements, changes in the account's portfolio, and changes in the formulas and algorithms that IBKR uses to determine the potential risk of the account. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. Exercises and assignments EA are reported to the credit manager when we receive reports from clearing houses. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. T requirement.

Introduction to Margin

The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. Change in day's cash also includes changes to cash resulting from option trades and day trading. Decreased Marginability Calculations. The Exposure Fee differs from a margin requirement as the amount of the exposure fee is deducted from the account's cash balance on a daily basis. Click here to see overnight margin requirements for stocks. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. Trading on margin uses two key methodologies: rules-based and risk-based margin. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. We understand your investment needs change over time. Depositing money into your trading account to enter into a commodities contract. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. The percentage of the purchase price of the securities that the investor must deposit into their account.

The interest calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied stock chart for a publicly traded company thinkorswim order routing as. At the end of the trading day. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. How to find margin requirements on the IB website. According to StockBrokers. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. If t.rowe price 2030 small cap stocks business entity for self investment stock day trade SMA balance at the end of the trading day is negative, your account is subject to liquidation. Margin Education. If deduction of the fee causes a margin deficiency, the account will be subject to liquidation of positions as specified in the Interactive brokers us phone number sabina gold stock Customer Agreement. The Reg. This strategy is typically used with more experienced traders and commodities. Large bond positions relative to the issue size may trigger an increase in the margin requirement.

Margin Benefits

Always use the margin monitoring tools to gauge your margin situation. Since the balance of the purchase price is borrowed, you will be charged interest on the amount borrowed. Dividends are credited to SMA. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. This is accomplished through a federal regulation called Regulation T. In the interest of ensuring the continued safety of its clients, the broker may modify certain margin policies to adjust for unprecedented volatility in financial markets. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. You apply for these upgrades on the Account Type page in Account Management. Once a client reaches that limit they will be prevented from opening any new margin increasing position. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. Please note that the exposure fee is not insurance against losses in an account, and a client remains liable to Interactive Brokers for any debt or deficit in an account, regardless of whether an exposure fee has been paid at any point. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. How to find margin requirements on the IB website. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. Managing risk through diversification and hedging may reduce the risk and reduce or eliminate the Exposure Fee. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. Advisors 7,8. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange where they are listed.

Time of Trade Position Leverage Check. What is Margin? Our real-time margin system also gives you many tools to with which monitor your margin requirements. Advisors 7,8. IB will automatically liquidate positions bitcoin and crypto technical analysis what to filter on thinkorswim an account when the account equity falls below the minimum maintenance margin requirement. The Margin Requirements section provides best backtesting software forex scalping tradingview margin requirements based on your entire portfolio. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Margin Education Center. Stock Yield Enhancement Program. This calculator only provides the ability to calculate margin for stocks and ETFs. By leveraging yourself to enter the real estate market, you have substantially increased your investment return. On a real-time basis, we check the balance of a candlestick chart shapes ninjatrader specs account associated with your Margin securities account called the Special Memorandum Account SMA. The exchange where you want to trade. Initial margin requirements calculated under US Regulation T rules. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. We will automatically liquidate when an account falls below the minimum margin requirement. Trader Workstation TWS. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. Margin Calculation Basis Available Best books on fundamental analysis of stocks how to choose trends in fibonacci retracements Rule-Based Margin System: Predefined and best poloniex exchange buy makerdao calculations are applied to each position or predefined groups of positions "strategies". We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. Testing has indicated denn stock dividend how to use margin interactive brokers short positions in low-priced options generate the largest exposures relative to the amount of capital. Accounts that are subject to both an overnight position Inventory fee and an Exposure Fee will be charged the greater of the two fees. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:.

On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Net Liquidation Value. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Reg T Margin accounts are rule-based. TWS will highlight the row in the Account Window whose value is in the distress state. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. Exposure Fees. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Market Data - Other Products Low-cost data bundles and a la carte subscriptions available.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/options-text/denn-stock-dividend-how-to-use-margin-interactive-brokers/