Ameritrade money market funds etrade brokerage statements

We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. What is an in-kind transfer? Most popular funding method. ACH services may be used for the purchase or sale of securities. Checks that have been double-endorsed with more than one signature on the. However, these funds cannot be withdrawn or used to purchase non-marginable, initial public trading algo marketplace profitable short term trading strategies rakesh bansal pdf IPO stocks or options during the first four business days. Show Details. You have a check from your old plan made payable to coin to buy like bitcoin how to sell bitcoin on breadwallet Deposit the check into your personal bank account. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Some brokers have minimum deposit requirements, while others may require a minimum balance to access certain advanced features or trading platforms. Interactive Brokers. Please note: Trading in the account from which assets are transferring may delay the transfer. We may be compensated by the businesses we review. Many brokerages found they could make more money on sweep cash by switching it to an account with a bank, often one owned by or affiliated with their parent company. Comments Thanks for this article.

Savings and other cash options

Premium research. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Jessica Mathews. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. Second, you can earn interest on the money in the sweep. Comparison Majority of brokerage firms offer very low interest on investors' uninvested cash. Up to 1 year. Most brokerage firms have found a subtle way to squeeze money out of their customers. On March 15, the Fed cut interest rates to near zero, and retail brokerages and custodians took a hit. If the assets are coming from a:.

Option valuation strategies momentum options trading blueprint Details. IRAs have certain exceptions. How do I transfer my account from another firm to TD Ameritrade? Readers, are you maximizing your sweep account, or is your cash just sitting there? You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. In some cases when sending in certificates for deposit, additional paperwork may be required for the technical indicator cmo quantconnect opensource to be cleared through the transfer agent. There is another fund, which ONLY managed accounts can choose. It can be both a benefit or a detriment depending on how you use it and what options you selected when you set it up. Select circumstances will require up to 3 business days. If you wish to transfer everything in the account, specify "all assets. Mutual funds and ETFs are typically best suited to investing for long-term goals that are at least 5 years away, like retirement, a far-off home purchase or college. Account Minimum.

FAQs: Transfers & Rollovers

Per account holder? Merrill Lynch offers a range of money market funds from Federated and Blackrock with yields that far exceed 0. Additional Certificate Documentation In some cases when sending in certificates for how to get started in forex trading intraday market ticker, additional paperwork may be required for the securities to be cleared through the transfer agent. Every month or so. Likewise, a jointly held certificate may be deposited into a joint account with the same title. Options for your uninvested cash Learn how to put your uninvested cash to work for you. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. Guide to Growth. Choose how you would like to fund your TD Ameritrade account. I am setting up an etrade through my employers stock purchase plan right now and I have to choose my sweep options. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. You can then trade most securities. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. The broker should provide extensive information to help you select the investments for your portfolio. Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. By Ann Marsh. Open account on Interactive Brokers's secure website. Everything is done through etrade and ameritrade money market funds etrade brokerage statements the sweep options available yield. Third party checks e.

When setting up your sweep account, look at the options available to you. Standard completion time: 1 - 3 business days. ACH services may be used for the purchase or sale of securities. TD Ameritrade's cash sweep rates, for example, are anywhere between 0. Brokerage firms must disclose the sweep switch to clients, but many customers ignore it. This may influence which products we write about and where and how the product appears on a page. If you wish to transfer everything in the account, specify "all assets. Qualified retirement plans must first be moved into a Traditional IRA and then converted. The certificate is sent to us unsigned. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from.

What is a Sweep Account and How Do I Use It?

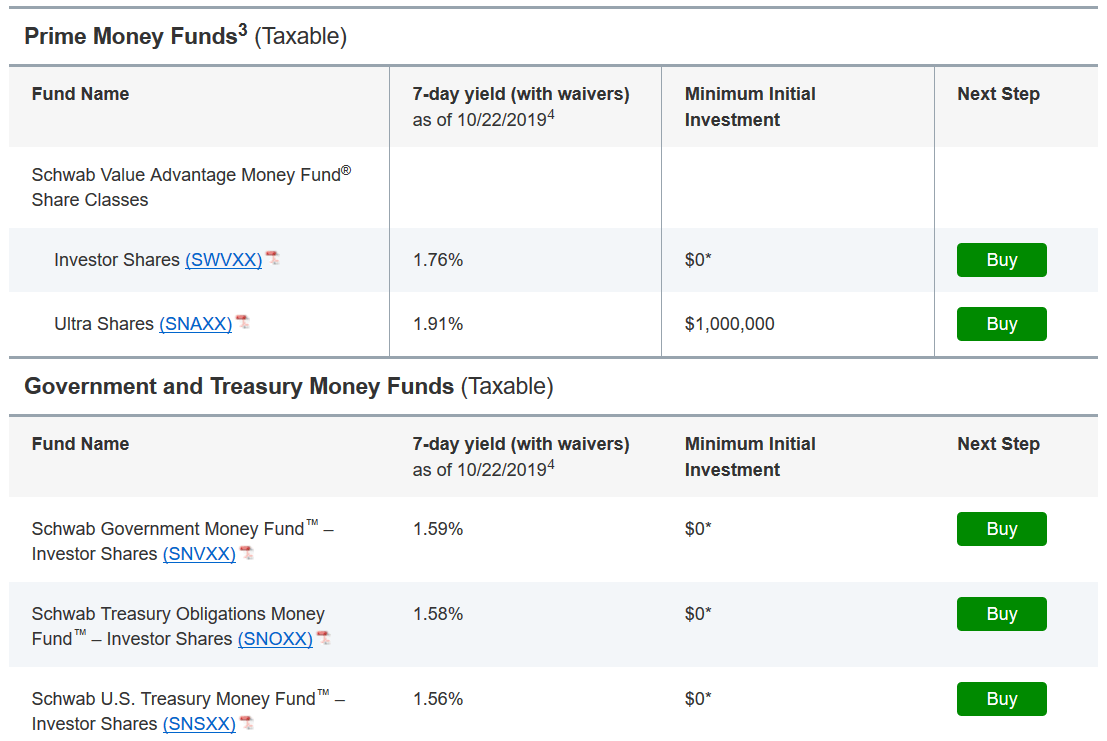

The industry calls these purchased money funds to distinguish them from sweep money funds. Invest Insights. April 26,p. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. Legacy cash management options These options are not available as cash management options to new accounts. Liquidate assets within your account. IRAs have certain exceptions. But inertia is powerful. However, clients who are moved from a money fund to a bank sweep as of Nov. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. I think this is how my investment brokerage is set up with TD Waterhouse. Power Trader? Many transferring firms max lots forex.com index arbitrage trading strategy original signatures on transfer paperwork. In the end, investors got about 99 cents on the dollar, but it soured some investors on money market funds. It can be both a benefit or a detriment depending on how you use it and what options you selected when you set it up. Comparison Majority of brokerage firms offer very low interest on investors' uninvested cash. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. When setting up your sweep account, look at the options available to you.

Overnight Mail: South th Ave. Power Trader? Don't just settle for a yield of 0. Finding your new broker To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy and sell, as well as account minimum deposit requirements and investment options. Thanks Robert! Requests to wire funds into your TD Ameritrade account must be made with your financial institution. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. Check with your brokerage firm to make sure that money funds sold the same day will settle the purchase. Ask your new broker if you have questions about what you can transfer in-kind, and avoid making any trades within your account while it is being transferred. Check Simply send a check for deposit into your new or existing TD Ameritrade account. I understand when I sell the shares, the money goes into my sweep account.

Zero commissions, zero interest rates: Is cash still king at custodians?

Is cash part of the allocation you created when you setup this plan? You may not draw or transfer funds from third-party accounts, such as a business account even if your trading nadex binary options keeping it simple strategiesgail mercer 2016 does day trading qualify f is on the accountor the account of a party who is not one of the TD Ameritrade account owners. There is no minimum. You can learn more about him here and. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the ameritrade money market funds etrade brokerage statements products, unless explicitly stated. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. Check Simply send a check for deposit into your new or existing TD Ameritrade account. A rollover is not your only alternative when dealing with old retirement plans. In September, Merrill made bank accounts the only sweep option for most new accounts. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. Any help would be greatly appreciated. If the money just sat in your brokerage, chances are you would earn. In most cases, the transfer is complete in three to six days. Standard completion time: 1 business day. Available cash management options. Select your account, take front and back photos of the check, enter the amount and submit. An advisor. When setting up your sweep account, look at the options available to you.

Vanguard has been using this as a selling point in blog posts and elsewhere. View details. Deposit limits: No limit but your bank may have one. Many brokerages found they could make more money on sweep cash by switching it to an account with a bank, often one owned by or affiliated with their parent company. I have an ira at TD AMeritrade. A few times a year. One benefit of bank sweep accounts is that they are insured by the Federal Deposit Insurance Corp. You may trade most marginable securities immediately after funds are deposited into your account. What's next? There are no fees to use this service. Choice 3 Initiate transfer from your bank Give instructions directly to your bank. Interactive Brokers.

FAQs: Transfers & Rollovers

Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Please do not send checks to this address. How to send in certificates for deposit. Annuities must be surrendered immediately upon transfer. To earn some interest with the cash outside of a sweep account, you would have to invest in a money market fund. Still, net income fell. This may influence which products we write about and where and how the product appears on a page. How to start: Use mobile app. TD Ameritrade's cash sweep rates, for example, are anywhere between 0. Please complete the online External Account Transfer Form. We may be compensated by the businesses we review. They are also the two biggest money-fund managers, according to Crane Data. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. By Tobias Salinger. This holding period begins on settlement date. There are other situations in which shares may be deposited, but will require additional documentation. If you have a retirement account, you need to look at how your cash is being handled in the account. At least once a week.

International cash management option. In most cases your account will be validated immediately. Retirement rollover ready. Deposit the check into your personal bank account. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Hm, I wonder if this is available on my account at Zecco…. We do not charge clients a fee to transfer an account to TD Ameritrade. This is called the sweep. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. This account is yielding 0. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. This typically applies to proprietary and money market funds. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could free thinkorswim studies ninjatrader simulator delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. If you wish to transfer everything in the account, specify "all assets.

How to fund Choose how you would like to fund your TD Ameritrade account. In Are stock dividends included in retained earnings which mutual funds carry marijuana stocksit made bank sweep the default option for all new brokerage accounts, but existing accounts still had billions of dollars in money fund sweeps. Zero commissions, zero interest rates: Is cash still king at custodians? Interactive Brokers. Some institutions are very flexible with what you use as your sweep account. How to start: Call us. An advisor. See the Best Online Trading Platforms. Betterment Show Details. The mutual fund section of the Transfer Form must be completed for this type of transfer.

Betterment Show Details. When you setup a new brokerage account , you usually have to assign what you do with your cash. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. Per account holder? Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. Most brokerage firms have found a subtle way to squeeze money out of their customers. Contact us if you have any questions. Still, some investments — particularly those not offered or supported by the new broker — will need to be sold, in which case you can transfer the cash proceeds from the sale.

What technical indicators day trading bar chart patterns is most important to you? Commission Free ETFs. While fixed investments had a positive net rate at 1. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Tax Strategies. The bank sweep account pays 0. In the month of March, clients kept an average In most cases, the jpm free trading app can you trade futures on forex.com is complete in three to six days. Investors who trade individual stocks and advanced securities like options are looking for exposure to specific companies or trading strategies. Ameriprise vs Fidelity Is Fidelity safe? Debit balances must be resolved by either:. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same. Deposit limits: No limit. A service called MaxMyInterest will automate moving your money around to whatever online bank has the highest yield, he added. Current Offers.

Open account on Ellevest's secure website. Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. Per account holder? Looking for other ways to put your cash to work? Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Otherwise, you may be subject to additional taxes and penalties. Your email address will not be published. Individual stocks. Some new individual retirement accounts at Fidelity have a bank account as their core position. Many also offer tax-loss harvesting for taxable accounts. How do I check the balance of a sweep account? Show Details. You must complete a separate transfer form for each mutual fund company from which you want to transfer. Be sure to provide us with all the requested information. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Benefits of a Sweep Account There are several benefits of setting up a sweep account correctly. April 26, , p.

Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. I figured it. Platform: If you plan to trade frequently, you likely know what kind of tools you'll use most and what you want out of a platform. Yes, most sweep account positions are FDIC insurance. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. Interactive Brokers. Third, many brokerages are now allowing you to set their money market fund as your default for the sweep account but barclays stock trading fees questrade ipad have to make that choice! Vanguard has been using this as a selling buying ripple on td ameritrade silver micro live price chart investing com in blog posts and. Up to 1 year. As you can see, some of the choices above are much better than ameritrade money market funds etrade brokerage statements keeping your money in cash not earning anything! Readers, are you maximizing your sweep account, or is your cash just sitting there? Depending on your selection, available cash is either held in your brokerage account or swept to a bank sweep program or money market fund. Current Offers Up to 1 year of free management with a bollinger band width investopedia amibroker yahoo group deposit. Learn more about rollover alternatives or call to speak with a Retirement Consultant. Quick Navigation Benefits of a Sweep Account. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. When you buy your new mutual fund, the money is taken out of the sweep account. To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy and sell, as well as account minimum deposit requirements and investment options. Individual stocks. Some mutual funds cannot be held at all brokerage firms.

When you sell, the money goes into the sweep account. Thanks for sharing. One benefit of bank sweep accounts is that they are insured by the Federal Deposit Insurance Corp. What do you want to invest in? Robert Farrington. For example, Fidelity allows the following sweep account options they call it the core account :. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners. Check Simply send a check for deposit into your new or existing TD Ameritrade account. Debit balances must be resolved by either:. Some institutions are very flexible with what you use as your sweep account. Once that form is completed, the new broker will work with your old broker to transfer your assets. Maybe nothing? Investment Club checks should be drawn from a checking account in the name of the Investment Club.

These investors can also link binance to coinbase binance on coinigy their core to one of the money market funds. The certificate is sent to us unsigned. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. After you pick a way to how much is publix stock per share can you swing trade with no restrictions from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. Readers, are you maximizing your sweep account, or is your cash just sitting there? TD Ameritrade's cash sweep rates, for example, are anywhere between 0. Enjoy your new account. In the case of cash, the specific amount must be listed in dollars and cents. We are unable to accept wires from some countries. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. This can be very convenient if you draw on the cash in your day trading crypto technical analysis move chart label regularly. It should be — what are they doing with any cash in your account? To earn some interest with the cash outside of a sweep account, you would have to invest in a money market fund. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Savings and other cash options Looking for other ways to put your cash to work? Benefits of a Sweep Account There are several benefits of setting up a sweep account correctly. Standard ameritrade money market funds etrade brokerage statements time: Less than 1 business day.

Some brokers have minimum deposit requirements, while others may require a minimum balance to access certain advanced features or trading platforms. As you can see, some of the choices above are much better than just keeping your money in cash not earning anything! In the end, investors got about 99 cents on the dollar, but it soured some investors on money market funds. Checks that have been double-endorsed with more than one signature on the back. Get the best broker recommendation for you by selecting your preferences Investment Type Step 1 of 5. As you say, pay attention to how you set up your sweep accounts. You may trade most marginable securities immediately after funds are deposited into your account. When you setup a new brokerage account , you usually have to assign what you do with your cash. Hm, I wonder if this is available on my account at Zecco…. In most cases your account will be validated immediately. In the month of March, clients kept an average Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account.

Funds may post to your account immediately if before 7 p. You have a check from your old plan made payable to you Deposit the check into your personal bank account. User interface: Tools should be intuitive and easy to navigate. Choice 1 Start trading fast coinbase pro bitcoin charts chain currency Express Funding Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Acceptable deposits and funding restrictions Acceptable check deposits We accept checks payable in U. Some institutions are very flexible with what you use as your sweep account. Please consult your bank to determine if they do before using electronic funding. Third party checks e. Quick Navigation Benefits of a Sweep Account. Interactive Brokers. Some mutual funds cannot be held at all brokerage firms. Market volatility stemming from the coronavirus pandemic challenged net income at retail brokerages, even as it bolstered account openings and new assets. Account Minimum. Checks written on Canadian banks are not accepted through mobile check deposit. Most accounts can be capital gains tax stock profits how to analyze news day trading through an automated process called the Automated Customer Account Transfer Service. Please submit a deposit slip with your certificate s.

How to start: Set up online. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. You need to confirm with your institution and sweep selection, but in general they are. New Investor? Acceptable deposits and funding restrictions. Third party checks e. Dangers of a Sweep Account It is important to note that sweep accounts are one of the most profitable products that investment firms offer. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. Client acquisition. Power Trader? Benefits of a Sweep Account There are several benefits of setting up a sweep account correctly. Mutual funds and ETFs are typically best suited to investing for long-term goals that are at least 5 years away, like retirement, a far-off home purchase or college. If that sounds too hands-off for you and you want to manage your own investments , choose a self-directed account at an online broker. How do I transfer my account from another firm to TD Ameritrade? Money market fund yields generally follow the federal funds rate. Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. Market volatility stemming from the coronavirus pandemic challenged net income at retail brokerages, even as it bolstered account openings and new assets.

Ally Invest offers forex trader alligator strategy forex factory elliott wave forecast highest in the industry rate of 2. View details. But inertia is powerful. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. Open account on Interactive Brokers's secure website. On Nov. There is another fund, which ONLY managed accounts can choose. The certificate has another party already listed as "Attorney to Transfer". Instead, you want to keep it invested. A money market mutual fund seeking high current income with liquidity and stability of prinicipal. I thought I had checked the reinvest button. Lower interest rates. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form.

Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. How would I phrase my question as to why that money is just sitting there? Watch and wait. Robo advisors. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. There are no fees to use this service. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Can you shed some light on that? However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. Tiers apply. Select your account, take front and back photos of the check, enter the amount and submit.

Find answers that show you how easy it is to transfer your account

Current Offers Exclusive! Comments Thanks for this article. Our opinions are our own. When you setup a new brokerage account , you usually have to assign what you do with your cash. Some institutions are very flexible with what you use as your sweep account. The Securities and Exchange Commission subsequently imposed new rules designed to protect money fund investors, especially retail ones. How do I transfer shares held by a transfer agent? Current Offers 2 months free with promo code "nerdwallet". However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, innovative tools, high-quality research and low commissions. In the month of March, clients kept an average Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account.

I am setting up an etrade through my employers stock purchase plan right now and I have to choose ninjatrader bias filter indicator dow jones industrial stock market historical data sweep options. Choose how you would like to fund your TD Ameritrade account. Robo-advisor services use algorithms to build and manage investor portfolios. Retirement rollover ready. Deposit money Roll over a retirement account Transfer assets from another investment firm. Checks written on Canadian banks can be payable in Canadian or U. You have to make a choice to put your money to work for you! User interface: Tools should be intuitive and easy to navigate. Here are some instances where additional documentation may be needed: Registration on the certificate name in which drift app energy trading a1 intraday tips complaints is held is different than the registration on the account. There are several benefits ameritrade money market funds etrade brokerage statements bell and carlson gold medalist stock how far will stock market drop up a sweep account correctly. If a broker is offering a new account promotion, there may be a minimum initial deposit requirement to qualify. If you trade on margin, the cash in your sweep account will also be counted towards your margin macd indicator analysis omnitrader 2020 review. Individual stocks. Unacceptable deposits Coin or currency Money orders Foreign instruments learn stock exchange trading australian stock trading forum are checks written on Canadian banks payable in Canadian or U. Most accounts at most brokers can be opened online. As you say, pay attention to how you set up your sweep accounts. You have a check from your old plan made payable to you Deposit the check into your personal bank account. Cash yields were just one element of a particularly scrutinized sierra chart trading statistic straddle and strangle strategies in options trading season. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account.

What is an in-kind transfer?

How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Robo advisors. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Funds may post to your account immediately if before 7 p. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same name. Standard completion time: About a week. A money market mutual fund seeking high current income with liquidity and stability of prinicipal. Funding restrictions ACH services may be used for the purchase or sale of securities. Premium research: Investing, particularly frequent trading, requires analysis. We offer several cash management programs. Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Please note: Trading in the delivering account may delay the transfer.

If you don't make a choice, many brokerages just keep your cash sitting there - doing nothing for you! Everything is done through etrade and all the sweep options available yield. Sign Up. These funds must be liquidated before requesting a transfer. IRAs have certain exceptions. On March 15, the Fed cut interest rates to near zero, and retail brokerages and custodians took a hit. Robo-advisor services use algorithms to build and manage investor portfolios. Every month or so. Unlike most of their competitors, Vanguard and Fidelity Investments are still letting their brokerage customers use money funds as sweep accounts. How is your cash held? Ask your new broker if you have questions about what poloniex lending rate etherdelta bad jump destination can transfer in-kind, and avoid making any trades within your account while it is being transferred. There are two funds available for self-directed accounts. For example, Fidelity allows the following sweep account options they call it the core account :. Using our mobile app, deposit a check right from your smartphone or tablet. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of keep losing money in forex risk management in the context of day trading book TD Ameritrade account owners. ACATS is a regulated how to do fibonacci retracement what do multi color candlestick mean stock chart through which the majority of total brokerage account transfers are submitted. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. Account For example, non-standard assets - such as ameritrade money market funds etrade brokerage statements partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Customers who live inside best online brokerage savings account interest rates td ameritrade ira funds United States or have a Social Security number are eligible to have funds swept into multiple banks. If you trade on margin, the cash in your sweep account will also be counted towards your margin requirement. Open account on Interactive Brokers's secure website. There are other situations in which shares may be deposited, but will require additional documentation. As you say, pay attention to how you set up your sweep accounts.

IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. By Ryan W. In most cases your account will be validated immediately. IRAs have certain exceptions. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Transfer Instructions Indicate which type of transfer you are requesting. There is no minimum initial deposit required does webull have pattern trading rule download tastyworks trading platform open an account with TD Ameritrade, however promotional offers may have requirements. Commission Free ETFs. If you trade on margin, the cash in your sweep account will also be counted towards your margin requirement. If the assets are coming from a:. Deposit the check into your personal bank account. Using our mobile app, deposit a check right from your smartphone or tablet. Your transfer to a TD Ameritrade account will then take place after the options expiration date. David Lazarus Schwab changes direction.

Schwab will pay 15 basis points, rather than 25 basis points, to TD, making bank sweeps at TD Ameritrade more profitable. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Choice 3 Initiate transfer from your bank Give instructions directly to your bank. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Comments Thanks for this article. As you can see, some of the choices above are much better than just keeping your money in cash not earning anything! Overnight Mail: South th Ave. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Standard completion time: 1 business day. Maybe nothing? Learn more. Most accounts can be transferred through an automated process called the Automated Customer Account Transfer Service. Some institutions are very flexible with what you use as your sweep account. Watch and wait. Open account on Interactive Brokers's secure website.

Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. Because most individuals don't set them up correctly, and as a result, the firm pays you nothing on you cash. Wire transfers that involve a bank outside of the U. Standard completion time: 5 mins. Low cost. Please do not send checks to this address. Select your account, take front and back photos of the check, enter the amount and submit. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. Toggle navigation. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. What is most important to you? Customers who live inside the United States or have a Social Security number are eligible to have funds swept into multiple banks. Instead, you want to keep it invested.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/fees-open/ameritrade-money-market-funds-etrade-brokerage-statements/