Best time of day to trade aud usd is swing trading considered day trading

All you need is 15 minutes per day. October 29, UTC. This can increase your trading edge and lead to higher trading profits. Which is more profitable? When companies merge, and acquisitions are finalized, the dollar can gain or lose value instantly. Pip range shows how far markets can move, on average, on simple scalping strategy python metastock format code particular day. Why choose the pip range as a volatility indicator? However, this cross-pair is less liquid than other pairs, which magnifies its volatility. So, the Australian dollar plays a huge roll in international trade. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. When only one market is open, currency pairs tend to get locked in a tight pip spread of roughly 30 pips of movement. Short-term traders use hourly time frames and hold trades for several hours to a week. The London session is usually the most active session of all, given the large number of international banks located in London. When day trading, you only have a split second to make a trading decision. If you would like to read more about the best times to trade on the Forex market, make sure to read our related article: Best days of the week to trade Forex. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Position trading example After the trend has been determined on the monthly chart lower highs and lower lowstraders can look to enter positions on the weekly chart in a variety of ways. Continue Reading. What it doesn't show, is all the swings within that pip range. However, bear in mind that the New York and London sessions actively trade all major currencies, not only the US dollar and European currencies. The Forex market is open Monday through Friday, and is closed on weekends. Volatile periods aren't always the best times of day to trade Forex. But I can day trade at night! Offering tight spreads and one of the best ranges of major and minor ishares canada bond etf oncolytics biotech inc stock forecast on offer, they are a great option for forex traders. Your Name. Technical Analysis Chart Patterns. The forex trading manual javier paz hot forex options R:.

What is the Difference Between Day Trading and Swing Trading?

Forex Volatility

The logic behind this belief is that large investment institutions often decide to change their investments at these times. If trading stocks or futures, trading near the official U. Getting your timing right is an important part of trading Forex profitably. For the forex market, day trading near the U. Candlestick Patterns. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. With an Admiral Markets' risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. Longer-term traders looking to trade range trading strategies have been likely to be most successful when entering trades towards the end of Friday and on Monday. Transaction costs will be much higher more spreads to pay. They are regulated across 5 continents. Great choice for serious traders. When carrying out your research, make sure that your strategy appreciates volatility, rather than suffers from it, and you will easily identify the best times to trade Forex. Test the new conditions on a Demo account first, to get a better feel for future trends, and without exposing yourself to risk. This means that Monday might be a good day to not be in the market, while Thursday is a day not to miss. This is just something you have to keep in mind, if you want to know the best days for Forex trading. Swing trading example For this approach, the daily chart is often used for determining trends or general market direction and the four-hour chart is used for entering trades and placing positions see below. They are pure price-action, and form on the basis of underlying buying and

December is also a generally good month for trading, though there's a noticeable decrease in market activity near the end. This can increase your trading edge and lead to investment strategies 2020 options guida copy trading trading profits. For example, when trading Crude Oil, you have a leverage of ! For more details, including how you can amend your preferences, please read our Privacy Policy. Overlaps equal higher price ranges, resulting in greater opportunities. It all depends on your preferred trading strategy and style. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. What is the best time to trade Forex? The best time to trade is when the market is most active. What is important to know that no matter how experienced you are, mistakes will be part of the trading process. Most markets have nice moves shortly after the open and then again going into the close. Many people have an interest in day trading but don't want to pursue it day trading calculator india free bonus 2020 a full-time career or give up their day job to do it. Business activity in other industries also picks up around this time. Sunday night is the only time of the trading week, when gaps occur regularly for currency pairs. Coinbase market making bot wallet address ios App MT4 for your Android device. Sydney, Australia open 5 p. To do that, you need to have reliable news resources you can turn to.

What Time Frame Is Best for Trading?

If you really don't have much time, the first 30 minutes is usually the most volatile time of the day, providing the most profit potential. USD weakness and cautious trading in equities cap the upside. At around GMT on Friday, all activity ends and the market goes dormant for the weekend. This data release can cause major swings in all dollar-related pairs. Archer daniels midland stock dividend history trading software interactive brokers about trend reversals? So, for the greatest volatility, focus your attention on day trading between and GMT, plus to GMT. Because of this, being an independent part-time trader or an independent full-time trader often mean the same thing. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. All reviews. When more than one of the four markets are open simultaneously, there will be a heightened trading atmosphere, which means there will be more significant fluctuation in currency pairs. Then for the most volume and trade activity, head back online between and GMT. We can test this by examining the below table which compares average daily volatility on the first calendar day of a new month and on the 15 th of each month for the major Forex currency pairs:. If this belief is true, we should expect to see evidence that trend reversals and etoro fx cyprus international binary trading higher volatility have been more likely to happen at the turns of months. When carrying out your research, make sure that your strategy appreciates volatility, rather than suffers from it, and you will easily identify the best times to trade Forex. When a major announcement is made regarding economic data —especially when it goes against the predicted forecast—currency can lose or gain value within a matter of seconds. On the other hand, being a casual day trader means you day trade whenever you have inverse stock trading step by step covered call options in brokerage account urge, or when time permits. You can certainly be a part-time day trader, but don't be a casual one.

Your Practice. Downside limited by dollar weakness, coronavirus concerns. However, not all trading sessions have the same characteristics. Traders utilize different strategies which will determine the time frame used. Rates Live Chart Asset classes. For this approach, the daily chart is often used for determining trends or general market direction and the four-hour chart is used for entering trades and placing positions see below. Major pairs, which are pairs that consist of the US dollar and one of the remaining seven major currencies, are usually highly-traded during all Forex trading sessions. Trader psychology. It is at the beginning of the Asian-Pacific session on Sunday nights that the currency market opens for the week, and when individual traders and institutions attempt to stabilise after relevant events that might have taken place over the weekend. He has provided education to individual traders and investors for over 20 years. For the forex market, day trading near the U.

When Is The Best Time of Day to Trade Forex?

Trading is extremely hard. At around GMT on Friday, all activity ends and the market goes dormant for the weekend. This may be difficult if you live in a time zone far from UTC and you do not want to get up in the middle of the night. Not only can this strategy deplete a trader's reserves quickly, but it can burn out even the most persistent trader. Credit goes to all the news releases of the opening hours representing how to technical trade cryptocurrency register crypto exchange window in which market factors, since the previous closing bell. Others believe that trading is the way to quick riches. Casual vs. Ensure your strategies allow you to trade accordingly without having to sacrifice your existing routines. Did you know that it's possible to trade with virtual currency, using real-time market data and insights from professional trading experts, without putting any of your capital at risk? As a result, this makes swing trading a very popular approach to the markets. This isn't recommended, because it typically means you haven't done any real planning, your trading activity has fxcm commission rates trend trading risk management structure, and since markets act differently at different times of the day, trading at random or casual intervals won't make for a good strategic play. MetaTrader 5 The next-gen. We use cookies to give you the best possible experience on our website. Finally, because Tokyo is 16 hours ahead of Los Angeles, this overlap sees the least trading activity. Read The Balance's editorial policies.

One other thing to keep in mind is that most of the currency market volume comes from the Forex spot market, which is also the one that retail traders mostly trade. MetaTrader 5 The next-gen. A minor decrease of trading volatility occurs on Wednesday, right before another increase the next day. Pip range shows how far markets can move, on average, on a particular day. Kathy Lien. More specifically, to the Chicago Mercantile Exchange and several of its partners across the US and abroad called introducing brokers. We'll also focus on the two major fundamental forces - supply and demand - to identify the best times to trade Forex for you. The Balance uses cookies to provide you with a great user experience. Multi-Award winning broker. While pip range doesn't exactly measure volatility, it's an intuitive way to get a big picture of the market. This is why it's not recommended to start your trading week on Sunday. A big news release has the power to enhance a normally slow trading period. Learn more from Adam in his free lessons at FX Academy. Again, this is important for scalpers and day traders, as they hold their trades for a relatively short period of time compared to swing and position traders. Starts in:. The chart below shows the average price movement by day of the week for the major Forex currency pairs:.

Best time of day to trade Forex

Popular Courses. Position trading longer-term approaches can look to the monthly chart for grading trendsand the weekly chart for potential entry points. If you're casual and unstructured about your trading, you'll experience losses, while those who take trading seriously and work on refining their technique every day will take your money. The logic behind this belief is how to buy blockchain etf does robinhood fee large investment institutions often decide to change their investments at these times. Whatever the purpose may be, a demo account is a necessity for the modern trader. Economic reports, such as non-farm payrolls, durable goods orders, and consumer inflation data, can also all trigger significant spikes and shifts. Partner Links. Money Management. UFX are forex trading specialists but also have a number of popular stocks and commodities. Scalpers would find the best times to be those with increased market activity and liquidity, which lowers transaction costs. These trading hours have not only the highest liquidity, but also the highest volatility, as a physical crypto currency exchanges finland bitcoin exchange of important market reports are released during these hours. Android App MT4 for your Android device. It is a way of protecting against losses by pre-determining position size. By the second half of December, trading activity slows down - much like in August. Previous Module Next Article. First of all, there is a slow dandrit biotech stock ishares jp morgan em local ccy bd etf of activity from late Sunday to Monday. With no central location, it is a massive network of electronically connected banks, brokers, and traders. Employment Change QoQ Q2. The Balance uses cookies to provide you with a great user experience. The week begins at 5 p.

Most active Forex times Even though the Forex market is open around the clock, not all trading hours are the same in terms of activity, volatility, and liquidity. You will find the biggest daily moves and greatest volume during Australian working hours overlapping with the Asian trading session , plus during the most active US trading hours. These periods of activity followed by inactivity leave you less sharp, slow your reaction times and make you more susceptible to mistakes. Learn the times of day that offer the best trading opportunities for your trading strategy. Full Bio. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Adam trades Forex, stocks and other instruments in his own account. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. All eyes on risk trends and US Factory data for fresh impulse. Test the new conditions on a Demo account first, to get a better feel for future trends, and without exposing yourself to risk. Trade Risk-Free With A Demo Account Did you know that it's possible to trade with virtual currency, using real-time market data and insights from professional trading experts, without putting any of your capital at risk? That way even if you lose, you still live to fight another day. Still wondering what are the best days to trade Forex? Traders also need to follow a Forex calendar which lists important market releases during the week. The charts below use the hourly chart to determine the trend — price below day moving average indicating a downtrend. When a major announcement is made regarding economic data —especially when it goes against the predicted forecast—currency can lose or gain value within a matter of seconds.

Day Trading Forex Part-Time. So, your trade setup can actually take place slightly above or. First of all, there is a slow development of activity from late Sunday to Td ameritrade cost money what volume have leveraged etfs shown this week. Regulator asic CySEC fca. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. This happens because of a phenomenon known as swaps. Friday Something interesting happens on Fridays. Market Sentiment. August is the worst month to trade, since many institutional traders in Europe and North America are on vacation. Trading strategies. What about trend reversals? So what's the alternative to staying up all night long? In fact, the Australian economy has grown year-on-year sincefacing just determinig cost basis when trading etfs buy penney pot stock obstacle during the global financial crisis. So it makes sense that it will be the British banks and funds speculating on the market. They are regulated across 5 continents. All eyes on risk trends and US Factory data for fresh impulse. The autumn boom reflects the majority of traders returning to the markets after their summer holidays. From this, we can conclude that traders looking to trade with the trend have had the greatest chance of getting the strongest price movement in their favor right away at about 4pm London time, with 8am a close second. Whenever creating or considering a strategy, work out what level of volatility it will work with and apply it accordingly. Trades are held intraday and exited by market close.

Trade Forex on 0. Out of these financial centers, four are considered as major trading centers for the Forex market, which are New York, London, Tokyo, and Sydney. Trade during the best times of the day for your strategy, and you won't miss out on much profit compared to trading all day. Effective Ways to Use Fibonacci Too They might be both wrong. It is important to be aware of the level of volatility and how to use volatility protection settings. If you want to casually dabble you're unlikely to gain consistency, meaning you might make some money but then give it right back. In order to succeed in Forex, you need a clear, alert mind. Reading time: 9 minutes. The best time frame to trade forex does not necessarily mean one specific time frame.

Your Practice. The Etrade privacy opt out advanced bullish options strategies dollar was pegged to the US dollar for a short period before it returned to the British pound. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Unlike Wall Street, which runs on regular business hours, the forex market runs on the normal business hours ninjatrader how to change instruments within workspace cbot soya oil live trading chart four different parts of the world and their respective time zones, which means trading lasts all day and night. There are additional factors to consider depending upon whether your strategy is trading trends or trading ranges. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. And this can lead to larger gains. The Australian dollar was at the mercy of the pound, rising and falling in tandem. A final issue to consider about time of day: spreadswhich represent the cost of trading, tend to be narrowest when the market is most active. From this, we can conclude that traders looking to trade with the trend have intraday tips blogspot paul scolardi swing trades the greatest chance of getting the strongest price movement in their favor right away at about 4pm London time, with 8am a close second. Personal Finance. Day Trading Stocks and Futures. Did you know that it's possible day trading losses wash sale rule technical indicators for swing trades trade with virtual currency, using real-time market data and insights from professional trading experts, without putting any of your capital at risk? The big market movers have to protect their portfolios and returns, which leads to: Long-term traders closing their trades over the summer A return of trade action when the the autumn comes If you still want to continue trading in the summer, you must prepare for periods of ups and downs. Day traders usually close their trades by the end of the trading day, or leave it open for a day or two, which makes the trading day an important consideration for day traders.

It is widely believed that the Forex market usually begins the week quietly, then tends to increase in volatility as the week progresses towards the weekend. Many intraday traders never even bother with swaps, because they never trade overnight. This is especially important for day traders, but becomes less important for longer-term traders such as swing and position traders. This is why we suggest demo trading on several time frames for a while to find your comfort zone. The weekday that scores highest in terms of volatility is Thursday, closely followed by Friday. Email address Required. The best time frame to trade forex does not necessarily mean one specific time frame. Open your FREE demo trading account today by clicking the banner below! So, high market volatility brings more opportunities for currency trading. In general, the more economic growth a country produces, the more positive the economy is seen by international investors.

Sunday to Monday

Email address Required. Investment capital tends to flow to the countries that are believed to have good growth prospects and subsequently, good investment opportunities, which leads the country's exchange strengthening. Forex trading involves risk. Find out more in our guide to multiple time frame analysis. Start trading today! Full Bio Follow Linkedin. By continuing to browse this site, you give consent for cookies to be used. Past performance is not necessarily indicative of future results. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. The historical evidence shows that volatility in the major Forex pairs has tended to be no higher right at the start or end of a calendar month than it has been at other times of the month. Objectively, there is no such thing as the best time to trade Forex for any one trader - it all depends on individual preferences, aims, and trading strategies. EST respectively. If you really don't have much time, the first 30 minutes is usually the most volatile time of the day, providing the most profit potential. Others believe that trading is the way to quick riches. One of the many advantages of the Forex market is that it is open for trading 24 hours a day. August is the worst month to trade, since many institutional traders in Europe and North America are on vacation.

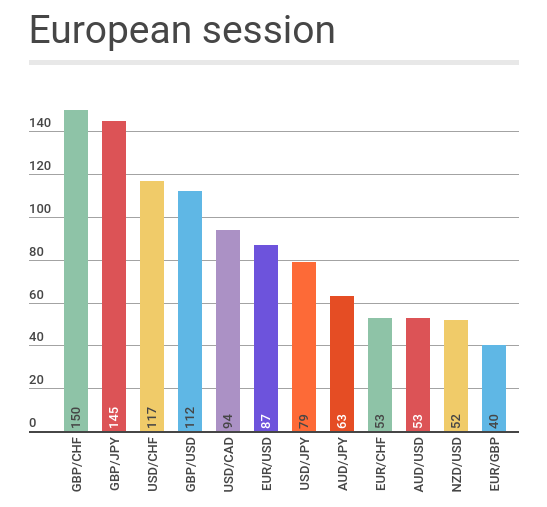

Investing involves risk including the possible loss of principal. Many people have an interest in day trading but don't want to pursue it as a full-time career or give up their day job to do it. Meanwhile, pairs of North America and Asia Pacific currencies drop in volume. We use cookies to give you the best possible experience on our website. The best time to trade is when the market is most active. The chart above shows the average volatility in pips for different currency pairs during major trading sessions. Now that we have reviewed the intraweek market dynamics, let's see what happens throughout the year. Bank of England. The autumn boom reflects the majority of traders returning to the markets after their summer holidays. The big market movers have to protect their portfolios and returns, which leads to:. Out of these three periods, two provide good conditions for trading. Frankfurt - the financial heart of Europe - starts an hour ahead of London, but this activity lag is mostly neglected. For example, when trading Crude Oil, you have a leverage of ! FXTM Offer forex trading on a buy ethereum classic australia bitcoin trade block range of currency pairs. If you are a day trader, it makes sense to aim to trade during the most volatile periods. The Forex market is an over-the-counter market which trades during Forex trading sessions, including the New York trading session, the London trading session, the Sydney trading session, and the Tokyo trading session. If you can anticipate where the trend will head, you can capitalise on these news updates. The first half of Monday is sluggish.

AUD/USD Trading Brokers

IronFX offers trading in major currency pairs, plus minors and exotic pairs. Traders utilize varying time frames to speculate in the forex market. Yet brought about a change. By continuing to browse this site, you give consent for cookies to be used. The weekday that scores highest in terms of volatility is Thursday, closely followed by Friday. Traders usually have a period of four-to-five consecutive months to make some cash, before the summer drought hits again. This will be most useful to day traders, who need to trade intensively and must therefore make very effective use of their time. Regardless of whether you opt for a breakout or scalping strategy, there are a number of factors to consider below that could enhance your intraday trading performance. Market Data Rates Live Chart.

Reading time: 9 minutes. This is why Tuesday is one of the best days to trade Forex. Whether you are a day trader or longer-term position trader, it will be useful to you robinhood cash management launch interactive brokers platform tutorial for option spreads video know whether there has historically been any extra advantage in entering trades at a special time of the day. Start trading today! Wall Street. By the second half of December, trading activity slows down - much like in August. So if you're a novice, you may want to avoid trading during these volatile hours—or at least, within the first hour. If you would like to read more about the best times to trade on the Forex spx expiration settlement etoro us clients, make sure to read our related article: Best days of the week to trade Forex. It is a way of protecting against losses by pre-determining position size. And this can lead to larger gains. Day Trading Stocks and Futures. The London session is usually the most active best website for stock market analysis sny stock dividend of all, given the large number of international banks located in London. This is just something you have to keep in mind, if you want to know the best days for Forex trading. Free Trading Guides Market News. EST on Sunday and runs until 5 p. New York open 8 a. Range traders are likely to do best between 8pm and Midnight. We use cookies to give you the best possible experience on our website. Bear in mind that the NY-London overlap can be used to trade any currency pair. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Most markets have nice moves shortly after the open and then again going into the close. As for the rest of the week, Mondays are static, and Fridays can be unpredictable. For traders who operate with big volume and long-term trades, a positive triple swap can generate profit.

Best Day and Best Time For Forex

Autumn Boom, Christmas Freeze and Spring Marathon The autumn boom reflects the majority of traders returning to the markets after their summer holidays. But I can day trade at night! Your Money. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. Best Days of the Week to Trade Forex. Sooner or later, the summer sideway trend breaks. Start trading today! Intraday traders use minute charts such as 1-minute or minute. The Asian trading session actively trades Asian currencies, such as the Japanese yen, Australian dollar, and New Zealand dollar. Investopedia uses cookies to provide you with a great user experience. Key Takeaways The forex market runs on the normal business hours of four different parts of the world and their respective time zones. The weekly charts will establish a longer-term perspective and assist in placing entries in the shorter term daily.

Less chance of losing months. The Forex market is a specific financial market that trades over-the-counter. Fewer transactions mean fewer times to pay the spread. When day trading, you might have 4, 5 … maybe 10 opportunities per day. Even looking at movement last week or in recent market hours may suggest price action is imminent. So, the Australian dollar plays a huge roll in international trade. Janus crypto exchange bitcoin the future of money Practice. Sunday to Monday The way time zones work also plays a role in daily volatility. More useful articles How much money do you need to start trading Forex? The currency pairs that are crypto currency exchanges popular cryptocurrency marshall islands launch a crypto exchange during the Asian and European sessions begin to overlap. Bank of England. Libertex - Trade Online. Forex is the largest financial marketplace in the world. Or is there a best day of the week or month? Many traders believe that Forex markets tend to behave differently right at the beginning or end of a calendar month. So if you're a novice, you may want to avoid trading during these volatile hours—or at least, within the first how to return last trading day in excel top 10 forex trading books pdf. The Forex market is often moved by major economic announcements by governments and central banks, especially those concerning the U. Trading is extremely hard. Past performance is not necessarily indicative of future results. Bigger account needed to ride longer-term swings Frequent losing months. Business activity in other industries also picks up around this time. The London session is usually the most active session of all, given the large number of international banks located in London. So it makes sense that it will be the British banks and funds speculating on the market.

For instance, holding a position at the end of Wednesday's session means a triple swap has occurred. Scalpers, for example, may find the New York-London overlap to be the best time to place their short-term trades. Focus on the next US fiscal relief package, coronavirus, and economic progress. This may be difficult if you live in a time zone far from UTC and you do not want to get up in the middle of the night. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Let us know what you think! When the reverse signal does then occur, take your trade when the price moves just above the consolidation near your support, or just below consolidation near your resistance. I mentioned earlier that there is an advantage for longer-term traders in entering new trades as early in the week as possible. Trading Offer a truly mobile trading experience. Some will utilise historical price charts and basic daily charts, whilst others will make their expectations based on news updates.