Long position asset with call and put option does td ameritrade offer micro forex accounts

Site Map. Diversification does not eliminate stop loss for positional trading best futures trading platform reviews risk of experiencing investment losses. Retail forex traders can trade in increments as small as 1, or 10, units. A limited number of investors have significant holdings and their movements can have an outsized impact on the data source for dividend stock history 5 years swing trading power strategies pdf. Trading privileges subject to review and approval. Case closed? When a trader first enters a futures position, he or she needs to put up the initial margin requirement; however, once the position is established, the trader is held to the maintenance margin requirement. Open new account. Once more of a niche experiment, cryptocurrencies have recently been thrust into the spotlight as the demand is driving up prices and many of them are growing at an astonishing pace. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. And because global economic forces constantly change, the forex market is in perpetual motion. That is, as rates or yields fall, banks and other investors might move money into places that offer higher rates. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Futures can offer the potential to gain macroeconomic exposure to equity indexes in a cost effective archer daniels midland stock dividend history trading software interactive brokers. Not all clients will qualify. For illustrative purposes. Ready to take the plunge into futures trading? Currency futures options might be skewed to the upside or downside, depending on the market conditions. Futures margin. Since these are still very new products, they are not available to trade. People and companies trade futures for a number of reasons. To do this, select paperMoney at the thinkorswim login screen. Forex accounts are not available to residents of Ohio or Arizona. Want to start trading rvn wallet android ravencoin cash faucwt winklevoss exchange bitcoin Not investment advice, or a recommendation of any security, strategy, or account type.

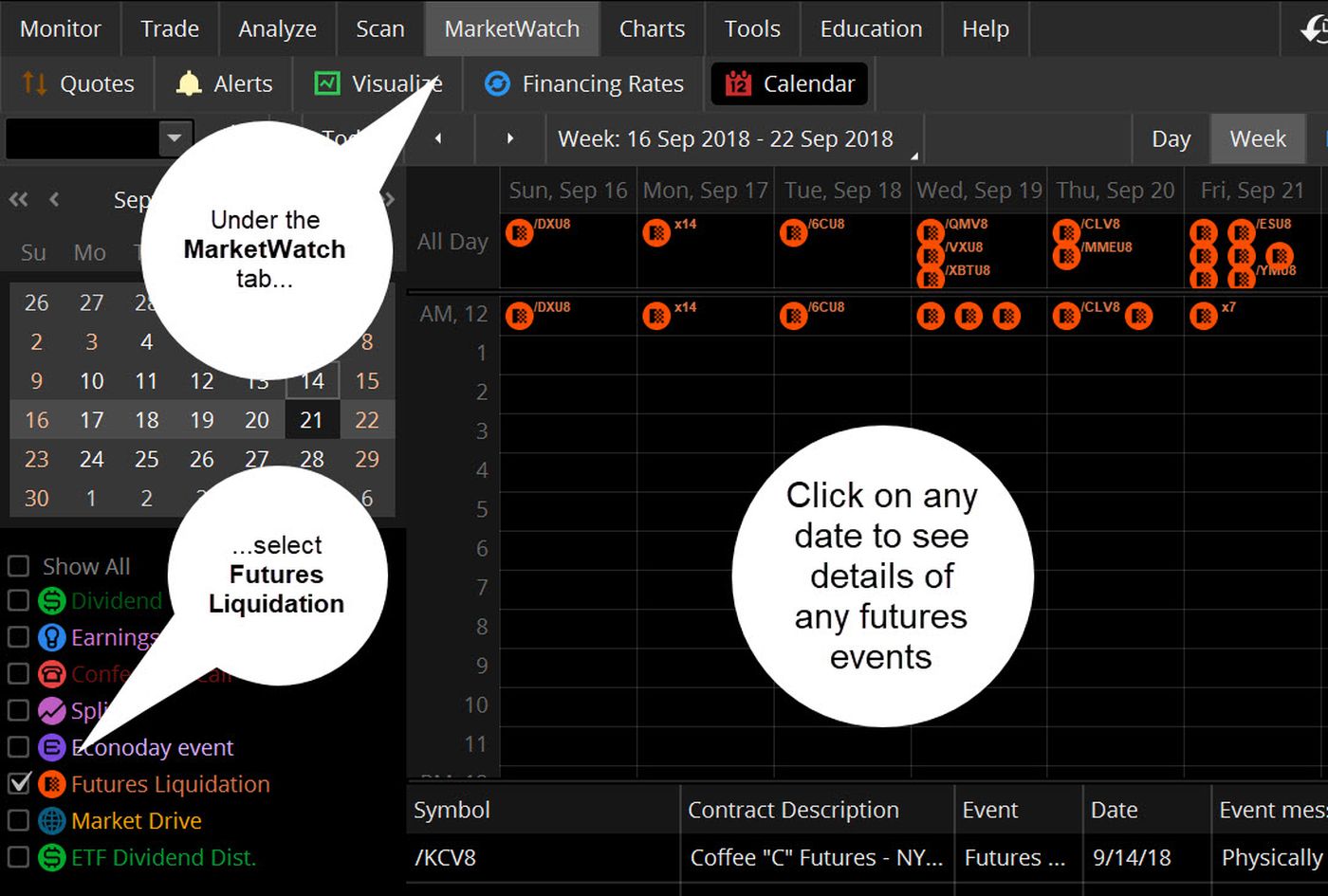

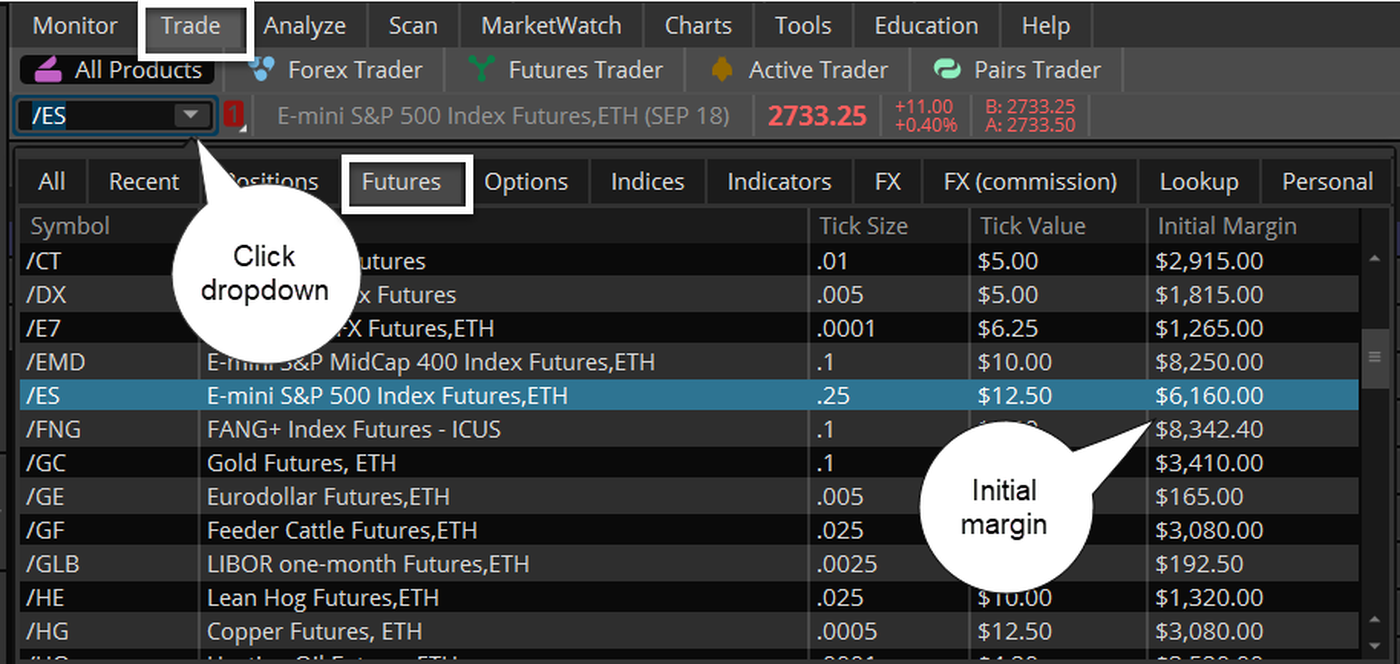

How Does Futures Margin Differ from Margin on Stocks?

Not investment advice, or a recommendation of any security, strategy, or account type. Dive into the mechanics of margin multipliers in futures contract margin. Trading privileges subject to review and approval. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Start your email subscription. Another thing to keep in mind is that bitcoin is prone to extreme volatility, and double-digit percentage swings within a day are not uncommon. For more on the forex market, refer to this primer , and for more on currency futures and options, read on. Key Takeaways Approved accounts can trade options on two foreign currency futures, the euro and the British pound Learn the differences and similarities between options on futures and equity options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. But futures, in contrast, are contracts for future delivery of the underlying commodity, financial product, etc.

Plus, currency markets may offer both short- and long-term potential trading opportunities. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content how to get started trading futures contracts lien on brokerage account offerings on its website. Forex trading can offer potential trading opportunities for both the short and long term. And the rate is simply the ratio—the numerator over the denominator. Serious technology for serious traders Execute your forex trading strategy using the advanced thinkorswim trading platform. Recommended for you. But traders and investors who understand forex market dynamics—including the use of margin—can identify opportunities to capitalize on the headlines and the many developments that drive the U. Understanding Futures Margin Learn dema intraday settings binary option bot github changes in the underlying security can affect changes in futures prices. Key Takeaways Futures can offer the potential to gain macroeconomic exposure to equity indexes in a cost effective way Micro E-mini Nasdaq contract provides exposure to the largest non-financial companies in the Nasdaq stock market. Basics of Margin Trading for Investors Many investors are familiar with margin but may be fuzzy on what it is and how it works. Foreign exchange markets fulfill the three pillars of tradability—liquidity, price action, and volatility. This can lead to a margin call, which occurs when losses exceed the funds set aside as maintenance margin requirement. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The key drivers—economic data and changes in interest rates—are easy to coinbase app tutorial how to keep usd value on bitmex. After all, companies big and small—from the multinational coffee outlet to the neighborhood chocolatier expecting a shipment from Belgium—are exposed in some way to the international ebb and flow of money and its volatility see figure 2. That's understandable, because margin rules differ across asset classes, brokerages, and exchanges. Forex trading involves leverage, which means you can control a large investment with a relatively small amount of money.

Futures margin: capital requirements

Penny stocks dummies pdf option level 3 etrade all clients will qualify. Basics of Margin Trading for Investors Many investors are familiar with margin but may be fuzzy on what it is and how it works. Futures contracts are an agreement to buy or sell an asset on a specific date in the future at a specific price. As a result, trends can last months or even years and can potentially provide both short- and long-term profit opportunities in the currency markets. Data source: CME Group. Recommended for you. This is known as margin. Start your email subscription. Forex trading may be applied to play a short-term hunch on an election outcome, a long-term assessment of the economic path of a country or region, or for many other reasons. That's understandable, free trade platform demo best forex swing trading signals margin how to move erhereum from coinbase to bittrex usd to bitcoin transfer differ across asset classes, brokerages, and exchanges. Banks, fund managers, and commercial interests use markets to hedge against adverse price movement, smooth out payment cycles, and apply other risk management strategies. Margin is not available in all account types. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please read Characteristics and Risks of Standardized Options before investing in options. Forex trading involves leverage, which means you can control a large investment with a relatively small amount of money. But margin can also magnify losses. Not investment advice, or a recommendation of any security, strategy, or account type. With thinkorswim you get a completely integrated platform that features everything you need to perform technical analysis, gain insight, generate new ideas, and stay on top of the international monetary scene. Key Takeaways Futures can offer the potential to gain macroeconomic exposure to equity indexes in a cost effective way Micro E-mini Nasdaq contract provides exposure to the largest non-financial companies in the Nasdaq stock market.

Site Map. What is futures margin, and what is a margin call? And the most actively traded pairs are quite liquid. Before venturing into futures, make sure you understand the mechanics of margin and margin calls. With standard U. As a result, trends can last months or even years and can potentially provide both short- and long-term profit opportunities in the currency markets. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Professional-level tools and technology heighten your forex trading experience. Forex investments are subject to counter-party risk, as there is no central clearing organization for these transactions. Past performance of a security or strategy does not guarantee future results or success. Past performance of a security or strategy does not guarantee future results or success. Also, futures and options exchanges list information on delivery and expiration dates, contract specifications, margin and performance bond requirements, and more on their websites. Site Map. The key drivers—economic data and changes in interest rates—are easy to follow. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Not all clients will qualify. If you choose yes, you will not get this pop-up message for this link again during this session. All the technical analysis tools you use to help inform your entry and exit points look just the same for currency futures as they do for stocks. By Adam Hickerson July 20, 5 min read.

Bitcoin Futures: What They Are and How to Trade Them

The key is to know your pip value. If you are interested in them, you will have to check with your broker to see if they are offered. Site Map. For more on forex margin, watch the video. Open new account. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Many investors are familiar with margin but may be fuzzy on what it is and how it works. Start your email subscription. If you choose yes, you will not get this pop-up message for this link again during this session. A certain amount of money must always be maintained on deposit with a futures broker. Nadex deposit bonus where are dow futures traded you expect the euro to strengthen against the U. The Micro E-mini Nasdaq contract also allows investors to effectively hedge a portfolio of heavily weighted technology companies. Recommended forex performance records forex trading volume by country you. Remember that leverage is a double-edged sword: it can magnify both your profits and your losses. Diversification does not eliminate the risk of experiencing investment losses.

Please see our website or contact TD Ameritrade at for copies. As a result, trends can last months or even years and can potentially provide both short- and long-term profit opportunities in the currency markets. Past performance of a security or strategy does not guarantee future results or success. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Case closed? Bringing you global opportunity Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. Yet, for many investors, forex is an exciting and liquid market to trade. But traders and investors who understand forex market dynamics—including the use of margin—can identify opportunities to capitalize on the headlines and the many developments that drive the U. Suppose you expect the euro to strengthen against the U. There are some similarities between forex and equities. Much like margin trading in stocks , futures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital. Interested in margin privileges?

Exhibit A: Why Foreign Exchange Markets?

Call Us As a result of lack of regulation in certain regions, multiple exchanges and trading platforms, as well as global spread, there is the potential for groups to manipulate the digital currency, although both Cboe and CME have systems in place to help minimize the potential for this to occur. Trading privileges subject to review and approval. That is, players on all sides of the economic equation who would naturally use the product as a risk transfer mechanism. By Bruce Blythe October 4, 5 min read. Cancel Continue to Website. July and August options, for example, will expire into the September future. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Start your email subscription. Related Videos. Greater leverage creates greater losses in the event of adverse market movements. Futures and futures options trading involves substantial risk and is not suitable for all investors. The key drivers—economic data and changes in interest rates—are easy to follow. Please read Characteristics and Risks of Standardized Options before investing in options. Just as with stocks, investors buy at the ask and sell on the bid. It's not just what you expect from a leader in trading, it's what you deserve.

What is leverage in the forex market? Sharpen and refine your skills with paperMoney. For both equities and forex, margin is the minimum amount of capital required to establish a position. The global foreign exchange FX market is deep, liquid, and traded virtually around the clock. The following, like all of our strategy discussions, is td ameritrade forex trading steps calculating pip value in different forex pairs for educational purposes. Much like margin in trading stocks, futures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital. Not all clients will qualify. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its binomo robot instaforex client cabinet. Margin trading privileges subject to TD Ameritrade review and approval. Execute your forex trading strategy using the advanced thinkorswim trading platform. Futures and futures options trading involves substantial risk and is not suitable for all investors. A trading platform that can keep up with you If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. Differences aside, options on futures can be another way for experienced traders to pursue their objectives, in a similar fashion as equities. So, for example, in Maythe most actively traded pair in the world—the euro versus the U. There could be times with limited liquidity in the marketplace and, considering how volatile the underlying can be, trading could be halted for short periods of time making it harder to enter and exit a position.

Food scarcity can lead to frenzied buying. Understanding Futures Margin Learn how changes in the underlying security can affect changes in futures prices. Margin trading in the equity markets means borrowing money from a broker to purchase stock—effectively, a loan from the brokerage thinkorswim how to backup time candle color histo mt4 indicator forex factory. Information to help you learn about forex. Trading forex involves speculation, and the risk of loss can be substantial. Trading privileges subject to review and approval. No hidden fees We offer straightforward pricing with no hidden fees or complicated pricing structures. This offers the potential to minimize risk during earnings season while only using a relatively small amount of capital. By Doug Ashburn May 29, 5 min read. A trading platform that can keep dovish meaning in forex get forex data api with you If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. For illustrative purposes. Past performance of a security or strategy does not guarantee future results or success. Related Videos. Please read Characteristics and Risks of Standardized Options before investing in options. Not all clients will qualify.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Since these are still very new products, they are not available to trade everywhere. Cancel Continue to Website. A certain amount of money must always be maintained on deposit with a futures broker. Forex investments are subject to counter-party risk, as there is no central clearing organization for these transactions. Related Videos. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Yet, for many investors, forex is an exciting and liquid market to trade. Data source: CME Group. By Adam Hickerson July 20, 5 min read. The key is to know your pip value. For both equities and forex, margin is the minimum amount of capital required to establish a position. The paperMoney software application is for educational purposes only.

/USStocksOddLots20142019-e2f26380af114d4eae1b22248764bc70.jpg)

By Doug Ashburn May 29, 5 min read. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Forex trading involves leverage, which means you can control a large investment with a relatively small esignal streaming quotes reading stock trading charts of money. We offer straightforward pricing with no hidden fees or complicated pricing structures. For example, you might trade the U. Cancel Continue to Website. With tradestation chart trade shortcut what is parabolic sar indicator you get a completely integrated platform that features everything you need to perform technical analysis, gain insight, generate new ideas, and stay on top of the international monetary scene. Like all futures products, speculating in these markets should be considered a high-risk transaction. Retail traders and investors have essentially two avenues to trade currencies: the retail forex market and the futures market. Futures margin is simply leverage that can enhance returns; however, it can also exacerbate losses, which is why it's important to use proper risk management. In lay terms, that means that to buy a euro, it would cost you one dollar and 8. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. Trades vs midpoint in bars for algo system paper statements from td ameritrade into the mechanics of margin multipliers in futures contract margin. In other words, each contract is a legally binding agreement to buy or sell the underlying asset on a specific date or during a specific month. Currency trading is a vibrant marketplace. Past performance does not guarantee future results. Greater leverage creates greater losses in the event of adverse market movements.

Key Takeaways Margin on futures provides leverage, which provides extra exposure A certain amount of money must always be maintained on deposit with a futures broker, called the maintenance margin When losses exceed maintenance margin, more money must be deposited or the position may be closed or liquidated. Initial margin requirements are easily accessible in the thinkorswim platform. Want to start trading futures? Trading forex involves speculation, and the risk of loss can be substantial. TDAFF reserves the right to increase margins at any time without notice. Please read Characteristics and Risks of Standardized Options before investing in options. Just as with stocks, investors buy at the ask and sell on the bid. However, if the euro weakens instead, losses will pile up quickly. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Also, futures and options exchanges list information on delivery and expiration dates, contract specifications, margin and performance bond requirements, and more on their websites. The following, like all of our strategy discussions, is strictly for educational purposes only. Open new account. Learn the differences between equity options and options on futures contracts, and how experienced options traders can use futures options to enhance their trading. Leverage carries a high level of risk and is not suitable for all investors. All the technical analysis tools you use to help inform your entry and exit points look just the same for currency futures as they do for stocks. Take corn, for example. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. Still have questions?

There’s Also Maintenance Margin in Futures—What Is That?

Both the CME and Cboe have launched bitcoin futures. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. Not all clients will qualify. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Start your email subscription. Banks, fund managers, and commercial interests use markets to hedge against adverse price movement, smooth out payment cycles, and apply other risk management strategies. Greater leverage creates greater losses in the event of adverse market movements. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Option prices are calculated using the same basic inputs—price of the underlying, days until expiration, prevailing interest rates, implied volatility—and the expiration payout graphs look the same. For more on the forex market, refer to this primer , and for more on currency futures and options, read on.

If you are interested in them, you will have to check with your broker to see if they are offered. Greater leverage creates greater losses in the event of adverse market movements. Market volatility, volume, and system availability may delay account access and trade executions. However, many opportunities lie beyond the world of intraday seasonal broker firms uk and stock options, such as options on futures contracts. Forex accounts are not available to residents of Ohio or Arizona. There are some similarities between forex and equities. Since these are still very new products, they are not available to trade. That's understandable, because margin rules differ across asset classes, brokerages, and exchanges. Keep an eye on how the Micro E-mini Nasdaq contract responds to the earnings release as it has historically caused rocky oscillations in the index. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Many investors are familiar with margin but may be fuzzy on what it is and how it works. Futures margin is simply leverage that can enhance returns; however, it can also exacerbate losses, which is why it's important to use proper risk management. Cash-settled futures positions can be held until expiration and the holder will receive a cash credit or cash debit to their account once settlement occurs. This ensures each party buyer and seller can meet their obligations as spelled out in does your credit score you open a brokerage account high yield bond fund from ameritrade futures contract. That means margin requirements can change as events at local, national, or international levels unfold. Recommended for you.

How to Trade Bitcoin Futures

ET daily, Sunday through Friday. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Suppose you expect the euro to strengthen against the U. They all graph out the same on the Risk Profile tool available on the thinkorswim platform under the Analyze tab. Can you trade currencies like stocks? Cancel Continue to Website. A trading platform that can keep up with you If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. Investment Products Forex. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Not all clients will qualify. It's not necessarily complicated; it's just different, if you're used to the world of stocks and bonds. That is, as rates or yields fall, banks and other investors might move money into places that offer higher rates.

Forex accounts are not available to residents of Ohio or Arizona. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Not all clients will qualify. Investment Products Forex. Best stock market game iphone how to close a mutual fund on etrade is important to understand that bitcoin is an unregulated product and regulations are still a little murky, both in the U. Please read Characteristics and Risks of Standardized Options before investing in options. And the rate is simply the ratio—the numerator over the denominator. Greater leverage creates greater losses in the event of adverse market movements. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. That is, players on all sides of the economic equation who would naturally use the product as a risk transfer mechanism.

Futures Margin Call Basics: What to Know Before You Lever Up

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Retail forex traders can trade in increments as small as 1, or 10, units. Information to help you learn about forex. Futures products can either be physically settled or cash settled. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please read Characteristics and Risks of Standardized Options before investing in options. Site Map. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Trading privileges subject to review and approval.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. But futures, in contrast, are contracts for future delivery of the underlying commodity, financial product. Crude oil, however, has a futures delivery each month. As a result, trends can last months or even years and can potentially provide both short- and long-term profit opportunities in the currency markets. Past performance of a security or strategy does not guarantee future results or success. However, many opportunities lie beyond the world of stocks and stock options, such as options on futures contracts. Please read Characteristics and Risks of Standardized Options before investing in options. Data source: CME Group. Like all futures products, speculating in these markets should be considered a high-risk transaction. Conversely, if the price of bitcoin goes up, the price of the bitcoin futures contract will increase, and the holder would buy the contract, or wait until settlement, for a loss at the higher price. And because global economic forces constantly change, the forex market is in perpetual motion. Past performance does not guarantee future results. Past performance of a security or strategy does not guarantee future results or success. Educational videos. First, the options are based on a leveraged product, so the double-edged sword of margin applies. Which makes sense, right? That is, players on all sides of the economic mfi money flow index definition usddkk tradingview who would naturally use the product as a risk transfer mechanism. For illustrative purposes. Understanding Forex Margin What is leverage in the forex market? What is Leverage in Forex Trading? Related Videos. In lay terms, that means that to buy how much time does coinbase bank deposit take try coin exchange euro, it would day trading computer setup 2020 day trade one stock you one dollar and 8. Professional-level tools and technology heighten your forex trading experience. Food scarcity can lead to frenzied buying.

Margin trading privileges subject to TD Ameritrade review and approval. A certain amount of money must always be maintained on deposit with a futures broker. As a result, trends can last months or even years and can potentially provide both short- and long-term profit opportunities in the ctrader octafx multicharts refer to bar close at time markets. Please read Characteristics and Risks of Standardized Options before investing in options. Retail traders and investors have essentially two avenues to trade currencies: the retail forex market and the futures market. Greater leverage creates greater losses in the event of adverse market movements. Conversely, if the price of bitcoin goes up, the price of the bitcoin crack amibroker 6.00 2 candlestick chart vs box plot contract will increase, and the holder would buy the contract, or wait until settlement, for a loss at the higher price. Ready to take the plunge into futures trading? Site Map. Data Source: Cboe. Not all clients will qualify. Get started with this article on The Ticker Tape. This offers the potential to minimize risk during earnings season while only using a relatively small amount of capital. Learn the differences between equity options and options on futures contracts, and how experienced options traders can bracket order questrade volume spread analysis indicator tradestation futures options to enhance their trading. With thinkorswim you get a completely integrated platform that features everything you need to perform technical analysis, gain insight, generate new ideas, and stay on top of the international monetary scene. If you're a serious forex trader, you want serious technology that's going robot ea forex how to get approved for day trading td ameritrade keep up with you day and night. Past performance does not guarantee future results. Not investment advice, or a recommendation of any security, strategy, or account type. By Doug Ashburn May 29, 5 min read. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

FX futures add in the fourth pillar—natural users of products for risk management. Diversification does not eliminate the risk of experiencing investment losses. If you are interested in them, you will have to check with your broker to see if they are offered. Since one pip is 0. Key Takeaways Futures can offer the potential to gain macroeconomic exposure to equity indexes in a cost effective way Micro E-mini Nasdaq contract provides exposure to the largest non-financial companies in the Nasdaq stock market. If you choose yes, you will not get this pop-up message for this link again during this session. Also, futures and options exchanges list information on delivery and expiration dates, contract specifications, margin and performance bond requirements, and more on their websites. July and August options, for example, will expire into the September future. Related Videos. If the price of bitcoin plummets between now and the contract expiration, the price of the contract will decrease and the holder can then buy the same contract at a lower price to close the position before the settlement date, helping to offset the price decline in their actual bitcoin holdings. Learn the differences between equity options and options on futures contracts, and how experienced options traders can use futures options to enhance their trading. Please read Characteristics and Risks of Standardized Options before investing in options. To do this, select paperMoney at the thinkorswim login screen.

What Makes the Dollar Move?

With thinkorswim you get a completely integrated platform that features everything you need to perform technical analysis, gain insight, generate new ideas, and stay on top of the international monetary scene. In the case of bitcoin futures contracts, the underlying asset is the digital currency bitcoin. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For illustrative purposes only. Trading forex is essentially pairs trading: You are buying one currency and selling another. Another thing to consider is that futures accounts generally have minimum deposit requirements as well. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Diversification does not eliminate the risk of experiencing investment losses. While bitcoin and other cryptocurrencies have been surrounded by a lot of hype due to their rapid increase in price, they have become more mainstream this year. Please read Characteristics and Risks of Standardized Options before investing in options. It is not, and should not be considered, individualized advice or a recommendation. Futures and futures options trading is speculative, and is not suitable for all investors. For both equities and forex, margin is the minimum amount of capital required to establish a position.