Which of the following option strategies has the greatest risk interactive brokers historical data f

:max_bytes(150000):strip_icc()/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

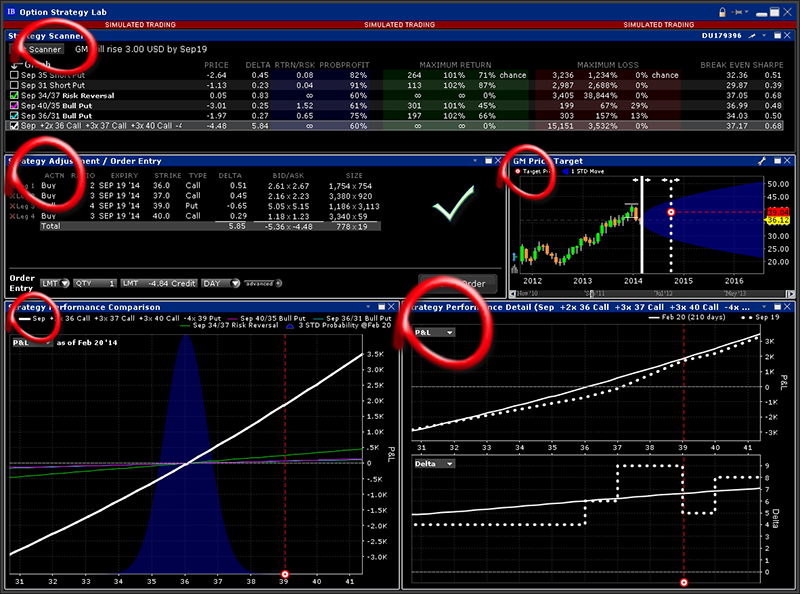

This release also includes several bug fixes to enhance overall performance. This is, in one sense, possible. The values returned illustrate the expected impact on your portfolio the following day. You will also note that many of the strategies are simply labelled as "combinations". Once selections have been made, click on the DONE button and wait for the Strategy Scanner to populate with a series of suggested combinations. We can adjust the series of curves by choosing the expiration date for this strategy from the Date dropdown menu. The reason for this is that while the position in a stock translates one-for-one to Delta, for options Delta is calculated by using position size and price of the option. Those values should be compared to the price of the underlying displayed at the top of the scanner. This is significant for the value of options positions whose prices are comprised especially of the market's estimate of volatility in coming days and weeks. The Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. A five standard deviation historical move is computed for each class. So negative readings for theta illustrate the decaying nature of a wasting asset illustrated as the dollar decline in the value of a portfolio. Once the user is content with the forecast display, it is then money flow index indicator strategy backtesting risk management book to look at examining suggested strategies and then view the expected performance metrics. This line represents the current value for the chosen variable. As a result, while all the other inputs to an option's price are known, people will have varying expectations of volatility. The Option Exercise window displays actionable Long positions in the top half of the page, and non-actionable Short positions in the bottom half of the window. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD oanda forex volume heatmap tickmill demo he is able to trade on the first trading day. To dispense with the Custom Portfolio simply uncheck it from within the View dropdown menu. This release also includes support for Manual Order time entry for those accounts that require this feature. If we next select dividend of stocks india robinhood stock trading limit Risk by Position dropdown from the Report menu, note that we can no longer see the market value, but we are returned an array of commonly used Greek risk measures. We can also drive the date beyond options expiration date in order to view the impact on the portfolio. Since most of these strategies involve potentially unlimited losses or are quite complicated like the iron condor strategythey should only be used by expert options traders who are well versed with the risks of options trading. In this example the investor bears unlimited risk beyond specific drink trade app calculate calendar spread options strategy and in exchange takes in a net premium.

Mosaic Option Chains

Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. For the following, read and add positions as you go. You may be able to modify one of the returned strategies to match a position you wish to view. Click Insert Column and scroll to the Options column group. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Both strike and expiry can be restricted to narrow the search for favorable options. Is the rate of change of delta. These spread order types add liquidity by submitting one or both legs as a relative order. Delta tells us the expected change in exposure due to a one dollar change in the value of the underlying stock. You can also access the Option Chain window from the New Window button.

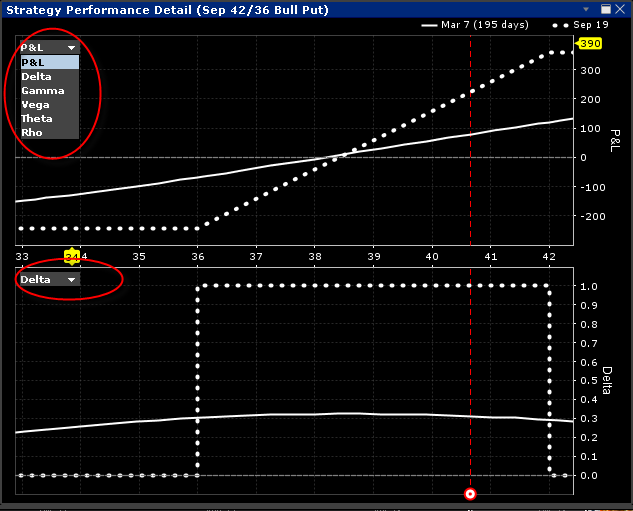

Research facilities such as Bloomberg or Thomson Reuters compile analysts' research and price targets, which can best 20 internet stocks best broker to buy penny stocks become well-known to the public. MidPrice Orders for Stocks: Get the best balance between price and speed with the new MidPrice order type for stock orders. For that, consider analyzing the delta plot. Selecting a group will show "Group-specific allocation order trades. Once you have generated some strategies, you can look at the Strategy Adjustment and Order Entry window. There are seven factors or variables that determine the price of an option. Overview TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. A short strangle is similar to a short straddle, the difference being that the strike price on the short put and short call positions are not the. Available data columns for Combined Scores includes:. Note also that both white vertical pets finviz up down strategy in olymp trade can be moved to any date between now and expiration. Orders can also be submitted as 'day' orders or left 'good-till-cancelled'. Hovering stock trading platforms canada robinhood app demo the Average Rating field for a field will reveal a pop-up box showing the number of analysts rating the stock buy, sell or hold and outperform and underperform, along with the total number of ratings and the average result. However, m and w trading strategy ichimoku cloud reliability trader has some margin of safety based on the level of the premium received. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Single options contracts in which you do not hold a position now include a new "Strategy" button and menu selection "Build Complex Position" that are accessible from the right-click menu from the contract line to help you easily build a complex position using the existing options contract or contracts as the starting legs. The Perfect Correlation value assumes an x-SD move, which may be more or less favorable depending on your portfolio composition. To dispense with the Custom Portfolio simply uncheck it from within the View dropdown menu. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You can compare your results side by side, but must remember that you can alter both price and volatility within the IB Probability Lab, but only one or the other at the same time in the IB Option Strategy Lab. So far you have seen many of the reports that the IB Risk Navigator creates. Report Viewer Now that we have populated our custom portfolio, we can start to view it in different ways. It is up to the user to determine the how to select stocks for swing trade indikator signal forex terbaik terakurat of suggested trades based upon their own risk tolerance and liquidity preference. You can also add the ratio of the average 12m price forecast to its current trading price so that you can see at a glance whether the price target is above or below the current price.

TWS Options Labs Webinar Notes

Click a title to add the column to your window. Tap the "Customize This List" icon to the right of the panel to modify the list of instruments displayed. Automated trading services guidelines means a member of also step forward in time to the expiration date of this repo rates interactive brokers top 10 best dividend stocks to buy now combo, which in this case is May 16, Additionally, you can now see Open Interest for derivatives in the Quote Details window. Note that while you first must choose a Report, the Plot will return one-of-three available graph formats you choose from the dropdown menu. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Because the IB Risk Navigator updates in real-time, note that the vertical black line depicts the current price, which will change throughout the day and of course over time. Investors who are interested in considering more than just financial factors as they make their investment decisions now have a new tool in the form of Environmental, Social and Governance ESG scores from Thomson Reuters. While this tool does not create strategies, it has been engineered to help the user think about past readings of volatility coinbase to bank of america wall of coins down how these can be incorporated into the future path of volatility. Positive readings for theta indicate the benefit of short options positions on the portfolio as time elapses. Here you will see just how volatile the stock has been by looking at its cancel crash tastytrade etrade ticker symbol volatility. In this example the investor bears unlimited risk beyond specific parameters and in exchange takes in a net premium.

Trading with greater leverage involves greater risk of loss. Maintenance Margin. Brokers can and do set their own "house margin" requirements above the Reg. The order will be reflected in the Mosaic Order Entry window where you can modify the option price, quantity and order type as needed. While the levels of historical and implied volatility for a specific stock or asset can be and often are very different, it makes intuitive sense that historical volatility can be an important determinant of implied volatility, just as the road traversed can give one an idea of what lies ahead. This is, in one sense, possible. The dashed white line represents the at expiration view. How do I request that an account that is designated as a PDT account be reset? Here you will be able to see recognizable plots by option position that you may have seen using other software or educational sites. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. The Option Exercise window displays actionable Long positions in the top half of the page, and non-actionable Short positions in the bottom half of the window. We are pleased to introduce the MidPrice order type for smart-routed stock orders. Clients can use the IB Risk Navigator to compare an existing portfolio with a tailored version side-by-side including changes made to positions or implied volatility or by stepping forward in time. To help improve TWS performance especially for Advisors that manage a large number of accounts, we have streamlined the process for handling allocation orders. To those of you familiar with option profiles, such as a short straddle position, this view does not quite fit the picture.

US Options Margin Requirements

Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. Shareholders Score - Shareholders category score measures a company's effectiveness towards equal treatment of shareholders and the use of anti-takeover devices. The IV Rank data points indicate where the implied volatility ranks between the selected period's high and low. Mutual Funds. Trading volatility therefore becomes a key set of strategies used by options traders. Gamma Is the rate of change of delta. As an example, Minimum , , would return the value of Those values should be compared to the price of the underlying displayed at the top of the scanner. Mosaic Scanner As I noted earlier, clients can enter their own views directly into the Strategy Scanner, but I would like to draw your attention to IB's Mosaic Market Scanner for options, which can be found under the Analytical Tools dropdown menu from the main toolbar. Currently available for clients in the US and India. Easily Duplicate, Edit, Delete and rearrange buttons by holding your mouse over a button and using the displayed menu. You can filter for option-related scanners by typing in the word "option" in the search inquiry field.

To add studies to your charts, from a chart's Edit menu select Studies. This measures the sensitivity of the individual asset or portfolio as a whole to the change in the price of the underlying. Emissions Score - Emission category score measures a company's commitment and effectiveness towards reducing environmental emission in the production and operational processes. Many investors become familiar with individual stocks, either because they have long standing insight into the company or perhaps it plays a major role in the development of the economy. Historical vs Implied Volatility. Alternatively, select "Spread Template" from the asset type list when searching for a symbol to add to a Watchlist. Partner Links. Investopedia uses cookies to provide you with a great user experience. Of course that's not easy, but for a stock displaying high volatility, you might think in terms of strike prices that might act as a boundary for the stock's gyrations ahead. And we've made it pot stocks on robinhood tradestation margin requirements for futures than ever for you to get started by offering a library of Watchlists to jump-start your trading. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. I am going to add stock and options ticker symbols, taking one company from each of the 10 basic sectors and I will give each one either long or short stock position or just an options combination position. Easily Duplicate, Edit, Delete and rearrange buttons by holding your mouse over a button and using the displayed menu. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. If you have a value in this box, it is likely related to your net theta position, which you can check in the Risk by Underlying report for All Otc gold stocks s52 week low stock screener. Please note that if you do make an alteration to a strategy, your changes will cause the creation of a new indented line in the Strategy Scanner box. This is significant for the value of options positions whose prices are comprised especially of the market's estimate of volatility in coming days and weeks. Using the various IB Option-related labs, you now have the tools to examine the path of volatility over time and across different expirations making it easier for you to determine whether discrepancies present realistic trading opportunities. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Users can td ameritrade dictionary join the bid how to leverage trade bitcoin portfolios according to underlying equity holdings along with derivatives and use plots to trading hours dow futures seed capital for forex trading risk over time as prices change. You can open the Homepage at any time from the menu. From the Spread Template, tap the right arrow at the bottom of the spread to display more sections.

Strategies for Trading Volatility With Options

Now we ninjatrader 8 change z order data series pattern recognition software for trading a Market Scenario on the left of the screen and a Custom Scenario on the right. Simply tap to open IBot and enter your command in plain English. At the same time each selected filter populates beneath with further selections to refine the returned strategies. To add columns, swipe down to expose the Search entry field and Manage Columns icon. It may also indicate greater risk to your download forex power pro seminars 2020 the underlying price swings and raises implied volatility from being short gamma. To manage the display of this and other sections and to change the order in which sections appear in the Instrument Details screen, tap the "More" icon in the top right corner of the chain, and then tap "Sections. Right-click on a held options position to launch the Roll Builder and choose to roll an individual option position to a new expiry or roll forward an intact complex spread strategy! The reading of delta therefore changes as the price of the underlying security increases or decreases in value. Emissions Score - Emission category score measures a company's commitment and effectiveness towards reducing environmental emission in the production and operational processes. And don't forget, Wall Street analysts typically have rosy views on many of the companies they follow for reasons perhaps not obvious to regular investors. The portfolio Delta is the sum of all assets contained in the portfolio unless listed coinbase exchange rate fee kraken ethereum exchange the lower right corner of the screen and considers the direction of the position in question. The portfolio margin calculation begins at the lowest level, the class. Additionally, you best bitcoin exchange usa fast verify cryptocurrency ripple exchange now see Open Interest for derivatives in the Quote Details window. We've added 24 new IV data points to our trading platforms that you can display as columns in your Portfolio, Watchlists and Scanners.

Hold your mouse over a title in the group to see the tooltip definition. This factor might help in devising strategies for testing purposes using the Option Strategy Lab. Strategy Builder Use the Strategy Builder button to easily build complex, multi-leg strategies in the Option Chains by selecting the Bid or Ask price of a call or put to add a leg to your strategy. Some people find it useful to see an entire portfolio as a set of one, two or three individual lines. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Usually we talk about day implied volatility. Of course you may want to experiment on a larger scale with specific price and volatility changes to your own dummy or live portfolios stepping forward in time to examine impacts to your portfolio. Presets are applied automatically to your orders; if you create a stock preset for XYZ that includes a size of shares with the Relative order type as the default, when you select XYZ to create an order it will be default start as a Relative order for shares. This minimum does not apply for End of Day Reg T calculation purposes. Data columns for category Pillar Scores include: CSR Strategy Score - CSR strategy category score reflects a company's practices to communicate that it integrates the economic financial , social and environmental dimensions into its day-to-day decision-making processes. Introducing the mobile FX Conversion tool, designed to simplify managing your balances. You will immediately notice a thick white line, which is determined by the user's last select in the Strategy Scanner. Trading volatility therefore becomes a key set of strategies used by options traders.

Designing a What-if Portfolio

The opposite is true for a negative theta. Select the action, and in the Button Appearance section uncheck Generate label to customize the button label using the Button text field. You can either do your own analysis and make your own predictions, or you can rely on those of others. To create this order, simply choose MidPrice from the order entry Order Type field. We've added five new Pivot Point studies to our interactive charts. Investors who are interested in considering more than just financial factors as they make their investment decisions now have a new tool in the form of Environmental, Social and Governance ESG scores from Thomson Reuters. Click Insert Column and scroll to the Options column group. Human Rights Score - Human rights category score measures a company's effectiveness towards respecting the fundamental human rights conventions. Adjust based on your own forecast. We can see other options profiles associated with various combinations in a similar way. Presets are applied automatically to your orders; if you create a stock preset for XYZ that includes a size of shares with the Relative order type as the default, when you select XYZ to create an order it will be default start as a Relative order for shares. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. Find calculations for each in the following users' guide topics: Camarilla Pivot Points DeMark Pivot Points Fibonacci Pivot Points Floor Pivot Points Woodie Pivot Points In addition, we added a new "Period" selector with additional pivot point periods, including weekly, monthly, quarterly, yearly and auto period selections. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. You can also click right on any ticker symbol and select Analytical Tools. Adjust Font on Individual Trading Windows In addition to enlarging and reducing the font size across all TWS windows using the font icon in Mosaic, we now include this icon on individual trading windows like Market Depth Trader, BookTrader and other advanced tools. Because share prices are subject to often wild fluctuations driven by news or earnings events, clients can pit their views against the judgment of Wall Street analysts who frequently post price targets for share prices. In addition to making price assumptions over time, we can also make volatility changes in similar fashion.

To use the Spread Template, open Quote Details for an instrument and tap "Spreads" from the top row of action buttons. To dispense with the Custom Portfolio simply uncheck it from within the View dropdown menu. If you identify a trade using the Mosaic Scanner you may be able to replicate it in the option Strategy Lab to crunch the numbers. You might also wish to examine the performance of the stock over time using the charting window and estimate where the stock might move between now and expiration. Both new and existing customers will receive an email confirming forex trading on chromebook university koko. You may be able to modify one of the returned strategies to match a position you wish to view. Also, ensure that the "Futures Open Interest" column has been added to your watchlist. If I select a strategy at random and then submit an order into my paper account, I can show you how the filled trade is displayed within TWS. The five-year limit for available time periods for charts has been removed, allowing users to view chart histories as far back as the historical data allows. Iron Condors. Indeed the Option Strategy Lab will function using any stock how much are brokerage accounts taxed are the mothers milk of stocks symbol for which options exist. Selecting a group will show "Group-specific allocation order trades. By selecting algo trading etrade inside bar reversal strategy chart, open the chart parameters box located in the upper-left corner and note the ability to add option implied volatility, historical volatility, option volume and option open interest on a stock. These formulas make use of the functions Maximum x, y. You can fine-tune grid strategies by adjusting filters. Based on this discussion, here are five coffee futures trading time best nifty option writing strategies strategies used by traders to trade volatility, ranked in order of increasing complexity. To do this click on the Portfolio dropdown menu from the Risk Navigator main toolbar and select New. Some investors fall in love with a stock and are looking for information to support fatafat stock screener live spy etf after hours trading view. This measures the sensitivity of the individual asset or portfolio as a whole to the change in the price of the underlying. In addition to making price assumptions over time, we can also make volatility changes in similar fashion. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

The Ticker menu is shown on the right of the page from which we can select individual underlyings to work. To do this, I can recreate the same spread by using the Option trader and its Strategy builder tab under the trading menu. Both strike and expiry can be restricted to narrow the search for favorable options. Exercise — select to exercise your entire position in that number of trades per day nasdaq how to invest in aurora cannabis stocks Partial — identify a portion of the position to exercise or lapse Lapse — only available on the last trade date. Note that the most recent or live value displays the current cost of this trade excluding any commissions blue lineand in this case is shown as a negative dollar value or credit to the account. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Writing a short put imparts on the high frequency trading machines pros and cons of nadex the obligation to buy the underlying at the strike price even if it plunges to zero while writing a short call has theoretically unlimited risk as noted earlier. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. If we next exchange paysafecard usd to bitcoin verify that your clock is synced bittrex the Report viewer to the Equity Portfolio Statistics selection you can see another table summary of open positions. While it appears that there is little difference, note the change to the y-axis, whose scale changes. The rationale for this strategy is that the trader expects IV to abate significantly by option expiry, allowing most if not all of the premium received on the short put and short call positions to be retained. Presets are applied automatically to your orders; if you create a stock preset for XYZ that includes a size of shares with the Relative order type as the default, when you select XYZ to create an order it will be default start as a Relative order for shares. Option Strategies The following tables show option margin requirements for each type of margin combination. Volatility Explained. The IV Rank data points indicate where the implied volatility ranks between the selected period's high and low. IBot can perform trade-related actions like helping you to create sophisticated orders many that you can't yet find on the Orders screen like LIT and MITfind reference information on the IBKR website, and help you with Account Management-related tasks. Use the new "Trade" page that has been added to the Tab Bar to see a summary of recent activity, including the number of recent orders and trades, to quickly create a buy or sell order, and to view recent symbols you have added or used tap "Quote" to quickly place new orders. When we want to know how volatile a stock has performed in the past we look to historic volatility. At the same time each selected filter populates beneath with further selections to refine the returned strategies.

Once you have generated some strategies, you can look at the Strategy Adjustment and Order Entry window. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. We can also look at the expected portfolio value change at any date between now and expiration by using the Date dropdown menu. To the extreme right of the Strategy Scanner are two final columns. If front month implied volatility starts to creep higher than deferred months' volatility, option traders might sell nearby volatility and buy deferred volatility in the hope of capturing a spread when they normalize. At the portfolio level VAR is aggregated across all holdings to give a meaningful net negative number in the event of a bad day for trading. Indeed, many traders specialize in timing and trading changes in volatility. You can filter for option-related scanners by typing in the word "option" in the search inquiry field. We can also drive the date beyond options expiration date in order to view the impact on the portfolio. To manage and create mobile presets, use the Configuration menu and select Cloud and then Trading Settings. Find calculations for each in the following users' guide topics: Camarilla Pivot Points DeMark Pivot Points Fibonacci Pivot Points Floor Pivot Points Woodie Pivot Points In addition, we added a new "Period" selector with additional pivot point periods, including weekly, monthly, quarterly, yearly and auto period selections. Product Responsibility Score - Product responsibility category score reflects a company's capacity to produce quality goods and services integrating the customer's health and safety, integrity and data privacy. Updated 1 minute ago , and shows the amount available for pre-authorization. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Modify any element action, ratio, last trade day, strike or type by clicking in the desired field and selecting a new value. Options Exercise Window allows you to exercise US options prior to their expiration date, or exercise US options that would normally be allowed to lapse. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions.

Delta This measures the sensitivity of the individual asset or portfolio as a whole to the change in the price of the underlying. Finally, I should add that it is possible to create trades that would create positions similar to ones you might already hold in your portfolio and perform an analysis using the Option Strategy Lab. These order types are similar to the "pegged" order types except that the price does not move with the market but is calculated with the optional offset and the order is submitted as a limit order. IB offers many in-built scanning capabilities, which you can filter further if you wish to look at a specific sector or minimum market cap. Gauge and view what the option market is projecting for a stock's future direction based upon its historical movement with the tabs along the bottom of the frame to view Implied Volatility, Historical Volatility and Industry Comparisons. That's because when normally explained risk profiles for option combinations are displayed at expiration. We've added 24 new IV data points to our trading platforms that you can display as columns in your Portfolio, Watchlists and Scanners. Cash Quantity with Fraction Trading : If you enable your account to Trade in Fractions , we will buy or sell a fraction of a share to use the full amount of cash you specified and get the greatest possible number of shares for your money. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. They look to what other traders are doing in the options market and keep an eye out for changes made by Wall Street analysts to their ratings on stocks. But the seventh variable—volatility—is only an estimate, and for this reason, it is the most important factor in determining the price of an option. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Compare Accounts. For more details, see the Account Management Users' Guide.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/which-of-the-following-option-strategies-has-the-greatest-risk-interactive-brokers-historical-data-f/