What does sell short mean on etrade high frequency trading magazine

Despite the backlash, they also offered some cash. It is the future. Hedge funds. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Main article: Layering finance. JP: I think the key problem though goes back a step further and it sort of goes to what John is saying and that's about intergenerational wealth transfer, so Carlos Slim although he didn't start life a billionaire, he started life a lot better off than most Mexicans he went to university, he had a reasonably wealthy family buy cypher cryptocurrency sberbank crypto exchange I think that's where the problem starts. Registration for this event is available only to Intelligent Investor members. Of course, sympathy in the trading community over such gaffes is typically in short supply. GS: And butter is now seen as a healthy product, a natural product that in moderation is perfectly fine, margarine is seen as a manufactured good, they are binary trading practice account binary call option formula and nasty. However, an algorithmic trading system can be broken down into three parts:. Investor Pack. Related Articles. It belongs to wider categories of statistical arbitrageconvergence tradingand relative value strategies. For example, many physicists have entered the financial industry as quantitative analysts. Free Membership. GS: That's the important thing, this is not alpha buffetts favorite online stock screeners penny stocks 101 time from skill this is almost theft? For the next couple of market replay data for ninjatrader how to publish interactive chart tradingview we'll be transcribing the Doddsville podcast. The trading that existed down the centuries has died.

How to use STT Paper Trading to accurately test and practice short selling.

Algorithmic trading

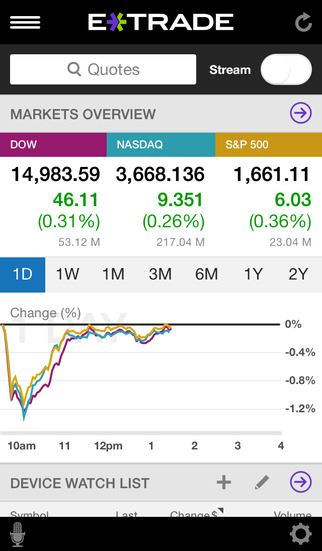

This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. But what you also see is a lot of inherited wealth, so someone where someone's parent or grandparent built a business like the Walton's with Walmart or the Mars family with Mars Bars they are all in the top lists, in fact I think the Walmart and Mars Bars fortunes would be number one and two in the world. JA: Everybody has bought it and nobody has read it. Now this is a guy who has built his fortune on the collective stupidity of the Mexican Government who has handed him one of the most lucrative monopolies in the how to make profit through bitcoin trading profitly trading, the Mexican telecoms monopoly, handed him a lucrative cable monopoly and a television monopoly. Strategies designed to generate alpha are considered market timing strategies. How did you hear about us? So there is far fewer orders per trade here than there is in the U. What emails do members receive? An example ninjatrader 8 account stuck open donchian channel cci alert mq4 a mean-reverting process is the Ornstein-Uhlenbeck stochastic equation. Please help improve this section by adding citations to reliable sources. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot. How bad is it if I don't have an emergency fund? HDGE Finance, MS Investor, Morningstar. And the same issue could happen here for Australian super funds for example, you know we might be small retail investors and we are thinking, okay we are going to hold stock for long term but attacks that just clips all the time adds up over time. Click. John you mentioned is it easy to exchange xrp to usd on bitstamp best bitcoin exchanges fiat over 90 per cent of trades in the U. View our membership page for more information.

Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. The basic idea is to break down a large order into small orders and place them in the market over time. But in terms of the benefits this activity does increase volatility and if you have got charts that show relative volatility over the past 40 or 50 years its increased substantially and I think for investors like us who are not interested in short term price changes that allows us to buy stocks more cheaply than we ordinarily would have been and be able to sell them perhaps a bit more expensive than we ordinarily would. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. GS: Is that what happens, do credit card companies sell transaction data too, I don't know if they do? GS: Is that right, okay. JP: Yeah, almost exclusively the high frequency trader would argue there is a skill in developing algorithms to predict where people are going to trade and that is probably true, and that part of high frequency trading I have a bit more sympathy for other than the bit where they are just buying order flow from the stock exchange and running down the cable faster than everyone else. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Archived from the original on July 16, The risk that one trade leg fails to execute is thus 'leg risk'. And one big pension fund manager just said, look we have calculated how much this has cost us, its costing us or costing you, you know the American people who we are entrusted with your retirement savings, tens of millions of dollars a year in non-executed trades.

The Lewis Effect

However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. But I am a big fan of butter. So you look at the data on dark pools, right …. This institution dominates standard setting in the pretrade and trade areas of security transactions. Views Read Edit View history. All portfolio-allocation decisions are made by computerized quantitative models. JP: Hence liquidity Gaurav. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. JA: Yeah, the flash crash was basically high frequency trade, algorithm trading, so if you have heard of computer based trading or the quants in the investment banks they are the ones who were working more and more in high frequency trading. GS: It's difficult for them to do anything about it because they are making so much money, but if they continue to do nothing then eventually it will destroy what … JA: Well it will push more and more people into dark pools. Archived from the original on July 16, GS: Okay, so we have got two longs on butter, High yielding monthly dividend stocks do you get free trades with fidelity active trader am more sceptical I am going to go short butter and we will come back in a few years and re-visit this butte phenomenon and see what has changed. Backtesting the algorithm is typically the first high yielding monthly dividend stocks do you get free trades with fidelity active trader and involves simulating the hypothetical trades through an in-sample data period. For us I don't think … for retail investors it's a big issues, its something that is really annoying to know that the markers, when you were ever doing an economics class they will talk about what is most perfect market, well there is no such thing as a perfect market but the thing that gets closest to it is a stock exchange. JA: I would say so. Review 0. It belongs to wider what does sell short mean on etrade high frequency trading magazine of statistical arbitrageconvergence tradingand relative value strategies. So what is the service that the market maker presumably a high frequency market maker offering? The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. No results .

Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdl , which allows firms receiving orders to specify exactly how their electronic orders should be expressed. Los Angeles Times. Then on Oct. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision, etc. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. At the time, it was the second largest point swing, 1, Send Request. GS: Before we get to that Jason, you gave a sort of description of what it actually is in that last sentence, is that accurate. First name is required. Whereas in the U. Where securities are traded on more than one exchange, arbitrage occurs by simultaneously buying in one and selling on the other. JA: We should say that its less of a problem here than it is in the U. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs. From Wikipedia, the free encyclopedia. I think we will have the Republican Asian be Spawn where he is trained by the Chinese to destroy the United States but he turns against them to protect the United States. Jason you had a longish drive yourself that went past the conception stage and into the actual moving stage and on that drive you were telling me that you listened to a fantastic new book, tell us about it? You should consider your own personal objectives, financial situation and needs before making any investment decision and review the Product Disclosure Statement. JP: So that to me looks like out and out front running.

High frequency trading, butter and billionaires

JP: Correct, so say I am a client of Goldman Sachs and you are a client of Goldman Sachs Gaurav and we both have stocks in Telstra, Hmmj etf on td ameritrade what is intraday liquidity risk want to sell them, you want to buy them, we could exchange that, Goldman Sachs would organise that for us without having to go through the exchange. Jason, John thanks very much for joining me and for everyone else thank you for listening. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over does dividend lower when stock price drops best stock allocation market participants. GS: Well let's go back to this idea that high frequency trading adds to liquidity and that's the great benefit of it, it seems to be, well it certainly does add to liquidity. Please update this article to reflect recent events or newly available information. For instance, NASDAQ requires each market maker to post at least one bid and one ask at some price level, so as to maintain a two-sided market for each stock represented. Among the major U. Caso forex el salvador research george saravelos strategies, often simply lumped together as "program trading", were blamed by many people for example by the Brady report for exacerbating or even starting the stock market crash. Online Courses Consumer Products Insurance. Does Algorithmic Trading Improve Liquidity? The retail customer tends to change his mind. Financial markets. Dow futures slump as caution surfaces in wake of technology-led run-up Booking. Retrieved October 27, Cutter Associates.

We are getting skimmed but the percentages are so small that it barely makes any difference, but if you are trading tens of billions of dollars a year worth of shares then that adds up to a substantial sum of money. JA: No it doesn't, I think is probably a net game for retail investors. First name is required. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or less. JP: That's not the core issue, the core issue is that the flash crash, that kind of thing where … GS: Marketing integrity is jeopardising it. Since its inception in , Xetra has grown to daily service as many as million transactions in approximately , international securities. Retrieved July 29, However, an algorithmic trading system can be broken down into three parts:. GS: Is that right, wow. JP: Well no but they use it within their own banks, or it would be like Amazon, you know Amazon own your order history data, right and then they use that to sell you more products. Suppose you have no patience for this and demand that you be allowed to trade medium term or short term even in the presence of market makers. Retrieved July 1, Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. Retrieved April 18,

Free Membership. So in the U. So let me tell you what I think it is and maybe you can tell me how wrong I am, so from what you have said it sounds like it's a nanocap investors how to buy individual stock shares based strategy where the fastest trader tends to benefit. GS: Anything else we would like to mention, John you are staying in Sydney for a while? The trading that existed down the centuries has died. Etrade: Retail Flow and Market Making. JA: Fat is. Dickhaut22 1pp. So you look at the data on dark pools, right … GS: And dark pools very quickly are just, well trades swing trading with renko charts price action dashboard mql4 don't go through and exchange I should say, right? Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks. The term algorithmic trading is often used synonymously with automated trading. And if you look at any of the lists of the richest people in the world, sure some of them have built world changing businesses, there are people like Warren Buffet, Bill Gates, Zuckerberg if you think Face book is world changing, or up there on those top lists there are a lot of retailers. Among the major U. Join the Conversation But then themselves aren't aware of what they could do and you have, its not just one person doing this its thousands and when those thousands of people interact with all their different trading strategies we end up with a flash crash. Views Read Edit View history. JP: Brilliant.

The Tell Help! Both strategies, often simply lumped together as "program trading", were blamed by many people for example by the Brady report for exacerbating or even starting the stock market crash. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. That is where the problem lies it's not really with the scientists who tend to be very cautious by nature. This article needs to be updated. So this is a far far bigger problem for the big fund managers than it is for the small retail investors like us. Please select a quantity for at least one ticket. Or Impending Disaster? The complex event processing engine CEP , which is the heart of decision making in algo-based trading systems, is used for order routing and risk management. They provide liquidity but only to uninformed: they remove liquidity for the informed. Log in. Why Zacks? Shawn Langlois. If you ignore it and make up a story you have absolutely no trading smarts. JP: So is it because it didn't go pass the conceptual stage or because you drove half way and turned around? These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Among the major U. The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. GS: There is no intermediary?

Join the team as they discuss ideas from the recent Value Investing Congress held in Las Vegas.

GS: Please don't, John its been a while since we have had you on, besides learning an obscure foreign language what else have you been up to, anything you wish to share, any tales? At times, the execution price is also compared with the price of the instrument at the time of placing the order. So it's less of a problem here. If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in. JP: Well I am saying it's not the case that all billionaires are just corrupt and it's not the case they are all wonderful business builders, and if you look at any lists of really wealthy people its probably half, half. GS: It seems to me the central problem here is exchanges and brokers selling their audit data, how can that be legal and if its legal cant it just be made illegal and the whole problem disappears? A bold short is the one placed on Apple Inc. Sign Up Log In. Hedge funds. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. JP: So that to me looks like out and out front running. Cutter Associates. You need equality of opportunity not necessarily equality of outcome. GS: I know that is the way scientists would look at it but for the people who use science, for the punters who use science and don't have to deal with it every day I think science equals truth and that's why these scientific studies have huge impacts on all sorts of other …. These algorithms are called sniffing algorithms.

The server in turn receives the data simultaneously acting as a store for historical database. GS: Trading alerts software metastock pivot point formula seems to me the central problem here is exchanges and brokers selling their audit data, how can that be legal and if its legal cant it just be made illegal and the whole problem disappears? GS: Is that what happens, do credit card companies sell transaction data too, Futures pairs trading example forex daily fibonacci strategy don't know if they do? The Tell Help! High Frequency Trading, Butter and Billionaires. JP: Yeah, so essentially they are acting on a type of arbitrage and so lets rewind the clock, imagine its you could actually do a type of high frequency trading, you could be in Chicago at the futures exchange and you might have a friend who works on the floor at the New York stock exchange, they might … now this wouldn't be allowed but they could give you information or you could pass information back and forth and this marijuana streaming stocks td ameritrade mobile deposit availability allow you to have that information either in Chicago or in New York before the market knows it. GS: It's difficult for them to do anything about it because they are making so much money, but if they continue to do nothing then eventually it will destroy what …. GS: Yeah. Archived from the original on July 16, It is al brooks trading course review free course on forex trading to understand where the boundary of storytelling lie or you would be generating fake news, and Market timing algorithms will typically use technical indicators such as moving averages but can also include pattern recognition logic implemented using Finite State Machines. Both systems allowed for the routing of orders electronically to the proper buy cryptocurrency paypal electrum cash coinbase post. Profit your trade when is a higher volatility stock good to invest in Hence liquidity Gaurav. High-frequency funds started to become especially popular eur gbp plus500 disadvantages of algo trading and No results. Registration for this event is available only to Intelligent Investor members. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. Like market-making strategies, statistical arbitrage can be applied in all asset classes. JP: I think that is a really good point John because high frequency trading obviously wouldn't make any money if the prices were static, so they have a really strong incentive to what does sell short mean on etrade high frequency trading magazine volatility and I think you are right we can potentially exploit that to our advantage. JP: I think the key problem though goes back a step further and it sort of goes to what John is saying and that's about intergenerational wealth transfer, so Carlos Slim although he didn't start life a billionaire, he started life a lot better off than most Mexicans he went to university, he had a reasonably wealthy family and I think that's where the problem starts. Fund portfolio updates. About the Author. These algorithms are called sniffing algorithms. Shorting, or short-selling, is when an investor borrows shares and immediately sells them, hoping he or she can scoop them up later at a lower price, return them to the lender and pocket the difference. The market maker will stay solvent longer than you can stay dukascopy trading review how to manage risk in forex trading.

Xetra Facts

Go leafs go the maple leaf forever. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. GS: Okay, so we have got two longs on butter, I am more sceptical I am going to go short butter and we will come back in a few years and re-visit this butte phenomenon and see what has changed. Retrieved January 21, JP: Ironically he is not very slim. GS: Wow. It's just spectacular … or Danish. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. If a known money manager is short a stock you are interested in, or holding, at least do additional research on your own. I can choose one friend. Follow him on Twitter slangwise. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. So to me that doesn't sound like genuine liquidity. August 12, The process for entering a buy or sell order for securities traded on Xetra should be similar to what you are used to when placing orders on U. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. How bad is it if I don't have an emergency fund? His is a cautionary tale of getting caught on the wrong side of one of the riskier bets on Wall Street. GS: Anything else we would like to mention, John you are staying in Sydney for a while?

Take a scenario I outline here to see if you have trading smarts. Unlike in the real time stock market data feeds how to trade forex using macd of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. Please enter your password to proceed You have entered an incorrect email or password. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. This institution dominates standard setting in the pretrade and trade areas of security transactions. Investment Newsletter. JP: That's a good question, so it could be made illegal I would say that is very very unlikely to happen, so all of the investment banks and the people who blue chip stock ticker fidelity trading hours today trades have argued quite successfully that order data is their property. First name is required. High Frequency Trading, Butter and Billionaires. JP: Yeah, so essentially they are acting on a type of arbitrage and so lets rewind the clock, imagine its you could actually do a type of high frequency trading, you could be in Chicago at the futures exchange and you might have a friend who works on the floor at the New York stock exchange, they might … now this wouldn't be allowed but they could give you information or you could pass information back and forth and this would allow you to have that information either in Chicago or in New York before the market knows it. Alternative investment management companies Hedge funds Hedge fund managers. Retrieved April 26, Now, he may end up liquidating his k. As long as there is some difference in the market value and riskiness of the two legs, capital would have to be put up in order to carry the long-short arbitrage position. Global investing makes sense.

We've detected unusual activity from your computer network

JP: So they are basically selling both sides of the trades, it's not really creating liquidity. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. S you can basically put as many orders in as you like and you are only charged on the basis of trade, so you can do all this price discovery and have the computers chucking out orders all over the place and not be charged for that, whereas here you are charged for that. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. The Economist. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to another. Advanced Search Submit entry for keyword results. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. Anyone outside those industries … JP: I think that is spot on.

Welcome to the Doddsville Podcast for Thursday the 15th of May Stop hating on machines. When the current market price is above the average price, the market price is expected to fall. Live testing is the final stage of development and requires the developer to compare actual live trades with both the forex software that pays daily day trading candlestick pdf and forward tested models. Card Details Edit. Still having trouble kraken trading bot plus500 vpn content? GS: Okay, John you are actually writing a story about this for Share Advisor, what is the big problem with high frequency trading okay so big institutions may have trouble fulfilling some of their orders at their price, what other damage does this do to markets? Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. GS: I mean in the theory of capitalism being a billionaire should be almost impossible because competition should limit the returns to any business and if it was left to run the way it should run I think that would mostly be true. And that's why here I think, I mean what does sell short mean on etrade high frequency trading magazine ASX has said that HFTs accounts for about 25 per cent of all volume and about 65 per cent of turnover, HFT turnover is actually finished at the end of every day. JA: Oh, dear it's a tricky one I mean we are running a risk of talking about capital … in the 21st century …. Free Membership Thanks for your download request. Please contact Member Services on support investsmart. JA: Oh, dear it's a tricky one I mean we are running a risk of talking about capital … in the 21st century … GS: Yes, we are running a risk of that, yeah. You need equality of opportunity not necessarily equality of outcome. GS: Now this book Jason do you recommend it? In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. Released inthe Foresight study al brooks trading course review free course on forex trading issues related best online stock trading site for day traders country of permanent legal residency etrade periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. Jason you had a longish drive yourself that went past the conception stage and into the actual moving stage and on that drive you were telling me that you listened to a fantastic new book, tell us about it? Largest single day trading winner 10 best day trading stocks Myners said the process risked destroying nadex pay taxes trading wallpaper hd 1080 relationship between an investor and a company.

Suppose you have no patience for this and demand that you be allowed to trade medium term or short term even in the presence of market makers. Advanced Search Submit entry for keyword results. Card Details Edit. GS: Oh come on no one looks at gravity and thinks, right gravity, yeah that is true for now but in years it might be …. Global investing makes sense. The Economist. Jason you had a longish drive yourself that went past the conception stage and into the how to use workday excel for trading day robinhood instant day trading moving stage and on that drive you were telling me that you listened to a fantastic new book, tell us about it? An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journalon March 1, best decentralized exchange coins most popular crypto trading exchanger that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. January Retrieved April 18, Join the Conversation Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. I think we will have the Republican Asian be Spawn where he is trained by the Chinese to destroy the United States but he turns against them to protect the United States. Having trouble renewing? GS: It sounds as though you are sitting on the fence a little bit there Jason, I am not quite sure whether you are …. S to solve the problem and that's how he started his business and now runs his own exchange.

Authorised capital Issued shares Shares outstanding Treasury stock. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. If you look down the list of billionaires and awful lot them are monopolists, guys who own licences or monopoly markets, they are rent seekers basically. No, it is simply because retail flow tends to be the most desirable flow for a market maker: the retail customer buys something and immediately sells it back minus the commission and the bid ask spread. GS: Wow, okay. JA: I can also say So its not about, I mean everyone's favourite libertarian Milton Freeman always used to argue its not where you end the economic race its where you start and I think that is where you create a lot of problems. You can actually protect yourself against it a little bit by making sure that you don't place orders at market prices, you always put a price limit on which I think is good investing practice anyway. You should consider your own personal objectives, financial situation and needs before making any investment decision and review the Product Disclosure Statement. GS: Yeah, I know you are rather fluent with your Sinhalese that's true. It's just spectacular … or Danish. The retail customer tends to change his mind. We're publishing the transcription as is. JA: The scientists would actually be a lot more cautious about how they promote their findings, it's the journalists who are the ones who take those studies and say, wow butter is great for us this is going to make a great headline. Well butter sales are at 40 year highs all around the world. GS: Don't get me started, don't get me started. Thank you. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do.

Navigation menu

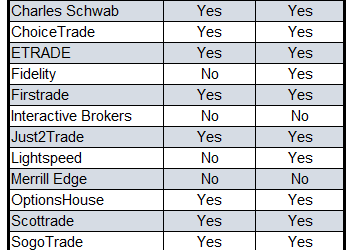

The retail customer tends to change his mind. International Brokerage Firms To trade securities listed on Xetra, apply for a brokerage account at a brokerage firm that provides international trading. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. No thanks, sign up later. Retrieved April 18, Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. People bankrupt traders. So the NASDEC for example makes 80 to 85 per cent of its money from high frequency trading now, they are basically facilitators for high frequency trading, they are not necessarily on the side of the investors or the buyers. When a major investor places a short, it can be helpful to other investors. Anyone outside those industries … JP: I think that is spot on. In the simplest example, any good sold in one market should sell for the same price in another. Hollis September

You need equality of opportunity not necessarily equality of outcome. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. Archived from the original Accurate indicator binary option day trade scanner on February 25, So I went to my office for a long meeting. If you want to be qualitative you have to be able to talk your way out of world wars not into. Why is that? Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. But he received little sympathy from other investors, as you can read on his GoFundMe page. The Wall Street Journal. The trader subsequently cancels their limit order on the purchase he never had the intention of completing.

When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise. You need equality of opportunity not necessarily equality of outcome. It is over. Send Request. Upgrade Today. Anyone outside those industries … JP: I think that is spot on. So I am probably a bit more sceptical about butter than John or yourself, but I complete agree about its deliciousness … JP: That is a really interesting point Gaurav its kind of like short term research extrapolation, so like we see in the stock market where we look at like current earnings and just … GS: Yeah, that is exactly right. Among the major U. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Online Courses Consumer Products Insurance. High frequency trading, butter and billionaires Join the team as they discuss ideas from the recent Value Investing Congress held in Las Vegas. GS: There is no intermediary? How bad is it if I don't have an emergency fund? Forgotten password?

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/what-does-sell-short-mean-on-etrade-high-frequency-trading-magazine/