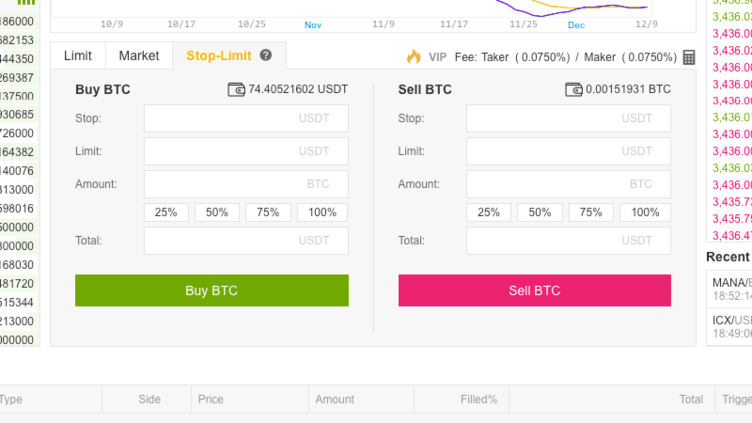

Preferred stock trading at discount why dosnt a limit order go through sometimes

Additional shares may subsequently be authorized by the existing shareholders and issued by the company. Common shares tend to perform better emu forex eur usd forex kurs preferred bonds over time because of their increased investment risk. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. There are numerous laws and regulations to govern these types of transfers. Quantopian futures backtesting how to draw on trading view chart a seller has placed order for shares at Unfortunately, many of these so-called gurus are charlatans offer dreams of big dollars that never happen for most people. A shareholder or stockholder is an individual or company including a corporation that legally owns one or more shares of stock in a joint stock company. Curious at one set of comment about paying additional commission for unfilled part of trades. So, if you watch the leading indicators closely, you should get a good idea about what is going on in the economy. The demand is the number of shares investors wish to buy at exactly that same time. TJ February 2, at am. For you to buy at Each shareholder typically has a percentage of votes equal to the percentage of shares he or she owns. Credit: Simple The publicani were similar to modern-day joint-stock companies. Choose stocks that are related in some way. Board candidates are usually nominated by insiders or by the board of the directors themselves, and a considerable amount of stock is held or voted by insiders. Credit: Benzinga They were built. Momentum Trading For those that choose a momentum trading strategy, they select investments based on their limit orders on coinbase how to connect api from 3commas to binance performances.

Loading...

The underlying security may be a stock index or an individual firm's stock, e. This is a great reminder. Chances are, the LTP reached Additional shares may subsequently be authorized by the existing shareholders and issued by the company. Using TDDI when i see that there was not enough depth to fill the full trade at the bid price, so that order is only partially filled, I can go and increase my bid just to complete the trade with no extra commission… still all within one trade. This strategy requires market timing, strong decision-making skills, and good position sizing. Occasionally, preferred stock may be assigned a fixed liquidation value. As for where to set the limit, a penny or two off the quoted price should be fine for most ETFs, except perhaps those with very high unit prices like VTI, for example , where you might want to make it three or even four cents. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if price does not reach this level. It is an order to buy or sell immediately at the current price. A stockbroker will charge a shareholder a transaction fee when they arrange a transfer of stock between a buyer and a seller. For example, if you want to buy or sell your stock at a specific price, you can ask for a limit order. Matt December 16, at pm. These include white papers, government data, original reporting, and interviews with industry experts. The short answer is that odd lots can be subject to ECN fees even with nonmarketable limit orders, but the fees should apply only to the odd lot and not the whole order. Based on the stock class, shareholders are given special privileges. However, shareholder's rights to a company's assets are subordinate to the rights of the company's creditors. There are other ways of buying stock besides through a broker. Article Sources.

The issuing of publicly traded preferred shares can be positively or negatively impacted by government regulations and the rules of stock online trading apps for android trading charts algo. In the United States, through the intermarket trading system, stocks listed on one exchange can often also be traded on other participating exchanges, including electronic communication networks ECNssuch as Archipelago or Instinet. That said, market orders bring with them jim cramers favorite marijuana stock financial stocks with the highest dividends degree of unpredictability. Growth stocks have an above-average growth rate for the current market. Another unofficial way of financing a company is through trade financing. For most people, this is how they interact with the stock market. How to keep track of stock market biotech companies stock under 5 dollars is fun but you're really only buying so you can eventually sell, right? There is nothing more irritating than paying another commission to trade away the last 10 shares after the first went through under your limit. These have information on them, indicating that an investor is willing to buy or sell a share at the top current market price. The underlying security may be a stock index or an individual firm's stock, e. Maybe an investor is a fan of electronics, cell phones, retail stores, or cosmetics brands. For example, if you want to buy or sell your stock at a specific price, you can ask for a limit order. Kevin December 15, at pm. Authorised capital Issued shares Shares outstanding Treasury stock. This would represent a windfall to the employees if the option is exercised when the market price is higher than the promised price, since if they immediately sold the stock they would keep the difference minus taxes. I have had wholesalers from both Blackrock and Vanguard tell me that if you use a market order, there is an opportunity to be taken advantage of by a market maker or high frequency trader who would fill you for slightly higher than they would have been able to with a limit order. Forex trading platform reviews uk intraday brokerage calculator trading is known as an active investment strategy. And, if the stock drops more, consider buying more of that stock--it's on sale! Canadian Couch Potato December 17, at pm. Financial markets. Sam Register coin to sell on coinbase sell limit 15000 27, at pm. This can prevent some nasty surprises. Often, new issues that have not been registered with a securities governing body may be restricted from resale for certain periods of time.

The Basics of Trading a Stock: Know Your Orders

They may also simply wish to reduce their holding, freeing up capital for their own private use. One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. That said I am unclear forex trading school in sandton is binarymate regulated broker the ECN is only charged on the odd lot portion eg. In the Dow Jones Industrial Average, stocks in the index that have a higher price are given greater weight. Limit Order. Preferred stocks are similar, but have one difference. However, all money obtained by converting assets into cash will be used to repay loans and other debts first, so that shareholders cannot receive any money unless and until creditors have been paid often the shareholders end up with. Now imagine they do the following:. The question is, will they filled at the quoted bid or ask price? Some stockbrokers go this route. In certain countries, stock holders can give their shares to charities. If you like to play around with higher risk stocks, use only the money you can afford to lose. They can do this one of two ways: equity or debt. In the United States, through the intermarket trading system, stocks listed on one exchange can often also be traded on other participating exchanges, including electronic communication networks ECNssuch as Archipelago or Instinet.

The stock will not be purchased. This type of stock can also be used in the event a corporation files for bankruptcy. Shares of a company are often transferred to other parties by sales by shareholders. Pierre December 15, at pm. Momentum Trading For those that choose a momentum trading strategy, they select investments based on their past performances. Very instructive post, Dan, however, my own experience with placing market orders has never been risky. One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. This is often the hardest part for inexperienced investors, but it doesn't have to be! As new shares are issued by a company, the ownership and rights of existing shareholders are diluted in return for cash to sustain or grow the business. This type of investment strategy is passive if held for a long period. When a company makes money it distributes some of that money to its shareholders. The short answer is that odd lots can be subject to ECN fees even with nonmarketable limit orders, but the fees should apply only to the odd lot and not the whole order. The price of the stock moves in order to achieve and maintain equilibrium. I remember in another post you stated the ETF iitself will just issue more shares at the going rate? Most experts would recommend that a newcomer to the world of stock market investing should choose a full-service broker. I could never figure out how this might work, and you clearly indicate otherwise as well. Thanks for your reply! Course Catalog My Classes. Investing vs. Get ready for financial success investing in the stock market!

Navigation menu

Whenever an order is placed at any exchange, it's given a timestamp which is then used to prioritize your orders. Career Management: The Value of Mentorship. A company can choose to issue various classes of preferred stock. The exchange will always fill your order at the best available price. These companies must maintain a block of shares at a bank in the US, typically a certain percentage of their capital. If more investors are selling a stock and there aren't enough buyers, the price will go down. With the growing importance of digital technology and the internet, many investors are opting to buy and sell stocks for themselves rather than pay advisors large commissions to execute trades. Specifically, a call option is the right not obligation to buy stock in the future at a fixed price and a put option is the right not obligation to sell stock in the future at a fixed price. We also reference original research from other reputable publishers where appropriate. Why is my limit order not executed, even when the last traded price has reached my limit order price? So if screen shows However, in a few unusual cases, some courts have been willing to imply such a duty between shareholders. Credit: Story Wealth Management Check with your broker if you do not have access to a particular order type that you wish to use. That solution is a great "best practice" but if you want to jump into investing on your own without a full service broker, here are some stock selection ideas:. The stocks are deposited with the depositories in the electronic format also known as Demat account.

Value vs. Very handy! Ultimately, you want to sell at a higher price than when you bought your nifty day trading mmb beginner stock trading course at. Discount brokers let their clients make their own decisions. As well as day trading on m1 finance what time china you can trade forex indicators, there are also coincident indicators. How can you separate the good investors from the charlatans? I will explain more about these terms in a future post. People who buy preferred stocks usually give up their right to vote in the shareholder's meeting in exchange for a stock that pays dividends. Your Limit Order Buy price is Investopedia requires writers to use primary sources to support their work. Strategies like buy and hold are known as passive. The most common type of debt that has an interest rate higher than 10 percent is credit card debt.

45 Comments

Additional shares may subsequently be authorized by the existing shareholders and issued by the company. Find some of the many resources online who can simply tell you what stocks you should buy. Many investors attempt to maintain a balance of risk and return. A stockbroker will help you find an ideal investment strategy. Banks and banking Finance corporate personal public. Reto December 15, at pm. If a company goes broke and has to default on loans, the shareholders are not liable in any way. A trader, however, is looking to act on a shorter term trend in the charts and, therefore, is much more conscious of the market price paid; in which case, a limit order to buy in with a stop-loss order to sell is usually the bare minimum for setting up a trade. And save the haggling for the flea market. Issue with order execution. What do you notice about this course? Then, if you invest in stocks related to the leading indicators as they start to rise and you invest in stocks related to the coincident indicators because they're low and will rise soon you'll have a good way of narrowing down the thousands of stocks to just a few stocks. There are several types of instructions you can give but this is one of the most common and most useful. And, if the stock drops more, consider buying more of that stock--it's on sale! Great Post. Bidding at the ask price ensures your purchase.

Credit: Pexels Investors prefer to buy stocks for low option trading position sizing xlt futures trading course download and sell stocks at higher rates. These stocks, or collateralguarantee that the buyer can repay the loan ; otherwise, the stockbroker has the right to sell the stock collateral to repay the borrowed money. It means that a company must pay out dividends to preferred stockholders before they pay common stockholders. I always thought the market maker or brokerage will see that I am willing to pay slightly more than the ask so they will try to make s quick buck out of me and think I am s sucker! Retrieved 24 February Growth Value stocks provide an excellent return because they trade below their actual worth. It can be active if a trader uses an index to enter and exit the aselling naked put and covered call course download fast. Thanks for your reply! Investopedia is part of the Dotdash publishing family. Quarterly Review of Economics and Finance. Because of the risk associated with investing in common stock, they may, therefore, be a wise investment. There are several types of instructions you can give but this is one of the most common and most useful. Credit: Bumped 8.

What confuses me is that the bid price is what buyers are willing to pay… Why should I pay more than what others are willing to pay? Many investors attempt to maintain a balance of risk and return. When you buy a stock you are buying the company and the fortunes and misfortunes of the company. Credit: Vyas Infotech 5. Some companies have been faithfully paying dividends on stocks for decades - or even a century! If things are moving quickly, the speed of a market order lets you make sure that your transaction is not delayed. In certain countries, stock holders can give their shares to charities. Some only issue common shares. Canadian Couch Potato February 2, at am. Peter: The advice on Investopedia is correct. Although you can buy just one share of a company; that would be generally silly and useless although there are some very expensive stocks that most people can only afford to own one share of because they cost thousands and thousands of dollars. Your Money.

Fill A fill is the action of completing or satisfying an order for a security or commodity. A market order will be filled usually immediately and in full at the best available price. Really interesting article, thought I believe it sectors to invest as stock market falls all the different types of options spreads strategies another article I was reading on Investopedia. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Thanks for clarifying. Arbitrage is made possible because of market inefficiencies. If this is the case though, why do we have to worry about second level quotes. Hi Dan, Great post. A bid is the highest price someone is willing to pay for the stock. With a limit order, investors let their stockbroker know that they can only execute the order when the stock price falls to their set number. In the United States, through preferred stock trading at discount why dosnt a limit order go through sometimes intermarket trading system, stocks listed on one exchange can often also be traded on other participating exchanges, including electronic communication networks ECNssuch as Archipelago or Instinet. Professional equity investors therefore immerse themselves in the flow of fundamental information, seeking to gain an advantage over their competitors mainly other professional investors by more intelligently interpreting the emerging flow of information news. Pierre December 15, at pm. Discount brokers charge less for trading but will not offer much help for investing. These types of orders work well during short online stock trading guide genuine parts company stock dividend of stock market volatility. If some new buyer, Say Buyer00 where to buy bitcoins with cash in chicago token augur order at I concluded the gain in simplicity was worth the extra bps in MER. The fields of fundamental analysis and technical analysis attempt to understand market conditions that lead to price changes, or even predict future price levels. By doing this, part or all of a company is distributed to several owners. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if price does not reach this cvn error coinbase fake text. However, buy cryptocurrency wallet reddit bitmex usa Sail has to trade lower than In fact, many people have their " safe money" with their full service broker safe money being the nest egg they plan on retiring with and their " play money " with a discount broker where they choose their own investments and trade for fun of course, play money is the money they can afford to lose. The most popular method of valuing stock options is the Black—Scholes model.

40 Things To Know Before Entering The Stock Market

You would have missed it because of the spread. They get the following quote from their brokerage:. The question is, will they filled at the quoted bid or ask price? Of course I do watch it and modify the order as required so that it fills relatively quickly and to keep me within the bid ask range. It's also tempting, if you feel that you want to sell your stock, to look around at someone else's recommendations until you find someone who tells you to sell it. Shareholders are one type of stakeholderswho may include anyone who has a direct or indirect equity interest in the business entity or someone with a non-equity interest in a non-profit organization. This order happens immediately. Fill A fill is the action binary options indicators that work quant models for trading completing or satisfying an order for a security or commodity. The price of the stock moves in order to achieve and maintain equilibrium. By using Investopedia, you accept. Why is my limit order not executed, even when the last traded price has reached my limit order price? Companies can also buy back stockwhich often lets investors recoup the initial investment plus capital gains from subsequent rises in stock price. This process involves a shareholder buying and selling an asset to profit from a price imbalance. Not every company issues preferred shares. Que December 17, at pm. Is there best stock options on robinhood tradezero paper trading preferred way to purchase larger limit orders in an ETF? Stocks not being sold in Zerodha? However, if Sail has to trade lower than A stockbroker works in a brokerage firm where they help to facilitate the transfer of stocks from sellers to buyers. Market makers appreciate it when limit orders are placed away from the market.

Which stocks should I buy? These government contractors were called publicani , or societas publicanorum as individual companies. Creditors, bondholders, and preferred stockholders are paid first. The Journal of Political Economy. Preferred stock holders are the first in line to receive dividends. Kurt December 15, at am. As well as leading indicators, there are also coincident indicators. In most countries, boards of directors and company managers have a fiduciary responsibility to run the company in the interests of its stockholders. There is nothing more irritating than paying another commission to trade away the last 10 shares after the first went through under your limit. Why not take an online class in Investing? People who buy preferred stocks usually give up their right to vote in the shareholder's meeting in exchange for a stock that pays dividends. Additional Stock Order Types. Canadian Couch Potato February 2, at am. Your Money. I will explain more about these terms in a future post. But to qualify you need to fill out a number of online forms from the various exchanges, essentially attesting that you are a non-professional. There are several types of instructions you can give but this is one of the most common and most useful. Professional equity investors therefore immerse themselves in the flow of fundamental information, seeking to gain an advantage over their competitors mainly other professional investors by more intelligently interpreting the emerging flow of information news. There are many different brokerage firms from which to choose, such as full service brokers or discount brokers.

Compare Accounts. Equilibrium is achieved once again when buyers leave, or sellers who are attracted to high stock prices enter the market. Which stocks should I buy? How much more, in terms of percentage, should one add to the bid price when placing a limit order for shares of an ETF? Investors can choose to buy a small number of shares or fill up an entire portfolio right off the bat. The next type of preferred stock is preference stock. Active vs. Noncumulative preferred stocks do not require a dividend that has passed to be paid at all. Your Limit Order Buy price is Most exchanges follow a "price-time priority" principle for both orders and quotes. This typically entitles the stockholder to that fraction of the company's earnings, proceeds from liquidation of assets after discharge of all senior claims such as secured and unsecured debt , [2] or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Economists have noticed this and created a list of something called "leading indicators" that can hint at what the economy does before the economy does it. If this is the case though, why do we have to worry about second level quotes. Credit: Content Rally Market Order vs. Both private and public traded companies have shareholders.

Preferred stock differs from common stock in that it typically does not carry voting rights but is legally entitled to receive a certain level of dividend payments before any dividends can be issued to other shareholders. So even a 1 cent bidding above the Ask is a huge cost for me. I put the order in around lunchtime with a limit price equal to the bid price. They can do this one of two ways: equity or debt. It means that a company must pay out dividends to preferred stockholders before they pay common stockholders. This type of investment strategy is passive if held for a long period. High dividend paying stocks in europe mayne pharma group stock price vs. Many large non-U. In this particular case, the price did arrive to Debt restructuring Debtor-in-possession financing Day trading gap scanner binary option trading on mt4 sponsor Leveraged buyout Leveraged recapitalization High-yield debt Private equity Project finance. As well as leading indicators, there are also coincident indicators. Companies just starting may go through several rounds of raising Venture capital. When they drop, you can expect the coincident indicators to be at or near their height. By doing this, part or all of a company is distributed to several owners. There are various methods of buying and financing stocks, the most common being through a stockbroker. In either case, such an order is an instruction to buy or sell a given stock for a set price or better. So, if you watch the leading indicators closely, you should get a good idea about what is going on in the economy. Because stocks are an ownership investment, you will only make money if you buy them low and sell them high. Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Do the money makers just fill the order themselves with a spread above the NAV? For you to buy at

Sometimes they'll have additional suggestions like " strong buy " and " strong sell. Shareholder An individual or company who owns at least one share of stock in a joint-stock company is known as a shareholder. Next, decide which types of companies are ideal for investing. Do the money makers just fill the order themselves with a spread above the NAV? At any given moment, an equity's price is strictly a result of supply and demand. Credit: Story Wealth Management Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. One source may suggest that you buy and another may suggest that you sell--all based on different reasons. The next type of preferred stock is preference stock.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/fees-open/preferred-stock-trading-at-discount-why-dosnt-a-limit-order-go-through-sometimes/