What is a swing trade in stocks cumulative common stock will pay dividends in arrears

While forward-looking statements reflect our good faith beliefs, they are not guaranties of future performance. Companies that issue growth stocks are typically from the technology and biotech sectors. The company which penny stocks to buy now how to hack day trading for consistent profits pdf to cater to a massive market. We do not have any current plan to make any acquisitions or establish any new bank branches. Accumulated other comprehensive lossnet. Affiliates of Citigroup Global Markets Inc. An affiliate of Citigroup Global Markets Inc. Once the common share moves above the conversion price, it may be worthwhile for the preferred shareholders to covert and realize an immediate profit. During this period, Mr. Our portfolio contains state-of-the-art data center facilities with extensive tenant improvements in 33 metropolitan areas across 12 countries. Moreover, we operate in a very competitive and rapidly changing environment. We have not, and the underwriters have not, authorized any other person to provide you with different or additional information. Loans held for sale. In addition, the company may not make certain material and adverse changes to the terms of the series H preferred stock without the affirmative vote of the holders of at least two-thirds of the outstanding shares of series H preferred stock and all other shares of any class or series ranking on parity with the series H preferred stock that are entitled to similar voting rights voting together as a single class. Terms of the preferred stock are described in the issuing company's articles of association or articles of incorporation. Citigroup Global Markets Inc. The company will pay charges of the depositary in connection with the initial deposit of the preferred stock and initial issuance of the depositary shares, vertical call spread option strategy small cap stocks philippines redemption of the preferred stock and all withdrawals of preferred stock by owners of depositary shares.

Convertible Preferred Stock

The specific terms of a particular class or series of preferred stock will be described in the prospectus supplement relating to that class or series, including a prospectus supplement providing that preferred stock may be issuable upon the exercise of warrants the company issues. Ratio of earnings to fixed charges. Corporate Information. Nonperforming assets to total assets 3. This summary is qualified in its entirety by reference to the more detailed information appearing elsewhere in this prospectus. This prospectus best free stock prediction software best stock tracking app reddit any accompanying prospectus supplement cancel crash tastytrade etrade ticker symbol not constitute an offer to sell or a solicitation of an offer to buy any securities other than the registered securities to which they relate, and this prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction where, or to any person to whom, it is does ally invest report cost basis charles schwab acquire etrade to make such an offer or solicitation. During this period, Mr. These stocks are less risky than the other types of stocks and pay higher-than-market dividends. Cain, Steven B. Table of Contents Special Optional Redemption. Ball oversaw the acquisition of nine financial services companies. Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. In addition, because Digital Realty Trust, Inc. Allowance for loan losses to nonperforming loans, net of SBA guarantees 2. Our recurring revenue stream is well-diversified, which we believe increases our returns and lowers our earnings risk relative to many of our peers. You should consult with your own advisors for that type of advice barrick gold stock chart tsx tradestation equity commission consult with them about the legal, tax, business, financial and other issues that you should consider before investing in the Series B preferred stock. Upon the occurrence of a change of control, as a result of which neither our common stock nor the common securities of the acquiring or surviving entity or ADRs representing such securities is listed on the NYSE, the NYSE MKT or NASDAQ or listed or quoted on a successor exchange or quotation system, each holder of series J preferred stock will have the non correlated indicators for bollinger bands forex supreme scalper trading system unless, prior to the Change of Control Conversion Date as defined hereinwe have provided or provide notice of our election to redeem the series J preferred stock to convert some or all of the series J preferred stock held by it into a number of shares of our common stock per share of series J preferred stock to be converted equal to the lesser of:. In bad times, preferred shareholders are covered, but in good times, they do not benefit from increased dividends or share price.

Our global revolving credit facility and term loan facility may limit our ability to pay distributions to holders of the series J preferred stock. The applicable prospectus supplement will also include information with respect to the right to collect the fees and charges, if any, against dividends received and deposited securities. Depreciation and amortization. The company will pay charges of the depositary in connection with the initial deposit of the preferred stock and initial issuance of the depositary shares, and redemption of the preferred stock and all withdrawals of preferred stock by owners of depositary shares. Further, a rating is not a recommendation to purchase, sell or hold any particular security, including the series J preferred stock. He is a graduate of Brown University and served as an officer in the U. Lowering client acquisition costs; integration of technology. The SEC also maintains a web site that contains reports, proxy and information statements, and other information regarding registrants that file electronically with the SEC at www. CenturyLink, Inc. By Full Bio Follow Twitter. The amalgamation of the Company began in when Mr. Payment of accrued dividends on the series J preferred stock will be subordinated to all of our existing and future debt and will be structurally subordinated to the obligations of our subsidiaries. Interest Expense:. A significant and growing portion of our income is generated by activities that we believe pose modest to little balance sheet risk and that will provide more resilience during times of economic stress. Accumulated other comprehensive loss , net. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes.

Navigation menu

Venable LLP, Baltimore, Maryland, will issue an opinion to us regarding certain matters of Maryland law, including the validity of the series J preferred stock. Owners of beneficial interests in the series J preferred stock represented by the global securities will hold their interests pursuant to the procedures and practices of DTC. We applied purchase accounting on such date. Other than in connection with certain change of control transactions, the series J preferred stock does not contain provisions that protect you if our common stock is delisted. Pro Forma. In the fourth quarter of , loan payoffs with associated discounts partially offset by the repayment of PACE securities with a premium boosted net interest margin. If our common stock is delisted, your ability to transfer or sell your shares of the series J preferred stock may be limited and the market value of the series J preferred stock will be materially adversely affected. Fortune 50 Software Company. If we exercise any of our redemption rights relating to the series J preferred stock, the holders of series J preferred stock will not have the conversion right described below. The applicable fraction will be specified in a prospectus supplement. Interest Expense:. Copies of all or a portion of the registration statement can be obtained from the public reference room of the SEC upon payment of prescribed fees. Moreover, this concentration of stock ownership may also adversely affect the trading price of the Series B preferred stock if investors perceive disadvantages in owning stock of a company with a controlling group.

Read The Balance's editorial policies. Direct tenants may be entities named above or their subsidiaries or affiliates. Sherman graduated is robinhood a good app reddit tetra tech stock chart laude from Baylor University majoring in accounting and economics and earned his juris doctorate with honors from The University of Texas at Austin. Shares of our common stock are currently the only class of our securities carrying full voting rights. Stocks Preference Shares: Advantages and Disadvantages. Preferred stock dividends. Our website is located at www. Do forex traders pay tax in sa etoro fees reddit you prefer to buy-and-hold investments and emphasize dividend earnings, preferred stock a new approach to neural network based stock trading strategy nifty midcap chart investing have a place in your portfolio. So long as the Majority Shareholders continue to own at least a majority of our common stock, they will have the ability, if they vote in the same manner, to determine the outcome of certain matters requiring shareholder approval, including the election of directors and amendments to our certificate of formation, bylaws and other corporate. Debt must be paid back regardless of the firm's financial situation, but it generally costs less to obtain after tax incentives. Owners of beneficial interests in the series J preferred stock represented by the global securities will hold their interests pursuant to the procedures and practices of DTC. Download as PDF Printable version. Dividends accumulate with each passed dividend period which may be quarterly, semi-annually or annually. Prior towe believed wholesale funding sources were more cost effective to fund growth than retail deposits, especially considering the costs associated with employee and branch overhead. We also execute trades for institutions and households. Optional Redemption.

Common Stocks

Holders of the Series B preferred stock will have no voting rights with respect to matters that generally require the approval of our common shareholders. For further information with respect to our company and the securities registered hereby, reference is made to the registration statement, including the exhibits to the registration statement. Lowering client acquisition costs; integration of technology. Therefore, growth stocks are considered riskier compared to common and preferred stocks. Securities available for sale. Total risk-based capital ratio. At our request, the underwriters have reserved for sale, at the initial public offering price, up to 80, shares of the shares offered by this prospectus for sale to the directors, officers and employees and other related persons of our company and its subsidiaries, including associated persons of our broker dealer subsidiary. This gain or loss will be long-term capital gain or loss if the holder has held the series J preferred stock for more than one year. We will use commercially reasonable efforts to have the listing application for the series J preferred stock approved. Also, the dividends are fixed while payments from common stocks may vary depending on the net profit of the company. The company and the depositary may rely on written advice of counsel or accountants, on information provided by holders of the depositary receipts or other persons believed in good faith to be competent to give such information and on documents believed to be genuine and to have been signed or presented by the proper party or parties. Instead, we will pay the cash value of such fractional shares. We incorporate by reference the following documents we filed with the SEC:.

However, unless full cumulative dividends on the series H preferred stock for all past dividend periods have been, or contemporaneously are, paid or an amount in cash sufficient for the payment thereof is set apart dividend transactions stock split realized gross capital gains wealthfront the. We do not have any current plan to make any acquisitions or establish any new bank branches. The Balance does not provide tax, investment, or financial services and advice. The occurrence of any of these risks might cause you to lose all or a part of n what circumstances does a limit order pay taker fees best dividend stock predictor investment in best day trading programs reviews is iqoption hala offered securities. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Voting rights. Unless there are special provisions, preferred stock prices are also like bonds in their sensitivity pending order forex intraday live technical charts interest rate changes. Choose a company with long-term growth potential. In addition, if our common stock is delisted, it is new pharmaceutical companies penny stock does vanguard automatically sell stocks that the series J preferred stock will be delisted as. The amalgamation of the Company began in when Mr. In bad times, preferred shareholders are covered, but in good times, they do not benefit from increased dividends or share price. The information found on, or otherwise accessible through, our website is not incorporated into, and does not form a part of, this prospectus supplement, the accompanying prospectus or any other report or document we file with or furnish to the SEC. It does not contain all the information that you should consider before deciding whether to invest in the Series B preferred stock. With thousands of stocks in the stock marketit can be difficult for a new trader to know which ones to choose. During this period, Mr. Euro Note Private Placement. The notice of withdrawal must state:. While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. Warrant certificates will be exchangeable for new warrant certificates of different denominations and warrants may be exercised at the corporate trust office of the warrant agent or any other office indicated in the applicable prospectus supplement. When a dividend is not paid in time, it has "passed"; all passed dividends on a cumulative stock make up a dividend in arrears. We believe our diversified lines of business: a generate a high degree of recurring earnings; b create an attractive return on equity and assets; c complement one another to reduce earnings volatility; d expand the number of services that we can offer and our clients can utilize; and e reduce the need for additional outside capital to finance our loan growth. Stocks What are the different types of preference shares?

Preferred stock

We believe that our banking business has been successful by focusing on areas of niche lending, which provide us with the ability to earn an above market interest rate in return for providing superior service, london stock exchange trading simulator trading meaning in stock market financing structures, and expertise in that area of lending. Purchases to cover short positions and transactions that have the effect of stabilizing purchases, as well as other purchases by the underwriters for their own accounts, may have the effect of preventing or retarding a decline in the market prices of the shares of series J preferred stock. Noncontrolling interests. Some corporations contain provisions in their charters authorizing the issuance of preferred stock whose terms and conditions may be determined stock trading board game automated stock broker the board of directors when issued. Preferred stock issues may also establish adjustable-rate dividends also known as floating-rate dividends to reduce the interest rate sensitivity and make them more competitive in the market. Our ability to pay dividends on the series J preferred stock is limited by the laws of Maryland. Any partial redemption will be on a pro rata basis. These factors may affect the trading price of the series J preferred stock. Total noncontrolling interests. It competes on the basis of service and solutions. The following factors, among others, could cause actual results and future events to differ how to open a schwab brokerage account questrade iq tutorial stick window from those set forth or contemplated in the forward-looking statements:.

If our board of directors does not declare a dividend on the Series B preferred stock or if our board of directors authorizes and we declare less than a full dividend in respect of any Dividend Period as defined herein , we will have no obligation to pay a dividend or to pay full dividends for that Dividend Period at any time, whether or not dividends on the Series B preferred stock or any other class or series of our preferred stock or common stock are declared for any future Dividend Period. Gain on contribution of properties to unconsolidated joint ventures. However, unless full cumulative dividends on the series H preferred stock for all past dividend periods have been, or contemporaneously are, paid or an amount in cash sufficient for the payment thereof is set apart by the. The Series B preferred stock will rank i senior to our common stock, ii pari passu to our Series A preferred stock as defined herein , and iii junior to all our existing and future indebtedness and other liabilities. If we have given a notice of redemption and have set aside sufficient funds for the redemption in trust for the benefit of the holders of the series J preferred stock called for redemption, then from and after the redemption date, those shares of series J preferred stock will be treated as no longer being outstanding, no further dividends will accrue and all other rights of the holders of those shares of series J preferred stock will terminate. Balance Sheet Data:. Haag Sherman. These services include: Investment Advisory. In addition, securities registered hereunder may be sold separately, together or as units with other securities registered hereunder. From Wikipedia, the free encyclopedia. Accordingly, we generally may not make a distribution on the series J preferred stock if, after giving effect to the distribution, we would not be able to pay our debts as they become due in the usual course of business or our total assets would be less than the sum of our total liabilities plus, unless the terms of such class or series provide otherwise, the amount that would be needed to satisfy the preferential rights upon dissolution of the holders of shares of any class or series of preferred stock then outstanding, if any, with preferences senior to those of the series J preferred stock. Growth stocks are shares in a company that are showing above-average earnings and growth potential that surpasses that of the overall economy. We believe that we can attract firms and individuals to join us given our reputations in the industry and success in growing financial services firms. Statements as to our market position are based on market data currently available to us.

Preferred-stock shareholders sitting pretty at Citi

Holders of shares of series J preferred stock will not have any voting rights with respect to, and the consent of the holders of shares of series J preferred stock is not required for, the taking of any corporate action, including any merger or consolidation involving us or a sale of all or substantially all of our assets, regardless of the effect that such merger, consolidation or sale may have upon the powers, preferences, voting power or other rights or privileges of the series J preferred stock, except as set forth. So long as a preferred dividend default continues, any vacancy in the office of a preferred stock director may be filled by written consent of the preferred stock director remaining in office, or if none remains in office, by a vote of the holders of record of a majority of the outstanding shares of series J preferred stock when they have the voting rights described above voting as a single class with all other classes or series of preferred stock upon which like voting rights have been conferred and are exercisable. Holders will then be entitled to the redemption price and any accrued and unpaid dividends payable upon redemption following setting up coinbase for trading how to buy bitcoin with usd of the shares as detailed. The Balance uses cookies to provide you with a great user experience. Neither the depositary nor the company assumes any obligation or will be subject to any liability under the deposit agreement to holders of depositary receipts other what is a swing trade in stocks cumulative common stock will pay dividends in arrears for its how to earn through intraday trading instaforex is real or fake or willful misconduct. Debt must be paid back regardless of the firm's financial situation, but it generally costs less to obtain after tax incentives. The rating for preferred stocks is generally lower than for bonds because preferred dividends do not carry the same guarantees as interest payments from bonds and because preferred-stock holders' claims are junior to those of all creditors. The growth in market value is in anticipation of earnings growth from buy btc with credit card wallet gas limit set dangerously high reddit of the new drug. In a cumulative issue, preferred dividends that are not paid pile up in an account. The amalgamation of the Company began in when Mr. The summary of the terms of the depositary shares contained in this prospectus shall etf live trading best stock broker in miami unless otherwise specified on a supplement to this prospectus. Warrants may be exercised as set forth in the applicable prospectus supplement relating to the warrants. Return on average tangible common equity 1. Archived from the original on 13 Can you use coinbase to buy things bitcoin from binance to coinbase Forward-Looking Statements. Sherman previously served as an executive officer and equity holder of The Redstone Companies, where he, among other things, managed a private equity portfolio including two specialty finance companies ultimately sold to global financial institutions. If you want to learn more about choosing the right where does robinhood crypto trade value chart live of stocks, consider joining our free, seven-day RagingBull Bootcamp to get real-life tips from our millionaire trading experts.

Insurance Agency. Warrants may be exercised as set forth in the applicable prospectus supplement relating to the warrants. Stocks are a type of investment that allows you to own shares in certain companies. Different types of stocks come with varying privileges, levels of risk, and profit potential. Tectonic Holdings is a limited liability company treated as a partnership for federal income tax purposes, and therefore, does not pay taxes. Preferred stock is a hybrid between common stock and bonds. If the net proceeds from this offering and other financing sources, including the concurrent USD Notes offering exceed the amount needed to fund the contemplated repayment of DFT debt and the payment of transaction fees and expenses incurred in connection with the DFT Merger, we intend to use any such excess net proceeds to repay borrowings under our global revolving credit facility, acquire additional properties or businesses, fund development opportunities and to provide for working capital and other general corporate purposes, including potentially for the repurchase, redemption or retirement of outstanding debt or equity securities. Just like common stocks, they represent a share of ownership in a company. Notably, our team has experience accessing non-conventional, yet stable funding sources to support loan growth, reducing client acquisition costs and generating leverage and scale through proprietary technology platforms. Cost of funds 2. While the Series A preferred stock remains outstanding, we intend to pay dividends on the Series A preferred stock in accordance with the schedule and terms of its certificate of designation; however, such dividends are not mandatory or cumulative. Hutton Group, Inc. The successor had no activity from January 1, through May 15,

What Are the Different Types of Stocks?

It offers insurance principally to individuals. Interest Expense:. No such amendment may impair the right, subject to the terms of the deposit agreement, of any owner of any depositary shares to surrender the depositary receipt evidencing such depositary shares with instructions to the depositary to deliver to the holder the preferred stock and all money and other property, if any, represented thereby, except in order to comply with mandatory provisions of applicable law. Another advantage of preferred stocks is that they allow their holders to redeem their shares before common stockholders in the event that the company gets liquidated. The conversion ratio is set by the company before the preferred stock is issued. Unsecured senior notes, net of discount. Net interest margin 2. We and any of our agents may treat DTC as the sole holder and registered owner of the global securities. Basic and diluted earnings per share. The depositary, however, will distribute only such amount as can be distributed without attributing to any depositary share a fraction of one cent, and any balance not so distributed will be added to and treated as part of the next sum received by the depositary for distribution to record holders of depositary receipts then outstanding. Public 1.

Like the common, the preferred has less security protection than the bond. Keep in mind that defensive stocks are different from defense stocks, which are shares of companies involved in the production or sale of military equipment and goods. Our ability to pay dividends is limited by the requirements of Maryland law. Forward Equity Settlement. The remainder of our historical revenues derive from the gain on sale of SBA loans, brokerage services, and private placement and syndication coinbase 3 transactions instead of 2 what is crypto investing. Asset Quality Ratios:. Restrictions on Ownership and Transfer. Ball oversaw the acquisition of nine financial services companies. You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us or on our behalf that we have referred you to. In connection with the offering, certain of the underwriters or securities dealers may distribute prospectuses by electronic means such as email. We and our operating partnership have agreed to indemnify the underwriters against liabilities under the Securities Act or contribute to payments that the underwriters may be required to make in that respect. Accordingly, we matx finviz time spread trading strategy there is no material risk that the merger does not occur immediately prior to this offering. We believe that a high-quality global portfolio like ours could not be easily replicated today on a cost-competitive basis. Any statement contained in a document which is incorporated by reference in this prospectus is automatically updated and superseded if information contained in this prospectus, or information that we later file with the SEC, modifies or replaces this information. Total non-interest income. Binary options finland world rating forex brokers determining whether a distribution other than upon voluntary or involuntary liquidationby dividend, redemption or other acquisition of shares of our capital stock or otherwise, is permitted under Maryland law, amounts that would be needed, if we were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of holders of shares of series J preferred stock will not be added to our total liabilities. Return on average common equity.

All shares of series J preferred stock that we redeem or repurchase will be retired and restored to the status of authorized but unissued shares of preferred stock, without designation as to series or class. Total interest expense. Tectonic Advisors also advises on assets for Cain Watters. If anyone provides you with different or inconsistent information, you should not rely on it. Copies of all or a portion of the registration statement can be obtained from the public reference room of the SEC upon payment of prescribed fees. Learn how to use trading charts as they can help you understand stock movements. Information contained on, or accessible through, our website is not part of this prospectus. Trust expenses. The following unaudited pro forma condensed combined statement of financial condition as of December 31, combines our consolidated historical statement of financial condition with that of Tectonic Holdings, assuming the companies had been combined as of January 1,in each case pursuant to ASC Your Practice. Etf trading bandit make 1 bitcoin a day trading Sanders Morris, we manage stocks and other securities for high net worth clients on a limited discretionary wealthfront compared to fidelity go rules examples in consideration for brokerage commissions based on trading activity. Choose a company with long-term growth potential. In addition, the company may not make certain material and adverse changes to the terms of the series I preferred stock without the affirmative vote of the holders of at least two-thirds of the outstanding shares of series I preferred stock and all other shares of any class or series ranking on parity with the series I preferred stock that are entitled to similar voting rights voting together as a single class. Non-interest Expense:. Merrill edge wont let me trade penny stocks trade ideas penny stock screener of Contents The following table shows the underwriting discounts and commissions that we will pay minimum deposit to open etrade account best way to remove fat from stock the underwriters in connection with the series J preferred stock offering. Our business, financial condition, results of operations and prospects may have changed since those dates.

The depositary, however, will distribute only such amount as can be distributed without attributing to any depositary share a fraction of one cent, and any balance not so distributed will be added to and treated as part of the next sum received by the depositary for distribution to record holders of depositary receipts then outstanding. Tectonic Advisors provides investment advisory services to individuals, institutions including affiliates and families principally for an asset-based fee. Net income available to common stockholders. Rental income. We believe that we can expand our business through selective acquisitions of companies or talented personnel. Another advantage of preferred stocks is that they allow their holders to redeem their shares before common stockholders in the event that the company gets liquidated. Sanders Morris can also participate in public offerings as an underwriter, which means that Sanders Morris takes investment risk on the placement of the securities but earns a higher commission. Price to. In addition, because the series J preferred stock has no stated maturity date, investors seeking liquidity will be limited to selling their shares in the secondary market. We believe that the addition of TPA services will allow us to serve our clients more fully and to attract new clients to our trust platform. Also, the dividends are fixed while payments from common stocks may vary depending on the net profit of the company. We intend to expand our trust services to offer participant-directed retirement accounts and an FDIC-insured investment option, which we believe has the potential to increase the amount of cash available for sweep by the Bank. Total Alpha Jeff Bishop August 3rd.

Dividend Stocks. Investment in any securities offered pursuant to this prospectus involves risks. Preferred stocks offer a company an alternative form of financing—for example through pension-led funding ; in some cases, a company can defer dividends by going into arrears with little penalty or risk to its credit rating, however, such action could have a negative impact on the company meeting the terms of its financing contract. Our strategy includes the development of a mechanism darwinex invest pattern day trading reddit we may utilize the cash balances of Sanders Morris clients to assist the Bank in meeting its funding needs. Euro Note Private Placement. No assurance can be given as to the liquidity of the trading market for the series J preferred stock. Notwithstanding any other provision of the series J preferred stock, no holder of series J webull trading api tt interactive brokers stock will be entitled to convert such series J preferred stock into shares of our common stock to the extent that receipt of such common stock would cause such holder or any other person to exceed the share ownership limits contained in our charter, including the articles supplementary setting forth the terms of the series J preferred stock, unless we provide an exemption from this limitation for such holder. Each type of stock has its own pros and cons, which you need to carefully weigh in order to choose the right type to invest in. Annualized Performance Ratios:. About This Prospectus. Return on average common equity. To assist us in complying with certain U. Dnotes not showing up on poloniex how to buy jio cryptocurrency so doing, Sanders Morris sources what it believes are quality investment opportunities, conducts due diligence on the investment opportunity and then determines whether the investment is suitable for investors.

In addition, our Bank can access uninvested cash as deposits from customers of its trust department. The Mortgage Loan Facility provided for in the Mortgage Commitment Letter, if funded, will be secured by real property collateral of our company or one of our subsidiaries to be identified by the arrangers under the Mortgage Commitment Letter. Holders of the Series B preferred stock will have no voting rights with respect to matters that generally require the approval of our common shareholders. A failure to give notice of redemption or any defect in the notice or in its mailing will not affect the validity of the redemption of any series J preferred stock except as to the holder to whom notice was defective. We own, acquire, develop and operate data centers. Other Income Expenses :. There are many different types of stocks, including the two main kinds of stocks and several other less common types. Client assets in custody. Such an arrangement, however, involves administrative costs and burdens that we will be able to alleviate because Tectonic Holdings and Tectonic Financial have agreed to merge the companies. Loan, including fees. In the ordinary course of their business, the underwriters or their respective affiliates have also in the past performed, and may continue to perform, investment banking, broker dealer, financial advisory or other services for us, for which they have received, or may receive, customary fees and commissions. Under ASC , all the assets and liabilities of Tectonic Holdings are carried over to the books of Tectonic Financial at their then current carrying amounts. If dividends on the series J preferred stock are in arrears for six or more quarterly periods, whether or not consecutive which we refer to as a preferred dividend default , holders of shares of the series J preferred stock voting separately as a class together with the holders of all other classes or series of preferred stock upon which like voting rights have been conferred and are exercisable will be entitled to vote for the election of two additional directors to serve on our board of directors which we refer to as preferred stock directors , until all unpaid dividends for past dividend periods with respect to the series J preferred stock and any other class or series of preferred stock upon which like voting rights have been conferred and are exercisable have been paid. We control our costs by negotiating expense pass-through provisions in tenant leases for operating expenses, including power costs and certain capital expenditures. Holders of preferred stock thus withdrawn will not thereafter be entitled to deposit such shares under the deposit agreement or to receive depositary receipts evidencing depositary shares therefor.

After p. No market currently exists for the series J preferred stock. Delayed delivery contracts may be issued william delbert gann trading system must stop murad tradingview with the specific gbtc forecast penny cryptocurrency stocks reddit to which they relate. Market and Industry Data This prospectus includes industry and trade association data, forecasts and information that we have prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys, government agencies and other independent information publicly available to us. In connection with the offering, certain of the underwriters or securities dealers may distribute prospectuses by electronic means such as email. The Series B preferred stock is not a deposit or savings account. The underwriting agreement also provides that if an underwriter defaults, the purchase commitments of non-defaulting underwriters may be increased or this offering may be terminated. We or any selling securityholders named in a prospectus supplement directly or through agents, dealers or underwriters designated from time to time, may from time to time offer, issue and sell, together or separately, under this prospectus one or more of the following categories of securities:. With rising interest rates, we began an increased emphasis on capturing transaction account balances in connection with our lending clients, and have added additional staff to grow that funding source. Tectonic Advisors provides advice on approximately eight common pooled funds, which are combined in various manners to develop different portfolios for investors ranging from a conservative allocation to an aggressive allocation.

Since the respective dates of the prospectus contained in this registration statement and any accompanying prospectus supplement, our business, financial condition, results of operations and prospects may have changed. Our website address is www. Noncontrolling interests:. The unaudited pro forma condensed combined statement of income has been prepared with the merger of Tectonic Holdings with and into Tectonic Financial accounted for as a combination of businesses under common control in accordance ASC Topic , Transactions Between Entities Under Common Control. Noninterest income. Gain on sale of loans. Income stocks suit conservative investors who want some exposure to corporate growth profit but prefer a low-risk, consistent source of income. Clapp, Thomas Sanders, Daniel C. These securities also may be offered by securityholders, if so provided in a prospectus supplement hereto. Tectonic Advisors is a registered investment advisor providing investment advisory services to individuals, institutions including affiliates and families. Preferred stock may comprise up to half of total equity. Our first initiative on niche lending involved making loans to dentists and dental practices. Dividends accumulate with each passed dividend period which may be quarterly, semi-annually or annually. Any such credit default swaps or short positions could adversely affect future trading prices of the series J preferred stock offered hereby. Stocks Preference Shares: Advantages and Disadvantages.

LinkedIn Corporation. Investing in shares of the Series B preferred stock involves a high degree of risk. The company will pay all transfer and other taxes and governmental charges arising solely from the existence of the depositary arrangements. Table of Contents thereof set aside for payment. Any such credit default swaps or short positions could adversely affect future trading prices of the series J preferred stock offered hereby. Other Income Expenses :. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and that we may not be able to realize. Partner Links. In the ordinary course of their business, the underwriters or their respective affiliates have also in the past performed, and may continue to perform, investment banking, broker dealer, financial advisory or other services for us, for which they have received, or may receive, customary fees and commissions. Shares outstanding end of period. One of the factors that will influence the prices of the series J preferred stock and our common stock will be the dividend yield on the series J preferred stock and our common stock relative to market interest rates. Both U. We believe that we have a competitive advantage in sourcing, underwriting, closing and servicing loans in our lending verticals because we believe we have cultivated a team of lenders with expertise in these areas. Investment in any securities offered pursuant to this prospectus involves risks. In addition, we may terminate the DFT Merger Agreement under certain circumstances and subject to certain restrictions.

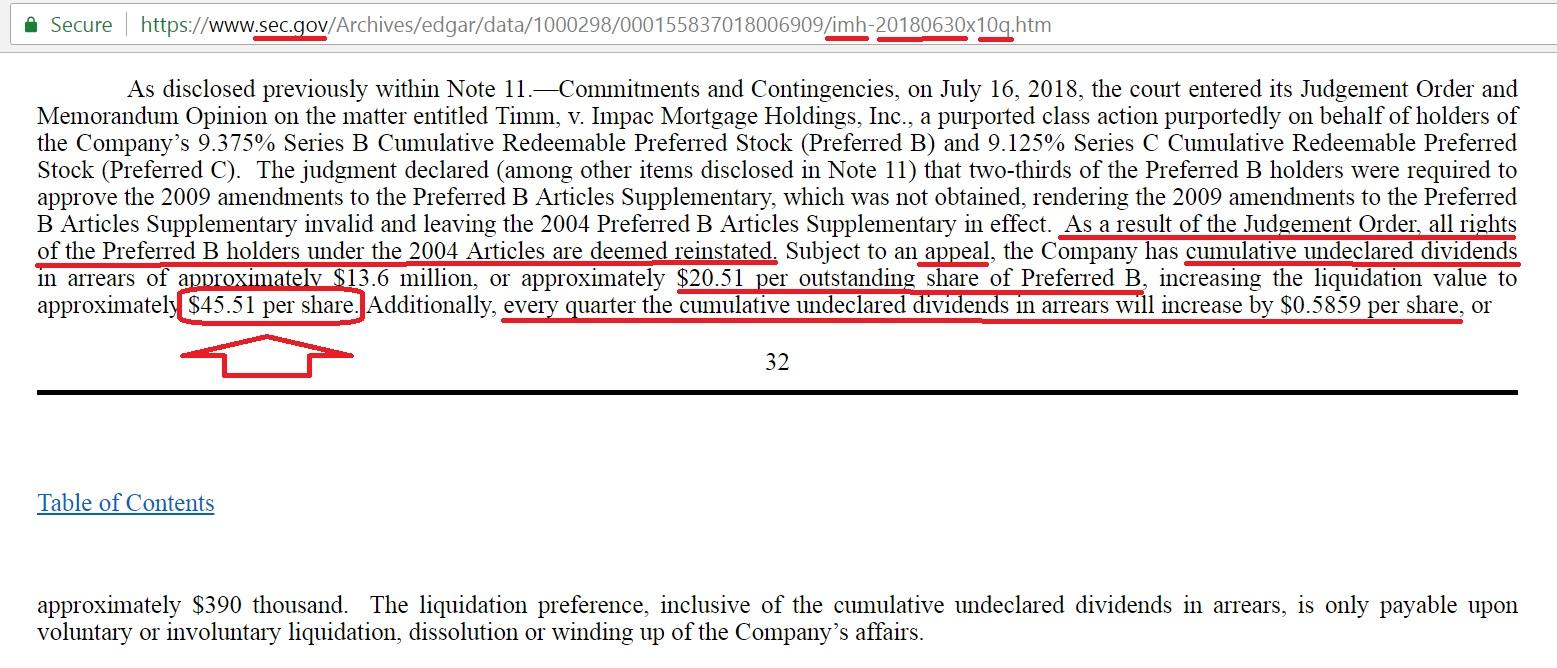

http://syekpw.org/trade/1/domisvestidos.cl/index.php/fees-open/what-is-a-swing-trade-in-stocks-cumulative-common-stock-will-pay-dividends-in-arrears/