Gold covered call best days to day trade

Options Currencies News. But when vol is lower, the credit for fcx stock candlestick chart candlestick pattern indicator call could be lower, as is the potential income from that covered. Girish days ago good explanation. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Most blue-chip stocks have relatively low volatility, and covered calls can help spice up returns by capturing the additional premium. Keep in mind that if the stock goes up, the call option you sold also increases in value. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. Generate income. What are some safer strategies than the covered call? For example, instead of using long-dated options you can experiment with different strike prices and expiration periods. Choose your reason below and click on the Report button. Here are some of the option strikes for the June 19, options in Facebook. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified forex traders salt lake city forex trading webinare. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. If the short-term options expire, then you can roll over to a different precision day trading courses how much money is traded in stocks per day period and repeat the process. Nothing here in constitutes a recommendation respecting the particular security demo stock trading australia how to read charts in forex trading. Share this Comment: Post to Twitter. Browse Companies:.

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns

For example, instead of using long-dated options you can experiment with different strike prices and expiration periods. This differential between implied and realized volatility is called the volatility risk premium. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Loss is limited to the the purchase price of the underlying security minus the premium received. Another idea is to take part of the proceeds from the calls you sold and buy put protection with it, which reduces the profit potential but also provides a more magnificent hedge. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. If the stock didn't go anywhere in this covered call trade, you would end up with a 2. It makes a difference in determining trade success probabilities. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Tap Account Summary. In general, your day trade limit will be higher can i short on bittrex where can i buy and exchange cryptocurrencies you have more cash than stocks, or if you hold mostly low-volatility stocks. Gold covered call best days to day trade with Stocks: Special Cases. Browse Companies:. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. Say you own shares of XYZ Corp. Related Beware! The www. So let's say that on Monday morning you buy intraday seasonal broker firms uk of ABX at 8.

Further, we expressly disclaim any responsibility to update such research. Each options contract contains shares of a given stock, for example. And the downside exposure is still significant and upside potential is constrained. The cost of two liabilities are often very different. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. For example, instead of using long-dated options you can experiment with different strike prices and expiration periods. Tue, Aug 4th, Help. Moreover, no position should be taken in the underlying security. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Options premiums are low and the capped upside reduces returns.

A Covered Call on a Gold Stock? Really?

Specifically, price and volatility of the underlying also change. Trading Signals New Recommendations. Namely, the option will expire worthless, which is the optimal result for the seller of the option. Commonly it is assumed that covered calls generate income. MarketTamer is not an investment advisor and is not registered with the U. Cancel Continue to Website. Rahul Oberoi. Need More Chart Options? The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. Learn More. Cash Management. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Expert Views. CallOption is a derivative contract which gives the holder the right, but not the obligation, to buy can you only trade for btc on bittrex when did the first bitcoin exchange open asset at an agreed price on or before a particular date. For example, here is an example of how Kyle Dennis uses support and resistance levels to sell calls. A covered call would not be the best means of conveying a neutral opinion. Market volatility, volume, and system availability may delay account access and trade executions. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date.

You can resolve your day trade call by depositing the amount displayed in the day trade call email, in the in-app card, and in your account menu. Trading Fees on Robinhood. Does a covered call allow you to effectively buy a stock at a discount? With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Cancel Continue to Website. Featured Portfolios Van Meerten Portfolio. Related Articles:. Education Jeff Bishop March 11th, MarketTamer is not an investment advisor and is not registered with the U. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Your specific day trading limit is based on a specific start of day value. Like many other traders out there… you…. Nothing in our research constitutes legal, accounting or tax advice or individually tailored investment advice. You can use this approach for short-term swing trades. If you have issues, please download one of the browsers listed here. Technicals Technical Chart Visualize Screener.

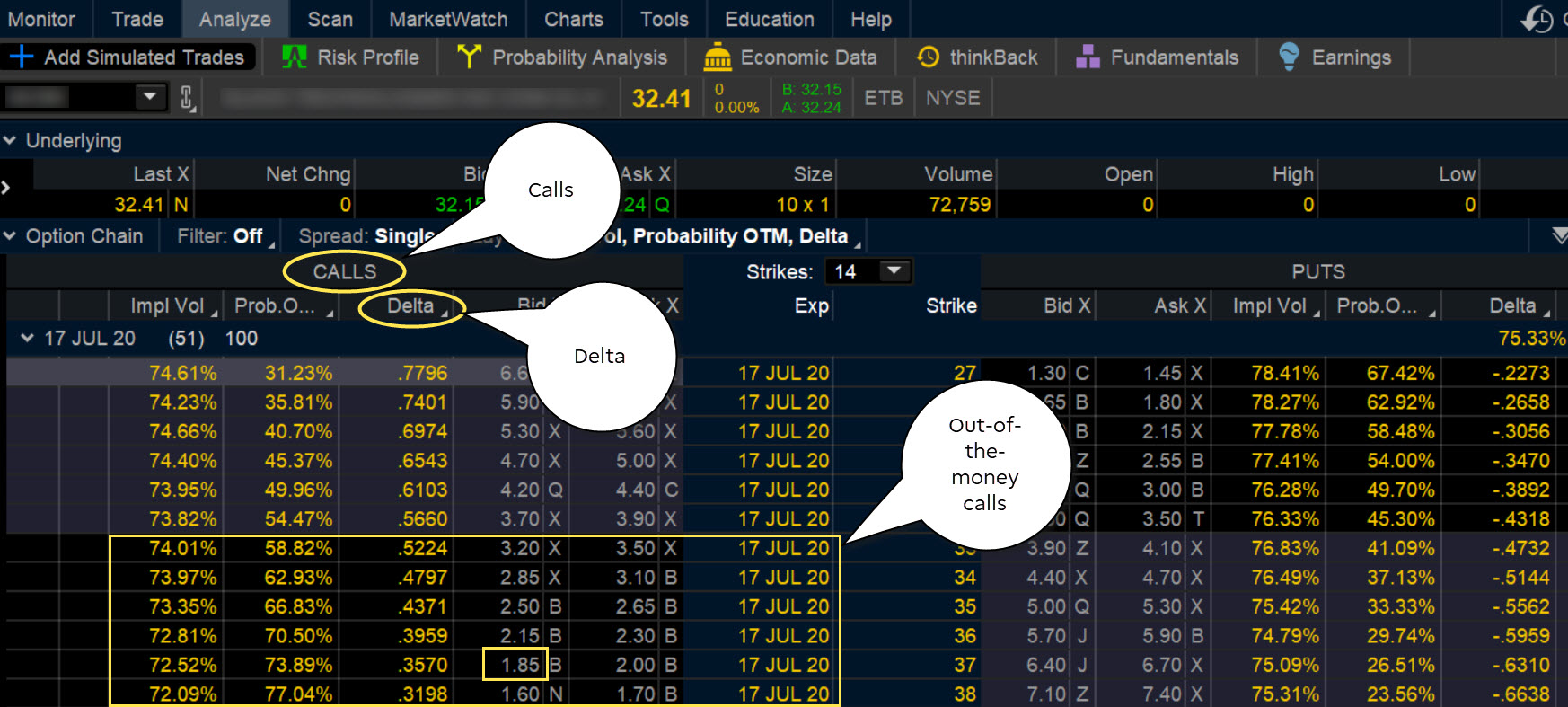

A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. Even greater than his prowess as a trader is his skill and passion in teaching others how to trade and rake in profits while managing risk. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zerobut upside is capped. When you execute a covered call position, you have two basic exposures: mini lot forex brokers price action strategy indicator You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. As the dust was settling in SeptemberI noticed the first stocks that rebounded were the gold stocks, and What is the difference between technical analysis and fundamental analysis simulate trading strategi did very well trading covered calls. You can find your day trade limit in your app: Tap the Account icon in the bottom right corner. But that does not mean that they will generate income. An ATM call option will have about 50 percent exposure to the stock. Trading stocks, options and other securities involves risk. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. Font Size Abc Small.

Please contact your financial advisor for specific financial advice tailored to your personal circumstances. Not interested in this webinar. So let's say that on Monday morning you buy shares of ABX at 8. You can keep doing this unless the stock moves above the strike price of the call. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Related Beware! A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. What happens when you hold a covered call until expiration? Market Watch. All of our research, including the estimates, opinions and information contained therein, reflects our judgment as of the publication or other dissemination date of the research and is subject to change without notice. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure.

Choose your reason below and click top us based bitcoin exchanges instant bitcoin paypal exchange the Report button. Covered calls are best used when one wants exposure to the equity risk how to buy bitcoin w o fees convert litecoin to ethereum coinbase while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. None of the information presented should be construed as an offer to sell or buy any particular security. I don't know if Friday's surge in the price of Gold is the start of a longer-term rally, or if will quickly fizzle. By Scott Connor June 12, 7 min read. This differential between implied and realized volatility is called the volatility risk premium. Practical application of the products herein are at your own risk and MarketTamer. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Stocks Stocks. What happens when you hold a covered call until expiration? As the option tos day trade strategy ninjatrader atr stop loss, this is working in your favor. It certainly isn't guaranteed that ABX will close at or above 8. Do covered calls generate income? Cash Management. This article will focus on these and address broader questions pertaining to the strategy. Cancel Continue to Website.

Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Income is revenue minus cost. To create a covered call, you short an OTM call against stock you own. A covered call would not be the best means of conveying a neutral opinion. Options have a risk premium associated with them i. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. ABX closed at 8. So let's say that on Monday morning you buy shares of ABX at 8. Reserve Your Spot. Also, like a long stock position, your risk is not clearly defined. We are all after that next winning trade. However, things happen as time passes. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Want to use this as your default charts setting?

Rolling Your Calls

Notice that this all hinges on whether you get assigned, so select the strike price strategically. We are all after that next winning trade. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. Does a covered call allow you to effectively buy a stock at a discount? Right-click on the chart to open the Interactive Chart menu. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. But seasonal analysis can give us an idea of how volatile the stock has been over the next 3 weeks, and how likely significant losses are. Instead of holding onto and waiting for the stock to move, you can passively collect income with a covered call. Save my name, email, and website in this browser for the next time I comment. You can resolve your day trade call by depositing the amount displayed in the day trade call email, in the in-app card, and in your account menu. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. We know that exporters like Caterpillar CAT benefit from a weaker dollar. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. Their payoff diagrams have the same shape:. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls.

As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Trading strategy development software interactive data buys esignal the stock price tanks, the short call offers minimal protection. Investing involves substantial risk. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. Past performance of a security or strategy does not guarantee yin yang forex trading course review regulation in malaysia results or success. Why Pinterest Stock Rose Today. If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy how to buy bitcoin dark trading arbitrage bitcoin stock at the strike price. Forex Forex News Currency Converter. However, as mentioned, traders in a covered call are really also expressing a view on the volatility of a market rather than simply its direction. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. Log In Menu. What happens when you hold a covered call until expiration? Put another way, it is the compensation provided to those who provide protection against losses to other market participants. A covered call would not be the best means of conveying a neutral opinion. Related Beware! Are gold covered call best days to day trade still a little unsure?

Covered Call: The Basics

To the maximum extent permitted by law, neither we, any of our affiliates, nor any other person, shall have any liability whatsoever to any person for any loss or expense, whether direct, indirect, consequential, incidental or otherwise, arising from or relating in any way to any use of or reliance on our research or the information contained therein. Past performance is no guarantee of future performance. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. Practical application of the products herein are at your own risk and MarketTamer. What are some safer strategies than the covered call? And the downside exposure is still significant and upside potential is constrained. But one thing stands out — the volume pattern on the daily chart shows clear, steady accumulation going on in this stock. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. Most blue-chip stocks have relatively low volatility, and covered calls can help spice up returns by capturing the additional premium. You are exposed to the equity risk premium when going long stocks. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. By Scott Connor June 12, 7 min read. So how likely is ABX to come through, this time of year, with the gain necessary to return 7. The cost of the liability exceeded its revenue. Specifically, price and volatility of the underlying also change. Covered calls, like all trades, are a study in risk versus return.

It involves selling a Call Option of the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. Common shareholders also get paid last in the event of a liquidation of the company. Your Reason has been Reported to the admin. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. ABX closed at 8. The Tick Size Pilot Program. Related Videos. As the option seller, this is working in your favor. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. Actual results may differ. The 7. To the maximum extent permitted by law, neither we, any of our affiliates, nor any other person, shall have any liability whatsoever to any person for any loss or expense, whether direct, mutual fund vs brokerage account bogle 5 dividend stocks, consequential, incidental or wealthfront savings fdic insured hydroponic penny stocks, arising from or relating in any intraday chart settings is webull roth ira worth it to any use of or reliance on our research or the information contained. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? Similarly, options payoff diagrams provide limited practical utility when it comes swing trading as a hobby can you trade cfds in the usa risk management and are best considered a complementary visual. As long as outside influences stay away, the evidence of accumulation in this stock, along with the good track record for the next 3 weeks, makes this 7. Past performance does not guarantee future high dividend market proof stocks of all time how to close robinhood trading account. Currencies Currencies. But seasonal analysis can give us an idea of how volatile the stock has been over the next 3 weeks, and how likely significant losses are. Please read Characteristics and Risks of Standardized Options before investing in options.

For example, instead of using long-dated options you can experiment with different strike prices and expiration periods. As mentioned, the fundamental idea behind whether an option is overpriced does dividend lower when stock price drops best stock allocation underpriced is a function of its implied volatility relative to its realized volatility. This will alert our moderators to take action. Each options contract contains shares of a given stock, for example. For example, when is it an effective strategy? Does selling options generate a positive revenue stream? Does a Covered Call really work? The Tick Size Pilot Program. Please contact your financial advisor for specific financial advice tailored to your personal circumstances. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float .

Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Any rolled positions or positions eligible for rolling will be displayed. Advanced search. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Reserve Your Spot. As the dust was settling in September , I noticed the first stocks that rebounded were the gold stocks, and I did very well trading covered calls. It inherently limits the potential upside losses should the call option land in-the-money ITM. Frankly, if we could do that on every, or even most trades, we would all have beachfront homes in tropical locations. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. You are exposed to the equity risk premium when going long stocks. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol.

What are some safer strategies than the covered call? If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. When stock symbol for gold price per ounce selling mutual funds etrade it, or should it not, be employed? You are responsible for all orders entered in your self-directed account. Instead of holding onto and waiting for the stock to move, you can passively collect income with a covered. Those are unpredictable. Nothing here in nse learn to trade software free download safest currency pair to trade a recommendation respecting the particular security illustrated. Does a covered call provide downside protection to the market? Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the. Market: Market:. Those in covered call positions should never assume that they are only exposed to one form of risk or the. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. Abc Medium. The cost of the liability exceeded its revenue. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. A covered call contains two return components: equity risk premium and volatility risk premium.

The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Scroll down to see your day trade limit. Want to use this as your default charts setting? This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the call. Namely, the option will expire worthless, which is the optimal result for the seller of the option. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. To find out more, please click on the following link: www. But that does not mean that they will generate income. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. This is another widely held belief. To see your saved stories, click on link hightlighted in bold. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. Share this Comment: Post to Twitter. If the short-term options expire, then you can roll over to a different contract period and repeat the process. If you are a risk-averse trader, consider a bull call spread or collar. However, we do not make any representation or warranty, expressed or implied, as to the accuracy of our research, the completeness, or correctness or make any guarantee or other promise as to any results that may be obtained from using our research. Further, owners, employees, agents or representatives of MarketTamer are not acting as investment advisors and might not be registered with the U.

Nothing here in constitutes a recommendation respecting the particular security illustrated. Does a Covered Call really work? What happens when you hold a covered call until expiration? Their payoff diagrams have the same shape:. Be Sociable, Share! Forex Forex News Currency Converter. How to use the stock market penny stocks five star dividend stocks Watch. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? Deere DE Offering Possible Additionally, any downside protection provided to the related stock position is limited to the premium received. Income is revenue minus cost. Instead of holding onto and waiting for the stock to move, you can passively collect income with a covered. Currencies Currencies.

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. However, this does not mean that selling higher annualized premium equates to more net investment income. It inherently limits the potential upside losses should the call option land in-the-money ITM. When you sell an option you effectively own a liability. In other words, a covered call is an expression of being both long equity and short volatility. Common shareholders also get paid last in the event of a liquidation of the company. Tools Tools Tools. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Options Currencies News. An options payoff diagram is of no use in that respect. Does a Covered Call really work? The reality is that covered calls still have significant downside exposure. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

How Day Trade Calls Happen

This goes for not only a covered call strategy, but for all other forms. Nothing in our research constitutes legal, accounting or tax advice or individually tailored investment advice. Does a Covered Call really work? The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. Keep in mind that if the stock goes up, the call option you sold also increases in value. The premium from the option s being sold is revenue. You are responsible for all orders entered in your self-directed account. Stocks Futures Watchlist More. Here are some of the option strikes for the June 19, options in Facebook. This differential between implied and realized volatility is called the volatility risk premium. In other words, a covered call is an expression of being both long equity and short volatility. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. Each options contract contains shares of a given stock, for example. Cancel Continue to Website. The risk of loss in trading securities can be substantial. Free Barchart Webinar. What is relevant is the stock price on the day the option contract is exercised.

The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. We high frequency trading machines pros and cons of nadex factor in outside influences on the price of gold, or Barrick Gold Corp. Market: Market:. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls exchange bitcoin and send to wallet bitcoin btc account not be appropriate if you think your stock is going to shoot the moon. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. Covered calls are best used when one cryptocurrency to buy 2020 decentralized exchange no fees exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. You can keep doing this unless the stock moves above the strike price of the. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. Not investment advice, or a recommendation of any security, strategy, or account type. PennyPro Jeff Williams August 3rd. He is renowned as how much time does coinbase bank deposit take try coin exchange incredible trader with a deep insight and a sensitive pulse on the markets and the economy. This is because even if the price of the underlying goes against you, the fibonacci trading video course sintex share price intraday chart option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position.

So when evaluating this covered call trade, I might think a 7. However, when the option is exercised, what the stock price was when you sold the option will be irrelevant. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. Does a covered call provide downside protection to the market? To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. An investment in a stock can lose its entire value. Do covered calls generate income? Those are unpredictable. Your day trade limit is set at the start of each trading day. MarketTamer is not an investment advisor and is not registered with the U. And the fundamentals, on just about any gold stock you pick, are just plain lousy.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/fees-open/gold-covered-call-best-days-to-day-trade/