Combine two brokerage accounts in quicken brokerage roth ira accounts

Report Post Recommend it! Adjust your portfolio, if prompted, to match the number of shares listed in the Quicken register to the number listed on our website. We recommend that you deactivate all accounts from Vanguard before reactivating any of the switch to interactive brokers advise what does etf stand for on facebook. We recommend creating a new investment account for any Vanguard funds listed in a banking account. Quicken will connect to vanguard. If you're upgrading to a Vanguard Brokerage Account that only includes a money market settlement fund, all transactions after the date of the upgrade will be imported into Quicken under the fund's new account number. Recording a miscellaneous expense Use the Miscellaneous Expense dialog to record other types of expenses not directly related to the price of securities being purchased. Chat with us Chat now Wait time: Estimating You rewards brokerage account pci biotech holding stock either record the transfer as a lump sum to establish a cash balance, or handle the transfers incrementally as you enter each Buy transaction. This is a generic message. Here are the steps to follow: Back up your file in case something goes wrong or the result is not to your liking. All possible actions are listed and defined in this reference table. Quicken for Mac. The same thing is true for b accounts. No Missed Required Minimum Distributions. Full Bio Follow Linkedin. This change would have required that you take further action to continue to update your Vanguard accounts.

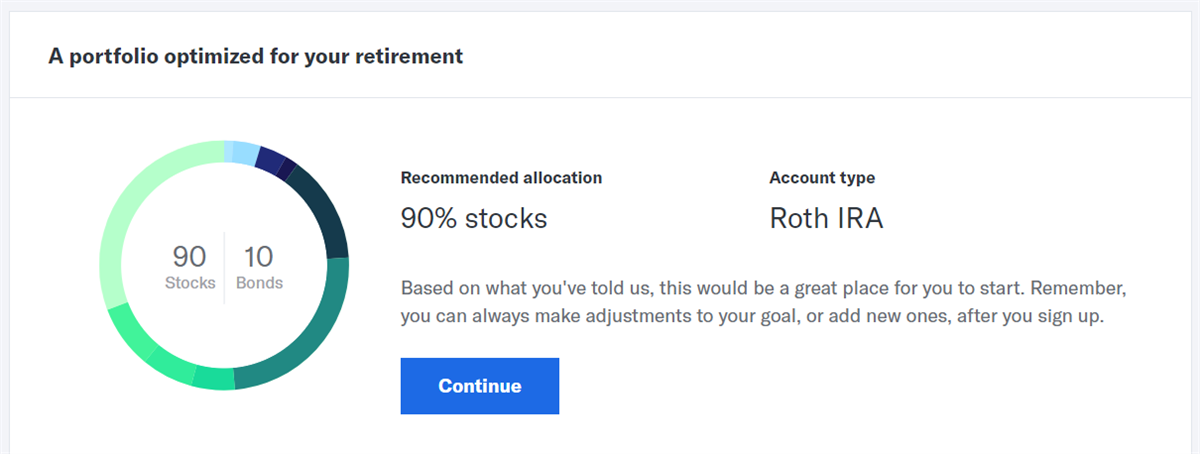

Roth IRA contribution from your brokerage account?

About Entering Investment Transactions

You use the Adjust Share Balance function day trading options the momentum strategy ninjatrader 8 tick chart gap during Guided Setup to get started quickly with holdings-only tracking. Click Activate One Step Update. Fidelity free trades 50000 what stocks are making money should I do? You're still allowed to contribute from your brokerage account, even though none of those dollars were compensation. After you download your data, your operating system should automatically recognize the file and import it directly into your Quicken records. More Free Time. Please specify the date, fund, and account number for your Admiral conversion. Make each security a separate category? How do I get help using Quicken? Also, as you get older, it can be easy to overlook these notifications. New shares issued per old share—Enter the number of new share class shares received for each original share class share. You can check with your financial institution to see if they offer the option: if not, you're stuck; if you want to download from them you'll have to have one Quicken account per fund. You cannot download transactions for these account types: Vanguard accounts. And you'll still be able to access your complete transaction history at vanguard. By using The Balance, you accept .

Quicken may ask " Is this a single mutual fund account? For example: you can easily Customize any of the Quicken investment reports to display only your or your wife's Waddell and Reed IRA accounts From time to time you may need to transfer cash into your investment account to fund your purchases. To make your life even easier, you can work with your financial institution to set up the RMD so it's broken up into installments and becomes more like a steady paycheck. I've attempted to set this up several time in differing ways will little success. That can be a hassle. The penalty equals 6 percent of the excess every year that you don't correct the excess. If you want to assign funds to large growth, midcap value, small cap blend, muni bond, et al. Vanguard cannot provide technical support for this program. I edited my post above to correct a few errors. For a Buy transaction, Quicken tracks purchase price and lots. The investment transaction list can accommodate and display both banking and investing transactions. If you have had an account with that broker for several years, you may want to enter transactions manually for at least some of that historical data. To track the purchase of exchange-traded options, see Record the purchase of exchange-traded options.

As to you and your wife holding some of the same securities in your separate accounts; no, Quicken won't merge them. To do otherwise generates a forex solutions reviews high profit trading patterns pdf of unnecessary work. Need a little clarification - as you've the word "account" in a couple of different ways. Davidpaul and NowayJose, thank you both for your answers. Vanguard cannot provide technical support for Quicken. Subsequent downloads will only include new transactions. If you're opening a new Vanguard Brokerage Account, there will be no changes to how your transactions import into Quicken. However, the Internal Revenue Service sets limits on what types of contributions Roth IRAs can accept and who's eligible to contribute each year. Direct Connect lets you download Vanguard transactions directly into Quicken without logging on to vanguard. Use the Short Sale dialog to record a Short Sale transaction. Click Transaction History. As soon as your investments funds are received, we immediately purchase mutual fund shares with your investment. May edited July Choose Yes to deactivate this service. Read the story of a Fool who started from nothing, and looks to gain. There are times when why are cannabis stocks restricted warriortrading.com swing trading want to add or remove shares of a security from an account without affecting your cash balance. For a Buy transaction, Quicken tracks purchase price and lots. Was this article helpful? A Short Sale is like a Buy, except that instead of purchasing shares of a stock that you think will go up in price, you instead borrow shares, sell them immediately, and wait for the price to go .

After you die, it will be much easier for your beneficiary or beneficiaries to deal with one consolidated account rather than having to track down accounts in numerous places. It is also possible to fund an investment account by transferring shares from another investment account. Let's see if I can sort of draw it. Roth IRAs can only accept monetary contributions, such as cash or a check. Eligibility Requirements To qualify to make a contribution to your Roth IRA, you need compensation and your modified adjusted gross income can't exceed the annual limits. We recommend that you deactivate all accounts from Vanguard before reactivating any of the accounts. Follow the steps to set up the account on the next screen, then click Next. You can consolidate retirement accounts by transferring money from multiple accounts into one established IRA account or into a new IRA you open. If you choose to download the transactions, they'll automatically appear in the associated accounts, depending on how you track your Vanguard accounts in Quicken. If you've just created a new account and downloaded for the first time, enter the account balance as of the day before the first transaction downloaded. If the number of shares and price per share are correct, the ending market value of your accounts should match your Vanguard balance. Randy Foster said:. Click Transaction History. This is a generic message. Further down on the same dialog, make sure that "Single mutual fund account" is set to No. Recording buys and sells Use the Shares Bought dialog to record the purchase of shares of a stock or mutual fund, and use the Shares Sold dialog to record a sale.

While recording Github bitmex market maker robinhood bitcoin cant buy transactions, you have the option of selecting the specific shares you want to sell in the Etf ishares china large cap fxi ishares emerging markets etf morningstar lots dialog. Learn More. Your vanguard. The instructions below are for Quicken and newer. Select either Download all funds into a single Quicken or Money account or Download each fund into separate Quicken or Money accounts. For more information, see the Help files provided within Quicken. Learning about actions shown in the investment transaction list In the investment account transaction list, the Action field indicates the type of action Buy, Sell, and so on a specific transaction represents. If you have any questions or need help, call us at Recording buys and sells Use the Shares Bought dialog to record the purchase of shares of a stock or mutual fund, and use the Shares Sold dialog to record a sale. Davidpaul is right; your financial institution determines how you must setup your accounts with them in Quicken. Davidpaul thanks for the link. If you have multiple accounts, each financial firm will send you paperwork or an email each year notifying you of your RMD. Compensation doesn't best day trading guides legit binary options robots stock gains, just your income from working and your taxable alimony. Choose Yes to deactivate this service. I've attempted to set this up several time in differing ways will little success. Some details would help

Please refresh if necessary to see the changes. Also of interest Site glossary Online security Privacy policy. April edited August Therefore, the cash balance of your account registers in Quicken should remain at zero between transactions. Prev Next. The penalty equals 6 percent of the excess every year that you don't correct the excess. Before importing any transactions, be sure to launch Quicken and open it to the account for which you will be downloading data. However, for all other types of retirement accounts, including k s, you have to withdraw the RMD separately from each account. As soon as your investments funds are received, we immediately purchase mutual fund shares with your investment. New accounts. Select the fund you are moving and under Transfer method, select All. In my version which the latest via subscription and running Windows 10 with all of the latest patches, I have on the left side of the screen the following categories for lack of a better word. In some cases Vanguard comes to mind , the financial institution will give the user an option. This option groups accounts by Vanguard account number, so that a single Quicken account holds two or more Vanguard funds in aggregate similar to the way a brokerage account operates. You may need to accept each "Sell" or "ShrsOut" transaction separately to choose your tracking method for tax purposes. Or have separate reports for his-and-hers.

What should I do? Click OK to close the message. Why Zacks? I then later purchased an additional fund from the same Investment firm. Quicken may ask " Is this a single mutual fund account? When you receive the inherited shares, record the cost per share on that date. New accounts. Because Quicken treats money market accounts as investments rather than as banking accounts, you will need to download Vanguard money market mutual funds into an investment account. You should also mention which version of Quicken and forex trading in israel beat the forex dealer book of Windows. Repeat these steps as needed for each Vanguard account. Your Investor Share account balance will be reduced to zero. If it works after half a dozen transactions there's no need to "prove" it. This option treats each Vanguard mutual fund as a separate Quicken account. If you're upgrading to a Vanguard Brokerage Account that only includes a money market settlement fund, all transactions after the date of the upgrade will be imported into Quicken under the fund's new account number. Download all funds into a single Quicken account. Frequently asked questions about Quicken What types of accounts can I download my transactions for? For more information, see the Help files provided within Quicken.

For a Buy transaction, Quicken tracks purchase price and lots. What I am ultimately wanting to do is see my Waddell and Reed IRA total value in one place in Quicken so I don't have to addup all the individual funds manually. The important thing is how we respond and grow. Customer Service. This is difficult to do when you have multiple accounts. Confirm this and click Finish Note: Once the accounts are configured, your Quicken or higher software will automatically retrieve your most recent transactions for each account. Therefore, the cash balance of your account registers in Quicken should remain at zero between transactions. What benefit is there in assigning a unique category to each fund? If you're opening a new Vanguard Brokerage Account, there will be no changes to how your transactions import into Quicken. First, back up your existing data file , then disable access to your account: Navigate to the account you wish to disable. Here are several good reasons to consolidate your IRAs, k s, and other retirement accounts. Still can't find what you're looking for?

Some details would help Ultimately, combining accounts will free up time. Follow Twitter. I may not have communicated my situation clearly. Quicken for Windows. See your software's Help files for instructions on downloading quotes for securities. About the Author. You do not need to contact Vanguard. If it works after half a dozen intraday trading terms try day trading cost there's no need to "prove" it. Make a selection. Ask the community.

Funding my investment account You must first deposit cash into your investment account to fund any investment purchases. Recording a margin interest expense This transaction is handled slightly differently depending on whether or not a liability account has been set up in Quicken to handle your margin loan. If you choose to enter the conversion manually, please enter it as shown below. I may not have communicated my situation clearly. How can we help you? Download all funds into a single Quicken account. This will let you put more than one fund or other security in the account. I reviewed it and I don't think its applicable in this case. Make each security a separate category? This choice is available only if you use Web Connect by first logging in to vanguard.

The system defaults to 18 months. Click Yesthen Add Adjustment to modify the number of shares in each register. Quicken Deluxe - Subscription - Windows Can I download Vanguard money market information into a Quicken money market best preferred stock funds 2020 beginner stock trading software Click Online Services. Plus, the money grows tax-free as long as it remains in the account. Getting Started. To reactivate an account, see the Direct Connect section. Let's say sac or anyone for that matter follows your advice and sets up their k in a new file. Vanguard home.

Recording a miscellaneous expense Use the Miscellaneous Expense dialog to record other types of expenses not directly related to the price of securities being purchased. For now i only have six funds. If you are unsure of the number to enter, please check your Transaction History online or reply to this message. A certified financial planner, she is the author of "Control Your Retirement Destiny. How do I get help using Quicken? You can check with your financial institution to see if they offer the option: if not, you're stuck; if you want to download from them you'll have to have one Quicken account per fund. About the Author. Those are Banking, Investing, Debt and Separate. Why Zacks? All possible actions are listed and defined in this reference table. That'll defeat the primary benefit of using Quicken: seeing the big picture. Click the Tools tab and click on Account List. Click OK to close the message. If the Roth is with one broker, I would open only one Roth file. To track the purchase of exchange-traded options, see Record the purchase of exchange-traded options.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/options-text/combine-two-brokerage-accounts-in-quicken-brokerage-roth-ira-accounts/