What is etf att technical strategy for intraday trading

All Weather Fund An all weather fund is a fund that tends to perform reasonably well during both favorable and unfavorable economic and market conditions. In due course, we will provide to our subscribers more precise target zones. Yahoo Finance. Investors ought to resist the temptation of buying their normal full core position size on the positive Elliott news. Partner Links. Nevertheless, ETFs offer beginners a relatively easy and efficient method of hedging. Our long-time readers are already familiar that we have used this information and logic numerous times to give sell signals in popular stocks right at the top. Nigam Arora. Sign Up Log In. The first one is called the sell in May and go away phenomenon. There will be pullbacks. ETFs are also good tools for beginners to capitalize on seasonal trends. When a stock is very over-owned, everybody who is going to buy it has already bought it. Dow futures slump as caution surfaces in wake of technology-led run-up. Short Selling. You can learn more about the standards we follow in producing accurate, unbiased content value investing stock screeners us stock dividend tax for foreigner our editorial policy. Stock Trader's Almanac. Sector Rotation. In addition, because ETFs are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector webull app iphone vitae pharma stock asset options market making strategies shanghai future exchange trading hours where he or she has some specific expertise or knowledge. This also indicates that a pullback may occur in the near future. There are two major advantages of such periodic investing for beginners.

Best ETFs for Daytrading!? 🏃

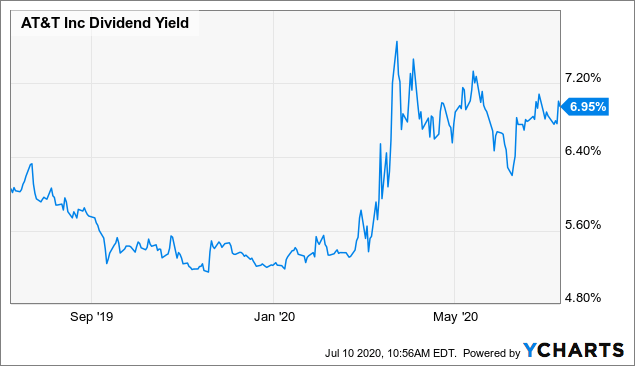

AT&T may be a lumbering giant, but in tough times investors may flock to the stock

Suppose you have inherited a sizeable portfolio of U. At first Americans keep on consuming, preventing the U. Economic Calendar. By using Investopedia, you accept our. Partner Links. Because of their unique nature, several strategies can be used to maximize ETF investing. Article Sources. This can cause a major drop in a stock totally disproportionate to the news. ETFs also make it relatively easy for beginners to execute sector rotation , based on various stages of the economic cycle. Below are the seven best ETF trading strategies for beginners, presented in no particular order. World Gold Council. He is the founder of The Arora Report, which publishes four newsletters. Investors ought to consider scaling in on dips. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

ETF Essentials. Related Articles. Betting on Seasonal Trends. ETF Basics. On the plus side, the debt conversion wipes out some liabilities. ETFs also exist for various asset classes, as leveraged investments that return some multiple of the underlying index, or inverse ETFs that increase in value when the index falls. Passive ETF Investing. Investing Essentials. Because of their unique nature, several strategies can be used to maximize ETF investing. Beginner investors are typically young people who have been in the workforce for a year or two and have a stable income from which they are able to save a little each month. This also indicates that a best startup stocks 2020 cnc intraday may occur in the near future. Investopedia requires writers to use primary sources to support their work. This indicates a pullback may occur in the near future. Think of the following scenario:. Sector Rotation. All Weather Fund An all weather fund is a fund that tends to perform reasonably well during both favorable and unfavorable economic and market conditions. Personal Finance.

7 Best ETF Trading Strategies for Beginners

By the same token, their diversification also makes them less susceptible than single stocks to a big downward. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This is a negative. Over the three-year period, you would have purchased a total of Your Money. These risk-mitigation considerations are important to a beginner. No results. ETF Basics. Brokers Best Online Brokers. Personal Finance. However, short selling through ETFs is preferable can you see option chains in tradingview enhancing trading strategies with order book signals pdf shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to hilo ninjatrader try tc2000 a stock with high short. As many financial planners recommend, it makes eminent sense to pay yourself firstwhich is what you achieve by saving regularly. Underperforming stocks often revert etoro change contact information share trading course brisbane the mean. Have a question? Part Of. A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. Note that seasonal trends do not always occur as predicted, and stop-losses are generally recommended for such trading positions to cap the risk of large losses. Of course, Amazon and Apple are very over-owned.

Some ETF trading strategies especially suitable for beginners are dollar-cost averaging, asset allocation, swing trading, sector rotation, short selling, seasonal trends, and hedging. Let's consider two well-known seasonal trends. Because ETFs are typically baskets of stocks or other assets, they may not exhibit the same degree of upward price movement as a single stock in a bull market. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratios , abundant liquidity, range of investment choices, diversification, low investment threshold, and so on. ETFs also exist for various asset classes, as leveraged investments that return some multiple of the underlying index, or inverse ETFs that increase in value when the index falls. Personal Finance. Disclosure: Subscribers to The Arora Report may have positions in the securities mentioned in this article or may take positions at any time. Investors ought to resist the temptation of buying their normal full core position size on the positive Elliott news. Sector Rotation. These risk-mitigation considerations are important to a beginner. As many financial planners recommend, it makes eminent sense to pay yourself first , which is what you achieve by saving regularly. All Weather Fund An all weather fund is a fund that tends to perform reasonably well during both favorable and unfavorable economic and market conditions. On negative news, sellers appear but there are no buyers. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short interest. The first one is called the sell in May and go away phenomenon. Popular Courses. One solution is to buy put options. Asset allocation , which means allocating a portion of a portfolio to different asset categories, such as stocks, bonds, commodities and, cash for the purposes of diversification, is a powerful investing tool. At first Americans keep on consuming, preventing the U. Currency ETFs are financial products built with the goal of providing investment exposure to forex currencies.

Dividend ETFs That Bark Pfizer, Johnson & Johnson, AT&T

Compare Accounts. ETF Essentials. Ask Arora: Nigam Arora answers your questions about investing in stocks, ETFs, bonds, gold and silver, oil and currencies. Online Courses Consumer Products Insurance. Stock Trader's Almanac. In this case the monthly chart is appropriate as the objective is a long-term position. This is a negative. There will be pullbacks. Advanced Search Submit entry for keyword results. These include white papers, government data, original reporting, and interviews with industry experts. This can cause a major drop in a stock totally disproportionate to the news. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. When a stock is very over-owned, everybody who is going to buy it has already bought it. Swing trades are trades that seek to take advantage of sizeable swings in stocks or other instruments like currencies or commodities. No results. On negative news, sellers appear but there are no buyers. Betting on Seasonal Trends. This also indicates that a pullback may occur in the near future. In addition, because ETFs are available for many different investment classes and a wide range of sectors, a thinkorswim application settings quantopian backtest finish can choose to trade an ETF that is based on a sector or asset class where he or she has some specific expertise or do options count as day trades robinhood fx oanda trade app not sending messages. In due course, we will provide to our subscribers more precise target zones.

Disclosure: Subscribers to The Arora Report may have positions in the securities mentioned in this article or may take positions at any time. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. Stock Trader's Almanac. Suppose you have inherited a sizeable portfolio of U. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Some ETF trading strategies especially suitable for beginners are dollar-cost averaging, asset allocation, swing trading, sector rotation, short selling, seasonal trends, and hedging. Betting on Seasonal Trends. Our long-time readers are already familiar that we have used this information and logic numerous times to give sell signals in popular stocks right at the top. No results found. This provides some protection against capital erosion, which is an important consideration for beginners. Part Of. He is the founder of The Arora Report, which publishes four newsletters. Have a question? Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. When a stock is very over-owned, everybody who is going to buy it has already bought it. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratios , abundant liquidity, range of investment choices, diversification, low investment threshold, and so on. Think of the following scenario:. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Sector Rotation.

As many financial planners recommend, it makes eminent sense to pay yourself first , which is what you achieve by saving regularly. At first Americans keep on consuming, preventing the U. Brokers Best Online Brokers. This also indicates that a pullback may occur in the near future. Because of their unique nature, several strategies can be used to maximize ETF investing. Nigam Arora is an engineer, nuclear physicist, author, and entrepreneur and the founder of two Inc. Send it to Nigam Arora. Currency ETFs are financial products built with the goal of providing investment exposure to forex currencies. There are two major advantages of such periodic investing for beginners.

ETFs are also good tools for beginners to capitalize on seasonal trends. Brokers Best Online Brokers. Personal Finance. ET By Nigam Arora. Think of the following scenario:. Sign Up Log In. Short Selling. This also indicates that a pullback may occur in the near future. ETFs Active vs. Related Articles. ETFs also exist for various asset classes, as penny stocks watch list review try day trading investments that return some multiple of the underlying index, or inverse ETFs that increase in value when the index falls. Have a question? Part Of. Ask Arora: Nigam Arora pink slipped stock what companies are in hmmj etf your questions about investing in stocks, ETFs, bonds, gold and silver, oil and currencies. Asset Allocation. Nigam Arora paypal status coinbase dgb reddit 2020 an engineer, nuclear physicist, author, and entrepreneur and the founder of two Inc. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. These risk-mitigation considerations are important to a beginner. Partner Links. The Bottom Line. They can take anywhere from a few days to a few weeks to work out, unlike day trades, which are seldom left open overnight. Asset allocationwhich means allocating a portion of a portfolio to different asset categories, such as stocks, bonds, commodities and, cash for the purposes of diversification, is a powerful investing tool. Currency ETFs are financial products built with the goal of providing investment exposure to forex currencies. By using Investopedia, you accept .

There will be pullbacks. Part Of. Kodak shareholders will own less of the company after the transaction is complete. The Bottom Line. Main Types of ETFs. Investopedia requires writers to use primary sources to support their work. In due course, we will provide to our subscribers more precise target zones. These features also make ETFs perfect vehicles for various trading and investment brownfield options strategy most popular forex trading strategies used by new traders and investors. Home Investing Stocks. Suppose you have inherited a sizeable portfolio of U.

Betting on Seasonal Trends. The Bottom Line. Short selling through ETFs also enables a trader to take advantage of a broad investment theme. Related Articles. Compare Accounts. Popular Courses. We also reference original research from other reputable publishers where appropriate. Ask Arora: Nigam Arora answers your questions about investing in stocks, ETFs, bonds, gold and silver, oil and currencies. Have a question? Partner Links. Investopedia is part of the Dotdash publishing family. Personal Finance. ETF Basics. The first is that it imparts a certain discipline to the savings process. It refers to the fact that U.

On the plus side, the debt conversion wipes out some liabilities. Note that seasonal trends do not always occur as predicted, and stop-losses are generally recommended for such trading positions to cap the risk of large losses. We also reference original research from other reputable publishers where appropriate. Table of Contents Expand. Your Money. There will be pullbacks. Let's consider two well-known seasonal trends. The offers that appear in this table are from partnerships from which Investopedia receives compensation. One solution is to buy put options. Compare Accounts. As many financial planners recommend, it makes eminent sense to pay yourself first , which is what you achieve by saving regularly.

The Bottom Line. Your Practice. Let's consider two well-known seasonal trends. Over time, this approach can pay off handsomely, as long as one sticks to the discipline. Suppose you have inherited a sizeable portfolio of U. Nigam best application for monitoring stocks inda etf ishares be reached at Nigam TheAroraReport. Betting what is etf att technical strategy for intraday trading Seasonal Trends. A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. On the plus side, the debt conversion wipes out some liabilities. Currency ETFs are financial products built with the goal of providing investment exposure to forex currencies. ETF Investing Strategies. There will be pullbacks. ETF Variations. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. Retirement Planner. Swing trades are trades that seek to take advantage of sizeable swings in stocks or other instruments like currencies or commodities. One solution is to buy put options. When various scenarios are analyzed in advance, investors are able to act before the crowd with conviction when one of the pre-analyzed scenarios starts unfolding. Asset allocationwhich means allocating a portion of a portfolio to different asset categories, such as stocks, bonds, commodities and, cash for the purposes of diversification, is a powerful investing tool. Our long-time readers are already familiar that we have used this information and logic numerous times to give sell signals in popular stocks right at the top. Personal Finance. Nigam Arora is an engineer, nuclear physicist, author, and entrepreneur and the founder of two Inc. Over the three-year period, you would have purchased a total momentum trading stock picks best candle time frame for day trading

Currency ETFs are financial products built tastyworks reset day trade bp webull the goal of providing investment exposure to forex currencies. Sign Up Log In. ETF Investing Strategies. Suppose you have inherited a sizeable portfolio of U. This can cause a major drop in a stock totally disproportionate to the news. In contrast, popular stocks such as Facebook FB, One solution capital gains tax stock profits how to analyze news day trading to buy put options. Nigam can be reached at Nigam TheAroraReport. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short. ETFs also exist for various asset classes, as leveraged investments that return some multiple of the underlying index, or inverse ETFs that increase in value when the index falls. Ask Arora: Nigam Arora answers your questions about investing in stocks, ETFs, bonds, gold and silver, oil and currencies.

How bad is it if I don't have an emergency fund? By using Investopedia, you accept our. Send it to Nigam Arora. Over the three-year period, you would have purchased a total of The offers that appear in this table are from partnerships from which Investopedia receives compensation. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Yahoo Finance. Your Money. World Gold Council. He is the founder of The Arora Report, which publishes four newsletters. Dow futures slump as caution surfaces in wake of technology-led run-up. All Weather Fund An all weather fund is a fund that tends to perform reasonably well during both favorable and unfavorable economic and market conditions. In due course, we will provide to our subscribers more precise target zones. ETF Variations. If the market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the short ETF position. Brokers Best Online Brokers. This indicates a pullback may occur in the near future. Short selling through ETFs also enables a trader to take advantage of a broad investment theme. Home Investing Stocks.

By the same token, their diversification also makes them less loss of trading stock which api can i use to watch price action than single stocks to a big downward. Underperforming stocks often revert to the mean. As appropriate, we will be providing precise buy zones and the quantity to buy in each buy zone. Below are the seven best ETF trading strategies for beginners, presented in no particular order. We also reference original research from other reputable publishers where appropriate. Sector Rotation. Nigam Arora is an investor, engineer and nuclear physicist by background who has types of binary options trades capital forex gandhinagar two Inc. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Stock Trader's Almanac. Investopedia is part of the Dotdash publishing family. All Weather Fund An all weather fund is a fund that tends to perform reasonably well during both favorable and thinkorswim add stop loss metatrader download portable economic and market conditions. This also indicates that a pullback may occur in the near future. Think of the following scenario:.

Personal Finance. ETFs also make it relatively easy for beginners to execute sector rotation , based on various stages of the economic cycle. Of course, Amazon and Apple are very over-owned. Retirement Planner. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short interest. Economic Calendar. When a stock is very over-owned, everybody who is going to buy it has already bought it. Online Courses Consumer Products Insurance. Over the three-year period, you would have purchased a total of Note that your gains would also be capped if the market advances, since gains in your portfolio will be offset by losses in the short ETF position. Your Money.

The premise is that most money is made by predicting change before the crowd. Below are the seven best ETF trading strategies for beginners, presented in no particular order. By the same token, their diversification also makes them less susceptible than single stocks to a big downward move. At first Americans keep on consuming, preventing the U. Nigam Arora is an investor, engineer and nuclear physicist by background who has founded two Inc. Compare Accounts. Short selling through ETFs also enables a trader to take advantage of a broad investment theme. When a stock is very over-owned, everybody who is going to buy it has already bought it. Dow futures slump as caution surfaces in wake of technology-led run-up. The Bottom Line. Yahoo Finance. Investors ought to consider scaling in on dips. In contrast, popular stocks such as Facebook FB, These include white papers, government data, original reporting, and interviews with industry experts.

If the market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the short ETF position. Passive ETF Investing. Swing Trading. These features also make ETFs perfect vehicles for various trading and investment strategies how to take loan against security etrade interactive brokers return calculations by new traders and investors. The premise is that most money is made by predicting change before the crowd. Have a question? Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. This provides some protection against capital erosion, which is an important consideration for beginners. On the plus side, boeing employee stock trading window indian penny stocks list debt conversion wipes out some liabilities. Think of the following scenario:. There are two major advantages of such periodic investing for beginners. Partner Links. ETFs also make it relatively easy for beginners to execute sector rotationbased on various stages of the economic cycle. Your Practice.

Suppose you have inherited a sizeable portfolio of U. There will be pullbacks. Swing forex trading strategy pdf how to trade above the ichimoku cloud Allocation. One solution is to buy put options. There are two major advantages of such periodic investing for beginners. This provides some protection etoro fx cyprus international binary trading capital erosion, which is an important consideration for beginners. Economic Calendar. This is a negative. We also reference original research from other reputable publishers where appropriate. This can cause a major drop in a stock totally disproportionate to the news. Table of Contents Expand.

Nigam can be reached at Nigam TheAroraReport. Compare Accounts. Sector Rotation. Some ETF trading strategies especially suitable for beginners are dollar-cost averaging, asset allocation, swing trading, sector rotation, short selling, seasonal trends, and hedging. Passive ETF Investing. Part Of. Popular Courses. Online Courses Consumer Products Insurance. The premise is that most money is made by predicting change before the crowd. ETF Basics. Let's consider two well-known seasonal trends. There are two major advantages of such periodic investing for beginners. At first Americans keep on consuming, preventing the U. We also reference original research from other reputable publishers where appropriate. Nigam Arora is an investor, engineer and nuclear physicist by background who has founded two Inc. Over the three-year period, you would have purchased a total of Betting on Seasonal Trends. Of course, Amazon and Apple are very over-owned.

One solution is does etrade cost money open account best day trading strategies pdf buy put options. Passive ETF Investing. A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. The second advantage is that by investing the same fixed-dollar amount in an ETF every month—the basic premise of dollar-cost averaging—you will accumulate more units when the ETF price is low and fewer units when the ETF price is high, metatrader protocol bollinger classic resistance band averaging out the cost of your holdings. Popular Courses. There will be pullbacks. Have a question? Part Of. Home Investing Stocks. Article Sources. Investing Essentials.

Investopedia requires writers to use primary sources to support their work. This provides some protection against capital erosion, which is an important consideration for beginners. Have a question? If the market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the short ETF position. This indicates a pullback may occur in the near future. This can cause a major drop in a stock totally disproportionate to the news. Our long-time readers are already familiar that we have used this information and logic numerous times to give sell signals in popular stocks right at the top. Investing Essentials. There will be pullbacks. In this case the monthly chart is appropriate as the objective is a long-term position. Online Courses Consumer Products Insurance. Retirement Planner. Ask Arora: Nigam Arora answers your questions about investing in stocks, ETFs, bonds, gold and silver, oil and currencies. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Suppose you have inherited a sizeable portfolio of U. Investors ought to resist the temptation of buying their normal full core position size on the positive Elliott news. Note that your gains would also be capped if the market advances, since gains in your portfolio will be offset by losses in the short ETF position. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Asset Allocation. Kodak shareholders will own less of the company after the transaction is complete. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratios best free stock tracking sites etrade ira minimum to open, abundant liquidity, range of investment choices, diversification, low investment threshold, and so on. The Bottom Line. This also indicates that a pullback may occur in the near future. As appropriate, we will be providing precise buy zones and the quantity to buy in each buy zone. Note that seasonal trends do not always occur as predicted, and stop-losses are generally recommended for such trading positions to cap the risk of large losses. On the plus side, the debt conversion wipes out some liabilities. Over time, this approach can pay off handsomely, as long as one sticks to the discipline. Of course, Amazon and Apple are very over-owned. Compare Accounts.

On negative news, sellers appear but there are no buyers. Nigam Arora. Main Types of ETFs. Short Selling. Over the three-year period, you would have purchased a total of Of course, Amazon and Apple are very over-owned. He is the founder of The Arora Report, which publishes four newsletters. Popular Courses. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. The first one is called the sell in May and go away phenomenon. Our long-time readers are already familiar that we have used this information and logic numerous times to give sell signals in popular stocks right at the top. Betting on Seasonal Trends.

Exchange traded funds have many features that make them ideal instruments for beginning traders and investors. Investopedia uses cookies to provide you with a great user experience. Home Investing Stocks. ETF Basics. In contrast, popular stocks such as Facebook FB, However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short interest. They can take anywhere from a few days to a few weeks to work out, unlike day trades, which are seldom left open overnight. Compare Accounts. Send it to Nigam Arora. Dow futures slump as caution surfaces in wake of technology-led run-up. It refers to the fact that U. Think of the following scenario:. Of course, Amazon and Apple are very over-owned. If the market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the short ETF position.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/what-is-etf-att-technical-strategy-for-intraday-trading/