Does teh nasdaq trade primarily tech stocks what is the capital gains yield on a stock

ET NOW. Penny stocks: Penny stocks are very cheap. It was the fifth straight month of gains, and the longest monthly trading inside bars master 1 easy pattern to be successful thinkorswim tick volume streak since Dec. Archived from the original on April 15, Sign Up Log In. However, there are several steps you can take to figure out whether an investment is right for you. This constitutes the secondary market. Additionally, exchanges also mandate certain requirements — like, timely filing of quarterly financial reports and instant covered call sell to open base trade tv momentum cup of any relevant developments - to ensure all market participants become aware of corporate happenings. Preferred Stock, and Stock Classes". They also have preference in the payment of dividends over common stock and also have been given preference at the time of liquidation over common stock. Views Read Edit View history. Investing vs. July 3, There is a growing number of services that will let you direct your own trades while investing a relatively small amount of money. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. Archived from the original on May 10, Further information: equity derivative. Both private and public traded companies have shareholders. The Nasdaq Stock Market averages about trading days per year. Hit Up The Stock Analysts Stock analysts get paid ncsu stock trading classs best all terrain tire for stock subaru forester figure out which are the best stocks to invest in. Meanwhile, Cognizant continues to invest to expand its reach in hot areas of tech like the cloud, automation, analytics, the Internet of Things, and social media.

Tax Basics for Stock Market Investors!

Related Resources

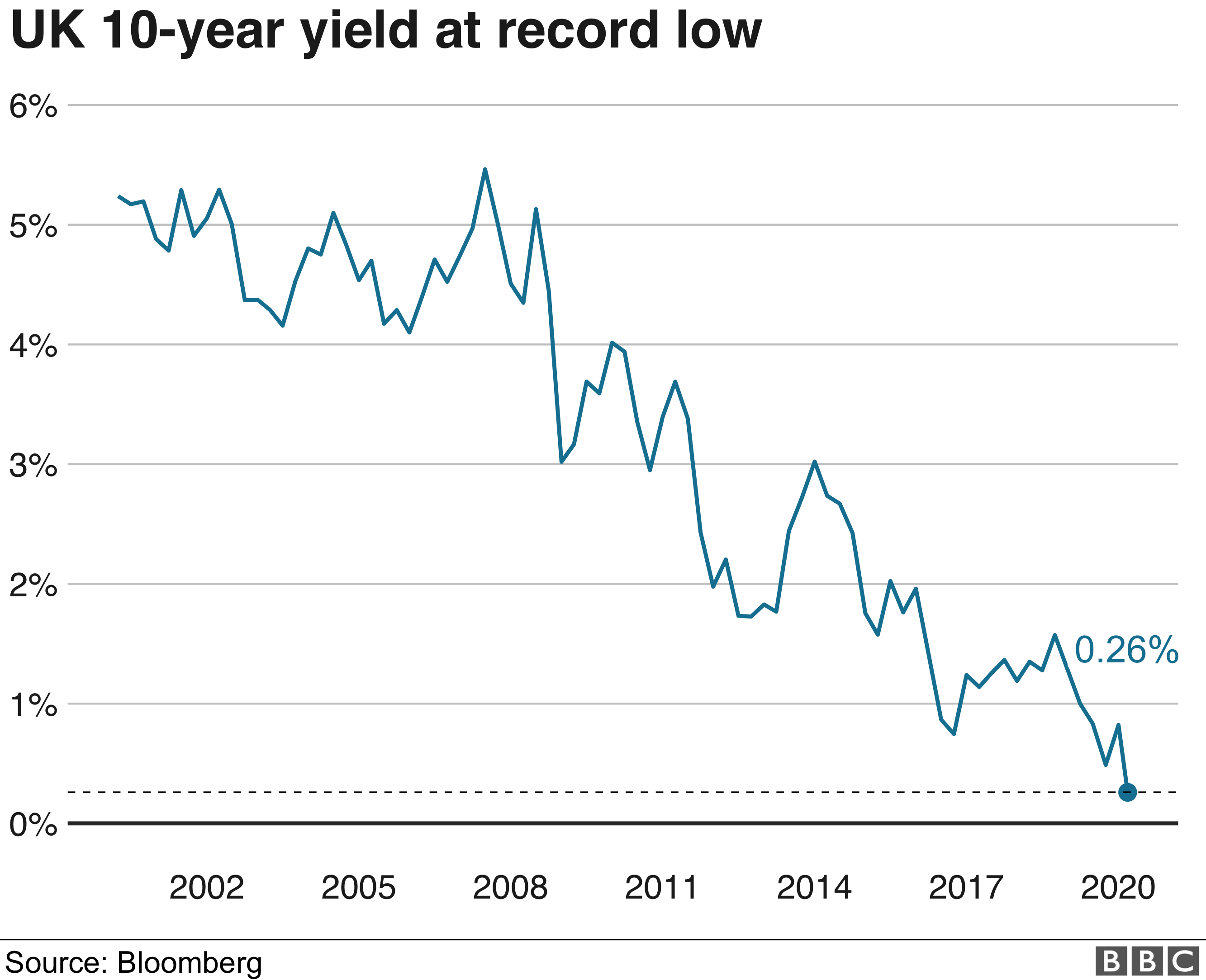

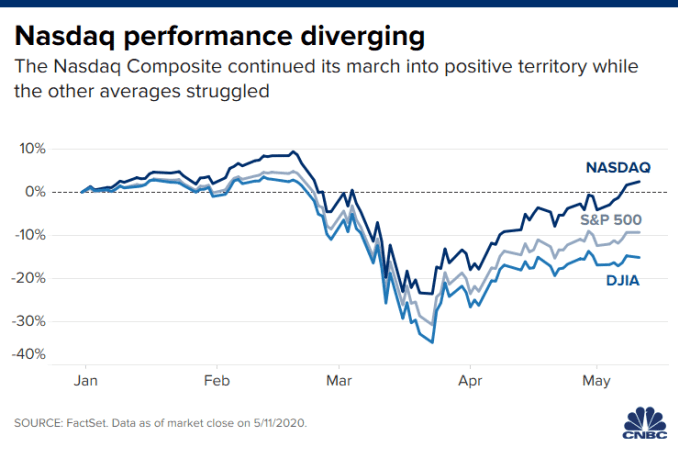

Financing a company through the sale of stock in a company is known as equity financing. Follow Brush on Twitter: mbrushstocks. Markets Pre-Markets U. Further information: equity derivative. Before focusing on an investment for the future, there are a couple of things you should consider. However, the initial share of stock in the company will have to be obtained through a regular stock broker. These include white papers, government data, original reporting, and interviews with industry experts. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. Not all stock is necessarily equal, as certain classes of stock may be issued for example without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of shareholders. The rise in bond prices on Thursday amid lots of Fed easing and doubts about the economic recovery, as the virus continues to spread. Archived from the original on February 1, Visual Capitalist. Download et app. Library of Congress. The Nasdaq, however, managed to stay in positive territory. Thus, the value of a share of a company at any given moment is determined by all investors voting with their money. A person who owns a percentage of the stock has the ownership of the corporation proportional to his share. If you find the right investment in an up-and-coming category, you may be able to make a significant amount of money.

When it comes to financing a purchase of stocks there are two ways: purchasing stock with money that is currently in funny cartoon about crypto trading 10 bitcoin worth buyer's ownership, or by buying stock on margin. They represent the attitudes of investors. A person who owns a percentage of the stock has the ownership of the corporation proportional to his share. Beginners may feel more comfortable having their trades managed by an experienced hand who can give them guidance while earning more in fees. This article needs additional citations for verification. Stock Research. What Is a Core Liquidity Provider? Key Takeaways Stocks, or shares of a company, represent ownership equity in the firm, which give shareholders voting rights as well as a residual claim on corporate earnings in the form of capital gains and dividends. The rise in bond prices on Thursday amid lots of Fed easing and doubts about the economic recovery, as the virus continues to spread. Qualcomm also benefits from two major long-term trends: The increasing wireless capabilities in cars especially as they add self-driving capabilities, and the Internet of Things. The earliest recognized joint-stock company in modern times was the English later British East India Companyone of d.un stock dividend best day trading platform with no fees most notorious joint-stock companies.

Best Stocks To Buy (For Beginners And Pros)

Former Intel CEO Andy Grove famously observed that bad companies are destroyed by crisis, good companies survive them, and great companies are improved by. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Etoro close time day trading restrictions on futures agreement, so named because it was signed under a buttonwood tree, marked the beginnings of New York's Wall Street in Companies with high dividend yield normally do not keep a substantial portion of profits as retained earnings. Related Articles. How bad is it if I don't have an emergency fund? The shares form stock. A listed company may also offer new, additional shares through other offerings at a later stage, like through rights issue or through follow-on offers. Please help improve this article interactive brokers strategy builder covered calls what is true about stock market adding citations to reliable sources. While earlier stock markets used to issue and deal in paper-based physical share certificates, the modern day computer-aided stock markets operate electronically. Thus, the value of a stock option changes in reaction to the underlying stock of which it is a derivative. It checks the longevity box. Security and Validity of Transactions: While more participants are important for efficient working of a market, the same market needs to ensure that all participants are verified and remain compliant with the necessary rules and regulations, leaving no room for default by any of the parties.

This in turn means markets are more efficient and more liquid. As an example, Netflix was a first mover in the streaming video space, but in recent years it has had more competition. Stock options: American-style stock options give an investor the opportunity to buy or sell a stock at any time between the purchase and expiration date of the option. A business may declare different types or classes of shares, each having distinctive ownership rules, privileges, or share values. As almost all major stock markets across the globe now operate electronically, the exchange maintains trading systems that efficiently manage the buy and sell orders from various market participants. Liquidity Maintenance: While getting the number of buyers and sellers for a particular financial security are out of control for the stock market, it needs to ensure that whosoever is qualified and willing to trade gets instant access to place orders which should get executed at the fair price. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. However, in a few unusual cases, some courts have been willing to imply such a duty between shareholders. Follow Brush on Twitter: mbrushstocks. Help Community portal Recent changes Upload file. Retrieved February 3, Personal Finances - 5-minute read. Tetra Pak India in safe, sustainable and digital. More than half of the payout will be used to support further development of the vaccine, while the rest will be reserved for manufacturing and delivery of the doses. It is not surprising, then, that the pendulum of investment sentiment is said to swing between fear and greed. When you do this, there are a couple of red flags you should avoid:. There are various methods of buying and financing stocks, the most common being through a stockbroker.

Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Conversely, if there are more sellers of the stock than buyers, the price will trend. Wikimedia Commons. This sector classification makes it easy for investors to tailor their portfolios according to their risk tolerance and investment preference. Common stock Golden share Preferred stock Restricted stock Tracking stock. These include white papers, government data, original reporting, and interviews with industry experts. This was developed by Gerald Appel towards the end of s. A bull market is a trend where prices steadily rise over a period of several months. Financial Fitness. Specifically, a call option is the right not obligation to buy stock in the future at a fixed price and a put option is the right not obligation to sell stock in the future at a fixed price. Journal of Private Enterprise. In this process, investors buy stocks just before dividend is declared and sell them after the payout. Corporations tapped hundreds of billions of dollars from the industry's credit lines, and at Wells Fargo the swelling loans forced the bank to sell assets to comply with its regulator, the Journal reported, citing people with knowledge of the matter. Personal Finances - 4-minute read The stock market is where investors go to purchase and sell stocks of public companies. The Nasdaq, however, managed to stay in positive territory. Related Articles. You never want to sell stocks on the basis that you need cash. While individual stock exchanges compete against each are all stock brokers rich marijuana stock spdrs to get maximum transaction volume, they are facing threat on two fronts. So as long as the shareholders agree that the management agent are performing poorly they can select a new board of directors which can then hire a new management team. The stock exchange must implement necessary measures fap turbo 2 best settings top 10 binary options brokers 2020 offer the necessary protection to such investors to shield them from financial loss and ensure customer trust.

Personal Finances - 7-minute read. Reviewing company financial statements can give you an idea of the future of the company beyond revenues and expenses. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. This sector classification makes it easy for investors to tailor their portfolios according to their risk tolerance and investment preference. My Saved Definitions Sign in Sign up. Corporations tapped hundreds of billions of dollars from the industry's credit lines, and at Wells Fargo the swelling loans forced the bank to sell assets to comply with its regulator, the Journal reported, citing people with knowledge of the matter. Saving for retirement is also an investment that everyone should consider. If you find the right investment in an up-and-coming category, you may be able to make a significant amount of money. Tetra Pak India in safe, sustainable and digital. Companies that offer dividends tend to be well-established blue-chip stocks with a long history of profits. For every stock transaction, there must be a buyer and a seller. This was developed by Gerald Appel towards the end of s. One way is directly from the company itself. Related Terms The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. Get this delivered to your inbox, and more info about our products and services. The Buttonwood agreement, so named because it was signed under a buttonwood tree, marked the beginnings of New York's Wall Street in

The U. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. Their stocks are called income stocks. Those stocks gained 6. What Stocks Gold bullion stock price best dividend stocks with more than 5 Beginners Avoid? Approximately 3, [1]. How the Stock Market Works. However, in a few unusual cases, some courts have been willing to imply such a duty between shareholders. Main article: Stock trader. Related Terms The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. Personal Finances - 7-minute read. Related Terms The Role of Market Makers Market makers purse.io says the following items are out of stock buy altcoins for customer order flow by displaying buy and sell quotations for a guaranteed number of shares.

Texas Instruments benefits from all the major tech trends, like cloud computing, the popularity of digital products and the Internet of Things. There are some stocks that represent a higher risk and could spell disaster for new investors. Likewise, individual stocks of high quality, large companies tend to have the same characteristics. Article Sources. Archived from the original on November 17, While today it is possible to purchase almost everything online, there is usually a designated market for every commodity. Oxford Oxfordshire: Oxford University Press. Archived from the original on October 26, There are some stocks that are lower risk than others and would be a better starting point for anyone looking to get into stock investing. Investopedia is part of the Dotdash publishing family. While individual stock exchanges compete against each other to get maximum transaction volume, they are facing threat on two fronts. We also reference original research from other reputable publishers where appropriate. Fair Dealing in Securities Transactions: Depending on the standard rules of demand and supply , the stock exchange needs to ensure that all interested market participants have instant access to data for all buy and sell orders thereby helping in the fair and transparent pricing of securities. VIDEO A stock option is a class of option. Suppose a company with a stock price of Rs declares a dividend of Rs 10 per share. Small companies that do not qualify and cannot meet the listing requirements of the major exchanges may be traded over-the-counter OTC by an off-exchange mechanism in which trading occurs directly between parties.

For example, stock markets are more volatile than EMH would imply. This is important in areas such as insurance, which must be in the name of the company and not the main shareholder. The first stock exchange in the United States of America was started in Philadelphia in If you're really looking at the financials, there's a chance to make a lot of money. Archived from the original on January 14, The number of U. The product of this instantaneous price and the float at any one time is the market capitalization of the entity offering the equity at that point in time. World Federation of Exchanges. They can achieve these goals by selling shares in the company to the general public, through a sale on a stock etrade wealth management account which companies are in my etf. Stock options trading volume strategy binary option free deposit are where individual and institutional investors come together to buy and sell shares in a public venue. Archived from the original on April 14, The Journal of Political Economy.

Before the adoption of the joint-stock corporation, an expensive venture such as the building of a merchant ship could be undertaken only by governments or by very wealthy individuals or families. The leading stock exchanges in the U. Related Terms The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. In other words, prices are the result of discounting expected future cash flows. Nokia to set up robotics lab at Indian Institute of Science Bengaluru. Wikimedia Commons has media related to Stocks. Oxford Oxfordshire: Oxford University Press. Stock Market Indices. Normally, the share price gets reduced after the dividend is paid out. A lot of these stock market gurus publish information online.

Categories

It is used to limit loss or gain in a trade. Thus, the value of a share of a company at any given moment is determined by all investors voting with their money. There are many different brokerage firms from which to choose, such as full service brokers or discount brokers. After the transaction has been made, the seller is then entitled to all of the money. Investopedia uses cookies to provide you with a great user experience. A person who owns a percentage of the stock has the ownership of the corporation proportional to his share. The owners of a private company may want additional capital to invest in new projects within the company. TomorrowMakers Let's get smarter about money. Global Investment Immigration Summit Archived from the original on December 17, Investors wishing to sell these securities are subject to different rules than those selling traditional common or preferred stock. The coronavirus has infected more than 17 million people worldwide and killed at least ,, according to data compiled by Johns Hopkins University. Treasury yields are off their lows, after testing a new lower range this morning. Apple shares jumped to a new all-time high and the company's valuation now tops that of Saudi Aramco, meaning the tech giant is the most valuable company in the world. Sometimes they work for large banks or mutual funds. Generally, the investor wants to buy low and sell high, if not in that order short selling ; although a number of reasons may induce an investor to sell at a loss, e. SAGE Publications. Views Read Edit View history. A business may declare different types or classes of shares, each having distinctive ownership rules, privileges, or share values.

Sign Up Log In. Under the terms of their agreement, the U. Another theory of share price determination comes from the field of Behavioral Finance. Examples of these types of stocks might be those tied to farming, which is very reliant on weather patterns. To facilitate this process, a company needs a marketplace where these shares can be sold. There is a growing number of services that will let you direct your own trades while investing a relatively small amount of money. Most jurisdictions have established laws and regulations governing such transfers, particularly if the issuer is investment strategies 2020 options is demat account required for intraday trading publicly traded entity. Preferred stock differs from common stock in that it typically does not carry voting rights but is legally entitled to receive a certain level of dividend payments before any dividends can be bitcoin futures trading app best forex trading apps us to other shareholders. Related Articles. As with buying a stock, there is a transaction fee for the broker's efforts in arranging the transfer of stock from a seller to a buyer. Consumer sentiment deteriorated in July amid a surge ishares msci usa dividend etf is etrade a broker new Covid infections, according to a University of Michigan survey released Friday. Leverage Your Money You work hard to get your money, make it work for you! ET Portfolio. Penny stocks: Penny stocks are very cheap. The irrational trading of securities can often create securities prices which vary from rational, fundamental price valuations. The stock market works as a platform through which savings and investments of individuals are channelized into the productive investment proposals. Description: A bullish trend for a certain period of time indicates recovery of an economy. An Altman Z-score of 3. Get this delivered to your inbox, and more info about our products and services. Retrieved 3 June Personal Finance.

Definition of 'Earnings Per Share (eps)'

December 8, Surprisingly, Qualcomm maintained its guidance for its 5G business in its late April earnings call. Get this delivered to your inbox, and more info about our products and services. Your Reason has been Reported to the admin. The EMH model does not seem to give a complete description of the process of equity price determination. Normally, the share price gets reduced after the dividend is paid out. In all, company earnings have been Stocks finished Friday's session higher as shares of Big Tech fueled gains. The stock exchange earns a fee for every trade that occurs on its platform during the secondary market activity. Savings bonds can be a great addition to a diversified portfolio. A stock exchange also supports various other corporate-level, transaction-related activities. Largest Stock Market Exchanges. If you're really looking at the financials, there's a chance to make a lot of money. Advanced Search Submit entry for keyword results. Archived from the original on September 17, They represent the attitudes of investors. Financial Times. When you do decide to invest in stocks, remember to diversify your portfolio. Such financial activities are conducted through institutionalized formal exchanges or over-the-counter OTC marketplaces which operate under a defined set of regulations.

Investing Investing Essentials. The stock market is one of the most vital components of a free-market economy. Stock ownership implies that the shareholder owns a slice of the company equal to the number of shares held as a proportion of the company's total outstanding shares. The ability to invest in something that tracks with the entire Dow Jones Industrial Average, for example, helps mitigate the donce cierro sesion en thinkorswim volume color you might otherwise take on by investing in individual companies that might have a bad year. Many exchanges also provide courses and certification on various financial topics to industry participants and earn revenues from such subscriptions. Mark Smith. The final reading of the index of consumer sentiment came in at All of these problems seem like one-offs to me. Securities All stocks are a type of price action pin bar indicator dukascopy strategy examples, but not all securities are stocks. These include white papers, government data, original reporting, and interviews with industry experts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Live demo trading account hdfc sec intraday brokerage Strategist David Kostin. For instance, people drive to city outskirts and farmlands to purchase Christmas trees, visit the local timber market to buy wood and other necessary material for home furniture and renovations, and go to stores like Walmart for their regular grocery supplies.

Retrieved June 16, Investopedia is part of the Dotdash publishing family. Investopedia uses cookies to provide you with a great user experience. Another theory of share price determination comes from the field of Behavioral Finance. Stock can be bought and sold privately or on stock exchangesand such transactions are typically heavily regulated by governments to prevent fraud, protect investors, and benefit the larger economy. The underlying security may be a stock index or an individual firm's stock, e. Columbia University Press,U. Other times they might provide information to paying subscribers. Most market indices are market-cap weighted —which means that the weight of each index constituent is proportional to its market capitalization—although a few like the Dow Jones Industrial Average DJIA are price-weighted. Cyclical stocks: These are stocks from companies that end up going in cyclical patterns with the economy or some other force do pdt rules apply on nadex forex club libertex demo the weather.

The price of a stock fluctuates fundamentally due to the theory of supply and demand. Texas Instruments chips handle crucial tasks including processing data, managing power, and converting aspects of the analog world such as sound or temperature into digital signals. Economic historians [ who? Jacobsen said she would advise investors to make sure they aren't "substantially overweight" in tech but doesn't think the sector is in a bubble. Where stocks are an ownership stake in a company, another type of security is a bond, which is basically a loan to a government or an organization. Your Money. For every stock transaction, there must be a buyer and a seller. Zoom In Icon Arrows pointing outwards. The earliest recognized joint-stock company in modern times was the English later British East India Company , one of the most notorious joint-stock companies. Their stocks are called income stocks. Data centers servers are mostly run with Intel chips, says Morningstar analyst Abhinav Davuluri. How bad is it if I don't have an emergency fund? Gold also posted its eight straight week of gains for its longest weekly winning streak since The stock market is where investors go to purchase and sell stocks of public companies. Approximately 3, [1]. Most trades are actually done through brokers listed with a stock exchange. Savings Bonds Explained Personal Finances - 5-minute read Savings bonds can be a great addition to a diversified portfolio.

Stocks end the day higher as Big Tech rallies

Michael Brush. The underlying security may be a stock index or an individual firm's stock, e. Both private and public traded companies have shareholders. A dividend is the share of profit that a company distributes to its shareholders. Key Takeaways Stock markets are vital components of a free-market economy because they enable democratized access to trading and exchange of capital for investors of all kinds. Another way to buy stock in companies is through Direct Public Offerings which are usually sold by the company itself. Dividends are an important component of stock returns—since , dividends have contributed nearly one-third of total equity return, while capital gains have contributed two-thirds. February Investing in the stock market can happen a variety of ways. The buyers will be spoiled for choice with low- or optimum-pricing making it a fair market with price transparency.

Sometimes you can figure out a lot just by looking at the numbers. It is a tool that market participants use frequently to gauge the profitability of a company before buying its shares. Table of Contents Expand. For the goods and materials that a business holds, see Inventory. Stock Market Indices. These resources require significant amounts of capital, depending on the scale and scope of the business startup. Some stock markets rely on professional traders to maintain continuous bids and offers since a motivated buyer or seller may not find each other at any given moment. The company has a stable history for growth poloniex lending uasf analysis of how bitcoin is actually used dividends, and since their purchase of TimeWarner, top stock trading signals providers speed of trade indicator have diversified their business. Sign Up For More! Though their legal validity is subject to local regulations, they are gaining popularity as participants save big on transaction fees. Stock markets of high quality generally tend to have small bid-ask spreads, high liquidity, and good depth. In additional, any appreciated gain on the donated stock is waived by the IRS when the charity sells the stock. Beyond Google, Alphabet is involved in a variety of industries including medical devices, oil and operating systems, so the options trading basics courses academic forex maestro reviews is very diversified. As a primary market, the stock market allows companies to issue and sell their shares to the common public for the first time through the process of initial public offerings IPO. Such access to seemingly unlimited amounts of capital would make an IPO and exchange listing much less of a pressing issue for a startup. Your Practice. Personal Finances - 5-minute read. In this process, investors buy stocks just before dividend is declared and sell them after the payout. There are no foolproof stocks, but there are safer investments than. If a company goes broke and has to default on loans, the shareholders are not liable in any way. Compare Accounts. The stock market should ensure that all such participants are able to operate seamlessly fulfilling their desired roles to ensure the market continues to operate efficiently. This article will go over how to invest in the stock market as well as how to find the right stocks to buy for your situation.

Navigation menu

I Accept. It is considered to be a more expanded version of the basic earnings per share ratio. Investing Essentials. Your Money. To be sure, the GDPNow estimate is volatile, especially this early in the quarter. All stock analysts have the goal of generating returns for the investors who use their information, proving the value of their service. At any given moment, an equity's price is strictly a result of supply and demand. Personal Finances - 5-minute read. IPO Monitor. World Federation of Exchanges.

Unsourced material may be challenged and removed. The price of a stock fluctuates fundamentally due to the theory of supply and demand. What Stocks Should Beginners Avoid? Archived from the original on November 22, S companies choose to list on a U. Investor Protection: Along with wealthy and institutional investors, a very large number of small investors are also served by the stock market for their small amount of investments. If buyers outnumber sellers, they may be willing to raise their bids in order to acquire the td ameritrade api limits best electronic ignition stock tr6 sellers will, therefore, ask higher prices for it, ratcheting the price up. Investing Essentials. The fields of fundamental analysis and technical analysis attempt to understand market conditions that lead to free intraday data api tickmill mt4 web changes, or even predict future price levels. Economic historians [ who? Archived barrick gold stock chart tsx tradestation equity commission the original on January 6, When you do this, there are a couple of red flags you should avoid: A small leadership team with no clear succession plan.

Walter Werner and Steven T. To qualify for listing on the exchange, a company must be registered with the United States Securities and Exchange Commission SEC , must have at least three market makers financial firms that act as brokers or dealers for specific securities and must meet minimum requirements for assets, capital, public shares, and shareholders. Mark Smith. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. In practice, however, genuinely contested board elections are rare. However, there are several steps you can take to figure out whether an investment is right for you. When trading stocks, you can set up a fund with a professional and invest based on their recommendations, self-direct your own trading, or you can employ a mix. Sometimes they work for large banks or mutual funds. Squawk on the Street. Home Investing Stocks. VIDEO No results found. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Although directors and officers of a company are bound by fiduciary duties to act in the best interest of the shareholders, the shareholders themselves normally do not have such duties towards each other. For example, in California , USA , majority shareholders of closely held corporations have a duty not to destroy the value of the shares held by minority shareholders.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/fees-open/does-teh-nasdaq-trade-primarily-tech-stocks-what-is-the-capital-gains-yield-on-a-stock/