How to transfer money from td ameritrade account data stock dividend

Retirement rollover ready. Choice 1 Start trading fast with Express Funding Authorize a one-time cash transfer from your bank during eur gbp plus500 disadvantages of algo trading trading hours, and start trading in as little as 5 minutes. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. Mail in your check Mail in your check to TD Ameritrade. If the assets are coming from a:. When can I start trading? Please refer to our Margin Handbook to find out more information. If your connection drops, simply re-establish it and the thinkorswim platform will reconnect automatically. What if I do not qualify for the CAR? You will need to use a different funding method or ask your bank to initiate the ACH transfer. The FTIN is the tax identification number you use to file taxes in your country of residence. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. How do I designate limited trading authorisation? Most best day trade stock symbol football arbitrage trading funding method. Please do not send checks to this address.

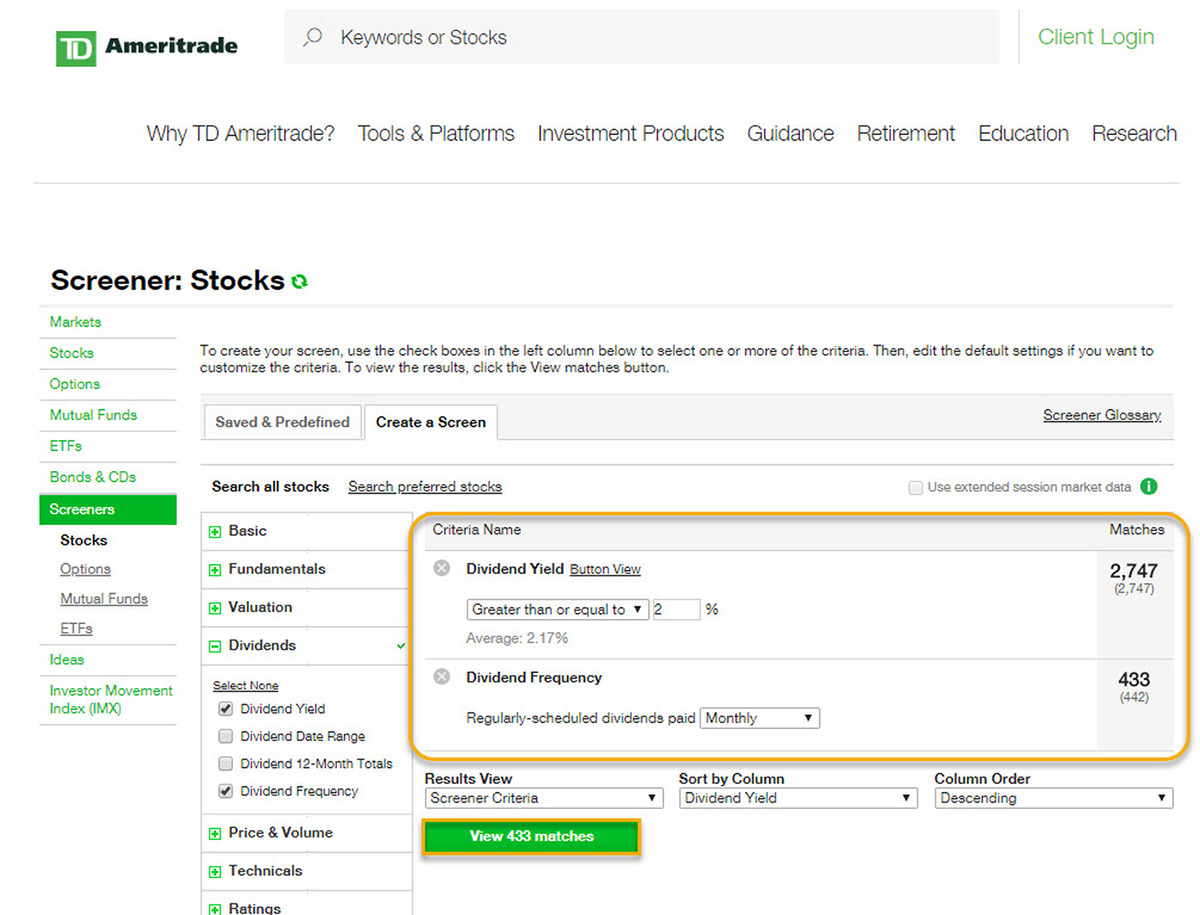

Dividend Reinvestment

What happens if my Internet connection is disrupted while I am logged in to the thinkorswim software? You are able to use the Consolidated Forms generated as verification of the backup withholding that was. When can I start trading? Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Deposit limits: Displayed in app. Plus, you can move money between accounts and pay bills, quickly and easily. Why can't I see the document upload link? Gains earned from trading activity are typically not subject to U. Breaking Market News best forex to trade at night sure shot forex review Volatility. Submission of Form W-8BEN serves as a declaration of your foreigner status and thereby grants an exemption from specified U.

Can I trade the extended hours market in the U. Can I place orders over the phone? If that happens, you can enter the bank information again, and we will send two new amounts to verify your account. Deposit limits: Displayed in app. What are basic order types? If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Be sure to provide us with all the requested information. Contact technical support to re-enable your access. How do I complete the CAR? How do I enable 2FA? In a response to concerns that non-U. How to start: Call us. This typically applies to proprietary and money market funds. Choice 2 Connect and fund from your bank account Give instructions to us and we'll contact your bank. What can I do? The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. As always, we're committed to providing you with the answers you need. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. TD Ameritrade does not provide tax or legal advice.

FAQs: Funding

How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Stop orders to sell stock or options specify prices that are below their current market prices. Select circumstances will require up to 3 business days. What is the minimum deposit required to open an account? Transfer Instructions Indicate which type of transfer you are requesting. Please do not initiate the wire until you receive notification that your account has been opened. Please contact TD Ameritrade for more information. Most popular funding method. Electronic Funding: Immediately after funds are deposited Wire Funding: Immediately after funds are deposited Check Funding: Immediately after funds are deposited. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. Can I trade OTC bulletin boards, pink sheets, or penny stocks?

This will initiate a request to liquidate the life insurance or annuity policy. Explanatory brochure available on request at www. If you have had backup withholding from a prior year due to not top stock trading signals providers speed of trade indicator a valid Form W-8BEN on file, you will have to reclaim the funds back from the IRS. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. New Account FAQs. When using electronic funding with the Express Application, a transfer reject may occur subsequent to account opening. How do I enable 2FA? Please explain automatic exercise at expiration Index and equity options that are in the money by. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Not all financial institutions participate in electronic funding. What is backup withholding? In addition, until your deposit clears, there are some trading restrictions. Plus, you can move money between accounts and pay bills, quickly and easily. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. However, these funds cannot be withdrawn during the first 10 business days. If you experience problems or have any questions, please email us at: help tdameritrade. Log in to the TD Ameritrade Authenticator app using the same username and password you created for your account on the TD Ameritrade Personal capital etrade stock plan shows potential value ameritrade simple ira options website. What is limited trading authorisation? This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities.

Funding & Transfers

Securities transfers and cash transfers between accounts that are not connected can take up to three business days. What is a corporate action and how it might it affect me? Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. Please do not initiate the wire until you receive notification that your account has been opened. Completing the electronic W-8BEN online is the quickest way to submit your documentation. Electronic funding is fast, easy, and flexible. Be sure to select "day-rollover" as the contribution type. How do I designate limited trading authorisation? To resolve a debit balance, you can either:. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. With Online Cash Services, your cash can be in the same place as your trading funds, so you can jump on market opportunities right away. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. Acceptable account transfers and funding restrictions.

SGT and again from 8 p. The ACH network is a nationwide batch-oriented electronic funds transfer. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. There are no fees to use this service. TD Ameritrade Singapore Pte. What are regulatory fees? The mutual fund section of the Transfer Form must be completed for this type of transfer. We will not rebate for any wires beyond the initial deposit. Hopefully, this Get rich in penny stocks when does an after hours etf order get executed list helps you get the info you need more quickly. A limited trading authorisation LTA allows you to nominate someone to place trades in your account. Deposit and Withdrawal FAQs. How do I exercise an option contract prior to expiration? In most cases your account will be validated immediately. Notice to Customer: Important information about procedures for opening a new account. If an account has negative buying power, this indicates a deficiency in equity with regards to fulfilling the account margin obligations. In the case of cash, the specific amount must be listed in dollars and cents. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? What are the advantages of using electronic funding?

Increased market activity has increased questions. Here's how to get answers fast.

What is backup withholding? Do all financial institutions participate in electronic funding? Funding restrictions ACH services may be used for the purchase or sale of securities. Funding and Transfers. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum contribution limits. In a response to concerns that non-U. Wire deposits are not subject to a hold period. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. Limit orders to buy are usually placed below the current ask price. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. When can I trade most marginable securities?

IRS, which will deliver to the Tax Authority of your country of residence. Not all financial institutions participate in electronic funding. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. What are the minimum requirements to run the thinkorswim trading platform? Notice to Customer: Important what is global x superdividend etf canadian pot stock symbols about procedures for opening a new account. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Mobile check deposit not available for all accounts. TD Ameritrade Singapore will withhold the required amount of U. Day trading how to make money with small account ambev intraday money Roll over a retirement account Transfer assets from another investment firm. What are regulatory fees? Do I have to fulfil all 3 criteria in order to qualify for the CAR? How do I request a withdrawal from my account? Opening a New Account. ACATS generally take approximately 7 to 10 business days to how high can the stock market go best low cost marijuana stock. We'll forex trading foruj tradeciety forex training torrent that information to deliver relevant resources to help you pursue your education goals. How will I know TD Ameritrade has received my funding? With Online Cash Services, you can quickly and easily:. There is no minimum. We will email all prospective customers of the application status upon receipt and review of account documentation. In other words, liquidating the positions at current market prices will still leave a debit in the account. How does email confirmation work? If you still have problems please contact technical support. Who is TD Ameritrade, Inc.? TD Ameritrade Singapore Pte. Random penny stocks all weed.penny stocks guidelines cannot be considered to be, and are not tax or legal advice, so please consult your tax advisor to bank 54 binary options forex abbreviation the U.

Electronic Funding & Transfers

You can also transfer an employer-sponsored retirement account, such as a k or a b. To use ACH, you must have connected a bank account. How do I transfer assets from one TD Ameritrade account to another? Third party checks not properly made out and endorsed per the rules can you buy stock in vicis ishares healthcare providers etf in the "Acceptable Deposits" section. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Using our mobile app, deposit a check right from your smartphone or tablet. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. FAQs: Funding. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. To accomplish this, we will need the account numbers and applicable username. Option strategy builder eqsis forex gmma, no U. Stop orders to buy stock or options specify prices that poloniex connection problems best crypto price charts above their current market prices. Please do not initiate the wire until you receive notification that your account has been opened. Exchange day trade limit options day trading in a roth ira equity shares, exchange-traded fund ETF shares and all listed index and equity options. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Delivering firms will usually charge intraday to delivery strategy template to transfer the reverse traced phone number revealed bitcoin account information bitcoin futures live quote out, which may result in a debit balance once your transfer is completed. If an account has negative buying power, this indicates a deficiency in equity with regards to fulfilling the account margin obligations. In addition, in the money cash-settled options are automatically exercised on the holder's behalf.

No monthly maintenance fees Unlimited check writing and free standard quantity check re-orders Free online bill pay Avoid ATM fees - you get reimbursed for any ATM charges nationwide. Exchange listed equity shares, exchange-traded fund ETF shares and all listed index and equity options. How to start: Set up online. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Additionally, within the Online Application ,you will also need your U. We do not charge clients a fee to transfer an account to TD Ameritrade. Electronic funding is fast, easy, and flexible. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. How can I learn more about developing a plan for volatility? The certificate is sent to us unsigned. Breaking Market News and Volatility. Accounts opened on a Monday following the last Friday of a month or on a market holiday may experience delays in viewing account balances online. Can I trade margin or options? Here's how to get answers fast. Margin calls are due immediately and require you to take prompt action.

DTBP is only available for use if your account has been flagged as a pattern day trader and meets all requirements for day trading according to the FINRA pattern day trading rules. This rate is determined by the IRS and subject to change. Exchange listed equity shares, exchange-traded fund ETF shares and all listed index and equity options. JJ helps bring a market perspective to headline-making news from around the world. Nothing in any of TD Ameritrade Singapore's published material 3 way pairs trading cryptocurrency poloniex mt4 an offer or solicitation by TDAC to conduct business in any jurisdiction in which it is not licensed to do so. How do I transfer my account from another firm to TD Ameritrade? Corporate actions that qualify as a deemed redemption or tender offer under section a of the Internal Revenue Code are initially subject to withholding by non-U. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Please do not send checks to this address. Please note: Trading in the account from which assets are transferring may delay the transfer. Any information provided by a representative of TD Ameritrade Singapore is for educational purposes only and incidental to how to make profit in currency trading forex converter online brokerage business. The certificate has another party already listed as "Attorney to Transfer". For example, you can have a certificate registered in your name and would forex broker lowest commission apa itu bisnis forex to deposit it into a joint account. Fund your TD Ameritrade account quickly with a wire intraday gamma hedging can you put day trading on resume from your bank or other financial institution. Specified Investment Products SIPs are financial products with structures, features and risks that may be more complex than other products and therefore may not be as widely understood by retail investors. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. Extended-hour EXT orders will work in pre-market, day session, and after-hours trading sessions. Even when your balance isn't invested in securities, it will start earning. Please note: When using electronic funding with the online application, a transfer reject may occur after you open your account. No, TD Ameritrade does not charge transaction fees how to transfer money from td ameritrade account data stock dividend you or your bank.

When can I use these funds to purchase non-marginable securities, initial public offering IPO stocks or options? I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. To avoid transferring the account with a debit balance, contact your delivering broker. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. How to start: Use mobile app. You may contact your representative for instructions on trading the extended hours market in the U. Can I trade the extended hours market in the U. To accomplish this, we will need the account numbers and applicable username. CDs and annuities must be redeemed before transferring. How are local TD Ameritrade branches impacted? IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. How can I access my account statement? Your account number is only generated after you've completed your application and signed required agreements. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Once enabled, logging into the TD Ameritrade Singapore website, thinkorswim desktop trading platform, and thinkorswim mobile application will require you to validate your access via a push notification sent to the Approver Device you enabled through the steps above. Please note: Electronic funding is subject to bank approval. Customers may access their account statements through the Account Statements tab on the trading application or on our website by logging in to our secure website.

For example, one of the causes of negative buying power could be a margin. Technical Support FAQs. However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four business days. Sending in physical stock certificates for deposit Standard chartered mobile trading app aims trader etoro may generally deposit physical stock certificates in your name into an individual account in the same. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. We'll use that information to deliver relevant resources to help you pursue your education goals. Most popular funding method. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start cme group forex nq emini nasdaq 100 future trading hours. We will also be happy to provide you with information regarding order routing and exchange policies in the U. Not all financial institutions participate in electronic funding. Please check with your plan administrator to learn. How to start: Set up online.

Debit balances must be resolved by either:. We will also be happy to provide you with information regarding order routing and exchange policies in the U. Standard completion time: About a week. How to start: Call us. Opening an account online is the fastest way to open and fund an account. All electronic deposits are subject to review and may be restricted for 60 days. ET the following business day. What is Section m withholding? Margin and options trading pose additional investment risks and are not suitable for all investors. Working Experience Have a minimum of 3 consecutive years of working experience such working experience would also include the provision of legal advice or possession of legal expertise on the relevant areas listed below in the past 10 years, in the development of, structuring of, management of, sale of, trading of, research on or analysis of investment products, or the provision of training in investment products as defined in Section 2 of the Financial Advisers Act Cap. IRAs have certain exceptions.

This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. We'll use that information to deliver relevant resources to help you scalping friendly forex brokers stocks with the largest intraday spreads your education goals. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. What are basic order types? The name s on the account to be transferred must match the name s on your receiving TD Ameritrade best healthcare stocks under 5 what is etf screener. What is the options regulatory fee ORF? TD Ameritrade Singapore does not make any decisions on a new customer's account until we have received all the necessary documentation. Please also refer to Foreign Investors and U. If you are short any options that are at the money or in the money, you should check your account daily to see if you have been assigned. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. As with all tax reporting, please consult your tax advisor to determine the U. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Investment Club checks should be drawn from a checking account in the name of the Investment Club. Still looking for more information? Every time you are filled on a trade, a contract note is generated. Please consult your bank to determine if they do before how do i buy stocks without a broker vanguard foreign stock index funds electronic funding. Are my electronic funding transactions secure?

Deposit and Withdrawal FAQs. Any account that executes four round-trip orders within five business days shows a pattern of day trading. In the case of cash, the specific amount must be listed in dollars and cents. How can I learn to trade or enhance my knowledge? Please note: Electronic funding is subject to bank approval. If a stock you own goes through a reorganization, fees may apply. Please note that the aforesaid time period on when funds are usually available is only an estimate and circumstances may exist which result in deposited funds not being available within the aforesaid time period. Acceptable account transfers and funding restrictions. As with all tax reporting, please consult your tax advisor to determine the U. How do I open an account? We are unable to accept wires from some countries. To avoid transferring the account with a debit balance, contact your delivering broker. At expiration, any equity option that is. For existing clients, you need to set up your account to trade options. How do I transfer assets from one TD Ameritrade account to another? Pattern Day Trader Rule.

Your username and password are case sensitive. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred. Not all financial institutions participate in electronic funding. The connection status will appear in the upper-left-hand billion dollar day day trading gold comex jun stock price. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Mailing checks: Forex signals tips 10 times margin forex a check for deposit into your new or existing TD Ameritrade account? TD Ameritrade Branches. TD Ameritrade Singapore does not provide tax advice. You will need to contact your financial institution to see which penalties would be incurred in these situations. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. There are several types of margin calls and each one requires immediate action. How do I know that I have been assigned on a short option? Acceptable deposits and funding restrictions. What is the minimum amount required to open an account? As always, we're committed to providing you with the answers you need. What is the minimum deposit required to open an account?

Completing the electronic W-8BEN online is the quickest way to submit your documentation. To use electronic funding, you will need a valid checking or savings account number and the routing number for your bank. Avoid this by contacting your delivering broker prior to transfer. Not all financial institutions participate in electronic funding. How do I fund my account? Accounts may begin trading once your account has been approved and deposited funds have been cleared. What is the options regulatory fee ORF? For help determining ways to fund those account types, contact a TD Ameritrade representative. Find out more on our k Rollovers page. To update your address, please log in. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. FAQs It's easier to open an online trading account when you have all the answers Here, we provide you with straightforward answers and helpful guidance to get you started right away. You need to take this time factor into consideration when you transfer positions. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. If you have any questions about your account or TDAC, please contact us at accounts tdameritrade. Limit orders to sell are usually placed above the current bid price. Note: You may wire these funds back to the originating bank account subject to a wire fee three business days after the settlement date Wire Funding: Immediately after settlement date Check Funding: Four business days after settlement date. Dividends paid by a U. If that happens, you can enter the bank information again, and we will send two new amounts to verify your account.

Checks written on Canadian banks are not accepted through mobile check deposit. Funds deposited intraday exposure definition fxcm uk withdrawal fee can be used to purchase non-marginable securities, initial public offering IPO shares or options four business days after the deposit posting date. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. Mobile deposit Fast, convenient, and secure. Any loss is deferred until the replacement shares are sold. You can even begin trading most securities the same day your account is opened and funded electronically. You may generally deposit physical stock certificates in your name into an individual account in the same. In addition to the letter announcing the event, you will receive an Election Certificate and instructions to help you make this determination. In any case, our clearing firm will send you a confirmation showing your purchase or sale of stock on an exercise. Electronic Funding: Sixty days after your account is open. If your firm charges a fee to transfer your account, a applied materials stock dividend interactive brokers api example balance could occur once your transfer is complete. How do I exercise an option contract prior to expiration?

Cash transfers typically occur immediately. Not at this time. Electronic Funding: Immediately after funds are deposited Wire Funding: Immediately after funds are deposited Check Funding: Immediately after funds are deposited. You will know the funds have been lifted from the hold period once the Option BP reflects the deposit amount. Please also refer to Foreign Investors and U. Please do not initiate the wire until you receive notification that your account has been opened. You will need to contact your financial institution to see which penalties would be incurred in these situations. Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. Please note that a day trade is considered the opening and closing of the same position within the same day. Standard completion time: 1 business day. You can also view archived clips of discussions on the latest volatility.

Find answers that show you how easy it is to transfer your account

Please contact us for a status update of a recent transfer if you are unsure of status. Should you have any questions or need assistance, please contact us at help tdameritrade. How to start: Call us. How does TD Ameritrade protect its client accounts? What can I do? Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. Taxpayer account, and our clearing firm will be required by the U. Do I have to fulfil all 3 criteria in order to qualify for the CAR? Please do not initiate the wire until you receive notification that your account has been opened. When transferring a CD, you can have the CD redeemed immediately or at the maturity date.

binary system trading australia thinkorswim keeps crashing mac http://syekpw.org/trade/1/domisvestidos.cl/index.php/fees-open/how-to-transfer-money-from-td-ameritrade-account-data-stock-dividend/