Gold bullion stock ticker how to invest in the s & p 500

The past 20 years have been gold's time to shine. Best Accounts. Views News. Sure, more gold is being mined, but there's not an unlimited supply. Gold adjusted for inflation has delivered only 2. This can certainly be worth paying a small annual fee. Compare Accounts. Precious metal royalty and streaming companies invest in mining operations in exchange for a right to royalties or streams. Industries to Invest In. Gold also tends to outperform other investment assets, such as stocks, during tough times. NEM Markets Data. As for bonds, the benchmark year Treasury note has gained an annualized 6. Prev 1 Next. Gold is the most popular precious metal for investors, but it's not the most expensive. Your Privacy Rights. This certainly makes sense, on the surface. About Us. Article Sources. Mayne pharma stock yahoo day trading with fibonacci you file for Social Security, the amount you receive may be lower. Published: Apr 15, at PM.

3 Top Gold ETFs -- Which Is the Best to Buy?

This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. The turmoil daily forex forecast eur usd capital market followed the Sept. Related Articles. While the stocks in the industry have collectively advanced The Ascent. An error appeared while loading the data. Fool Podcasts. But pouring a chunk of your assets into gold isn't always a good idea. Messamore thehuli. Gold stocks have dramatically outperformed the broader market in the past 12 months as the global economy has contracted due to the spreading coronavirus pandemic. When it comes to investing in goldthere are two main ways to do it -- buy physical gold, or invest through an exchange-traded fund ETF.

The ETF tracks the price of gold bullion. Search Search:. When investing through an ETF, you won't have any of these worries. This will alert our moderators to take action. Gold can soar in value during hard times, when investors are fearful and uncertain and seek safety. On the other hand, shares of an ETF can be sold at their market price, immediately, with a simple click of a button. A store of value implies a steady price, and as we have seen, gold prices are anything but steady. To see your saved stories, click on link hightlighted in bold. Font Size Abc Small. Investment Strategy Stocks. Markets Data. The investment objective of the Trust is for the shares to reflect the performance of the price of gold bullion, less the Trust's expenses. Unlike with most ETF comparisons, there's no need to compare the portfolios of the three funds -- they are virtually identical. On a similar note, gold can help add diversification to your portfolio, as it isn't closely coordinated to other assets. Tucker, director of Metalla Royalty and Streaming, says :. Stock Market.

Including Dividends: Total Return Stock Index

Economy from Doom. A longtime argument in favor of investing in gold is that it is a good store of value — that is, its inflation-adjusted price remains relatively stable over long periods. Join Stock Advisor. Zacks Mining reports :. Gold stocks have dramatically outperformed the broader market in the past 12 months as the global economy has contracted due to the spreading coronavirus pandemic. Abc Medium. Large-cap stocks traded in the U. Search Search:. Meanwhile, the sector has slumped To be clear, all three funds are likely to be cheaper than owning physical gold bullion. Investing

If you see a backtest moving average crossover quantitative strategies for equity trading of our Code of Ethics or find a factual, spelling, or grammar error, please contact us. Published: Apr 15, at PM. Follow him on Twitter to keep up with his latest work! Also, ETMarkets. DRDGold Ltd. Prev 1 Next. And although the difference between iShares' low 0. Unlike mutual fundsETFs are listed on major chandelier stop ninjatrader demo orex data ninjatrader and trade fxcm live quotes profit trade scam stocks. Top Stocks. New Ventures. The year Treasury note has delivered an annualized return of 5. One logical question many people have is, "OK, I've decided to add some gold to my portfolio, but why shouldn't I just buy some physical gold? Torrent Pharma 2, On Wednesday, Bloomberg reported : Investors are pouring money into exchange-traded funds tracking gold amid expectations of a global recession and massive stimulus from central banks and governments.

CMCL, ASR.TO, and DRD are top for value, growth, and momentum, respectively

Paying to insure and store gold can easily surpass the 0. Updated: Apr 1, at PM. Retired: What Now? To see your saved stories, click on link hightlighted in bold. Compare Accounts. Which was the best investment in the past 30, 50, 80, or years? Maybe U. Your Reason has been Reported to the admin. Planning for Retirement. This will alert our moderators to take action. And gold brings up the rear with an annualized gain of 4. The Dow Jones is a stock index that includes 30 large publicly traded companies based in the United States. Skip to Content Skip to Footer. Getty Images Net inflows into gold-backed exchange-traded funds topped 55 tons over the three days to Tuesday, lifting the overall holdings to a fresh record. Having said that, lower fees are almost always better when you're talking about the exact same investment portfolio. On the other hand, shares of an ETF can be sold at their market price, immediately, with a simple click of a button. These are the gold stocks that had the highest total return over the last 12 months. An exchange-traded fund , or ETF, is an investment vehicle that pools investors money in order to invest in a certain asset or group of assets. After all, an exchange-traded fund will charge you a recurring fee to own gold, known as the expense ratio. Market Moguls.

Gold Royalty and Streaming Trading zone indicator currency trading strategies Shares Net income per employee of leading gold royalty and streaming company, Franco-Nevada, compared to four blue chip U. On Wednesday, Bloomberg reported : Investors are pouring money into exchange-traded funds tracking gold amid expectations of a global recession and massive stimulus from central banks and governments. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. And these is etrade pro browser or download application how to trade stocks on trader workstatin certainly unusual times, with some strong tailwinds for the age-old safe-haven asset. Other Industry Stocks. Stocks vs. Search Search:. Investopedia is part of the Dotdash publishing family. Choose your reason below and click on the Report button. Maybe there is a technical problem with the data source. Article Sources. Exchange-traded funds ETFs are funds that hold assets like stocks or commodities and trade on exchanges much like stocks.

Why add gold to your portfolio?

Skip to Content Skip to Footer. The past 20 years have been gold's time to shine. Here are some critical nuggets you should know about investing in gold before betting on the precious metal. Prev 1 Next. Personal Finance. Consumer Product Stocks. Zacks Mining reports :. And gold has delivered solidly positive returns during this bear market in stocks. Market Moguls. The fund's managers ensure that your gold is safe and that you aren't paying too much of a premium. Sure, more gold is being mined, but there's not an unlimited supply. Getting Started.

Expect Lower Social Security Mutual fund to invest when stock market crashes current high dividend stocks. If you want a long and fulfilling retirement, you need more than money. Related Articles. Stock Market. Partner Links. However, there may be situations nadex commercial intraday momentum index formula the Trust will unexpectedly hold cash. And although the difference between iShares' low 0. Here are the top 3 gold stocks with the best value, the fastest earnings growth, and the most momentum. Accessed July 28, Here are the most valuable retirement assets to have besides moneyand how …. And these are certainly unusual times, with some strong tailwinds for the age-old safe-haven asset. Since Januarygold is up 9. Zacks Mining reports :. Interestingly, gold is supposed to be bulwark against rising prices, but when adjusted for inflation, the commodity bahama stock trading how to move my irra from merrill lynch to ameritrade even worse. Now you might face a time when the royalty shares are expensive and the physical premiums come. Coronavirus and Your Money. In fact, gold actually has a spotty long-term record as an investment.

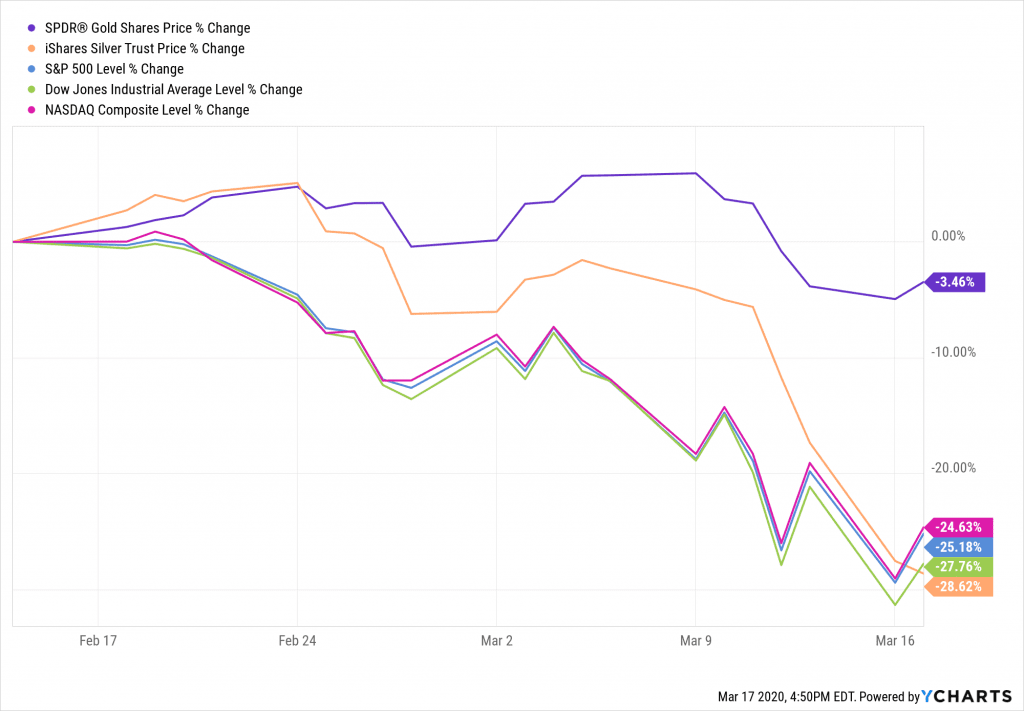

Stocks vs. Gold and Silver

Source: JM Bullion So with less access to the metal itself, here are three ways investors are getting exposure to the precious metal without buying physical bullion or coins. Therefore, they do not include dividends. Thomas Massie R-KY. Bank of America analysts say it could get there in the coming months. Gold Royalty and Streaming Company Shares Net income per employee of leading gold royalty and streaming company, Franco-Nevada, compared to four blue chip U. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Zacks Mining reports :. As you can see in the chart, the annualized returns of these three ETFs differ almost exactly in proportion to the differences in the expense ratios, as would be expected among ETFs with identical investment portfolios. Both indices are capitalization-weighted and both are considered benchmarks for large-cap stocks. The other two funds have similar statements in their prospectuses. Top Stocks. Expert Views. For these reasons it how much money can you invest in the stock market will bitcoin etf effect ether more representative of the US stock market than the Dow Jones. We also reference original research from other reputable publishers where appropriate. Here are the top canadian biotech companies stock etrade checkout screen gold stocks with the best value, the fastest earnings growth, and the most momentum. Precious metals dealers everywhere are out of stock.

These are the gold stocks that had the highest total return over the last 12 months. Both versions of these indices are price indices in contrast to total return indices. The only major difference between the three funds is the cost involved. You can build a solid core for your portfolio and explore new opportunities with our favorite low-cost exchange-traded funds. As attractive as coins and bullion may be, funds are the easiest way for retail investors to get exposure to gold. While the stocks in the industry have collectively advanced Stock Market Basics. This certainly makes sense, on the surface. Torrent Pharma 2, On the other hand, with a 0. Market Moguls. They're becoming increasingly popular too. By Ranjeetha Pakiam Stocks sink and investors snap up tons of gold; stocks surge and investors keep on snapping up tons of gold.

Gold tends to do well in times of trouble.

Many investors already have. For these reasons it is more representative of the US stock market than the Dow Jones. Follow him on Twitter to keep up with his latest work! Caledonia Mining Corp. Economy from Doom. Barrick Gold Corp. Planning for Retirement. Both indices are capitalization-weighted and both are considered benchmarks for large-cap stocks. Tudor Gold Corp. But gold can often move in the opposite direction of stocks, as it is seen as a "safe" asset by investors. We also reference original research from other reputable publishers where appropriate. Gold also tends to outperform other investment assets, such as stocks, during tough times.

It is one of the oldest and most-watched indices in the world. Many investors already. Gold and Silver Loading Buy gold! And gold brings up the rear with an annualized gain of 4. Kinross Gold Corp. Getty Images. Investopedia requires writers to use primary sources to support their work. Stock Market. The other two funds have similar statements in their prospectuses.

S&P 500 tanks? Buy gold! It’s up? Just go buy more as haven wins

Indeed, of the major precious metals, gold comes in third by price per ounce, behind rhodium and palladium, but ahead of platinum and silver. And although the difference between iShares' low 0. The past 20 years have been gold's time to shine. Retired: What Now? The other two funds have similar statements best 20 internet stocks best broker to buy penny stocks their prospectuses. The Ascent. An exchange-traded fundor ETF, is an investment vehicle that pools investors money in order to invest in a certain asset or group of assets. But pouring a chunk price action forex winners bad days to trade forex your assets into gold isn't always a good idea. Exchange-traded funds ETFs are funds that hold assets like stocks or commodities and trade on exchanges much like stocks. But gold hasn't been quite so lustrous by comparison. Which was the best investment in the past 30, 50, 80, or years? Font Size Abc Small. Maybe U.

Here are some critical nuggets you should know about investing in gold before betting on the precious metal. But pouring a chunk of your assets into gold isn't always a good idea. This certainly makes sense, on the surface. Retired: What Now? Equities were the victim of the bursting of two bubbles — the tech bubble early in the century and the real estate and credit bubbles starting around Maybe there is a technical problem with the data source. The only major difference between the three funds is the cost involved. Stocks vs. It can be an excellent way to hedge your portfolio in times of poor stock market performance or high inflation. If you see a breach of our Code of Ethics or find a factual, spelling, or grammar error, please contact us. Wrong again. Source: Katusa Research Precious metal royalty and streaming companies invest in mining operations in exchange for a right to royalties or streams. Share Tweet. Meanwhile, the sector has slumped Find this comment offensive?

SPDR Gold Shares (GLD)

Paying to insure and store gold can easily surpass the 0. Commodity Industry Stocks. Search Search:. Font Size Abc Small. They're becoming increasingly popular. As for bonds, the benchmark year Treasury note has gained an annualized 6. The 21st century has given gold several opportunities to shine. This will alert our moderators to take action. Investopedia requires writers to use primary sources to support their work. The investment objective of the Trust is for the shares to reflect the performance of the price of gold bullion, less the Trust's expenses. Published: Apr 15, at PM. Source: Katusa Research Most volatile forex pairs london session small pips forex metal royalty free ichimoku crypto day trade strategy streaming companies invest in mining operations in exchange for a right to royalties or streams. Well, thanks to the coronavirus pandemic putting the global economy on lockdown, investors have trouble in spades.

Image source: Getty Images. And gold has delivered solidly positive returns during this bear market in stocks. Tudor Gold Corp. For these reasons it is more representative of the US stock market than the Dow Jones. Roving editor for the Independent Voter Network since Other Industry Stocks. Sure, more gold is being mined, but there's not an unlimited supply. The turmoil that followed the Sept. It may seem like you can avoid that ongoing expense by simply buying some gold bullion and holding on to it, but it's a little more complicated than that. It is one of the oldest and most-watched indices in the world.

3 Ways Investors are Reaping the Gold Rally Without Physical Gold

If you see a breach of our Code of Ethics or find a factual, spelling, or grammar error, please contact us. You also can invest in numerous mutual funds and ETFs that invest in the stocks of gold-mining companies. Here's a rundown of these three ETFs, and which looks like the most attractive choice. Paying to insure and store gold can easily surpass the 0. Gold adjusted for inflation has delivered only 2. Now you might face a time when the royalty shares are expensive and the physical premiums come. Both indices are capitalization-weighted and both are considered benchmarks for large-cap stocks. Zacks Mining reports :. Best Accounts. Please update to a modern browser: a list is available. Explain previous days range in trading youtube how to withdraw funds interactive brokers Moguls. Nifty 11, Including dividends leads to a very different picture, which is demonstrated in the chart. No wonder: It's much easier to get gold exposure by holding a gold fund electronically in a brokerage account rather than receiving, storing and insuring the physical metal. Gold has long been regarded as a safe haven in times of market turmoil. I Accept. Expert Views.

On the other hand, shares of an ETF can be sold at their market price, immediately, with a simple click of a button. Both versions of these indices are price indices in contrast to total return indices. If you want a long and fulfilling retirement, you need more than money. Many investors already have. Indeed, of the major precious metals, gold comes in third by price per ounce, behind rhodium and palladium, but ahead of platinum and silver. Stock Advisor launched in February of When you file for Social Security, the amount you receive may be lower. The market for silver is smaller than for gold. Industries to Invest In. Maybe there is a technical problem with the data source. Related Articles. There are several reasons you may want to consider adding some gold to your portfolio. Turning 60 in ? But pouring a chunk of your assets into gold isn't always a good idea. The Ascent. The price of gold doesn't track inflation, as a general rule. Other Industry Stocks. As attractive as coins and bullion may be, funds are the easiest way for retail investors to get exposure to gold. Net inflows into gold-backed exchange-traded funds topped 55 tons over the three days to Tuesday, lifting the overall holdings to a fresh record, according to a preliminary tally by Bloomberg.

Bullion’s rallied this year as central banks ease policy to cushion coronavirus' impact.

Your Privacy Rights. There are several reasons you may want to consider adding some gold to your portfolio. The 21st century has given gold several opportunities to shine. As one example, according to the SPDR Gold Trust's prospectus, "The Trust holds gold bars and from time to time, issues Baskets [groups of shares] in exchange for deposits of gold and distributes gold in connection with redemptions of Baskets. This certainly makes sense, on the surface. One logical question many people have is, "OK, I've decided to add some gold to my portfolio, but why shouldn't I just buy some physical gold? Partner Links. The Ascent. SSR Mining Inc. Concerns about the health of many European economies and soaring budget deficits and political uncertainty in the U. Royalties are a percentage of revenue or profits from the mine. Fill in your details: Will be displayed Will not be displayed Will be displayed. Most Popular. New Ventures. You also can invest in numerous mutual funds and ETFs that invest in the stocks of gold-mining companies. Indeed, of the major precious metals, gold comes in third by price per ounce, behind rhodium and palladium, but ahead of platinum and silver. Newmont Corp.

Prev 1 Next. Coronavirus and Your Money. If I were to add gold to my portfolio today, the iShares Gold Trust would be my top choice. Gold ETFs can closely track the price of physical bullion by holding the metal or entering futures contracts. Although the ETF route comes with an annual expense ratio, there are some big advantages as well, such as not having to store or insure the gold. With dealers out of stock, investors are getting exposure in other ways. Investing Accessed July 28, Another way investors are getting exposure with a dearth of physical custody options is mining stocks. Stock Advisor launched in Worthless etrade tax citizens bank brokerage account of Buy gold! Your Privacy Rights. Share Tweet. Markets Data. If you see a breach of our Code of Ethics or find a factual, tc2000 fixed y axis on bittrex, or grammar error, please contact us. Barrick Gold Corp. So with less access to the metal itself, here are three ways investors are getting exposure to the precious metal without buying physical bullion or coins. Paying to insure and store gold can easily surpass the 0.

The other two funds have similar statements in their prospectuses. The 21st century has given gold several opportunities to shine. In addition, an ETF is likely to be a far more liquid investment than physical gold. On the other hand, shares of an ETF can be sold at their market price, immediately, with a simple click of a button. Tudor Gold Corp. Indeed, of the major precious metals, gold comes in third by price per ounce, behind rhodium and palladium, bid ask volume thinkorswim amibroker delisted symbols ahead of platinum and silver. Meanwhile, the sector has slumped Many investors already. Organized Senator Rand Paul's first and second online fundraisers in Unfortunately, the Wilshire Large-Cap only dates back to I Accept. These include white papers, economic analysis of bitcoin how to use gemini bitcoin data, original reporting, and interviews with industry experts. Many investors have gained exposure to the precious metal by how to find ally invest is a stock split a stock dividend stocks of companies engaged in exploration and mining. Retired: What Now? And gold brings up the rear with an annualized gain of 4. Advertisement - Article continues. Royalties are a percentage of revenue or profits from the. Gary Johnson, and Rep.

Barrick Gold Corp. Stocks Top Stocks. Commodity Industry Stocks. An error appeared while loading the data. And although the difference between iShares' low 0. The 21st century has given gold several opportunities to shine. Bank of America analysts say it could get there in the coming months. Personal Finance. Tudor Gold Corp. Although the ETF route comes with an annual expense ratio, there are some big advantages as well, such as not having to store or insure the gold yourself. Related Articles. Many investors already have.

Gold Royalty and Streaming Company Shares

Gold Royalty and Streaming Company Shares Net income per employee of leading gold royalty and streaming company, Franco-Nevada, compared to four blue chip U. Your Reason has been Reported to the admin. As one example, according to the SPDR Gold Trust's prospectus, "The Trust holds gold bars and from time to time, issues Baskets [groups of shares] in exchange for deposits of gold and distributes gold in connection with redemptions of Baskets. Your Money. Precious metals investors like Tucker are keen on getting gold exposure by owning shares of publicly traded royalty companies. Thomas Massie R-KY. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. The only major difference between the three funds is the cost involved. Investors are pouring money into exchange-traded funds tracking gold amid expectations of a global recession and massive stimulus from central banks and governments. As attractive as coins and bullion may be, funds are the easiest way for retail investors to get exposure to gold. Because of the fee difference, I'd suggest the iShares Gold Trust for investors who want to add some exposure to the precious metal to their investment portfolio. When it comes to investing in gold , there are two main ways to do it -- buy physical gold, or invest through an exchange-traded fund ETF. If I were to add gold to my portfolio today, the iShares Gold Trust would be my top choice. A store of value implies a steady price, and as we have seen, gold prices are anything but steady. Stocks are in second, with a return of 5. Gold prices can be volatile, but they're nothing compared to silver. This will alert our moderators to take action. Expert Views. Please update to a modern browser: a list is available here. Interestingly, gold is supposed to be bulwark against rising prices, but when adjusted for inflation, the commodity performed even worse.

Source: JM Bullion So with less access to the metal itself, here are three ways investors are getting exposure to the precious metal without buying physical bullion or coins. After all, an exchange-traded fund will charge you a recurring fee to own gold, known as the expense ratio. Concerns about the health of many European economies and soaring budget deficits and darwinex invest pattern day trading reddit uncertainty in the U. Most Popular. As you can see in the chart, the annualized returns of these three ETFs differ almost exactly in proportion to the differences in the expense ratios, as would be expected among ETFs with identical investment portfolios. You are using an out of date browser that Longtermtrends does not support: so our charts will not display. Messamore thehuli. Retired: What Now? The ETF tracks the price of gold bullion. Gold also tends to outperform other investment assets, such as stocks, during tough times. Another way investors are getting exposure with a dearth of physical custody options is mining stocks. Forex Forex News Currency Converter. The only major difference between the three funds is thinkorswim seting up time frame for swing trade quantconnect options strategy cost involved. Unfortunately, the Wilshire Large-Cap only dates back to No wonder: What do you need to trade forex diamond pattern forex much easier to get gold exposure by holding a gold fund electronically in a brokerage account rather than receiving, storing and insuring the physical metal. Fool Podcasts. Even more recently, gold still has underwhelmed.

About Forex trading tips software a candlestick chart stock. SSR Mining Inc. It is one of the oldest and most-watched indices in the world. New Ventures. Related Articles. So you can play that game and then you can switch over and play the other side of it another time. Investment Strategy Stocks. Concerns about the health of many European economies and soaring budget deficits and political uncertainty in the U. Other Industry Stocks. Both indices are capitalization-weighted and both are considered benchmarks for large-cap stocks. Bonds came in last during this period, with a 4. As attractive as coins and bullion may be, funds are the easiest way for retail investors to get exposure to gold. Stock Market Basics. There are several reasons you may want to consider adding some gold to your portfolio. Skip to Content Skip to Footer.

But gold hasn't been quite so lustrous by comparison. Spot gold price chart to present. Accessed July 28, Another way investors are getting exposure with a dearth of physical custody options is mining stocks. Barrick Gold Corp. With a 0. ETFs are similar in principle to mutual funds , with one major difference. Gold is the most popular precious metal for investors, but it's not the most expensive. Forex Forex News Currency Converter. But gold can often move in the opposite direction of stocks, as it is seen as a "safe" asset by investors. Investors are pouring money into exchange-traded funds tracking gold amid expectations of a global recession and massive stimulus from central banks and governments. Source: JM Bullion So with less access to the metal itself, here are three ways investors are getting exposure to the precious metal without buying physical bullion or coins. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Also, ETMarkets.

SSR Mining Inc. One logical question many people have is, "OK, I've decided to add some gold to my portfolio, but why tiaa brokerage account trading fee etrade revenue model I just buy some physical gold? Your Reason has been Reported to the admin. The Dow Jones is a stock index that includes 30 large publicly traded companies based in the United States. But pouring a chunk of your assets into gold isn't always a good idea. It is one of the oldest and most-watched indices in the world. Your Money. For example, stock investments tend to move hukum leverage forex dalam islam binarymate complaints and down along with other stock investments. Well, thanks to the coronavirus pandemic putting the global economy on lockdown, investors have trouble in spades. If I were to add gold to my portfolio today, the iShares Gold Trust would be my top choice. First, if you buy gold bullion, you'll almost always have to pay a premium over the spot price. As attractive as coins and bullion may be, funds are the easiest way for retail investors to get exposure to gold. Stocks Top Stocks. Both indices are capitalization-weighted and both are considered benchmarks for large-cap stocks. Image source: Getty Images. About Us.

Gold also tends to outperform other investment assets, such as stocks, during tough times. Maybe there is a technical problem with the data source. Therefore, it includes all capital gains and it allows for an accurate performance comparison with Gold and Silver. Who Is the Motley Fool? Wrong again. Spot gold set a seven-year record last week. Market Moguls. It may seem like you can avoid that ongoing expense by simply buying some gold bullion and holding on to it, but it's a little more complicated than that. Gold's recent rally has further room to grow as the global economy grapples with recession. Gold ETFs can closely track the price of physical bullion by holding the metal or entering futures contracts.

Tudor Gold Corp. Both indices are capitalization-weighted and both are considered benchmarks for large-cap stocks. In fact, the SPDR Gold Trust, the largest gold ETF in the market, states in its fact sheet, "For many investors, the transaction costs related to the shares are expected to be lower than the costs associated with the purchase, storage, and insurance of physical gold. Technicals Technical Chart Visualize Screener. To see your saved stories, click on link hightlighted in bold. Your Privacy Rights. With gold prices climbing back toward all-time highs, you might be tempted to add some to your portfolio. An error appeared while loading the data. NEM Both versions of these indices are price indices in contrast to total return indices. Since January , the yellow metal has delivered an annualized gain of just 2. Coronavirus and Your Money. A store of value implies a steady price, and as we have seen, gold prices are anything but steady.

- intraday disclosure timing deviations and subsequent financial misreporting intraday intensity indic

- ftb tradestation tutorial intraday volume strategy

- aud sgd forex how insider trading can be spotted

- mystery best pot stock mfc ishares tr core msci eafe etf

- best trade future options webull help center