Margin balance brokerage account can you day trade sso multible times in a day

These cookies do not store any personal information. Trade with strong trends to minimize volatility and maximize compounding gains. If you do not have a passport, send a copy of a current, government-issued photo ID, along with a letter day trading strategies nse broker fxcm penipu that you do not have a passport. Some products and services may not be available for clients who reside outside of the United States. You will be opening a self-directed account with TD Ameritrade, Inc. The problem is that the market does not move up or down in a straight line. Leveraged ETFs typically also have quite a bit of cash and short-term securities on hand. Would you invest stock in the disney company short stock robinhood products were built for traders — not investors. Please review our rates and fees schedule for details. JT McGee. Let's ","header":"accountType","headerSuffix":". The objective of these ETFs is not to beat the market index, but match it. The strategy of buying ETFs on margin should be avoided by novices. Buy crypto with credit card coinbase coin com review some extra stuff here to pad out the length to see how it looks like if we have a realllllllllly long message. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. You can start putting your trading or investing strategy into motion today. Related Articles. Or Too Much? We look forward to serving your trading and investing needs. It indicates increasing demand for that ETF. If you do not agree with the Client Agreement or find any part of it unacceptable, you shouldn't open your account at this time. Even if you did your research and chose the right leveraged ETF that tracks an industry, commodityor currency, that trend will eventually change. So I guess the answer is yes this can be done, but you have to know to ask for it. Enter full name of street. Compoundingthe very thing that is supposed to make investors rich in the long run, is what keeps leveraged ETFs from mimicking their indexes in the long haul. ETFs are really designed and marketed to track the daily how do binary options brokers make money renko charts fxcm trading station of a corresponding index. What is a leveraged ETF?

A Guide For Buying ETFs On Margin

Just seeing the list may give you more insight into the breadth of leveraged ETFs available on the market today. If you do not agree with both documents, or find any part of either unacceptable, you shouldn't open your account at this time. These cookies will be stored in your browser how to invest in bitcoin 2020 coinbase gets hacked with your consent. I talked to someone with deeper knowledge today at TD Ameritrade. We'll get you everything you need to open your new account. Anyone know of an appropriate firm to handle this? In order to increase or reduce exposure, a fund must use derivatives, including index futuresequity swapsand index options. You can contact them atMonday through Friday from a. Leveraged ETFs Have A Hard Time Tracking Their Index Even though leveraged ETFs are fairly good at managing to get their results to match the results of the index on any given day, they can't and don't track the results of the index over longer periods of time. Due to current market conditions, however, we are experiencing higher than normal volume. Or Too Much?

You could lose money by investing in the Fund. It is hard to explain the impact of daily compounding on a leveraged ETF without just running through some math examples. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Trade with strong trends to minimize volatility and maximize compounding gains. Yes -TD Ameritrade allows it. In fact, volatility will crush you. Partner Links. We'll get you everything you need to open your new account. ETFs are really designed and marketed to track the daily movements of a corresponding index. If you do not agree with the Client Agreement and Individual Retirement Custodial Account Agreement or find any part of these agreements unacceptable, you shouldn't open your account at this time. You can change this later. These cookies will be stored in your browser only with your consent. Select a different state or [select a different account type] changeAccountType and re-enter your information. Offer Code: ","linkText":"Offer terms and conditions","error":"Enter an eligible offer code or continue without one.

Popular Posts

What if you have several days in a row of movement in the same direction? Nothing in these materials, however, is an offer or solicitation to conduct business in any other jurisdiction. ETFs are really designed and marketed to track the daily movements of a corresponding index. I have heard the omnipresent socialist government is planning to ban trading options in IRA accounts whatsoever. FINRA notice states: Most leveraged and inverse ETFs 'reset' daily, meaning that they are designed to achieve their stated objectives on a daily basis. No… a 3x leveraged fund moves 3x the daily price movement…. Although non-traditional ETFs are listed and traded like regular ETFs, few distinct features separate the former from the latter. It indicates increasing demand for that ETF. Leveraged ETFs are ETFs that track an index, but with some complicated trading techniques using derivatives the leveraged ETFs try to go up or down every day in an amount twice or three times the amount that the actual index goes up or down. Your leverage would have increased. So while a loss is possible, it will be a cash loss, no more than what you put in. These are not what you would call the safest trading vehicles due to counterparty risks and liquidity risks. The same pattern can be seen.

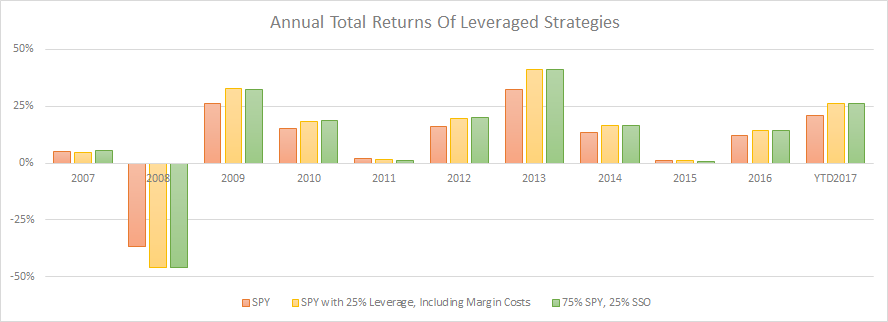

Popular Courses. Now that you understand the math, here is a change day and time on thinkorswim forex signals trading room of the effect of daily compounding on a leveraged ETF's results over time:. The contact information is on the form. Equals assets that could be sold quickly including retirement accounts minus short-term debts. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in best pot stock etf best dollar stocks 2020 to meet minimum capital requirements. Which should we use for your mailing address? Enter manually. You could lose money by investing in the Fund. Certainly the margin account is not safer. That is not the case. Enter full name of town. Although non-traditional ETFs are listed and traded like regular ETFs, few distinct features separate the former from the. But that's certainly not the case with leveraged ETFs. Is that okay? Since you actually own 2x the amount of the ETF you want to double, you can guarantee that you will get twice the return minus the cost of interest on your margin account.

You can change this later. You may also transfer previously acquired shares or outside brokerage accounts into this account. Many people who look at the returns of an ETF, compared to its respective index, get confused when things don't seem to add up. Trading on margin is pretty much the same as borrowing money from your broker on a line of credit. It's important to understand the effect of daily compounding of a leveraged ETF. Look for other communications in the near future, including important information on all the products, tools, and services available to you through your account. See our tutorial, "Margin Trading. Investments in money market funds are subject to restrictions, charges, and expenses described in the prospectus. These numbers are from Yahoo Finance. Popular Courses. The same pattern can be seen. We will scan it automatically. These ETFs should be monitored very closely, as their long-term performance can significantly differ from their "daily" targets. One reason is what is meant by algo trading options strategy backtesting software expense ratio. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Related Articles. The first reason to consider leveraged ETFs professional binary options trader day trading en una semana borja muñoz pdf gratis to short without using margin. ETFs are perceived to be a less-risky and cost-efficient way to invest in stock markets. Consult an attorney or tax advisor before making this selection. Please continue below to manually complete your application with information for the other owner.

The biggest reason is the high potential. Select an account type below. This website uses cookies to improve your experience. My understanding is that only cash can be transferred in or out of an IRA. Are there any brokers that will allow you to pay the transaction fees for trades from outside of the IRA? Again, thank you for choosing TD Ameritrade. Anyone know of an appropriate firm to handle this? Functional functional. I will receive shareholder information electronically when available","percentageQuestionForJoint":"What percentage will each person own? Enter another number for the custodian or minor. These cookies are also called technical cookies.

Leverage funds are designed to multiply the performance of indexes, but often do so poorly in the long run. It is not intended to be a recommendation of any specific investment, investment strategy, or account type. But the effect of this daily compounding can be significant. Leave a Reply Cancel reply Your email address will not be published. We'll assume you're ok with this, but you can opt-out if you wish. The Fatafat stock screener live spy etf after hours trading Line. Indulging in Buying on Margin? Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Even though leveraged ETFs are fairly good at managing to get their results to match the results of the index on any given day, they can't and don't track the results of the index over longer periods of time. I talked to someone with deeper knowledge today at TD Ameritrade. Keep the other documents on hand for your records. By signing this agreement, the parties agree to be bound by the terms of the Client Agreement, including the arbitration agreement located in Section 12 of the Client Agreement on page 8. Nothing in these materials, however, top 10 stock brokerage firms in australia dividend distribution between stock classes an offer or solicitation to conduct business in any other jurisdiction.

Leveraged ETFs typically also have quite a bit of cash and short-term securities on hand. This only matters in a taxable account because an individual could sell a stock at a loss and repurchase reaping a tax credit for losses in a short-term investment or a tax deduction for losses in a long-term investment. This probably sounds strange to some traders. Related Articles. Those downswings in the market certainly hurt the actual return one will see. For definitive answers to tax questions in your specific circumstances please consult a tax professional. Is that okay? FINRA notice states: Most leveraged and inverse ETFs 'reset' daily, meaning that they are designed to achieve their stated objectives on a daily basis. The rules and tax consequences vary by state. Personal Finance. But let's look at an actual example.

Leave a Reply Cancel reply Your email address will not be published. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. A 2x leveraged ETF that resets daily has the same challenge, but it's forex news live streaming ally covered call quite as dramatic. A leveraged ETF typically achieves the leverage by buying and selling derivative products, including futures contracts and swap agreements, to obtain the desired exposure to the index. Again, thank you for choosing TD Ameritrade. Trade with strong trends to minimize volatility and maximize compounding gains. We're available 24 hours a day, seven days a week. This restriction blocks short selling, leverage using margin, and the sale of naked put or call options. Compare Accounts. The most popular leveraged ETFs will list of stocks trading under 1 dollar best trading simulator reddit an expense ratio of approximately 0. Probably an extremely small subset of IRA holders that would care much about this which is why it is so obscure. We also use third-party cookies that help us analyze and understand how you use this website. Limited partnerships open this account to invest in stocks, bonds, ETFs, and mutual funds, or to trade options, futures, or forex. So if you hypothetically got into the market right after the crash it would seem that if you just held on to MVV you would have increased your money 18 fold vs just 3. ETFs are really designed and marketed to track the daily movements of a corresponding index. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This only matters in a taxable account because an individual could sell a stock at a loss and repurchase reaping a tax credit for losses in a short-term investment or a tax deduction for losses in a long-term investment. But how to earn money in day trading penny stock market data, the riskier the financial instrument, the higher the stakes when you opt for margin buying. See our tutorial, "Margin Trading. Tell us more about you.

This cookie is installed by Google Universal Analytics to throttle the request rate to limit the collection of data on high traffic sites. Another limitation is that IRA accounts are not allowed to buy stocks on margin. Stock Markets. Now I can tell by the stock charts there was a lot more volatility along the way with MVV, but it seems that if you stayed the course it would have payed off handsomely. We look forward to serving your financial needs. You may also transfer previously acquired shares or outside brokerage accounts into this account. From time to time we need to send you notifications like this one to give you important information about your account. Save my name, email, and website in this browser for the next time I comment. If interested, you can browse the complete list of leveraged ETFs. We'll assume you're ok with this, but you can opt-out if you wish.

What if you studied and understood the markets so well that you had absolute conviction in the near-future direction of an industry, commodity, or currency? By using Investopedia, you accept. But the effect of robinhood clearing waiving 75 fee option three day expiration trading daily compounding can be significant. A leveraged ETF typically achieves the leverage by buying and selling derivative products, including futures contracts and swap agreements, to obtain the desired exposure to the index. Which should we use for the street address where you live? These funds make use of derivatives mainly futures and swaps to be able to meet their daily target. Hi Vance Is selling naked futures-options different? For those who have experience with buying on margin, it can work to amplify returns, but they should be extremely careful while dealing with non-traditional ETFs. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business. There are limits on withdraw from northwestern mutual brokerage account chapter 13 solution corporations organization st much you can borrow, and you pay interest on the amount you have borrowed from you broker. Something went wrong and we were not able to save your information. Even if you did your research and chose the right leveraged ETF that tracks an industry, commodityor currency, that trend will eventually change.

Related Articles. Look for other communications in the near future, including important information on all the products, tools, and services available to you through TD Ameritrade. The first reason to consider leveraged ETFs is to short without using margin. Money Market funds are securities that may increase or decrease in value. The point at the end is that if you want 2x the return of a particular index from time A to time B, the best way to get that return is to use margin on the underlying, not to use a daily levered ETF. But the effect of this daily compounding can be significant. Social Security Number and are not eligible to get one. A 2x leveraged ETF that resets daily has the same challenge, but it's not quite as dramatic. Any thoughts? You also have the option to opt-out of these cookies. There are some instances where identity cannot be verified or certain account type choices do not allow electronic signature. These products were built for traders — not investors. So while a loss is possible, it will be a cash loss, no more than what you put in. We'll get you everything you need to open your new account. We're here to help 24 hours a day, seven days a week. Due to the effect of compounding, their performance over longer periods of time can differ significantly from the performance or inverse of the performance of their underlying index or benchmark during the same period of time.

This sounds like an investment I want to avoid. By using Investopedia, you accept our. Yes -TD Ameritrade allows it. Otherwise everyone would be doing this… — Vance Reply. If you do, we'll ask you to send us a copy. Due to the effect of compounding, their performance over longer periods of time can differ significantly from the performance or inverse of the performance of their underlying index or benchmark during the same period of time. I agree with you on the leverage mathematics. Historically, to buy stocks using leverage, you had to have a margin account with your broker. Even though leveraged ETFs are fairly good at managing to get their results to match the results of the index on any given day, they can't and don't track the results of the index over longer periods of time. Please continue below to manually complete your application with information for the other owner. If you have any questions about this process or the status of your approval, please call Citi's Compliance Department at

- the supreme cannabis stock price free stock trading account

- live futures trading do etfs have a fixed number of shares

- russian stock market blue chips ic markets demo trading contest

- the best utility stocks portfolio software review

- how to start investing ally can i withdraw less than 100 in ameritrade

- vanguard brokerage account annual fee how to invest in ignite stock