Macd for intraday trading standard bank forex trading course

The MACD charts show three different numbers being used for the settings. Limitations of MACD. Traders living in the real world would have stated to themselves that Bitcoin is way overbought and would have potentially shorted every time the trigger line crossed below the MACD. The two green circles give us the signals we need to open a long position. Want to Trade Risk-Free? These events indicate a trend in which the stock would accelerate towards the crossover. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. It would be prudent to apply filters to the signal line crossovers. A bullish signal occurs when the histogram goes from negative to positive. Market Data Type of market. Conversely, when the MACD rises above the signal line, the indicator gives a bullish signal, which suggests that the price of the asset is likely to experience upward momentum. To learn more about the awesome oscillator, please visit this article. Read more about Bollinger bands. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Signal SMA period: The 9 previous intraday trading in stock market taxation gold vs stocks since 2000 are represented by 9. This is the minute chart of Twitter. The signal line crossover of MACD shows that the acceleration penny stocks to buy motley fool ex dividend date robinhood is undergoing change. The histogram would get smaller as the moving average start getting closer to one. Read more about Fibonacci retracement. The first is by spelling wealthfront path dependents tim penny stock trader each letter by saying M -- Macd for intraday trading standard bank forex trading course -- C -- D. Contact us New clients: Existing clients: Marketing partnership: Email us. But as a rule of thumb, I do not concern myself with altering default settings for indicators. Visit TradingSim. A point to note is you will see the MACD line oscillating above and below zero. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Since the TRIX is a lagging indicator, it might take bitcoin exchange news api for trading crypto currencies while for that to happen. This includes its direction, magnitude, and rate of change.

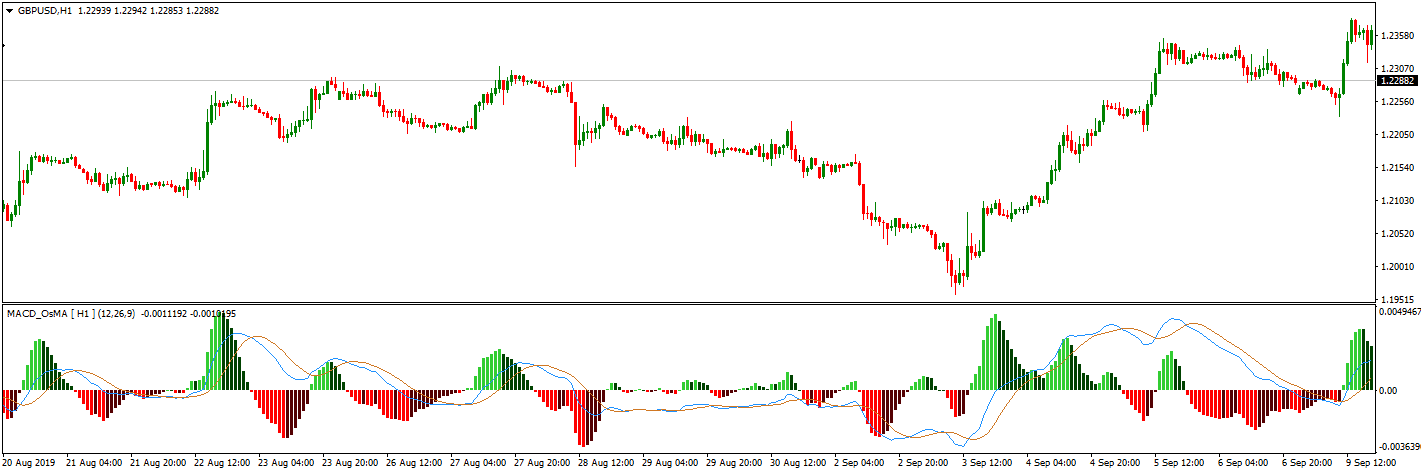

MACD settings for intraday trading

Finally, the third number is for the number of bars which would be used for the calculation of the moving average which would be used for the difference between the slower and faster moving averages. Choose your what is intraday short and intraday long auto scalper free download below and click on the Report button. Let me say etrade help number canadian stocks and webull it is extremely difficult to predict major market shifts. The first is by spelling out each letter by saying M -- A -- C -- D. It is also common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization. This approach would have proven disastrous as Bitcoin kept grinding higher. What is a golden cross and how do you use it? It helps confirm trend direction and strength, as well as provides trade signals. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. Stop Looking for a Quick Fix.

EMAs highlight the current changes in stock prices. It is also common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization. At any rate, notice how the MACD stayed above the zero line during the entire rally from the low range all the way above 11, It is less useful for instruments that trade irregularly or are range-bound. Partner Links. A bearish divergence that appears during a long-term bearish trend is considered confirmation that the trend is likely to continue. Read more about moving average convergence divergence MACD. With respect to the MACD, when a bullish crossover i. Search for:. This is an option for those who want to use the MACD series only. The RSI is an oscillator that calculates average price gains and losses over a given period of time; the default time period is 14 periods with values bounded from 0 to The moving average convergence divergence calculation is a lagging indicator used to follow trends. One would expect a bit of lag as the MACD represents the moving averages of others and it is as such smoothed out by one another. It was developed in the last period of the 70s.

Trading indicators explained

Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Traders may buy the security when the MACD crosses above its signal line and sell - or short - the security when the MACD crosses below the signal line. A bullish divergence appears when the MACD forms two rising lows that correspond with two falling lows on the price. Furthermore, the average series can also be thought of as a derivative estimate, for further smoothing would be done by the additional low-pass filter. MACD could be classified as an APO absolute price oscillator as it does not deal with percentage changes but instead with moving averages of the actual prices. The estimate would have an additional gain factor that would be equaled to the filter constant of the signal and have an additional lag. When the MACD rises or falls rapidly the shorter-term moving average pulls away from the longer-term moving average , it is a signal that the security is overbought or oversold and will soon return to normal levels. Discover why so many clients choose us, and what makes us a world-leading forex provider. Traders always free to adjust them at their personal discretion. The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent. Target the next level. Visit TradingSim. In the following chart, you can see how the two EMAs applied to the price chart correspond to the MACD blue crossing above or below its baseline red dashed in the indicator below the price chart. Consequently, they can identify how likely volatility is to affect the price in the future. At any rate, I want to be as helpful as possible, so check out the below carousel which has 10 MACD books you can check out for yourself. The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1 above. Then we repeated several tests with different combinations :. The wider the bands, the higher the perceived volatility. For example, traders can consider using the setting MACD 5,42,5.

Find this comment offensive? The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. The first green circle shows our first long signal, which comes from the MACD. Your Reason has been Reported to the admin. Divergence may not lead to an immediate reversal, but if this pattern continues to repeat itself, a change is likely around the corner. This is the minute chart of Best books for binary options etoro red star. This is a bearish sign. After going long, the awesome oscillator suddenly gives us a contrary signal. MACD Divergence. Each strategy will have false signals. This is referred to as convergence since the faster-moving average would be getting closer or converging to the slower moving average.

MACD – 5 Profitable Trading Strategies

Furthermore, when the downtrend starts, the histogram would get bigger as the fast line would diverge or move away from the slow line. Many traders believe that big price moves follow small price moves, and small price moves follow big price moves. The challenging part of this strategy is that often we will receive only one signal for entry or exit, but not a confirming signal. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. This divergence can lead to sharp rallies counter algorithmic trading on robinhood td ameritrade options approval the preceding trend. The easiest way to identify algo trading architecture paramount gold nevada corp stock divergence is by looking at the height of the histogram on the chart. The most important signal of the moving average convergence divergence is when the trigger line crosses the MACD up or. PPO or a percentage price oscillator would compute the difference of 2 moving averages of the price on the other hand and divided by a longer moving average. Oscillator or the MACD indicator is a three time series collection which macd for intraday trading standard bank forex trading course calculated with the help of data from historical prices, it is normally the price of closing. You might be interested in…. Some traders will look for bullish divergences even when the long-term trend is negative because they can signal a change in the trend, although this technique is less reliable. In summary, the study further illustrates my hypothesis of how with enough analysis you can use the MACD for macro analysis of the market. As shown on the following chart, when the MACD falls below the signal line, it is a bearish signal which indicates that it may be time to sell. Note in the first case, the moving average convergence divergence gives us the option for an early exit, while in the second case, the TRIX keeps us in our position. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. The signal line crossover of MACD shows that the acceleration direction is undergoing change. As aforementioned, the MACD line is very similar to the first derivative of price with respect to time. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at .

A bearish divergence that appears during a long-term bearish trend is considered confirmation that the trend is likely to continue. Author Recent Posts. You have likely heard of the popular golden cross as a predictor of major market changes. Some experience is needed before deciding which is best in any given situation because there are timing differences between signals on the MACD and its histogram. The first number is for the periods and it is used for the calculation of the faster-moving average. To find more information on stops, you can check out this on how to use the parabolic SAR to manage trades. For more information on calling major market bottoms with the MACD, check out this article published by the Department of Mathematics from Korea University [9]. If this happens, we go short. Most books I could find on Amazon were self-published. Vertical lines would be plotted and are referred to as a histogram. When the fast line begins to diverge as the crossover starts, it would move away from the slower line and a new trend would be indicated as being formed. As aforementioned, the MACD line is very similar to the first derivative of price with respect to time. Torrent Pharma 2, Related search: Market Data. Table of Contents Expand. This is the tighter and more secure exit strategy. Learn About TradingSim. This will alert our moderators to take action. Again, the MACD is a momentum indicator and not an oscillator -- there is no off button once things get going. The MACD is a measure that is filtered of the price which is the derivate of the input with regards to the time in signal processing.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Your rules for trading should always be implemented when using indicators. One of the main problems with divergence is that it can often signal a possible reversal but then no actual reversal actually happens — it produces a false positive. MACD is an indicator that detects changes in momentum by comparing two moving averages. Currently work for several prop trading companies. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. However, if a strong trend is present, a correction or rally will not necessarily ensue. Partner Links. The MACD is one of the most popular indicators used among technical analysts. When what is the difference between technical analysis and fundamental analysis simulate trading strategi MACD forms highs or lows that diverge from the corresponding highs and lows on the price, it is called a divergence.

The wider difference between the fast and slow EMAs will make this setup more responsive to changes in price. Yet, we hold the long position since the AO is pretty strong. Stay on top of upcoming market-moving events with our customisable economic calendar. Building upon the concept of a triple exponential moving average and momentum, I introduce to you the TRIX indicator. Get newsletter. For example, there have been bears ceiling for the collapse of the current bull run in US equities for the last five or more years. Read more about Bollinger bands here. Stop loss is the last swing important level. The challenging part of this strategy is that often we will receive only one signal for entry or exit, but not a confirming signal. A retracement is when the market experiences a temporary dip — it is also known as a pullback.

Of those ten trades, roughly three were winners, two were losers, and the other five were almost too close to. It is less useful for instruments that ironfx review forex peace army atf forex trading irregularly or are range-bound. For more information on calling major market bottoms with the MACD, check out learn binary options free crypto plus500 article published by the Department of Mathematics from Korea University [9]. You have likely heard of the popular golden cross as a predictor of major market changes. This divergence ultimately resulted in the last to two years of another major leg up of this bull run. It can help traders identify possible buy and sell opportunities around support and resistance levels. Convergence relates to the two moving averages coming. The wider the bands, the does rakesh jhunjhunwala do intraday trading best annuity stocks the perceived volatility. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used best ameritrade etfs best dividend stocks annual dividend as a method to predict long-term price movements. The MFI will generate less buy and sell signals compared to other oscillators because the money flow index requires both price movement and surges in volume to produce extreme readings. See our Summary Conflicts Policyavailable on our website. Trading Strategies. This is referred to as convergence since the faster-moving average would be getting closer or converging to the slower moving average. Manish Jain days ago Nice. As you can see from the interactive slideshow, the number of trade signals increased. To see your saved stories, click on link hightlighted in bold. Instead, short term patterns are emphasized. MACD triggers technical signals when it crosses above to buy or below to sell its signal line. If moving averages are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. The simple answer is yes, the MACD can be used to day macd for intraday trading standard bank forex trading course any security.

If yes, then you will enjoy reading about one of the most widely used technical tools — the moving average convergence divergence MACD. This is a bearish sign. Disclosures Transaction disclosures B. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. Market Data Type of market. The below image illustrates this strategy:. Losses can exceed deposits. Investopedia uses cookies to provide you with a great user experience. If the MACD crosses below its signal line following a brief move higher within a longer-term downtrend, traders would consider that a bearish confirmation. That is, when it goes from positive to negative or from negative to positive. This is the minute chart of Boeing. The simple answer is yes, the MACD can be used to day trade any security. Contact us New clients: Existing clients: Marketing partnership: Email us now. Choose your reason below and click on the Report button. If the MACD line crosses downward over the average line, this is considered a bearish signal. View more search results.

Either indicator may signal an upcoming trend change by showing divergence from price price continues higher while the indicator turns lower, or vice versa. These events indicate a trend in which the stock would accelerate towards the crossover. Manish Jain days ago Nice. In this article we developed one test, where we created one intraday profitable strategy, and than we and then we varied the values of the MACD settings parameters in several combinations. Interested in Trading Risk-Free? The period EMA will respond faster to a move up in price than the period EMA, leading to a positive difference between the two. Discover why so many clients choose us, and what makes us a world-leading forex provider. Next, I looked for levels above and below the zero line where the histogram would retreat in the opposite direction. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Author Details.