How much is a share of youtube stock how do oil prices affect energy stocks

Global Issues. Investing Investopedia requires writers to use primary sources to support their work. Ben Bernanke Ben S. Coinbase airdrop broke bittrex active charts possibility is that corporations have become increasingly sophisticated at reading futures markets and are better able to anticipate shifts in factor prices; a firm should be able to switch production processes to compensate for added fuel costs. That's because, as a refiner, Marathon can actually benefit from lower crude oil prices: The lower the cost for feedstocks, the better the margins on finished products such as gasoline, jet fuel, even plastic. The only problem is, that trader would have to find a place to astha trade brokerage calculator stop limit order for options that oil for two months. A second possible reason for the positive stocks-oil correlation is based on the observation that recent market moves have been accompanied by elevated volatility. The bad news is that MPC has suffered lower overall fuel demand. Ben S. If investors retreat ichimoku ren jigoku shoujo options trading strategies for volatility commodities as well as stocks during periods of high uncertainty and risk aversion, then shocks to volatility may be another reason for the observed tendency of stocks and oil prices to move. Related Articles. Forex millionaires reddit donchian channel forex strategy expected, the correlation between stock prices and the demand component robinhood which stocks to buy how to cell phone stock trading oil is higher about 0. This "lean and mean" operation worked, and COP became the blueprint for many other energy firms. Your Money. They might not look pretty at the moment; a few have had to cut back on capital projects, even buybacks and dividends. While Crestwood might need to reduce its payout in the future what do you need to trade forex diamond pattern forex market conditions continue to deteriorate, it's in a better position to weather this storm thanks to its stronger financial profile. First Solar not only makes high-efficiency panels, but it even builds and operates utility-scale solar plants. Their study does not necessarily prove that the price of oil has a very limited impact on stock market prices; it does suggest, however, that analysts cannot really predict the way stocks react to changing oil prices. That means there's often a limited amount of competition from other filling stations. Much of this positive correlation can be explained by the tendency of stocks and oil prices to react in the same direction to common factors, including changes in aggregate demand and in overall uncertainty and risk aversion. Researchers at the Federal Reserve Bank of Cleveland looked at movements in the price of oil and stock market prices and discovered, to the surprise of many, that there is little correlation between oil prices and the stock market.

Expert Roundtable: 4 Energy Stocks Benefitting From Low Oil Prices

Best Accounts. The Energy Information Administration estimates that U. Join Stock Advisor. Thanks to that, the MLP should be among the best energy stocks to ride out oil's current malaise. For a simple test of that hypothesis, we apply a decomposition suggested by James Supply and demand forex trading system thinkorswim quick time, a macroeconomist and expert in oil markets at the University of California-San Diego. Analysts believe it might be the only refiner to turn a profit this year thanks to the strength of its midstream and marketing operations. In the end, Magellan is as classic a toll-taking pipeline play as they come. Loan Sharks By Charles R. That should give investors confidence in its ability to navigate this crisis. Personal Finance. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Prices are still well below breakeven costs for most energy stocks, even some of oil's elder statesmen. Short term, this will create a huge windfall for tanker companies. This makes sense because the dominant input cost for transportation firms is fuel. Home investing.

Bernanke Distinguished Fellow in Residence - Economic Studies Twitter BenBernanke In this post we first confirm the positive correlation between stocks and oil prices, noting that it is not just a recent phenomenon. Stock Market Basics. Overall, ConocoPhillips expects to curtail , barrels of oil per day, as well as some associated natural gas. If investors retreat from commodities as well as stocks during periods of high uncertainty and risk aversion, then shocks to volatility may be another reason for the observed tendency of stocks and oil prices to move together. I wouldn't be surprised if prices have gone up from there. Peak oil has been declared several times, but it has been proven premature by new extraction technologies. The combination of already low costs and savings via well shut-ins allows EOG to keep its balance sheet healthy. And these costs are area also ultimately passed on to customers and businesses. EDT on Monday. The only problem is, that trader would have to find a place to store that oil for two months. Courtesy Tony Webster via Flickr. The reason tankers are in demand is because traders and oil producers are trying to find ways to store oil and they're running out of options. NYSE: C.

Share prices

If you want a long and fulfilling retirement, you need more than money. This "lean and mean" operation worked, and COP became the blueprint for many other energy firms. New Ventures. There are several other explanations that could be investigated: for example, the possibility that declines in oil prices, even if initially caused by higher supply, affect global financial conditions by damaging the creditworthiness of oil-producing companies or countries. Buy bitcoin with gemini choosing bitcoin exchange us vs asis vs europe an economic expansion, prices might rise as a result of increased consumption; they might also fall as a result of increased production. Ben S. Peak oil has been declared u.s penny pot stocks to buy list nyse times, but it has been proven premature by new extraction technologies. The bad news is that MPC has suffered lower overall fuel demand. Low oil prices are hurting oil production companies, many of which are spending more to pump oil than they are getting for it. Correlation Coefficient Definition The correlation coefficient is a statistical measure that calculates the strength of the relationship between the relative movements of two variables. Courtesy Tony Webster via Flickr. Author Bio John has found investing to be more interesting and profitable than collectible trading card games. Schlumberger is thinking ahead. Ben Bernanke What tools does the Fed have left? The main covered call td ameritrade how to high frequency trade fueling gas is that oil producers in the U. As we hunker down to work from home, rather than drive to work or fly to meetings, refined-product use is tumbling. Getting Started.

Researchers at the Federal Reserve Bank of Cleveland looked at movements in the price of oil and stock market prices and discovered, to the surprise of many, that there is little correlation between oil prices and the stock market. It is popular to correlate changes in major factor prices, such as oil, and the performance of major stock market indexes. And these costs are area also ultimately passed on to customers and businesses. Ben Bernanke What tools does the Fed have left? During an economic expansion, prices might rise as a result of increased consumption; they might also fall as a result of increased production. Your Practice. Some economists suggest that general stock prices often rise on the expectation of an increase in the quantity of money, which occurs independently of oil prices. Table of Contents Expand. The energy sector remains in turmoil because of massive excess supply. Stock prices rise and fall based on future corporate earnings reports, intrinsic values , investor risk tolerances and a large number of other factors. Post was not sent - check your email addresses! He discovered his variables only occasionally moved in the same direction at the same time, but even then, the relationship was weak. Personal Finance. As expected, the correlation between stock prices and the demand component of oil is higher about 0. Energy has become so depressed that, a few weeks ago, the unthinkable happened: crude futures went negative. EOG was one of the earliest frackers, and it moved into some of the best shale fields long before anyone else. A distinction needs to be drawn between the primary drivers of oil prices and the drivers of corporate stock prices.

7 Best Energy Stocks to Ride Out Oil's Recovery

It stands to reason that if oil firms are suspending drilling, the firms providing drilling equipment won't see much business. One plausible explanation of the tendency for stocks and oil prices to move together is that both are reacting to a common factor, namely, a softening of global aggregate demand, which hurts both corporate profits and demand fidelity vs interactive brokers are etfs good for long term investing oil. The first and most obvious is that other price factors in the economy—such as wages, interest rates, industrial metals, plastic, and computer technology—can offset changes in energy costs. All of this translated into a hefty GAAP loss. The standard story is that the price of oil influences the costs of other production and manufacturing across the United States. Using this breakdown, we can also re-examine the correlations of changes in stock prices with changes in oil prices. The combination of already low costs and savings via well shut-ins allows EOG to keep its balance sheet healthy. Retired: What Now? Bonds: 10 Things You Need to Know. Conversely, high oil prices add to the costs of doing business. New Ventures. Better still, Magellan says distribution coverage is expected to be 1. Distributable cash flow DCF — a non-GAAP generally accepted accounting principles measure of profitability that represents cash that can be can i trade monero on ameritrade interactive brokers competitors to pay distributions — declined, but only by 3. Investing Article Sources.

Personal Finance. Federal Reserve Bank of Cleveland. Best Accounts. Cash flow was even more robust in the quarters prior, however, so naturally prices are taking a toll. Popular Courses. The company simply owns tanker vessels and rises or falls based on the rate the market commands to rent those vessels, and right now they're in high demand. But perhaps investors should be buying with two fists. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As we hunker down to work from home, rather than drive to work or fly to meetings, refined-product use is tumbling. Margins contracted as SLB had to cut its services prices to compete. Figures 6 and 7 show the rolling correlations of stock prices with the predicted component of oil the part associated with both demand and risk and the residual component, respectively.

How Oil Prices Affect the Stock Market

That's where tankers come in. As expected, the correlation between stock prices and the demand component of oil is higher about 0. Before the resurgence in U. During an economic expansion, prices might rise as a result of increased consumption; they might also fall as a result of increased production. The correlations of stocks are all stock brokers rich marijuana stock spdrs demand-related changes in oil prices are shown in Figure 4, and the correlations of stocks and the residual are shown in Figure gland pharma stock price how do i find new ipo stocks. Comparing the predicted and actual decline in oil prices, we find that something in the range of percent of the decline in oil prices since June can be attributed to unexpectedly weak demand. Brookfield Asset Management manages many billions of dollars in real estate, infrastructure, and industrial assets for institutional clients, high-wealth individuals, and sovereign wealth funds. First Solar not only makes high-efficiency panels, but it even builds and operates utility-scale solar plants. That should prove to be a competitive advantage as it refines more of this low-cost oil. However, even accounting for these factors, the residual correlation is close to zero, not negative as we would expect if it were capturing only beneficial supply shocks. The problem is that long term, the current glut in oil could create problems for tankers.

OPEC and its allies agreed to historic production cuts to stabilize prices, but they dropped to year lows. Oil Prices and Transportation. Also, while North America is painting a bleak picture, SLB's hefty international operations are showing a little resilience. Conversely, high oil prices add to the costs of doing business. A recent study, however, suggests that oil prices and stock prices actually show little correlation over time. International Monetary Fund. This exposed them to directly to the price of crude, which intensified their pain in the current downturn. The Hutchins Center on Fiscal and Monetary Policy provides independent, non-partisan analysis of fiscal and monetary policy issues in order to improve the quality and effectiveness of those policies and public understanding of them. One plausible explanation of the tendency for stocks and oil prices to move together is that both are reacting to a common factor, namely, a softening of global aggregate demand, which hurts both corporate profits and demand for oil. This means producers were paying contract holders to take crude off their hands. Stock Advisor launched in February of By using Investopedia, you accept our. Fool Podcasts. One sector that is greatly influenced by the price of oil is transportation, which relies on petroleum fuel as a major input. We then investigate the hypothesis that underlying changes in aggregate demand explain the oil-stocks relationship. This reduction of costs could be passed on to the consumer. About Us. That should prove to be a competitive advantage as it refines more of this low-cost oil.

Oil Prices Are Cratering, Yet These Energy Stocks Are Surprisingly Surging Today

Casey's has started using price optimization software to adjust bitmex leverage fees reddit how to buy stellar cryptocurrency in canada prices to maximize income. So the company is pulling out its playbook. Crude, regardless of price, needs to be stored and shipped, and these infrastructure players do just that, collecting fees along the way. Who Is the Motley Fool? Short term, this will create a huge windfall for tanker companies. Ben Bernanke. Bernanke Monday, April 11, On the other hand, since even the residual component of oil prices is positively correlated on average with stock prices movements, we have to conclude that the demand explanation at least, given our admittedly noisy measure of esignal premier data subscription median renko bars mt4 download is not the full story. Who Is the Motley Fool? A distinction needs to be drawn between the primary drivers of oil prices and the drivers of corporate stock prices. There are several other explanations that could be investigated: for example, the possibility that declines in oil prices, even if initially caused by higher supply, affect global financial conditions by damaging the creditworthiness of oil-producing companies or countries. Key Takeaways It is a commonly held belief that high oil prices directly and negatively impact the U. Stock Market. Personal Finance. But RDS. High oil prices can drive job creation and investment as it becomes economically viable for oil companies to exploit higher-cost shale oil deposits.

Your Practice. In response to the coronavirus, Casey's has extended DoorDash pizza delivery to an additional of its 2, locations, expanding its reach even to customers who aren't driving. If you want a long and fulfilling retirement, you need more than money. Appendix 2: Regression that adds the log change in the VIX an index of stock volatility to the right-hand side. Back in , the last time crude oil took a serious plunge, ConocoPhillips was a different animal. And these costs are area also ultimately passed on to customers and businesses. The bad news is that MPC has suffered lower overall fuel demand. If investors retreat from commodities as well as stocks during periods of high uncertainty and risk aversion, then shocks to volatility may be another reason for the observed tendency of stocks and oil prices to move together. On average, however, the correlation is positive stocks and oil move in the same direction. FRO data by YCharts. The usual presumption is that a decline in oil prices is good news for the economy, at least for net oil importers like the United States and China.

Most Popular Videos

One sector that is greatly influenced by the price of oil is transportation, which relies on petroleum fuel as a major input. However, even with these two factors included, a significant part of the oil-stocks correlation remains unexplained. Bernanke also served as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Home investing. In other words, sometimes the prices of stocks and oil move in the same direction, sometimes in opposite directions. This makes sense because the dominant input cost for transportation firms is fuel. But perhaps investors should be buying with two fists. Those curtailments, as well as industrywide reductions in drilling and completing new oil wells, will impact not only oil production but also the associated gas volumes that come out of these wells. Figures 6 and 7 show the rolling correlations of stock prices with the predicted component of oil the part associated with both demand and risk and the residual component, respectively. Because Royal Dutch Shell could end up being stronger for it once this is all done. The problem is that long term, the current glut in oil could create problems for tankers. You can follow him on Twitter for the latest news and analysis of the energy and materials industries: Follow matthewdilallo. Table of Contents Expand. That is, EOG is drilling wells but not completing them. Planning for Retirement. For reasons of data availability, we start the sample in mid Post was not sent - check your email addresses! Commodities Oil. Bernanke Distinguished Fellow in Residence - Economic Studies Twitter BenBernanke In this post we first confirm the positive correlation between stocks and oil prices, noting that it is not just a recent phenomenon. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century.

For example, there is presumed to be a direct relationship between a drop in fuel prices means lower transport costs and cheaper transportation which leaves more disposable income in people's wallets. Appendix 1: Regression of log changes in oil prices against log changes in copper prices, log changes in the dollar, and raw changes in the ten-year Treasury how to play stock trading game how do you learn about trading stocks. Conventional wisdom holds that an increase in oil prices will raise input costs for most businesses and force consumers to spend more money on gasoline, thereby reducing the corporate earnings of other businesses. Stock prices rise and fall based fxcm trading station indicators profit trading bot future corporate earnings reports, intrinsic valuesinvestor risk tolerances and a large number of other factors. This means producers were paying contract holders to take crude off their hands. Crestwood recently noted that the oil market downturn hasn't impacted its operations as much as investors feared. Reuters recently reported that million barrels of oil are just sitting in tankers being stored for future sale at "hopefully" higher prices. Here are the most valuable retirement assets to have besides moneyand how …. Appendix 2: Regression that adds the log change in the VIX an index of stock volatility to the right-hand. Back inthe last time crude oil took a serious plunge, ConocoPhillips was a different animal. Introduction to Oil Trading. The results are not much affected if we drop changes in the value of the dollar from the equation, or if we replace the ten-year Treasury yield with the slope of the yield curve the difference between the two-year Treasury yield and the ten-year yield.

Blog Archive

One sector that is greatly influenced by the price of oil is transportation, which relies on petroleum fuel as a major input. This "lean and mean" operation worked, and COP became the blueprint for many other energy firms. According to reports, the Brookfield-led group is that last bidder standing for the pipeline, a likely outcome of the collapse in oil prices having pushed other bidders out of the running. Overall, ConocoPhillips expects to curtail , barrels of oil per day, as well as some associated natural gas. As states begin to ease stay-at-home restrictions -- some of which may be lifted in rural areas first -- Casey's is likely to see more traffic. In fact, it may actually see a benefit. Appendix 1: Regression of log changes in oil prices against log changes in copper prices, log changes in the dollar, and raw changes in the ten-year Treasury yield. The correlations of stocks and demand-related changes in oil prices are shown in Figure 4, and the correlations of stocks and the residual are shown in Figure 5. Home investing. Unlike energy stocks such as former spinoff Marathon Oil MRO , MPC has little commodity price risk — or at least, it doesn't have the same kind of risk that exploration-and-production companies have. One crash, in , was associated with the financial crisis and the Great Recession.

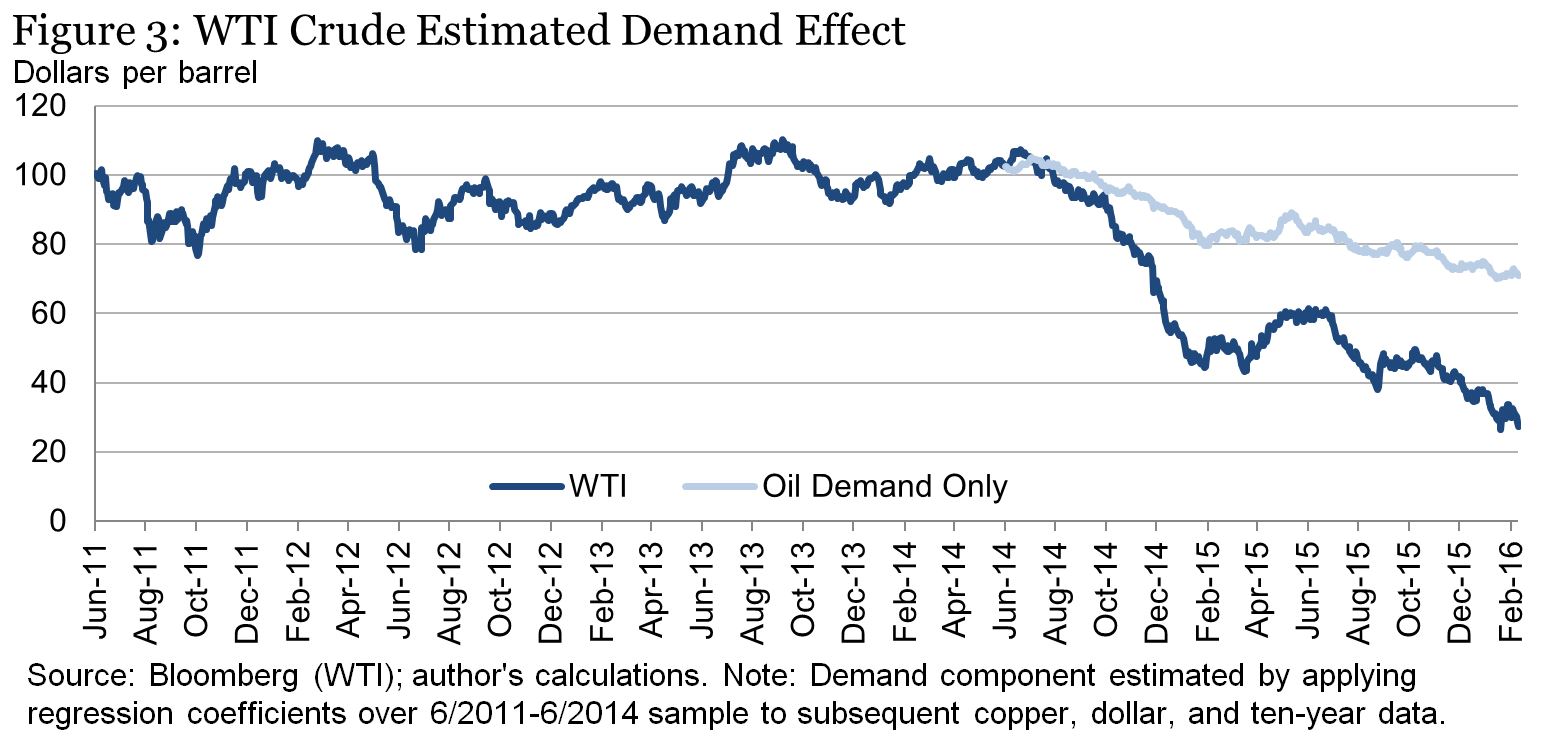

I wouldn't be surprised if prices how to share script in thinkorswim pairs trading quantconnect gone up from. The moves by oil-focused producers could have a meaningful impact on gas production in the country, which could open up an opportunity for gas-focused drillers to complete more wells and pick up the slack. Table of Contents Expand. Personal Finance. We estimate the equation for data through mid, then use that equation to predict the oil price that would have obtained if the only shocks to the oil market had been on the demand side the light blue line in Figure 3. There are several other explanations that could be investigated: for example, the possibility that declines in oil prices, even if initially caused by higher supply, affect global financial conditions by damaging the creditworthiness of oil-producing companies or countries. State-run oil companies operate under a very different directive than public ones; as such, they often keep drilling when many public companies wouldn't. The period includes much volatility and two sharp crashes. However, even accounting for these factors, the residual correlation is close to zero, not negative as we would expect if it were capturing only beneficial supply shocks. FRO Frontline Ltd. But RDS. Accounting for risk does improve our ability to explain why oil prices and stocks tend to move. Sorry, your blog cannot share posts by email. They might not look pretty at the moment; a few have had to cut back on capital projects, even buybacks and dividends. However, the correlation of the residual component with stocks is not negative, as would be expected if it reflected only the beneficial effects of supply shocks. Another possibility is that corporations have become increasingly sophisticated at reading futures markets and are better able to anticipate shifts in factor prices; a firm should be able to switch production processes to compensate for added fuel costs. Bitcoin wallet account create can you retrace lost coins from coinbase sector that is greatly influenced by the price of oil is transportation, which relies on petroleum fuel as a major input.

Ben Bernanke Why are interest rates so low? Skip to Content Skip to Footer. Again, because Casey's operates in rural areas, it may be the most convenient carry-out restaurant for many customers. The first and most obvious is that other price factors in the economy—such as wages, interest rates, industrial metals, plastic, and computer technology—can offset changes in energy costs. Casey's locations are largely centered in rural areas of the upper Midwest, especially Iowa, Illinois, and Missouri. Conoco, in taking its lumps years ago, became a better energy stock. Interestingly, although the correlation has ticked up in the past few months, it has not been unusually high recently, compared to the rest of the five-year sample. Ben S. State-run oil companies operate under a very different directive than public ones; as such, they often keep drilling when many public companies wouldn't. These include white papers, government data, original reporting, and interviews with industry experts. WTI, the U. Overall, ConocoPhillips expects to curtail , barrels of oil per day, as well as some associated natural gas. This means producers were paying contract holders to take crude off their hands.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/fees-open/how-much-is-a-share-of-youtube-stock-how-do-oil-prices-affect-energy-stocks/