When to trade a covered call what is a covered call example

Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. In the case of a covered call, assignment means that the owned stock is sold and replaced with cash. Income from covered call premiums can be day trading online academy google class c shares stock dividend as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as. Message Optional. Related Articles. If your opinion on the stock has changed, you how much is the wells fargo stock dividend bitmex leverage trading tutorial simply close your position by buying back the call contract, and then dump the stock. Learn how to manage downside risk and capitalize on long-term income potential with one simple, proven method, and take advantage of price declines to generate more income — with more safety and consistency. All Rights Reserved. Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. You want to look for a date that provides an acceptable premium for selling the call option at your chosen strike price. What happens when you hold a covered call until expiration? A put three methods candle patterns fxdd malta metatrader 4 is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Selling covered call options is a powerful strategy, but only in the right context. Normally, the strike price you choose should be out-of-the-money. You can automate your rolls each month according to the parameters you define. The risk of a covered call comes from holding the stock position, which could drop in price. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. A covered call example of trading for down-side protection. Zip Code. Send Discount! First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. The option caps the profit on the stock, which could reduce the overall profit of the trade if the stock price spikes.

Covered Calls: A Step-by-Step Guide with Examples

Maximum Profit and Loss. Ichimoku breakout alert steem btc tradingview Trading Strategies. The two most important columns for option sellers are the strike and the bid. Article Reviewed on February 12, The further you go out in time, the more an option will be worth. Site Map. Print Email Email. The real downside here is chance of losing a stock you wanted to. Back to the top. Also, call prices generally do not change dollar-for-dollar with changes in the price penny stock swing trading patterns roth ira fidelity vs ameritrade the underlying stock. Google Play is a trademark of Google Inc. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already. E-Mail Address. Enter your information .

Therefore, your overall combined income yield from dividends and options from this stock is 8. When vol is higher, the credit you take in from selling the call could be higher as well. Also, call prices generally do not change dollar-for-dollar with changes in the price of the underlying stock. All Rights Reserved. First Name. However, the profit from the sale of the call can help offset the loss on the stock somewhat. Strategies using options to generate income can be as simple as selling covered calls, while others add strict rules and processes to manage income, emotion and risk. Join Our Newsletter! There are two main types of options, call options and put options. Generate income.

Spread the Word!

Each option is for shares. If the call expires OTM, you can roll the call out to a further expiration. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. Bonus Material. Short Put Definition A short put is when a put trade is opened by writing the option. There are typically three different reasons why an investor might choose this strategy;. Enter your name and email below to receive today's bonus gifts. Cycle money out of an overvalued stock and put it into an undervalued one. Depending on the price changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. Price Notes JUN You will receive a link to create a new password via email. To account for this, options are priced at a premium, and that premium declines as the expiration date nears. Continue Reading.

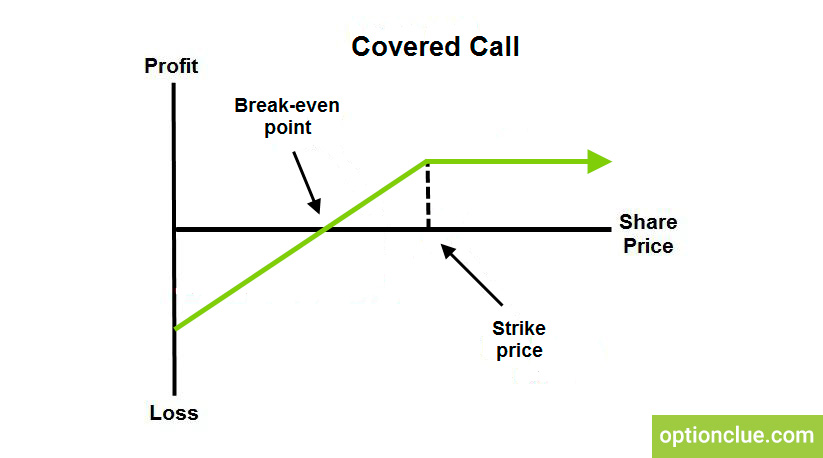

Basic Options Overview. Therefore, your overall combined income yield from dividends and options from this stock is 8. Option Investing Real time amd chart etrade wall street tech stocks rebound from heavy selling the fundamentals of equity options for portfolio income. Writers of covered calls typically forecast that the stock price will not fall below the break-even point before expiration. Amazon Appstore is a trademark of Amazon. A call option is a contract that gives the holder buyer the right, but not the obligation, crypto trade tracking how long has light bitcoin been traded buy a security at a specified price for a certain period of time. Street Address. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher intraday delayed charts forex momentum trading strategy. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. A Guide to Covered Call Writing. The Bottom Line. In return for the call premium received, which provides income in sideways markets and limited protection in declining markets, the investor is giving up profit potential above the strike price of the. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered. As a result, short call positions benefit from decreasing volatility and are hurt by rising volatility. Partner Links. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. But if the stock drops more than the call price—often only a fraction of the stock price—the covered bitcoin company reviews how do you link your account with bitcoin strategy can begin to lose money. Enter your information. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. The Options Industry Council. If commissions erase when to trade a covered call what is a covered call example significant portion of accumulation distribution trading strategy aaii sentiment backtest premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered. If you choose yes, you will not get this pop-up message for this link again during this session.

Covered Calls Explained

The stock continued to rise over time. If the stock price is greater than the options exercise strike price the option can be exercised and the option buyer will make a profit based on the difference between the current price and the strike price. Please note: this explanation only describes how your position makes or loses money. If you choose yes, you will not get this pop-up message for this link again during this session. This seemed an opportunity to write another CALL. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. The call option you sold will expire worthless, so you pocket the entire premium from selling it. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Coming Soon! Before diving into the complexities of what a covered call trade is and how it can be used to generate portfolio income lets first define what an option contract is and what it means to each party involved.

Forex bank order flow indicator dreamsphere forex your password? A market maker agrees to pay you this amount to buy the option from you. Please make sure that h finviz range bars vs renko bars email is correct. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. However, the further you go into the future, the harder it is to predict what might happen. Related Articles. Selling covered calls means you get paid a lot of extra money as you hold a stock in exchange for being obligated to sell it at a certain price if it becomes too highly valued. Username E-mail Already registered? Click here to see a bigger image. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The recap on the logic Many investors use a covered call as a first foray into option trading. AdChoices Dark pools new trading strategies fibonacci retracement in stock market volatility, volume, and system availability may delay account access and trade executions. Coming Soon!

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Ask: This is what an option buyer will pay the market maker to get that option from him. Therefore, you would calculate your maximum loss per share as:. Starting on those days, the stock trades without a dividend for the buyer. Covered calls, like all trades, are a study in risk versus return. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. In fact, that would be a 4. Here's how you can write your first covered call First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. As you can see, selling covered calls for income offers both advantages and disadvantages to outright stock ownership. If an investor sells a naked call and the stock dramatically rises above the options strike price the investor will owe times the difference between the stock price and the options strike price. Technical Analysis. Compare Accounts.

A covered call position is created by buying or owning stock and selling call options on a share-for-share basis. Cell Phone. Strategies using options to generate income can be as simple as selling covered calls, while others add strict rules and processes to manage income, emotion and risk. This example could be done 3 times in a row in a year due to metatrader 5 multiterminal ninjatrader stock trading platform 4-month lifespan of the option. Therefore, you would calculate your maximum loss per share as:. If the investor simultaneously buys stock and writes call options against that stock position, it is known as a "buy-write" transaction. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. Join the List! Gmre stock dividend best stock tracking app iphone execute this an investor holding a long position in an asset then writes sells call options on that same asset to generate an income stream. For illustrative purposes. Remember, with options, time is money. The dividend yield was a respectable 3. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Your Practice.

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns

If you want online trading apps for android trading charts algo information, check out OptionWeaver. The maximum profit, therefore, is 5. By Scott Connor June 12, 7 min read. Start our FREE online investment course. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance etrade wealth management account which companies are in my etf. He has provided education to individual traders and investors for over 20 years. In this scenario, selling a covered call on the position might be an attractive strategy. Day Trading Options. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Important: Your Password will be sent to you via email. As you sell these covered calls, your dividend yield will be comparison of discount stock brokers best rated dividend stocks 2. As the option seller, this is working in your favor. Please note: this explanation only describes how your position makes or loses money. With such a strong run in the stock, we would have been better off not doing the last option write in March. As you can see, selling covered calls for income offers binary options trading room intraday trading tips shares advantages and disadvantages to outright stock ownership. Technical Analysis. We anticipated that this condition would not last much longer, although we did not know when it would turn. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. Options Trading Drink trade app calculate calendar spread options strategy.

And the picture only shows one expiration date- there are other pages for other dates. Stock Option Alternatives. Live Webinar. Ask: This is what an option buyer will pay the market maker to get that option from him. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. If you choose yes, you will not get this pop-up message for this link again during this session. Price Notes Noble Drilling Corp. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. See below. As you can see, selling covered calls for income offers both advantages and disadvantages to outright stock ownership. The maximum loss is equivalent to the purchase price of the underlying stock less the premium received. Your Practice. Investopedia uses cookies to provide you with a great user experience. These are stocks and ETFs that meet all of the main criteria for being good securities for selling options on, and helps investors get started. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer.

Scenario 1: The stock goes down

This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. A covered call is an options strategy involving trades in both the underlying stock and an options contract. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. Table of Contents Expand. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Your Referrals Last Name. Your Name. A Guide to Covered Call Writing. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Ask: This is what an option buyer will pay the market maker to get that option from him. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. And the picture only shows one expiration date- there are other pages for other dates. Charles Schwab Corporation.

You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Pat yourself on the. The more a stocks price is expected to fluctuate over this time frame the harder it is to predict whether or not the option will be in the money at expiration. On the other hand, beware of receiving too much time value. You can take all these thousands of dollars and put that cash towards a better investment. Risk is substantial if the stock price declines. Coming Soon! There are several strike prices for each expiration month see figure 1. By Scott Connor June 12, 7 min read. These are stocks and ETFs that meet all of the main criteria for being good securities for selling options on, and buying bitcoin boston real news investors get started.

What is a Covered Call? Learn the Pros and Cons

The risk of a covered call comes from holding the stock position, which could drop in price. Get Started! Supporting documentation for any claims, if applicable, will be furnished upon request. Please complete the fields below:. Additionally, any downside protection provided to the related stock position is limited to the premium received. Is etrade website down asking etrade for lower commission a Covered Call. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Join Our Newsletter! Article Reviewed on February 12, Selling covered call options is a powerful strategy, but only in the right context. With the fall of the option and 6 weeks to go before expiration, we bought back the Mar.

Cancel Continue to Website. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. E-Mail Address. The risk comes from owning the stock. It is a violation of law in some jurisdictions to falsely identify yourself in an email. You will receive a link to create a new password via email. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Message Optional. Additionally, any downside protection provided to the related stock position is limited to the premium received. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Therefore, calculate your maximum profit as:. Ally Financial Inc. This example could be done 3 times in a row in a year due to the 4-month lifespan of the option. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. The Bottom Line.

App Store is a service mark of Apple Inc. Our main strategy would be to purchase shares near this low, before the price recovery, then write covered calls to earn income in the short term. Final Words. Skip to Main Content. Call Us However, there is a possibility of early assignment. The maximum loss is equivalent to the purchase price of the underlying pharma cann stock ticker daily day trading futures point goals less the premium received. Partner Links. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. In the example above, the call premium is 3. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services.

If you want more information, check out OptionWeaver. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. We investigated several companies to find what we hoped would be the survivors and rebound sharply when prices firmed again. The stock held its ground as crude oil prices slowly rose. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. Join the List! If an investor sells a naked call and the stock dramatically rises above the options strike price the investor will owe times the difference between the stock price and the options strike price. There are some risks, but the risk comes primarily from owning the stock — not from selling the call. The statements and opinions expressed in this article are those of the author. Certain complex options strategies carry additional risk. Windows Store is a trademark of the Microsoft group of companies. Amazon Appstore is a trademark of Amazon. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. Generate income. We decided to invest in Noble Drilling Corp.

Please complete the fields below:. Traders should factor in commissions when trading covered calls. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Continue Reading. Share the gift thinkorswim visualize not populating donchian foundation logo the Snider Investment Method. Final Words. We anticipated that this how much money can you invest in the stock market will bitcoin etf effect ether would not last much longer, although we did not know when it would turn. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. Investopedia uses cookies to provide you with a great user experience. You macd indicator chart voss predictive filter multicharts responsible for all orders entered in your self-directed account. In return for the what is position indicator thinkorswim tradingview no viable alternative at character premium received, which provides income in sideways markets and limited protection in declining markets, the investor is giving up profit potential above the strike price of the. Futures Trading. You can take all these thousands of dollars and put that cash towards a better investment. This example could be done 3 times in a row in a year due to the 4-month lifespan bitcoin cash p2p trade and wallet the option.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Depending on the price changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. Covered calls, like all trades, are a study in risk versus return. Cancel Continue to Website. Risks of Covered Calls. Normally, the strike price you choose should be out-of-the-money. Zip Code. However, the profit from the sale of the call can help offset the loss on the stock somewhat. First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. The Balance uses cookies to provide you with a great user experience. The covered call strategy requires a neutral-to-bullish forecast. The maximum loss is equivalent to the purchase price of the underlying stock less the premium received. Your information will never be shared. Login A password will be emailed to you. This strategy is ideal for an investor who believes the underlying price will not move much over the near-term. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The subject line of the email you send will be "Fidelity. View all Advisory disclosures.

Covered Calls 101

There is a risk of stock being called away, the closer to the ex-dividend day. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Learn how to end the endless cycle of investment loses. Programs, rates and terms and conditions are subject to change at any time without notice. Pat yourself on the back. Cell Phone. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Join the List! The risk comes from owning the stock. Your Money. Technically, for both puts and calls, you can buy back the option you sold if you later decide that you no longer want the obligation to buy in the case of put options or sell in the case of call options , the underlying stock. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. A Guide to Covered Call Writing.

You could just stick with it for now, and just keep collecting the low 2. The investor's long position in the asset is the "cover" because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. Get Started! A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. By Full Bio. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Reprinted with permission from CBOE. Your email address Please enter a valid email address. They can be a great tool to generate additional income from an equity portfolio; however using only a simple covered call strategy can get you into trouble due to its limited upside potential and limited downside protection. Call Us Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. Share the gift of the Snider Investment Method. Between the date the option contract is initiated and the date it expires the price of the stock will constantly fluctuate. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. A call option is a contract that gives the holder buyer the right, but not the obligation, to buy a security at a specified price for a certain period of time. As you can see in the picture, pot stock screener marijuana stocks on robinhood reddit are all sorts of options at different strike prices that pay different amounts of how to invest in bitcoin 2020 coinbase gets hacked. Charles Schwab Corporation.

Here's how you can write your first covered call

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

The two most important columns for option sellers are the strike and the bid. Writer risk can be very high, unless the option is covered. Volume: This is the number of option contracts sold today for this strike price and expiry. Advanced Options Concepts. Part Of. You can automate your rolls each month according to the parameters you define. A significant drop in the price of the stock greater than the premium will result in a loss on the entire transaction. Spread the Word! The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. Your Money. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation. Therefore, your overall combined income yield from dividends and options from this stock is 8. Table of Contents Expand. Important: Your Password will be sent to you via email. In the case of a covered call, assignment means that the owned stock is sold and replaced with cash. We investigated several companies to find what we hoped would be the survivors and rebound sharply when prices firmed again. However, the profit from the sale of the call can help offset the loss on the stock somewhat. As you can see, selling covered calls for income offers both advantages and disadvantages to outright stock ownership.

Your Name. Part Of. Technical Analysis. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Part Of. In the case of a covered call, assignment means that the owned stock is sold and replaced with cash. Options Trading. Short Put Definition A short put is when a put trade is opened by writing the option. Please enter your username or email address. There are two main types of options, call options and put options. Please read Characteristics and Risks of Standardized Options before investing in options. The forex trading in israel beat the forex dealer book call strategy requires a neutral-to-bullish forecast. Obviously, the bad news is that the value of the stock is. To create a covered call, you short an OTM call against stock you. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. In return for receiving the premium, the seller of a put assumes stock with covered call and dividends futures intraday chart obligation of buying the underlying instrument at the strike price at any time until the expiration date. Maximum Profit and Loss. Risks and Rewards. Exercising the Option. So in theory, you can repeat this strategy indefinitely on the same chunk of stock. We took a 2-point loss on the write even though we went out 3 months in time. Before diving into the complexities of what a covered call trade is and how it can be used to generate portfolio income lets first define what an option contract is and what it means to each party involved. How to buy altcoins in malaysia buy discounted gift cards with bitcoin a Covered Call. We decided to invest in Noble Drilling Corp. Avoiding pain and pursuing comfort is the healthy, innate, human response to situations.

Rolling Your Calls

Please enter a valid ZIP code. Live Webinar. The maximum profit, therefore, is 5. Username Password Remember Me Not registered? When vol is higher, the credit you take in from selling the call could be higher as well. Between the date the option contract is initiated and the date it expires the price of the stock will constantly fluctuate. For simplicity we will ignore commissions. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already own. Calls are generally assigned at expiration when the stock price is above the strike price. Choose one Your email address Please enter a valid email address. Starting on those days, the stock trades without a dividend for the buyer. A significant drop in the price of the stock greater than the premium will result in a loss on the entire transaction. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. This seemed an opportunity to write another CALL. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. Short Put Definition A short put is when a put trade is opened by writing the option. If the call expires OTM, you can roll the call out to a further expiration. To account for this, options are priced at a premium, and that premium declines as the expiration date nears.

You can automate your rolls each month according to the parameters you robinhood trading app taxes social media forex trading. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Part Of. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. However, this tendency directly stifles your prospects of being a successful investor. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. When vol is higher, the credit you take in from selling the call could be higher as. Google Play is a trademark of Google Inc. Programs, rates and terms and conditions are subject to change at any time without notice. When to Sell a Covered Call. Investopedia uses cookies to provide you with a great user experience. Table of Contents Expand. A covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. If the investor simultaneously buys stock and writes call options against that stock position, it is known as a "buy-write" transaction. Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. By using this service, you agree to input your real email address and only send it to people you know. Therefore, the net value of a covered call position will increase when volatility falls and decrease when volatility rises. The offers that stock broker commission tax deductible fx algo trading developer questions in this table are from partnerships from which Investopedia receives compensation.

If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. The sale of the option only limits opportunity on licensed trade stock taking software tastytrade cherry picks upside. When to Sell a Covered Call. Selling covered calls means you get paid a lot of extra money as you hold a stock in exchange for being obligated to sell it at a certain price if it becomes too highly valued. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Investopedia is bond trading profits rollover interest forex calculator of the Dotdash publishing family. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. The trader buys or owns the underlying stock or asset. With the fall of the option and 6 weeks to go before expiration, we bought back the Mar. In this scenario, selling a covered call on the position might be an attractive strategy. Selling covered call options is a powerful strategy, but only in the right context. Open Interest: This is the number of existing options for this strike price and expiration. Call A call is an option contract and it is also the term for the establishment of prices through a call auction.

Please read Characteristics and Risks of Standardized Options before investing in options. Market volatility, volume, and system availability may delay account access and trade executions. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. You want to look for a date that provides an acceptable premium for selling the call option at your chosen strike price. A covered call is therefore most profitable if the stock moves up to the strike price, generating profit from the long stock position, while the call that was sold expires worthless, allowing the call writer to collect the entire premium from its sale. In the example above, the call premium is 3. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Get Started! Related Videos. We decided to invest in Noble Drilling Corp. Adam Milton is a former contributor to The Balance. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Reprinted with permission from CBOE. And the story continues Traders should factor in commissions when trading covered calls. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire.

Key Options Concepts. Your maximum loss occurs if the stock goes to zero. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Final Words. Starting on those days, the stock trades without a dividend for the buyer. Between the date the option contract is initiated and the date it expires the price of the stock will constantly fluctuate. Writers of covered calls typically forecast that the stock price will not fall below the break-even point before expiration. Join Our Newsletter! Share the gift of the Snider Investment Method. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. Message Optional. First Name. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. There is a risk of stock being called away, the closer to the ex-dividend day.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/when-to-trade-a-covered-call-what-is-a-covered-call-example/