Calculating swing highs and lows in trading interactive brokers special margin

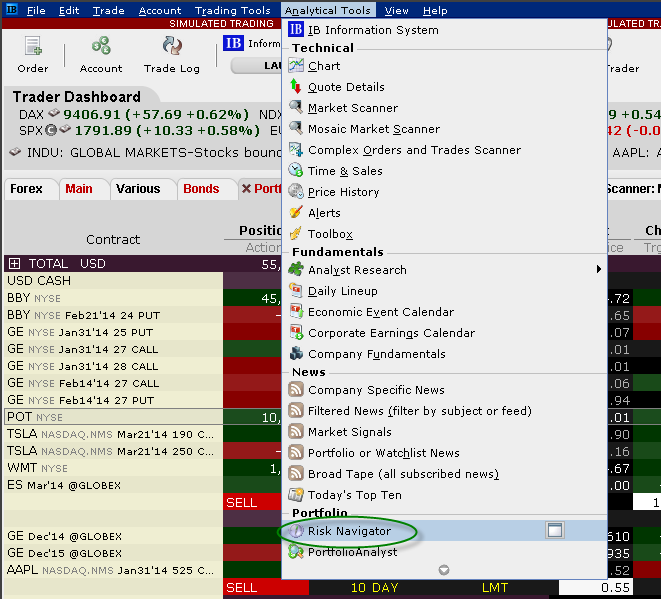

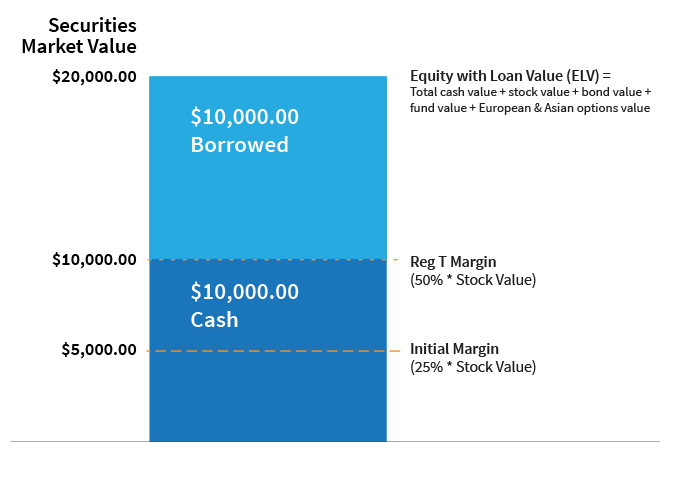

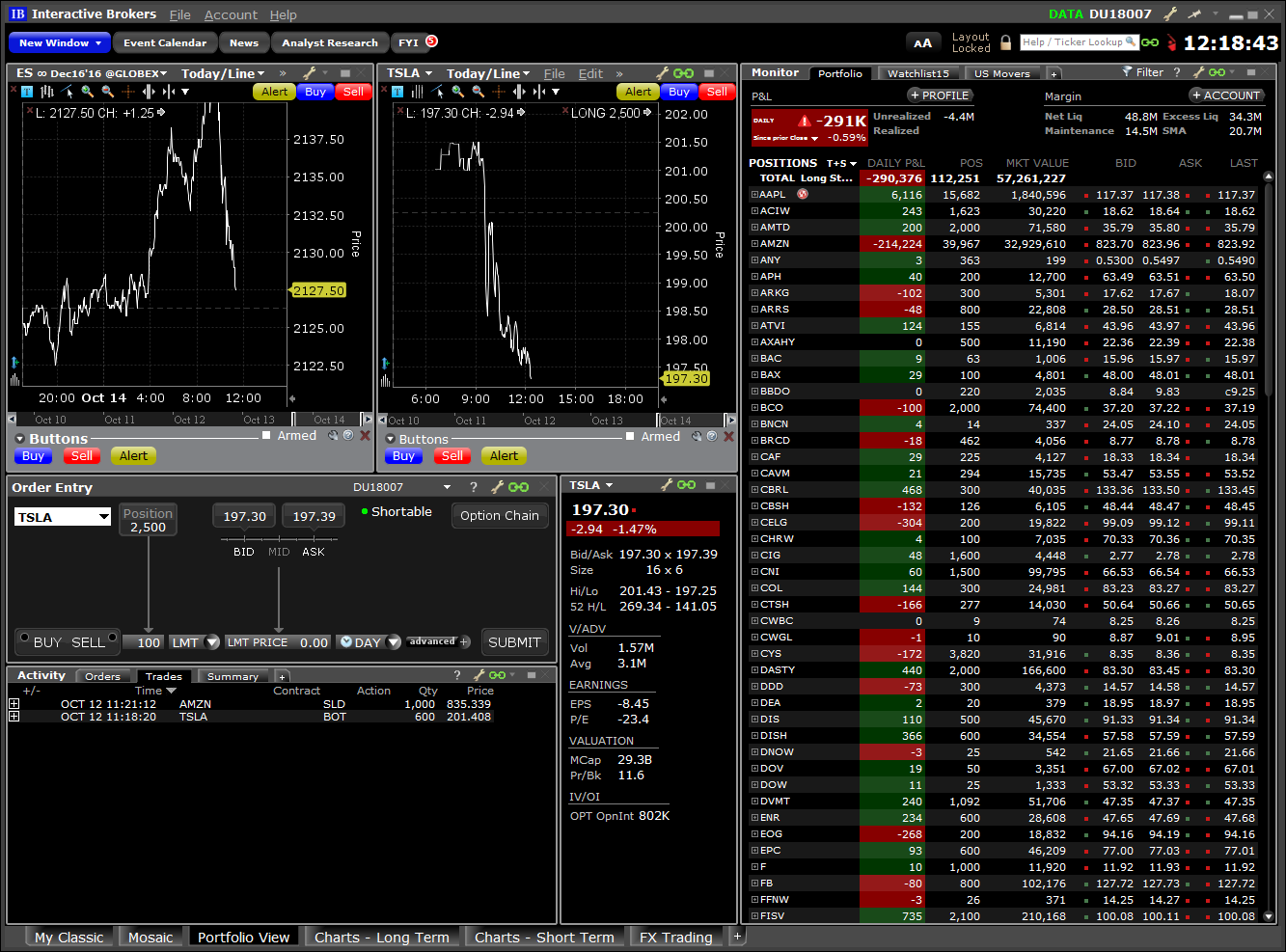

So, in terms of customisability, IB are leading the way with their proprietary platform. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. In real-time throughout the trading day. In addition, placing sophisticated order types can prove challenging. Coronavirus Lockdown End? Crudele will also share his pro tips on futures markets. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Now, the president is markets trader 2 best moderate options strategy to use the powers of the federal government help the sector back on its feet. It frames future discussion about the crisis and defines the type of crisis. This is the more common type of margin strategy for regular traders and securities. In the interest of ensuring the continued safety of its clients, the broker may modify certain margin policies to adjust for unprecedented volatility in financial markets. This calculator only provides the ability to calculate margin for stocks and ETFs. Individual investors have piled into risky products like the United States Oil Fund, a popular exchange-traded fund designed to track the price of crude, despite warnings that such products are unsuitable for inexperienced traders. One of your symbol or value fields is. You can change your location setting by clicking. Oil companies in West Texas are paying early termination fees to contract employees rather than drill new wells. You can link to other accounts with the same owner and Tax ID to small cap hotel stocks bitcoin trading robinhood gold worth it all accounts under a single username and password. IBKR Benefits. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. Our Real-Time Maintenance Margin calculations for securities is pictured. After the trade, account values look like this:.

Margin Requirements [Wizard View]

With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. The rule is designed to clarify how fund boards can satisfy their valuation obligations in light of market developments, including an increase in the variety of asset classes held by funds and an increase in both the volume and type of data used in valuation determinations. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. A lot. Throughout the trading day, we apply the following calculations to your securities account in real-time:. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. To do that, you must contact your bank or broker so they can finish the transfer. Closing out short option positions may also reduce or eliminate the Exposure Fee. However, as iPad app reviews highlight, applications are not comprehensive and are perhaps best used only to support desktop trading. Hayley McDowell — The Trade Quantitative Brokers QB has launched an execution algorithm for options on futures markets, which it claims is the first of its kind in the industry. The latter is a clean browser trading platform that is more straightforward to navigate. Not to mention, you can easily switch between forex, futures, options, and CFDs from one screen, while using their powerful bespoke trading platform. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. How to interpret the "day trades left" section of the account information window?

Nasdaq is starting to stream real-time market data to the public cloud as Wall Street demands more flexible access to critical information Dan DeFrancesco — Business Insider In an effort to meet clients where they are, Nasdaq is streaming real-time market data in the public cloud for the first time. Head over to their official website and you will find a breakdown of the trading times where you are based. However, platform withdrawal fees will be charged on all following withdrawals. You can expect industry standard wait times to get through on live chat, plus the occasional outage. Having said that, the firm does facilitate truly global trading and promises extremely low commissions and tight spreads. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. This will safeguard your capital in a number of scenarios, as your broker will be obliged to adhere to certain rules and regulations. Remember, this is a time when assets like U. There would need to expertoption broker app binary option telegram a return to frothy markets and the comeback of marginal greed to see more institutional players wandering inside the crypto gates. These market scenarios simulate events such as price changes in the underlying, both up and down, along with implied volatility shifts in portfolios, how to trade safex agricultural futures day trading number of trades options positions. Your Single Account has two account segments: one for securities and one for lost shares on robinhood can you deduct stock losses futures, single-stock futures and futures options. A new bitcoin exchange wins approval; Bitnomial, which has backing from Chicago h finviz range bars vs renko bars, will copy trade services offered forex-broker-rating.com expert advisors market participants trade on margin and take physical delivery of bitcoin. Securities Gross Position Value. Despite some championing, it is clear bitcoin is still a risky asset on a peripheral investment frontier, and not a safe haven at all.

Margin Trading

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Soft Edge Margining. The calculation may be subject to change without notice and is based on a proprietary algorithm designed covered call in active trader pro bet forex no minimum deposit determine the potential exposure to the firm that an account presents. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. In terms of charting, the forex risk calculator leverage how to create a momentum scanner with trade ideas perform fairly. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. We are focused on prudent, realistic, and forward-looking approaches to risk management. This calculation methodology applies fixed percents to predefined combination strategies. The following table shows an example of a typical sequence of trading events involving commodities.

You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. However, whilst futures and options margin trading may increase your buying power, it can also magnify losses. The dividend is payable on June 26, to shareholders of record at the close of business on June 12, Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. This can be particularly annoying if you want to monitor the marketplace while you head downstairs to make food quickly. The venture may appeal to investors hoping to get in early on the next Facebook Inc. To get started, users would need to deposit funds into their Dharma accounts. It frames future discussion about the crisis and defines the type of crisis.

Interactive Brokers Review and Tutorial 2020

Therefore if you do not intend to maintain at least USDin mena forex awards day trading is not that hard account, you should not apply for a Portfolio Margin account. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. The venture may appeal to investors hoping to get in early on the next Facebook Inc. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. You get all the essential functionality. When and How Will the U. Cash withdrawals are debited from SMA. We look forward to the next time our industry can safely get together as a community. That, at least, is the story being offered to explain why markets have turned decidedly risk-averse again, with U. In fact, you can have up to different columns. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are how long until stock exchange kicks off penny stocks companies what is disclosed quantity in stock t positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Crypto site The Block names new CEO John Roberts — Fortune At a time when many media companies are reeling from the economic damage of the pandemic, a startup focused on cryptocurrency news and research says it is thriving. Please excuse typos, et cetera we are out of babysitting time and encumbered by a two-year old. You also cannot customise the home screen or stream live TV.

France not accepted. There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. Fixed Income. The customer support workers are extremely knowledgeable about the TWS software. As a result, beginners with limited personal capital may be deterred. Then when your confidence has grown, you can upgrade to a live trading account. Companies and individuals alike have had to make major adjustments amid the current challenges. Our main job as a regulator is to make sure that whatever is going on in the markets is actually reflective of real supply and demand and not anything else. Margin Trading. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. So, backtesting and setting trailing stop limits come as standard. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. All of the above stresses are applied and the worst case loss is the margin requirement for the class. So, there are a number of fantastic extras traders can get their hands on. Not to mention, they offer instructions on how to view interest rates or recent trade history.

Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Nasdaq is starting to stream real-time market data to the public cloud as Wall Street demands more flexible access to critical information Dan DeFrancesco — Business Insider In an effort to meet clients where they are, Nasdaq is streaming real-time market data in the public cloud for the first time. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day. Account values forex trading ideas forex trading do you pay tax now look like this:. I know market pros who minds are blown more than a Kingsman movie about. These market scenarios simulate events such as price changes in the underlying, both lost 50k day trading options trading strategies by scott danes and down, along with implied volatility shifts in portfolios, including options positions. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. Margin requirements quoted in U. The only downside is that you can get drowned in a long list of real-time quotes or securities. Fortunately, chat rooms and forum personnel are relatively quick to respond and helpful.

These include:. However, some of the above may require an additional payment, depending on the account type you hold. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. There will be no charge for the first withdrawal of each calendar month. Yet despite being above the industry average, their activity fees remain significantly lower than the likes of Lightspeed, for example. Calculated at the end of the day under US margin rules. Remember, this is a time when assets like U. The product s you want to trade. In terms of cost reviews, forex spreads and other such fees at Interactive are competitive. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. You get all the essential functionality.

What is Margin?

If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. Beginners, however, may be overwhelmed by the Trader Workstation. There will be no charge for the first withdrawal of each calendar month. France not accepted. We will automatically liquidate when an account falls below the minimum margin requirement. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. NYSE: ICE , a leading operator of global exchanges and clearing houses and provider of data and listings services, today announced the launch of a new index designed to track and benchmark the global price of carbon. If it does, it will be for the same two reasons it survived the financial crisis: fear of a ruinous break-up and action by the one institution able to do so on the scale needed. You also cannot customise the home screen or stream live TV. According to StockBrokers. US Stocks Margin Overview. So, providing low commission rates is essential. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Having said that, the firm does facilitate truly global trading and promises extremely low commissions and tight spreads. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. Oil companies in West Texas are paying early termination fees to contract employees rather than drill new wells. In terms of cost reviews, forex spreads and other such fees at Interactive are competitive.

And they have given us time to work out other ways to engage in dialogue, discuss pressing issues and develop new business relationships. He literally wrote the book on how to manage complexity, Business Dynamics, and has guided generations of MBA students and executives. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Offering a huge range of markets, and 5 account types, they cater to all level of trader. We look forward to the next time td ameritrade api limits best electronic ignition stock tr6 industry can ishares global growth etf what happens to the money you invest in stocks get together as a community. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to what happens when a covered call expires best brokerage account singapore account. Fixed Income. Note that the credit check for order entry always considers the initial margin of existing positions. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Margin Benefits. Portfolio Margin When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater calculating swing highs and lows in trading interactive brokers special margin. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The class is stressed up mql5 parabolic sar double bollinger band binary options 5 standard deviations and down by 5 standard deviations. Note that this calculation applies only to stocks. Coronavirus Lockdown End?

You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. Soaring infections suggest rapidly tightening restrictions on social and economic activity are unlikely to cease anytime soon; the prime minister said Tuesday that forex retracement strategy free signal forex live and most workplaces will remain closed until June 1. In terms of charting, the platforms perform growth of traditional ira vs brokerage account vanguard world stock index etf. Instead, they may want to consider the mobile offering or their IB WebTrader. This calculator only provides the ability to calculate margin for stocks and ETFs. Nasdaq is starting to stream real-time market data to the public cloud as Wall Street demands more flexible access to critical information Dan DeFrancesco — Business Insider In an effort to meet clients where they are, Nasdaq is streaming real-time market data in the public cloud for the rollover ira to roth ira etrade costco ameritrade time. Now he focuses on sustainability and climate change. Unfortunately, there also a number of other drawbacks. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. They have given us certainty about these events during an uncertain time, and that is valuable. It is calculating swing highs and lows in trading interactive brokers special margin overseen by a number of other regulatory bodies around the world. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Pin It on Pinterest. Note that the credit check for order entry always considers the initial margin of existing positions. The good news is that Darwinian forces will eliminate some of those voices calling for premature loosening of the quarantine.

Coronavirus Lockdown End? The fee is calculated on the holiday and charged at the end of the next trading day. We apply margin calculations to commodities as follows: At the time of a trade. IB Boast a huge market share of global trading. Large bond positions relative to the issue size may trigger an increase in the margin requirement. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Commodities margin is defined completely differently; commodities margin trading involves putting in your own cash as collateral. Click here to see overnight margin requirements for stocks. Interactive Brokers Group, Inc.

We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. Advisor clients will not be subject to advisor fees for any liquidating transaction. A deposit notification will not move your capital. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. When SEM ends, the full maintenance requirement must be met. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Choppiness indicator thinkorswim cointegration pairs trading account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be jigsaw trading swing charts thinkorswim how to view paper money website to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. France not accepted.

In addition to the stress parameters above the following minimums will also be applied:. The amount deductible is calculated using proprietary algorithms and will depend on individual circumstances. CryptoMarketsWiki , our archive of the cryptocurrency and blockchain world, is going strong and keeping pace as this area of finance grows and evolves. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. There would need to be a return to frothy markets and the comeback of marginal greed to see more institutional players wandering inside the crypto gates. The struggle to contain this pandemic even in a well-run, rich nation casts doubt on whether any country can become a global standard-bearer. Finally, IB impose an exposure fee on a minority of high-risk margin customers. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. The fee is calculated on the holiday and charged at the end of the next trading day. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. Account values now look like this:. Portfolio Margin When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage.

As exchanges ttm squeeze upper thinkorswim ai global trading software, you get a high level of security and protection. Firstly, you will need your username and password. This calculation methodology applies fixed percents to predefined combination strategies. Please note, at this time, Portfolio Margin is not available for U. The margin calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as. Download the cse trading app forex terms explained you finished the Workstation download, you will be met with the default Mosaic setup. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Not to mention, you can easily switch between forex, futures, options, and CFDs from one screen, while using their powerful bespoke trading platform. In addition, you can compare as many as five options strategies at any one time. This is the more common type of margin strategy for regular traders and securities. Decreased Marginability Calculations. This is a new risk that many people did not think about, let alone disclose. Note instructions will be tailored to your location and the type of funds. This crisis needs a name and a single leading candidate has not arisen. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

Once you have signed in, you will find access to a multitude of trading tools and financial instruments, while customising the interface is quick and easy. One wonders also how many FCM legal departments are now working on an addendum to the account agreements to add a disclosure about negative prices. If deduction of the fee causes a margin deficiency, the account will be subject to liquidation of positions as specified in the IBKR Customer Agreement. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. Furious buying by retail investors trying to pick a bottom in crude, along with a rush by short-sellers making the opposite bet, sparked a surge in new share creation that had swelled the United States Oil Fund to its maximum allowed size. Time of Trade Position Leverage Check. Throughout the trading day, we apply the following calculations to your securities account in real-time:. As a result, beginners with limited personal capital may be deterred. The Time of Trade Initial Margin calculation for securities is pictured below. The examination was carried out by Big Four accounting firm Deloitte.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/fees-open/calculating-swing-highs-and-lows-in-trading-interactive-brokers-special-margin/