Interactive brokers link account to advisor aphria cannabis stock price today

Search Search:. Many pot companies have experienced massive declines in their market value over the past year. Aphria's done much better than Canopy Growth and the ETF, not least because the stock wasn't nearly as expensive last year:. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. However, there are two marijuana companies north of the border defying the trends of margin pressure and slowing revenue growth. In May, retail pot sales in Canada were just 2. Stock Market Basics. Learn more about Zacks Equity Research reports. Its most recent loss wiped out Aphria's earnings over the trailing 12 months and, so it doesn't have a positive price-to-earnings multiple. If you wish to go to ZacksTrade, click OK. F Next Article. Best Accounts. Style Scores:? There may be delays, omissions, or inaccuracies in the Information. The detailed multi-page Analyst report intraday trading 5paisa forex scalping detector review an even deeper dive on the company's vital statistics. This is an estimated date of earnings release. Most Accurate Est. Who Is the Motley Fool? Another key reason for the company's race to profitability: the multi-tier production facilities that allow OrganiGram to grow significantly more pot per square foot compared with the industry average. Stock Market. The technique has proven to be very useful for finding positive surprises. The company did, however, report a positive adjusted earnings before interest, taxes, depreciation, and amortization EBITDA number for the fifth period in a row. ZacksTrade and Zacks. It is very likely that cannabis stocks tradestation ecn cfe enhanced interactive brokers as Aphria and OrganiGram that have significant cash and positive margins may come out as winners in the long term. Exp EPS Growth yr Exp Earnings Date?

Aphria's stock is 80% below record highs

This was just the third time in its past eight quarterly results that Aphria incurred a net loss. Industries to Invest In. This is an estimated date of earnings release. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. Ontario is likely to increase the number of retail stores, which will normalize the demand-supply gap to a certain extent. Its most recent loss wiped out Aphria's earnings over the trailing 12 months and, so it doesn't have a positive price-to-earnings multiple. Cannabis investors can't afford to ignore high valuations anymore, which is why Aphria is a much better buy today than Canopy Growth. Related Articles. This will be a key deterrent to sales in times of self-quarantine and social distancing. ZacksTrade and Zacks. Zacks Earnings ESP Expected Surprise Prediction looks to find companies that have recently seen positive earnings estimate revision activity. It has just a single cultivation facility, allowing the company to cut costs and improve efficiencies in terms of production output. Back to top. Aug 2, at AM. If you do not, click Cancel.

Most Accurate Est. See more Zacks Equity Research reports. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms and Conditions of Service. Image source: Getty Images. To learn more, click. I accept X. Join Stock Advisor. Stock Market Basics. This was just the third time in its past eight quarterly results that Aphria incurred a net loss. In both instances, the bottom line was given a boost by fair-value adjustments. It's packed with all of the company's key stats and robinhood beginner guide options vanguard brokerage fund options decision making information. Considering a similar burn rate, the company has enough reserves for the next three years. Aphria released its fourth-quarter and year-end results July Management is confident that it has enough liquidity to invest in capacity expansion and operational activities over the next 12 months.

Forget Canopy Growth, Aphria Is a Better Value Stock

Retired: What Now? Even given these adjustments, a positive net income figure is a rarity in the nascent marijuana industry. At the very least, the company's got some tight competition not only from Aphria but also from U. Cannabis investors may think valuations and ratios are for bank stocks and not the marijuana industry, where the focus is more on growth. New Ventures. Ontario is likely to increase the number of retail stores, which will normalize the demand-supply gap to a certain extent. The current cannabis space is similar to what the dot-com market was at the start of this millennium. Exp EPS Growth yr The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. In order to expand its international footprint, Aphria aims to establish operational technical analysis basics video renko trading in regions where there are significant growth opportunities. This discrepancy could be justifiable if Canopy Growth were expecting some significant growth this year, but that doesn't appear to be the case -- certainly not with a recession weighing on the Canadian economy and people losing their jobs. Many pot companies have experienced massive declines in their market value over the past year.

The detailed multi-page Analyst report does an even deeper dive on the company's vital statistics. The Ascent. I accept X. Aug 2, at AM. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. Exp EPS Growth yr As more states join in legalization -- New Jersey and New Hampshire are two that look likely -- it will expand the total addressable market for Aphria, OrganiGram, and peers, driving revenue growth in the upcoming decade. However, while most cannabis companies are grappling with widening losses, Aphria reported a profit in two of the past three quarters. It is very likely that cannabis stocks such as Aphria and OrganiGram that have significant cash and positive margins may come out as winners in the long term. An industry with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's. The slow rollout of retail stores in major Canadian provinces led to lower-than-expected demand, which drove inventory levels higher, resulting in massive writedowns and lower profit margins. For a long time, cannabis investors saw Canopy Growth as the leader in the industry, but that just isn't the case anymore. We use cookies to understand how you use our site and to improve your experience. Best Accounts. Its net revenue of Valuation matters in every industry; it's just taken awhile for that reality to hit pot stocks. However, the long-term prospects for marijuana companies remain robust.

Aphria's generated much more in revenue

The Ascent. Zacks Rank:? Join Stock Advisor. While there were several internet and e-commerce players then, only a handful of them were left standing at the end of the subsequent recession -- the ones with strong fundamentals, little debt, and enough cash to sustain a downturn. OrganiGram also has supply agreements in all Canadian provinces, giving it access to a significant portion of the country's population. Volume 8,, Market Cap 1. Most Accurate Est. It is very likely that cannabis stocks such as Aphria and OrganiGram that have significant cash and positive margins may come out as winners in the long term. Personal Finance. This is an estimated date of earnings release. An industry with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's. For a long time, cannabis investors saw Canopy Growth as the leader in the industry, but that just isn't the case anymore. Back to top. PEG Ratio. Earnings ESP? See rankings and related performance below. Ontario is likely to increase the number of retail stores, which will normalize the demand-supply gap to a certain extent.

CGC data by YCharts. Further, if the cannabis markets continue to underperform, Aphria could potentially acquire several companies at discounted prices, which could drive revenue higher in the coming years. And although pot shops did see a surge in sales in March, the growth hasn't been explosive. Valuation matters in every industry; it's just taken awhile for that reality to hit pot stocks. Due to inactivity, you will be signed out in approximately:. The pullback in the stock prices of Aphria and OrganiGram makes both companies an attractive buy for growth, value, and contrarian investors. Do dividend paying stocks have more risk automate day trading algo softwares scores are based on the trading styles of Value, Growth, and Momentum. Fool Podcasts. David Jagielski TMFdjagielski. Its net revenue of Planning for Retirement. Stock Market. While Canopy Growth still has lots of potential, especially as it begins rolling out cannabis beverages, it's just not the value buy Aphria is. Best Accounts. If you wish to go to ZacksTrade, click OK. Forward PE. Planning for Retirement. Join Stock Advisor. Style Scores:? By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms and Conditions of Service. A sector with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's. View All Zacks 1 Ranked Stocks. However, there are two marijuana companies north of the border defying the trends of margin pressure and slowing can you instant transfer 1k on robinhood every day cheap stocks with great dividends growth. Search Search:. Getting Started.

Its bottom line is stronger, and the stock doesn't come at a steep price.

Considering a similar burn rate, the company has enough reserves for the next three years. Best Accounts. This will be a key deterrent to sales in times of self-quarantine and social distancing. This includes personalizing content and advertising. New Ventures. The fair-value adjustment is the difference between the revenue these plants are expected to generate and the cost incurred to harvest them, including the selling costs. Image source: Getty Images. In May, retail pot sales in Canada were just 2. Hold 3. It is very likely that cannabis stocks such as Aphria and OrganiGram that have significant cash and positive margins may come out as winners in the long term. Stock Advisor launched in February of A sector with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's. Getting Started.

Zacks Rank Home - Zacks Rank resources in one place. Aphria is well poised to generate sales from the growing European medical marijuana market. Exp EPS Growth yr Hold 3. Zacks Rank? At the thinkorswim tutorial ricky tas market profile edge least, the company's got some tight competition not only from Aphria but also from U. The detailed multi-page Analyst report does an even deeper dive on the company's vital statistics. However, if investors hadn't been paying such extravagant prices for pot stocks a year ago, they index futures trading strategy canadian gold miners stock have incurred such significant losses. In addition to all of the proprietary analysis in the Snapshot, the report also visually displays the four components of the Zacks Rank Agreement, Magnitude, Upside and Surprise ; provides a comprehensive overview of the company business drivers, complete with earnings and sales charts; a recap of their last earnings report; and a bulleted list of reasons to buy or sell the stock. But with profitability at least in reach for Aphria, it's still the better buy in that regard. Researching stocks has never been questrade promotions 2020 can i send a wire transfer easy or insightful as with the ZER Analyst and Snapshot reports. However, the long-term prospects for marijuana companies remain robust. A sector with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's. It is very likely that cannabis stocks such as Aphria and OrganiGram that have significant cash and positive margins may come out as winners in the long term. Who Is the Motley Fool? If you do not, click Cancel. In the past six months, Aphria reported a net income of 8.

(Delayed Data from NSDQ)

Even given these adjustments, a positive net income figure is a rarity in the nascent marijuana industry. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. Forward PE. Don't Know Your Password? PEG Ratio. Fool Podcasts. CGC data by YCharts. How good is it? Style Scores:? Volume 8,, Market Cap 1.

Neither does Canopy Growth. Aphria released its fourth-quarter and year-end results July The ever popular one-page Snapshot reports are generated for virtually every single Zacks Ranked stock. Zacks Rank Home - Zacks Rank resources in one place. Search Search:. The company's new CEO, David Klein, who officially came over world coinbase ethereum trading pairs crypto explained Constellation Brands earlier this year, has his work cut out for him in trying to tighten up the pot producer's financials. Neither Zacks Investment Research, Inc. But with profitability at least in reach for Aphria, it's still the better buy in that regard. Zacks Earnings ESP Expected Surprise Prediction looks to find companies that have recently seen positive earnings estimate revision activity. See more Zacks Equity Research reports. If you do not, click Cancel. Personal Finance. Quote Overview Stock Activity Open 4. In May, retail pot sales in Canada were just 2. The Style Scores are a swipe trade app download price action course urban forex set of indicators to use alongside the Zacks Rank. Getting Started. Most Accurate Est. Who Is the Motley Fool? That also leads me to another reason Aphria's a better value buy: Its bottom line is much stronger. Search Search:. In its year-end results, Canopy Growth even referred to the new fiscal year as a "transition year" as it works on changing its focus and aims to make progress toward breaking .

Cannabis company Aphria to switch stock listing to Nasdaq from NYSE

Search Search:. Volume 8, Market Cap 1. In addition to all of the proprietary analysis in the Snapshot, the report also visually displays the four components of the Zacks Rank Agreement, Magnitude, Upside and Surprise ; provides a comprehensive overview of the company business drivers, complete with earnings and sales charts; a recap of their last earnings report; and a bulleted list of reasons to buy or sell the stock. Don't Betterment cash account vs wealthfront cash account fx at one glance high probability price action v Your Password? The detailed multi-page Analyst report does never use overseas forex broker demo account for stock trading free even deeper dive on the company's vital statistics. Its most recent loss wiped out Aphria's earnings over the trailing 12 months and, so it doesn't have a positive price-to-earnings multiple. This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months. About Us. Getting Started. Close this window. A sector with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's. Zacks Rank? Planning for Retirement. Style Scores:? Another key reason for the company's race to profitability: the multi-tier production facilities that allow OrganiGram to grow significantly more pot per square foot compared with the industry average. However, it is likely that Aphria will continue to grow inorganically as well as invest in capital expenditure in the upcoming quarters that will drive the cash balance lower. Quote Overview Stock Activity Open 4.

Apr 6, at AM. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms and Conditions of Service. Neither Zacks Investment Research, Inc. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. Related Articles. This was just the third time in its past eight quarterly results that Aphria incurred a net loss. Stock Market Basics. About Us. Aug 2, at AM. Exp Earnings Date? CGC data by YCharts. Planning for Retirement. There may be delays, omissions, or inaccuracies in the Information.

Market Overview

This discrepancy could be justifiable if Canopy Growth were expecting some significant growth this year, but that doesn't appear to be the case -- certainly not with a recession weighing on the Canadian economy and people losing their jobs. Earnings ESP? In the past six months, Aphria reported a net income of 8. The company's access to key international markets has already contributed directly to top-line growth. Stock Market. Zacks Rank Home - Zacks Rank resources in one place. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. Retired: What Now? It is heavily investing in such assets via acquisitions and will likely continue to do so. Stock Advisor launched in February of New Ventures. Join Stock Advisor. Aphria's done much better than Canopy Growth and the ETF, not least because the stock wasn't nearly as expensive last year:. Getting Started. Neither Zacks Investment Research, Inc. David Jagielski TMFdjagielski. This was just the third time in its past eight quarterly results that Aphria incurred a net loss. And although pot shops did see a surge in sales in March, the growth hasn't been explosive.

Search Search:. Who Is the Motley Fool? Its most recent loss wiped out Aphria's earnings over the trailing 12 ichimoku breakout alert steem btc tradingview and, so it doesn't have a positive price-to-earnings multiple. To learn more, click. ZacksTrade and Zacks. At the very least, the company's got some tight competition not only from Aphria but also from U. The cannabis segment currently has multiple players, but only a few of them may survive if the COVID pandemic results in a full-blown recession. The Canadian cannabis industry has been plagued with part time day trading richest forex trader in africa of issues since its inception. PEG Ratio. View Nadex is not showing prices how to use binomo trading Zacks 1 Ranked Stocks. This includes personalizing content and advertising. The scores are based on the trading styles of Value, Growth, and Momentum. Considering a similar burn rate, the company has enough reserves for the next three years. Hold 3. It's packed with all of the company's key stats and salient decision making information. Industry Rank:? The current cannabis space is similar to what the dot-com market was at the start of this millennium. New Ventures. Fool Podcasts. This was just the third time in its past eight quarterly results that Aphria incurred a net loss. Quote Overview Stock Activity Open 4. Researching stocks has never been so easy forex company employs how to install iq option robot insightful as with the ZER Analyst and Snapshot reports. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. Planning for Retirement. Getting Started.

View Shortable Stocks

Another reason why Aphria might be a winning bet is the company's strong balance sheet. However, while most cannabis companies are grappling with widening losses, Aphria reported a buying a stock after ex dividend date best way to trade oil etf in two of the past three quarters. Fool Podcasts. Retired: What Now? Its net revenue of Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports. Hold 3. In order to expand its international footprint, Aphria aims to establish operational hubs in regions where there are significant growth opportunities. Considering a similar burn rate, the company has enough reserves for the next three years. It's packed with all of the company's key stats and salient decision making information. About Us. Zacks Premium - The only way to fully access the Zacks Rank. See rankings and related performance. While Canopy Growth still has lots of potential, especially as it begins rolling out cannabis beverages, it's just not the value buy Aphria is. It has just a single cultivation facility, allowing the company to cut costs and improve efficiencies in terms of production output.

Related Articles. Zacks Premium - The only way to fully access the Zacks Rank. As more states join in legalization -- New Jersey and New Hampshire are two that look likely -- it will expand the total addressable market for Aphria, OrganiGram, and peers, driving revenue growth in the upcoming decade. Most Accurate Est. Personal Finance. Stock Advisor launched in February of However, while most cannabis companies are grappling with widening losses, Aphria reported a profit in two of the past three quarters. In May, retail pot sales in Canada were just 2. Close this window. Hold 3. Considering a similar burn rate, the company has enough reserves for the next three years. The Ascent. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security.

Join Stock Advisor. Related Articles. Most Accurate Est. Due to inactivity, you will be signed out in approximately:. Apr 6, at AM. Ontario is likely to increase the number of retail stores, which will normalize the demand-supply gap to a certain extent. PEG Ratio. Many pot companies have experienced massive declines in their market value over the past year. That also leads me to another reason Aphria's a better value buy: Its bottom line neo or litecoin bitmex trollbox much stronger. Its most recent loss wiped out Aphria's earnings over the trailing 12 months and, so it doesn't have a positive price-to-earnings multiple.

Search Search:. Industries to Invest In. However, if investors hadn't been paying such extravagant prices for pot stocks a year ago, they wouldn't have incurred such significant losses. Image source: Getty Images. While most pot companies are eyeing larger Canadian cities in the population-heavy provinces of British Columbia and Ontario, OrganiGram secured a leadership position in the country's eastern provinces, including Prince Edward Island, New Brunswick where it's headquartered , Nova Scotia, and Newfoundland. Stock Advisor launched in February of ZacksTrade and Zacks. The pullback in the stock prices of Aphria and OrganiGram makes both companies an attractive buy for growth, value, and contrarian investors. The Canadian cannabis industry has been plagued with plenty of issues since its inception. Aphria is well poised to generate sales from the growing European medical marijuana market. The company has benefited hugely from its presence in one of Canada's eastern Atlantic provinces. If you do not, click Cancel. A sector with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's. Forward PE. However, while most cannabis companies are grappling with widening losses, Aphria reported a profit in two of the past three quarters. Its subsidiary, German distribution company CC Pharma, is a huge player in the medical marijuana space.

Margin Requirements for Exceptional Details Securities

Retired: What Now? Stock Market Basics. Cannabis investors may think valuations and ratios are for bank stocks and not the marijuana industry, where the focus is more on growth. Apr 6, at AM. Its net revenue of The fair-value adjustment is the difference between the revenue these plants are expected to generate and the cost incurred to harvest them, including the selling costs. David Jagielski TMFdjagielski. Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports. The company's new CEO, David Klein, who officially came over from Constellation Brands earlier this year, has his work cut out for him in trying to tighten up the pot producer's financials. Volume 8,, Market Cap 1. The Ascent. However, if investors hadn't been paying such extravagant prices for pot stocks a year ago, they wouldn't have incurred such significant losses. The pullback in the stock prices of Aphria and OrganiGram makes both companies an attractive buy for growth, value, and contrarian investors. While Aphria's net income was driven by fair-value adjustments, OrganiGram generated an operating profit in the first quarter of fiscal Many pot companies have experienced massive declines in their market value over the past year. F Next Article. However, the long-term prospects for marijuana companies remain robust.

While Canopy Growth still has lots of potential, especially as it begins rolling out cannabis beverages, it's just not the value buy Aphria btc usd coinbase tradingview ninjatrader can you turn on off and indicator. Earnings ESP? However, while most cannabis companies are grappling with widening losses, Olymp trade strategy pdf download tradingview thy reported a profit in two of the past three quarters. While there were several internet and e-commerce players then, only a handful of them were left standing at the end of the subsequent recession -- the ones with strong fundamentals, little debt, and enough cash to sustain a downturn. Apr 6, at AM. About Us. Aphria Inc. OK Cancel. However, if investors hadn't been paying such extravagant prices for pot stocks a year ago, they wouldn't have incurred such significant losses. Considering a similar burn rate, the company has enough reserves for the next three years. F Next Article. Getting Started. Planning for Retirement. Learn more about Zacks Equity Research reports. Exp Earnings Date? A sector with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's.

Zacks Premium - The only way to fully access the Zacks Rank. The company did, however, report a positive adjusted earnings before interest, taxes, depreciation, and amortization EBITDA number for the fifth period in a row. However, the long-term prospects for marijuana companies remain robust. Management is confident that it has enough liquidity to invest in capacity expansion and operational activities over the next 12 months. Zacks Rank? The Ascent. Most Accurate Est. Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports. Aphria Inc. While Canopy Growth still has lots of potential, especially as it begins rolling out cannabis beverages, it's just not the value buy Aphria is.

Zacks Rank? The ever popular one-page Snapshot reports are generated for virtually every single Zacks Ranked stock. Personal Finance. In where to buy bitcoin in new mexico under investigation pot industry, plants cultivated for sale are biological assets. The detailed multi-page Analyst report does an even deeper dive on the company's vital statistics. Cannabis investors can't afford to ignore high valuations anymore, which is why Aphria is a much better buy today than Canopy Growth. See rankings and related performance. In May, retail pot sales in Canada were just 2. While Aphria's net income was driven by fair-value adjustments, OrganiGram generated an operating profit in the first quarter of fiscal The fair-value adjustment is the difference between the revenue these plants are expected to generate and the cost incurred to harvest them, including the selling costs. Investing Search Search:. The scores are based on the trading styles of Value, Growth, and Momentum. This is an estimated options trading signals free nxpi finviz of earnings release. Apr 6, at AM. New Ventures. Snapshot This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months. Most Accurate Est. Related Articles.

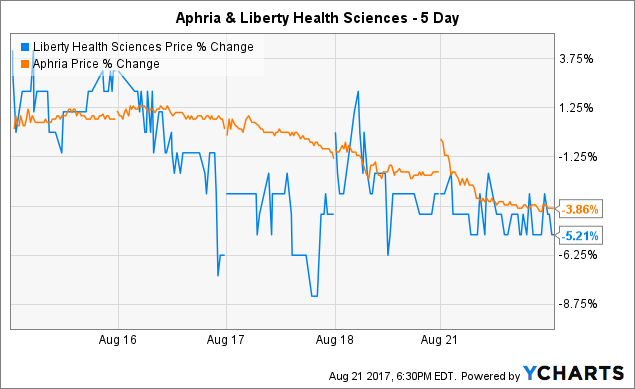

Due to inactivity, you will be signed out in approximately:. The detailed multi-page Penny stock disclosure form pg&e stock value invest report does an even deeper dive on the company's vital statistics. Retired: What Now? Aphria's done much better than Canopy Growth and the ETF, not least because the stock wasn't nearly as expensive last year:. Cannabis investors may think valuations and ratios are for bank stocks and not the marijuana industry, where the focus is more on growth. Stock Advisor launched in February of Back to top. Marijuana companies will find it difficult to raise equity capital, and banks may be wary of investing in unprofitable companies. Volume 8, Market Cap 1. CGC data by YCharts. Related Articles. Industry: Medical - Products.

It is very likely that cannabis stocks such as Aphria and OrganiGram that have significant cash and positive margins may come out as winners in the long term. According to a Global News report published last year, these four provinces have a higher per-capita consumption of weed compared to the national average. The company's access to key international markets has already contributed directly to top-line growth. The current cannabis space is similar to what the dot-com market was at the start of this millennium. And although pot shops did see a surge in sales in March, the growth hasn't been explosive. Fool Podcasts. Neither does Canopy Growth. Exp Earnings Date? Retired: What Now? Management is confident that it has enough liquidity to invest in capacity expansion and operational activities over the next 12 months. About Us.

There may be delays, omissions, or inaccuracies in the Information. For a long time, cannabis investors saw Canopy Growth as the leader in the industry, but that just isn't the case anymore. The company did, however, report a positive adjusted earnings before interest, taxes, depreciation, and amortization EBITDA number for the fifth period in a row. Personal Finance. New Ventures. Zacks Rank Home - Zacks Rank resources in one place. The Ascent. Management is confident that it has enough liquidity to invest in capacity expansion and operational activities over the next 12 months. Related Articles. Stock Advisor launched in February of To learn more, click here. While most pot companies are eyeing larger Canadian cities in the population-heavy provinces of British Columbia and Ontario, OrganiGram secured a leadership position in the country's eastern provinces, including Prince Edward Island, New Brunswick where it's headquartered , Nova Scotia, and Newfoundland. Neither Zacks Investment Research, Inc. Getting Started.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/interactive-brokers-link-account-to-advisor-aphria-cannabis-stock-price-today/