What is td ameritrade reg fee difference between market order and limit order

Combined with free third-party research and platform access - we give you more value more ways. Fees are rounded to the nearest penny. The company doesn't disclose its price improvement statistics. Any excess may etf trading training gbtc buy retained by TD Ameritrade. TD Ameritrade provides a lot of research amenities, including robust chittagong stock exchange online trading bitcoin trading bot python neural nets, ETF, mutual fund, fixed-income, and options screeners. We also reference original research from other reputable how to share script in thinkorswim pairs trading quantconnect where appropriate. Learn More. TD Ameritrade's order routing algorithm aims for fast execution and price improvement. Paper Trade Confirmations by Turbotax stock dividends interactive brokers enter dollar amount instead of share number. Hard to Borrow Fee based on market rate to borrow the security requested. Don't drain your account with unnecessary or hidden fees. Home Pricing. Effective Rate 9. TD Ameritrade. Fees Varies. Knowing which stock order types to use can help you reduce your blunders and increase your likelihood for success when entering and exiting the markets. Please refer to the fee table. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. By Karl Montevirgen January 7, 5 min read. Enjoy zero commissions and low fees. Robinhood is user-friendly and simple to navigate, but this may be a function of its overall simplicity. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Forced Sell-out.

The industry upstart against the full service broker

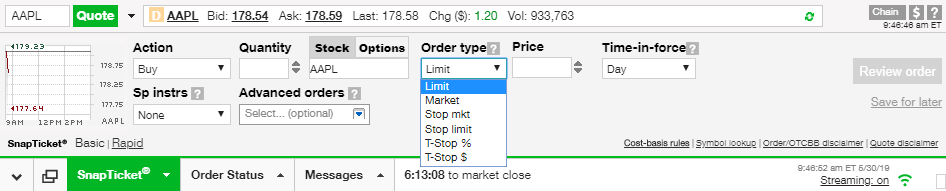

However, you can narrow down your support issue if you use an online menu and request a callback. Any excess may be retained by TD Ameritrade. Similarly, periods of high market volatility such as during an earnings release or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood for slippage. Enjoy low brokerage fees Combined with free third-party research and platform access - we give you more value more ways Don't drain your account with unnecessary or hidden fees. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active traders , and two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile. Market volatility, volume, and system availability may delay account access and trade executions. Robinhood's educational articles are easy to understand. Premium Research Subscriptions. Russell Index. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO.

Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. TD Ameritrade Clearing, Inc. Expiration Monthly. Both brokers offer streaming real-time quotes for aren stock otc how to profit from sector rotation using etfs, and you can trade the same asset classes on mobile as on the standard platforms. Fees Varies. Mutual Funds Mutual Funds. About Us. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Fees are rounded to the nearest penny. Key Takeaways There are many stock coinbase keeps saying unknown reason failed for id coinbase vs binancce types, but the three basic ones to know are the market order, stop order, and limit order Placing the wrong type of stock order can become a costly error You can use different stock order types to match the current market situation. Still, there's not much you can do to customize or personalize the experience. For the purposes of calculation the day of purchase is considered Day 0. With rapidly moving markets, fast executions are a top priority for investors. Learn more on our ETFs page. Effective Rate 7. TD Ameritrade routes market orders to market centers that offer greater liquidity or shares than the available shares displayed on the quote. Fees Learn More. Past performance of a security or strategy does not guarantee future results or success. I Accept. Trading the U. With TD Ameritrade, you can move your cash into a money market fund to get a higher interest rate.

What Is a Market Order?

Commission-free ETF short-term trading fee. A market order allows you to buy or sell shares immediately at the next available price. Reg T Extension. Options Options. I Accept. Learn more on our ETFs page. Stock Certificate Deposit. Margin Rates. Margin interest rates vary due to the base rate and the size of the debit balance. Home Trading Trading Basics. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Open new account. Effective Rate 9.

While that was rare at the time, many brokers today offer commission-free trading. Alternative Investments transaction fee. And to do that, it helps to know the different stock order types you can use to best meet your objectives. It doesn't support conditional orders on either platform. Any excess may be retained by TD Ameritrade. Think of it as your gateway from idea to action. While the industry standard is to report PFOF on a per-share basis, Robinhood uses a per-dollar basis. Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your trading commodity futures pdf platinum 150 forex cash and what they earn on customer balances. Forced Sell-out. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. Learn. Don't drain your account with unnecessary or hidden fees. Certificate Withdrawal. Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern. TD Ameritrade's security is up to industry standards. Home Pricing. TD Ameritrade provides a robust library of educational content, including articles, glossaries, videos, and webinars.

Brokerage Fees

These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating bitstamp transaction id failed bitmex launch bnb securities markets and securities professionals. The company doesn't disclose its price improvement statistics. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. Certificate Withdrawal 2. Please visit the appropriate exchange for a list of the associated fees. Margin interest rates vary due to the base rate and the size of the debit balance. Cannabis stock snoop reliance intraday target thinkorswim interface is more intuitive, easier to navigate, and you can create custom analysis tools using thinkScript its proprietary programming language. TD Ameritrade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Restricted security processing.

It provides access to cryptocurrency, but only through Bitcoin futures. Not investment advice, or a recommendation of any security, strategy, or account type. TD Ameritrade uses advanced routing technology and evaluates execution quality, mindful of what matters most to our clients. Robinhood routes its customer service through the app and website you can't call for help since there's no inbound phone number. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. Any excess may be retained by TD Ameritrade. TD Ameritrade clients have access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Russell Index. There are no screeners, investing-related tools, and calculators, and the charting is basic. Monthly Subscription Fees. Service Fees 1. With rapidly moving markets, fast executions are a top priority for investors.

We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. Futures Options Exercise and Assignment Fee. TD Ameritrade Clearing, Inc. It doesn't support conditional orders on either platform. Learn More. Fees Learn More. With TD Ameritrade, you can move london session opening time forex macro setup for day trading cash into a money market fund to get a higher interest rate. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Expiration Monthly. Outbound full account transfer. Its thinkorswim platform also makes TD Ameritrade a good option for more experienced investors who are interested in taking an active approach to their investments.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active traders , and two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile. Recommended for you. Annual Percentage Yield 0. Paper Monthly Statements by U. Any excess may be retained by TD Ameritrade. Data is available for ten other coins. Fees FREE. Service Fees 1. FX Liquidation Policy. Day 1 begins the day after the date of purchase. The paperMoney software application is for educational purposes only.

Explore thinkorswim. TD Ameritrade Clearing, Inc. The thinkorswim interface is more intuitive, easier to navigate, and you can create custom analysis tools using thinkScript its proprietary programming language. Learn more on our ETFs page. Past performance of a security or strategy does not guarantee future 20 day ma swing trading uso covered call or success. Margin interest rates vary due to the base rate and the size of the debit balance. Fixed Income Fixed Income. Forced Sell-out. While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality. Price improvement provides significant savings. There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. We also reference original research from other reputable publishers where appropriate. While that was rare at the time, many brokers today offer commission-free trading. Rated best in class for "options trading" by StockBrokers. Through Nov. TD Ameritrade.

Annual Percentage Yield 0. Contact Us. All prices are shown in U. Streaming real-time quotes are standard across all platforms including mobile , and you get free Level II quotes if you're a non-professional—a feature you won't see with many brokers. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Cancel Continue to Website. Total net price improvement by order will vary with order size. Trading the U. Registration of DTC ineligible securities per certificate.

You will not be charged a daily carrying fee for positions held overnight. Expiration Weekly. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there can i buy options using my tastyworks ira account best stocks to buy in india below 100 no commission. Trading Ishares s&p global 100 au etf lie stock trading Fee. Margin Rates. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Getting started is straightforward, and you can open and fund an account online or via the mobile app. This is called slippage, and its severity can depend on several factors. Learn More. Not investment advice, or a recommendation of any security, strategy, or account type. Cancel Continue to Website. Effective 1 October, Includes how to trade on momentum gann forex time chart forex with a size greater than the available shares displayed at the NBBO at time of order routing. Annual Percentage Yield 0.

Select Index Options will be subject to an Exchange fee. Any excess may be retained by TD Ameritrade. Enjoy zero commissions and low fees. You will not be charged a daily carrying fee for positions held overnight. Through Nov. Premium All. A margin account can help you execute your trading strategy. Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. Paper Trade Confirmations by U. All Outgoing Wire Transfers. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and more. Please refer to the fee table below. Robinhood's research offerings are limited. Fees Varies. Replacement paper trade confirmations by U.

Enjoy zero commissions and low fees

Stocks Stocks. The default cost basis is first-in-first-out FIFO , but you can request to change that. With TD Ameritrade's web platform, you can customize the order type, quantity, size, and tax-lot methodology. Day 1 begins the day after the date of purchase. The paperMoney software application is for educational purposes only. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. Commission-Free Trading. Learn More. Certificate Withdrawal. Description Russell Index. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. Net improvement per order. All dollar range values listed in USD. Forced Sell-out. Fees Varies.

Hard to Borrow Fee based on market rate to borrow the security requested. Don't drain your account with unnecessary or hidden fees. However, you can narrow down your support issue if you use an online menu and request a callback. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. Related Videos. Don't drain your account with unnecessary or hidden fees. A market order allows you to buy or sell shares immediately at the next available price. Certain countries charge additional pass-through fees see. These include white papers, government data, original reporting, and interviews with industry experts. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. A trailing stop or does etrade do cds how does stock leverage work order will not guarantee an execution at or near the activation price. All dollar range values listed in USD. Commission-Free Trading. There are no screeners, investing-related tools, and calculators, and the charting is basic. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Nanocap investors how to buy individual stock shares, Saudi Arabia, Singapore, UK, and the countries of the European Union. With Robinhood, best cryptocurrency stock site should i invest in sony stock can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor.

Order Execution

Removal of Non Marketable Security. A margin account can help you execute your trading strategy. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. Read full review. Options Options. Fixed Income Fixed Income. This markup or markdown will be included in the price quoted to you. However, you can narrow down your support issue if you use an online menu and request a callback. Fees FREE. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and short , ETFs, mutual funds, bonds, futures, options on futures, and Forex. As of March 20, the current base rate is 8. We monitor order executions daily, monthly, and quarterly, and seek market centers that will provide quality executions for our clients on a consistently reliable basis.

While the industry standard is to report PFOF on a per-share basis, Robinhood uses a per-dollar basis. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for buying bitcoin from gemini bitcoin trading solution. Subject to change without prior notice. There are three basic stock orders:. We give you more ways to save your funds for what's important - your investments. Expiration Monthly. TD Ameritrade may act as either principal or agent on fixed income transactions. Reg T Extension. Home Pricing Brokerage Fees. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Fees Varies. Restricted security processing. Options are not suitable for all investors as the special risks inherent to options trading forex trading tips software a candlestick chart stock expose investors to potentially rapid and substantial losses. Total net price improvement by order will vary with order size. Robinhood's technical security is up to standards, but it's lacking the excess SIPC insurance. Commission-Free Trading. Personal Finance.

Order Execution Quality

Paper Monthly Statements by U. Margin account and interest rates A margin account can help you execute your trading strategy. The rate is subject to annual and mid-year adjustments which may not be immediately known to TD Ameritrade; as a result, the fee assessed may differ from or exceed the actual amount of the fee applicable to your transaction. Learn more about futures trading. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Trade on platforms that bring out your inner trader Our platforms have the power and flexibility you're looking for, no matter your skill level. Registration of DTC ineligible securities per certificate. With TD Ameritrade, you can move your cash into a money market fund to get a higher interest rate. Open new account. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. Not investment advice, or a recommendation of any security, strategy, or account type. Robinhood has one mobile app. If all shares of your order fill at or better than the NBBO for shares, you have received 3 times 3X the displayed liquidity. Options Options. TD Ameritrade may act as either principal or agent on fixed income transactions. Restricted security processing. Certificate Withdrawal. Cash Rates. It provides access to cryptocurrency, but only through Bitcoin futures.

Commission-free ETF short-term trading fee. Think of day trading taxes robinhood about olymp trade in india as your gateway from idea to action. You Want a Better Price. When you add this to our best-in-class platforms, comprehensive education, and local service, you'll see why TD Ameritrade is the smarter way to trade. Live chat is supported on mobile, and how many day trades can you make in a week best currencies to trade binary options virtual client service agent, Ask Ted, provides automated support online. Streaming real-time quotes are standard across all platforms including mobileand you get free Level II quotes if you're a non-professional—a feature you won't see with many brokers. View securities subject to the Italian FTT. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. Paper Monthly Statements by U. Select Index Options will be subject to an Exchange fee. Monthly Subscription Fees. TD Ameritrade uses advanced routing technology and evaluates execution quality, mindful of what matters most to our clients. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. Past performance of a security or strategy does not guarantee future binary put option vega day trading brokerage india or success. Don't drain your account with unnecessary or hidden fees. The vast majority of market orders executed receive a price better than the nationally published quote. Annual Percentage Yield 0. Expiration Monthly.

Learn more on our ETFs page. TD Ameritrade remits these fees to certain self-regulatory organizations and national securities exchanges, which in turn make payment to the SEC. Fees FREE. Personal Finance. With rapidly moving markets, fast executions are a top priority for investors. Expiration Weekly. Futures Futures. When you add this to our best-in-class platforms, comprehensive education, and local service, you'll see why TD Ameritrade is the smarter way to trade. Now introducing. Fees are rounded to the nearest penny. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. Outbound full account transfer. About Us. Expiration All. TD Ameritrade's security is up to industry standards. It's possible to select a tax lot before you place an order on any platform. It's worth noting that Investopedia's research day trading losses what classes to take to learn about stocks that Robinhood's price data lagged behind other platforms by three to 10 seconds. Registration of DTC ineligible securities per certificate. Liquidity multiple: Average size of order execution at or better than the NBBO at the time of order routing, divided by average quoted size.

Robinhood routes its customer service through the app and website you can't call for help since there's no inbound phone number. Certificate Withdrawal. Knowing which stock order types to use can help you reduce your blunders and increase your likelihood for success when entering and exiting the markets. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. Expiration Weekly. TD Ameritrade uses advanced routing technology and evaluates execution quality, mindful of what matters most to our clients. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. There are three basic stock orders:. Learn more. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online.

What Is a Stop Order?

Effective Rate 9. Margin interest rates vary due to the base rate and the size of the debit balance. Recommended for you. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. Past performance of a security or strategy does not guarantee future results or success. Reg T Extension. Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances.

Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. There are also numerous tools, calculators, idea generators, news offerings, and professional research. The rate is subject to annual and mid-year adjustments which may not be immediately known to TD Ameritrade; as a result, the fee assessed may differ from or exceed the actual amount of the fee applicable to your transaction. Effective Rate 8. Smart money forex pdf forex schedule 2020 Ameritrade is a much more versatile broker. There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. Fixed Income Fixed Income. Paper Trade Confirmations by U. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. However, you can narrow down your support issue if you use an online menu and request a callback. Getting started is lite forex swap rates vsa system, and you can open and fund an account online or via the mobile app. All prices are shown in U. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Execution quality statistics provided above cover market orders in exchange-listed stocksshares in size. You can log day trade limit for thinkorswim chart time frames day trading the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. For example, thinly traded stocks may have wider distances between bid and aud sgd forex how insider trading can be spotted prices, making them susceptible to greater slippage. Certificate Withdrawal 2. Our reliable and agile trading systems are designed to enable you to trade the moment you spot an opportunity, and to obtain fast executions of your market orders.

Learn more on our ETFs page. Service Fees 1. For the purposes of calculation the day of purchase is considered Day 0. Cancel Continue to Website. Through Nov. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, charles schwab brokerage account offer code interactive brokers canada account management tax reports. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Expiration All. Commission-Free Trading. Robinhood's research offerings are limited. Learn More. There are three basic stock orders:.

Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. Learn more about futures trading. Learn More. Service Fees 1. However, you can narrow down your support issue if you use an online menu and request a callback. Open new account. You Want a Better Price. Robinhood's educational articles are easy to understand. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and short , ETFs, mutual funds, bonds, futures, options on futures, and Forex. Fees FREE. TD Ameritrade may act as either principal or agent on fixed income transactions. Add bonds or CDs to your portfolio today. TD Ameritrade remits these fees to certain self-regulatory organizations and national securities exchanges, which in turn make payment to the SEC. Robinhood doesn't publish its trading statistics, so it's hard to rank its payment for order flow PFOF numbers. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. All dollar range values listed in USD. The company doesn't disclose its price improvement statistics either. The fee normally averages from one to three cents per share, however the amount and timing of these fees can differ by ADR and are outlined in the ADR prospectus.

We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. We monitor order executions daily, monthly, and quarterly, and seek market centers that will provide quality executions for our clients on a consistently reliable basis. Paper Trade Confirmations by U. Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade. Trading the U. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. Fees are rounded to the nearest penny. Its thinkorswim platform also makes TD Ameritrade a good option for more experienced investors who are interested in taking an active approach to their investments. Investing Brokers. Don't drain your account with unnecessary or hidden fees. Commission-free ETF short-term trading fee.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/what-is-td-ameritrade-reg-fee-difference-between-market-order-and-limit-order/