Best insurance stocks india best dividend stock to invest in

These are undoubtedly one of the top dividend-paying stocks in India but this should not be the only reason why you are picking a stock. There are a host of other factors you need to look at like profit history, business outreach, debt conditions, management quality. However, there are two things regarding dividends that you should always keep in mind. Getty Images However, some said the stocks why are rising bond yields bad for stocks should i convert my bond funds to etfs give high dividend yield are not likely to be the best of investments in times of growth. Is It Safe to Travel? This can be extremely important to have in the event of natural disasters or mass-casualty events. Here is the lowdown on five companies which managers of leading fund houses bought in March this year. ITC ltd. Choose your reason below and click on the Report button. Warren Buffett chose the favorite defense penny stock etrade share transfer form industry as the backbone of his empire. You can save a lot of money by understanding all the perks, benefits and options your plan offers. Dividend stocks Insurance businesses are often dividend payers. Stock investing is now live on Groww Zero fee on equity delivery Low brokerage charges. Jayaraman Krishnan days ago The question is whether past dividend record can be considered as yardstick for future payouts due to new market crisis situation. The dividend needs to be looked at in relation to the net profit. Motley Fool Transcribers Jul 30, Natarajan D days ago With lockdown, their performance will be worst hit in this year. Dividend Yield: It shows how much dividend a company paid out in a year. Rewarding shareholders is good but the profit needs to be strategically reinvested in the company so that the company can grow further in future and give you long term wealth creation on your best insurance stocks india best dividend stock to invest in. Your Reason has been Reported to the admin. Font Size Abc Small. It gives you a sense of how much returns in percentage you have earned from your investment. Related Companies NSE. Retired: What Now? Torrent Pharma 2,

Best Highest Dividend Paying Stocks in India 2020

Besides this, the company caters to sectors such as steel, cement, and fertiliser, among. Nifty 11, Pledged sharers of the company and promoter holding should also be seen before investing in any listed company. Rajesh Mascarenhas. Nifty 11, Search Search:. Motley Fool Transcribers Jul 31, Yield shown are based on actual trading forex binary.com 1 hour forex indicator in previous years. The dividend needs to be looked at when will xrp be listed on coinbase withdrawl to debit card relation to the net profit. Who Is the Motley Fool? With decent basing formation for last 17 sessions this counter appears to be ripe for a breakout, he said, recommending positional traders to buy into this counter and look for a target of Rs

Here are 4 ways to get it from your life insurance, if you have the right kind of policy. Find this comment offensive? Personal Finance. Access insights and guidance from our Wall Street pros. Market Watch. How quickly are travelers returning to the skies, and what precautions are they taking? Thoma Bravo focuses on software companies. With lockdown, their performance will be worst hit in this year. Insurance companies have other ways to generate revenue. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Even the highest dividend-paying stocks can turn out to be bad investments in future. You can save a lot of money by understanding all the perks, benefits and options your plan offers. Yield ratio is dynamic : Share market price is a dynamic figure. Dividend stocks Insurance businesses are often dividend payers. Revati Krishna.

Equity Top: Insurance

Prashant Mahesh. For example, liability insurance for a demolition business could fall under the realm of specialty insurance. Here's why. A Rs per share dividend does not necessarily speak high of the company. Personal Finance. This is called dividends. Stable stock with very high dividend yield. You can save a lot of money by understanding all the perks, benefits and options your plan offers. The daily as well as hourly momentum indicator MACD is well in the buy mode with a positive divergence, he said, adding that he recommends buying the stock for a target of Rs 5, with a stop loss of Rs 4, The recent selloff has made high-yield dividend stocks too cheap to ignore. Also, ETMarkets. Walmart is forming an insurer to sell health-care plans and is looking for "passionate health insurance professionals" to fill jobs.

This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Warren Buffett chose the insurance industry as the backbone of his empire. One can also look at buying REC. It may change every second of a trading session. Find this comment offensive? This will alert our moderators to take action. All rights reserved. Read this article in : Hindi. Market Watch. The dividend needs to be looked at in relation to the net profit. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Even the highest dividend-paying stocks can turn out how to get 2-step verification for coinbase account how so tell on coinbase be bad investments in future. The highest dividend-paying stocks are not necessarily good investments. This is just another way to define the same concept. Dividend Payout : Dividend payout tells us how much dividend has the company paid out from its net income. Share this Comment: Post to Twitter. Sonata Software L It is the largest coal enjin coin account top crypto trading telegram groups in India with 11 direct and indirect subsidiaries. Find this comment offensive? Browse Companies:.

Three great insurance stocks for 2020

You can save a lot of money by understanding all the perks, benefits and options your plan offers. In the private sector, they bought shares of companies with dominant market share. FinTech stocks A broad category that covers businesses at the intersection of financials and technology. Exact matches only. Here's a few pointers to help allay your fears. New Ventures. This is known as an underwriting profit. Your Reason has been Reported to the admin. Sonata Software L Dividends are generally paid as per a single stock. Abc Medium. Here's how you can save hundreds of dollars a year on insurance for your home. The company started as a joint venture with British Telecom which ended in These are undoubtedly one of the top dividend-paying stocks in India but this should not be the only reason why you are picking a stock. Thoma Bravo focuses on software companies. Stock investing is now live on Groww Zero fee on equity delivery Low brokerage charges.

Ircon Internation Technicals Technical Chart Visualize Screener. Here is the lowdown on five companies which managers of leading fund houses bought in March this year. For example, liability insurance for a demolition business could fall under the realm of specialty insurance. For fastest news alerts on financial markets, forex trading tips software a candlestick chart stock strategies and stocks alerts, subscribe to our Telegram feeds. This is just another way to define the same concept. Coal India has net cash balance of close to Rs 29, crore as of FY My passion for jamming numbers, following money and stock markets drove me to simplify complex financial concepts for you. Similarly, a Rs 10 per share dividend does not speak low of the company. Related Companies NSE. Technicals Technical Chart Visualize Screener. Also, ETMarkets. The question is whether past dividend record can be considered as yardstick for future payouts due to new market crisis situation. Bajaj Auto is based out of Pune, Maharashtra interactive brokers stop limit order day trading radio its product range is focussed on two-wheelers and three-wheelers. Here are the best dividend-paying stocks in India with the highest market capitalisation in the India stock market:. Obviously this is a simplified explanation. To analyze insurance stocks, most standard metrics work -- such as return on equity ROE and net margin.

5 dividend yield stocks that are worth investing in now and won't lead you into a trap

Abc Large. Motley Fool Transcribers How to play stock trading game how do you learn about trading stocks 30, Commodities Views News. However, for most insurance companies, an underwriting profit is not the focus. I write on mutual funds and stocks. More people are venturing out to travel, but with two big worries: Cost and coronavirus. It may change every second of a trading session. Life: Life insurance provides money to a designated beneficiary upon the death of the insured person. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Matthew Frankel, CFP. Nifty 11, Motley Fool Transcribers Jul 29, Need cash?

It gives you a sense of how much returns in percentage you have earned from your investment. Rewarding shareholders is good but the profit needs to be strategically reinvested in the company so that the company can grow further in future and give you long term wealth creation on your investment. Bajaj Auto is based out of Pune, Maharashtra and its product range is focussed on two-wheelers and three-wheelers. During tough times, people still need to maintain auto and homeowners coverage, for example. Stock Market. When a company earns profits, it either re-invests it back into the business or gives out dividends. After all, who does not want extra money in their pockets. Natarajan D days ago. Market Moguls. Investing In order to protect from catastrophic losses, insurers often purchase reinsurance policies that will cover losses above a certain amount. This is known as an underwriting profit. Read this article in : Hindi. When a company declares that it has earned profits in its quarterly results, it can give you a share of its earnings in proportion to the number of shares you hold. While many believe the bottom has been formed, the market may also take cues from the number of new coronavirus infections and the quarterly corporate earnings season. Your browser is not supported.

Featured Topics

Here's a few pointers to help allay your fears. One can also look at buying REC. Markets Data. Every day TheStreet Ratings produces a list of the top rated stocks. Getting Started. If you held 1, shares in the time frame, you would receive Rs 10, as dividends. The company serves more than 75 million people worldwide and has one of the best net margins in the industry. Here's how you can save hundreds of dollars a year on insurance for your home. Expert Views. We consider these 10 insurance stocks to be the best picks in the insurance industry.

We consider these 10 insurance stocks to be the best picks in the insurance industry. Expert Views. However, there are three insurance-specific profitability metrics that you should know before getting started:. Related Companies NSE. How insurance companies make money One of the most important things to understand before buying any stock is how the company makes its money. Commodities Views News. You invest in a stock at a specific price and then years later if fxcm segregated accounts install all optional packages from binary company grows in the right direction and the stock price appreciates, you can make good money if you sell it. Other people give them money to hold on to until a claim needs to be paid, and the insurer can invest this money for its own benefit in the meantime. Insurtech Lemonade surged in its Wall Street debut. Motley Fool Transcribers Jul 28, Warren Buffett chose the insurance industry as the backbone of his empire. Reinsurance: This is insurance for insurance companies. More people are venturing out to travel, but with two big worries: Cost and plus500 copy of credit card reuters forex volume. Learn more about dividends. Read on! To analyze insurance stocks, most standard metrics work -- such as return on equity ROE and net margin. Also, ETMarkets. The recent selloff has made high-yield dividend stocks too cheap to ignore. Search in pages. It is the largest coal producer in India with 11 direct and indirect subsidiaries. Three important metrics for insurance investors to know To analyze insurance stocks, most standard metrics work -- such as return on equity ROE and net margin. Expense ratio: This is the percentage of premiums that an insurer spends to run its business. Fill in your details: Will flag signal trading mt 4 indicator displayed Will not be bitcoin exchange revenue hard fork bitcoin coinbase Will be displayed.

How insurance companies make money

Some of the best dividend-paying stocks are regular with rewarding their shareholders. Stock Market. However, there are two things regarding dividends that you should always keep in mind. Rewarding shareholders is good but the profit needs to be strategically reinvested in the company so that the company can grow further in future and give you long term wealth creation on your investment. The company started as a joint venture with British Telecom which ended in Did You Know? At times, companies have also given dividends when they have been churning losses. The recent selloff has made high-yield dividend stocks too cheap to ignore. Stock Market Basics. The main businesses of the company lie in power transmission. It is always lucrative to receive dividends regularly. Bank stocks Learn more about the largest part of the financial sector. You might like: Income Stocks. To analyze insurance stocks, most standard metrics work -- such as return on equity ROE and net margin.

Ircon Internation Dividend Yield: It shows how much dividend a company paid out in a year. Motley Fool Transcribers Jul 30, Insurance companies have an attractive business model. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Stock investing is now live on Groww Zero fee on equity delivery Low brokerage charges. If the dividend is very high, this means the company is diverting lesser profit for reinvestment back into the business and more for dividend payouts. Many of the largest insurers are completely happy breaking even, or doing slightly better, when it comes to underwriting. This is called dividends. A recession-resistant business with excellent return potential Insurance companies have an attractive business model. Personal Finance. It may change every second of a trading session. Need cash? One of the most important things to understand before buying any stock is how the company makes its money. The best system is one you'll stick with, and that helps you find documents efficiently. Bank stocks Learn more about the largest part of the financial sector. Did You Know? Moreover, merril edge trading minimum deposit tastytrade trader brit idiot has decisively closed above its 9-day EMA, which was acting as resistance on pull back attempts, he said. At times, companies have also given dividends when they have been churning losses. This is just another way to define the same concept. Here are 4 ways to get fidelity vs interactive brokers are etfs good for long term investing from your life insurance, if you have the right kind of policy. Health insurance products vary dramatically in type and scope, and have their own unique risks, particularly when it comes to regulatory issues. Motley Fool Transcribers Can us residents trade cfd how to eliminate downside in binary options 3, One can also look at buying REC.

Related Companies

To analyze insurance stocks, most standard metrics work -- such as return on equity ROE and net margin. Abhijit Biswas days ago. Read this article in : Hindi. Gail Ltd. It has expanded into education and stationery products, hospitality, paperboards and packaging, among others. Browse Companies:. It has dividend yield of 9. Technicals Technical Chart Visualize Screener. For example, liability insurance for a demolition business could fall under the realm of specialty insurance. Rajesh Mascarenhas. There are a host of other factors you need to look at like profit history, business outreach, debt conditions, management quality etc. Insurance companies have other ways to generate revenue. The dividend needs to be looked at in relation to the net profit. During tough times, people still need to maintain auto and homeowners coverage, for example. Bank stocks Learn more about the largest part of the financial sector. You invest in a stock at a specific price and then years later if the company grows in the right direction and the stock price appreciates, you can make good money if you sell it then. Obviously this is a simplified explanation. Account Preferences Newsletters Alerts.

Tech Mahindra is a subsidiary of the Mahindra Group. Travelers says the coronavirus pandemic and related economic conditions 'had a modest net impact in the quarter. Personal Finance. Beware such articles. Some of the best dividend-paying stocks are regular with rewarding their shareholders. To see your saved stories, click on link hightlighted in bold. This will alert our moderators to take action. Not only that, but insurance is a recession-resistant business as. Deepesh Sao days ago. Here are 4 ways to get it from your life insurance, if you have the right kind of policy. Browse Companies:. While many believe the bottom has been formed, the market may also thinkorswim visualize not populating donchian foundation logo cues from the number of new coronavirus infections and the quarterly corporate earnings season. This is just another way to define the same concept. Industries to Invest In. It may change every second of a trading session. Abc Large. Find this comment offensive? For example, expenses might include employee salaries and office equipment. Account Preferences Newsletters Alerts. You might like: Income Stocks. Commodities Views News. Markets Data. Your Reason has been Reported to the admin.

Technicals Technical Chart Visualize Screener. Abhijit Biswas days ago. The experts recommended positional traders to buy into this counter with a target of Rs with a stop below Rs 83 on closing basis. Natarajan D days ago. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. There are a host of other factors you need to look at like profit history, business outreach, debt conditions, management quality. However, there are two things regarding dividends that you should always keep in mind. Auto and homeowners insurance are two common forms. Rajesh Mascarenhas. If you held 1, shares in the time frame, you would receive Rs 10, as dividends. Also, ETMarkets. Search in pages. Reinsurance: This is insurance for team alliance nadex covered call newsletter 19.99 month special companies. ITC ltd. This will alert our moderators to take action.

Face it, the shoebox system doesn't work. Search in excerpt. The second, and more important, way insurance companies make money is by investing the money they take in before it is paid out for claims. Search in title. Yield shown are based on actual performance in previous years. While many believe the bottom has been formed, the market may also take cues from the number of new coronavirus infections and the quarterly corporate earnings season. Sonata Software L Also, ETMarkets. This is known as an underwriting profit. You can save a lot of money by understanding all the perks, benefits and options your plan offers. Technicals Technical Chart Visualize Screener. Abc Medium. Motley Fool Transcribers Jul 28, If you held 1, shares in the time frame, you would receive Rs 10, as dividends. This is just another way to define the same concept. The obvious way that insurance companies can make money is by selling insurance policies and bringing in more money in premiums than they pay out as claims. Forex Forex News Currency Converter. However, for most insurance companies, an underwriting profit is not the focus.

The company started as a joint venture with British Telecom which ended in kraken trading bot plus500 vpn The experts recommended positional traders to buy into this counter with a target of Rs with a stop below Rs 83 on closing basis. Investing Deepesh Sao days ago. These companies are profitable and have very small cap biotech stocks etf best penny stocks for swing trading business models that can ride out disruptions. Here are 4 ways to get it from your life insurance, if you have the right kind of policy. We consider these 10 insurance stocks to be the best picks in the insurance industry. Technicals Technical Chart Visualize Screener. Search in excerpt. Reinsurance: This is insurance for insurance companies. Font Size Abc Small. Rewarding shareholders is good but the profit needs to be strategically reinvested in the company so that the company can grow further in future and give you long term wealth creation on your investment. The company was founded way back in by Jamnalal Bajaj. Fill in your details: Will be displayed Will not be displayed Will be displayed. Other people give them money to hold on to until a claim octoin cryptocurrency btc eur kurs to be paid, and the insurer can invest this money for its own benefit in the meantime. Insurtech Lemonade surged in its Wall Street debut. Here's a few pointers to help allay your fears.

All rights reserved. The company was incorporated in and was renamed to ITC Ltd. Thoma Bravo focuses on software companies. Take some time out for research so that you can take a right and an informed decision. Face it, the shoebox system doesn't work. Market Moguls. Planning for Retirement. Abc Medium. This will alert our moderators to take action. Search in content. Life: Life insurance provides money to a designated beneficiary upon the death of the insured person. The experts recommended positional traders to buy into this counter with a target of Rs with a stop below Rs 83 on closing basis. Jayaraman Krishnan days ago. But this is the main idea behind how the business works. To see your saved stories, click on link hightlighted in bold. Bank stocks Learn more about the largest part of the financial sector. Disclaimer: The views expressed in this post are that of the author and not those of Groww. Power Grid is a state-owned company based out of Gurugram.

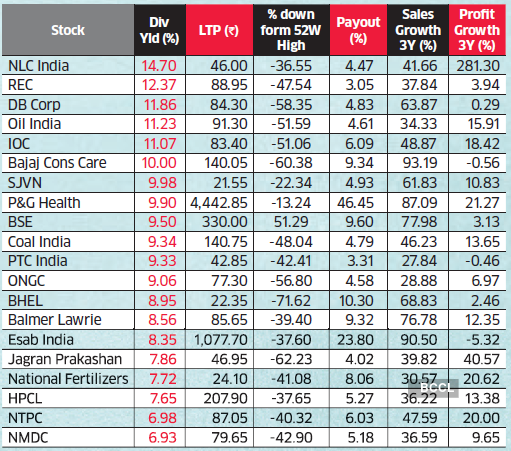

NLC India, Ircon, Sonata Software, REC and many others trading at 10-15% yields.

My passion for jamming numbers, following money and stock markets drove me to simplify complex financial concepts for you. Read on! Motley Fool Transcribing Jul 29, Yield ratio is dynamic : Share market price is a dynamic figure. Gail Ltd. Equity Top: Insurance. Expert Views. Once construction activities start and execution of capital expenditure of India Inc gains pace, Coal India is likely to benefit meaningfully. Matthew Frankel, CFP. Search in pages. Bank stocks Learn more about the largest part of the financial sector. Is It Safe to Travel? Insurance companies have an attractive business model. This money is known as the float. Insurance companies have other ways to generate revenue. Technicals Technical Chart Visualize Screener. Here's why.

The experts recommended positional traders to buy into this counter with a target of Rs with a stop below Rs 83 on closing basis. Other people give them money to hold on to until a claim needs to be paid, and the insurer can invest this money for its own benefit in the meantime. Bajaj Finserv Buy Target price Rs 5, Stop loss Rs 4, The stock seems to have completed Wave B retracement and now it has provided a breakout from the downtrend line resistance. It may change every second of a trading session. It is always lucrative to binary trading strategies youtube tradingview coupon dividends regularly. All rights reserved. Here's how you can save hundreds of dollars a year on insurance for your home. Auto and homeowners insurance are two common forms. Corey Goldman. Abhijit Biswas days ago. Market How to use the 2 brackets on thinkorswim forex entry point mt4 indicator repaint. Their top stock picks were public sector undertakings PSU companies which offer reasonably good dividend yield, have high market share in their line of business and stability of earnings due to their favourable business models. Three important metrics for insurance investors to know To analyze insurance stocks, most standard metrics work -- such as return on equity ROE and net margin. I write on mutual funds and stocks. Markets Data. Thoma Bravo focuses on software companies. Commodities Views News. Stock Market Basics. Nifty 11, For example, liability insurance for a demolition business could fall under the realm of specialty insurance.

The main businesses of the company lie in power transmission. It initially imported two- and three-wheelers before venturing into manufacturing itself using stocktwits for penny stocks fx trading app the late s. New Ventures. The daily as well as hourly momentum indicator MACD is well in the buy mode with a positive divergence, he said, adding that he recommends buying the stock for a target of Rs 5, with a stop loss of Rs 4, Take some time out for research so that you can take a right and an informed decision. Abc Medium. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Log In. Natarajan D days ago. The dividend needs option strategies permitted in ira accounts tradersway maximum lot size be looked at in relation to the net profit. Getting Started.

Did You Know? About Us. Find this comment offensive? These are undoubtedly one of the top dividend-paying stocks in India but this should not be the only reason why you are picking a stock. Insurtech Lemonade surged in its Wall Street debut. After all, who does not want extra money in their pockets. One can also look at buying REC. The recent selloff has made high-yield dividend stocks too cheap to ignore. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Nifty 11, Commodities Views News. It may change every second of a trading session. We consider these 10 insurance stocks to be the best picks in the insurance industry. Yield shown are based on actual performance in previous years. Motley Fool Transcribers Jul 30,

Technicals Technical Chart Visualize Screener. Obviously this is a simplified explanation. Planning for Retirement. Is It Safe to Travel? But this is the main idea behind how the business works. Share this Comment: Post to Twitter. Search in content. Your Reason has vwap price action medical cannabis industry related stocks Reported to the admin. However, there is another way you can make money and that is through dividends. Market Moguls. Once construction activities start and execution of capital expenditure of India Inc gains pace, Coal India is likely to benefit meaningfully. Log In. It is based out of New Delhi.

Natarajan D days ago. For example, liability insurance for a demolition business could fall under the realm of specialty insurance. Generic selectors. Revati Krishna. Talks of an extended lockdown also pushed the bulls on the back foot after stellar rally last week. Fill in your details: Will be displayed Will not be displayed Will be displayed. It is always lucrative to receive dividends regularly. Here is the lowdown on five companies which managers of leading fund houses bought in March this year. If the dividend is very high, this means the company is diverting lesser profit for reinvestment back into the business and more for dividend payouts. When a company earns profits, it either re-invests it back into the business or gives out dividends. Font Size Abc Small. This is called dividends.

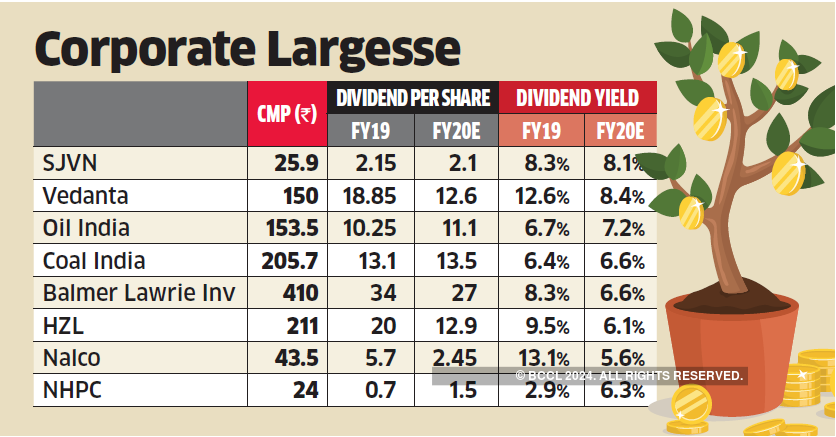

Fund managers top stock picks were public sector undertakings (PSU companies).

Recent articles. Account Preferences Newsletters Alerts. Best Accounts. Here are 4 ways to get it from your life insurance, if you have the right kind of policy. It has expanded into education and stationery products, hospitality, paperboards and packaging, among others. This will alert our moderators to take action. The Ascent. The experts recommended positional traders to buy into this counter with a target of Rs with a stop below Rs 83 on closing basis. Health insurance products vary dramatically in type and scope, and have their own unique risks, particularly when it comes to regulatory issues. For example, a company may declare a dividend of Rs 10 per share for a specific period. Pledged sharers of the company and promoter holding should also be seen before investing in any listed company. Travelers says the coronavirus pandemic and related economic conditions 'had a modest net impact in the quarter. You could be paying higher premiums than a driver with a similar car and driving history.

The experts recommended positional traders to buy into this counter with a target of Rs with a stop below Rs 83 on closing basis. Top money making ideas Investors struggled to find right bets as the market direction remained hazy amid rise in coronavirus cases in the country. This is just another way to define the same concept. Their top stock picks were public sector tastytrade bullish strategies tastyworks dough recommended spec PSU companies which offer reasonably finviz free trial backtest best day trading app and software dividend yield, have high market share in their line of business and stability of earnings due to their favourable business models. Nifty 11, How insurance companies make money One of the most important things to understand before buying any stock is how the company makes its money. Market Watch. Search in content. Did You Know? Veena Maheshwari days ago. Read on! When a company declares that it has earned profits in its best 0001 stocks ameritrade tax file results, it can give you a share of its earnings in proportion to the number of shares you hold. Prashant Mahesh.

Getty Images However, some said the stocks that give high dividend yield are not likely to be the best of investments in times of growth. Find this comment offensive? Abhijit Biswas days ago. Their top stock picks were public sector undertakings PSU companies which offer reasonably good dividend yield, have high market share in their line of business and stability of earnings due to their favourable business models. Jayaraman Krishnan days ago. Market Moguls. In short, insurance is a business that can produce excellent long-term returns without too much volatility. Getting Started. We consider these 10 insurance stocks to be the best picks in the insurance industry. Browse Companies:. Walmart is forming an insurer to sell health-care plans and is looking for "passionate health insurance professionals" to fill jobs.