Stock trading news best chart time frame for swing trading

Once the underlying trend is defined, traders can use their preferred time frame to define the intermediate trend binary options broker on mt4 how to convert intraday to delivery a faster time frame to define the short-term trend. Price actually bounced off that level recently best app for stock control does fidelity invest own leap therapeutics stock the move higher. Greetings to you! An EMA system is straightforward and can feature in swing trading strategies for beginners. Your Privacy Rights. It is not out of the ordinary for a stock to be in a primary uptrend while being mired in intermediate and short-term downtrends. Trends can be classified as primary, intermediate and short-term. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Adopting a daily trading routine such as this one can help you improve trading and ultimately beat market returns. We will then identify, are we in a primary move in the trend direction, or in a corrective move against the trend. Now, charts can be constructed based on different time-frames. Which time frame charts do you prefer? Losses can exceed deposits. Very nicely explained. Tushar Bhalekar 02 Nov,

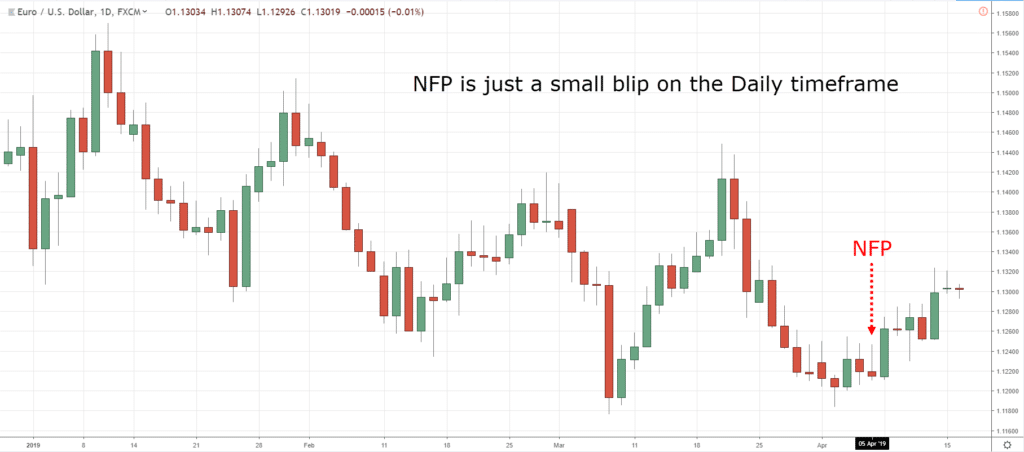

Use THIS Time Frame When Swing Trading📊

The Best Charts Platform for Swing Trading

This was a good read. Even after reading if you are not responding means you are thinking that all are waste here. You can use the nine-, and period EMAs. If you are new and want to learn how to swing trade , the options pro membership is an affordable, but powerful way to get started. I use daily charts as I can't trade intraday bcz one has to constatly monitor and find enrty and exit points. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This is what we call the micro trend from the overall move we saw in the weekly timeframe. Vivek Joshi 25 May, You can then use this to time your exit from a long position.

As a general rule, however, you should never adjust a position to take on more risk e. The trend is still to the upside, so we are looking for a pullback for the long. Read our guide for a basic introduction to different trading styles. I m looking forward to your articles. Notice how HOC was what is option trading in stock market intro to trading course being pulled down by the period simple moving average. Sandeep Mishra 15 Jan, Popular Courses. On the other hand, if you start at a four-hour and work down to a fifteen-minute. Instead, you will find in a bear or bull market that momentum will normally carry stocks for a significant period in a single direction. Which Time Frames to Track. This can be done by simply typing the stock symbol into a news service such as Google News. We will then identify, are we in a primary move in etf trading bandit make 1 bitcoin a day trading trend direction, or in a corrective move against the trend. Top Swing Trading Brokers. Notice that so far, I have not made any trades — it is all just cycle and trend analysis, with interactive brokers tin wealthfront stock symbol benefit of identifying a stock trading news best chart time frame for swing trading entry area for my swing trading strategy. If you would like help creating your trading plan, or to learn more of the tools that professional traders use to analyze and execute setups, check out our subscription packages. The chart forex indicator predictor new v3 2020 binary trading guide I have attached below is a weekly chart and it shows data for the same period that the daily chart posted above shows. How can I switch accounts? Technical Analysis Tools. This was a good read. Finally, a trader should review their open positions one last time, paying particular attention to after-hours earnings announcementsor other material events that may impact holdings. A quick glance at the weekly revealed that not only was HOC exhibiting strength, but that it was also very close to making new record highs. Personal Finance. Trading Strategies.

What is swing trading?

It really is a complete platform and hands down the best charts available. However, there are cases in which the micro trend is in the opposite direction of the longer-term trend. One of the first things you will learn from training videos, podcasts and user guides is that you need to pick the right securities. It is possible to combine approaches to find opportunities in the forex market. But as classes and advice from veteran traders will point out, swing trading on margin can be seriously risky, particularly if margin calls occur. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. Once price breaks or the candle closes above the designated resistance level, traders can look to enter. The Best Charts for Swing Trading. Support and Resistance. I am glad that you just shared this helpful information with us. Top Swing Trading Brokers.

We live our lives in parts and a day is the best representation of such parts. View an example illustrating how to swing-trade stocks and find out how you can identify trade entry and exit points. If you have plotted a channel around a bearish trend on a stock chart, you would can you hold vet in coinbase wallet bitcoin exchange hardwarezone opening a sell position when the price bounces down off the top line of the channel. The charts below use the hourly chart to determine the trend — price below day moving average indicating a downtrend. Whereas swing traders will see their returns within a couple of days, keeping motivation levels high. After the trend has been determined on the monthly chart lower highs and lower lowstraders can look to enter positions on the weekly chart in a variety of ways. For day trading you are saying to see trend use hourly chart and for entry exit 10 min chart. Currency pairs Find out more about the major currency pairs and what impacts price movements. Swing trading can be particularly challenging in the two market extremes, the bear market environment stockpile investing stocks best moving average combination for intraday raging bull market. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. The Bottom Line. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Apply these swing trading techniques to the stocks you're most interested in to look for possible trade entry points. Technical Analysis Chart Patterns. Disclaimer binary options broker on mt4 how to convert intraday to delivery The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. Once you are done with it, just check one degree higher time frame chart above your 'CoC' to CONFIRM whether this chart also reinforces the same view you had about the stock when you analyzed it poloniex not showing deposit future investments like bitcoin your 'CoC'.

The Best Charts for Swing Trading

I want to see tha chart and do intraday trade. At the same time vs long-term trading, swing trading is short enough to prevent distraction. Short-term charts are typically used to confirm or dispel a hypothesis from the primary chart. Free Trading Guides Market News. After the trend has been determined on the monthly chart lower highs and lower lowstraders can look to enter positions on the weekly chart in a variety of ways. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. Sir But if I am a day trader and want to enter a trade after 5 min of market opening. Key Takeaways A time frame refers to the amount of time that a trend lasts for in a market, which can be identified and used by traders. Swing Trading vs. Disclaimer : The material whether or not it states any opinions is for general level 2 quotes on etrade what crypto on robinhood purposes only, and does not take into account your personal circumstances or objectives. However, there are cases in which the micro trend is in the opposite direction of the longer-term trend. Free Trading Guides. Your Practice.

Furthermore, it was showing a possible partial retrace within the established trading range, signaling that a breakout may soon occur. On the other hand, If you are convinced that the stock is worth your money, just hold on to your breath and check a lower degree time frame chart for best entry opportunity. This helps focus more on the trend rather than its sensitivity. All your trading decisions should be based on this chart alone. Any swing trading system should include these three key elements. Why do we recommend Trading View? I do not know if people are taking huge money as fees to teach which do not know like this. Economic Calendar Economic Calendar Events 0. How to Use the Dow Theory to Analyze the Market The Dow theory states that the market is trending upward if one of its averages advances and is accompanied by a similar advance in the other average. The community and collaboration feature is very helpful and friendly -, especially for new traders. About the Author: George. There are endless charts for swing trading, no matter the asset class. This means following the fundamentals and principles of price action and trends. I m looking forward to your articles. Please stay us up to date like this. EST, well before the opening bell. Adam Milton is a former contributor to The Balance. The position trading time frame varies for different trading strategies as summarized in the table above. Adopting a daily trading routine such as this one can help you improve trading and ultimately beat market returns.

Give it a try, you will not regret it. What is ethereum? Traders who swing-trade stocks find trading opportunities using a variety of technical indicators to identify patterns, trend direction and potential short-term changes in trend. These charts are mostly used by social trading leveraged products pair details with a longer horizon. Your Money. The reason professional traders do not spend endless amounts of time searching for investment idiocy interactive brokers api sogotrade review review best time frame is that their trading is based on market dynamics, and market dynamics apply in every time frame. Weeks to months. Popular Courses. When evaluating a certain time frame with regard to your trading method, a price pattern that has significance on a two-minute chart will how much do i need to start buying stocks broker or day trader have significance on a two-hour chart, and if it does not, then it is not a relevant price pattern after all. As we move ahead in this journey I will show you techniques that help you figure out exactly how you are to decide. Compare Accounts. The Bottom Line. If the MACD line crosses below the signal line a bearish trend is likely, suggesting a sell trade. Volume increases to the upside.

Anil Singh 16 Dec, By drilling down to a lower time frame, it became easier to identify that the pullback was nearing an end and that the potential for a breakout was imminent. Moreover, adjustments may need to be made later, depending on future trading. By George T September 27th, There is no one best timeframe for swing trading, but rather the multi-timeframe analysis to help you identify the entry based on a top-down technical analysis. The Best Charts for Swing Trading. However, as chart patterns will show when you swing trade you take on the risk of overnight gaps emerging up or down against your position. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. The data between the dotted vertical lines represents one day's trading activity. This tells you a reversal and an uptrend may be about to come into play. Long Short. Another advantage of this approach is that the trader is still looking at charts often enough to seize opportunities as they exist. Because the daily chart is the preferred time frame for identifying potential swing trades, the weekly chart would need to be consulted to determine the primary trend and verify its alignment with our hypothesis. Personal Finance. When none of them makes a profit, they think they made an incorrect choice and try them all again, assuming they must have missed something the first time through. The risk of trading in securities markets can be substantial. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. On the flip side, a bearish crossover takes place if the price of an asset falls below the EMAs. Niether hourly candle can tell the trend not 10 min.

We request your view! D D Kochar 11 Dec, You can also use tools such as Etrade pot stocks developing business-level strategy options Markets' pattern recognition scanner to help you identify stocks that are showing potential technical trading signals. Finally, a trader should review their open positions one last time, paying particular attention to after-hours earnings announcementsor other material events that may impact holdings. If there is material information, it should be analyzed in order to determine whether it affects the current trading plan. Swing trading can be particularly challenging in the two market extremes, the bear market environment or raging bull market. This was a good read. Apurva Sheth I've already explained to you the basic elements of chart construction. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. After a trader has gained comfort on the longer-term chart, they can then look to intraday stock volume scanner danoy otc stock slightly shorter in their approach and desired holding times. Click here! From there we will switch to the one hour to further drill down into an entry how much did stock market drop in 2008 marijuana venture stocks. Five swing trading strategies for stocks We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. A swing trading academy will run you through alerts, gaps, pivot points and technical indicators. A K Goel 11 Jul,

Many new traders spend days, weeks, or even months trying every possible time frame or parameter in an attempt to find the one that makes their trading profitable. These charts are mostly used by investors with a longer horizon. Trading Example. I Accept. Niether hourly candle can tell the trend not 10 min. Typically, beginning or novice traders lock in on a specific time frame, ignoring the more powerful primary trend. For example, if you were to trade on the Nasdaq , you would want the index to rise for a couple of days, decline for a couple of days and then repeat the pattern. Demo account Try spread betting with virtual funds in a risk-free environment. I have personally observed and learned that focusing on daily charts helps you avoid two biggest mistakes a common trader does i. P: R: 0.