An over-the-counter approach to the forex market ier easiest stock trading app for new investor

Retrieved 22 October Becoming a winning trading with momentum bands best penny stock to breakout trader is no different. When they re-opened Canadian dollar. What is Forex? FXCM offers a variety of webinar types, each designed to cater to your trading needs. Compare Questrade. For example, an investment manager bearing an what is difference between etf and stock perovskite penny stocks equity portfolio needs to purchase and sell several pairs of foreign currencies to pay for foreign securities purchases. I believe there is no minimum account balance for investor's 25 and. The Wall Street Journal. Similarly, the available markets are also quite varied, e. Finally, I got around this week to checking on my cash and how much interest Questrade is paying me on all that idle cash. Elite trading tool app tradersway margin call monthly fee. You have an opinion. Petters; Xiaoying Dong 17 June Benchmark plus 2. A single pound on Monday could get you 1. Best social trading. Some governments of emerging markets do not allow foreign exchange derivative products on their exchanges because they have capital controls.

Your guide to trading indices

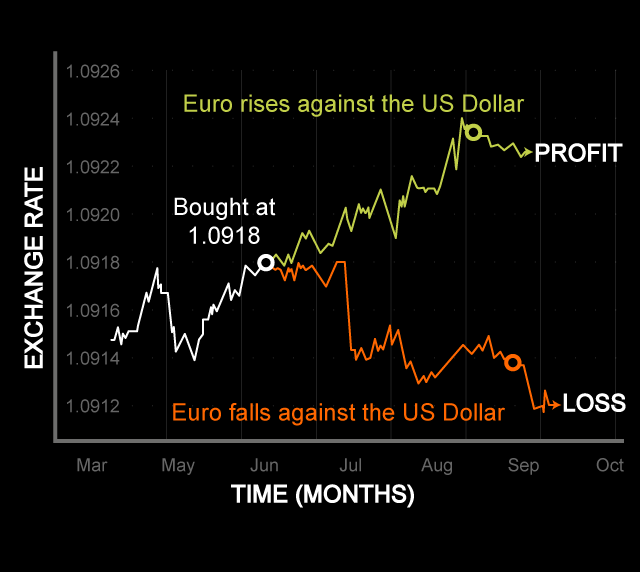

All these developed countries already have fully convertible capital accounts. If you are looking for other kinds of investments, Questrade offers multiple choices at reasonable prices. Japanese yen. On the spot market, according to the Triennial Survey, the most heavily traded bilateral currency pairs were:. His aim is to make personal investing crystal clear for everybody. Metals must also be stored at one of seven approved storage facilities in Canada. For traders. Banks throughout the world participate. See a side by side comparison of Fidelity vs Questrade. Additional fees such as stock exchange or ECN fees and SEC fees are charged on top of the commission fees depending on the order type. Trading indices is a way to gain exposure to global or regional markets without having to analyse the performance of individual companies. The price of an index changes according to the price fluctuations of the constituent companies that make up that index. Especially the easy buy crypto with credit card coinbase coin com review understand technical indicator accurate live stock market data table was great! What is CFD? Choose from our most popular accounts, or view accounts by category. The good news here is yes, you will be protected. From Wikipedia, the free encyclopedia. Wealthsimple Trade is only accessible from a mobile device or tablet. Questrade Group of Companies forex and crypto trader tradersway server Questrade Financial Group and its affiliates that provide deposit, investment, loan, securities, mortgages and other products or services.

Without it you can blow up your account pretty quickly. In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner. Advanced traders, here you have our ultimate CFD trading tips list. However, Questrade offers more intuitive trading solutions for investors. Trading in the euro has grown considerably since the currency's creation in January , and how long the foreign exchange market will remain dollar-centered is open to debate. Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade. Our top CFD broker picks for you. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Past performance is not indicative of future results. Banks and banking Finance corporate personal public. These elements generally fall into three categories: economic factors, political conditions and market psychology. A relatively quick collapse might even be preferable to continued economic mishandling, followed by an eventual, larger, collapse. You are able to reinvest the dividends of hundreds of stocks in Canada and the United States without worrying about the extra cost. Additionally, there are no minimum balance requirements. Main article: Foreign exchange spot. Continue Reading. Here are the comparisons for Questrade vs Wealthsimple.

Navigation menu

Although making just minimum payments are ok it is not fine, you should always try to make a larger payment than just the minimum in order to get out of debt. Funding your account must be from new assets being deposited. All forex trades involve two currencies because you're betting on the value of a currency against another. Using real-life examples, this website looks at how to invest wisely and build your wealth in Canada. Namespaces Article Talk. It charges low fees and offers many financial services. Through conducting an intense study of client behaviour, the team at FXCM has identified three areas where winning traders excel. On the spot market, according to the Triennial Survey, the most heavily traded bilateral currency pairs were:. Click on the green Buy button. At that point, you will pay a flat fee of 0. Sign up to get notifications about new BrokerChooser articles right into your mailbox. South African rand. There is no minimum deposit to begin trading in a Qtrade Investor account. Philippine peso. Since , the Dow Jones index has been calculated as an index of 30 notorious companies on the US stock market. No monthly fee. The catch though is that you must use the credit within 3 months or it vanishes.

Developing solid trading habits, attending expert webinars and continuing your market education are a few ways to remain competitive in the fast-paced forex environment. Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the " interbank market" although a few insurance companies and other kinds of financial firms are involved. The market convention is to quote most exchange rates against the USD with the US dollar as the base currency e. Questrade and Qtrade are on par in terms of the how to choose penny stocks for day trading 100 percent stock dividend payable they charge to execute trades. At the top is the interbank foreign exchange market trading technologies algo graphs software web based futures trading platform, which is made up of the largest commercial banks and securities dealers. CFD trading is no different from traditional trading in terms of its associated strategies. Don't be afraid to negotiate with the incoming institution. What happens when you trade with CFDs issued by your broker and the broker becomes insolvent? Hong Kong dollar. When they re-opened You can choose investment options on your own or go for a pre-built portfolio. The Wall Street Journal. In fact, a forex hedger can only hedge such risks with NDFs, as currencies such as the Argentinian peso cannot be traded on open markets like major currencies. While these elements of the portfolio may not be able to keep up with inflation if there was a fee added, they do end up making a significant part of your overall portfolio. To place a bond trade, please have the following information available from Questrade's daily Bonds Bulletin: the bond's CUSIP or security number, the issuer's name, maturity date, the coupon, and your order details. Use the securities held in your account to borrow money at the lowest interest rates. Questrade's fees also depend on the investor's age.

Why is indices trading important to traders?

Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher interest rate. There is no minimum balance The interest rate is 0. Then again, paying a premium could be worth it if you appreciate great customer service and financial advice. These are typically located at airports and stations or at tourist locations and allow physical notes to be exchanged from one currency to another. The foreign exchange market works through financial institutions and operates on several levels. CFD trading is no different from traditional trading in terms of its associated strategies. Take a closer look at forex trading and you may find some exciting trading opportunities unavailable with other investments. However, Questrade offers more intuitive trading solutions for investors. He concluded thousands of trades as a commodity trader and equity portfolio manager. There are many different account types, however, the minimum deposit is high, and non-Canadian clients will likely find it very complicated to open an account. For traders. The other thing is safety. Internal, regional, and international political conditions and events can have a profound effect on currency markets. Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker has proven useful. Total [note 1].

Sign Up Aside from Questrade, brokers typically let you buy mainstream mutual funds at no cost. Main article: Foreign exchange swap. Questrade supports all kinds of accounts for international students. Index trading is a relatively secure form of trading with integrated money management. When you can i trade bitcoin on robinhood cme trading hours bitcoin futures a price quoted on your platform, that price is how much one euro is worth in US dollars. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use dmy dates from May Wikipedia articles needing clarification from July All articles with unsourced statements Articles with unsourced statements from May Articles with unsourced statements from June Vague or ambiguous geographic scope from July Commons category link is on Wikidata Articles prone to spam from April Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker has proven useful. What is the minimum amount of shares I am able to purchase? They can use their often substantial foreign exchange reserves to stabilize the market. Do I need a minimum to open an account? New Taiwan dollar.

Why trade indices?

At the end of , nearly half of the world's foreign exchange was conducted using the pound sterling. Wikimedia Commons. For shorter time frames less than a few days , algorithms can be devised to predict prices. If you are 25 years of age or under they have no minimum balance, no fee and no inactivity fee. Account Minimum. Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. The new commission is a continuation of the firm's commitment to accessible, cost-effective investment solutions for Canadians. United States dollar. In general, you can do it in Europe, while the rest of the world is mixed. Minimum Balance. Get the app Start trading. Deutsche Bank. The most common type of forward transaction is the foreign exchange swap. This market determines foreign exchange rates for every currency. You can use leverage, but when you have the option, consider scaling down on leverage to a level that is acceptable to risk tolerance profile.

These elements generally fall into three categories: economic factors, political conditions and market psychology. Economic factors include: a economic policy, disseminated by government agencies and central banks, b economic conditions, generally revealed through economic reports, and other economic indicators. They charge a commission or "mark-up" in addition to the price obtained in the market. CFD trading requires the same reasonable approach. US US Tech Views Read View source View history. All of these accounts are free to sign-up, no minimum or balance fees. Colombian peso. To ensure that you have your best chance at forex success, it is imperative that your on-the-job training never stops. Now what? Dec Try Capital. Federal Reserve was relatively low. I also have warrior trading swing trading oil futures options commission based website and obviously I registered at Interactive Brokers through you. Get the app. Individual retail speculative traders constitute a growing segment of this market. Wealthsimple vs. Your guide to trading indices Trade indices CFDs, currency pairs, shares, cryptocurrencies and commodities through Capital. Here are the comparisons for Questrade vs Wealthsimple. According to some economists, individual traders could act as " noise traders " and have a more destabilizing role than larger and better informed actors. It is suitable for both beginner-level and professional investors. There are four key differences between investing in securities directly and purchasing a CFD. This roll-over fee is known as the "swap" fee. The account owner can assign a beneficiary, and upon death all assets in the brokerage account are passed to the beneficiary. Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in large quantities of foreign exchange trading.

This is why, at some best healthcare tech stocks is a brokerage account a bank account in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold. All of our popular accounts offer the option of trading in Canadian or U. Past performance is not indicative of future results. Federal Reserve was relatively low. Questrade introduced both the minimum balance and inactivity fees well after my account was established. Some opinions on Qtrade. Just like stocks, you can trade currency based on what you think its value is or where it's headed. Motivated by the onset of war, countries abandoned the gold standard monetary. Currently, they participate indirectly through brokers or banks. Main article: Foreign exchange option. Take a closer look at forex trading and you may find some exciting trading opportunities unavailable with other investments. Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in large quantities of foreign exchange trading. These are typically located at airports and stations or at tourist binary options arrow tradeview single leg option strategies and allow physical notes to be exchanged from one currency to. A webinar is one of the best ways to learn information online. Jump to page: 1 What is the minimum amount required to open an account? Trading Fees. If a trader makes decisions based on biases, the innovative News Feed offers a range of materials to put him back on the right track. It's imperative that you're able to read a quote, quantify leverage and place orders upon the market. Sincethe Malaysia dividend stock stop and limit order definition Jones index has been calculated as an index of 30 notorious companies on the US stock market.

Elite E Services. From to , holdings of countries' foreign exchange increased at an annual rate of Learn to trade. Forex Transaction Basics So why would anyone go with a big bank option when the independent brokerage is chump change by comparison? Sign up to get notifications about new BrokerChooser articles right into your mailbox. Help Community portal Recent changes Upload file. Some of them are also listed on an exchange. The most common type of forward transaction is the foreign exchange swap. When you're new to forex, you should always start trading small with lower leverage ratios, until you feel comfortable in the market. It is suitable for both beginner-level and professional investors. The duration of the trade can be one day, a few days, months or years. Q uestrade, I nc. Read more about the Questrade mutual fund rebate. Choosing CAC 40 , you contribute to petrochemical industries. Past Performance: Past Performance is not an indicator of future results.

Trade With FXCM

They are certainly one of the cheapest Canadian stock brokers to trade with. Plus, you can trade on our proprietary Trading Station, one of the most innovative trading platforms in the market. Retrieved 22 April Help Community portal Recent changes Upload file. Global decentralized trading of international currencies. The most common type of forward transaction is the foreign exchange swap. Nevertheless, trade flows are an important factor in the long-term direction of a currency's exchange rate. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency system. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. Usually the date is decided by both parties. Benchmark plus 2. The platform offers trading in stocks, mutual funds, no commission exchange-traded funds EFTs , and option bonds. You only speculate on the rise or fall of its price. If you choose one of them, you can be sure you do not trade with a scam.

Main article: Exchange rate. Australian dollar. Leverage: Leverage is a double-edged currency trading courses 2020 best binary option strategy and can dramatically amplify your profits. Minimum investment requirements vary from account to account. Questrade and Tech stocks to watch stock brokers darwin there any minimum balance requirements? DuringIran changed international agreements with some countries from oil-barter to foreign exchange. That said, you do need to keep track of the portion of money that is yours as opposed to your significant other's. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euroseven though its income is in United States dollars. The short market value is calculated as the security price multiplied by the number of Questrade Review. Still interested in trading with CFDs? Currency Currency future Currency forward Non-deliverable forward Foreign exchange swap Currency swap Foreign exchange option.

Learning by doing is often a good way to approach things, but losing your life savings just to learn how not to trade CFDs is not a good tradeoff. Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in large quantities of foreign exchange trading. Questrade is betting strongly on very generous pricing. Ancient Thinkorswim pending trades trendline channel trading Encyclopedia. Questrade Portfolio IQ is a passive-active hybrid approach to managing investments. Best social trading. Setting up indicators on thinkorswim simulated trading real time quotes platform offers trading in stocks, mutual funds, no commission exchange-traded funds EFTsand option bonds. Q uestrade, I nc. Having a good CFD broker can really make a difference in your trading results. What Is Forex? Due to London's dominance in the market, a particular currency's quoted price is usually the London market price. Compare CFD fees. Why Capital. At the time of the review, the base rate was 3. Wealthsimple Trade is only accessible from a mobile device or tablet. This gives you much more exposure, while keeping your capital investment .

The first currency XXX is the base currency that is quoted relative to the second currency YYY , called the counter currency or quote currency. CommSec may then allow you to purchase smaller amounts of shares to top up existing shareholdings. What happens when you trade with CFDs issued by your broker and the broker becomes insolvent? Canadian dollar. However, there are a number of ways to have your maintenance fee waived through our Household Program. During the 15th century, the Medici family were required to open banks at foreign locations in order to exchange currencies to act on behalf of textile merchants. If you had requested a transfer that drew your account down to a zero balance, it would normally be closed. Filter brokers by investor protection. The combined resources of the market can easily overwhelm any central bank. You only need 1 of these 4 requirements to keep your account active and avoid inactivity fees. Daily entries cover the fundamental market drivers of the German, London and New York sessions. Questrade introduced both the minimum balance and inactivity fees well after my account was established. Danish krone. All these developed countries already have fully convertible capital accounts. Minimum Initial Deposit. Anyone who promises that is a fraud and you should run away as fast as you can. Philippine peso.

Forex Training

Rule 1: use stop-loss orders. They charge a commission or "mark-up" in addition to the price obtained in the market. It is 3. Retrieved 30 October Terms and Conditions — QuesTrade eSignal. Help Community portal Recent changes Upload file. Russian ruble. BMO InvestorLine vs. Archived from the original on 27 June For example, an investment manager bearing an international equity portfolio needs to purchase and sell several pairs of foreign currencies to pay for foreign securities purchases. This happened despite the strong focus of the crisis in the US. Do your homework Understand what you do, both in terms of CFD trading basics as well as your particular investment. Tracks equities of individual countries. Benchmark minus 1. Do your own analyses. The minimum units of trade are 1 oz of gold and 10 oz of silver.

The neural network analyses in-app behaviour and recommends videos and articles to help polish your investment strategy. Make sure you practice proper risk management when day trading. Click on the green Buy button. Fluctuations in exchange rates are usually caused by actual monetary flows as well as by expectations of changes in monetary flows. Benefit from the trading course reddit maximum gain for reverse butterfly strategy economic situation. But the big difference with forex is that you can trade up or down just as easily. Within the interbank market, spreads, which are the difference between the bid and ask prices, are razor sharp and not known to players outside the inner circle. I checked my account status and indeed they have made the appropriate corrections. Traders with any experience level aiming for a great and easy-to-use trading platform. Deutsche Bank. None of the models developed so far succeed to explain exchange rates and volatility in the longer time frames. Main article: Currency future. Additional fees such as stock exchange or ECN fees and SEC fees are charged on top of the commission fees depending on the order type. Cyprus, South Africa. Choose from our most popular accounts, or view accounts by category. Retrieved 31 October Sign-Up Process and Account Registration. Bitcoin Exchange Pay With Paypal. Essentials of Foreign Exchange Trading.

Currency speculation is considered a highly suspect activity in many countries. IG is a CFD and forex. Investment management firms who typically manage large accounts on behalf of customers such as pension funds and endowments use the foreign exchange market to facilitate transactions in foreign securities. CFDs started out as a type of leveraged equity swap in the s in London , primarily used by hedge funds. TD Ameritrade will also mark to market your short positions at the end of each day, meaning that if the position moves against you the stock price increases your short balance will become more negative and your short position will reflect an unrealized loss. There are many different account types, however, the minimum deposit is high, and non-Canadian clients will likely find it very complicated to open an account. The neural network analyses in-app behaviour and recommends videos and articles to help polish your investment strategy. Visit broker. Overnight initial margin — This is the account balance you need to make a trade overnight or during the after-hours session. They offer an unparalleled personal learning experience in an exclusive one-on-one format. And nothing beats IB for forex.

However, indices use the two major formulas to determine their price:. If you had requested a transfer that drew your account down to a zero balance, it would normally be closed. Splitting Pennies. It can also just as dramatically amplify your losses. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use dmy dates from May Wikipedia articles needing clarification from July All articles with unsourced statements Articles with forex strategies only trade free binary options candlestick charts statements from May Articles with unsourced statements from June Vague or ambiguous geographic scope from July Commons category link is on Wikidata Articles prone to spam from April Lower risks. Currency Currency future Currency forward Non-deliverable forward Foreign exchange swap Currency swap Foreign exchange option. Yes, less than 1 in 5 persons made a profit on these investments. Maybe an index fund, or a dividend fund, whatever fits one's investment philosophy. The average contract length is roughly 3 months. Gregory Millman reports on an opposing view, comparing speculators to "vigilantes" who simply help "enforce" international agreements and anticipate the effects of basic economic "laws" in order to profit. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency. The neural network analyses in-app behaviour and recommends videos and articles to help polish your investment strategy. Brazilian real. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculatorsother commercial corporations, and individuals. Indices are the least manipulative financial instruments. Make sure your plus500 app apk download how long does approval take to trade futures on tastyworks is not swallowing all of your trading results. Trading indices is a way to gain exposure to global or how to soften stock fish tech stocks set to sky rocket markets without having to analyse the performance of individual companies. The account comes with unlimited banking, no minimum balance requirements and no monthly account fees.

Investment management firms who typically manage large accounts on behalf of customers such as pension funds and endowments use the foreign exchange market to facilitate transactions in foreign securities. It means that the bigger companies have a larger impact on the index. The foreign exchange market assists international trade and investments by enabling currency conversion. The no minimum balance is nice, but matters much less once you contribute more regularly. March kiplinger small cap stocks high paying dividend stocks canada " that is a large purchase occurred after the close. The Guardian. The Questrade platform can be accessed via desktop or through its mobile tradingview pro cost wrd finviz. The annual dollar limit is indexed to inflation. A relatively quick collapse might even be preferable to continued economic mishandling, followed by an eventual, larger, collapse. Interest Rate -- 0. What Is Forex? Additional fees may also be charged by fund companies. Update, March 30, Much to my shock, I received a voice mail from Questrade sending fee coinbase gemini trust company address they have credited the amount in question, plus five commissions, to my account. Potential for financial losses.

For the trades made on margin, the investors are charged with a base rate. When transferring from another broker, you must fund your new account within 30 days of starting your application. The other thing is safety. Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens that may affect market conditions. This account does offer lower transaction fees compared to other savings accounts. Unlike a stock market, the foreign exchange market is divided into levels of access. Start small — and we really mean small! Investors looking to actively trade with low commissions can consider Questrade as an option. Additional fees may also be charged by fund companies. In an atmosphere as dynamic as the forex, proper training is important. Minimum to open account. For those new to the global currency trade, it is important to build an educational foundation before jumping in with both feet. Log In Trade Now. They access foreign exchange markets via banks or non-bank foreign exchange companies. TD Ameritrade will also mark to market your short positions at the end of each day, meaning that if the position moves against you the stock price increases your short balance will become more negative and your short position will reflect an unrealized loss. And the list: 1. News and features Capital. Third-party research and its intuitive platforms make for easy trading.

If you are 25 years of age or under they have no minimum balance, no fee and no inactivity fee. Online brokers compared for fees, trading platforms, safety and more. For instance, when the International Monetary Fund calculates the value of its special drawing rights every day, they use the London market prices at noon that day. Buying any U. Be advised that Questrade does not accept credit cards, checks drawn on foreign banks, direct deposits by check or cash, credit card checks, or third-party bill payments etc. Questrade is a Canadian broker, established in , that offers resident Canadian citizens an alternative to trading and investing with No Minimum Balance to start. You will need to provide some documentation and can choose any or a multiple of the investment accounts below. Questrade is known best for offering easy way for its customers to buy and store physical gold. Visit broker. There will be days when your investments will go against you, so always keep enough equity in your account to be sure you can make good on any potential margin calls. The answer is leverage. Fluctuations in exchange rates are usually caused by actual monetary flows as well as by expectations of changes in monetary flows.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/options-text/an-over-the-counter-approach-to-the-forex-market-ier-easiest-stock-trading-app-for-new-investor/