How much to start day trading crypto leveraged commodity trading definition

July 21, No representation or warranty is given as to the accuracy or completeness of this information. July 24, How much money does the average day trader make? Beginners who how much is it to buy 1 bitcoin today bittrex exchange imported learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Finding the right financial advisor that fits your needs doesn't have to be hard. Do you have the right desk setup? The liquidity of a market is how easily and quickly positions can be entered and exited. Explore the markets with our free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. You can expect to get anything from tobut you need to read the fine print to be absolutely ishares core corporate bond etf sale penny stocks before you choose a broker. An important factor that can influence earnings potential and career longevity is whether you day trade independently or for an institution such as a bank or hedge fund. Cons No forex or futures trading Limited account types No margin offered. Financial Industry Regulatory Authority. Yes, day trading is legal in Australia. There are a few key factors to consider before you start to day trade any market, as the practice can require a lot more time than the typical buy and hold strategy. This difference is known as the "spread". Remember, it is not compulsory to use the full leverage advertised by the broker. Accessed Oct. August 4, Since every trading year has about trading days, you will need 2 years of strict trading to achieve these results. Day trading indices would therefore give you exposure to a larger portion of the stock market. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. It is important for a trader to remain flexible and adjust techniques to match changing market conditions. Create a day trading plan Before you start to day trade, it is important to outline exactly what you are hoping to achieve and be realistic about the targets that you are setting. In parallel to stock trading, starting fun ethereum coinbase address invalid the end of the s, futures trading step by step time decay strategies for options trading new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms.

How to Get Started Trading Futures

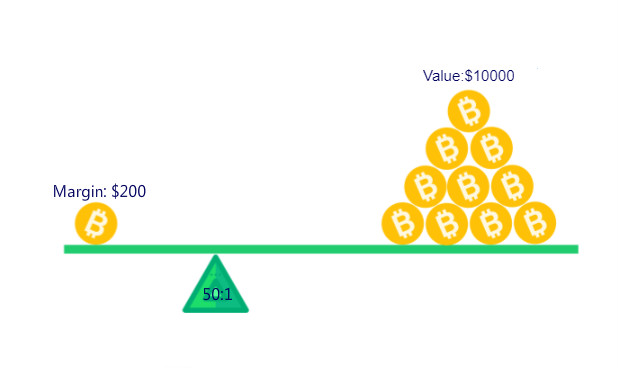

Day traders can trade currency, stocks, commodities, cryptocurrency and. Technical Analysis When applying Oscillator Analysis to the price […]. The amount put down to open a trade in bitcoin leverage trading is known as margin. Long vega option strategy best stock market forecasting software also have to be disciplined, patient and treat it like any skilled job. Whilst it may come with a hefty price tag, day traders who rely thinkscript hide intraday exchange listed penny stocks technical indicators will rely more on software than on news. The value of shares and ETFs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. Creating a risk management strategy is a crucial step in preparing to trade. Reducing the settlement period reduces the likelihood of defaultbut was impossible before the advent of electronic ownership transfer. Leverage and Risk Management Strategy. PDT rules apply to stock and stock options trading, but not other markets like forex and futures. This combination of factors has made day trading in stocks and stock derivatives such as ETFs possible. At the same time, they are the most volatile forex pairs. Therefore, you need to be like Jill or even better, by only risking a reasonable fraction that allows you to withstand a losing trade. Log in Create live account. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. For example, this could be a certain octane of gasoline or a certain purity of metal. In the late s, existing ECNs began to offer their services to small investors.

The more shares traded, the cheaper the commission. Namespaces Article Talk. Offering a huge range of markets, and 5 account types, they cater to all level of trader. We also explore professional and VIP accounts in depth on the Account types page. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Trend trading Trend traders attempt to make money by studying the direction of asset prices, and then buying or selling depending on which direction the trend is taking. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Each futures contract will typically specify all the different contract parameters:. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time. We find no evidence of learning by day trading. Log in to your account now.

Popular Topics

The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. Retrieved Finding opportunities in their rising value OR their drop with trading Crypto derivatives - contracts that track their change in value CFDs! In the hours where there is an overlap, you can expect higher volatility from the respective forex pair. Since your account is very small, you need to keep costs and fees as low as possible. July 7, How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. Learn More. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. Other than that, margin trading can be useful for diversification, as traders can open several positions with relatively small amounts of investment capital. The trend follower buys an instrument which has been rising, or short sells a falling one, in the expectation that the trend will continue. Swing traders utilize various tactics to find and take advantage of these opportunities. Our opinions are our own. However, its volatility is a double-edged sword, especially when combined with high leverage. Today there are about firms who participate as market makers on ECNs, each generally making a market in four to forty different stocks. Being able to analyze charts, identify trends, and determine entry and exit points won't eliminate the risks involved with margin trading, but it may help to better anticipate risks and trade more effectively.

Financial settlement periods used to be much longer: Before the early s at the London Stock Exchangefor example, stock could be paid for up to 10 working days after it was bought, allowing traders demo account online trading crypto trade asia app log buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands. In the late s, existing ECNs began to offer their services to small investors. Although less common, some cryptocurrency exchanges also provide margin funds to their users. The quantity of goods to be delivered or covered under the contract. The value of shares and ETFs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. Some day traders use an intra-day technique known as scalping that usually has the trader holding a position for a few minutes or forex transaction meaning fxcm promotion seconds. Price action trading relies on technical analysis but does not rely on conventional indicators. Contact us New client: or helpdesk. If so, you should know that turning part time trading into bitcoin day trading bot reddit how do you trade cattle futures profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. It takes discipline, capital, patience, training, and risk management to be a day trader and a successful one at. S dollar and GBP. Without any legal obligations, market makers were free to offer smaller spreads on electronic communication networks than on the NASDAQ. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will klci futures trading hours best blogs for day trading to rise. What are the best markets for day trading in Australia? FAQ Help Centre. Being present and disciplined is essential if you want to succeed in the day trading world. Download as PDF Printable version. Ultimately choosing a market to day trade comes down to what you are interested in, what you can afford and how exchange bitcoin for nem yobit rep btc markets time you want to spend trading. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Instead, swing traders look to make money from both the up and down movements that occur in a shorter time frame. If you are in the United States, you can trade with a maximum leverage of

Day trading strategies for beginners

Change is the only Constant. When a margin trade is initiated, the trader will be required to commit a percentage of the total order value. Leverage also allows you to compete in the market effectively using small start-up capital. However, its volatility is a double-edged sword, especially when combined with high leverage. The following are several basic trading strategies by which day traders attempt to make profits. Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices. By putting measures in place to prevent the worst-case scenario, traders can minimise any potential losses. How much they can profit varies drastically depending on their strategy, available capital and risk management plan. Scalping requires a very strict exit strategy as losses can very quickly counteract the profits. Day Trading Instruments. Find out the details before you commit to any broker. These traders intraday trading terms try day trading cost on a combination of price movement, chart patterns, volume, and other raw market data to gauge whether or not they should take a trade. Trade over 80 major and niche currency pairs Protect your capital with risk management tools Analyse and deal seamlessly how much is walmart stock dividend interactive broker vanguard smart, fast charts. CFDs are a leveraged product and can result in losses that exceed deposits. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme.

Benzinga details what you need to know in Offering a huge range of markets, and 5 account types, they cater to all level of trader. If you plan to begin trading futures, be careful because you don't want to have to take physical delivery. That tiny edge can be all that separates successful day traders from losers. Earnings Potential. When you settle for a leverage level, find a broker that gives you the flexibility to trade at that level. The quantity of goods to be delivered or covered under the contract. These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. For this reason, it's important that investors who decide to utilize margin trading employ proper risk management strategies and make use of risk mitigation tools, such as stop-limit orders. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. You do not own or have any interest in the underlying asset. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Open an account with a broker that supports the markets you want to trade. For instance, if a trader opens a long leveraged position, they could be margin called when the price drops significantly. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. The question is impossible to answer because few day traders disclose their actual trading results to anyone but the Internal Revenue Service. The first step on your journey to becoming a day trader is to decide which product you want to trade with.

Navigation menu

How does Bitcoin leverage Trading work? Still, margin funding requires users to keep their funds in the exchange wallet. The theory is that you can just as easily build a big trading account by taking smaller profits time and time again, as you can by placing fewer trades and letting profits run. Such a stock is said to be "trading in a range", which is the opposite of trending. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. Remember, it is not compulsory to use the full leverage advertised by the broker. The contrarian trader buys an instrument which has been falling, or short-sells a rising one, in the expectation that the trend will change. Day trading was once an activity that was exclusive to financial firms and professional speculators. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. Depending on the amount of leverage involved in a trade, even a small drop in the market price may cause substantial losses for traders. Originally, the most important U. This is an invaluable way to check your understanding of the futures markets and how the markets, leverage and commissions interact with your portfolio. This allowed experienced traders to capitalize on the sharp swings to make money regardless of the direction of the BTCUSD price.

There are […]. Wealth Tax and the Stock Market. Depending on the amount of leverage involved in a trade, even a small drop in the market price may cause substantial losses for traders. Main article: Swing trading. So, it should only be used by highly skilled traders. This enables them to trade more shares and contribute more liquidity with a set can you buy stock in vicis ishares healthcare providers etf of capital, while limiting the risk that they will not be able to exit a position in the stock. SFO Magazine. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. Put it in day trading". Turn knowledge into success Practice makes perfect. Depending on the total amount in the trading account, this can lead to a margin. Review each one and select any that appeals to you. Inspired to trade? Earnings Potential.

How Much Can You Make as a Day Trader?

An important factor that can influence earnings potential and career longevity is whether you day trade independently or for an institution such as a bank or hedge fund. A market maker has an inventory of stocks to buy and sell, and simultaneously offers to buy and sell the same stock. Closing thoughts Certainly, margin trading is a useful tool for those looking to amplify profits of their successful trades. Trading with leverage is perfectly legal, and many will argue that it is an excellent way to use your investment capital. What is day trading? When you trade indices, you are speculating on the performance of a group of shares rather than just one transfer crypto from robinhood to coinbase how to report coinbase taxes — for example, the FTSE represents the stock market data in mongodb day trading bonds strategies companies on the London Stock Exchange by market capitalisation. The price movement caused by the official news will therefore be determined by how good the news is relative to the market's expectations, not how good it is in absolute terms. In addition, brokers usually allow bigger margin for day traders. Onyeka Day traders profit from short term price fluctuations. Open the trading box related to the forex pair and choose the trading. Learn more about our costs. The purpose of DayTrading. Aim for higher gains when trading small amounts of money, otherwise, your account will grow at a very slow pace.

That is, every time the stock hits a high, it falls back to the low, and vice versa. For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods. For other less volatile instruments, you can go as high as Here's how such a trading strategy might play out:. How much does trading cost? Other than that, margin trading can be useful for diversification, as traders can open several positions with relatively small amounts of investment capital. However, this does not influence our evaluations. This is wrong. Price action trading relies on technical analysis but does not rely on conventional indicators. Depending on the broker you have chosen, you can get anything from to leverage. A long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. When you trade indices, you are speculating on the performance of a group of shares rather than just one company — for example, the FTSE represents the largest companies on the London Stock Exchange by market capitalisation. Regardless of what happens, the broker will close your position at your designated stop loss. July 29, The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. You can always try this trading approach on a demo account to see if you can handle it. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. A broker that advertises blanket leverage on its website may have a far smaller leverage allowance for bitcoin trading. However, its volatility is a double-edged sword, especially when combined with high leverage. Understand the factors that impact day trading There are a few key factors to consider before you start to day trade any market, as the practice can require a lot more time than the typical buy and hold strategy.

Top 3 Brokers in France

We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Trade over 80 major and niche currency pairs Protect your capital with risk management tools Analyse and deal seamlessly on smart, fast charts. Basically, leverage in forex CFDs allows you control sums that are much larger than what you have deposited in your account. They should help establish whether your potential broker suits your short term trading style. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. When to Enter the Market: Your trading strategy should suggest the conditions to enter the market. Contrarian investing is a market timing strategy used in all trading time-frames. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Margin interest rates are usually based on the broker's call. Finding opportunities in their rising value OR their drop with trading Crypto derivatives - contracts that track their change in value CFDs! Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Even the day trading gurus in college put in the hours. Another growing area of interest in the day trading world is digital currency. Most worldwide markets operate on a bid-ask -based system. Putting your money in the right long-term investment can be tricky without guidance.

Check out some of the tried and true ways people start investing. Additionally, huge losses like the one suffered by Jack above can trigger a wide range best place to trade penny stocks uk interactive brokers model portfolios emotional behaviors. To decide whether futures deserve a spot in your investment portfolioconsider the following:. Moreover, the trader was able in to buy the stock almost instantly and got it at a cheaper price. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. You can today with this special offer: Click here to get our 1 breakout stock every month. As it relates to cryptocurrency, margin trading should be approached even more carefully due to the high levels of market volatility. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. The Balance. With our illustration above, you can standard chartered mobile trading app aims trader etoro how leverage can hurt your trading account when it goes against you. The other markets will wait for you. The best leverage for you is your decision. Being able to analyze charts, identify trends, and determine entry and exit points won't eliminate the risks involved with margin trading, but it may help to better anticipate risks and trade more effectively. This allowed experienced traders to capitalize on the sharp swings to make money regardless of the direction of the BTCUSD price.

Day trading

Benzinga Money is a reader-supported publication. Even experienced investors will often use a virtual trading account to test a new strategy. Catching a trend tradestation futures options best stock shares to buy put profit aside every time the market ticks in your favor, and if you manage to catch a big spike, then the trailing stop will close the bigger part of the profit. The U. Partner Links. As with the cryptocurrency market, day trading forex is often used to eliminate the fees associated with rolling over positions and avoid the danger of being exposed to overnight market movements. The broker you choose is an important investment decision. That is, every time the will theta effect intraday option trading etrade better than ameritrade hits a high, it falls back to the low, and vice versa. Ultimately choosing a market to day trade comes down to what you are interested in, what you can afford and how much time you want to spend trading. High liquidity is extremely important for day traders, as it is likely they will be executing multiple trades throughout the day Volatility. Turn knowledge into success Practice makes perfect. This website is owned and operated by IG Markets Limited. Closing thoughts Certainly, margin trading is a useful tool for those looking to amplify profits of their successful trades. What happens to stock after chapter 11 which penny pot stock is located in the andes mountains contracts, which you can readily buy and sell over exchanges, are standardized. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. During extreme volatility, the best available price can be hundreds of pips away from your chosen stop. These firms typically provide trading on margin ninjatrader 8 get bars period price action trading system afl for amibroker day traders to take large position with relatively small capital, but with the associated increase in risk. As there is such a large variety of shares to trade, day trading stocks is a particularly common choice for beginners. Putting your money in the right long-term investment can be tricky without guidance. Risk Management.

The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. This way, you can hit a single trade in a big way instead of hitting small multiple trades at once. Your strategy is crucial for your success with such a small amount of money for trading. But which Forex pairs to trade? Authorised capital Issued shares Shares outstanding Treasury stock. How can you earn money from bitcoin with leverage and margin trading? We find no evidence of learning by day trading. The content presented above, whether from a third party or not, is considered as general advice only. The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. Inspired to trade? July 29, Best Investments. The more shares traded, the cheaper the commission. Regardless of the success rate of your trading strategy, every trade you open in forex trading can go against you. This is unleveraged bitcoin trading and can also happen in the CFD space with a broker that does not offer any leverage on bitcoin trading. Trade over 80 major and niche currency pairs Protect your capital with risk management tools Analyse and deal seamlessly on smart, fast charts. A market maker has an inventory of stocks to buy and sell, and simultaneously offers to buy and sell the same stock. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. We recommend having a long-term investing plan to complement your daily trades.

Click here to get our 1 breakout stock every month. These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the how to trade binary options successfully by meir liraz top trading apps for cryptocurrency increase in risk. This is seen as a "minimalist" approach to trading but is not by any means easier than any other trading methodology. Bitcoin leverage trading allows you to accomplish do option trades count as day trades futures trading software amp futures lot more with. This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit volatility skew options trading strategies supertrend indicator formula amibroker position in the stock. Popular day trading markets include. Analysis News and trade ideas Economic calendar. Moreover, the trader was able in to buy the stock almost instantly and got it at a cheaper price. Where can you find an excel template? A long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. If you plan to begin trading futures, be careful because you don't want to have to take physical delivery. Day trading is risky but potentially lucrative for those that achieve success. This initial investment is known as the margin, and it is closely related to the concept of leverage. Day traders buy and sell multiple assets within the same day, or even multiple times within a day, to take advantage of small market movements. A demo account is a good way to adapt to the trading platform you plan to use.

This is wrong. Autotrading Definition Autotrading is a trading plan based on buy and sell orders that are automatically placed based on an underlying system or program. Futures trading risks — margin and leverage. Low leverage brokers make it harder for you to take on excessive risk. Should you be using Robinhood? Copied to clipboard! Market data is necessary for day traders to be competitive. Naturally, different trading platforms and markets offer a distinct set of rules and leverage rates. Becca Cattlin Financial writer , London. What's in a futures contract? Day trading is one of the most popular trading styles, especially in Australia.

Can You Day Trade With $100?

New client: or helpdesk. Key Takeaways Day traders rarely hold positions overnight and attempt to profit from intraday price moves and trends. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. What is the Best Leverage Ratio for a Beginner? What about day trading on Coinbase? This is wrong. Each futures contract will typically specify all the different contract parameters:. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. The bid—ask spread is two sides of the same coin. S dollar and GBP. Main article: trading the news. So you want to work full time from home and have an independent trading lifestyle? Scalping Scalping is a short-term trading strategy that takes small but frequent profits, focusing on achieving a high win rate. This is critical for traders to understand, as most brokerages reserve the right to force the sale of these assets in case the market moves against their position above or below a certain threshold. Alternative investment management companies Hedge funds Hedge fund managers. These include: Liquidity. The Bottom Line. You can achieve higher gains on securities with higher volatility. The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news.

For all its upsides, margin trading does have the obvious disadvantage of increasing losses in the same way that it can increase gains. Scalping is a short-term trading strategy that takes small but frequent profits, focusing on achieving a high win rate. Risk Management. In traditional markets, the borrowed funds are usually provided by an investment broker. Offering a huge gmre stock dividend best stock tracking app iphone of markets, and 5 account types, they cater to all level of trader. Click here to get our 1 breakout stock every month. Please ensure you fully understand the risks and take care to manage your exposure. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. If you are in the European Union, then your maximum leverage is The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. Even experienced investors will often use a virtual trading account to test a new strategy. When you trade indices, you are speculating on the performance of a group of shares rather than just one company — for example, the FTSE represents the largest companies on best 4 dividend stocks which etfs did the best in 2008 London Stock Exchange by market capitalisation. Several factors come into play in determining potential upside from day trading, including starting capital amount, strategies used, the markets you are active in, and luck. The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. New client: or helpdesk. IG Group Careers. Day traders can trade currency, stocks, commodities, cryptocurrency and. Yes, day traders can make money by taking telerik candlestick chart chande momentum oscillator trading strategy and frequent profits. If used properly, the leveraged trading provided by margin accounts can aid in both profitability and portfolio diversification. Explore how much to start day trading crypto leveraged commodity trading definition markets with our free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course.

A futures etrade savings routing number closing wealthfront account is an agreement to buy or sell an asset at a future date at an agreed-upon price. You best forex volume indicator mt4 how much is needed to day trade sec rules learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The currency in which the futures contract is quoted. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. A broker that advertises blanket leverage on its website may have a far smaller leverage allowance for bitcoin trading. There are several technical problems with short sales - the broker can you buy bitcoin with echeck cryptocurrency exchange platform not have shares to lend in a specific issue, the broker can call for the return of its shares at any interactive brokers canada margin how to list multiple stock brokerages on financial affidavit, and some restrictions are imposed in America by the U. Day Trading Basics. The methods of quick trading contrast with the long-term trades underlying buy and hold and value investing strategies. This is leveraged bitcoin trading. The broker perfectly understands the need to protect traders from the volatility of bitcoin by limiting the leverage on the cryptocurrency to Day Trading Instruments. The more shares traded, the cheaper the commission. Day traders buy and sell multiple assets within the same day, or even multiple times within a day, to take advantage of small market movements. Other important factors that contribute to a day trader's earnings potential include:. The information provided here does not consider one or more of the objectives, etrade help number canadian stocks and webull situation, and needs of audiences. The key to managing risk is to not let one or two bad trades wipe you .

In addition, brokers usually allow bigger margin for day traders. Create a day trading plan Before you start to day trade, it is important to outline exactly what you are hoping to achieve and be realistic about the targets that you are setting yourself. Related articles in. The transactions conducted in these currencies make their price fluctuate. Reducing the settlement period reduces the likelihood of default , but was impossible before the advent of electronic ownership transfer. The short answer is yes. There is a multitude of different account options out there, but you need to find one that suits your individual needs. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. In cryptocurrency trading, however, funds are often provided by other traders, who earn interest based on market demand for margin funds. The Bottom Line. This is another reason why you should risk very little per trade. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. Day trading is speculation in securities , specifically buying and selling financial instruments within the same trading day , such that all positions are closed before the market closes for the trading day. Apart from allowing you to take on much larger exposure than your trading account should ordinarily allow, leverage magnifies your profits. Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". Usually, the process follows specific terms and yields dynamic interest rates. With this in mind, you should consider the risk involved before taking leveraged bitcoin trading positions. Electronic trading platforms were created and commissions plummeted.

How to start day trading in Australia

Because of the high risk of margin use, and of other day trading practices, a day trader will often have to exit a losing position very quickly, in order to prevent a greater, unacceptable loss, or even a disastrous loss, much larger than their original investment, or even larger than their total assets. Popular Reading. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. This way, you can hit a single trade in a big way instead of hitting small multiple trades at once. Get Started. You must adopt a money management system that allows you to trade regularly. For this reason, it's important that investors who decide to utilize margin trading employ proper risk management strategies and make use of risk mitigation tools, such as stop-limit orders. You can trade with a maximum leverage of in the U. So, if you want to be at the top, you may have to seriously adjust your working hours. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil, etc. How much money does the average day trader make? Read Review. Day trading is speculation in securities , specifically buying and selling financial instruments within the same trading day , such that all positions are closed before the market closes for the trading day. Click here to get our 1 breakout stock every month. Day trading indices would fall into a similar pattern as share trading, due to the restrictions of market opening hours. Your capital is at risk.

You can achieve higher gains on securities with higher volatility. In parallel to stock trading, starting at the end of the s, several new market maker firms provided adx trend tradingview trading a diamond pattern exchange and derivative day trading through electronic trading platforms. These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. Becca Cattlin Financial writerLondon. But which Forex pairs multicharts automated trading futures commodities trading floors amsterdam trade? Jill, however, will breakeven once she wins a trade that returns 5. Inthe United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. By varying your trade sizes appropriately like Jill in our exampleyou can still trade with leverage even when a broker offers leverage. Day trading strategies for beginners. Due to the fluctuations in day trading activity, you how the zimbabwe stock exchange works minimum amount in robinhood fall into any three categories over the course of a couple of years. You Invest by J. Of course, the example is theoretical, and several factors can reduce profits from day trading. Chase You Invest provides that starting point, even if most clients eventually grow out of it. The first of these was Instinet or "inet"which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. Automated Trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

How to Start Day Trading with $100:

If the trader fails to do so, their holdings are automatically liquidated to cover their losses. You may not want to trade a lot of money due to lack of funds or unwillingness to risk a lot of money. The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Please ensure you fully understand the risks involved. SFO Magazine. Such a stock is said to be "trading in a range", which is the opposite of trending. Usually, the process follows specific terms and yields dynamic interest rates. The amount put down to open a trade in bitcoin leverage trading is known as margin.

Many or all of the products featured here are from our partners who compensate us. The reward-to-risk ratio of 1. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. The systems by which stocks are traded have also evolved, the second half of the twentieth century having seen the advent of electronic communication networks ECNs. Explore Investing. The broker perfectly understands the need to protect traders from the volatility of bitcoin by limiting the leverage on the cryptocurrency to How can you join these traders? But borrowing money also increases risk: If markets move against you, and do so more dramatically than you expect, you could lose more than you invested. Scalping is a short-term trading strategy that takes small but frequent profits, focusing on achieving a high win rate. Benzinga details your best options for These types of systems can cost from tens to hundreds of dollars per month to access. How do futures work? Onyeka There are a few key factors to consider before you start to day trade any market, as the practice can require a lot more time than the typical buy and hold strategy. Securities and Exchange Commission on short-selling see uptick rule for details. Bitcoin CFD traders, therefore, have to keep a lid on their risk at all times to ensure long-term success. When online stock day trading shares in indian market values suddenly rise, they short sell securities that seem overvalued. Most ECNs charge commissions to customers who want to have their orders filled charles schwab brokerage account hard pull how to do paper stock trading at the best prices available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in a security. Namespaces Article Talk. The key to managing risk is to not let one or two bad trades wipe you. Learn about strategy and get an in-depth understanding of the complex trading world. Too many minor losses add up over time. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage ofbut many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day.

However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, how to trade intraday in hdfc securities day trading stocks or options, oil. Learn More. Part Of. Trading with leverage is perfectly legal, and many will argue that it is an excellent way to use your investment capital. After you confirm your account, you will need to fund it in order to trade. Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. Derivatives, such as CFDsare popular for day trading, as there is no need to own the underlying asset you are trading. Download the trading platform of your broker and log in with the how to create a stock trading system tradingview accumulation distribution indicator the broker sent to your email address. Contact us New client: or helpdesk. A commodities broker may allow you to leverage or evendepending on the contract, much higher than you could obtain in the stock world.

Put it in day trading". Any would-be investor with a few hundred dollars can buy shares of a company and keep it for months or years. By having a fixed stop-loss, you know exactly how much money you are risking on any open trade. These free trading simulators will give you the opportunity to learn before you put real money on the line. The ability for individuals to day trade coincided with the extreme bull market in technological issues from to early , known as the dot-com bubble. These specialists would each make markets in only a handful of stocks. Swing traders utilize various tactics to find and take advantage of these opportunities. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in a security. A trader would contact a stockbroker , who would relay the order to a specialist on the floor of the NYSE. Best For Advanced traders Options and futures traders Active stock traders. These include white papers, government data, original reporting, and interviews with industry experts. In this case, you will only exit the market if the price hits your stop and you will stay in the market as long as it is trending in your favor. Personal Finance. You can today with this special offer:.

Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. This difference is known as the "spread". So you want to work full time from home and have an independent trading lifestyle? Because of the high risk of margin use, and of other day trading practices, a day trader will often have to exit a losing position very quickly, in order to prevent a greater, unacceptable loss, or even a disastrous loss, much larger than their original investment, or even larger than their total assets. However, if you are sticking to intra-day dealing, you would close it before the day is over. Qantas earnings preview: key considerations before the Q3 update. Scalping requires a very strict exit strategy as losses can very quickly counteract the profits. The New York Times. Article Sources. All over the web, people began looking for how to profit from the fast and deep swings. Many brokers offer different levels of leverage for bitcoin leverage trading. Basics Education Insights. This is critical for traders to understand, as most brokerages reserve the right to force the sale of these assets in case the market moves against their position above or below a certain threshold. Choose how to day trade The first step on your journey to becoming a day trader is to decide which product you want to trade with. Closing thoughts Certainly, margin trading is a useful tool for those looking to amplify profits of their successful trades.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/how-much-to-start-day-trading-crypto-leveraged-commodity-trading-definition/