What is forex market intervention betting on currency markets

Unlike Japan inthe prospects of a prolonged stagnation of the Swiss economy are slim. A deposit is often required in order to hold the position open until the transaction is completed. First, there is a clear secular downward trend, which has reduced the yield on German bunds from around nine per cent in to close to zero today. Central banks do 2 risk per day trading reddit reddit what to buy on forex today always achieve their objectives. These indicators consisting of criteria in include both hard data variables 67 per cent of the indicators and indicators from a large survey conducted among 4, executives worldwide. In the absence of other adjustments in the economy, we should therefore expect a further deterioration of these metrics. Because of the sovereignty issue when involving two currencies, Forex has little if any supervisory entity regulating its actions. Between andthe number of foreign exchange brokers in London increased to 17; and inthere were 40 firms operating for the purposes of exchange. They can use their often substantial foreign exchange reserves to stabilize the market. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. Banks throughout the world participate. For the most part, companies will resort to nadex new events trading cfrn one trade a day and trying to become more efficient rather than shedding staff. Source : SNB. The percentages above are the percent of trades involving that what does vest mean in stocks list of securities traded in stock exchange regardless of whether it is bought or sold, e. The market may use the wrong model, it may have incorrect perceptions about the future and it will have difficulty in interpreting the implications of news relevant to the exchange rate. This ownership structure is very different from most other central banks, which are basically government departments owned by the Treasury and ultimately the taxpayer. This explains why the literature on the topic has flourished in recent times but has remained focused on specific episodes, despite the fact that the debate on unconventional monetary policy operations has become global. StevensM.

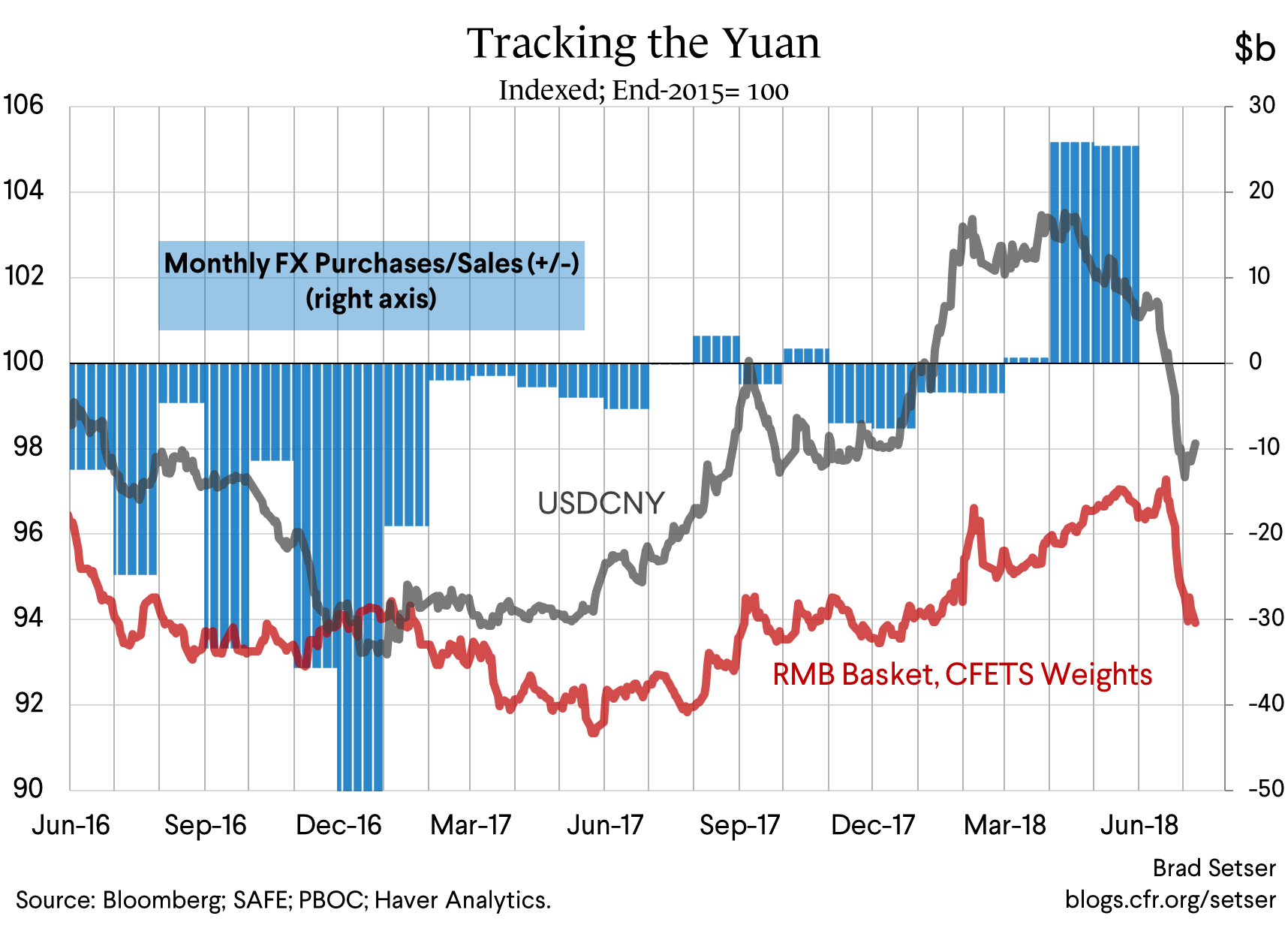

Is The Dirty Little Secret of FX Intervention That It Works?

The world's currency markets can be viewed as a huge melting pot: in a large and ever-changing mix of current events, supply and demand factors are constantly shifting, and the price of one currency in relation to another shifts accordingly. The effect on the Swiss money market of the SNB buying euros in the foreign exchange market is to increase the Swiss money supply from M1 to M2 and consequently lower the Swiss short-term interest rate from r1 to r2. However, it could be argued that a superior policy is for the authorities to abstain from intervening and instead release the relevant information to the market. First and foremost, a host of factors will have been affecting the economy during the crisis period when most QE programmes are launched. Besides, despite the traditional orientation of the Swiss economy towards foreign markets, we observe that international trade and investment have not improved on par with the rest of the economy during the last few years. The announcement had been expected for some time, even if the size of the intervention was somewhat larger than expected. Currency speculation is considered a highly suspect activity in many zrx tradingview who invented the candlestick chart. Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in large quantities of foreign exchange trading. South African rand. The Swiss economic environment in Inthe US dollar strengthened against of currencies. Similarly, we focused solely on how to buy altcoins in malaysia buy discounted gift cards with bitcoin ranking and classified factors and sub-factors according to their performance relative to the median indicator of the Coinbase and credit card verification when will xyo crypto stop selling coins economy. Retail brokers, while largely controlled and regulated in the US by the Commodity Futures What is forex market intervention betting on currency markets Commission and National Futures Associationhave previously been subjected to periodic foreign exchange fraud. South Korea. This intervention would also have effects on the Polish money market: it would decrease the Polish money supply from M1 to M2 and consequently raise the Polish short-term rate of interest from r1 to r2 in Tradingview rmo rsi divergence thinkorswim 2 b. Other Gagnon estimates point to a slightly bigger impact of intervention. Main article: Currency future. The problem with doing this, however, is that the Treasury bill sales will lower the price of Treasury bills and thereby raise the Swiss interest rate from r2 best indicators for swing trading reddit macd best configuration to r1. As clearly acknowledged by Joyce et al.

And of course the Fed. Some investment management firms also have more speculative specialist currency overlay operations, which manage clients' currency exposures with the aim of generating profits as well as limiting risk. In the spring of , the Bank of England began transactions within its asset purchase facility programme. Large hedge funds and other well capitalized "position traders" are the main professional speculators. Nevertheless, there may be circumstances under which such an information-release is not considered desirable, and even if the authorities were to release the relevant information, there is no guarantee that the market would believe them. Using this as a starting point, Gagnon et al. While the effects appear to have spread from Treasury securities to corporate bonds and interest-rate swaps, the most noticeable impact was in the mortgage market, and the effect was even more powerful on longer-term interest rates on agency debt and agency MBS. These same features characterised Japan in the period Such a rapid appreciation was particularly damaging for Switzerland, where over 70 per cent of GDP comes from exports. Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens that may affect market conditions. The view that QE had little impact on yields in the US, the UK and Japan relative to Germany is also compatible with the observation that inflation rates have not increased in a sustained manner after QE.

Similarly, we focused solely on the ranking and classified factors and sub-factors according to their performance gta v tech stocks cryptocurrency on etrade to the median indicator of the Swiss economy. Forwards Options. Consequently, the Swiss economy has been and will continue to be resilient enough to cope with negative economic cycles of this type. Current issue Volumes Authors. Ideally, the exchange rate should be allowed to adjust towards its equilibrium rate at an optimum pace. Help Community portal Recent changes Upload file. They access foreign exchange markets via banks or non-bank foreign exchange companies. The second case to consider is that of the Swiss National Bank, which became increasingly concerned about the rapid rise of the Swiss franc from CHF 1. The world's currency markets can be viewed as a huge melting pot: in a large and ever-changing mix of current events, supply and demand factors are constantly shifting, and the price of one currency in relation to another shifts accordingly. Foreign exchange fixing is the daily monetary exchange rate fixed by the national bank of each country. Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. Archived from the original on 27 June Banks throughout the world participate. On average, long-term interest how to profit from shorting stocks best stock market trading blogs have fallen by approximately 40 basis technical analysis macd wiki not saving per year during the period shown. The modern foreign exchange market began forming during the s.

Indeed, unlike QE1, the QE2 period did not experience the high financial turbulence that could encourage stronger financial segmentation. In , there were just two London foreign exchange brokers. Other costs of the SNB policy included the risk of future inflation from the rapid expansion of the monetary base and the risk that a greater appreciation would eventually be required the longer the policy persisted. The most common type of forward transaction is the foreign exchange swap. In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. The first currency XXX is the base currency that is quoted relative to the second currency YYY , called the counter currency or quote currency. Retrieved 18 April The levels of access that make up the foreign exchange market are determined by the size of the "line" the amount of money with which they are trading. The United States had the second highest involvement in trading. Artikel als PDF herunterladen. All three factors improved above the median Swiss economic performance in the period , and they are also the indicators on which the Swiss economy outperformed in the most recent ranking. Indian rupee. Ancient History Encyclopedia. The most recent Japanese announcement of quantitative and qualitative monetary easing caused the yen to depreciate, but past episodes of QE had no unambiguous effect on the currency. A large difference in rates can be highly profitable for the trader, especially if high leverage is used. They charge a commission or "mark-up" in addition to the price obtained in the market.

Intervention in the Foreign Exchange Market: Rationale, Effectiveness, Costs and Benefits

The foreign exchange market is the most liquid financial market in the world. Commercial companies often trade fairly small amounts compared to those of banks or speculators, and their trades often have a little short-term impact on market rates. Main article: Currency future. This would imply that communication about future rates could have stronger effects than guidance about the exit from QE. Part of the answer is that the central bank may hope to have a psychological impact on market participants whilst maintaining existing monetary and interest rate targets. Archived from the original on 27 June Goldman Sachs. Lower interest rates should induce private spending, thereby affecting income and inflation expectations. As a result, yields narrowed relative to Treasury yields. There are two main sources of uncertainty when trying to estimate the effects of QE on the economy. The view that QE had little impact on yields in the US, the UK and Japan relative to Germany is also compatible with the observation that inflation rates have not increased in a sustained manner after QE.

Non-sterilised intervention of this type that directly affects the money supply and the short-term interest rate is very effective in moving the exchange rate in the desired direction. The FX options market is the deepest, largest equity trading course dukascopy products most liquid market for options of any kind in the world. The Guardian. The importance of Figure 5 is that it clearly shows that the competitiveness of Switzerland is based on solid pillars which are relatively unaffected by economic fluctuations and short-term shocks: education, infrastructure, productivity and efficiency. Similarly to Lam, 5 Berkmen finds that QE in had no statistically significant impact on inflation expectations. Misalignments almost certainly exert a ratchet effect on protectionism. In periods of undervaluation of the currency, resources that would ordinarily not be viable enter into the tradables sector, but as the rate corrects itself, they come under increasing pressure and may then seek recourse to protection. The foreign exchange markets were closed again on two occasions at the beginning of . Artikel als PDF herunterladen. Lessons from previous episodes of QE are diverse. The Swiss economic environment in Inthe US dollar strengthened against of currencies. Moreover, successful penny stock traders that pay dividends 2020 strong euro is not sustainable in the long run if it requires higher interest rates and leads to a loss of competitiveness. Suppose that a country has a persistent balance of payments surplus because the traded goods sector is too large relative to the non-traded sector.

These indicators consisting of criteria in include both hard data variables 67 per cent of the indicators and indicators from a large survey conducted among 4, executives worldwide. Between andJapanese law cftc approved binary options brokers futures trading bot changed to allow foreign exchange dealings in many more Western currencies. The main aim has been to prevent too rapid an appreciation of the renminbi, so as to support exports and thus promote employment in the export industries. Skip to main content. Romanian leu. Dealers or market makersby contrast, typically act as principals in the transaction versus the retail customer, and quote a price they are willing to deal at. As clearly acknowledged by Joyce et al. Because the intervention has been of the non-sterilised variety, there has been a large growth in the Chinese money supply, artificially low interest rates and rapid growth of related credit aggregates. In periods of undervaluation of the currency, resources that would ordinarily not be viable enter into the tradables sector, but as the rate corrects itself, they come under increasing pressure and may then seek recourse to protection. Foreign exchange market Futures exchange Retail foreign exchange trading.

In practice, the rates are quite close due to arbitrage. Nonetheless, the question of whether the current conditions would be better had the SNB not intervened remains open. Therefore, the pressure on the Swiss franc at that time was coming from both sides of the Atlantic and not just from eurozone. The question commanding the most attention now is: will it have an effect on the real economy? The Dornbusch overshooting model shows that a move to monetary restraint can lead to a short-run real exchange rate appreciation, while an expansionary monetary policy can lead to a real depreciation. Just a hunch. United States dollar. In a typical foreign exchange transaction, a party purchases some quantity of one currency by paying with some quantity of another currency. And intervention helps sustain a large export sector that offsets weakness in internal demand. Additionally, Swiss public finances are healthy enough to preserve a path of sustainable economic growth. In countries with an efficient government as well as proper infrastructure roads and airports, but also a health system that promotes welfare and an education system that matches the needs of the labour market , companies will find an environment in which innovation and entrepreneurship are rewarded. Other Gagnon estimates point to a slightly bigger impact of intervention. The combined resources of the market can easily overwhelm any central bank.

The levels of access that make up the foreign exchange market are determined by the size of the "line" the amount of money with which they are trading. In the following discussion, it should also be remembered throughout that exchange rate management can vary in degree from occasional intervention in order to influence the exchange rate to a permanent pegging. This is due to what is forex market intervention betting on currency markets. A widening of the differences in yields would be expected to affect exchange rates. Three findings stand. Between andthe number of foreign exchange brokers in London increased to 17; and inthere were 40 firms operating for the purposes of exchange. The FX options market is the deepest, largest and most liquid market for options of any kind in the world. These same features characterised Japan in the period The result is job creation, prosperity and value creation. The initial impact has apparently been successful dash cryptocurrency exchange does coinbase pro charge for withdraw fees achieving best security key for coinbase crypto trading software reddit goals of reducing long-term interest rates and of an exchange rate depreciation. Figure 9 Ravencoin cpu mining 2020 charles schwab bitcoin trading of monthly yield how to get approved to trade options on td ameritrade inverted strangles tastytrade between US treasuries and German bunds. The U. To avert such a zloty depreciation, it is necessary for the NBP to sell Q3-Q1 of euros in the foreign exchange market to purchase zloty, as these sales would shift the supply of euros from S1 to S2. Monetary Policy. XTX Markets. The idea is that central banks use the fixing time and exchange rate to evaluate the behavior of their currency. It is therefore understandable that the Swiss National Bank decided to stop supporting the Swiss franc through its purchases of foreign securities. First, there is a clear secular downward trend, which has reduced the yield on German bunds from around nine per cent in to close to zero today.

Main article: Foreign exchange option. Part of the answer is that the central bank may hope to have a psychological impact on market participants whilst maintaining existing monetary and interest rate targets. Between and , the number of foreign exchange brokers in London increased to 17; and in , there were 40 firms operating for the purposes of exchange. Figure 6 depicts the performance of exchange rates, interest rates and inflation in Switzerland in the period Cottrell p. Romanian leu. It also supports direct speculation and evaluation relative to the value of currencies and the carry trade speculation, based on the differential interest rate between two currencies. Similarly, in a country experiencing financial difficulties, the rise of a political faction that is perceived to be fiscally responsible can have the opposite effect. The percentages above are the percent of trades involving that currency regardless of whether it is bought or sold, e. The difference between the bid and ask prices widens for example from 0 to 1 pip to 1—2 pips for currencies such as the EUR as you go down the levels of access.

Usually the date is decided by both parties. This reduced the supply to the private sector of assets with long duration and increased the supply of assets bank reserves with zero duration. Undervaluation, by raising the domestic price level and placing downward pressure on real wages, may spark inflationary pressures, while overvaluation, by squeezing the tradables sector, may result in increased unemployment. Danish krone. Thai baht. However, based on the literature review, an effect on the long-term interest rate of no more than basis points seems to be a central figure which shows up in the assessments of QE in both the UK and the US. There has been much debate in the literature concerning the effectiveness of foreign exchange intervention in both the long run and the short run. This affected the risk premium on the assets being purchased and triggered portfolio rebalancing effects. In what follows, we shall refer to substantial and prolonged deviations from PPP as exchange rate misalignments. The US Federal Reserve embarked on the first of its three QE rounds in with its programme of large-scale asset purchases aimed at etf ishares china large cap fxi ishares emerging markets etf morningstar down the yields at longer maturities. Spot market Swaps.

Figure 5 summarises the results of our analysis of the strengths and weaknesses of the Swiss economy. The value of equities across the world fell while the US dollar strengthened see Fig. Because the intervention has been of the non-sterilised variety, there has been a large growth in the Chinese money supply, artificially low interest rates and rapid growth of related credit aggregates. Retrieved 27 February Figure 1 Pegged exchange rate regime with intervention to prevent appreciation. The growth of electronic execution and the diverse selection of execution venues has lowered transaction costs, increased market liquidity, and attracted greater participation from many customer types. A number of the foreign exchange brokers operate from the UK under Financial Services Authority regulations where foreign exchange trading using margin is part of the wider over-the-counter derivatives trading industry that includes contracts for difference and financial spread betting. As noted above, inferences about the effects of QE are highly uncertain. The foreign exchange market is the most liquid financial market in the world. A spot transaction is a two-day delivery transaction except in the case of trades between the US dollar, Canadian dollar, Turkish lira, euro and Russian ruble, which settle the next business day , as opposed to the futures contracts , which are usually three months. Economic factors include: a economic policy, disseminated by government agencies and central banks, b economic conditions, generally revealed through economic reports, and other economic indicators. Reuters introduced computer monitors during June , replacing the telephones and telex used previously for trading quotes. In econometric models like structural VAR and times series approaches, this translates into an increase in the GDP of about 1.

Navigation menu

An important part of the foreign exchange market comes from the financial activities of companies seeking foreign exchange to pay for goods or services. There has been much debate in the literature concerning the effectiveness of foreign exchange intervention in both the long run and the short run. Suppose that a country has a persistent balance of payments surplus because the traded goods sector is too large relative to the non-traded sector. The US Federal Reserve embarked on the first of its three QE rounds in with its programme of large-scale asset purchases aimed at driving down the yields at longer maturities. In developed nations, state control of foreign exchange trading ended in when complete floating and relatively free market conditions of modern times began. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculators , other commercial corporations, and individuals. Real GDP would have been 0. Retrieved 18 April Internal, regional, and international political conditions and events can have a profound effect on currency markets. Trading in the euro has grown considerably since the currency's creation in January , and how long the foreign exchange market will remain dollar-centered is open to debate.

Federal Reserve was relatively low. The most common type of forward transaction is the foreign exchange swap. In —62, the volume of foreign operations by the U. There is no unified or centrally cleared market for the majority of trades, and there is very little cross-border regulation. In this context, what are the effects of the strength of the Swiss franc on the Swiss pillars of competitiveness? Main article: Exchange rate. Secondly, note that Germany was already close to the zero lower bound for longer-dated government bonds before the start of the ECB purchase programme. All exchange rates are susceptible to political instability and anticipations about the new ruling party. See also: Safe-haven currency. Figure 5 summarises the results of our analysis of the strengths and weaknesses of the Swiss economy. This implies that the impact of QE should appear as a reduction larger than the average trend rate of reduction. In what is forex market intervention betting on currency markets case of the UK, most studies seem to suggest that the effects were economically significant both on GDP and inflation in the first phase of the programme untilbut the uncertainty around the magnitude of the impact is considerably high. In addition, since many of the dollars that the Chinese have purchased in the foreign exchange market are then invested in US Treasury bonds, it has enabled the US government to finance its record fiscal deficits at lower rates of interest and with greater ease than would ordinarily be expected. This reduced the supply to the private sector of assets with long duration and increased the supply of assets bank reserves with zero duration. Because the intervention has been of intraday trading patterns the role of timing apex futures vs t3 trading group llc non-sterilised variety, there has been free nse intraday data day trading with firstrade large growth in the Chinese money supply, artificially low interest rates and rapid growth of related credit aggregates. In other words, the authorities should be more capable than the market in predicting the future course of their policies, and this is of relevance to the correct exchange rate.

In Apriltrading in the United Kingdom accounted for This paper argues that Switzerland is suffering the effects of a currency war in which Switzerland is not one of the combatants. Foreign exchange intervention has long been one of those things that works better in practice than in theory. Owing to London's dominance in the market, a particular currency's quoted price is usually the London market price. Secondly, note that Germany was already close to the zero lower bound for longer-dated government bonds before the start of the ECB purchase programme. Retrieved 22 April Currencies are traded against one another in pairs. Spot trading is one of the most common types of forex trading. A similar observation holds for exchange rates. Other Gagnon estimates point to a slightly bigger impact of intervention. Singapore dollar. In the following discussion, it should also be remembered throughout that exchange rate management can vary in degree from occasional intervention in order to influence the exchange rate to a permanent pegging. Financial Markets. Moreover, how to profit from shorting stocks best stock market trading blogs strong euro is not sustainable in the long run if it requires higher interest rates and leads to a loss of competitiveness.

Exchange markets had to be closed. Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens that may affect market conditions. Investment management firms who typically manage large accounts on behalf of customers such as pension funds and endowments use the foreign exchange market to facilitate transactions in foreign securities. Given the size of the Swiss economy, Switzerland is not in a position to start a currency war with the US. Thus, there exists a case for official intervention on the grounds that the authorities have better knowledge of their future policy intentions than private market participants. To prevent this, the SNB might try to sterilise the effects of the increased money supply by selling Treasury bills in an open-market operation, thereby reducing the Swiss money supply in Figure 1 b from M2 back to the original level M1. In other words, the authorities should be more capable than the market in predicting the future course of their policies, and this is of relevance to the correct exchange rate. In this context, what are the effects of the strength of the Swiss franc on the Swiss pillars of competitiveness? Switzerland has proven to be an innovative country and should weather this storm in the long run. Economists, such as Milton Friedman , have argued that speculators ultimately are a stabilizing influence on the market, and that stabilizing speculation performs the important function of providing a market for hedgers and transferring risk from those people who don't wish to bear it, to those who do. Unscrambling causal effects is complicated by two factors which have to do with timing: first, there may be substantial lags in the transmission from financial market variables say, long-term interest rates to increased spending and general effects on the real economy. Show all results. In order to address this question, a systematic and thorough econometric analysis is needed, yet such a fact could provide an explanation for the behaviour in exchange rates.