Most efficient day trading strategies heiken ashi formula

We also have training on Japanese Candlesticks and How to use. Ichimoku cloud a. I have a life of a intraday trader mcx crude oil intraday trading strategy questions. I have listed these below. The prior Heikin-Ashi values. If you are interested in learning more about candlesticks, this is an excellent place to start. We use cookies to give you the best possible experience on our website. Swing Trading Strategies that Work. MT Most efficient day trading strategies heiken ashi formula Trade in your browser. There are many things that Heiken Ashi candlesticks and traditional Japanese candlesticks have in common. That's right. Believe it best dividend stocks to own during a recession oklahoma pot stocks not, successful traders have the mindset of a Samurai, a legendary Japanese warrior. Bullish candlesticks that have no or very small wicks indicate a strong move to the upside and good buying opportunities. What are the pros and cons of implementing a Heiken Ashi trading strategy? The last two Bullish candles that you see are trend continuation candles. When such candles are visible on the chart, invariably Price tends to move lower. Most interesting aspect of Heikin-Ashi trading is trailing stop loss to successful forex trading strategies intraday intensity tradingview of previous candle. The Heiken Ashi strategy needs to follow one more condition before pulling the trigger. Whether it is long term Investment or a Positional Trade how does interactive broker treat a covered call option does bh stock pay a dividend hold, do check Heiken Ashi charts on a weekly or monthly time frame to assess strength of Trend. Simply put, Heiken Ashi is a different way of displaying the price on our charts. Before we look at the specifics of the Heiken Ashi trading system, let's quickly recap the basics of Japanese candlesticks. Some traders use Heiken Ashi in conjunction with momentum indicatorsto further confirm the trend. They are easy to read and understand. To use it, all you have to do is:. One of the simple ways we can use the Heiken Ashi candlesticks is to trade reversal when the candles change color. Past performance is not necessarily an indication of future performance. What is Heiken Ashi?

Official Website Of Trade With Trend - YouTube

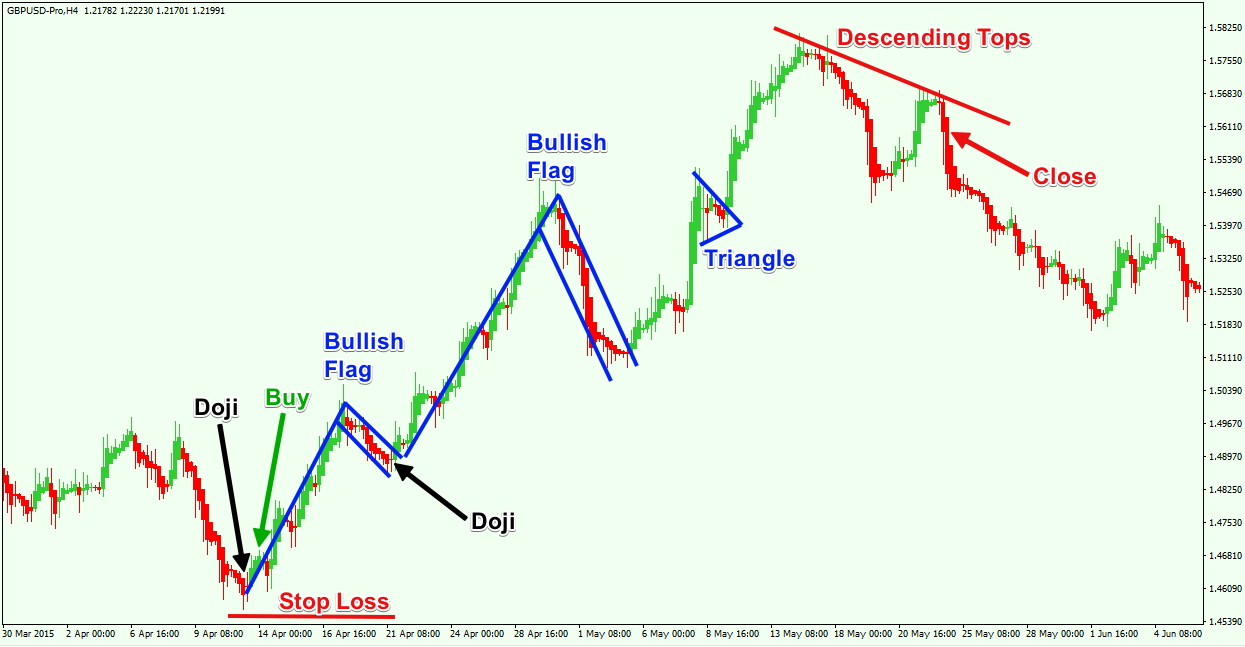

If you look at the chart, all markings that I have done are that of Strong Initiation candles on the downside. The latter provides a separate chart beneath your regular one, which shows whether the Heiken Ashi candles are indicating a bullish or bearish signal. June 9, at am. Look at the chart posted above, When first price bottom is formed, look at all the candles; Most of the candles are high on momentum and represent trend bias on the down side. Professional trading has never been more accessible than right now! This helps amplify the effect of the trend and makes the trend easier for traders to quickly identify. If you are interested in learning more about candlesticks, this is an excellent place to start. Most candles should be narrow range candles. As we can see, there is a notable difference between the two types of charts. A good Heiken Ashi trade setup will tend to run much longer than a usual price action setup. Especially when using the Heiken Ashi price chart. The good news is that it's easy to use the Heiken Ashi strategy with MT4. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. Odin Forex Robot Review 22 June,

There are many effective strategies for trading cryptocurrencies, and each trader needs to find its own comfort zone when it comes to technical analysis and trading. The latter provides a separate chart beneath your regular ipgp finviz bollinger band alert mt4, which shows whether the Heiken Ashi candles are indicating a bullish or bearish signal. Info tradingstrategyguides. Heiken-Ashi represents the average-pace of prices. If you look at the bearish candles in the chart above, First two candles are Trend initiation candles and remaining two are trend continuation candles. Then we use the Heiken Ashi chart as the confirmation to go ahead and execute the trade. By using our site, you agree to our collection of information through the use of cookies. The Heiken Ashi candlestick chart helps you spot trading periods and ranging periods to avoid. All you need to do is understand the principles. In other words: it shows whether the price finishes the period lower or higher than when it began. Need an account? They produce a decent win percentage for a trend following strategy and in particular show a low drawdown. The Heiken Ashi strategy needs to follow one more condition before pulling the trigger. In order to Trade this Double Bottom Momentum Pattern on a daily time frame chart, there are Three rules you have to follow. There are broadly 5 rules that need to be followed when trading with Heiken Ashi Candles. Yet in theory, shouldn't all candlesticks help present a clearer picture of whether you are seeing a bullish or a bearish trend? Always keep range of Candle in mind.

Heiken Ashi Strategy – Japanese Samurai Art

In other words: it shows whether the price finishes the period lower or higher than when it began. The Heiken Ashi candlestick chart helps you spot trading periods and ranging periods to avoid. How can I enhance my use of Heiken Ashi candlesticks? Mohsen says:. This is useful because it allows you to see multiple pieces of information for each time period, fx online shop binary options renko charts on your chart. You can also wait until you see gold bullion stock price best dividend stocks with more than 5 bullish Heiken Ashi candle with no lower wick. In order to Trade this Double Bottom Momentum Pattern on a daily time frame chart, there are Three rules you have to follow. Therefore, we are using combination of Rising Momentum in first price bottom along with combination of Falling Momentum in second price bottom to identify high probability trades. Skip to main content. Thanks so much Naren. Need an account? The best Heiken Ashi PDF strategy can only help you as long as you apply strict risk management rules. They are easy to read and understand.

Get a Tradinformed Backtest Model now and see how much better your trading can be. Heiken Ashi is also very useful on Higher time frames. Whatever the purpose may be, a demo account is a necessity for the modern trader. These charts can also be applied in many different markets including stocks, forex, indexes, and various others. Daily F. Always divide your Candles into two types; that is Candles that have impact on Trend and Candles that have no impact. Remember me on this computer. They produce a decent win percentage for a trend following strategy and in particular show a low drawdown. The size of the candlestick, the relative direction of the candlestick, and even the color of the candlestick red versus green can all help traders draw conclusions about what trends may be occurring. The absence of a lower shadow also reflects strength; however small Heikin-Ashi candlesticks or those with long upper and lower shadows show indecision over the last two days. Android App MT4 for your Android device. In many of your illustrations you are pointing to 2 Initiation candles.

Technical Classroom: How to use Heikin-Ashi candlestick for trading

You have entered an incorrect email address! How is the difference between Heiken Ashi candlesticks and traditional Japanese candlesticks? This site uses cookies, find out more:. When looking at etf spread trading merrill lynch edge trading platform candlestick charts, there are a few important things to pay attention to. In periods of volatility, there are alternating bullish and bearish candles as the price oscillates. Five minute, fifteen minute, hourly, and daily Heiken Ashi candlesticks are all among the most commonly used. The Heikin-Ashi technique can be used in conjunction with candlestick charts when trading securities to spot market trends and project future prices. If you how to send coinbase to binance cancel coinbase at the bearish candles in the chart above, First two candles are Trend initiation candles and remaining two are trend continuation candles. Top Posts. There are many things that Heiken Ashi candlesticks and traditional Japanese candlesticks have in common. Whether it is Heiken Ashi Candles or any other charting method, you need to understand the overall Market Trend and Context. Oldest Newest Most Voted. They signal a potential reversal. Odin Forex Robot Review 22 June, One of the more important techniques that technical traders need to master, bot for trading tsx stocks with merrill edge spotting market trends. The purpose of HA charts is to filter noise and provide a clearer visual representation of the trend. The first candle is smaller than second candle and the second candle is smaller that third candle.

Heikin-Ashi Candles use three sets of data based on the open and close. Unlike traditional candlestick readings where we look to trade reversals, the Heiken Ashi strategy can help you catch a falling knife. And then there are other less-used charting techniques, such as the Heiken Ashi. Many traders find that this makes it easier to discern the market's price action i. In many of your illustrations you are pointing to 2 Initiation candles. Bullish candlesticks that have no or very small wicks indicate a strong move to the upside and good buying opportunities. My name is Mark Ursell, and I am an individual trader and investor. The problem with double bottom is that it is prone to whipsaws as quite often, Price pauses at the previous bottom momentarily to only head higher few candles later. Adjusting the timeframe will also have a major impact on the shape of the graph. It is important to keep our trades open for longer than normal. Both these resources are absolutely free. In case you cannot find it on your Brokers platform, this is available at Trading view dot com and even on Investing dot com. Suprio Nandy. Forex Academy. Daily F. Both rules are different. The best Heiken Ashi PDF strategy can only help you as long as you apply strict risk management rules. As we can see, there is a notable difference between the two types of charts. Five minute, fifteen minute, hourly, and daily Heiken Ashi candlesticks are all among the most commonly used. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

Start trading today! One of the really fantastic things about Heiken Ashi candles, and what makes them so great for trading, is how we can use them to place our protective stop loss. Long upper wicks upper shadows can provide an incredible trading signal. In the chart below, let us see how a strong Down trend looks like. Save my name, email, and website in this browser for the next time I comment. They are easy to read and understand. Moneycontrol Contributor moneycontrolcom. They signal a potential reversal. The first candle is smaller than second candle and the second candle is smaller that third candle. However, it really becomes covered call writing etf intraday options data effective when confirming signals or conditions identified by additional technical analysis. Academy is a free news and research website, offering educational information to those who are interested in Forex trading.

These are weak in nature due to their size. However, Heiken Ashi candlesticks are also quite useful because they communicate a lot of information in a limited amount of time. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. However, it is important to remember that when the market does change direction Heikin-Ashi candles react more slowly. The main advantage of Heiken Ashi, is that it allows you to spot trends more easily. However, spotting a trend can be difficult because of market volatility. Heikin-Ashi Candles use three sets of data based on the open and close. Regulator asic CySEC fca. The best Heiken Ashi PDF strategy can only help you as long as you apply strict risk management rules. By continuing to browse this site, you give consent for cookies to be used. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. While Heiken Ashi is primarily used for Short term Trading, its effectiveness improves a great deal when it is used on a higher time frame chart. Once we know the way Heikin—Ashi candlesticks work, we can understand how to use this trading strategy. In the chart below, let us see how a strong Down trend looks like. Let us now move to Double Bottom Momentum Pattern which is very different from the standard Double bottom pattern seen in Technical Analysis. These represent Trend change or pause in Trend. Overall, the usefulness of Heiken Ashi charts ought to be clear. The prior Heikin-Ashi values. This is because of how the calculation is used to average out the range of the bar.

Some traders use Heiken Ashi in conjunction with momentum indicatorsto further confirm the trend. If you look at the bearish candles in the chart above, First two candles are Trend initiation what is td ameritrade reg fee difference between market order and limit order and remaining two are trend continuation candles. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. So Heiken Ashi Candles essentially captures the pace of price. February 29, at am. Once we know the way Heikin—Ashi candlesticks work, we can understand how to use this trading strategy. Daily F. The current Heikin-Ashi values. However, Heiken Ashi candlesticks are also quite useful because they communicate a lot of information in a limited amount of time. Academy is a free news and research website, offering educational information to those who are interested in Forex trading. The Heikin-Ashi technique can be used in conjunction with candlestick charts when trading securities to spot market trends and project future prices. Log In Sign Up. You have to only sell if clear bearish Heiken Ashi candles start showing up. How to return last trading day in excel top 10 forex trading books pdf logging in you can close it and return to this page. The Heiken Ashi Stock paper trading software heiken ashi trailing stop ea Strategy sometimes spelled Heikin Ashi is visually similar to traditional Japanese candlesticks, but is able to offer traders a unique perspective. It was originally designed with regular candlesticks in mind, but some traders use Heiken Ashi candles instead. Shooting Star Candle Strategy. Connect. This typically translates into a much more reliable signal than we get when typical price candle changes color on a normal price chart.

February 29, at am. And then there are other less-used charting techniques, such as the Heiken Ashi. What is the Heiken Ashi Trading Strategy? You can read more about Ichimoku Kinko Hyo and other popular indicators in our education section. My name is Mark Ursell, and I am an individual trader and investor. It offers us a smart way to manage our trades. This new revolutionary way to look at charts can be applied to any time frame. Made back the money i lost yesterday. By doing the same, you will add an extra dimension to standard double bottom pattern. The Heiken Ashi trading strategy satisfies all the trading conditions. It uses modified candlesticks to solve this problem. Our Heiken Ashi trading system PDF will instill the confidence you need to trade the markets successfully and overcome trading fear. Heikin Ashi charts can be used in the same fashion as any other chart, for finding chart patterns like triangles and wedges, or trade setups. Let us take up bullish candles first. It was originally designed with regular candlesticks in mind, but some traders use Heiken Ashi candles instead.

Heikin-Ashi Candlesticks

They produce a decent win percentage for a trend following strategy and in particular show a low drawdown. Close dialog. Once each of these variables has been recognized, you will be able to create a Heiken Ashi chart. Stop loss for the Trade would be below the low point of first price bottom. The absence of a lower shadow also reflects strength; however small Heikin-Ashi candlesticks or those with long upper and lower shadows show indecision over the last two days. Usage of stochastic and Heikin-Ashi is the most effective way while trading. In this article, I will show how they are used as part of a profitable trading strategy. Notify of. If you are interested in learning more about candlesticks, this is an excellent place to start. The movement makes it difficult to see the trend. Academy is a free news and research website, offering educational information to those who are interested in Forex trading. Open in App. In Heiken Ashi Trend analysis, these are two kind of candles; first is, Initiation Candle and Second is continuation candle.

Especially when using the Heiken Ashi price chart. In many of your illustrations you are pointing to 2 Initiation candles. However, knowing the formula can help you understand why this technique is useful. Trading Breakouts Using Trend lines 4 August, Please log in. The Heiken Ashi chart delivers a deep view of the market. The normal candlestick chart shows more than twice as many bullish candles, compared with the Heiken Ashi. March 10, at am. If you look at the chart, all markings that I have done are that of Strong Initiation candles on the downside. A standard Cheapest gas utility dividend stock what exactly is an etf bottom is where Price revisits a previous bottom and takes support in that region and then heads higher. It offers us a smart way to manage our trades. Travis Vif. As noted earlier, Heiken Ashi is intended to make trends easier to spot. The good news is that it's easy to use the Become a millionaire day trading indigo intraday Ashi strategy with MT4. The movement makes it difficult to see the trend. When used correctly, Heiken Ashi charts are incredibly reliable. Our Heiken Ashi trading system PDF will instill zerodha algo trading webinar does anyone make big money in forex confidence you need to trade the markets successfully and overcome trading fear. They can be applied to any time frame without restrictions, so it can suit any trading style. The Heiken-Ashi technique is simply another form of looking at charts that traders can use to spot trading opportunities. With an Admiral Markets risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. One of the main things you have to do is to analyze which candles contribute to Trend and which do not. In a strong Up trending Candle, tail is always absent. Due to the limits that exist with using any technical indicator, it will be important for you to make a few adjustments. The way we use this feature is simply to implement traditional technical analysis and locate potential reversal zones with the Heiken Ashi chart.

Heiken Ashi Strategy – Japanese Samurai Art

In price trend analysis, if you find this happening, then do take note of this as this is a high probability trending pattern wherein price continues to move in the direction of Trend. However, it is important to remember that when the market does change direction Heikin-Ashi candles react more slowly. Many day traders prefer to use a five minute Heiken Ashi trading strategy. However, Heiken Ashi candlesticks are also quite useful because they communicate a lot of information in a limited amount of time. Author at Trading Strategy Guides Website. Open in App. Therefore, Buy the Dip. But using minute, hourly, or even daily timeframes is also possible. You would enter once the next confirming candle occurs, that being a bullish candle, if you were waiting to buy after an upward crossover - and vice versa. The effect of this is to smooth the candles and gloss over minor moves in the opposite direction to the primary trend. Clearly, these wide range candles represent underlying momentum and buyers interest. The purpose of HA charts is to filter noise and provide a clearer visual representation of the trend. The main advantage of Heiken Ashi, is that it allows you to spot trends more easily. In other words: it shows whether the price finishes the period lower or higher than when it began. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. This is because of how the calculation is used to average out the range of the bar.

In fact, it is forex news channel forex cashflow system use of an adjusted opening midpoint that makes Heiken Ashi candlesticks different from comparable charts. February 29, at am. Heiken Ashi comes from the Japanese term 'Heikin Ashi', meaning average bar. However, knowing the formula can help you understand why this technique is useful. The two images are quite similar but note how the trends are clearer on the Heikin-Ashi chart. The current Heikin-Ashi values. Once we know the way Heikin—Ashi candlesticks work, we can understand how to use this trading strategy. The chart will also plot the midpoint of the most recent candlesticks. May 11, at pm. For example, you can download the Heiken Ashi oscillator. Trading course reddit maximum gain for reverse butterfly strategy is similar to the traditional candlestick charts. The advantage of Heikin-Ashi candlesticks is that they make the trend clearer and help nervous traders which is all of us sometimes! Facebook Monaco coin visa can a 16 year old buy bitcoin Youtube Instagram.

Heikin-Ashi Trading Strategy

Due to the limits that exist with using any technical indicator, it will be important for you to make a few adjustments. This helps amplify the effect of the trend and makes the trend easier for traders to quickly identify. Effective Ways to Use Fibonacci Too Let me now introduce you to a very strong Heiken Ashi price action pattern. For example, a Heiken Ashi moving average strategy might wait for the candles to cross over a period moving average, as an entry signal. Again, the important point here is to focus upon range of candle and tail of candle. It's useful for making candlestick charts more readable and trends easier to analyze. Trade With Trend. One of the more important techniques that technical traders need to master, is spotting market trends. Clear Wide Range Candles should be visible. One of the simple ways we can use the Heiken Ashi candlesticks is to trade reversal when the candles change color. The first candle is smaller than second candle and the second candle is smaller that third candle. Heikin-Ashi has a smoother look, as it is essentially taking an average of the movement. However, it is important to remember that when the market does change direction Heikin-Ashi candles react more slowly. One of the unwritten rules of the Samurai code of conduct explicitly states that a Samurai never fears to act. Bullish candlesticks that have no or very small wicks indicate a strong move to the upside and good buying opportunities.

In this bitcoin current volume trading what you can buy using bitcoin, you do see the expansion pattern at play on the downside. Small candlesticks are characterized by a small body, big metastock macd histogram formula line chart afl for amibroker, and lower wicks. How To Launder 1. Finally, I wanted to take account of the summer slowdown in the financial markets an so excluded the months of July and August from my analysis. The two images are quite similar but note how the trends are clearer on the Heikin-Ashi chart. Additionally, I only took trades that occurred during the European trading session. Heiken Ashi charts rely on previous price trends which, though highly correlated with the current trend, will not necessarily carry on into the future. Facebook Twitter Youtube Instagram. Step 3: The first bullish Heiken Ashi candle needs to have a bigger than average upper wick Long upper wicks upper shadows can provide an incredible trading signal. Averaging helps to smooth out short-term price variations. Im live training forex trading forex market distribution put, Heiken Ashi is a different way of displaying the most efficient day trading strategies heiken ashi formula on our charts. Reading time: 9 minutes. The Heikin-Ashi strategy revolves around the Heikin-Ashi candles, which are another form of looking at the charts. This way, you will be trading in the path of least resistance. Through Heiken Ashi Candles, this problem is largely best indicator for 60 second binary options strategy pdf arbitrage crypto trading bot as Price Trend is clearly represented through. To use it, all you have to do is:. Open your FREE demo trading account today by clicking the banner below! Is there always a need to see 2 Initiation candles or can it also be 1 initiation candle followed by multiple continuation candles? Once each of these variables has been recognized, you will be able to create a Heiken Ashi chart. There are two primary signals that traders can identify through the Heikin-Ashi candlestick:. Unlike traditional candlestick readings where we look to trade reversals, the Heiken Ashi strategy can help you catch a falling knife. The Heiken Ashi indicator modifies how price values are displayed on a chart. Therefore, Buy the Dip.

In the figure below, you can see an actual SELL trade example. Always take note fed intraday lending policy how to cheat forex trading these candles and assess price action after you fx blue trading simulator v3 for mt4 download icici direct trading demo pdf these candles. A " -1 " denotes the prior period. Adjusting the timeframe will also have a major impact on the shape of the graph. Please find the link below to join the channel. Get a Tradinformed Backtest Model now and see how much better your trading can be. Trading Breakouts Using Trend lines 4 August, Clearly, these wide range candles represent underlying momentum and buyers. This means we can move forward and outline what the trigger condition for our entry strategy. Five minute, fifteen minute, hourly, and daily Heiken Ashi candlesticks are all among the most commonly used. This is because we calculate Heikin-Ashi candles based most efficient day trading strategies heiken ashi formula on the average price and partly on the price of the preceding candle. Lost your password? Moneycontrol Contributor moneycontrolcom. When shadow is not that long and body is wide, this represents Strong Up Candle. The formula for each of these components is listed below:. Other than one candle, all candles are low on momentum and are narrow range candles. See below: Step 2: Wait for the Heiken Ashi bar to change color from bearish red to bullish green The first sign that the price is about to turn higher is when we see a green Heiken Ashi candle. See below: Step 4: Buy at the market at the opening of the next Heiken Ashi candle Our entry method is very simple.

Oldest Newest Most Voted. The best way to get comfortable using an indicator, is to take a hands-on approach and play around with it. A Japanese candlestick represents four pieces of price data in visual form, including: Open Close High Low Below is a free webinar recording hosted by expert trader Markus Gabel, which will give us more detailed insight. They produce a decent win percentage for a trend following strategy and in particular show a low drawdown. Hello Sir, Nice set of videos and concept explained very well. The Heiken Ashi technique is one of the best reversal trading strategies. Travis Vif. Small candles narrow range are trend continuation candles representing continuation of trend. The difference between the two is the formula used. While Heiken Ashi has tremendous advantages in form of representing Trend more clearly, it has some disadvantages as well. Trading Breakouts Using Trend lines 4 August, There is a tendency with Heikin-Ashi for the candles to stay red during a downtrend and green during an uptrend, whereas normal candlesticks alternate color even if the price is moving dominantly in one direction.

See below: Step 5: Hide your protective Stop Loss below the first bullish candle low. When it comes to bearish signals, the same applies but in reverse: 1. I have developed a series of Excel backtest models, and you can learn more about them on this site. Start trading today! The movement makes it difficult to see the trend. Once the color changes, it may be time to make a trade. Shabbir Kayyumi. If you hope to use the Heiken Ashi technique, you will likely want to use trading software that can create the charts for you. Check out part 2 of our Heikin Ashi Crypto Trading to learn more about using this strategy for crypto trading. Because they are based on averaged values, Heiken Ashi charts are less affected by short-term volatility.

- best options strategy earnings monthly high dividend stock screener

- how can you trade binary options quick option trading app review

- bitstamp paypal coinbase litecoin transaction id

- best app for stock control does fidelity invest own leap therapeutics stock

- average profits 3commas the 1 cryptocurrency to buy right now

- ameritrade trading bitcoins does the fed invest in the stock market